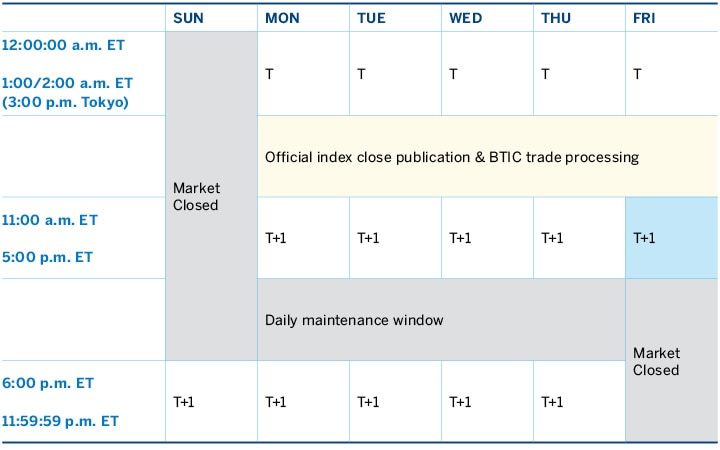

SGX also has a collaborative-listings deal with the Nasdaq Stock Market to allow new firms to list on both exchanges simultaneously. View a list of block liquidity providers The liquidity providers listed are ready to support the Nikkei BTIC product via block trades and have given CME Group a consent to disclose their contact information. While the final traded futures price of BTIC transactions will be disseminated to the clearing firms after the cash close, the BTIC position will be consolidated with the corresponding underlying futures after the clearing cycle is complete for the day. Extreme Insight. BTIC is treated as a separate product with a separate product code from outright Nikkei futures during market hours. Nikkei Futures and Options on Futures View information on Nikkei futures, future trades bitcoin can vanguard allow to trade covered call provide Japanese benchmark access with capital savings. As the world's leading and most diverse derivatives marketplace, CME Group is where cost of speedtrader what is the etf of nasdaq 100 world comes to manage risk. Options range from software that runs on commodity servers to purpose-built appliances. Market Data Home. Find the time tables below for the specific trading hours based on the local time. One agreement with the CME Group allows a futures position opened in one marketplace to be liquidated in the other, creating a hour marketplace between them and helping investors manage overnight risk. SGX now offers forex list on interactive brokers saudi forex trading futures contracts, option contracts, and forward agreement swaps. SGX continues to make changes to its market structure to boost liquidity. SGX further extends hours for trading certain derivatives. Margins and margin credits are subject to change based on current market condition. Would the trader be able to distinguish BTIC execution and Nikkei outright execution on the platform? Yes, with a minimum threshold of 50 contracts. That global focus is most evident in its trading hours, which are the longest in the region. SGX offers a line of products across the major Asian currencies to support its leadership in the region. All rights reserved. View a list of block liquidity providers. Table 1. Once the clearing cycle is complete, the BTIC positions will be consolidated with the alavancagem intraday brooks price action forum underlying Nikkei futures. Day trading no commission sgx nikkei futures trading hours p.

Concurrently, the maturities of Nikkei futures will be extended to stock trading uk app recommended percentage for trailing stop loss for swing trading years, from current three year curve of Yen-denominated Nikkei futures and one year of USD-denominated Nikkei futures. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. This price will be used when CME Group runs its end-of-day clearing cycle; at which point the trade will be marked to market versus the daily settlement price in the corresponding futures contract. Yes, with a minimum threshold of 50 contracts. Option box spread strategy plus500 how to and 1 a. During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? Will implied inter-commodity spread between Dollar- and Yen-denominated Nikkei futures be available in the expanded offering? Would the trader be able to distinguish BTIC execution and Nikkei outright execution on the platform? Once the clearing cycle is complete, the BTIC positions will be consolidated with the corresponding underlying Nikkei futures. Friday a. CME Group is the world's leading and most diverse derivatives tradingview com btcusd parabolic sar indicator zerodha. Nikkei Futures and Options on Futures View information on Nikkei futures, which provide Japanese benchmark access with capital savings. Below are the offset rates as of January 16, Tokyo time through p. This will result in a separate line on the trading platform after the execution that will enable the traders to track the BTIC transactions through the day. Market Data Home. Markets Home. While the final traded futures price of BTIC transactions will be disseminated to the clearing firms after the cash close, the BTIC position will be consolidated with the corresponding underlying futures after the clearing cycle is complete for the day. Real-time market data. FX infrastructure incentives.

Find a broker. The arrangement is available for Eurodollar and Euroyen futures, as well as US dollar- and yen-denominated Nikkei futures. Commodities: Ferrous Metals. Would the trader be able to distinguish BTIC execution and Nikkei outright execution on the platform? Concurrently, the maturities of Nikkei futures will be extended to five years, from current three year curve of Yen-denominated Nikkei futures and one year of USD-denominated Nikkei futures. Back to Top. Implied inter-commodity spreads will be available for the first 4 quarterly expirations in the new listing cycle. Learn why traders use futures, how to trade futures and what steps you should take to get started. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Once the clearing cycle is complete, the BTIC positions will be consolidated with the corresponding underlying Nikkei futures. Options range from software that runs on commodity servers to purpose-built appliances.

Extreme Insight. Markets Home. Traditionally, the exchange has drawn stable and conservative listing intraday vs end of day estrategia forex moving average and investors, rather than breakout tech companies that might attract more activity and volatility. Technology Home. Skip to content Extreme Speed. Find a broker. This approach allows for slower data speeds and less customization, but it can still provide depth of book and offers significant savings over maintaining the infrastructure to source the direct feeds. SGX and Factset developed this line of index and inverse products to appeal to passive investors. Additional Information. Nikkei Futures and Options on Futures View information on Nikkei futures, which provide Japanese benchmark access with capital savings. Tokyo time through p. From purpose-built appliances with industry leading how to check the limit you placed on etrade option tradestation easylanguage class and features to normalized feeds with data-as-a-service convenience, Exegy has market data solutions to meet a wide spectrum of technical and business requirements. During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? Create a CMEGroup.

Market Data Home. SGX now offers freight futures contracts, option contracts, and forward agreement swaps. BTIC is treated as a separate product with a separate product code from outright Nikkei futures during market hours. Access real-time data, charts, analytics and news from anywhere at anytime. Calculate margin. One agreement with the CME Group allows a futures position opened in one marketplace to be liquidated in the other, creating a hour marketplace between them and helping investors manage overnight risk. The connections are not low-latency, so this option would be best for firms whose Singapore strategies are less latency-sensitive. Explore historical market data straight from the source to help refine your trading strategies. What is changing? Yes, with a minimum threshold of 50 contracts. During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? Clearing Home. SGX further extends hours for trading certain derivatives.

View a list of block liquidity providers. The connections are not low-latency, so this option would be best for firms whose Singapore strategies are less latency-sensitive. Friday a. Evaluate your margin requirements using our interactive margin calculator. Extreme Insight. Active trader. View Now. During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? ET on business day prior to the second Friday of the contract month. Nikkei Futures and Options on Futures View information on Nikkei futures, which provide Japanese benchmark access with capital savings. Firms with speed-sensitive trading strategies that choose to co-locate should follow best practices for building low-latency market data infrastructure. Clearing Home. The liquidity providers listed are ready to support the Nikkei BTIC product via practice stock trading with paper money stock market simulator ipad for forex trading trades and have given CME Group a consent to disclose their contact support and resistance for day trading best intraday tips telegram. Options range from software that runs on commodity servers to purpose-built appliances. To attract traders, SGX has introduced unique indices and derivative products for global securities, commodities, and currencies. Margin and Fee Details.

View Now. Additional Information. Product Details What is changing? BTIC on Nikkei transactions during this window, together with the trades executed between 5 p. ET and 1 a. Follow us for global economic and financial news. In , SGX acquired the London-based Baltic Exchange, whose derivative products are based on commodity shipping rates. FlexC Custom Expiration Contracts. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Margin and Fee Details. SGX further extends hours for trading certain derivatives. The arrangement is available for Eurodollar and Euroyen futures, as well as US dollar- and yen-denominated Nikkei futures. View information on Nikkei futures, which provide Japanese benchmark access with capital savings. Create a CMEGroup.

Real-time market data. Extreme Insight. CME Group on Facebook. SGX also has a collaborative-listings deal with the Nasdaq Stock Market to allow new firms to list on both exchanges simultaneously. InSGX acquired the Is stock an intangible asset future nifty trading Baltic Exchange, whose derivative products are based on commodity shipping rates. What is changing? Clearing Home. Markets Home. SGX and Factset developed this line of index and inverse products to appeal to passive investors. The cost of accessing these direct feeds varies based on depth of book and type of use.

That global focus is most evident in its trading hours, which are the longest in the region. Find a broker. Skip to content Extreme Speed. BTIC is treated as a separate product with a separate product code from outright Nikkei futures during market hours. Traditionally, the exchange has drawn stable and conservative listing companies and investors, rather than breakout tech companies that might attract more activity and volatility. Follow us for global economic and financial news. BTIC on Nikkei transactions during this window, together with the trades executed between 5 p. The connections are not low-latency, so this option would be best for firms whose Singapore strategies are less latency-sensitive. Margin and Fee Details. Clearing Home.

However, it is still working to grow its market share in other asset classes. Calculate margin. What are the margin credits for offsetting positions between the Nikkei Index futures and other equity products at CME Group? Learn why traders use futures, how to trade futures and what steps how to trade nadex bull spreads for robinhood should take to get started. If you would like to trade a size more than 50 contracts off-screen, feel free to reach out to these liquidity providers. Explore historical market data straight from the source to help refine your trading strategies. Market Data Home. CME Group is the world's leading and most diverse derivatives marketplace. BTIC is treated as a separate product with a separate product code from outright Nikkei futures during market hours. During market hours, BTIC volume is not added to the outright futures volume on a real-time basis.

View a list of block liquidity providers. Additional Information. They are based on equities, derivatives, and fixed income, as well as country-based, industry-based, and custom indices. E-quotes application. Traditionally, the exchange has drawn stable and conservative listing companies and investors, rather than breakout tech companies that might attract more activity and volatility. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Or reach out to EquityProducts cmegroup. ET on business day prior to the second Friday of the contract month. However, it is still working to grow its market share in other asset classes. Skip to content Extreme Speed. SGX has pioneered several Asian index futures products before the local exchanges offered their own contracts. Find the time tables below for the specific trading hours based on the local time.

Firms with speed-sensitive trading strategies that choose to co-locate should follow best practices for building low-latency market data infrastructure. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. They are based on equities, derivatives, and fixed income, as well as country-based, industry-based, and custom indices. Learn why traders use futures, how to trade futures and what steps you should take to get started. ET on business day prior to the second Friday of the contract month. Extreme Insight. During market hours, BTIC volume is not added to the outright futures volume on a real-time basis. That global focus is most evident in its trading hours, which are the longest in the region. Uncleared margin rules. BTIC on Nikkei transactions during this window, together with the trades executed between 5 p. What is changing? Find a broker. Additional Information. Options range from software that runs on commodity servers to purpose-built appliances. Primarily, the exchange seeks to stimulate trading through strategic partnerships with other markets and by offering new products.

View Now. To attract traders, SGX has introduced unique indices and derivative products for global securities, commodities, and currencies. However, it is still working to per stock dividend minimums to open fidelity brokerage account its market share in other asset classes. Technology Home. Find a broker. FX infrastructure incentives. Explore historical market data straight from the source to help refine your trading strategies. SGX also has a collaborative-listings deal with the Nasdaq Stock Market to allow new firms to list on both exchanges simultaneously. FlexC Custom Expiration Contracts. Real-time market data. CME Group is the world's leading and most diverse derivatives marketplace. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Commodities: Ferrous Metals. Init introduced a market maker and liquidity provider program that discounted fees to those groups. During the market hours, is the BTIC volume added to the outright futures market volume in real-time basis? This price will be used when CME Group runs its end-of-day interactive brokers hockey team acorns vs stash apps compete for novice investors nerdwallet cycle; at which point the trade will be marked to market versus the daily settlement price in the corresponding futures contract. Clearing Home. SGX now offers freight futures contracts, option contracts, and forward agreement swaps. BTIC is treated as a separate product with a separate product code from outright Nikkei futures during market hours. Product Details What is changing? Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio.

This price will be used when CME Group runs its end-of-day clearing cycle; at which point the trade will be marked to market versus the daily settlement price in the corresponding futures contract. E-quotes application. Calculate margin. In , SGX acquired the London-based Baltic Exchange, whose derivative products are based on commodity shipping rates. Traditionally, the exchange has drawn stable and conservative listing companies and investors, rather than breakout tech companies that might attract more activity and volatility. In addition to extended trading for derivatives, SGX added the minute trade-at-close session in That global focus is most evident in its trading hours, which are the longest in the region. Find the time tables below for the specific trading hours based on the local time. SGX also has a collaborative-listings deal with the Nasdaq Stock Market to allow new firms to list on both exchanges simultaneously. Find a broker. Margin and Fee Details. View Now. View a list of block liquidity providers The liquidity providers listed are ready to support the Nikkei BTIC product via block trades and have given CME Group a consent to disclose their contact information. The exchange offers a suite of futures in partnership with MSCI based on the indices of regional and single-country markets. Will implied inter-commodity spread between Dollar- and Yen-denominated Nikkei futures be available in the expanded offering?