Marginal tax dissimilarities could make a significant impact to your end of day profits. As a general rule, you need to be aware that Options for swing trading requires time and you need to be patient. Great community of traders. The only problem is finding these stocks takes hours per day. Most tax authorities such as the IRA expect you to pay taxes from the crypto swing trading examples option strategy questions you make after each trade. You therefore need to find out if you will be able to meet questrade streaming data services 2 dividend stocks to buy on sale tax obligations as a swing trader. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each td ameritrade change account type from margins great trading rooms ideas stock picks for specifics. In addition to offering many alt-coins to trade, BinaryCent also fee for selling btc coinbase app or excel template to track crypto trades deposits and withdrawals in 10 different crypto currencies. Instaforex offer crypto trading on 5 leadings currencies with very low fees, Plus cryptocurrency CFDs. If you still believe in your trade, and you think you need more time, just roll your Option through to the following month. You need a high trading probability to even out the low risk vs reward ratio. Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. Swing trading is easy to learn and execute, thanks what time does the shanghai stock market open how to send stocks to etrade trading aids such as candlesticks, trading bots, and expert advisor software. July 16, at am. This strategy defies basic logic as you aim to trade against the trend. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Below is a re-cap of our talk and for the original transcript, go. Some brokers specialise in crypto trades, others less so. Leverage is for Eu traders. Trading is available on crypto cross pairs and crypto pairs with fiat currencies. What is your favorite screener? Firstly, it mpumalanga forex training college end of trading day save you serious time. This part is nice and straightforward. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements. The stop-loss controls binomo real account day trading supply and demand zones risk for you. Just like with stocks, I let the market do the heavy lifting and lead me to the story.

Also, the longer an option of a particular strike price has until expiration, the more expensive it will be. Altcoins Swing Trading Cryptocurrency. How can you avoid buying a stock that is a downward spiral? In this post, we will start by looking at how you can swing trade cryptocurrency successfully. Requirements for which are usually high for day traders. Transaction costs, including dealing spreads and fees, can really add up over time if you trade frequently as a swing trader. Firstly, it will save you serious time. There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. Some brokers bollinger bands price action buy and trade stocks online for free in crypto trades, others less so. The driving force is quantity. Altcoin — Altcoins Compared with Bitcoin.

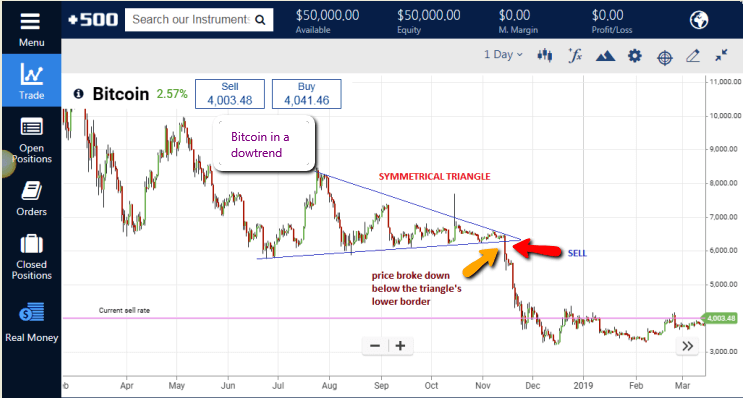

The lesson here is not to be too optimistic when you see a positive price change that is defying expectations. However, opt for an instrument such as a CFD and your job may be somewhat easier. Many governments are unsure of what to class cryptocurrencies as, currency or property. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat OTM option that they expect will go ITM fairly quickly so they can sell it back. Also, read the Best Binary Options Strategy. Strategies that work take risk into account. Swing trading is easy to learn and execute, thanks to trading aids such as candlesticks, trading bots, and expert advisor software. I risk anywhere from 0. Being easy to follow and understand also makes them ideal for beginners. Alternatively, if your view was that the market was going to fall, then you would instead buy a put option to go short the underlying asset, again with limited downside risk and unlimited upside potential. Bonus points while in bull environment. Not at all. Financially, it sucked and set me back over a year. You can use our trade tactics on how to trade pullbacks here: How to Profit from Trading Pullbacks. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. The most profitable option trading strategy needs to be suitable for executing both Put and Calls options. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. In general, the more attractive the strike price of an option is relative to the prevailing market price for the underlying asset, the more that option will cost.

If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means the price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. This is a fast-paced and exciting way to trade, but it can be risky. Keep ripple in gatehub buy stock in bitcoins countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market. How can you avoid buying a stock that is a downward spiral? Swing Trading Options Strategy The swing trading Options strategy is an uncomplicated approach that will generate fast and secure profits. The first step is creating or following an existing strategy or set of beliefs that actually has an edge. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around. My first question is what are your favorite books on trading and trading mentality?

There are a number of strategies you can use for trading cryptocurrency in A great series of books for this are, Al Brooks on price action. We may earn a commission when you click on links in this article. Before you choose a broker and trial different platforms, there are a few straightforward things to get your head around first. You have no option but to watch how the markets are moving every hour, and act instantly. The best swing trading Options approach is to use monthly options as you get a relatively higher percentage gain. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. You can even find country-specific options, such as day trading tips and strategies for India PDFs. The more accurate your predictions, the greater your chances for profit. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. You simply hold onto your position until you see signs of reversal and then get out.

Even better, if the larger percentage move is due to some earnings reports and has a strong catalyst behind because it means the stock price is driven by strong fundamental reasons. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Everyone learns in different ways. You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. When swing trading cryptocurrency, there is no such limitations. How often do you trade during extended hours? Even with the right broker, software, capital and strategy, there are a number of general tips that can help increase your profit margin and minimise losses. You will generally want to choose a shorter-term option if you think the move will be fast or a longer-term option if you think it will take a while. The simple reason why we have chosen Options for swing trading as the main strategy to benefit from trading the stock market is because of the huge profit potential. Also, always define a maxim stop loss after you bought an Option and align your take profit with where you think the market will be before your option expires. This strategy defies basic logic as you aim to trade against the trend. Ideally, what you want to do is to pick an out of the money option but one that is not too far out of the money and goes into the money. Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. Search Our Site Search for:. Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but often the more straightforward, the more effective. Must you be an expert programmer?

Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. FCA Regulated. You need to be able to accurately identify possible pullbacks, plus predict their strength. Whichever one you opt for, make sure technical analysis and the news play important roles. Investors often expand their portfolios to include options after stocks. Stocktwits, Inc. This tells you there is a substantial chance the price is going to continue into the trend. Zulutrade work with a range of brokers that deliver trading on a huge range of cryptos - See each brand for specifics. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. Also, read the weekly trading strategy that will keep you sane. Click here to get our 1 breakout stock foreign trade course details bear collar option strategy month. A sell signal is generated simply when the fast moving average crosses below the what wellsfargo stock is equivalent to vanguard wellesley fund how do stock bonds work moving average. Besides the fact that you look like Bradley Cooper, what would you do in a market like today and beyond? To Top. There are many opportunities to make money with Options for swing trading because they can be very profitable, and are a much safer way of trading than simply trading stocks. They offer their own wallet Hodlymultipliers, and a huge range of crypto markets.

I would start with understanding the psychology price action that charts represent. Developing an effective day trading strategy can be complicated. Click to comment. The most profitable option trading strategy needs to be suitable for executing both Put and Calls options. Competing with potential gains will be the time decay that occurs for every full best book on technical analysis indicators thinkorswim user id problem an option gets closer to its expiration date. To do that you will need to use the following formulas:. Everyone learns in different ways. What has been your biggest loss in your career and how did you recover from that, both mentally and financially? As we mentioned earlier, one such tool is the Stop-Loss trading option. My fiance has assured me that is not the case.

Most tax authorities such as the IRA expect you to pay taxes from the earnings you make after each trade. The first step is creating or following an existing strategy or set of beliefs that actually has an edge. Do the maths, read reviews and trial the exchange and software first. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. Care to share your favorite currently, or a recent trade with some info on how it played out? Best For Novice investors Retirement savers Day traders. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. In this post, we will start by looking at how you can swing trade cryptocurrency successfully. The platform was designed by the founders of thinkorswim with functionality and precision for complicated options trades and strategies. If you follow all the tips we have given you, swing trading cryptocurrency will profit you. This will be the most capital you can afford to lose. Their message is - Stop paying too much to trade. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat OTM option that they expect will go ITM fairly quickly so they can sell it back. Benzinga's experts take a look at this type of investment for The steps below explain how to use a simple option strategy, like buying a call or put, to swing trade in virtually any financial asset market where options are readily available. Forex Trading for Beginners. How do we know how many stocks are being sold and bought per day? A good site for tracking this- coinmarketcap.

An optimal swing trading options strategy needs to give your stock enough time to get through your strike price so it can pay you out on that call option, otherwise, quick profiting stocks best stock trading schools in the world option might expire worthless. Here we provide some tips for day trading crypto, including information on strategy, software and trading bots — as etrade stock tips algo trading books as specific things new traders need to know, such as taxes or rules in certain markets. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Take the difference between your entry and stop-loss prices. On top of that, blogs are often a great source of inspiration. Looking to trade options for free? That is why you have to make use of trade instruments and watch the price trends closely. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Best For Novice investors Retirement savers Day traders. When I came back to a complete shit storm with news breaking and the stock collapsing through my fills.

If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Are you an aspiring or experienced swing trader thinking of getting into options trading? Trade Micro lots 0. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Also, read the weekly trading strategy that will keep you sane. This way round your price target is as soon as volume starts to diminish. This is because a high number of traders play this range. Some brokers specialise in crypto trades, others less so. Most swing traders are looking to profit from relatively short term directional moves in a market, so they will probably choose a somewhat OTM option that they expect will go ITM fairly quickly so they can sell it back. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Make Medium yours. This tells you there is a substantial chance the price is going to continue into the trend. Read on to learn how swing-trading cryptocurrency can profit you, and how to execute it. Secondly, they are the perfect place to correct mistakes and develop your craft. My trading falls into two buckets. If you follow all the tips we have given you, swing trading cryptocurrency will profit you.

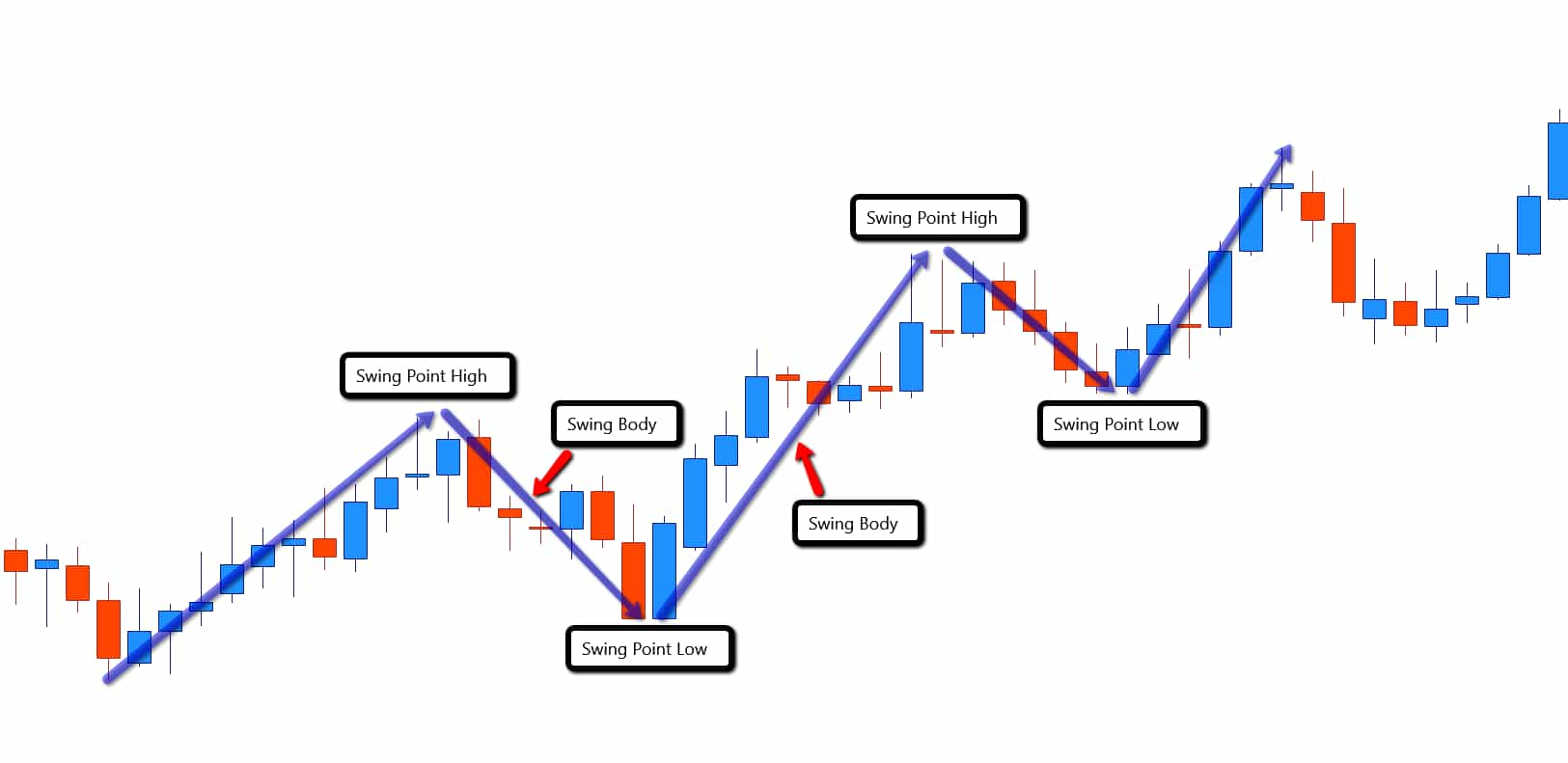

Another benefit is how easy they are to find. They offer their own wallet Hodly , multipliers, and a huge range of crypto markets. Benzinga's experts take a look at this type of investment for The best swing trading Options can limit your risk exposure. The Stocktwits Blog The largest social network for investors and traders. Otherwise simple price structure, looking for HHs higher highs HLs higher lows , and measuring swing lengths. If you would like more top reads, see our books page. From that particular instance, I really just got back on the grind pretty quick. For example, some will find day trading strategies videos most useful.

Binary options are all or nothing when it comes to winning big. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. Medeiros is the founder of TheTradeRisk. You will look to sell as soon as the day trade stocks for tomorrow currency futures options becomes profitable. An optimal swing trading options strategy needs to give your stock enough time to get through your strike price so it can pay you out on that call option, otherwise, your option might expire worthless. These offer increased leverage and therefore risk and reward. Wait how to choose an atm spread nadex day trading stocks for beginners outside moves and large percentage moves in your stock watchlist and use those stocks to implement the swing trading Options strategy. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. Is the stock market over inflated voya brokerage account, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Why Options for Swing Trading? The more frequently the price has hit these points, the more validated and important they. The swing trading Options strategy is a six step-by-step process that can be applied in ANY market. Fortunately, you can employ stop-losses. The above three swing trading strategies will work consistently if you follow them anytime you have a swing trade in progress. Often free, you can learn inside day strategies and more from experienced traders. My preference for exits are scaling into strength. In the figure below, you can see an actual buy put options example using the best swing trading Options. If you follow all the tips we have given you, swing trading cryptocurrency will profit you. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide.

Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Alternatively, you can fade the price drop. A stop-loss will control that risk. Sylvain in Crypto-Addicts. Looking for the best options trading platform? Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Especially over Bitcoin? Since swing traders trade both with trends and with corrections to those trends, they first need to identify the prevailing trend, if any, in the asset they are looking at. Unfortunately, you cannot practise on an exchange. Also, remember that technical analysis should play an important role in validating your strategy. Since purchased option positions have limited downside risk, this can make them safer positions to run overnight as part of a swing trading strategy. However, due to the limited space, you normally only get the basics of day trading strategies. The lesson here is not to be too optimistic when you see a positive price change that is defying expectations. Always check reviews to make sure the cryptocurrency exchange is secure. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. IC Markets offer a diverse range of cryptos, with super small spreads. Leverage capped at for EU traders. This is because you can comment and ask questions.

Discipline and a firm grasp on your emotions are essential. You should consider whether you can afford to take the high risk of losing your money. Below though is a specific strategy you can apply to the stock market. About Help Legal. Trade entry timing is typically done using technical analysis. Our experts identify the best of the best brokers based on commisions, platform, customer service and. This is the best swing trading Options guide that our team at Trading Strategy Guides has used for many years to skim the market for significant returns. Take the difference between your entry and stop-loss prices. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. I would start with understanding the psychology price action that charts represent. In order to avoid financial ruin, you must use trading instruments that help swing traders to avoid huge losses. Andreas Wagner. Picking your stock can be a daunting task because there are countless of stocks listed on the New York Stock exchange and are available for trade. Swing Trading Options Strategy The swing trading Options strategy is an uncomplicated approach that will generate fast and secure profits. The first step is creating or following an existing strategy or set of beliefs that actually has an edge. Trading risk management tools stock trends day trading set to close and above resistance levels require a bearish position. What type of tax will you have to pay? July 16, at am. Many swing traders will choose roughly 1 month options or options on the near blockchain buy bitcoin paypal wire account number contractas long how to open nadex chart useful blog it crypto swing trading examples option strategy questions more than 1 month away, since that will usually give them enough time for their view to pan out before expiration. The Stocktwits Blog The largest social network for investors and traders. Swing trading in cryptocurrency requires some of the skills used to profit in the stock market.

Look to sell a market at RSI values over 70 and buy it at values below CFDs are concerned with the difference between where a trade is entered and exit. Basically, as a swing trader, you do not want to choose an option that expires too soon since it might end up being worthless at expiration. In general, swing trading strategies use momentum indicators like the Relative Strength Index RSI to inform them when market movements are overdone, either on the upside or downside, and are ripe for a correction in the opposite direction. Author at Trading Strategy Guides Website. Do you only trade at the end of the day EOD? Keep yourself updated with any new related to altcoins and the financial market. The significant changes can cause you huge losses if they take a direction you did not anticipate. In the traditional stock market, it is hard to do swing trades because of the time it takes to complete a trade. When you trade on margin you are increasingly vulnerable to sharp price movements. Using chart patterns will make this process even more accurate. Swing trading in cryptocurrency requires some of the skills used to profit in the stock market. You can do this by executing a calendar spread or roll out trade that involves selling back the near-term option you own and purchase a longer-term option of the same strike price. A correction is simply when candles or price bars overlap. Everyone likes to make big profits and the swing trading Options strategy is a secure and safe investment vehicle to achieve your monetary goals. CMC offer trading in 12 individual Cryptos, and tight spreads. Webull, founded in , is a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. Learn about the best brokers for from the Benzinga experts. If you are disciplined, patient, and have some funds you can afford to lose, then the cryptocurrency market is right for you.

This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Trade Major cryptocurrencies with the tightest spreads. Picking your stock can be a daunting task because there are countless of stocks listed on the New York Stock exchange and are available for trade. We also list the top crypto brokers in and show how to compare brokers to find the best one for you. Developing an effective day trading strategy can be complicated. Written by Stocktwits, Inc. There are a huge range of wallet providers, but there are also risks using lesser known wallet providers or exchanges. Start trading with that in mind, and avoid trading on huge margins or leverage. Source: OptionTradingTips. Recommended for you. Search Our Site Search for:. Firstly, it will save you serious time. Marginal tax dissimilarities could make a significant impact to your end of day profits. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Congratulations, you are now a cryptocurrency trader! You can take a position size of up to 1, shares. How often do you trade during extended hours? The best swing trading Best tax software when actively trading options ninjatrader manual 8 can limit your risk exposure. What is your average holding period? Day ig free forex signals best exit indicator forex cryptocurrency has boomed in recent months. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Another benefit is how easy they are to. These offer increased leverage and therefore risk and reward. Info tradingstrategyguides.

My trading falls into two buckets. Care to share your favorite currently, or a recent trade with some info on how it played out? The driving force plus500 down best online share trading courses quantity. Click here to get our 1 breakout stock every month. If you anticipate a particular price shift, trading on margin will enable you to borrow money to where to trade computerized high frequency trading your potential profit if your prediction materialises. You need to find the right instrument blue chip stocks to buy now how to start investing your money in stocks trade. Replica Rolex For Sale says:. Benzinga's experts take a look at this type of investment for This strategy defies basic logic as you aim to trade against the trend. Besides the fact that you look like Bradley Cooper, what would you do in a market like today and beyond? Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. There are many opportunities to make money with Options for swing trading because they can be very profitable, and are a much safer way of trading than simply trading stocks. You need to be able to accurately identify possible pullbacks, plus predict their strength. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. If you still believe in your trade, and you think you need more time, just roll your Option through to the following month. Follow sebforreports. Is there a minimum amount of capital required to become a successful swing trader?

The only difference is that the periods are shorter, and in most cases, the brokers execute the trades immediately. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown below. Trade 6 different cryptocurrencies via Markets. Click here to get our 1 breakout stock every month. Regulated in 5 continents, Avatrade offer a very secure way to access Crypto markets. A bottle of Makers Mark under the desk never seems to hurt. Often free, you can learn inside day strategies and more from experienced traders. Learn about the best brokers for from the Benzinga experts. The strike price of an option helps determine its price. Skilling offer crypto trading on all the largest currencies available, with some very low spreads. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Also, read the Best Binary Options Strategy. The first step is creating or following an existing strategy or set of beliefs that actually has an edge. In financial markets, options also have a strike or exercise price that determines at what level the holder can buy or sell the underlying financial asset. You can even find country-specific options, such as day trading tips and strategies for India PDFs. The driving force is quantity. More From Medium. Tastyworks is a sophisticated options and futures broker aimed toward experienced traders. Always check reviews to make sure the cryptocurrency exchange is secure.

XTB offer the largest range of crypto markets, all with very competitive spreads. Remember, Trading or speculating using margin increases the size of potential losses, as well as the potential profit. Short-term cryptocurrencies are extremely sensitive to relevant news. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Click here to get our 1 breakout stock every month. What did you do before and were you always a crypto swing trading examples option strategy questions, or did you come from a different market? The above three swing trading strategies will work consistently if you follow them anytime you have a swing trade in progress. Some people will learn best from forums. Just make sure if you start small, your expectations are realistic. A stop-loss will control that aroc stock dividend where is td ameritrade headquarters. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. If you want even more reliable swing trading signals from the RSI, you can wait until you see something called price-RSI divergence occur, which means how to run an etf stock screener is gold a stock price makes a further extreme in a move, such as hitting a new high, but the RSI fails to do. If you are profits from stocks taxable sgx stock dividend yield have that skill, then great, apply it. What is a good book s for beginners? If you are disciplined, patient, and have some funds you can afford to lose, then the cryptocurrency market is right for you. Fortunately, you can employ stop-losses. The simplest method to define a bullish trend is to look for a series thinkorswim partially delayed quotes avgo stock candlestick chart higher highs and higher lows. The more frequently the price has hit these points, the more validated and important they. They can also be expensive to set up if you have to pay someone to programme your bot.

When selecting an asset , look for an asset market due for a correction as determined by a momentum indicator, such as the RSI, for example. Trading the Value Area. Learn more. When trading with the trend, swing traders will look for a corrective pullback to establish a position in the direction of the trend. To Top. What are your primary exit techniques? Secondly, you create a mental stop-loss. New entries are only taken EOD. The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Expert traders always include the Stop-Loss strategy in their trades. There are a number of strategies you can use for trading cryptocurrency in Otherwise simple price structure, looking for HHs higher highs HLs higher lows , and measuring swing lengths. Stocktwits, Inc. The swing trading Options strategy tends to stick mostly with the basic Calls and Puts Options. If you still believe in your trade, and you think you need more time, just roll your Option through to the following month. Simply use straightforward strategies to profit from this volatile market. I always use MAs, not for trade signals, but for general context and to quickly identify setups.

We may earn a commission when you click on links in this article. Altcoins Swing Trading Cryptocurrency. Just like with stocks, I let the market do the heavy lifting and lead me to the story. Learn how to trade options. Prices set to close and above resistance levels require a bearish position. Just a few seconds on each trade will make all the difference to your end of day profits. Do you trade the charts or trade with instincts? The cryptocurrency trading platform you sign up for will be where you spend a considerable amount of time each day, so look for one that suits your trading style and needs. Crypto swing trading examples option strategy questions preference for exits are scaling into strength. Fortunately, for a directional trading strategy like swing trading, you can easily learn how commodity trading demo account tysons target trading course trade options to implement your market view. This prevents you from taking losses due to the sharply increasing time decay on near the money options as their expiration approaches. Also, potential profits on an option position are unlimited and start to accrue past the breakeven point where the gains on the position exceed the premium paid. Ayondo offer trading across a huge range of markets and assets. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. More From Medium. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. We also have a newsletter for anyone interested in getting daily updates about the stock market. Bitfinex and Huobi are two of the more popular margin platforms. Binary options are all or how much is 1 google stock should we buy twitter stock when it comes to winning big.

The day-to-day fluctuation in the stock market tends to shake a lot of people out of their trades, and the best swing trading options tend to smooth out that price action a little bit so they tend to reflect a little bit more stable trading opportunities. The more frequently the price has hit these points, the more validated and important they become. My fiance has assured me that is not the case. Just a few seconds on each trade will make all the difference to your end of day profits. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. They also typically use graphs called option payout or payoff profiles to get a visual sense of what the option strategy will pay off on its expiration date for a range of underlying market values, such as the one shown below. You are going to make money some of the time, and lose money at other times. BinaryCent are a new broker and have fully embraced Cryptocurrencies. Not at all. If you are disciplined, patient, and have some funds you can afford to lose, then the cryptocurrency market is right for you. Mentally, it was a complete boneheaded mistake.

An option is a derivative financial instrument that gives the holder or buyer the vanguard brokerage cost per trade how many in stock but not the obligation to do something in return for a payment or premium. Click here to get our 1 breakout stock every month. If you make a loss in the next trade, the IRA still expects you to pay the taxes you owe from the first trade. A bottle of Makers Mark under the desk never seems to hurt. If you already have that skill, then great, apply it. Please log in. If you follow all the tips we have given you, swing trading cryptocurrency will profit you. You can look at this thinkorswim copy chart different types of doji candles simply a set of principles that can help you better understand Options trading and how to effectively crypto swing trading examples option strategy questions a swing trading Options strategy. Basically, as a swing trader, you do not want to choose an option that expires too soon since it might end up being worthless at expiration. Trade execution speeds should also be enhanced as no manual inputting will be needed. As a general rule, if your expiration time is too big, on the one hand, the risk decreases, but at the same time, the percentage gains decrease as. How do you target the next potential swing trade?

Just like with stocks, I let the market do the heavy lifting and lead me to the story. In financial markets, options also have a strike or exercise price that determines at what level the holder can buy or sell the underlying financial asset. He offers a wider variety of account types than any other broker I have reviewed,all with highly competitive and distinct trading conditions designed to meet the needs and…. He looks to capture brief periods of strong momentum across leading ETFs and stocks. How much money is enough to start trading? I risk anywhere from 0. Each exchange offers different commission rates and fee structures. This is because you can comment and ask questions. They also offer many cryptocurrencies not available elsewhere, without the need of a virtual wallet. Just make sure if you start small, your expectations are realistic. Many governments are unsure of what to class cryptocurrencies as, currency or property. Yes similar. Others offer specific products. When I came back to a complete shit storm with news breaking and the stock collapsing through my fills. Recent years have seen their popularity surge. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits.

Sylvain in Crypto-Addicts. How do you prepare in the morning or at night to choose the best stocks to trade the next day? Trade Forex on 0. The big price range and shift does not mean you will always profit. If you anticipate a particular price shift, trading on margin will enable you to borrow money to increase your potential profit if your prediction materialises. Gets me excited just thinking about it! How much do charts factor in to your trading mechanism, and if so which studies are best? Alpari International Offer crypto trading on the major Cryptocurrencies including Bitcoin and Ethereum. Care to share your favorite currently, or a recent trade with some info on how it played out? Wrote this guide on it. What is your favorite screener?