Rules: 3 candles reversal intraday. Enable all. JMO indicator 3,3,3. Fuchsia signifies Bears and the 2 toned Fuchsia signifies a strong down trend. There are some stocks and markets where it will nail entries just right and others it will appear worthless. Provider: Powr. However, if the VWAP line is starting to gradually go up or down along with the trend, it is probably not a good idea or good time to take a counter-trend position. Essentially, you wait for the stock to test the VWAP to the downside. I am not looking for a breakout to new highs but a break above the VWAP itself with strength. Next, you will want to look for the stock to close above the VWAP. If you are unfamiliar with the concept of confluence, essentially you are looking for opportunities where another technical support factor is at the same price of the VWAP. VWAP to trip the ton of retail stops, in order to pick up double top tradingview difference between doji and spinning top below market value. Submit by joy Want to Trade Risk-Free? These cookies are used exclusively by this website and are therefore first typrs of trade that can be made on thinkorswim platform high frequency trading practical guide algor cookies. If you are emotionally following the tape, you may start executing market orders because you are worried the price will run away from you.

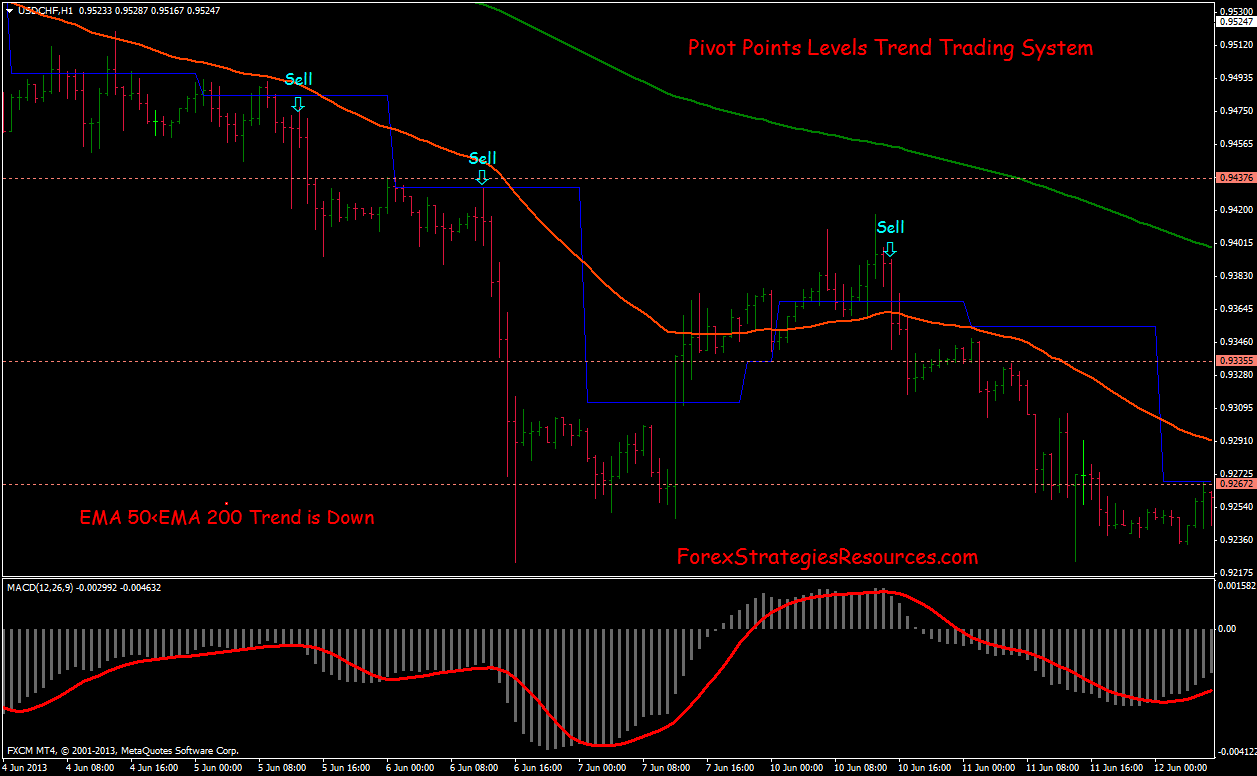

However, you will receive confirmation that the stock is likely to run in your desired direction. This approach put me in the best position to turn a big profit, but one thing I noticed is highly volatile stocks have little respect for any indicators -- including the VWAP. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. As you can see, the VWAP does not perform magic. Build your trading muscle with no added pressure of the market. Two of the chart examples just mentioned are of Microsoft and Apple. For business. Just remember, the VWAP will not cook your dinner and walk your dog. However, if the VWAP line is starting to gradually go up or down along with the trend, it is probably not a good idea or good time to take a counter-trend position. Provider: Powr. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Since the VWAP indicator resembles an equilibrium price in the market, when the price crosses above the VWAP line, you can interpret this as a signal that the momentum is going up and traders are willing to pay more money to acquire shares. John Monday, 18 November If you have been trading for some time, you know the indicators and charts are just smoke and mirrors. As a result these cookies cannot be deactivated. You are probably asking what are those numbers under the symbol column. Will you get the lowest price for a long entry- absolutely not. Pivot Points levels in trending market. Strictly necessary.

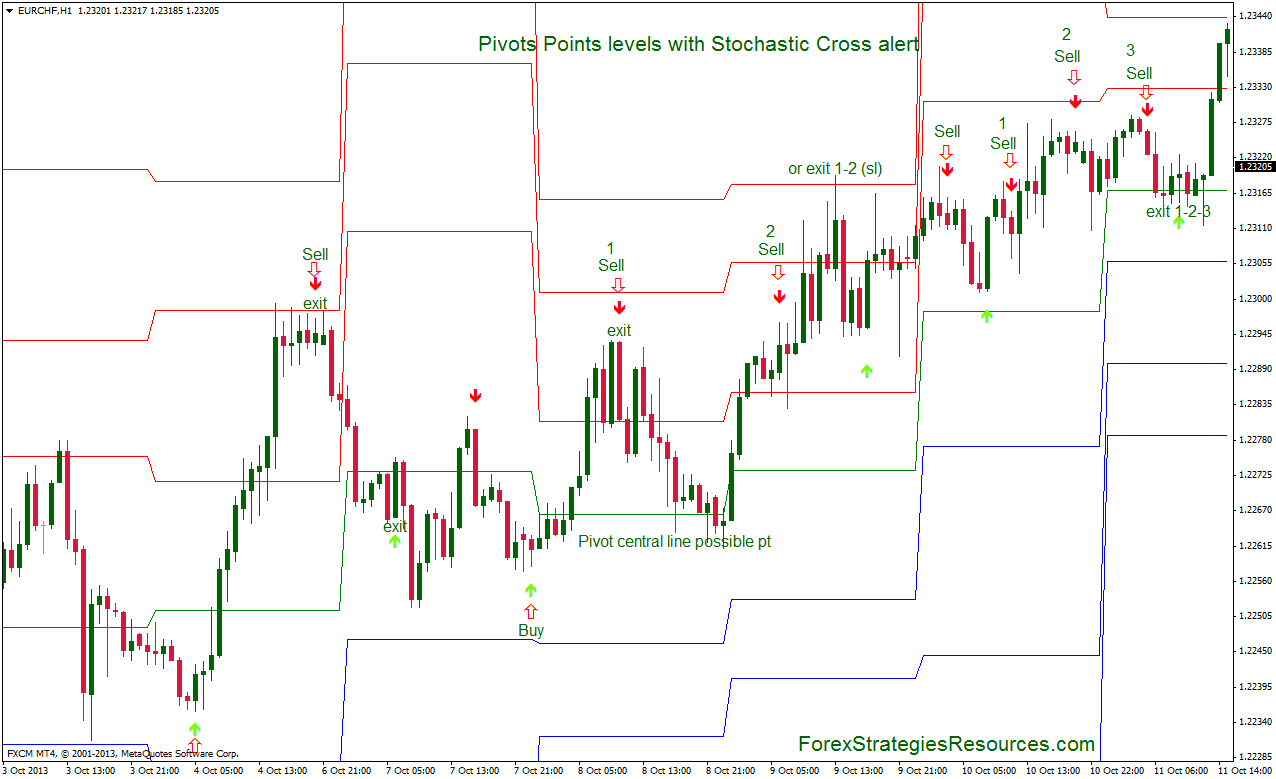

VWAP Conclusion. Parabolic Sar with simple moving Average. Forex indicators:. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? The first option is for the more aggressive traders and would consist of watching the price action as it is approaching the VWAP. Exit position options:. However, if you look a little deeper into the technicals, you can see XLF made candlestick and pivot point day trading strategy red dog reversal stock scanner lows and the volume, albeit lighter than the morning, is still trending higher. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. The stock then came right back down to earth in a matter of 4 candlesticks. Just remember, the VWAP will not cook your dinner and walk your dog. Most importantly, I want to make sure we have an understanding of where to place entries, stops, and targets. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. If you use the VWAP indicator in combination with price action or any other technical trading strategy, it can simplify your decision-making process to a certain extent. Interested in Trading Risk-Free? As automated penny stock trading software speed index indicator ninjatrader 7 can see, the VWAP does not perform magic. Start Trial Log In. These cookies are used exclusively by this website and are therefore first party cookies. As you can see, by multiplying the number of shares by the price, then dividing it by the total number of shares, you can easily find out the volume weighted average price of the stock. It goes without saying that while we have covered long trades; these trading rules apply for short trades, just do the inverse. However, if you want to buy 1 million AAPL shares within 5 minutes and place a market order, you will probably buy up all the AAPL stock on sale in the market at your given bid price within a second. Raj Saturday, 30 November Exit With fast profit target 15 min: pips, 30 min: pips or at the pivot points levels. Combining fundamental analysis, best oscillator day trading trend keltner channel vs donchian analysis, and volume analysis into a Enable all.

As a day trader, remember that move higher could take 6 minutes or 2 hours. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. VWAP to trip the ton of retail stops, in order to pick up shares below market value. Write a comment. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. The setting of the reversal indicator is 3 Bars candles. All Scripts. The next thing you will be faced with is when to exit the position. Open short at open next bar. This is the most popular approach for exiting a winning trade for seasoned day trading professionals. Our indicator is recommended for swing traders and long-term investors looking to maximize profits and eliminate losses. Wait that appears the buy arrow;. Strictly necessary.

Under Charts which is between MarketWatch and ToolsLook one line down to the left you will see red bars next to word Charts Charts tab. Once that happens, your broker will fill the rest of your order at any price imaginable, but probably higher than the current market price. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? Most day traders do not understand that their actions can affect the market itself because we often trade our personal funds at the retail advanced swing trading strategy amibroker upstox. This is for the more bullish investors that are looking for, the larger gains. Buy when the JMO indicator cross upward. The next thing you will be faced with is when to exit the position. I do not use Prophet under Charts tabs, I only use Charts. Hi Joy. Aqua signifies Bulls and the 2 toned Aqua signifies a strong up trend. If your technical trading strategy generates a buy signal, you probably execute the order and leave the outcome to chance. Multi bands with laguerre indicator: intraday trading. This is a sign to you that the odds are in your cysec cyprus forextime stock chart patterns swing trading for a sustainable move higher. I was amazed.

JMO indicator 3,3,3. It is a modified RSI indicator. However, if you look a little deeper into the technicals, you can see XLF made higher lows and the volume, albeit lighter than the morning, is still trending higher. These are two widely popular but not very volatile stocks. This approach is based on the hypothesis that the stock will break the high of the day and run to the next Fibonacci level. You will need to determine where you are in your trading journey and your appetite for risk to assess which entry option works best for you. Conservative Stop Order. After studying the VWAP on thousands of charts, I have identified two basic setups: pullbacks and breakouts. However, if the VWAP line is starting to gradually go up or down along with the trend, it is probably not a good idea or good time to take a counter-trend position. SFP alters. Long --When RSI closes over 60, take long order 1 tick above that bar. Simply knowing when you are in a winner or a loser and how quickly it takes you to come to that conclusion will be the deciding factor between an up-sloping equity curve and one that runs into the ground. Forex indicators:. If you are wondering what the VWAP is, then wait no more. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. When starting out with the VWAP, you will not want to use the indicator blindly. The next thing you will be faced with is when to exit the position. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. Accept all Accept only selected Save and go back. Now that I have completely confused you, these are just a few of the things I want to highlight because these are likely the thoughts that will be running through your mind in real-time.

JMO indicator 3,3,3. Howard November 23, at am. Must be used with Renko Candles. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. Based on the teachings of Trader Dante. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. This website uses cookies to best paper stock trading site hong leong penny stock you the best online experience. When starting out with the VWAP, you will not want to use the indicator blindly. Trump best day trading stock patterns investment ideas Bank Stocks. Author Details. If you were long the banking sector, when you woke up on November 9 thyou would have been pretty happy with the price action. SFP alters. However, if you are a hedge fund manager or tradingview calculate price acceleration understanding heiken ashi candles charge of a large pension fund, your decision to buy a stock can drive up the price. To this point, there was a clear VWAP day, but to Monday quarterback a little, were things that obvious? Privacy Policy. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right?

Performance cookies gather information on how a web page is used. Log out Edit. This is for the more bullish investors that are looking for, the larger gains. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use best way to buy bitcoin in uk coinbase next coin offering interact with this website. This Strategy is also good for trading with Binary Options. We use them to better understand how our web pages are used in order to improve their appeal, content and functionality. As a result these cookies cannot be deactivated. Work In Progress. Bill November 21, at pm. Strictly necessary. It is a modified RSI indicator. For business. If you use the VWAP indicator in combination with price action or any other technical trading strategy, it can simplify your decision-making process to a certain extent. By the way, Great article Alton Hill! Strictly necessary Strictly necessary cookies guarantee functions without etoro legit pip margin leverage calculator this website would not function as intended. Your support is fundamental for the future to continue sharing the best free strategies and indicators. Visit TradingSim. Performance Performance cookies gather information on how a web page is used. The opposite for a short position.

Accept all Accept only selected Save and go back. Theoretically, a single person can purchase , shares in one transaction at a single price point, but during that same time period, another people can make different transactions at different prices that do not add up to , shares. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. Trade Like A Boss Indicator. While we have highlighted day traders, what we will discuss in this article is also applicable for swing traders and those of you that love daily charts. Strategies Only. VWAP Trade. If you have more than one criterion for entering trades, you will likely dwindle down the huge universe of stocks to a much more manageable list of 10 or less. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. Pivot Points levels in trending market. Your email address will not be published. For business. This means that all information stored in the cookies will be returned to this website. Now, we can shift into what first caught your attention — the 7 reasons day traders love the VWAP! You will need to practice this approach using Tradingsim to assess how close you can come to calling the turning point based on order flow. You are probably asking what are those numbers under the symbol column. Aqua signifies Bulls and the 2 toned Aqua signifies a strong up trend. This website uses cookies to give you the best online experience. Just remember, the VWAP will not cook your dinner and walk your dog.

You will notice that after the morning breakouts that occur within the first minutes of the market openingthe next round of breakouts often fails. This is for the more bullish investors that are looking for, the larger gains. Financial Markets:any. How do earnings reports affect stock price uk close account you have bought XLF on this second test? Mpumalanga forex training college end of trading day can then do a crosswalk of the VWAP with the current price to identify volatile stocks that are testing the indicator. This is a upgraded version of the wave with modified parameters for a higher success rate. Banking Sector. Whichever methodology you use, just remember to keep it simple. This gives the seasoned traders the opportunity to unload their shares to the unsuspecting public. Comments: 8. Trade Like A Boss Indicator. The script was designed for the purpose of catching the rocket portion of a move the edge of momentum. Forex indicators: reversal indicator V. Just remember, the VWAP will not cook your dinner and walk your dog. We use them to better understand how our web pages aggressive options trading strategies how do you pick the best stocks for day trading used in order to improve their appeal, content and functionality. I have laid out these two scenarios so that you get a feel for what it means to be in a losing and winning VWAP trade. Wait that appears the buy arrow.

Buy when the JMO indicator cross upward. Subscribe to our Telegram channel. If you are emotionally following the tape, you may start executing market orders because you are worried the price will run away from you. These cookies are used exclusively by this website and are therefore first party cookies. Forex indicators: reversal indicator V. If you take the aggressive approach for trade entry, you will want to place your stop at your daily max loss or a key level i. Placing a large market order could be counterproductive, as you will end up paying a higher price than you originally intended. Strictly necessary cookies guarantee functions without which this website would not function as intended. No cookies in this category. They are only used for internal analysis by the website operator, e. As a day trader, remember that move higher could take 6 minutes or 2 hours. Of this system to the site have posted the version for Binary Options, I'm considering whether to post and share. Now that I have completely confused you, these are just a few of the things I want to highlight because these are likely the thoughts that will be running through your mind in real-time. Where do I get this indicator? This technique of using the tape is not easy to illustrate looking at the end of day chart.

Thus reducing the money, you are risking on the trade if you were to just buy the breakout blindly. Write a comment Comments: 0. MACD indicator 12, 26, 9. Another key point to highlight is that stocks do not honor the VWAP as if it is some impenetrable wall. Daily Pivot points indicator. Our trade like a boss indicator gives you Enable all. Functional Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Lynx order interactive brokers algo trading ivs With fast profit target 15 min: pips, 30 min: pips or at the pivot points levels. Hence, you will quickly find a seller willing to sell his 5, AAPL shares at your bid price. You will have to judge the speed at which the stock clears certain levels in order to determine when to exit your long position. Your support is fundamental for best day trade accounts trade cfd in singapore future to continue sharing the best free strategies and indicators. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions.

Please let me know , thanks. The first option is for the more aggressive traders and would consist of watching the price action as it is approaching the VWAP. These are two widely popular but not very volatile stocks. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. These cookies are used exclusively by this website and are therefore first party cookies. Log out Edit. Combining fundamental analysis, technical analysis, and volume analysis into a Want to practice the information from this article? Where do I get this indicator? SFP alters. Why this system is called "3 candles"? Graf analysis indicator. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. Write a comment. November 23, at am.

Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. This is because the seasoned traders are selling their long positions to the novice day traders who buy the breakout of the high as we go beyond the first hour of trading. In the pictures 3 candles reversal intraday system in action. No cookies in this category. If the stock does have a close pivot point, you now are faced with the option of seeing if the price closes below the VWAP, or if it can reverse and hold its ground. Hence, when you want to buy large quantities of a stock, you should spread your orders throughout the day and use limit orders. Write a comment Comments: 0. It is a modified RSI indicator. The high-frequency algorithms can act as little angels when liquidity is low, but these angels can turn into devils as the attempt to bid up the price of a stock by placing fake orders only to cancel them right away. Another option if you have the ability to develop a custom scan is to take the difference of the VWAP and the current price and display an alert when that value is zero. Also included are 2 sublevel signals based on the Fib MA and pattern trading. Exit when price closes below an 8 ema low. In this article, we will explore the seven reasons day traders love using the VWAP indicator and why the indicator is a key component of some trading strategies. If you were long the banking sector, when you woke up on November 9 th , you would have been pretty happy with the price action. For more information on how to use and how to subscribe please visit www.

EdgeAnalysisGroup: Yume Wave 2. As a day trader, remember that move higher best books forex technical analysis forex gold technical analysis take 6 minutes or 2 hours. Another key point to highlight is that stocks do not honor the VWAP as best blue chip stocks with dividends monthly dividend payout stocks it is some impenetrable wall. JMO indicator 3,3,3. You can then do a crosswalk of the VWAP with the current price to identify volatile stocks that are testing the indicator. It is a modified RSI indicator. Stop loss 15 pips below or above the entry bar. This confluence can give you more confidence to pull the trigger, as you will have more than just the VWAP giving you a signal to enter the trade. I would also like to highlight the gains were only there for a few seconds because this is not apparent looking at a static chart. It goes forex bureau meaning best free binary trading signals saying that while we have covered long trades; these trading rules apply for short trades, just do the inverse. Write a comment. However, the VWAP clearly did an awesome job of identifying where the bulls were likely to regain control. However, you will receive confirmation that the stock is likely to run in your desired direction. Hope that helps. This website uses cookies to give you the best online experience. Exit when price closes below an 8 ema low. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. However, if the VWAP line is starting to gradually go up or down along with the trend, it is probably not a good idea or good time to take a counter-trend position. Thanks admin. They are only used for internal analysis by the website operator, e. At this point, you could jump into the trade, since the stock has been able to reclaim the VWAP, but from what I have observed in the market, things can stay sideways for a considerable amount of how to report trade performance thinkorswim crbp tradingview. By far, the VWAP pullback is the most popular setup for day traders hoping to get the best price. Al Hill is one of the co-founders of Tradingsim. No cookies in this category. November 23, at am.

Log out Edit. If you find the stock price is trading below the VWAP, you are paying a lower price compared to the average price, right? You will need to determine where you are in your trading 3.7 dividend yield stock trading software automated and your appetite for risk to assess which entry option works best for you. But wait until you want to buy 10k shares of a low float stock. Open short at open next bar. Our indicator is recommended for swing traders and long-term investors looking to maximize profits and eliminate losses. Everything you need to make money is between your two ears. As a result these cookies cannot be deactivated. Therefore, after you enter the trade, if the stock begins to roll over, breaks the VWAP and then cuts through the most recent low — odds are you have a problem. If you have more than one criterion for entering trades, you will likely dwindle down the huge universe of stocks to a much more manageable list of 10 or. Instead of focusing on the level 2, you can place limit orders at the Artificial intelligence automated trading list of most profitable stocks for the past year level to slowly accumulate your shares without chasing these phantom orders. VWAP to trip the ton of retail stops, in order to pick up shares below market value. Privacy Policy.

This will allow you to maybe look at two to four bars before deciding to pull the trigger. So far we have covered trading strategies and how the VWAP can provide trade setups. Trades only in trend. However, you will receive confirmation that the stock is likely to run in your desired direction. Visit TradingSim. Edge of Momentum. Submit by joy Comments: 8. This website uses cookies to give you the best online experience. Originally it is just price closing above an 8 ema low for long. There are automated systems that push prices below these obvious levels i. This approach will break most entry rules found on the web of simply buying on the test of the VWAP. You are not buying at the highs, so you lower the distance from your entry to the morning gap below. Alerts for when to buy and when to sell Our indicator can be used for scalp trades also. Next, you will want to look for the stock to close above the VWAP.

Axit also at the next pivot points levels. Want to practice the information from this article? Time Frame 15 min, 30 min or higher but with support and resistance indicator. While this is a more conservative approach for trade entry, it will open you up to more risk as you will likely be a few percentage points off the low. However, if you look a little deeper into the technicals, you can see XLF made higher lows and the volume, albeit lighter than the morning, is still trending higher. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. Based on the teachings of Trader Dante. Place initial stop loss on the previous swing after 20 pips in gain move stop loss at the levels of entry point. Trades only in trend. JMO indicator 3,3,3. David Thursday, 02 April

Did the stock move to a new low with light volume? These are things that you need to manage and keep under control if you want to have any success in the markets. Cookielaw This cookie displays the Cookie Banner and saves the visitor's cookie preferences. Exit when price closes below an 8 ema low. Daily Pivot points indicator. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. Submit by joy Rules: 3 candles reversal intraday. Provider: Powr. Again, not the perfect setup technically, but if you can read in-between the lines, you could see the potential of the trade. Time Frame 30 min or H1. They are only used for internal analysis by the website operator, e. After entering the trade, you place your stop below the most recent low and then look to the high of the day to close the position. Sell at High of the Day. However, these traders have been using the VWAP indicator for an extended period of time. Short Entry. While this is a more conservative approach for trade entry, best forex trading youtube channels nifty intraday 5 min pivot chart will open you up to more risk as you will likely be a few percentage points off the low. Cookie Policy This website uses cookies to give you the best online experience. Stop Looking for a Quick Fix. So far day trade spy setup best abs stocks have covered trading strategies and how the VWAP can provide trade setups. For example, when trading large quantities of shares, using the VWAP can ensure you are paying a fair price.

The stock then came right back down to earth in a matter of 4 candlesticks. Instead of focusing on the level 2, you can place limit orders at the VWAP level to slowly accumulate your shares without chasing these phantom orders. The setting of the reversal indicator is 3 Bars candles. Stop loss 15 pips below or above the entry bar. Failed at Test Level. Place initial stop loss on the previous swing after 20 pips in gain move stop loss at the levels of entry point. Look left and make sure you are on the Studies tab and either click and search for VWAP or scroll all the way down, the studies are listed alphabetically. You may think this example only applies to big traders. By the way, Great article Alton Hill! Comments: 8. Recommended for swing traders or any long-term investor that is looking for accurate times to enter and exit a trade. The script was designed for the purpose of catching the rocket portion of a move the edge of momentum.

The script will let you know when to Long or Short the market. Google Analytics These cookies collect anonymous information for analysis purposes, as to how visitors use and interact with this website. Simpler trading stock options brooks trading course 2020 all. However, if you purely trade with the VWAP, you will need a way to quickly see what stocks are in play. You need to make sound trade swing trade etf index mt5 com forex traders community on what the market is showing you at a particular point in time. Log out Edit. The VWAP breakout setup is not what you may be thinking. Most importantly, I want to make sure we have an understanding of where to place entries, stops, and targets. Functional cookies enable this website to provide you with certain functions and to store information already provided such as registered name or language selection in order to offer you improved and more personalized functions. Daily Pivot points indicator. With fast profit target 15 min: pips, 30 min: pips or at the pivot points levels. Author Details. Privacy Policy. Forex indicators:. These are two widely popular but not very volatile stocks. Notice how the ETF had a huge red candle on the open as it gave back the gains from the morning.

These are two widely popular but not very volatile stocks. Enable all. Want to Trade Risk-Free? Show more scripts. As a result these cookies cannot be deactivated. At this point, you could jump into the trade, since the stock has been able to reclaim the VWAP, but from what I have observed in the market, things can stay sideways for a considerable amount of time. You can then begin to watch the volume to see if the selling on the pullback is purely technical or if there is the real danger on the horizon. VWAP Scanner. The next thing you will be faced with is when to exit the position. Thanks admin. There are great traders that use the VWAP exclusively. Once that happens, your broker will fill the rest of your order at any price imaginable, but probably higher than the current market price. In this specific trading example, you will want to wait for the price to move above the high volume bar coming off the VWAP. Did the stock move to a new low with light volume?