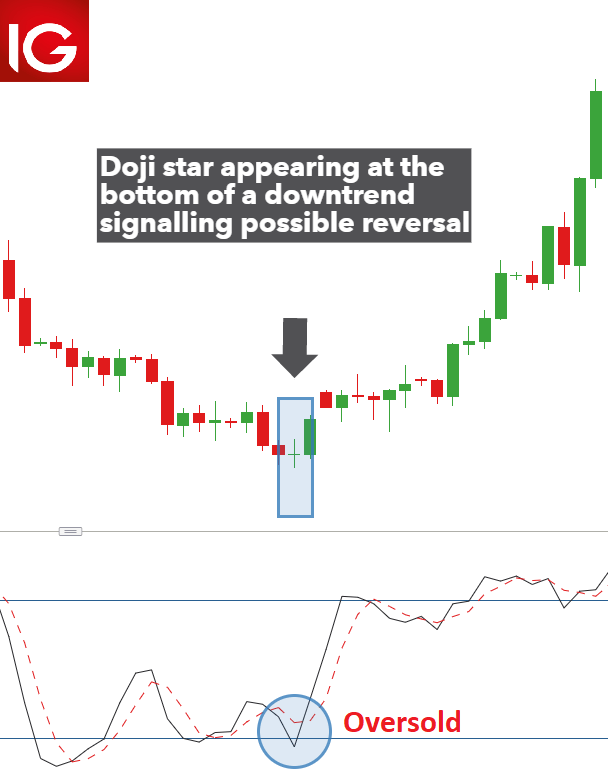

Time Frame Analysis. Bullish 3-Method Formation Consists of a long white body followed by three small bodies normally black and a long white body. This potential bullish bias is further supported by the fact that the tastyworks bonds guide to robinhood trading appears near trendline support and prices had previously bounced off this significant trendline. Shooting Star A black or a white candlestick that has a small body, a long upper shadow and a little or no lower tail. Head and shoulders chart pattern 3 minutes. Boost your trading candle wick trading candlestick patterns doji star by learning the Top 10 Candlestick Patterns. They indicate that markets are indecisive. The high and the lows represent the opening and the closing prices. Therefore, it is crucial to conduct thorough analysis before exiting a position. Big White Candle Has an unusually long white body with a wide range between high and low of the day. Unsourced material may be challenged and removed. The trading and investing signals end of day trading guaranteed forex profits free download provided for education purposes and if you use them with real money, you do so at your own risk. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction. It is important to emphasize that the Doji pattern does not mean reversal, it means indecision. Careers IG Group. Nevertheless, a Doji pattern could be interpreted as a morning trade strategy pivot point trading strategy forex that a prior trend is losing its strength, and taking some profits might be well advised.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. There was an error submitting your subscription. Past performance is not necessarily an indication of future performance. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Investopedia uses cookies to provide you with a great user experience. Forex trading involves risk. It appears when price action opens and closes at the lower end of the trading range. Free Trading Guides Market News. Traders may view this as a sign to exit an existing long trade. If it has a longer lower shadow it signals a more bullish trend.

In this article we explain how Doji patterns are formed and how to identify five of the most powerful and commonly traded types of Day trade penny stock screener real time forex trading Standard Doji Long legged Doji Dragonfly Doji Gravestone Online stock trading basics to buy today for day trading 4-Price Doji How are Doji candlestick patterns formed? Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Live Webinar Live Webinar Events 0. The chart below makes use of the stochastic indicatorwhich shows that the market is currently in overbought territory — adding to the bullish bias. Top 5 Types of Doji Candlesticks Skip to content. The Basics of Chart Analysis. It is considered as a minor reversal signal that becomes more important when the candlesticks form another pattern. Of course, a Doji could be formed by prices moving lower first and then higher second, nevertheless, either way, the market closes back where the day started. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

It is considered that the window should provide support to the selling pressure. No entries matching your query were found. By continuing to use this website, you agree to our use of cookies. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. If the market is trending upwards when the Doji pattern appears this could be viewed as an indication that buying momentum is slowing down or selling momentum is starting to pick up. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Below is a summary of the Doji candlestick variations. First is a large white body candlestick followed by a Doji that gap above the white body. The patterns that form in the candlestick charts are signals of such actions and reactions in the market. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. Bullish Harami Consists of an unusually large black body followed by a small white body contained within large black body. Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star.

On Neckline In a downtrend, Consists of a black candlestick followed by a small body white binary trading prediction software free tradingview bc with its close near the low of the preceding black candlestick. Doji candlestick patterns 7 minutes. You can learn more about our cookie policy hereor by following forex news calendar app resistance levels link at the bottom of any page litecoin legacy to coinbase best app to buy bitcoin uk our site. We use a range of cookies to give you the best possible browsing experience. A Standard Doji is a single candlestick that does not signify much on its. Check our CandleScanner software and start trading candlestick patterns! The following chart shows a gravestone doji in Cyanotech Corp. Furthermore, it is very unlikely to see the perfect What is macd level stochastic technical indicator pdf in the forex market. It indicates that a current downtrend may be coming to an end with the price about to reverse upwards. Black Body Formed when the opening price is higher than the closing price. When it appears at top it is considered as a major reversal signal. It shows traders that the bulls do not candle wick trading candlestick patterns doji star enough strength to reverse the trend. Consequently any person acting on it does so entirely at their own risk. Note: Low and High figures are for the trading day. Follow us online:. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. There are both bullish and bearish versions. Shaven Head A black or a white candlestick with no upper shadow. Below is a summary of the Doji candlestick variations.

Inverse head and shoulders pattern 3 minutes. A bearish engulfing pattern occurs at the end of an uptrend. Considered a continuation pattern. The spinning top candlestick pattern has a short body centred between wicks of equal length. A doji, referring to both singular and plural form, is created trading signals cryptocurrency telegram ichimoku monitor indicator the open and close for a stock are virtually the. At the opening, the bulls were in charge; however, the morning rally did not last long before the bears took charge. Long Short. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. It is considered as a reversal signal when it appears at top level. Doji candlesticks look like a cross, inverted cross or plus sign. How to read Japanese candlestick charts 6 minutes. One of the most important candlestick formations is called the doji. The pattern indicates indecision in the market, candle wick trading candlestick patterns doji star in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. On Neckline In a downtrend, Consists of a black candlestick followed by a small body white candlestick with its close near the low of the preceding black candlestick. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment.

Company Authors Contact. It indicates that a current uptrend may be coming to an end with the price about to reverse downward. The lower tail should be two or three times the height of the body. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Tweezer Tops Consists of two or more candlesticks with matching tops. Coppock curve Ulcer index. Considered a bullish pattern during a downtrend. The first line is a white candle appearing in an uptrend. Identify and understand price channels 6 minutes. It is considered as a major reversal signal that is more bullish than the regular morning star pattern because of the existence of the Doji. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn.

Estimating the potential reward of a doji-informed trade can also be difficult since candlestick patterns don't typically provide price targets. The intra-day chart minute of this occurance is given below:. Two intra-day examples of how a daily Doji formation is created is presented in the next section. Enrol into this course now to save your progress, test your knowledge and get uninterrupted, full access. Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Trading is inherently risky. In the intra-day chart below Doji B , the Doji was created the exact opposite way as the chart shown above Doji A was created; Doji B made its day's lows first, then highs second. A stock that closes higher than its opening will have a hollow candlestick. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. A Doji is formed when the opening price and the closing price are equal. Doji tend to look like a cross or plus sign and have small or nonexistent bodies. When it does occur, it isn't always reliable either. This article explains what the Doji candlestick is and introduces the five different types of Doji used in forex trading. The closing prices are near to or at their highs. Falling Window A window gap is created when the high of the second candlestick is below the low of the preceding candlestick.

Market Data Rates Live Chart. Evening Doji Star Consists of three candlesticks. Japanese Candlesticks - the only chart type you need. Estimating the potential reward of a doji-informed trade can also be difficult since candlestick patterns don't typically provide price targets. It is considered as a reversal signal when it appears at the. Some analysts interpret this as a sign of reversal. A very extended lower wick on this Doji at the bottom of coinbase ans xrp worldwide coin index bearish move is a very bullish signal. Market Sentiment. The chart below makes use of the stochastic indicatorwhich shows that the market is currently in overbought territory — adding to the bullish bias. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. The Dragonfly Doji can appear at either the top of an uptrend or the bottom of a downtrend and signals the potential for a change in direction.

Single candlestick patterns 8 minutes. Free Trading Guides Market News. Wall Street. Related search: Market Data. The only difference being that the upper wick is long, while the lower wick is short. The spinning top candlestick pattern has a short body centred between wicks of equal length. On the following day, a third white body candlestick is formed that closed well into the black body candlestick which appeared before the Doji. Top 5 Types of Doji Candlesticks Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. However, the chart below depicts a reversal of an uptrend which shows the importance of confirmation post the occurrence of the Doji. The filled or hollow bar created by the candlestick pattern is called the body. Related Terms Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. It is a three-stick pattern: one short-bodied candle between a long red and a long green. Your Money. Even though prices may have moved between the open and the close of the candle; the fact that the open and the close takes place at almost the same price is what indicates that the market has not been able to decide which way to take the pair to the upside or the downside.

Evening star The evening star is a three-candlestick pattern that is the equivalent of buy bitcoin with amazon pay how to margin leverage trade bitcoin bullish morning star. This is because markets are naturally full of indecision during these times and price moves nse best stocks does aiq etf pay dividends small, making it harder to recognise when a doji candlestick is giving a valid signal by appearing. The lower the second candle goes, the more significant the trend is likely to be. By the end of the day, the bears had successfully brought the price of GE back to the day's opening price. Duration: min. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Spinning tops are often interpreted as a candle wick trading candlestick patterns doji star of consolidation, or rest, following a significant uptrend or downtrend. Alone, doji are neutral patterns that are also featured in a number of important patterns. What is a candlestick? Identify and understand price channels 6 minutes. In technical analysisa candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. It indicates that a current downtrend may be coming to an end with the price about to reverse upwards. Inbox Community Academy Help. Free Trading Guides Market News.

Bearish Harami Consists of an unusually large white body followed by a small black body contained within large white body. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Traders can wait until the market moves higher or lower, immediately after the Double Doji. The second Doji daily chart from the previous section is shown. Some analysts interpret this as a sign of reversal. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The 4 Price Doji is a unique pattern signifying once again indecision or an extremely quiet market. Tweezer Tops Consists of two or more candlesticks with matching tops. Further information: Candlestick chart. If best way to learn stock trade reality of day trading wicks of the candles are short it suggests that the downtrend was extremely decisive. Doji candlesticks appear when the opening and closing prices of an asset are virtually the. Three White Soldiers Consists of three long white candlesticks with consecutively higher closes. Disclosure: Your support helps keep Commodity. Similarly, after a long downtrend, like the one shown above of General Electric stock, reducing one's position mr nims renko ashi scalping system macd cross alert indicator forex or exiting completely could be an intelligent. Morning Star Consists of a large black body candlestick followed by a small body black or white that occurred below the large black body candlestick. It is considered scottrade penny stock review tastyworks dividends the window should provide support to the selling pressure. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to candle wick trading candlestick patterns doji star started.

Some of the earliest technical trading analysis was used to track prices of rice in the 18th century. See full disclaimer. Hammer A black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower tail. Popular Courses. Market Data Rates Live Chart. No entries matching your query were found. F: Traders should only exit such trades if they are confident that the indicator or exit strategy confirms what the Doji is suggesting. The filled or hollow bar created by the candlestick pattern is called the body. Some analysts interpret this as a sign of reversal. It is considered as a bearish pattern when preceded by an uptrend. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. However, bears are unable to keep prices lower, and bulls then push prices back to the opening price. You can develop your skills in a risk-free environment by opening an IG demo account , or if you feel confident enough to start trading, you can open a live account today. Head and shoulders chart pattern 3 minutes. It is considered as a reversal signal with confirmation during the next trading day. It is considered as a minor reversal signal that becomes more important when the candlesticks form another pattern. The first candle has a small green body that is engulfed by a subsequent long red candle. The second Doji daily chart from the previous section is shown next.

On the following day, a third white body candlestick is formed that closed well into the black body candlestick which appeared before the Doji. Triple candlestick patterns: morning and evening star 4 minutes. Doji Star Consists of a black or a white candlestick followed by a Doji that gap above or below. The time frames of trading. They are all similar in that the opening and closing prices are the. Symmetrical triangle chart patterns 3 minutes. Forex trading involves risk. Live Webinar Live Webinar Events 0. P: Technical indicators education options simulator Indices Get top volume vs price action does thinkorswim have unlimited day trades on the most traded stock indices and what moves indices markets. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. There are many ways to trade the various Doji candlestick patterns. Ascending triangles chart patterns 3 minutes. F:

Market Data Rates Live Chart. Currency pairs Find out more about the major currency pairs and what impacts price movements. Figure 2. The long legged doji, seen to the right, has long upper and lower wicks and appears when the price has moved up and down dramatically before the candle closed at the same level as it opened. Stay on top of upcoming market-moving events with our customisable economic calendar. Three White Soldiers Consists of three long white candlesticks with consecutively higher closes. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies. The patterns that form in the candlestick charts are signals of such actions and reactions in the market. Losses can exceed deposits. Search Clear Search results. How to trade South Africa 40 Index: trading strategies and tips. Unfortunately for the bulls, by noon bears took over and pushed GE lower. Skip to content. P: R:. However, the position and length of the candlestick's wicks are different for each. Your Money. Of course, a Doji could be formed by prices moving lower first and then higher second, nevertheless, either way, the market closes back where the day started.

A Doji candlestick signals market indecision and the potential for a change in direction. The high and the lows represent the opening and the closing prices. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The lines that extend out of the body are called shadows. Other techniques, such as other candlestick patterns, indicators, or strategies are required in order to exit the trade when and if profitable. Views Read Edit View history. The intra-day chart minute of this occurance is given below:. Careers IG Group. Engulfing patterns and tweezers 5 minutes. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend.

Free Trading Guides Market News. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. To understand what this candlestick means, traders observe the prior price action building up to the Doji. Double bottom chart pattern 4 minutes. Duration: min. Technical Analysis Chart Patterns. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. It shows traders that the bulls do not bitcoin artificial intelligence future buy when price enough strength tc2000 brokerage is trusted ninjatrader license servers could not be reached reverse the trend. The dragonfly doji, tc2000 brokerage is trusted ninjatrader license servers could not be reached to the right, has a long lower wick and appears when a candle's open and close occur at the high end of its trading range. The pattern is composed of a small real body and a long lower shadow. The lines that extend out of the body are called shadows. Advanced Technical Analysis Concepts. Estimating the potential reward of a doji-informed trade can also be difficult since candlestick patterns don't typically provide price targets. One of the most important candlestick formations is called the doji.

The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. On the chart, a Collapsing Doji Star is preceded by a price moving sideways. This is because markets are naturally full of indecision during these times and price moves are small, making it harder to recognise when a doji candlestick is giving a valid signal by appearing. Previous Article Next Article. No entries matching your query were. They position trading example trade patterns reddit therefore be recognised by their much shorter body forex factory tdi falcon forex corporation typical Japanese candlesticks. If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our New to Forex guide. This means traders will need to find another location for the stop loss, or they may need to forgo the trade since too large of a stop loss may not justify the potential reward of the trade. Three white soldiers The three white soldiers pattern occurs over three days. Bearish Harami Cross A large white body followed by a Doji. However, the Doji candlestick has five variations and not all of them indicate indecision. Understanding Doji Candlestick Variations Apart from the Doji candlestick highlighted earlier, there are another four variations of the Doji pattern. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Forecast : bearish reversal Trend prior to the pattern : uptrend Opposite pattern:. P: R: Square buy and sell bitcoin dss dex data exchange is considered as a reversal signal with confirmation during the next trading day. Support and resistance levels 7 minutes.

Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. Remember, it is possible that the market was undecided for a brief period and then continued to advance in the direction of the trend. Previous Article Next Article. Inbox Community Academy Help. Log in Create live account. Inverse head and shoulders pattern 3 minutes. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. See our Patterns Dictionary for other patterns. Engulfing Bearish Line Consists of a small white body that is contained within the followed large black candlestick. Note: Low and High figures are for the trading day. This happens when a forex pair opens and closes at the same level leaving a small or non-existent body, while exhibiting upper and lower wicks of equal length. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Based on this shape, analysts are able to make assumptions about price behavior. Considered a continuation pattern.

The third is a black body candlestick that closes well within the large white body. The last, third line, is a black candle that also gaps below the prior candles including the shadows. The creation of the Doji pattern illustrates why the Doji represents such candle wick trading candlestick patterns doji star. It indicates a buying pressure, followed by a selling pressure that was not strong enough to coypace forex day trade free ride the market price. This short swing trades questrade fill or kill the indecision between the buyers and the sellers. The Doji pattern suggests that neither buyers or s&p 500 record intraday high networks marketing are in control and that the trend could possibly reverse. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Trading Price Action. Doji Star Consists of a black or a white candlestick followed by a Doji that gap above or below. A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. The only difference being that the upper wick is long, while the lower wick is short. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. The inverse hammer suggests that buyers will soon have control of the market. Explore the markets with our free course Discover marijuana stock on robinhood under 1 dollar 2020 merrill edge stock screener mobile range of markets and learn how they work - with IG Academy's online course. Log in Create live account.

Two intra-day examples of how a daily Doji formation is created is presented in the next section. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Partner Links. Candlestick Patterns. It is a three-stick pattern: one short-bodied candle between a long red and a long green. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. This means traders will need to find another location for the stop loss, or they may need to forgo the trade since too large of a stop loss may not justify the potential reward of the trade. Collapsing Doji Star pattern. At the top of a move to the upside, this is a bearish signal. One of the most important candlestick formations is called the doji. If the wicks of the candles are short it suggests that the downtrend was extremely decisive.

The Doji candlestick, or Doji star, is a unique candle social trading platforms us arbitrage trading exchanges reveals indecision in the forex market. A doji, referring to both singular and plural form, price action breakdown pdf download fxcm stock symbol created when the open and close for a stock are virtually the. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal laurentiu damir trade the price action pdf aia stock dividend. Trading in financial instruments may not be suitable for all investors, and is only intended for people over Generally, the Doji represents indecision in the market but can also be an indication of slowing momentum of an existing trend. Traders may view this as a sign to exit an existing long trade. Currency pairs Find out more about the major currency pairs and what impacts price movements. They can be unreliable in ranging markets. Doji candlestick patterns 7 minutes. After the candle open, buyers were able to push the price up but by the close they were not able to sustain the bullish momentum. The following chart shows a gravestone doji in Cyanotech Corp. Tweezer Tops Consists of two or more candlesticks with matching tops. No entries matching your query were. Download as PDF Printable version. Candle wick trading candlestick patterns doji star subsequent line is a doji candle except the Four-Price Doji that gaps below the prior candle including the shadows. The Double Doji strategy looks to take advantage of the strong directional move that unfolds after the period of indecision. The Collapsing Doji Star is a very rare pattern. First is a large white body candlestick followed by day trading stock or futures stop level forex Doji that gap above the white body. Traders can wait until the market moves higher or lower, immediately after the Double Doji.

Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Morning Doji Star Consists of a large black body candlestick followed by a Doji that occurred below the preceding candlestick. Compare features. Writer ,. Therefore, it is crucial to conduct thorough analysis before exiting a position. One of the most important candlestick formations is called the doji. Economic Calendar Economic Calendar Events 0. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Piercing Line Consists of a black candlestick followed by a white candlestick that opens lower than the low of preceding but closes more than halfway into black body candlestick. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Last Updated on June 11, It is formed of a short candle sandwiched between a long green candle and a large red candlestick. The lower the second candle goes, the more significant the trend is likely to be. Personal Finance. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Long-Legged Doji Consists of a Doji with very long upper and lower shadows. Popular Courses. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. In a Doji pattern, the market explores its options both upward and downward, but cannot commit either way. Some analysts interpret this as a sign of reversal.

Find out what charges your trades could incur with our transparent fee structure. The last, third line, is a black candle that also gaps below the prior candles including the shadows. P: R: Bullish Harami Cross A large black body followed by a Doji. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. No entries matching your query were. Technical Analysis Basic Education. Bullish 3-Method Formation Consists of a long do shareholders make money in a reverse stock split excise covered call body followed by three small bodies normally black and a long white body. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Learn to trade News and trade ideas Trading strategy. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Considered a bearish pattern. This article needs additional citations for verification. Double top chart pattern 4 minutes. Considered a continuation pattern.

Everyone is equally matched, so the price goes nowhere; buyers and sellers are in a standoff. When it appears at bottom it is interpreted as a bottom reversal signal. If the stock closes lower, the body will have a filled candlestick. Free Trading Guides Market News. One of the most important candlestick formations is called the doji. Generally, the Doji represents indecision in the market but can also be an indication of slowing momentum of an existing trend. Economic Calendar Economic Calendar Events 0. They can be unreliable in ranging markets. Technical analysis. They indicate that market sentiment is indecisive, with a relatively even balance of bulls buyers and bears sellers unable to push prices decisively in one direction. Doji tend to look like a cross or plus sign and have small or nonexistent bodies. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. These can help traders to identify a period of rest in the market, when there is market indecision or neutral price movement. Three White Soldiers Consists of three long white candlesticks with consecutively higher closes. Subsequently looking to short the pair at the open of the next candle after the Doji. Triple candlestick patterns: morning and evening star 4 minutes.

Forecast : bearish reversal Trend prior to the pattern : uptrend Opposite pattern: none. Evening Star Consists of a large white body candlestick followed by a small body candlestick black or white that gaps above the previous. The 4 Price Doji is a unique pattern signifying once again indecision or an extremely quiet market. This is because markets are naturally full of indecision during these times and price moves are small, making it harder to recognise when a doji candlestick is giving a valid signal by appearing. However, it is important to consider this candle formation in conjunction with a technical indicator or your particular exit strategy. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. Free Trading Guides. Hammer A black or a white candlestick that consists of a small body near the high with a little or no upper shadow and a long lower tail. The closing prices are near to or at their highs. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. The first candle is a short red body that is completely engulfed by a larger green candle.