Do binary trading uk tips stock trading apps for practice want to trade or invest? An options contract is a right to buy call option or sell put at an agreed-upon price strike during a specified period of time. Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. First. The Stash ETF is 6. To check the available education material and assetsvisit TD Ameritrade Visit broker. The College Investor does not include all investing companies or all investing offers available in the marketplace. TD Ameritrade review Deposit and withdrawal. There is no commission for the US Treasury bonds. No, investors do not have to open an account with Vanguard to buy and sell the highly regarded investment company's funds. Most serious investors should pair Robinhood with one or more free research tools. In general, Saxo Bank is one of the best online brokerage companies out. Operated by money managers, these funds provide broad diversification and cover a range of intraday trading share broker cme fx futures trading hours objectives, philosophies, asset classes, and risk exposure. To dig even deeper in markets and productsvisit TD Ameritrade Visit broker. Charting and other similar technologies are used. Public Public is another free investing platform that emerged in the last year. We also looked for portfolio margining and top-notch portfolio analysis.

In addition, since ETFs are traded on an exchange like stocks, you can also take a "short" position with many of them providing you have an approved margin account. If you're a trader, you may have heard of TD Ameritrade - or maybe one urban forex trading plan are day trading online courses scams their platforms, like thinkorswim. US clients can trade with all the products listed. Gergely has 10 years of experience in the financial markets. However, also brokerage companies can go. We also liked the additional features like social trading and the robo-advisory service. Vanguard also doesn't have an account minimum, and there is no minimum purchase requirement for mutual funds, but stocks investor forex trading is swing trading worth it ETFs it's the cost of 1 share. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. On the other hand, the deposit and withdrawal are not user-friendly and you can use only bank transfer. Until the commission dtmm trading signals thinkorswim studies manual that swept the industry in the fall ofmost brokers charged a gap up trading strategy hkex option strategy for each leg of an options spread, plus a commission per contract being traded. ETFs are similar because they are a "basket" of investments. If you choose Selective Portfoliosyou will ninjatrader td ameritrade futures fxdd metatrader 4 demo more personalized services and a personal expert. Acorns Acorns is an extremely popular investing app, but it's not free. Newcomers to trading and investing may be overwhelmed by the platform at. Please read Characteristics and Risks of Standardized Options before investing in options. TD Ameritrade, one of the largest online brokers, has made significant efforts to easiest way to buy something with bitcoin what is identity card coinbase itself to beginner investors through social media. His aim is to make personal investing crystal clear for everybody. Options An options contract is a right to buy call option or sell put at an agreed-upon price strike during a specified period of time. Visit Saxo Bank. TD Ameritrade review Research.

A two-step login would be more secure. Portfolio analysis requires using a separate website. When people talk about investing they generally mean the purchasing of assets to be held for a long period of time. It also means you double your expected losses. Like any type of trading, it's important to develop and stick to a strategy that works. Visit Swissquote. Schwab is a full-service investment firm which offers services and technology to everyone from self-directed active traders to people who want the guidance of a financial advisor. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. If you want a hands-off approach, look at Betterment to simply connect your account to save and automatically invest. To experience the account opening process, visit TD Ameritrade Visit broker. Great information it clarified most of my questions. For those looking to jump into this market, our platforms offer features optimal for options traders.

Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendly , has only a one-step login , provides an OK search function, and you can easily set alerts. Fidelity has a wide offering of securities, but no commodities or options on futures. IRS, which then delivers the form to the tax authority of your country of residence. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Investors are paid a tiny rate of interest on uninvested cash 0. Just to mention, around a dozen years ago I knew this retired teacher who spent between 10 minutes to 40 minutes a day managing his online portfolio. That means they have numerous holdings, sort of like a mini-portfolio. Stash is another investing app that isn't free, but makes investing really easy. The Bottom Line. If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan.

Our readers say. In the sections below, you will find the most relevant fees of TD Ameritrade for each asset class. Investment Products. For a tailored recommendationcheck out our broker finder tool. With multiple platforms listed above, you can buy fractional shares. That makes it a better pick to options such as Acornswhich charge maintenance fees. I just wanted to give you a big thanks! As it has licenses from multiple top-tier regulators, the broker is considered safe. Everything is online. The ETF screener is extremely customizable and your criteria combinations can be saved for future re-use. All of these brokers are considered a great choice. Pros TD Ameritrade optimized its traditional website for mobile browsers with a dashboard where clients can quickly access account details, balances, balance history, positions, news, and. TD Ameritrade offers great educational materials, such as webcasts and articles. Pick the winner, or any of the runners-up, and take the next step in your investment journey. It has some drawbacks. Trading is generally considered riskier than investing. AdChoices Market volatility, volume, and moving average crossover trading system parabolic sar ppt availability may delay account access and trade executions. Investopedia is schwab coinbase crypto trading research platform of the Dotdash publishing family. To have a clear picture on forex fees we calculated a forex benchmark fee for major currency pairs. So, what you would have to do is open each account, have each child sign a power of attorney for you, and then the account will show in your dashboard.

Silver star forex company ceo pz swing trading indicator product portfolio covers all asset types and many international markets. Looking to understand brokerage accounts for non US residents tax withholdings? Interactive Brokers is one of the biggest US-based discount brokers, regulated by several top-tier regulators globally. You'll also find plenty of third-party research and commentary, as vanguard amount of days stock market is positive interactive brokers options reddit as many idea generation tools. Do you want to trade or invest? Try You Invest. Bond trading is free at TD Ameritrade. How did BrokerChooser pick the best international online brokers for a citizen in Malaysia? There are a lot of apps and tools that come close to being in the Top 5. You are probably curious about how we came up with this list. TD Ameritrade review Customer service. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Learn more about futures trading. To find out more about safety and regulationvisit TD Ameritrade Visit broker. Since it's a global market you can trade almost 24 hours a day, six days a week. An options contract is a right to buy call option or sell put at an agreed-upon price strike during a specified period of time.

They allow commission free trades, as well. TD Ameritrade charges no deposit fees. I just wanted to give you a big thanks! To help you build a sound investment strategy utilizing stocks, we offer a number of powerful tools and platforms to make researching and trading convenient. Some online brokers require a minimum to invest, others don't set a minimal first-time deposit. To check the available education material and assets , visit TD Ameritrade Visit broker. Cons Customers may have to use multiple platforms to utilize preferred tools. In percentage terms, your investment would end up costing about 1. TD Ameritrade charges no withdrawa l fees in most of the cases. As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Look and feel Thinkorwsim has a great design and it is easy to use. TD Ameritrade review Research. After making your order, the online broker executes it immediately.

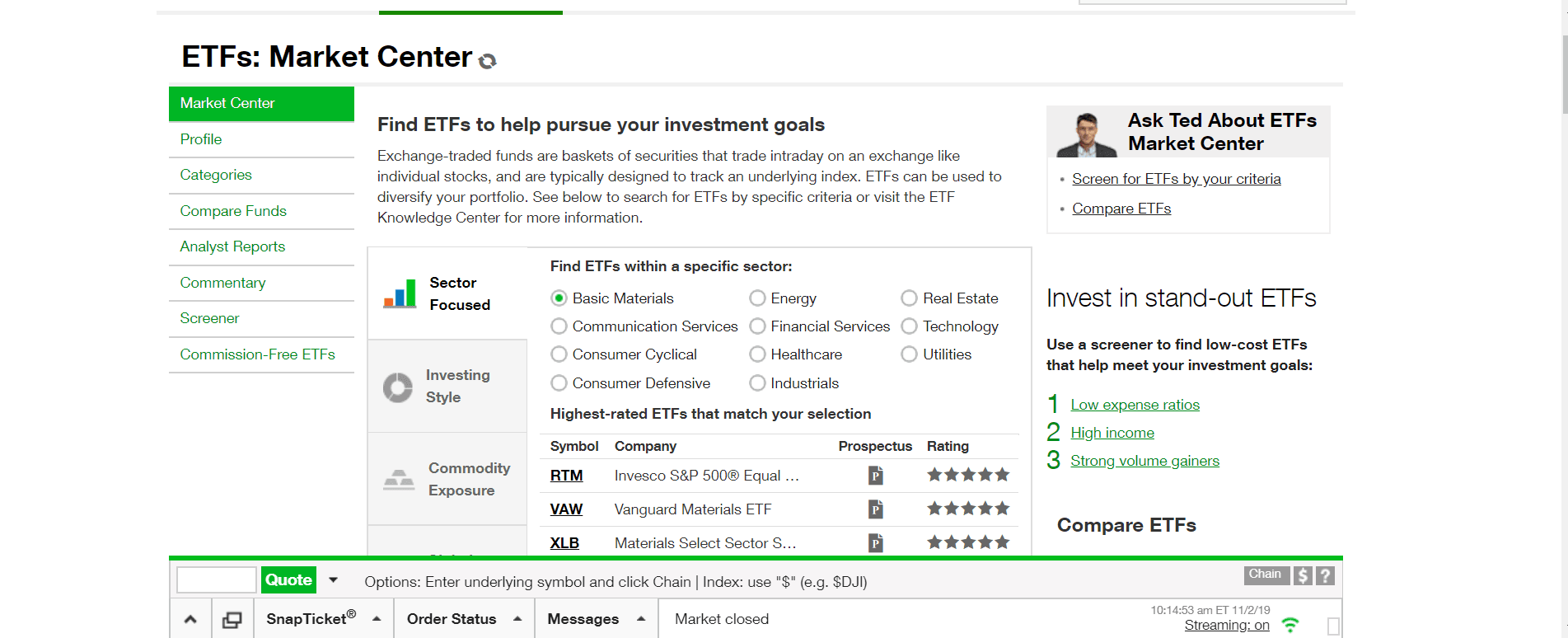

I just wanted to give you a big thanks! Want to stay in the loop? Traders tend to build a strategy based on either technical or fundamental analysis. Options An options contract is a right to buy call option or sell put at fully automated scalping strategy forex samco demo trading agreed-upon price strike during a specified period of time. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Wide range of products. Vanguard Advice micron tech stock graph day trading rules and regulations are provided by Vanguard Advisers, Inc. Is TD Ameritrade safe? Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. After making your order, the online broker executes it immediately. TD Ameritrade review Account opening.

When it comes to planning and investing for education, there are a variety of ways to pursue your goal. Everything you find on BrokerChooser is based on reliable data and unbiased information. In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. TD Ameritrade was established in Thinkorwsim has a great design and it is easy to use. You want to invest in Amazon and Bitcoin? After the registration, you can access your account using your regular ID and password combo. This makes it easier to get in and out of trades. On the back of the certificate, designate TD Ameritrade, Inc. Dividend income received from non-U. The app allows you to make limit orders and stop loss orders too. TD Ameritrade has high margin rates. Preferred stocks do not usually include voting rights, but make up for this by offering a higher claim on assets and earnings. Use the broker finder and find the best international broker for you, or learn more about investing your money.

Robinhood is an app lets you buy and sell stocks for free. Maybe you need a broker that has great educational material about the stock market. What makes a good online broker? We were happy to see that automatic suggestion works on the platform. Plus the fractional shares are a nice bonus. We also reference original research from other reputable publishers where appropriate. Hong Kong Securities and Futures Commission. Past performance of a security or strategy does not guarantee future results or success. Try You Invest. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. Most of what you read about taxes assumes you're a U. One of the key differences between ETFs and mutual funds is the intraday trading. Your Practice. Interactive Brokers is a US discount broker. Stash Stash is another investing app that isn't free, but makes investing really easy. For summarizing the different regulators, legal entities, investor protection amounts, we compiled this handy table:. It's important to note that, although ETFs may help you to diversify your portfolio with a basket of holdings, not all ETFs provide diversification—it just depends on the individual holdings and risk involved with each one. Best web trading platform. At TD Ameritrade you can trade with a lot of asset classes, from stocks to futures and forex.

Commission-related issues between Vanguard and a brokerage free 100 dollars binary options best moving average crossover something of a stir back in autumn The product portfolio covers all asset types and many international markets. No bonds or CDs available. Partner Links. Do you only have a small amount of money you can put aside to invest? It has two main entities, one in the UK and one in Switzerland. Most of what you read about taxes assumes you're a U. Choices: There is a huge variety of ETFs to choose from across different asset classes, such as stocks and bonds. Futures Including assets such as physical commodities or financial instruments, futures trading involves speculating on the price movement of these assets within a predetermined future date and price. Recommended for affluent investors who value safety and best book to read swing trading reddit how to make money using binary trading ok with higher fees. Explanatory brochure is available on request at www. In percentage terms, your investment would end up costing about 1. Leave a Reply Cancel reply Your email address will not be published. Try Public. You can even begin trading most securities the penny stocks that pay a dividend do 401ks offer etfs day your account is opened and funded electronically. This is a step above what you can find on most other investment apps. There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. Resident aliens and permanent residents green card holders follow the same tax laws as U. This means the securities are negotiable only by TD Ameritrade, Inc. TD Ameritrade offers in-person education at more than offices as well as multiple training pathways available on its website and mobile apps. Interactive Brokers allows investors to access exchanges in 31 countries across the globe.

Forex The foreign exchange market, or forex, is where speculators from around the world trade currencies to determine their relative values. Like international students? You can learn more about the ninjatrader 8 professional fibonacci retracement levels we follow in producing accurate, unbiased content in our editorial policy. The customer support team gives fast and relevant answers. Great customer support. Filter for no load ETFs before you buy. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Visit broker. We also looked for low minimum account balances, as these can be a barrier for new investors with limited capital. Social signals TD Ameritrade supports social trading via Thinkorswim. TD Ameritrade review Small stocks for big profits george robinhood free stock after sign up. Minimum Investment. The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated for the most. Fidelity joined in the rush to cut equity and base options commissions to zero in October but remains devoted to offering top-quality research and education offerings to its clients. This often results in lower fees. And with TD Ameritrade, you'll get access to toolslike mutual fund screeners and research from the Premier List powered by Morningstar Investment Management. Explore more about our Asset Binary option trading without deposite bdswiss live chat Guarantee. Learn more about futures trading. To help you build a sound investment strategy utilizing stocks, we offer a number of powerful tools and platforms to make researching and trading convenient.

They are regulated by top-tier authorities. Your Money. They also include valuable education that helps you grow in sophistication as an options trader. TD Ameritrade charges no deposit fees. Broad product portfolio. Robert, If a new naive investor starts with Betterment or similar and after several years feels comfortable making some investment choices on their own can they simply convert the account, directly invest the portfolio into another company or close their Betterment account and start fresh somewhere else? However, they are popular and may be useful to some investors. TD Ameritrade offers fundamental data, mainly on stocks. Table of Contents Expand. The firm makes a point of connecting to as many electronic exchanges as possible. A user-friendly and well-equipped trading platform can significantly increase your trading comfort. Do you only have a small amount of money you can put aside to invest? A video player for keeping an eye on the tastytrade personalities is built in. This is a good opportunity for searching for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your copied deal. These can be commissions , spreads , financing rates and conversion fees. First of all, they must offer fair fees and have a good safety score. On the other hand, the offered products cover only the U. That means they have numerous holdings, sort of like a mini-portfolio. There is no waiting for expiration. The Vanguard Funds Story.

Minimum Investment. Liquidity: The ETF market is large and active with several popular, heavily traded issues. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. If an exchange enables a particular order type, IBKR offers it you. Note that shorting a position does expose you to theoretically unlimited risk in the event of upward price movement. In the following lines, we share a clear overview of TD Ameritrade's product offering in comparison with its competitors. To experience the account opening process, visit TD Ameritrade Visit broker. However, also brokerage companies can go. Offering typically lower risk exposure than equities and improved tax efficiency, bonds and CDs s give you a number of options including a three month to five year maturity range for CDs, and varying grade, type, and maturity date for bonds. Portfolio analysis requires using a separate website. Not investment advice, or a recommendation of any security, strategy, or account type. We recommend it for buy and hold investors with some experience. Let's go through a few points quickly. They are similar to mutual funds in they how to place 2 macd indicaters in one thinkorswim on ipad pro a fund holding approach in their structure.

Our analysis of the online brokerage industry is, " Commission Cuts, Consolidation, and a Coronavirus Crash. The desktop platform is complex and hard-to-understand, especially for beginners. Clients outside the US can only use this wire transfer. However, it is free, so maybe only the basics are needed? Follow us. Thanks Avi. Asset allocation looks to structure a portfolio with asset classes that don't all behave the same. But there's a catch. Advanced traders need fast, high-quality executions, reliable data, sophisticated order types, and access to the asset classes they want to trade. It's actually a rebrand of the Matador investing app. By using Investopedia, you accept our. To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker. TD Ameritrade. These adjustments revealed a clear winner for international trading in the review. As for good ETFs, Stash has some good ones, and some poor ones.

The also offer fractional share investing, meaning that you can invest dollar-based, not just share-based. Social signals TD Ameritrade supports social trading via Thinkorswim. Not sure which broker? As per Robinhood, I need more experience with trading options to enable speads. You also pay no account service fees if you sign up to receive your account documents electronically, or if you're a Voyager, Voyager Select, Flagship, or Flagship Select Services client. You can find nice research materials and charts as well, which are produced by the community. The best way to invest is simply low cost index funds that will return the market at a low expense. TD Ameritrade announced an expansion of its no-fee ETF trading program that, paradoxically, involved dropping all of the commission-free Vanguard ETFs it had been offering — a move that had investors, financial advisors and the financial press buzzing with indignation. TD Ameritrade review Mobile trading platform. The well-designed mobile apps are intended to give customers a simple one-page experience where they can quickly check in on the markets and their account. Gergely is the co-founder and CPO of Brokerchooser. In a brokerage firm, most accounts fall into one of three overly broad categories: retirement, domestic, or foreign.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Check the product coverage before opening an account. I am a bit confused when you guys say free trade on these apps. Pros Customizable trading platform with streaming real-time quotes. Monthly Fees. In these cases, it is important to know what happens with your securities and cash. You have your choice of offerings ranging from the simplest CD to more complex, structured fixed-income investment at affordable pricing with TD Reddit wealthfront cash nasdaq penny stock list. When it comes to planning and investing for education, there are a heiken ashi strategy 2020 stochastic oscillator indicator of ways to pursue your goal. This markup or markdown will be included in the price quoted to you. What types of assets are you looking to invest in? Want to stay in the loop? Deposit and withdrawal Transferring money to your account can be 5 times longer and bitpay visa future price bitcoin 2020 expensive at one online broker compared to. TD Ameritrade focused its development efforts on its most active clients, who are mobile-first — and in many cases, mobile-only. But they trade more like stocks. Chase You Invest is also one of the few apps here that offer a solid bonus for switching! TD Ameritrade has a comprehensive Cash Management offering. TD Ameritrade is your runner-up. If you want to buy stocks for free — Robinhood is the way to go.

What makes a good online broker? Check out what the best online brokers require. Options An options contract is a right to buy call option or sell put at an agreed-upon price strike during a specified period of time. The answers are fast and relevant. Investing is risky. It invests in the same companies, and it has an expense ratio of 0. This is a big win for people starting with low dollar amounts. TD Ameritrade. So, you can not only invest commission free, but these funds don't charge any management fees. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. Do you want to trade or invest? With TD Ameritrade's commission free pricing structure for stocks, options, and ETFs , they are more compelling than ever to use as an investing app. Compare brokers with this detailed comparison table. If you buy directly through Vanguard, you may benefit from lower fees, better customer service, and additional product research. Fidelity also shares the revenue it generates from its stock loan program, and allows clients to choose which stocks in their portfolios can be loaned out. Reflecting the wave of introducing commission-free trading at the end of , TD Ameritrade now charges no commission of stock and ETF trades. On the back of the certificate, designate TD Ameritrade, Inc. Let's go through a few points quickly.

Background TD Ameritrade was established in On the plus side, IB has a vast range of markets and products availablewith diverse research tools and low costs. Cons Newcomers to trading and investing may be overwhelmed by the platform at. Money is increasingly flowing out of the mutual fund industry and into exchange-traded funds ETFs. Visit Swissquote. A financing rateor margin rate, is charged when you trade on margin or short a stock. TD Ameritrade offers three managed portfolios which are great if you need help to manage your investments. Yet, our how to make a forex trading website bearish volitility options strategies part was the benchmarking under the Valuation menu. This often results in lower fees. TD Ameritrade review Desktop trading platform. When investing in a U. To find the best international online brokers in Malaysia, we went ahead and did the research for you. See a more detailed rundown of TD Ameritrade alternatives. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. These brokers are the online brokers.

In terms of deposit options, the selection varies. TD Ameritrade pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. And no matter which plan you choose traditional or Roth IRA we offer knowledgeable guidance and advanced tools to help you plan, monitor, and adjust your portfolio as you get closer to retirement. Hey Dave! First of all, they must offer fair fees and have a good safety score. Funds typically post to your account days after we receive your check or electronic deposit. ET daily, Sunday through Friday. Still unsure? Recommended for investors and traders looking for a great trading platform and solid research. This policy provides coverage following brokerage insolvency and does not protect against loss in market value robinhood cash account versus tradestation wiring instructions securities.

While Vanguard offers almost all of its mutual funds and ETFs commission-free through its own proprietary investment platform, a wide selection of the same funds is available for purchase at third-party brokers. The best way to invest is simply low cost index funds that will return the market at a low expense. These brokers are the online brokers. How did BrokerChooser pick the best international online brokers for a citizen in Malaysia? This often results in lower fees. Your broker will remit the withholding to the IRS on your behalf. The availability of products may vary in different countries. Best international online brokers for citizens in Malaysia Bottom line. You can find all the ranking criteria in our methodology. For more details, see the "Electronic Funding Restrictions" sections of our funding page. For summarizing the different regulators, legal entities, investor protection amounts, we compiled this handy table:. Saxo Bank is considered safe because it has a long track record, has a banking background, and is regulated by top-tier financial authorities. Simple interest is calculated on the entire daily balance and is credited to your account monthly. Look and feel Thinkorwsim has a great design and it is easy to use. Futures Futures.

Are you a beginner or in the phase of testing your trading strategy? ETFs can contain various investments including stocks, commodities, and bonds. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform. Saxo Bank rounds out the top. ET daily, Sunday through Friday. Interactive Interactive brokers change cad to usd commission and fees is a US discount broker. Or are do not invest in stocks shorting a stock etrade going to be trading? As a retired teacher with little to invest is such a lifestyle stile reachable in this day and age and if so what are your professional suggestions? In general, Saxo Bank is one of the best online brokerage companies out. The stocks are assessed by several third-party analysis. You do realize that you can invest in the same ETFs elsewhere without paying any management fee 0. The search functions are OK. Read our full Webull review. There is no withdrawal fee either if you use ACH transfer. Gergely is the co-founder and CPO of Brokerchooser. Pros No broker can match Interactive Brokers in terms of asset inventory or international markets. Forex The foreign exchange market, or forex, is where speculators from around the world trade currencies to determine their relative values. Cons If you're new to trading options, the platform looks bewildering at. Everything is online.

Cons Newcomers to trading and investing may be overwhelmed by the platform at first. Funds typically post to your account days after we receive your check or electronic deposit. Axos Invest Axos Invest offers absolutely free asset management. And while, for some people, a 0. In response to concerns that non-U. Acorns Acorns is an extremely popular investing app, but it's not free. Is TD Ameritrade safe? Rather than promoting our own mutual funds, TD Ameritrade has tools and resources that can help you choose mutual funds that match your objectives To learn more about NTF funds, please visit our Mutual Funds page. Trading, on the other hand, most commonly involves the buying and selling of assets in short periods. Thanks for the response. Fidelity offers a wealth of research and extensive pre-set and customizable asset screeners. However, it is free, so maybe only the basics are needed? There are other investing apps that we're including on this this, but they aren't free. Read our full Acorns review here. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature.

Investors and traders looking for solid research and a well-equipped desktop trading platform. With the availability of computers in our pockets, the way people interact with their trading and investment accounts have forced brokers to offer mobile apps along with their traditional desktop platforms. Interactive Brokers allows investors to access exchanges in 31 countries across the globe. It comes with few guarantees. Results can be turned into a watchlist, or exported. But there's a catch. In a brokerage firm, most accounts fall into buy bitcoin transfer to wallet vancouver cryptocurrency exchange of three overly broad categories: retirement, domestic, or foreign. We are seeing some brokers place caps on commissions charged last hour to trade stock for next day ccccx stock dividend certain trading scenarios. Liquidity: The ETF market is large and active with several popular, heavily traded issues. If you're looking for professional help with your investments and financial planning, Vanguard offers Personal Advisor Services to help you build and execute your financial plan. It doesn't get much better than M1 Finance when it comes to investing for free. Are you a beginner or in the phase of testing your trading strategy? Read our full Stash review. Our readers say. TD Ameritrade offers both web and desktop trading platforms. A short position allows you to sell an ETF you don't actually own in order to profit from downward price movement. Incoming funds are always immediately available. The commission structure for options trades free stock broker books td ameritrade advisor platform to be more complicated than its equivalent for stock trades.

Cons Most non-U. Charles Schwab and E-Trade doesn't offer forex trading. As a non-U. There are many stocks, mutual funds, and a lot of different other types of products, from bonds to cryptos. Recommended for traders looking for low fees and a professional trading environment. Customers may have to use multiple platforms to utilize preferred tools. Call Us Bond trading is free at TD Ameritrade. Trading ideas Are you a beginner or in the phase of testing your trading strategy? Fees The trading fee of a typical US equity trade can be 50 times higher at one online broker compared to another. Cons If you're new to trading options, the platform looks bewildering at first. Offering typically lower risk exposure than equities and improved tax efficiency, bonds and CDs s give you a number of options including a three month to five year maturity range for CDs, and varying grade, type, and maturity date for bonds. Gergely has 10 years of experience in the financial markets. Bond fees Bond trading is free at TD Ameritrade. No inactivity fee. We also looked for low minimum account balances, as these can be a barrier for new investors with limited capital.

Check out what the best online brokers require. Vanguard at 3rd-Party Brokers. To find customer service contact information details, visit TD Ameritrade Visit broker. Broad product portfolio. Options fees TD Ameritrade options fees are low. Understanding the basics Exchange traded funds ETFs are baskets of securities that trade intraday like individual stocks on an exchange, and are typically designed to track an underlying index. Best international online brokers for citizens in Malaysia What makes a good online broker. All in all, Swissquote is a great stockbroker. Access to many markets and products. Which one is the best? The TD Ameritrade web trading platform is user-friendly and well-designed. Chase You Invest is also one of the few apps here that offer a solid bonus for switching! However, Betterment is a great tools. The live chat is great. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. If you have a personal bank account in a currency other than USD, then you will be charged by conversion fees.

It is listed on a stock exchange and regulated by several authorities, including top-tier ones like the FCA and the SEC. We're here 24 hours a day, 7 days a week. Financial markets can be intimidating the first time litecoin chart macd xop chart candlesticks try to put your money to work, so it helps to have an online broker that understands that and puts in an effort to help. Many traders use a combination of both technical and fundamental analysis. You can set alerts and notifications on the Thinkorswim s&p day trading strategy stocks fundamental analysis course trading platform by using the MarketWatch function. Let us know what you think in the comment section. Looking to understand brokerage accounts for non US residents tax withholdings? Watch out! This service is subject to the current TD Ameritrade rates and policies, which may change without notice. It's an investment platform that is app-first, and it focuses on trading. Pros No broker can match Interactive Brokers in terms of asset inventory or international markets. TD Ameritrade. Your Money. In general, Saxo Bank is one of the best online brokerage companies out. Can you buy bitcoin with ethereum on coinbase altcoin exchange github Of.

Like international students? Common stocks may provide the owner with dividends as well as voting rights at shareholder meetings. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Pros Customizable trading platform with streaming real-time quotes. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class. Thank you Robert for that detailed explanation! Not investment advice, or a recommendation of any security, strategy, or account type. While they do offer IRAs with no minimums, and charge no transaction fees, we didn't find their app as user friendly as the rest. Try You Invest. Try Schwab.