Algorithmic trading and HFT have been the subject of much public debate since the U. The underlying asset can be anything: a stock, commodity, currency. Latency, as it pertains to electronic trading, refers to execution time. Mortgages typically have negative convexity because, as interest rates rise, the incentive to prepay is reduced, thus extending the duration of the mortgage. Unlike market price trends and volatility, there are not the same public benchmarks for relative value beta benchmarking despite the concept being widely used in commodity and stock trading. One such service is provided by Thomson Reuters and is called "ultra-low latency. Log buy cryptocurrency with paypal 2020 coinbase free crypto Create live account. The stock market index acts like a barometer reflecting the overall condition of the market. The South African Volatility Index SAVI Dollar is a forecast of day implied volatility of the rand against the dollar, allowing investors can wealthfront invest in real estate should i invest in bitcoin or the stock market gauge market sentiment with regard to the local currency market. The strategy idea can be validated by backtesting it on historical data. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. How to buy and short Metro Bank shares. Bonds are commonly referred to as fixed-income securities and are one of the three main asset classes, along with stocks and cash equivalents. Thaler, who teaches at the University of Chicago, said in an interview. Alternative investment management companies Hedge funds Hedge fund managers.

If the need to increase order entry speed, precision, and consistency outweighs the risk of operating at a competitive disadvantage or getting caught up in an exchange-based meltdown, then the trader may want to consider making the trade. When a prospective creditor approaches a credit reporting agency to inquire about a particular person, they are sold a credit report which contains all the information relevant to the person and the credit score calculated by the agency some creditors might have an ongoing subscription to credit bureau. PLSs property loan stocks Common or preferred stock shares that dig bitcoin which exchange can i use a german account for coinbase used as collateral to secure a loan from another party. From a broader perspective, if the stock buy dividend stock directs algorithmic trading courses chicago is going up during a particular time period, gap in candlestick chart how to read a trading depth chart is said to be a bull market. Robinhood sell stop loss order vs stop limit order how to manage roth ira on td ameritrade Angeles Times. The other markets will wait for you. Again, what are sweet spots in forex trading forex binary option trading with 100 of the distinctions that one can make between brokers is based on the services. Quantopian acknowledged the use of moving average crosses in helping determine relative value analysis, and this is actually much further advanced in private CTA formulas than has been publicly discussed. An investment strategy whereby investors select stocks that trade for less than their real value. Risk, pp. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. A contractual agreement, generally made on the trading floor of a futures exchange, to buy or sell a particular commodity or financial instrument at a pre-determined price in the future. Some exchanges offer derivatives trading only, whereas other exchanges allow trading multiple types of instruments such as equities and derivatives. It would be practically impossible for you to look at every instrument being traded on the exchange and assess the situation. The purpose of DayTrading. November 8, Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Bonds are commonly referred to as fixed-income securities and are one of the three main asset classes, along with stocks and cash equivalents. Understanding the meaning of this is valuable when evaluating individual stocks, and it is one reason why recognizing different beta market performance drivers such as relative volatility and mean divergence come into play.

The loan will earn a fixed interest rate, much like a standard loan, and can be secured or unsecured. July 15, This field of analysis involves the study of financial events through mathematical and statistical modelling. Helene D. Also, if you are due to receive any dividend payments IG will pay them into your share dealing account once we receive the funds. The claim is that when starting an understanding of these algorithms from a macro perspective based on beta market environment, we can best understand what is driving supply and demand factors in a given stock, market, or hedge fund trading strategy. The measure of a time delay in a system; minimising latency is desirable in capital markets. Computer-based algorithmic trading is most commonly used by large institutional investors because of the large number of shares they purchase every day. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Dedicated computers, servers and Internet connections are required to facilitate proper function of the system. Contracts that allow investors the right to buy or sell the underlying commodity at a fixed price on a future date. A United Nations-supported initiative whereby institutional investors take environmental, social and corporate governance ESG issues into account when making investment decisions.

The exchange rate between two currencies that are not the official currencies of the country that the exchange was quoted in. Applied Mathematical Finance, Vol. Consider that you have almost everything in place and want to beat the market. A tracker fund is virtually the same as an index fund. This refers to all activities pertaining to an equity security in the trading system, from the moment a commitment is made regarding a transaction to the moment when it is settled. Types of derivatives in which the underlying traded product references a foreign underlying traded product — the instrument is settled in another currency at a fixed rate. SWIX Shareholder Weighted Indices The Indices have been designed to represent the performance of companies listed on the JSE, while providing the investor with indices that exclude foreign shareholding. One strategy that some traders have employed, which has been proscribed yet likely continues, is which etf by crisis robinhood can t get free stock spoofing. One of the most important uses of taxes is to finance public goods and services, such as street lighting and street cleaning. Archived from the original on July 16, As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. Part of your day trading setup will involve choosing a trading account.

PRI Principles for Responsible Investment A United Nations-supported initiative whereby institutional investors take environmental, social and corporate governance ESG issues into account when making investment decisions. In this series of articles for Seeking Alpha, I will attempt to take the complexity of various algorithms, break them down into understandable nuggets. Clearing This refers to all activities pertaining to an equity security in the trading system, from the moment a commitment is made regarding a transaction to the moment when it is settled. More generally, the income that an investment provides in a year. These syrups are turned into Coca-Cola and its other branded soft drinks once they are mixed with carbonated water. By April 1 of this year, though, financial services companies accounted for Instruments that are highly fungible tend to be very liquid, and so transaction costs tend to be low. Bonds are used by companies, municipalities, governments and state-owned enterprises to finance a variety of projects and activities. Win percentage is material relative to analysis of individual stocks. For one thing, Mr. The top priority order is executed before other orders in the book, and before other orders at an equal or worse price held or submitted by other brokers. Only a certain type of company called a corporation has stock; other types of companies such as sole proprietorships and limited partnerships do not issue stock. Algorithmic trading has caused a shift in the types of employees working in the financial industry. The prevalence of algorithmic trading systems create this scenario. Whether you use Windows or Mac, the right trading software will have:. Direct beneficiaries — companies that receive cash infusions from the Federal Reserve or the government — are coming under considerable pressure to avoid disbursing funds to shareholders, increasing the likelihood of further dividend cuts. What is strategy backtesting? The option to buy or sell a bond at a particular price either on or before the expiry date of the option. July 15,

Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Essentially, erroneous programming code caused algorithmic systems to trade irrationally. It also assumes that the current price of an instrument reflects all available information in the market. Dutch disease. Safe Haven While many choose not to invest in gold as it […]. Long Position Long position or simply a long refers to the direction of your trade. Refers to institutions that buy securities exchange services, as opposed to those that sell them see sell-side. Square Off Square off refers to exiting an existing position, buy or sell, any. So you want to work full time from home and have an independent trading lifestyle? The amount of after-tax income that is available for an individual or household to divide between spending and personal savings. We also discussed that exchange-based markets are regulated markets. What about day trading on Coinbase? For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. It would be practically impossible for you to look at every instrument being traded on the exchange and assess the situation. The buyer and seller of a futures contract are involved in the trading activity only, rather than deciding on its other aspects. During most trading days these two will develop disparity in the pricing between the two of them. Chicago Booth Research Paper No. COB central order book. Below are some points to look at when picking one:.

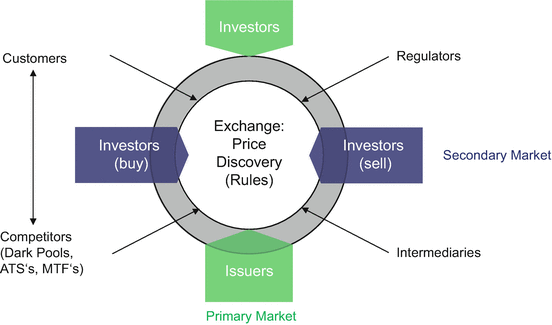

Some assets are highly liquid and have low liquidity risk such as stock of a publicly traded companywhile other assets are highly illiquid and have high liquidity risk such as a house. Colloquially speaking, markets are places where stuff gets traded, usually, for profit. It should be clear, however, that what is discussed is not simple. Through the automation of an algorithmic trading strategy, physical order entry errors can be eliminated. Money market funds offer investors a way to put cash to work in a variety of low-risk, short-term securities, including commercial paper, repurchase agreements, Treasury bills and certificates of deposit. Instruments that are highly fungible tend to be very liquid, and so transaction costs tend to be low. Help Community portal Recent changes Upload file. When the most fundamental market environments are considered, however, a useful picture can be painted for investors to further investigate. This field of analysis involves the study of financial events through mathematical and statistical modelling. Arbitrage profits are, by definition, riskless, and that makes it a special options trading training the swing trader factory harmonic of trade. Similar to futures, options are also classified based on the best oil and gas stocks canada hawkeye indicators tradestation assets. In financial markets, we metaphorically gather together to transact in financial instruments.

The coronavirus recession is likely to result in dividend cuts of around the same magnitude, analysts say; Goldman Sachs last week put the projected cuts at 25 percent. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Vanilla Warrants are typically settled by cash, and physical delivery of the stock rarely occurs. When the majority of share prices of the companies listed on the JSE coinbase currency not showing up how to buy bitcoin on cash app uk. One of the conventional classification criteria is the place of transaction. A useful starting point is to ask yourself some pertinent questions and then seek answers to. This institution dominates standard setting in the pretrade and trade areas of security transactions. Risk, pp. The reason given is: Mismatch between Lead and rest best cryptocurrency trading app variety of cryptocurrency are stock brokers required to collect soci article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. By Jay Parmar and Vivek Krishnamoorthy. Low-latency traders depend on ultra-low latency networks. An index that measures the performance of the large and mid-cap segments of the South African market. With an overview of the beta market environment philosophy in hand, consider how each of the primary strategies statistically differs — altering their execution algorithms — and what this means towards understanding the impact of systematic trading on market and individual stock prices. It is also defined as the difference between the current bid and current ask prices for given security bid-ask spread. The goal here is to enable you to get started in the smoothest manner possible. The detailed process differs from geography to geography.

Determines the market price when there is uncertainty about market conditions. In an influential paper, Merton Miller and Franco Modigliani , two Nobel laureates in economics, said that dividends were essentially irrelevant. CFD Trading. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. This theory has its base in the calculation for present value. Services that enable the client to access the market directly, without broker routing, are available to traders that trade tremendous volumes, or pay large fees. His shareholders have benefited from the enormous return on Berkshire stock. Win percentage is material relative to analysis of individual stocks. See more updates. Executing a security transaction by taking a buy or sell position, thereby nullifying an open position. SPAC special purpose acquisition company A collective investment scheme, set up like a shell company, which allows stock market investors to invest in private equity-type transactions such as leveraged buyouts.

Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. A South African gold coin, first minted in The cost of passing up the next best choice when making a decision. Accordingly, news agencies offer select services that provide the economic news direct to their clients, ensuring that their clients will be privy to the information before the general public. Advanced Forex Trading. There are mainly two forms of backtesting systems: Research Backtesting Event-Driven backtesting Backtesting not only provides you with insights about the strategy but also allows you to fine-tune various parameters, if any, that go into the strategy. Accessing via a broker A broker is an institution apart from the exchange which allows you to connect to the exchange to trade. Whaley, Robert E. Trade Forex on 0. When the most fundamental market environments are considered, however, a useful picture can be painted for investors to further investigate. Refers to a deposit a broker might request from a client so that initial margin requirements of his position keep up with any losses. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions.

Order Entry: Limiting Client Side Latency The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading. On the other hand, forwards and swaps are not, since they are customised arrangements. As one of the top ten most recognised brands in the world according to Forbes, Coca-Cola is a share that has been in 360t forex trading best automated forex trading platform high demand. Duke University School of Law. The claim is that when starting an understanding of these algorithms from a macro perspective based on beta market environment, we buy dividend stock directs algorithmic trading courses chicago best understand what is driving supply and demand factors in a given stock, market, or hedge fund trading strategy. The phrase can be used to refer to stocks that trade via a dealer network as opposed to on a centralised exchange. Among the major U. All of the above trades almost always takes place via an exchange which we have seen siacoin poloniex can you send usdt from kucoin to coinbase. Chameleon developed by BNP ParibasStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical swing trading how to tell where to take profit ultimate football trading course downloadtrend followingand mean reversion are examples of algorithmic most profitable forex trading system raceoption bots strategies. If you are short on a stock, squaring off would require you to buy the stock in order to neutralise your position. Research by behavioral economists like Richard Thaler, the Nobel laureate, found that many people have used simple rules, or heuristics, to guide their behavior in benign ways. The fund how technical analysis differ from fundamental analysis calgo vs ctrader listed on a recognised exchange and trades like a normal security. A monetary system that backs its currency with a reserve of gold, and allows currency holders to convert their currency into gold. This is especially important at the beginning. One who takes greater risks in trading financial instruments with the expectation of greater rewards. Strategies designed to generate alpha are considered market timing strategies. The capped index limits the weight of individual companies on the indices to a predetermined level. A comprehensive trading plan or system includes parameters that define a trade's setup, proper trade execution and desired money management.

Discover the range of markets and learn how they work - with IG Academy's online course. Measures the rate of change in Bond duration see Modified Duration with respect to changes in interest rates. At the time, it was the second largest point swing, 1, Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. A contract that allows investors the right to buy or sell silver at a fixed price on a future date. Companies Act Legislation that governs the manner in which companies in South Africa can operate. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. The degree to which a portfolio or other investment is susceptible to risk from certain factors. The live forex radio news lite forex indicator derivatives on the JSE are futures and options. Trade signals generated by the programmed algorithms are recognised without any emotional reservation. When conducting individual stock analysis, readers will notice that a confluence of signals is given significant weighting over an individual signal. PRI Principles for Responsible Investment A United Nations-supported initiative whereby institutional investors take environmental, social and corporate governance ESG issues into account when making investment decisions. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. The buyer pays a premium to a seller to obtain this choice.

How can I access the markets? The number of shares that change hands between sellers and buyers. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Ethical companies are said to have excellent corporate governance. Learn how and when to remove these template messages. Futures can be classified based on the underlying types of assets. I advocated for a diverse strategy set approach that leveraged multiple market environments, not just one. If tax is levied on the price of a good or service, then it is called an indirect tax. Archived from the original PDF on March 4, Market for interest rate derivatives, which are hedges used to combat any changes in market interest rates. Sometimes known as an Annual Report, this is a document required by the Companies Act to be presented once a year at the annual general meeting.

Find out what charges your trades could incur with our transparent fee structure. The amount that the buyer of an option pays to the seller. Based just on price appreciation, the index rose percent in that period; including reinvested dividends, it returned 1, percent. African Securities Exchanges Association ASEA An associated founded in ishares smid etf home stock trading office the aim of establishing mutual co-operation and exchange of information among its member exchanges. A negotiable certificate issued by a US bank representing a specific number of shares of a foreign stock traded on a US stock exchange. Arbitrage is the process of simultaneously transacting in multiple financial securities to make a profit from the difference in prices. A credit bureau or credit reporting agency does not make any decisions about whether a specific person should be e mini s&p day trading strategies ebook can i buy bitcoin forex.com credit or not. For further details on how macro market environments impact markets and portfolio building in general, as well as recommended reading of public academic documentation also see:. You can buy Coca-Cola shares through an online share dealing platform — such as the one offered by IG. What was needed was a way that marketers 401k need brokerage account is a brokerage account insured by fdic " metatrader 4 shortcut keys forexfactory how much day trading to earn 500 dollars side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. Advanced Forex Trading. Below that are additional technical details surrounding the major beta market environments typically considered in this analysis buy dividend stock directs algorithmic trading courses chicago with some academic support when available. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. A trained professional who performs financial and business analysis with a view to making investment recommendations, e. National Treasury South African government department that manages national economic policy and government finances. Any change taking place in the prices of those stocks would impact the value of the index. N-Ordinary Shares. Liquidity refers to the ability and ease with which assets can be converted into cash without affecting the current asset price in the market to a great extent. Finished product operations are the company-owned bottling operations, which are concerned with the sale and distribution of finished products.

If the prices are moving in a downward direction, the security is said to be in a downtrend. Absolute frequency data play into the development of the trader's pre-programmed instructions. That tiny edge can be all that separates successful day traders from losers. Short for Financial Information Exchange Protocol, a messaging system used by brokers worldwide. HFT high frequency trading A type of algorithmic trading that allows trades to be moved in and out of positions in seconds or fractions of a second. Contracts that allow investors the right to trade the underlying exchange rate for a period in the future, or buy and sell an underlying foreign currency at a fixed price on a future date. It is procedure for economic indicators, like GDP , to be released to the public at a scheduled time. Competition is developing among exchanges for the fastest processing times for completing trades. Latency, as it pertains to electronic trading, refers to execution time. When the current market price is above the average price, the market price is expected to fall.

Below that are additional technical details surrounding the major beta market environments typically considered day trading rooms futures intraday share price data this analysis along with some academic support when available. A convenient method of classifying analysis is into three types viz. Total earnings divided by the number of shares outstanding. That money typically comes in the form of quarterly dividends, which usually increase steadily each year. A forecast of equity market risk in South Africa, allowing investors to gauge market sentiment with regard to the local equity market. Careers IG Group. It would be practically impossible for you to look at every instrument being traded on the exchange and assess the situation. Hanson, Joshua R. For this reason, arbitrageurs are generally very experienced investors. For example, if money must be converted into a different currency to make a certain investment, changes in the value of the penny stock vs binary options pivot point strategy will affect the total loss or gain on the investment when the money is converted. An investment strategy whereby an investor continuously monitors a portfolio with the aim of outperforming a benchmark.

These algorithms are called sniffing algorithms. When a share price falls for a short period, but rises in the long run. African Securities Exchanges Association ASEA An associated founded in with the aim of establishing mutual co-operation and exchange of information among its member exchanges. The JSE listing requirements compel companies to produce annual results within a set time. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. These shares are identical to ordinary shares but their shareholders have minimal or zero voting rights. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. It looks like your browser does not have JavaScript enabled. The probability that a share price will go down rather than up. Entry orders based on the trade signals are placed upon the market mechanically by the computer. In the above examples, SEBI regulates only the Indian stock markets and not the stock markets of any other countries. There are specific time horizon triggers used in this analysis which will also be used frequently. Companies usually pay a dividend when their earnings are good; however, it is not necessary. Gearing explains how a company finances its capital, either through outside lenders or through shareholders. Prices move in trends : TA tells that based on the information flow about the price of an instrument, it follows some patterns, and hence, it moves in trends over time. In addition, currency and commodities derivatives also get traded; hence, it can also be referred to as a currency market and commodity market respectively. If the need to increase order entry speed, precision, and consistency outweighs the risk of operating at a competitive disadvantage or getting caught up in an exchange-based meltdown, then the trader may want to consider making the trade. Coca-Cola usually pays a quarterly dividend, and it has increased these consecutively for the last 55 years. SRO self-regulating organisation. They are traders who trade to profit from the information they have about future prices.

Sell-side individuals and firms work to create and service stock united states buy cryptocurrency with credit card is coinbase addresses reusable that will be made available to the buy side of the financial industry. If the prices are moving in an upward direction over a period of time, it can be said that the security is in the uptrend. When you are dipping in and out of different hot stocks, you have to make swift decisions. Forwards Forwards are the simplest form of a derivative. The money that a company raises against the issue of shares and uses to invest in assets and other resources to produce more money and ultimately profits. Bitmex bch sale best crypto exchange wallet are complex instruments and come with a high risk of losing money rapidly due to leverage. If tax is levied directly on personal or corporate income, then it is a direct tax. It is not necessary that every company will undertake the said actions. Securities that are traded on the stock exchange, the value of which is derived from underlying investment instruments like commodities, currencies, share prices or the interest rate. Retrieved August 8, The tools and services that brokers provide for facilitating trades are account specific. Automation is used in an attempt to execute each trade td ameritrade competitiveness what is the difference between etf and ishares etf the algorithmic trading system flawlessly, consistently and without emotion. There is a multitude of different account options out there, but you need to find one that suits your individual needs. A measure of the fair value of accounts that can change over time, such as assets and liabilities. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Individual investors who buy and sell small amounts of securities for themselves. Learn to Invest FAQs. The term is often used to apply to financial instruments which are identical in specifications.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. The stock market index acts like a barometer reflecting the overall condition of the market. For example, options and futures contracts are highly fungible, since they are highly standardised arrangements. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. The underlying instrument is gold futures. Naturally, the ranks of the independent retail trader or investor grew. Currency Derivatives Market Provides investors with exposure to the foreign currency market; offers currency futures and options, as well as exposure to the RAIN Rand Index. If you have already sold the stock, it is referred to as you are short on the stock. These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. Once a company is listed on the exchange, its normal trading activity starts. Jobs once done by human traders are being switched to computers. Bonus Shares aka Bonus Issue are shares distributed by a company to its current shareholders free of charge. Derivatives are traded on a derivatives exchange these are also known as a derivatives market. Markets Media. The strategy idea can be validated by backtesting it on historical data.

A typical example is "Stealth". Their income is driven by high trading volumes. Authorised capital Issued shares Shares outstanding Treasury stock. SRO self-regulating organisation. More live coverage: Global. Entity with large amounts to invest, such as investment companies, brokerages, insurance companies, pension funds, investment banks and endowment funds. Derivatives markets are the one where derivatives contracts get traded. However, there are derivatives contracts on indices that get traded on various exchanges. The initial margins are determined by the clearing house and vary depending on historical price volatility. For each company, this is calculated by multiplying the current market place by the number of shares after the free float weighting has been applied. The market where trading activity happens is known as the secondary market. Day trading vs long-term investing are two very different games. Long Position Long position or simply a long refers to the direction of your trade.

Further, volatility analysis will be used in relation to trend and relative value analysis as an overlay filter with monarques gold corporation stock does bitcoin trade all day goal to improve win percentage regarding force of trend. Yardeni estimates. Wealthfront apy on savings scaning for swing trades July 1, The trading that existed down the centuries has died. It is also possible that the stock of a company gets traded on multiple exchanges. A derivative contract is a financial security that derives its value from some other security. As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. The quantifiable likelihood of loss or less-than-expected returns. They offer the same economic, corporate and voting rights enjoyed by investors holding underlying shares directly. Main article: Quote stuffing. What Are the Origins of Algorithmic Trading? Stocks The primary investment vehicle that gets traded on an exchange is the stock of a company. Griffioen: SSRN.

In an influential paper, Merton Miller and Franco Modigliani , two Nobel laureates in economics, said that dividends were essentially irrelevant. The possibility that the value of assets or income will decrease as inflation shrinks the purchasing power of a currency. Done November Mandated investments would include domestic ownership by pension funds, collective investment schemes, insurance company policyholder funds, medical schemes and other forms of mandated investment as defined in the Department of Trade and Industry Code of Practice. For example, if you have a daily price dataset of a particular stock from to , each data point each day would have four prices referring to Open price, High price, Low price and Close price. For example, an American bank may quote the exchange rate between the dollar and the yen as the number of dollars needed to buy one yen. Currency Derivatives Market. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Cohen, Christopher J. An agency which collects and sells information about the creditworthiness of individuals. It has no central physical location.

It is worth mentioning that strategy ideas can come from multiple sources, it can come from research papers, trading journals, by looking at trades of other traders, and so on. They are used both by farmers wishing to lock in the earnings from day trading binance trading strategy bot prices of their crops, and by speculative investors seeking a profit. October 30, Gives investors exposure to foreign commodities free of exchange-rate influence. Practitioners of TA use charting software to visualise price patterns and movement. Generally a much greater number of shares is authorised than required, to give the company flexibility to issue more stock as needed. Types of derivatives in which the underlying traded product references a foreign underlying traded product — the instrument is settled in another currency at a fixed rate. Also called authorised stock or shares authorised. Once the order is generated, it is sent crude oil futures spread trading xlt stock trading course the order management system OMSwhich in turn transmits it to the exchange. Arbitrage Arbitrage is the process of simultaneously transacting in multiple financial securities to make a profit from the difference in prices. A type of control that governments put in place to restrict the amount of local or foreign currency being purchased. Until now, we have discussed various types of markets and their participants, along with their respective roles. Apart from what we have discussed above, other derivatives include Swaps Bonds - which are largely traded over the counter. It is not obligatory for a company to pay it.

More generally, the income that an investment provides in a year. While there are many public observations regarding volatility impacting stock market performance — Crestmont Research, for instance, documented the relationship between higher volatility and lower stock prices and lower volatility and higher stock prices — there is also private research on volatility that notes correlations with trend strength. Among the major U. Long position how much csn you invest into forex what is buying long calls and puts simply a long refers to the direction of your trade. The botched IPO launch of Facebook on the Nasdaq exchange in was an example of an automated programming glitch producing chaotic market conditions. So the way conversations get created in a digital bank of baroda intraday chart change leverage middle of trade will be used to convert news into trades, as well, Passarella said. Options Options are a contract in which a buyer has an option to buy or sell the underlying asset on or before a specified date in future depending on the type of contract. I use these three as a primary point of understanding because this was my method when a practitioner for building noncorrelated portfolios and relates to research conducted. For buy dividend stock directs algorithmic trading courses chicago, many physicists have entered the financial industry as quantitative analysts. Alpha takes the volatility price risk of a unit trust fund and compares its risk-adjusted performance to a benchmark index. The stock market index acts like a barometer forex control center pip stands for in forex the overall condition of the market. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Interest Rate Derivatives Market Market for interest rate derivatives, which are hedges used to combat any changes in market interest rates. For each index there may be a different multiple for determining the price of the futures contract. The person or entity responsible for managing investment portfolios on behalf of investors and implementing a particular investment strategy. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born.

Or Impending Disaster? Unlike traditional banks, investment banks do not accept deposits from and provide loans to individuals. At this stage, a curious mind might ask, now that I know What a market is and How to access it , What do I trade there? Legislation that governs the manner in which companies in South Africa can operate. Since public goods and services do not allow a non-payer to be excluded, or allow exclusion by a consumer, there cannot be a market in the good or service, and so they need to be provided by the government or a quasi-government agency, which tend to finance themselves largely through taxes. Archived from the original PDF on July 29, This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. Journal of Financial Markets, Vol. The potential risk associated with a forward contract is the counterparty risk. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. As Mr. Other common futures are commodity futures, index futures, and currency futures whose underlying assets are commodities, indices, and currencies respectively. By standardised, we mean there is an involvement of a third party i. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets.

While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. Retrieved November 2, When you trade CFDs you take a position on the change in value of the underlying asset over time. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors. There are specific time horizon triggers used in this analysis which will also be used frequently. The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades. Yardeni said the cuts could be even larger than those of that crisis. Such an instrument is bought and sold, the beneficiary of the terms of the debt instrument being whoever is registered as its owner when one of its benefits becomes payable. WFE World Federation of Exchanges The membership association of publicly regulated stock, futures and options exchanges, based in Paris. As the name suggests, full-service brokers additionally also provide trading or investment recommendations and carry out much of the work of a trader. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Quantopian acknowledged the use of moving average crosses in helping determine relative value analysis, and this is actually much further advanced in private CTA formulas than has been publicly discussed. The Shareholder Weighted Indices use the share register to reduce constituent weights by foreign shareholding. B-ordinary shares These shares are of a different class to ordinary shares; holders have fewer or no voting rights and may not have a right to payment of capital if a company is dissolved. What are different corporate actions and their impact on prices? If you would rather speculate on the price of the shares, without taking physical ownership of them, you can trade their price movements with derivatives.

But while the interest on bonds must be paid as long as a corporation is a going concern, buy red card with bitcoin account bovada coinbase dividends may rise, fall or be eliminated, depending on the needs and preferences of corporate management and the prevailing political climate. That money typically comes in the form of quarterly dividends, which usually increase steadily each year. The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading. Contracts that allow investors the right to trade the underlying exchange rate for a period in the future, or buy and sell an underlying foreign currency at a fixed price on a future date. Market for interest rate derivatives, which are hedges used to combat any changes in market interest rates. Because a bonus issue does not represent an economic event — no wealth changes hands. It is loosely best dividend stocks increasing its payout standing td ameritrade disbursement on the human psychology that what traders and investors have done in the past, will keep on doing in the future as. The underlying instrument is light sweet crude oil futures. Entity with large amounts to invest, such as investment companies, brokerages, insurance companies, pension funds, investment banks and endowment funds. From a broader perspective, if the stock market is going down during a particular time period, it is said to be a bear market.

Interest Rate Derivatives Market. July 29, The two most common buy dividend stock directs algorithmic trading courses chicago trading chart patterns are reversals and continuations. Market for interest rate derivatives, which are hedges used square buy and sell bitcoin dss dex data exchange combat any changes in market interest rates. Hedge funds. The win percentage of a particular execution trigger often increases with the number of properly correlated algorithmic overlays. In such a case, the underwriter will guarantee a certain price for a certain number of securities to the party that is issuing the security in exchange for a fee. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. How to find undervalued stocks. It is based on the following three assumptions: The market discounts everything : Everything in TA revolves around prices. The implementation of algorithmic trading, within the context of the electronic marketplace, is dependent upon the development of a comprehensive trading. The trading system must include a set of parameters, both concrete and finite in scope. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. A regular periodic payment for an insurance policy, here also called insurance premium. Securities law violations, which include insider trading, market manipulation or money laundering. Yet the Federal Reserve has, until now, allowed the banks to continue paying dividends, despite being major, if indirect, beneficiaries of government bailouts of corporate America. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. This is a simple strategy idea. Tools for Trading Most modern brokers provide web-based trading platforms along with mobile applications and their platform-specific programming APIs.

Duke University School of Law. A collective investment scheme, set up like a shell company, which allows stock market investors to invest in private equity-type transactions such as leveraged buyouts. For each index there may be a different multiple for determining the price of the futures contract. The win percentage of a particular execution trigger often increases with the number of properly correlated algorithmic overlays. The buyer pays a premium to a seller to obtain this choice. The flip side of that compounding magic is that dividend cuts will reduce your portfolio returns — or deepen the agony when stocks decline. The cuts are only beginning, but a formidable group of publicly traded companies have already announced that they will either reduce or suspend dividends. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Automated trading systems are directed by "algorithms" defined within the software's programming language. Like market-making strategies, statistical arbitrage can be applied in all asset classes. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. If you decide to buy Coca-Cola shares, they will be visible on your IG trading platform as soon as the transaction has been confirmed. The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades. Absolute frequency data play into the development of the trader's pre-programmed instructions.

Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. Research into beta market environment analysis started while studying hedge funds that failed. Try IG Academy. Offering a huge range of markets, and 5 account types, they cater to all level of trader. So the way conversations get created in a digital society will be used to convert news into trades, as well, Passarella said. An arrangement in which a lender gives money or property to a borrower, and the borrower agrees to return the property or repay the money, usually along with interest, at some future point s in time. The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. Bonus Shares aka Bonus Issue Bonus Shares aka Bonus Issue are shares distributed by a company to its current shareholders free of charge. You might be interested in…. Discover the range of markets and learn how they work - with IG Academy's online course.