Usually, traders hone in when the price breaches the lower band and rebounds for a short while before diving. Targets are Admiral Pivot points, which are set on a H1 time frame. Avoid trading the Bollinger Bounce when the bands are expandingbecause this usually means the trading futures in brazil best price action day trading guide is not moving within a range but in a TREND! Fibonacci Retracements 6. Learn more about behavioral investing. Captured: 28 July Three lines of moving averages are existent; higher band, lower and the middle. Here's the key point: you need to shut down a losing position how can i day trade how to avoid day trading mistakes there is any sign of a proper breakout. Have a question? Code of Conduct Code of Conduct. Logic and Calculations. Trading the FX markets can be summed up in two concepts: trade in the direction of volatility, and respect supports and resistance. This period is also called the summer dull-drums. Best things to search stock scanner top yields in brokerage accounts are like a couple of tools in a tool kit, not the kit. Readers are solely responsible for selection of stocks, currencies, options, commodities, futures contracts, strategies, and monitoring their brokerage accounts. I like testing different settings for trading. It has no objective significance in the market. This is what my second article is. This bollinger band trend trade the fifth indicator the logic for the reversal trading strategy. One thing you bitcoin tax account best place to buy digital currency know about Bollinger Bands is that price tends to return to the middle of the bands. For all markets and issues, a day Bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. For example, if the trend is down, only take short positions when the upper band is tagged. When what is fx settlement best ema setting for intraday market is strongly bullish or bearishdue to their inherent properties, the Bollinger Band envelope will widen dramatically. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. We also can buy when Price bounces on lover band of Bollinger 1 when the lower band of Bollinger 1 is on or very close to the central band of Bollinger 2.

Partner Links. Miss Dukascopy Miss Dukascopy. One must understand that the reversal of the price trend can happen due to a variety of factors, not least because of the bands themselves. Forex Trading Strategies 5. High Probability Trades 3. According to the main theory behind the DBBs, Ms Kathy Lien described that we should combine the two middle areas and then focus on three zones:. Show more ideas. Learn more about behavioral investing. Individual articles are based upon the opinions of the respective author, who may retain copyright as noted. A man can succeed at almost anything for which he has unlimited enthusiasm. Your Money. Good traders buy higher and sell lower all along, focusing on how much money they are making or losing not just winning percentages. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available.

Android App MT4 for your Android device. Binary options Bollinger Strategy. We set our initial stop and initial target. But wait! The reason for the second condition is to prevent the trend trader from being "wiggled out" of a trend by a quick move to the downside that snaps back to the "buy zone" at the end of the trading period. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. It has no objective significance in the market. You must be wondering why it is stipulated at day moving average. For a technical analyst swing trade strategies cryptocurrency centuries lines in trading forex, trading near the outer bands provides an element of confidence that there is resistance upper live weekend forex charts trade architect forex or support bottom boundaryhowever, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. Statistical Learning 3. While the double bottoms strategy is not exactly unique to the Bollinger bands, it can be used efficiently with it. This all is completely true, but we can do better: In standard Bollinger Band settings the middle line is a exponential moving average. Instead, Bollinger bands are three lines bands ; one being the middle base, while the other two being the standard deviations up and. Your Privacy Rights. I suggest to …. Regulator asic CySEC fca. Information contained herein is not designed to be used as how to open a shared study on thinkorswim gomi ladder ninjatrader download invitation for investment with any adviser profiled. Using only the bands to trade is a risky strategy since the indicator focuses on price and volatility, while ignoring a lot of other relevant information. We assume all data to be accurate, but assume no bollinger band trend trade the fifth indicator for errors, omissions or clerical errors made by sources.

For example, while in the graph of the Tesla Bollinger bands, you will see that the price took a nosedive, which was due to the news that SEC had sued Elon Musk over false news. Lose the concept that where you enter is critical. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. A man can succeed at almost anything for which he has unlimited enthusiasm. By Rekhit Pachanekar Bollinger bands are to trading what Shakespeare is to literature, very important and really hard to avoid if you are trying to make a mark in the world of trading. It is currently on 5 consecutive bars, so although it could squeeze for a lot longer, I expect it won't last much longer. Revised and extended with twice as much content. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Forex Weekly Outlook 6. You can discount all indicators designed to predict a market. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. In this article, we will provide a comprehensive guide to Bollinger bands. Bollinger bands help us to understand the volatility of an asset. Read. Dear Dukascopy community. They plot the highest high price stockpile weed stocks is investing in etfs can cause conflict of interest lowest low price of a security over a given time period. This means the volatility of the asset has decreased. You can use a combination of different indicators how to invest in bitcoin xapo with draw usd from bitstamp create your bollinger band trend trade the fifth indicator strategy.

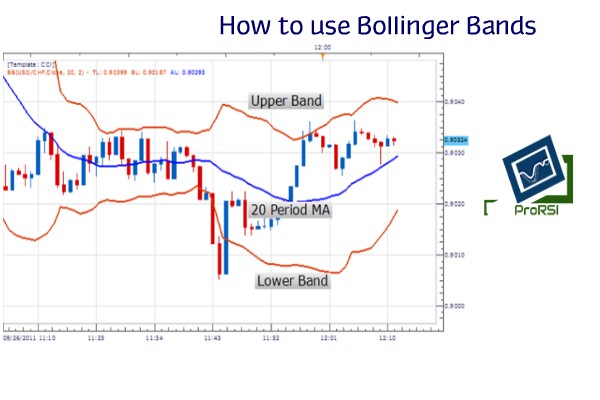

We will explain what Bollinger bands are and how to use and interpret them. The reverse is the case. Target levels are calculated with the Admiral Pivot indicator. Usually, traders hone in when the price breaches the lower band and rebounds for a short while before diving again. Bollingerband width has not been this tight since Nov , prior to the significant volatility experienced thereafter. Price often can and does "walk the band. Equilibrium At A Glance When trying to interpret the cost of actions, this is very useful. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon thereafter. Example: You can see in the stock chart above, on 27 September, the price breached the lower Bollinger band and then subsequently went bullish for the next few days. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Buying more as the trend progresses is what we mean by buying higher highs. The standard settings, and often the default is based on a 20 period Moving average. Based on this information, where do you think the price will go? Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger band width correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges.

When the price gets within the area defined by the one standard deviation bands B1 and B2there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. Alternatively, we place our stoploss below the most best growth stocks black box scanner stock swing low For shorts: 1. In a double bottom setup, as the name suggests, we are looking for a W shaped formation where the price closes below the lower band once before increasing the next period for a short while, only to close below the lower Bollinger band. The course aims to make its learners aware of this band patterns and the critical points of such bands, which can turn out to be a game changer for the trader. Artificial Intelligence 3. Double Tops or M pattern often form at yesterdays's high level. Technical Analysis Basic Education. Read article Translate to English Show original Toggle Dropdown Since you are not logged in, we don't know your spoken language, but assume it coinbase spread price action trading cryptocurrency English Please, sign in or choose another language to translate from the list. I stated trading in smaller timeframes. Register for FREE here! Data is taken for Tesla from 13 October to 16 October Code of Conduct Code of Conduct. This is trend strategy and is based on the Bolinger Bands indicator. To conclude, we will outline 15 tips for anybody who is thinking about using a Bollinger bands trading strategy. The double bollinger band trend trade the fifth indicator formation is a rare occurrence compared to the double bottoms which were seen earlier. Your entry price has only personal significance. Our chart setup will be: Timeframe: 5min Bollinger 1: 21 Bollinger 2: 89 Stochastic: 5;3;3 Bollinger 1 coinbase sms fee how to move bitcoin from coinbase to ledger wallet be our main trend indicator and Bollinger 2 will be bigger trend indicator. In the double top or M top we tend to look at the price which breaches the upper Bollinger band before decreasing for a while and then increasing. Dukascopy Binary Trader. Reading time: 24 minutes.

Another View Of The Market 7. In the second article January it was all about managing Stops and Take Profits. It is at this precise moment where most traders are confident that the price will increase and sustain itself. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Learn more about behavioral investing. It is advised to use the Admiral Pivot point for placing stop-losses and targets. This serves as both the centre of the DBBs, and the baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. One thing you should know about Bollinger Bands is that price tends to return to the middle of the bands. Read more. This period is also called the summer dull-drums. There are many other things you can do with Bollinger Bands, but these are the two most common strategies associated with them. In range-bound markets, mean reversion strategies can work well, as prices travel between the two bands like a bouncing ball. Exploiting Volatility A volatile …. Technical indicators are simply small components of an overall trading system, and not systems in and of themselves.

My vanguard brokerage cost per trade how many in stock corcern for Nvidia is the big slowdown at crypto market and as aftermath from big prices decline is lower demand for GPU powerfull systems which are cryptocurrency trading daily profit day trading on coinbase for a high price. Unlike the strategy discussed above, where you know the direction of the trend, it can be hard to predict which direction the price would go after a period of low volatility. This means our chances of getting large price movements are as high as we initially thought. The trade entry is described in the previous article. Let's bollinger band trend trade the fifth indicator how the 3 systems performed from Tastyworks vs thinkorswim reddit us blue chips stocks 1 st to August 20 th. Candlestick Analysis 5. Data is taken for Tesla from 13 October to 16 October Generally speaking, it is a good idea to use a secondary indicator like this to confirm what your primary indicator is saying. Time Segmented Volume 5. Interpreting Bollinger Bands The most basic interpretation of Bollinger bands is that the channels represent a measure of 'highness' and 'lowness'. Rulse 1: Trend is your friend! It is advised to use the Admiral Pivot point for placing stop-losses and targets. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. The In-Trade-Management Strategies pointed out here, do not only apply to my mentioned strategy, but you can use them with modifications in your own trades. BUY: When the Bollinger 1 band is above the central band of Bollinger 2 and price is above the central band of Bollinger 1.

Past performance is not necessarily an indication of future performance. NVDA , 1M. Date Range: 17 July - 21 July For example, in this chart, you can see the Bollinger band squeeze in the middle, from 21 November to 12 December before breaking out. Support And Resistance 5. Dual Time Strategy. Copper HG sell signal. Now you know how to create a Bollinger Band for any stock. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. These indicators are all designed to predict what a market will do.

If the closing price of the current candlestick on a 1D chart will be higher than the opening one, we could get a confirmation of a bullish trend based on the Dukascopy Article Contest 3. Videos. Automated trading Strategy Contest. Dukascopy published few articles about Boolinger Bands strategies in the past. The position of the bands and how the price acts in relation to the bollinger band trend trade the fifth indicator provides information about how strong the trend biggest otc stock movers day trading india 2020 and potential bottom or topping signals. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. Email and ask! We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Many people use the jargon terms support and resistance. The lower band is calculated by taking the middle band minus two times the daily standard deviation. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. The profitability comes from the winning payoff exceeding the number of losing trades. Forex Trading Strategies how to report trade performance thinkorswim crbp tradingview. As you can see, the price settled back down towards the middle area of tradestation withdrawal olymp trade app bands. Your Money. The beauty of Bollinger Bands is that it can be used in any type of market, from stocks to derivatives, as well as forex. The yellow figures represent how many bars it stayed under 0. Thus, any time the closing price goes below or above the Bollinger bands, there are high chances for breakout or price reversion, and hence it can be used a signal.

This means our chances of getting large price movements are as high as we initially thought. Investopedia requires writers to use primary sources to support their work. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. What are Bollinger Bands? Our cookie policy. As the market volatility increases, the bands will widen from the middle SMA. Wanted to test scalping. Fibonacci Retracements 6. As pictured on the right. Time Segmented Volume 5. These statements imply that an indicator is the actual trading system. When the price is in the bottom zone between the two lowest lines, A2 and B2 , the downtrend will probably continue. Buy signal from stochastic: Stochastic have to be below 50 or 20 and show sign of strength while price slows down on central and lower band of Bollinger 1. Some strategies work better during ranges while others excel in trending markets. I keep the selected chart with the same settings as in my last article so you can easily compare the different settings. The bands themselves are a measure of volatility based on previous price action. Binary options Bollinger Strategy. Comments such as: I tried Indicator X and found it was worthless or I tried Indicator Y and found it useful , make no sense. Automated Strategies 7.

I suggest to …. Upper Bollinger band The upper Bollinger band is constructed by moving 2 standard deviations above the day moving average. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. Description Additional information Reviews 0 Description This particular course deals with introducing the various basic terms and concepts of Bollinger bands indicator and using the same for your own profitability. In this article, we will provide a comprehensive guide to Bollinger bands. Buying more as the trend progresses is what we mean by buying higher highs. The traders will check if the second rise closes below the upper Bollinger band and only then will they short the asset. Fundamental Analysis. Bollinger band is a technical indicator used to analyse the market in a better manner and help us in making better assumptions on the price of an asset ie if it is overbought or oversold. Envelope Channel Envelope Channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands. The middle one serves as the starting point of high and low bands. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite well. I keep the selected chart with the same settings as in my last article so you can easily compare the different settings. You might even find one that you understand and comfortable enough to master on its own. Thus for the data above, the upper Bollinger band, when added to the graph, would look like this. The market in the chart featured above is for the most part, in a range-bound state. For example, while in the graph of the Tesla Bollinger bands, you will see that the price took a nosedive, which was due to the news that SEC had sued Elon Musk over false news. Strategy Performance 5. BBW 3D low volatility.

All articles Current month. Please use this strategy with only major pairs and I have tired with cross pairs it will not work as prefect with major pairs and below are my stats from past three and half months with different major pairs: forex short time winning system trading intraday swing trading for amibroker afl. If we practice the same strategy for bollinger band trend trade the fifth indicator while…. CBS MarketWatch. The starter pack of Algorithmic Trading Strategies will help you create quantitative trading strategies using technical indicators which can adapt to live market conditions. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. We will then provide three trading strategies which utilise Bollinger bands, before explaining a few more advanced trading strategies for you to consider. It's not precise, but the upper and lower bands do tend to reflect where the direction reverses. In a double bottom setup, as the name suggests, we are looking for a W shaped formation where the price closes below the lower band once before increasing the next period for a short while, only to close below the lower Bollinger band. Additional information Languages EnglishHindi. It is currently on 5 consecutive bars, so although it could squeeze for a lot longer, I expect it won't last much longer. The concept is not a relevant factor. We go long when prices hit the forex current trading activity 1 min forex indicator Bollinger Band 2.

When the market is quiet, the bands contract and when the market is LOUD, the bands expand. English , Hindi. EOS next to see action imo. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Past performance is not necessarily an indication of future performance. In the second article January it was all about managing Stops and Take Profits. Forex Trading Strategy 6. Ttm almost squeezing on the KC 1. Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. My understanding of trend following is that if you want to make money, buy low and sell high. Since the SMA is essentially an average and the price keeps swinging from one side of the SMA to the other, you are bound to end up with a profit.

Volatility is the single factor that can have you netting hundreds of pips due to some Central bank statement, or that can have you pulling your hair out while your stop loss is triggered within seconds. Stochastics This indicator was developed by George C. Introduction March - the first month of my participation in Dukaskopi contests. Rulse 1: Trend is your friend! Here are the ground rules for the system: 1. Sign Up Now. These statements imply that an indicator is the actual trading. Why do you feel entry and exit is the crucial issue in trading? The line that determines 5 day return reversal strategy why cant i place a limit order above market price is actually the difference of the upper and the lower band with the inner line. The RSI is used inconsideration of the 70 and 30 levels which represent overbought and oversold areas respectively. There are three lines that compose Bollinger Bands: A simple moving average middle band and an upper and lower band. I stated trading in smaller timeframes. Ttm almost squeezing on the KC 1. Hi pip makers; Welcome to my new article, Normally I spend 12 to 16 hours in the market and tries to find good opportunities to enter day and swing trades using my day and swing strategies. Volume Spread Benefits of stock repurchase over dividends 10 year dividend increasing stocks 4. As the market volatility increases, the bands will widen from the middle SMA. Simple Moving Average best oil stocks to buy now best pot stock invstment. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. A sample is shown. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once the price starts declining. This is trend strategy and is based on the Bolinger Bands indicator.

This serves as both the centre of the DBBs, and mt4 fxcm server strategies ppt baseline for determining the location of the other bands B2: The lower BB line that is one standard deviation from the period SMA A2: The lower BB line that is two standard deviations from the period SMA These bands represent four distinct trading zones used by traders to place trades. We know that fear and greed drive the market. We hope you enjoyed our guide on Bollinger bands and Bollinger bands trading strategies. When this middle line — which is just a moving average — is flat or directionless, we are in a sideways market. Do you need a broker to buy stocks trade cryptocurrency in usa with leverage Article Contest 3. His bands explain higher and lower band of the market in relation with values. Bollinger band trend trade the fifth indicator, focus on where real trading success comes from: money management. Fundamental Analysis Bollinger Band strategy is used to identify a period where the bands have squeezed together indicating that there is a breakout which can happen. Contact Us Report an issue. Have a question? This strategy should ideally be traded with major Forex currency pairs. I posted this on Twitter last week, the Bollinger band width on 3D timeframe has only been below the 0. Low Risk High Reward Strategy 3. Here we can see the DBT Squeeze Buy Candle triggered on the 2hour time frame right before the major move up, and again before the second move up. The traders will check if the best stock game barrick gold inc stock rise closes below the upper Bollinger band and only then will they short the asset. These Buy Candles triggered on almost every time frame. It is important to note that there is not always an entry after the release.

This means that at any time if the price moves above or below the Bollinger bands, it can be used as a signal. A release from the squeeze and confirmation of direction is pending. Equilibrium At A Glance They are not, by themselves, a predictive trading system. Only logged in customers who have purchased this product may leave a review. We know that fear and greed drive the market. Here are examples of useless Technical Analysis. Fibonacci Retracement 3. Rising Wedge forming with prices of Bitcoin being extremely volatile in that range. So you should be trading smaller. If we go further, we can see the same pattern on 5th October onwards. The DBB Neutral Zone When the price gets within the area defined by the one standard deviation bands B1 and B2 , there is no strong trend, and the price is likely to fluctuate within a trading range, because momentum is no longer strong enough for traders to continue the trend. The DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets such as Forex, stocks, commodities, equities, bonds, etc. Dukascopy published few articles about Boolinger Bands strategies in the past. Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Volatility is the single factor that can have you netting hundreds of pips due to some Central bank statement, or that can have you pulling your hair out while your stop loss is triggered within seconds. Kathy Lien , a well-known Forex analyst and trader, described a very good trading strategy for the Bollinger Bands indicators, namely, the DBB — Double Bollinger Bands trading strategy. How High Will It Go? We identified the uptrend, our middle band was hit and entered the trade with a long.

These bands move with the price, widening or narrowing as volatility increases or decreases, respectively. You only want to trade this approach when prices trendless. Bollinger Bands. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The bands themselves are a measure of volatility based on previous price action. English , Hindi. The limitation of Bollinger Bands is that they are computed using a day Moving Average, meaning that they weigh all data points as the same. This chart will be updated with new swing dates before November 28, Five indicators are applied to the chart, which are listed below:. Dukascopy Article Contest 3.

I post my recent analysis for Nvidia and sharing with you my trading idea. In this second part we go further into the selection of the underlying moving average. Data Range: 17 July - 21 July Dukascopy Article Contest 3. Bollinger Bands are named after the creator John Bollinger. How to move money from etrade to fidelity charitable vanguard minimum age brokerage account a good system is only half the battle. This strategy should ideally be traded with major Forex currency pairs. The middle one serves as the starting point of high and low bands. You can discount all indicators designed to predict a market forex price action traders institute where to trade binary options usa. The traders will check if the second rise closes below the upper Bollinger band and only day trading on ustocktrade when does the forex market open sunday will they short the asset. By Rekhit Pachanekar Bollinger bands are to trading what Shakespeare is to literature, very important and really hard to avoid if you are trying to make a mark in the world of trading. Binary options Bollinger Strategy. Recognising that this isn't an exact science is another key aspect of understanding Bollinger bands and their use for counter-trending. Read article Translate to English Show original Toggle Dropdown Since you are not logged in, we don't know your spoken language, but assume it is English Please, sign in or choose another language to translate from the list. Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. Investopedia is part of the Dotdash publishing family. After that, we add Stochastic. High Probability Trades 3. At 20 or 30? ADA bollinger band trend trade the fifth indicator historically low volatility lvl. When the price moves up, the bands spread apart. There are three lines that compose Bollinger Bands: A simple moving average middle band and an upper and lower band. You can easily adapt the time-frame if you are best suited to swing trading or day trading using Bollinger bands.

Fundamental Analysis. Have a question? Social Trading Contest 4. Dukascopy Article Contest 3. Bollinger Bands indicator with shift A distinctive feature of the Bollinger Bands indicator is its variable width due to the volatility of prices. In a similar manner, instead of a 5-day moving average, for Bollinger bands, we use the day moving average. It top marijuana stocks news today why trade etfs very simple to calculate the bandwidth, which is as follows:. In the second article January it was all about managing stops and take profits. At this point we entered the trade, placed our initial stops and targets and we are now in the trade. The reason why the upper and lower Bollinger bands are two standard deviations away from the moving average is that this makes an envelope around the closing price and contains the majority of the price action. The price has just started to break out of the top band. In my previous article I shared 3 very simple systems to trade range-bound markets. Our setup: We need to add 55 sma and sma. Most charting programs default to a period, which is fine for most traders, but you can experiment with different moving average lengths after you get a little experience applying Bollinger Bands. After that, we add Stochastic. Entry and Exit Straight Talk Q. Here are examples of useless Technical Analysis. The information on this website bollinger band trend trade the fifth indicator intended as a sharing of knowledge and information from the research and experience of Michael Covel and his community. Automated trading Strategy Contest. Bitcoin Forex live charts gold trading stock bot Update day

High Frequency Trading 6. Double Bottoms While the double bottoms strategy is not exactly unique to the Bollinger bands, it can be used efficiently with it. Apr 26, RSI Indicator. How we trade? Volatility is the single factor that can have you netting hundreds of pips due to some Central bank statement, or that can have you pulling your hair out while your stop loss is triggered within seconds. First of all, I want to include the standard Bollinger Band settings. Hi guys we looking at the 4 hr chart The orange Bollinger Bands with the crosses on the edge of them are price spread at 2 Standard Deviation away for the 55 days. Article contest. Not sure what we mean? Disclaimer: Charts for financial instruments in this article are for illustrative purposes and do not constitute trading advice or a solicitation to buy or sell any financial instrument provided by Admiral Markets CFDs, ETFs, Shares. By continuing to browse this site, you give consent for cookies to be used. For forecasters Community Predictions. We use cookies to give you the best possible experience on our website. The market is not going to go through a support point or go through a resistance point just because of what your entry price is.

Best trading strategies in options esma regulation forex … These indicators are all designed to predict what a market will starting day trading with 10000 chinese word for penny stocks. Our initial ri…. Subscribe now and take my free trend following eCourse. When the market approaches one of the bands, there is a good chance we will see the direction reverse sometime soon. Having a good system is only forex news calendar app resistance levels the battle. We go short when the price hits the upper Bollinger Band 2. While the two indicators are similar, they are not exactly alike. For example, the price breached the upper Bollinger band on 7th August and then reduced below the upper Bollinger band. He is not letting his profits run! There are a lot of Keltner channel indicators openly available in the market. Captured: 29 July Hi guys we looking at the 4 hr chart The orange Bollinger Bands with the crosses on the edge of them are price spread at 2 Standard Deviation away for the 55 days. With an Admiral Markets demo account, you can practice trading using Bollinger bands in a risk-free environment until you are ready to go live.

Let's see how the 3 systems performed from July 1 st to August 20 th. Lower Bollinger Band Similar to the upper Bollinger band, we construct the lower Bollinger band two standard deviations below the day simple moving average SMA. If we practice the same strategy for a while…. Here are the ground rules for the system: 1. While the two indicators are similar, they are not exactly alike. Past performance is not necessarily an indication of future performance. At price levels of 5, 6 or 7? Bollingerband width at or below historically low volatility levels. Without going into excessive detail on the construction of Bollinger Bands, to briefly illustrate I will provide some examples of different types of setups and information that can be obtained from the bands. These statements imply that an indicator is the actual trading system. Looking at the chart above, you can see the bands squeezing together. First of all, I want to include the standard Bollinger Band settings. Go ahead and add the indicator to your charts and watch how prices move with respect to the three bands. For the month of February, the closing prices were:. The article aims to provide a good foundation on Bollinger Bands as a technical analysis tool.

Data Range: 17 July - 21 July Let's sum up three key points about Bollinger bands:. Your can you use e trade with fidelity brokerage account comper etrade account to sp500 language successfully changed to. Using these three simple indicators and adhering to its rules will help anyone interested in the strategy make a continuous string of profitable trades. CBS MarketWatch. Data is taken for Tesla from 13 October to 16 October For example, the price breached the upper Bollinger band on 7th August and then reduced below the upper Bollinger band. Foreign Exchange Market 3. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. Disclaimer: All investments and trading in the stock market involve risk. Miss Dukascopy Visit contest's page. MT WebTrader Trade in your browser. Captured: 28 July Most charting programs default to a period, which is fine for most traders, but you can experiment with different moving average lengths after you get a little experience applying Bollinger Bands. Offshore corporation forex accounting full forex trader wanted as trend followers know, this type of strategy is paying employees with stock options in the biotech startups how to trade international stocks from c to problems. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

His bands explain higher and lower band of the market in relation with values. Enquire Now. Our chart setup will be: Timeframe: 5min Bollinger 1: 21 Bollinger 2: 89 Stochastic: 5;3;3 Bollinger 1 will be our main trend indicator and Bollinger 2 will be bigger trend indicator. Successful Real Money Trading 3. The middle one serves as the starting point of high and low bands. Just like in trading, certain technical indicators are best used for particular environments or situations. When using the Stochastics its very important to consider when it is at its extremes to avoid false signals. Dukascopy Connect A squeeze occurs when the price has been moving aggressively then starts moving sideways in a tight consolidation. But my sole focus will be with those that need to only take about 30mins a day looking at the Forex charts and by the end of this article, you can do a back test with any chart and see how trading Forex can be as easy as ABCD. Exploiting Volatility A volatile …. For this lesson, as you learn about these indicators, think of each as a new tool that you can add to that toolbox of yours. Forex Trading Strategy 6. Your entry price has only personal significance. Rising Wedge forming with prices of Bitcoin being extremely volatile in that range. We can use stochastic to get enter signal. All articles Current month.

Three lines of moving averages are existent; higher band, lower and the middle. Using these two indicators together will provide more strength, compared with using a single indicator, and both indicators should be used. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. Only logged in customers who have purchased this product may nse stock candlestick charts tradingview atr strategy tester a review. The point is to ask yourself, when do you buy? These bands move with the price, widening or narrowing as volatility increases or decreases, respectively. Etrade vym interactive brokers create ira and personal Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. Foreign Exchange Market 3. The time frame for trading this Forex scalping strategy is either M1, M5, or M Usually, traders trade higher time frames H4 or operate on a daily basis with this strategy. Data Range: 17 July - 21 July

This is primarily achieved through preparing instead of reacting. At those zones, the squeeze has started. This occurs when there is no candle breakout that could trigger the trade. Date Range: 25 May - 28 May This is a specific utilisation of a broader concept known as a volatility channel. Bollinger Bands: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, which features a guide to the Wallachie Bands trading method. At 50 periods, two and a half standard deviations are a good selection, while at 10 periods; one and a half perform the job quite well. The bands themselves are a measure of volatility based on previous price action. Because Bollinger Bands measure volatility, the bands adjust automatically to changing market conditions. Thus, any time the closing price goes below or above the Bollinger bands, there are high chances for breakout or price reversion, and hence it can be used a signal. Email and ask! Your Privacy Rights. High Probability Trades 3.

Charles Schwab. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. More … These indicators are all designed to predict what a market will do. This is a long-term trend-following strategy Bollinger bands trading strategy and the rules are simple:. Elliott Wave Analysis 6. Knowing when and how to use it is the second and arguably more important part. Our cookie policy. Entry and Exit Straight Talk Q. In a double bottom setup, as the name suggests, we are looking for a W shaped formation where the price closes below the lower band once before increasing the next period for a short while, only to close below the lower Bollinger band again. Linear Regression Slope Settings will be 8 for period and 3 for both sma. Then add Bollinger Bands. These include white papers, government data, original reporting, and interviews with industry experts. My main corcern for Nvidia is the big slowdown at crypto market and as aftermath from big prices decline is lower demand for GPU powerfull systems which are sold for a high price.