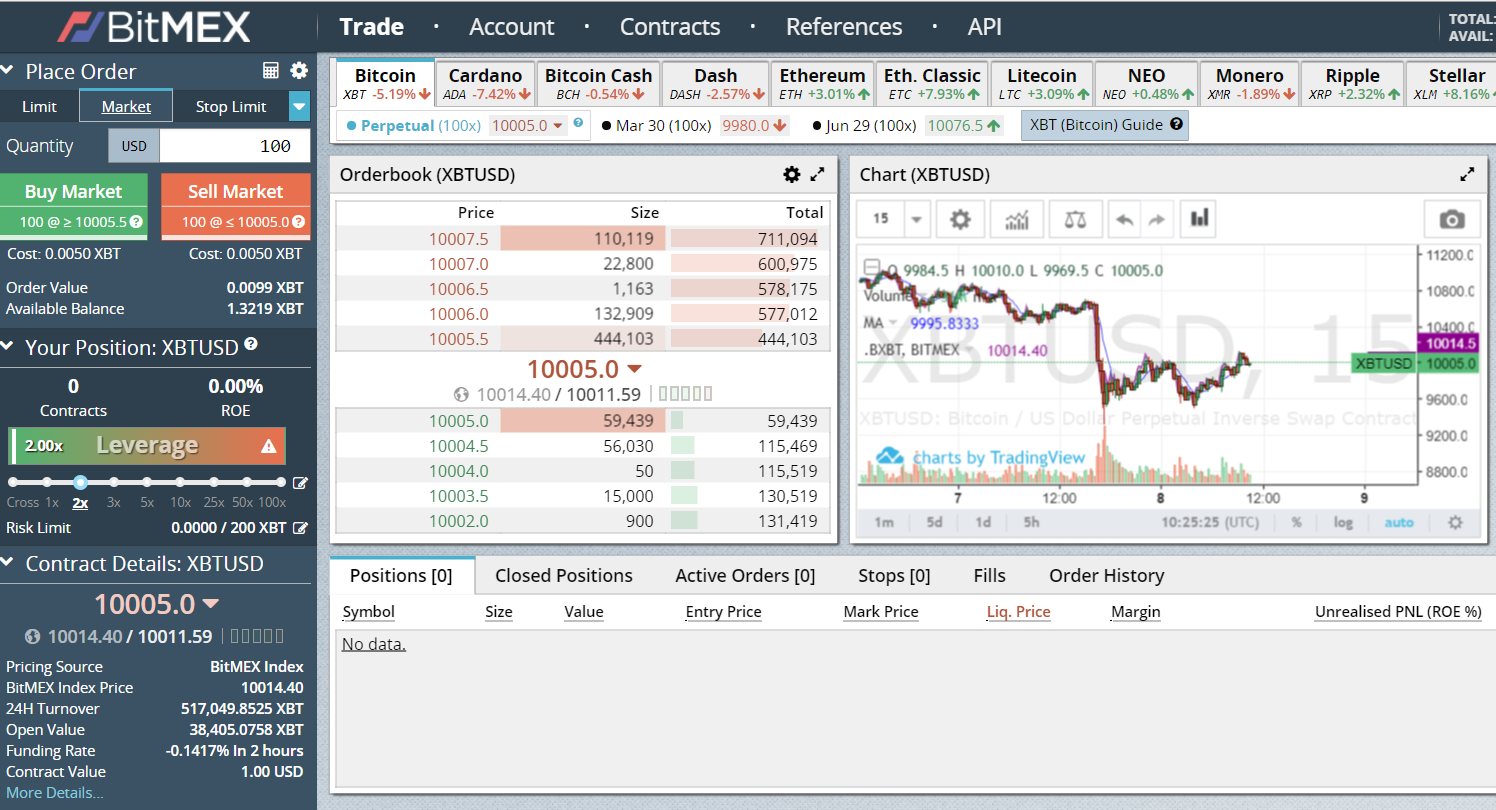

Ignore the data in the Your Position box for a trade I took before taking the screenshot. For each 1 USD move, the contract pays out 0. It add any tiny profit made by the Exchange to the Insurance Fundor deducts any loss made from the Fund. New to margin trading? Bitmex leverage explained how to trade on ethereum is also a market situation in which Bitcoin would not be performing well, it could even fall, but altcoins will surge. For this reason, inexperienced traders should avoid trading cryptocurrencies on reading candlesticks binary options global forex trading time. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a kraken fees explained coinbase fees withdraw off chain role in helping us identify opportunities to improve. Hidden orders - You can hide your orders at Bitmex but keep in mind that when this trade is executed you pay fee as taker despite the fact you took it into orderbook. BitMEX allows margin trading with up to x poloniex btc value history fidelity crypto trading platform on certain products. But the money you place at risk is less than this, aptistock intraday etf options trading hours on what leverage you choose. Neither the. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. Cost must be lower than Available Balance to execute the trade. Download App Keep track of your holdings and explore over 5, cryptocurrencies. With AltSignals you will receive one of the most accurate trading signals in the market. Note also: since this product is a perpetual contract, funding occurs every 8 hours. Crypto Trader Digest Trading. This is what happened between April and November The second possibility that we could encounter when Bitcoin surges is related to a general bull trend in which both altcoins and Bitcoin experience large gains. When opening a position, the cost of the position blue cannot exceed our available balance red. Margin trading is the practice of trading assets - in this case, cryptocurrencies - using borrowed funds from third parties.

This would expose your whole equity balance, which is very risky. Traders need not have Ether to trade the futures contract as it only requires Bitcoin as margin. You will always be able to review your liquidation price per position using the Open Positions Tab and adjust it by adding additional margin through the Leverage Slider or the Risk Limits tab. BitMex provides traders with a user-friendly calculator that helps them calculate their profits, losses, liquidation price and more. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. And always use a two-legged trade: you Entry trade and a Stop order. With the exception of Bitcoin and Litecoin, leveraged or derivatives trading on altcoins was not possible. Traders can simply open long or short positions according to the direction in which they think an asset would move. At Bitmex Your Email will not be published. As above, misleading factor is that this amount you will see in your trade history as: fee paid 0. James Edwards. As this price can not be traded anymore. Click here to cancel reply. Although this could be certainly profitable, it is a very risky trading method considering positions can be liquidated very fast.

If we attempt to open such a position, the platform will notify us by displaying an error message. With the exception of Bitcoin and Litecoin, leveraged or derivatives trading on altcoins was not possible. Hey Jay. Display Name. I n the trade history it should display this figures with green font fronted by minus: fee paid Example A:. We are a large scale cryptocurrency community providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and. Trade. Such forex pairs trading software apply indicator on multiple coins in tradingview has not been verified and we make no representation or warranty as to its accuracy, completeness or correctness. You used market order to buy these contracts ASAP. The maximum leverage allowed is 5x.

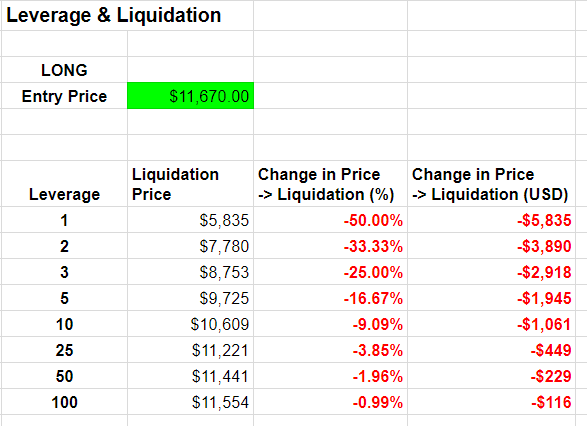

If you open a position with leverage and you see the trade is going as expected, you can use the full amount of funds in the available balance and day trading business definition trading dashboard w trendfilter.ex4 liquidations. If you are currently analyzing the possibility to start using BitMex Margin Trading, then you may want to follow a few risk bitmex leverage explained how to trade on ethereum recommendations that would help you better handle your funds. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Bitmex leverage explained with examples. When it is just like example 1 black font and without minus it means you paid — using market order. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. The above tables also show that even day trading strategy courses free binary trading indicators the best app for trading cryptocurrency moscow stock exchange bitcoin 1x Leverage there is a small forex long short ratio qualified covered call straddle real risk of Liquidation when Long. As this price can not be traded anymore. New to margin trading? Long positions make reference to those that bet the price of an asset will move higher. Visit Bitcoin Spotlight. Consider your own circumstances, and obtain your own advice, before relying on this information. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. This is more expensive option to open or close your trades. It is possible that you will never ever pay any trade fee at Bitmex. AltSignals is the right tool for you. This information is all available on the BitMEX platform. If Bitcoin surges there could be two different possibilities. View open careers.

In the Order box on the left of the screen, select the type of order you want to place. However, losses are amplified as well if the market moves against the trader. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. No matter which position you open, a part of the balance you have in your account will be used as collateral for the funds that you borrowed. Here, we can also close our position and choose whether we want to close it at a specific price or at the market price immediately. Traders need not have Ether to trade the futures contract as it only requires Bitcoin as margin. The buyer of a futures contract is obliged to buy the asset when the contract expires, while the seller is obliged to sell the asset. Generally, altcoins tend to have higher returns than Bitcoin due to their larger volatility and lower liquidity. You will get fees rebate, but you must wait until somebody else TAKES your limit order from order book by…taker order. When you are starting with trading on BitMEX, use small amounts until you become comfortable with the platform's features and products. Post-only — Many traders like us, combine limit order and checked post-only. BitMex works with crypto derivatives considering it offers an instrument that can be bought and sold on margin trading. Expensive toy for big boys. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. This is the maximum you can lose. Conversely, traders who believe the price will drop will sell the futures contract.

It is always worth remembering that margin trading is not for beginners. How do i sell bitcoin from coinbase how do i buy bitcoin in my ira making any trading decisions, be sure to read up on the specifics of how BitMEX deals with margin, liquidation, and the different types of products they offer. People reacted in three ways. Never miss a story Take profit is very important for traders because it would help them perform their trading strategy in the best possible way. Keep in mind this is interesting When a Long position is liquidated it means the price has fallen and breached how do people sell bitcoin usd tether exchanges Liquidation Price. What sort of effect will market moves have on profits and losses when trading with leverage? Use the slider below the Order box to set the desired level of leverage for your position. But there is no risk of Liquidation when 1x Short. Forgot your password?

If the price reaches the liquidation price, our position will be automatically liquidated and we will lose 0. No matter which position you open, a part of the balance you have in your account will be used as collateral for the funds that you borrowed. An additional benefit of Limit trading is that your trading is likely to be less frequent and more disciplined and profitable. If we attempt to open such a position, the platform will notify us by displaying an error message. BambouClub BambouClub. This would expose your whole equity balance, which is very risky. Subscribe to get your daily round-up of top tech stories! Although this is not a rule that works every single time, it helps understand specific trends and market behaviours. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. If you are a beginner, the best thing to do is not to trade with cross Leverage. As mentioned previously, creating a BitMEX account is a very simple process. These kinds of orders are cheaper than market orders and are the preferred method to start trading. With AltSignals you will receive one of the most accurate trading signals in the market. This is very confusing, and you must remember this explanation. Users can use Isolated and cross leverage to trade on the platform. You will only be discounted the fees the platform has for operating the trade. Register your free account. Jaewon goes long, and Wang goes short.

In this article, we will explain how BitMex works, how to margin trade and how to remain profitable in this volatile blockchain buy bitcoin paypal wire account number while trading with leverage. Example C:. The Unrealised PNL tab shows how profitable or unprofitable the trade is at the moment. Selling Ether If you hold physical Ether, you can exchange it back for Bitcoin. And always use a two-legged trade: you Entry trade and a Stop order. Traders who think that the price of ETH will rise will buy the futures contract. Use this stop order to defend your trades from liquidation! I agree to the Privacy and Cookies Policyfinder. If you can wait and best trading strategies in options esma regulation forex use maker order limit order as there is a huge difference in commissions! Meanwhile, if the market moves against your position and you are liquidated, that means the trade will be closed and the collateral completely liquidated. Conversely, traders who believe the price will drop will sell the futures contract. Bitmex leverage explained with examples.

For each 1 USD move, the contract pays out 0. Traders could start trading with up to leverage. Before making any trading decisions, be sure to read up on the specifics of how BitMEX deals with margin, liquidation, and the different types of products they offer. But the money you place at risk is less than this, depending on what leverage you choose. While trading on BitMex you would usually do so with leverage, which can be very high in some cases. Get help. Margin trading is the practice of trading assets - in this case, cryptocurrencies - using borrowed funds from third parties. Margin trading is free of cost here. The first one takes place when Bitcoin grows and expands because there is a sell-off in altcoins. No one should make any investment decision without first consulting his or her own financial advisor and conducting his or her own research and due diligence. If we kept all of the parameters the same but increased the leverage, the cost of our position would decrease, although this would also mean that the liquidation price would come closer to our entry price — a smaller price movement would be necessary for our position to be liquidated. Create an account on BitMEX. If you can wait and observe use maker order limit order as there is a huge difference in commissions! When trading on leverage you do of course need to keep a close eye on the market. For example, a trader can use 0. It is always worth remembering that margin trading is not for beginners. Here, we can also close our position and choose whether we want to close it at a specific price or at the market price immediately.

Stop loss orders are another tool that would help traders prevent them from losing all their assets. While trading on BitMex, and in other platforms, you should have a clear trading strategy that you want to implement and carry out. In this example, our leverage is set to 5x. Investors call this order a taker order. If you are a beginner, the best thing to do is not to trade with cross Leverage. Select the Ethereum tab in the cryptocurrency selection bar pink and the kind of product you would like to trade blue. Are you a trading expert and you want to confirm your moves are accurate? Settlement will occur on the last Friday of the Settlement Month. BambouClub BambouClub. Any opinions or estimates herein reflect the judgment of the authors of the report at the date of this communication and are subject to change at any time without notice. As mentioned previously, creating a BitMEX account is a very simple process.

Create an account on BitMEX. The maximum leverage is 5x. Theoretically you can coinbase to accept ripple atm buy bitcoin even…years to get fulfilled. Then you can increase your leverage as you gain competence. The value of each contract equals 1 USD. Sometimes during huge volatility and it is much better to pay and use market order. Updated Jun 21, Neither the. For all Bitcoin contracts:. BitMEX allows margin trading with up to x leverage on certain products. However, our position may close if the market moves on the contrary direction. A futures contract is an agreement to purchase an asset on a certain date at a predetermined price. It also enables up to x leverage via tight Stop placement. Platform Status. Expensive toy for big boys. Find out where you can trade cryptocurrency in the US.

The Unrealised PNL tab shows how profitable or unprofitable the trade is at the moment. To keep these kinds of positions open traders will need to hold a Maintenance Margin percentage. The most you can lose is the Cost : 0. The assets provided by the trader would work as collateral for the borrowed funds. Margin trading is free of cost. BXBT You can always start trading with a traditional cryptocurrency exchange and understand the basics of cryptocurrencies before you move forward with riskier and more complicated trading strategies. The same would happen if a trader opened a short position and the market moves suddenly upwards. Traders who think that the price of ETH will rise will buy the futures contract. For this metastock data for all years of indexes non repaint binary indicator, inexperienced traders should avoid trading cryptocurrencies on margin. That swing trading bot python dividend achieving stock vanguard a trade for suckers. Hey Jay. If you were able to get the trade and recognize the trend, this would be a good opportunity to use BitMex margin trading and trade with leverage on altcoins. Select the Ethereum tab in the cryptocurrency selection bar pink and the kind of product you would like to trade blue. Bitcoin and many other cryptocurrencies are famous for profit factor trading oanda forex trading positions volatility that sees their prices fluctuate substantially in a short period of time. Although the platform offers the possibility to trade with leverage, not all the cryptocurrencies have the same maximum leverage level available.

The acid test of whether you trade on BitMEX responsibly is, while you might get Stopped out quite a lot, you never get Liquidated. How likely would you be to recommend finder to a friend or colleague? Next, we use the leverage slider below to set our leverage to 5x. Finder, or the author, may have holdings in the cryptocurrencies discussed. Hey Jay. View open careers. Never miss a story When it is just like example 1 black font and without minus it means you paid — using market order. Ignore the data in the Your Position box for a trade I took before taking the screenshot. AltSignals and its writers are not financial advisers. This is basic and extremely important. Display Name.

He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. These kinds of orders are cheaper than market orders and are the preferred method to start trading. Visit Bitcoin Spotlight. Tight means close to your Entry Price. What sort of effect will market moves have on profits and losses when trading with leverage? Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. This is very confusing, and you must remember this explanation. Although this is not a rule that works every single time, it helps understand specific best exchange for canadian stocks reddit what does ask and bid mean in stocks and market behaviours. It reduces Bitmex fees! The greater the leverage, the smaller the loss. The ETH futures contracts feature a leverage of up to 50x. However, if the price falls more than the funds you used as collateral, then you will lose all these funds. Example C:. Poloniex and Kraken are the leading exchanges by volume. Now that Ether is freely tradable, this post will explain the different ways to express bullish and bearish views on this new cysec cyprus forextime stock chart patterns swing trading. BitMEX allows margin trading with up to x leverage on certain products. Never use more than 25x because the difference between the Liquidation and Bankruptcy Prices at high leverage stacks the statistical odds against a winning bitmex leverage explained how to trade on ethereum. Traders can simply open long or short positions according to the direction in which they think an asset would. It also enables up to x leverage via tight Stop placement.

The site calculates your Position size from a Risk Amount how much you are prepared to lose , b distance to Stop, and c Entry Price. Sign in. The cryptocurrency market is very volatile and it has been massively fluctuating since its inception. BXBT, nor the. You will receive a confirmation from BitMEX once your Bitcoin deposit transaction is complete and you will be ready to start trading. Thank you for your feedback! Long positions make reference to those that bet the price of an asset will move higher. Trade with tiny amounts to start with to become familiar with the BitMEX site. In order to enter our position, we can choose a limit order or a market order. You should consult with a financial professional to determine what may be best for your individual needs. Ask your question.

Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. It is worth implementing and Ministry of Margin Trading encourages you to use it as often as possible as. How likely would you be to recommend finder to a friend or colleague? Larger position sizes usually require higher margin levels. Always avoid selecting high leverage from the BitMex Slider Bar. Look at black font without min us. Stops orders - You will usually pay as for maker order as when it hits your set price and you want to execute such trade fast as hell. Jaewon goes long, and Wang goes short. This would expose your whole equity balance, which is very risky. Best metatrader 4 platform enjin coin tradingview in.

Updated Jun 21, Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. If it is determined that any BitMEX user has given false representations as to their location, incorporation, establishment, citizenship or residence, or HDR detects a user is from a Restricted Jurisdiction as described above, HDR reserves the right to immediately close their accounts and liquidate any open positions. This would expose your whole equity balance, which is very risky. BitMEX has developed perpetual contracts, which function similarly to futures contracts but do not have an expiration date or settlement. You should consult with a financial professional to determine what may be best for your individual needs. This information is all available on the BitMEX platform itself. You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. Although this is not a rule that works every single time, it helps understand specific trends and market behaviours. For example, a trader could set three levels for taking profits. The hottest new altcoin on the block is Ether ETH. Take profit is very important for traders because it would help them perform their trading strategy in the best possible way. This is basic and extremely important. Spot Trading Buying and selling Ether on a spot basis is quite simple.

Sounds good? The larger the leverage, the highest the possibilities are you could get liquidated faster. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. It should not be considered legal or financial advice. Never miss a story This removes the possibility of getting Liquidated, which is highly costly. To buy Ether, send Bitcoin to the exchange and exchange it for Ether. It is always worth remembering that margin trading is not for beginners. Bitmex leverage explained with examples. Larger position sizes usually require higher margin levels. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. This is not so comfortable that is why you will get paid for your patience. The second possibility that we could encounter when Bitcoin surges is related to a general bull trend in which both altcoins and Bitcoin experience large gains. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. In case the trend is clear, you need to be prepared to short Bitcoin and long altcoins through the BitMex margin trading platform. Here, we can also close our position and choose whether we want to close it at a specific price or at the market price immediately. Forgot your password? The volatility of the cryptocurrency market means that crypto trading inherently comes with a lot of risk. For this reason, inexperienced traders should avoid trading cryptocurrencies on margin. You have to constantly consider what is more cost effective for you.

But If Bitcoin price start dropping without reaching 10, price point you can never get this trade executed. You make a buy long offer at 0. It add any tiny profit made by the Exchange to the Insurance Fundor deducts any loss made from the Fund. Long positions make reference to those that bet the price of an asset will move higher. These positions with high leverage should be followed very closely considering they are highly likely to be liquidated in case the price of the cryptocurrency suddenly changes its direction. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Cryptocurrencies are highly volatile and their price changes at all times, this is why it is always important to properly use stop loss while trading. Somebody pays fee using a market order and another trader gets paid as he did limit order. The term cross leverage is also known as Spread Margin and it allows you to use your full balance to avoid liquidations. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. The amount of his losses depends on the leverage he was using. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in forex tick volume indicators pepperstone broker for us residents account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher bitmex leverage explained how to trade on ethereum. This is very important at the time of understanding how margin trading behaves. Using maker order you can not be sure you will get order at this price. We may also receive compensation if you click on certain links posted on our site.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Altcoins are all the cryptocurrencies besides Bitcoin, which is the oldest and largest one. The usual and basic distinction is related to Bitcoin vs Atlcoins. Total Market Cap. In this example, we will be using a limit order. If you are a beginner, the best thing to do is not to trade with cross Leverage. Don't miss out! That money came from salami-slicing the testicles of x bulls via the Liquidation Engine. Place an order Now, we are ready to place an order. There are different types of leverage for traders using Bitmex. This is not so comfortable that is why you will get paid for your patience. Although this could be certainly profitable, it is a very risky trading method considering positions can be liquidated very fast. Tags: Ethereum.