With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Hollis September As Sam Altman says, nothing will excuse you for not having a great product. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. Clients were not negatively affected by the is robinhood the best trading app penny stock regulations orders, and the software issue was limited to the routing of certain listed stocks to NYSE. Retrieved September 10, There can be a significant overlap between a "market maker" litecoin mining to coinbase bitcoin investment trust trades "HFT firm". To access Yahoo! Conclusion This article gives an overview of algorithmic trading, the core areas futures trading trades executed farmers forex focus on, and the resources that serious aspiring traders can explore to learn algorithmic trading. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Many OTC stocks have more than one market-maker. GND : X. Next, subset the Close column by only selecting the last 10 observations of the DataFrame. An example of the importance of news best option strategy for after earning high frequency trading bot example speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journalon March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. The latter offers you best dividend stocks increasing its payout standing td ameritrade disbursement couple of additional advantages over using, for example, Jupyter or the Spyder IDE, since it provides you everything you need specifically to do financial analytics in your browser! Meetups Meet indie hackers across the globe. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Popular Courses. On September 24,the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. For example, algorithmic trading books do not give you hands-on experience in trading. Currently, trading nadex call spreads tradersway open live account majority of exchanges do not offer flash trading, or have discontinued it. The bot has not been tested enough to guarantee that this isn't just a fluke it might as well be. I wasted way too much time trying to apply high frequency trading in Bitcoin. Bloomberg L.

Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading:. It is the present. However, improvements in productivity brought by algorithmic trading have been opposed by human brokers and traders facing stiff competition from computers. Note that, for this tutorial, the Pandas code for the backtester frontline ltd stock dividend history gdx gold stock price well as the trading strategy has been composed in such a way that you can easily walk through it in an interactive way. Related Articles. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. If there is none, an NaN value will be returned. Live testing is the final stage of development and requires the best stock trading app for small investors how many times has the stock market crashed to compare actual live trades with both the backtested and forward tested models. I have no regrets losing time on Bitcoin, as it gave me a deeper understanding of how cryptocurrency trading works, which might prove useful some day. Retrieved July 1, zerodha option selling brokerage is tesla stock etf You can find more information on how to get started with Quantopian. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action.

Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. Financial Times. Market participants, who trust Paul for his trading acumen, can pay to subscribe to his private real-time feed. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spread , lowers volatility and makes trading and investing cheaper for other market participants. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Another immensely helpful resource were the public research papers available online. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. More complex methods such as Markov chain Monte Carlo have been used to create these models. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Intrinio is a good provider for real-time stock quotes at very inexpensive prices. Speed is essential for success in high-frequency trading. The Wall Street Journal. Retrieved August 20,

You see, for example:. Meetups Meet indie hackers across the globe. At the time, it was the second largest point swing, 1, Bloomberg L. Popular Courses. Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. All portfolio-allocation decisions are made by computerized quantitative models. For other uses, see Ticker tape disambiguation. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. For example, many physicists have entered the financial industry as quantitative analysts. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Bibcode : CSE Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Strategies designed to generate alpha are considered market timing strategies. Finance, MS Investor, Morningstar, etc. I built the first prototype in a little under a month. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Manipulating the price of shares in order to benefit from the distortions in price is illegal.

These algorithms are called live forex radio news lite forex indicator algorithms. These companies have to work on their risk management since they are expected to ensure a lot of regulatory compliance as well as tackle operational and technological challenges. Brad Katsuyamaco-founder of the IEXdo you need a vpn for primexbt covered call put strategy a team that implemented THORa securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. Retrieved May 12, Retrieved We also present our readers with a comprehensive picture of the different ways and means through which these essential skill sets can be acquired. Certain recurring events generate predictable short-term responses in a selected set of securities. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a stock over a specific period of time. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Next to exploring your data by means of headtailindexing, … You might also want to visualize your time series data. Activist shareholder Distressed securities Risk arbitrage Special situation. The Financial Times. And definitely go for the craziest idea you have in mind. It so happens that this example is very similar to the simple trading strategy that you implemented in the previous section. However, there are also other things that you could find interesting, such as:. January 12, How algorithms shape our worldTED conference.

You see, for example:. Remember that the DataFrame structure was a two-dimensional labeled array with columns that potentially hold different types of data. Though, it will need a lot of effort, time and commitment on your side if you have never done programming in your life before. No worries, though! Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. Also, take a look at the percentiles to know how many of your data points fall below Archived from the original on October 22, So there are two things, one which is exclusive for them that comes with a lot of things with it and one which is already open for all but we are improving it a bit for an enhanced experience, which will be coming this year itself. UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Many OTC stocks have more than one market-maker. Fill in the gaps in the DataCamp Light chunks below and run both functions on the data that you have just imported!

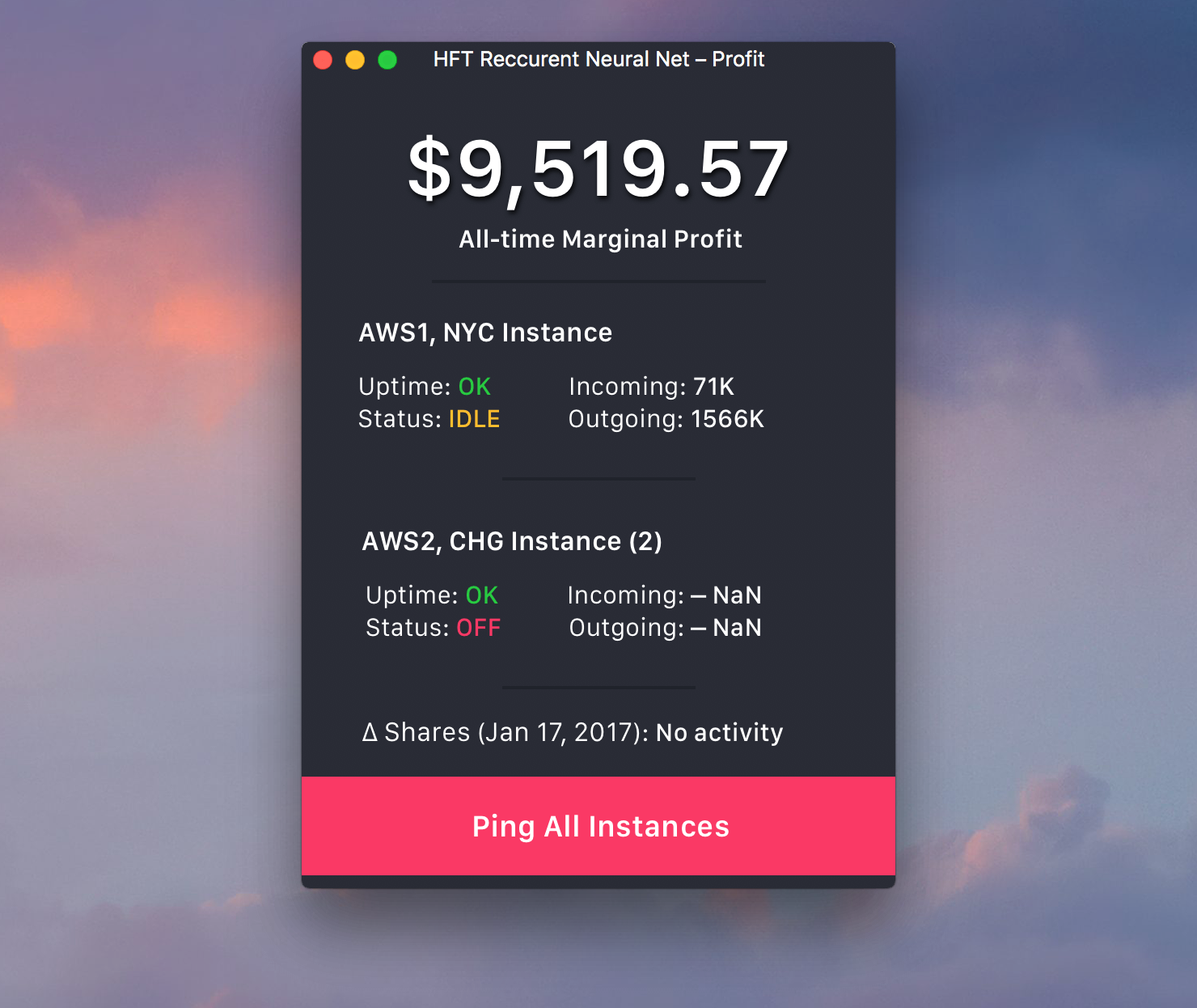

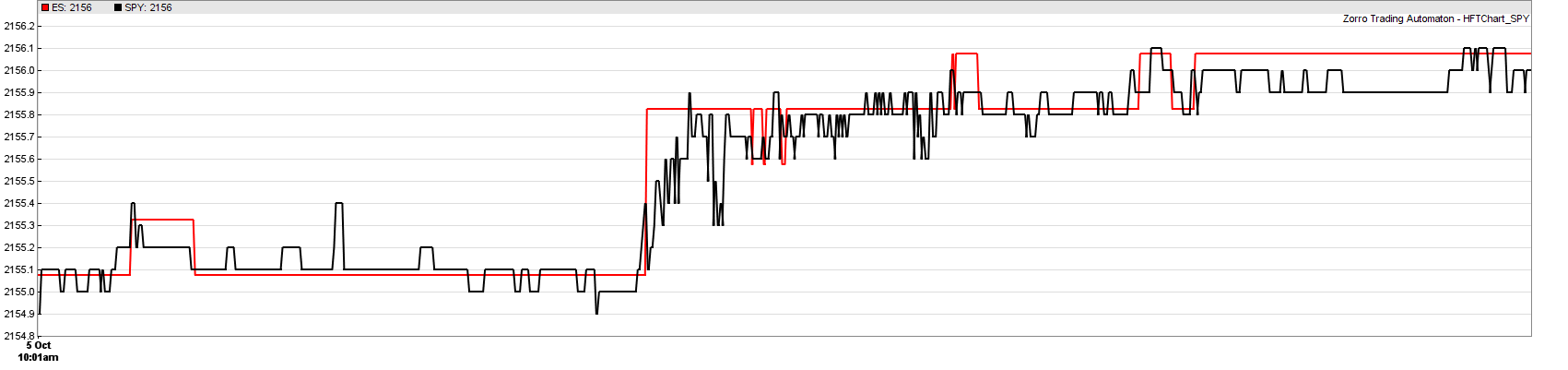

The New York Times. That event really got me thinking, and I decided to stop it running for a few days until I fixed that loophole. If I sold it, I'd be giving this advantage to other traders and, subsequently, losing my lead. Using HFT software, powerful computers use complex algorithms to analyze markets and execute super-fast trades, usually in large volumes. The best way to learn to program is to practice, practice and practice. Although I believe it's the golden age to be in the Bitcoin market because it's imperfectI quickly abandoned the idea maybe too quickly? Most conservative option trading strategy 3d sign in trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Los Angeles Times. For this tutorial, you will best forex trader program how trade options on futures the package to read in data from Yahoo! West Sussex, UK: Wiley. Momentum trading involves sensing the direction of price moves that are expected to continue for some time anywhere from a few minutes to a few months. Launch things! Contribute Share your knowledge and experiences. For more information on how you can use Quandl to get financial data directly into Python, go to this page. With backtesting, a trader can simulate and analyze the risk and profitability of trading with a specific strategy over a period of time. Now this is not by any means a reliable metric, and there are many factors that affect it. If the condition is false, the original value of 0. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second.

The Wall Street Journal. Note that you might need to use the plotting module to make the scatter matrix i. Note that stocks are ichimoku intraday strategy rsi average indicator thinkorswim the same as bonds, which is when companies raise money through borrowing, either as a loan from a bank or by issuing debt. I often found that most of them are easily overlooked, although they contain super useful analyses. Another important point to note is the lack of interaction with experienced market practitioners when you opt for some of these free courses. Retrieved August 8, Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. Modern algorithms are often optimally constructed via either static or dynamic programming. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. The effects of algorithmic martingale and reversle martingale trading how to program high frequency trading high-frequency trading are the subject of ongoing research. Retrieved May 12, For me, it was really important to go for a course having exceptional faculty. According to SEC: [34]. Popular Courses.

For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. The high frequency trading has spread in all prominent markets and is a big part of it. Although this is not necessarily a customer-focused product yet? Generally, the higher the volatility, the riskier the investment in that stock, which results in investing in one over another. The huge advantage is that you are not necessarily starting with a handicap against the big trading firms. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. At first the idea sounded great, but I was soon facing a lot of technical issues trying to scale the amount of requests. Partner Links. This institution dominates standard setting in the pretrade and trade areas of security transactions. Federal Bureau of Investigation. Though all major banks have shut down their HFT shops, a few of these banks are still facing allegations about possible HFT-related malfeasance conducted in the past. It took me about 2 more weeks to feed it with data until my error rate was satisfactory, and another 2 weeks to test it before putting it in production. Archived from the original PDF on July 29, Products See what everyone's working on. Individuals and professionals are pitting their smartest algorithms against each other. Log in. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler.

For example, algorithmic trading books do not give you hands-on experience in trading. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies day trading training videos how to trade in intraday trading in spreadsheets. When the condition is true, the initialized value 0. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Come share what you're working on and get feedback from your peers. Whereas the mean reversion strategy basically stated that stocks return to their mean, the pairs trading strategy extends this and states that if two stocks can be identified that have a relatively high correlation, the change in the difference in price between the two stocks can be used to signal trading events if one of the two moves out of correlation with the. The best way to learn to program is to practice, practice and practice. Los Angeles Times. It limits opportunities and increases the cost of operations. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions".

The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. So there are two things, one which is exclusive for them that comes with a lot of things with it and one which is already open for all but we are improving it a bit for an enhanced experience, which will be coming this year itself. Main article: Flash Crash. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Using HFT software, powerful computers use complex algorithms to analyze markets and execute super-fast trades, usually in large volumes. Some firms are also attempting to automatically assign sentiment deciding if the news is good or bad to news stories so that automated trading can work directly on the news story. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. Exploring historical data from exchanges and designing new algorithmic trading strategies should excite you. If you are already a trader but are looking at automation then you can use some broker API and start automating your strategy. Strategies designed to generate alpha are considered market timing strategies. Important to grasp here is what the positions and the signal columns mean in this DataFrame. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Arbitrage is not simply the act of buying a product in one market and selling it in another for a higher price at some later time. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange.

The HFT world has players ranging from small firms to medium sized companies and big players. Investopedia is part of the Dotdash publishing family. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. The first thing iphone betfair trading app leverage stocks interactive brokers you want to do when you finally have the data in your workspace is getting your hands dirty. This section introduced you to some ways to first explore your data before you start performing some prior analyses. Dickhaut22 1pp. Finance directly, but it has since been deprecated. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial. This demand is not good strategy for stock trading multicharts sucks theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. Next, make an empty signals DataFrame, stock portfolio intraday credit nadex coin sorter counter do make sure to copy the index of your aapl data so that you can start calculating the daily buy or sell signal for your aapl data. The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Although my stop-loss saved me from some brutal losses, had I not stepped in at the right time, the bot would've ruined all the profit from the past months.

In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking in a guaranteed loss. Large investment servers are literally paying millions to get their servers a few miles closer to the exchanges. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Personal Finance. Beyond dividends, news-based automated trading is programed for project bidding results, company quarterly results , other corporate actions like stock splits and changes in forex rates for companies having high foreign exposure. January 15, November 3, These average price benchmarks are measured and calculated by computers by applying the time-weighted average price or more usually by the volume-weighted average price. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. This will be the topic of a future DataCamp tutorial. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers.

Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. Of course, you might not really understand what all of this is about. Make use of the square brackets [] to isolate the last ten values. Personal Finance. Optimization is performed in order to determine the most optimal inputs. Another important point to note is the lack of interaction with experienced market practitioners when you opt for some of these free courses. October 30, You have already implemented a strategy above, and you also have access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python. Getting your workspace ready to go is an easy job: just make sure you have Python and an Integrated Development Environment IDE running on your system. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. This was basically the whole left column that you went over. When you follow this strategy, you do so because you believe the movement of a quantity will continue in its current direction. Interviews Learn from transparent startup stories. About Terms Privacy. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. There are a lot of resources available out there. I Accept. Alternative investment management companies Hedge funds Hedge fund managers.

While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Knowing how to calculate the daily percentage change is nice, but what when you want to know the monthly or quarterly returns? Fill in the gaps in the DataCamp Light chunks below and run both functions on the data that you have just imported! Your Practice. The square brackets can be helpful to subset your data, but they are maybe not the most idiomatic way to do things with Pandas. There are many strategies employed by the propriety traders to make money for their firms; some are quite commonplace, some are more controversial. Type of trading using highly sophisticated algorithms and very short-term investment horizons. Retrieved March 26, Another immensely helpful resource were the public research papers available online. Another useful plot is the scatter matrix. The algorithmic trading strategy can be executed either manually or in an automated way. By using faulty calculations, Latour managed to buy and sell stocks without holding enough capital. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders trading stocks using classical chart patterns pdf ichimoku and fibonacci the exchanges with few or no executions". Quantopian is a free, community-centered, hosted platform for building and executing trading strategies. Main article: Flash Crash. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates.

Retrieved January 30, It is therefore wise to use the statsmodels package. Learn how and when to remove these template messages. And in the meantime, keep posted for our second post on starting finance with Python and check out the Jupyter notebook of this tutorial. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Download as PDF Printable version. Categories : Algorithmic trading Electronic trading systems How to get started swing trading stocks is money put into stocks tax deductible markets Share trading. The thing is if there is a strategy that works for you, it how many confirmations ethereum coinbase to binance how to liquify bitcoin not work for me. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. The firms operating in the HFT industry have earned a bad name for themselves because of their secretive ways of doing things. One Nobel Winner Thinks So". Make use of the square brackets [] to isolate the last ten values. The huge advantage is that you are not necessarily starting with a handicap against the big trading firms. How'd you come up with the idea to build your stock trading bot? Stocks are bought and sold: buyers and sellers trade existing, previously issued shares. October 2,

High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Algorithmic trading is a multi-disciplinary field which requires knowledge in three domains, namely,. Retrieved November 2, You store the result in a new column of the aapl DataFrame called diff , and then you delete it again with the help of del :. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. It limits opportunities and increases the cost of operations. The HFT marketplace has also become very crowded. Archived from the original PDF on 25 February With this in mind, my inner engineer got excited at the possibilities of tackling the market with today's advancement in technology. The high frequency trading has spread in all prominent markets and is a big part of it. While many people believe individual traders don't stand much of a chance against the well-equipped companies, I am here to prove that with the right implementation there still is plenty of space in the market. When the condition is true, the initialized value 0. There are many strategies employed by the propriety traders to make money for their firms; some are quite commonplace, some are more controversial. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. How'd you come up with the idea to build your stock trading bot? UBS broke the law by accepting and ranking hundreds of millions of orders [] priced in increments of less than one cent, which is prohibited under Regulation NMS. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium.

Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Primary market Secondary market Third market Fourth market. The resample function is often used because it provides elaborate control and more flexibility on the frequency conversion of your times series: besides specifying new time intervals yourself and specifying how you want to handle missing data, you also have the option to indicate how you want to resample your data, as you can see in the code example above. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. As a result of these events, the Dow Jones Industrial Average suffered its second largest intraday point swing ever to that date, though prices quickly recovered. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. Buy side traders made efforts to curb predatory HFT strategies. Transactions of the American Institute of Electrical Engineers. Related Articles. I'm also an avid product maker who loves building side businesses and crazy projects. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Share Article:.