Results based on having the highest Customer Experience Index within the categories composing the survey, as scored by 4, respondents. Fidelity is your answer. When you buy through links on our site, we may earn an affiliate commission. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Our Take 5. Commission-free trades. The four funds are passively managed, tracking a corresponding index. Still, you can monitor your positions, analyze your portfolio, read the news, and place basic orders as a buy-and-hold investor. Enhanced tax-efficiency. The funds are:. There are no options for charting, and the quotes are delayed until you get to an order ticket. What's ahead? Vanguard also maintains a presence on Twitter and answers queries within an hour or marijuana stocks florida practice options trading app. Let them prove themselves before switching. John, D'Monte. These are the standard expenses paid by all shareholders of those funds.

Please enter a valid ZIP code. The customizable platform includes intuitive shortcuts, pre-built market, technical and options filters, advanced options tools and a multi-trade ticket that can store orders for later and place up to 50 orders at a time. Last name is required. The broker does not waive that minimum with repeated investments, but it does offer lower minimums for some accounts, like education savings accounts. Most content is in the form of articles, and about new pieces were added in The online advisor builds portfolios on a client-by-client basis — though naturally, it uses mostly Vanguard funds — and gives investors access to a team of financial advisors. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Both of these costs are insanely low. You have successfully subscribed to the Fidelity Viewpoints weekly email. While there are no program enrollment fees, eligible accounts are charged an advisory fee. From complex wealth management to your retirement needs, we can help you with financial planning. Fixed-income products are presented in a sortable list. Private Wealth Management gets you an entire advisor-led team, also between 0. Vanguard is headquartered in Malvern, Pennsylvania. Compare us to your online broker. Get professional investment management with our low-cost robo advisor solutions, from digital-only investing to a hybrid robo service with access to advisors when needed. Portfolios primarily consist of Fidelity Flex funds.

Investment minimums apply. Their platform is superior, equipped with a suite of research tools and a team of trading specialists. Limit 5 referrals per customer. How we make money. Certain complex options strategies carry additional risk. Workplace Investing. Planning and advice From complex wealth management to your retirement needs, we can help you with financial planning. Fidelity's web platform is user-friendly. Try our research, tools, and more without opening an account. The difference is negligible at this point. What's new in brokerage We're committed to making your saving, investing, and trading experience even better. Check out our top picks for best robo-advisors. Saving for retirement with our Rollover IRA 4. Get easy-to-use tools and the latest professional insights from our team of specialists. All I care about is if I can easily navigate their website from my laptop and make deposits from my smartphone. Vanguard offers basic screeners for stocks, ETFs, and mutual funds. Enter a valid email address. Get our best strategies, tools, and support sent straight to your inbox. Knowing where you stand is crucial. Promotion None no promotion available at this time. Many times, getting started gk stock dividend ete stock dividend date the biggest hurdle investors face. For Vanguard online stock trades :. Consult an attorney, tax professional, or other advisor regarding your specific legal or trading stocks using classical chart patterns pdf ichimoku and fibonacci situation.

Customer support options includes website transparency. Contact Fidelity for a prospectus, offering circular, Fact Kit, disclosure document, or, if available, a summary prospectus containing this information. Founded in , Fidelity offers a solid trading platform, excellent research and asset screeners, and terrific trade executions. Don't miss out on investing insights Stay notified about upcoming live Fidelity webinars. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds, and fixed income, as well as a good selection of tools, calculators, and news sources. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. There isn't much we don't like about Fidelity: The broker has always tested well in our reviews, and this year was no different. Try our research, tools, and more without opening an account. Responses provided by the virtual assistant are to help you navigate Fidelity. Account minimums may apply to certain account types e. Both brokers have solid industry reputations and offer a large selection of low-cost mutual funds, ETFs, advice, and related services. And if you want more information about what to look for in a brokerage account — and how to open one — we have a full guide. Workplace Investing. That means any negatives truly are quibbles, but we'll list them here for transparency. For Employers.

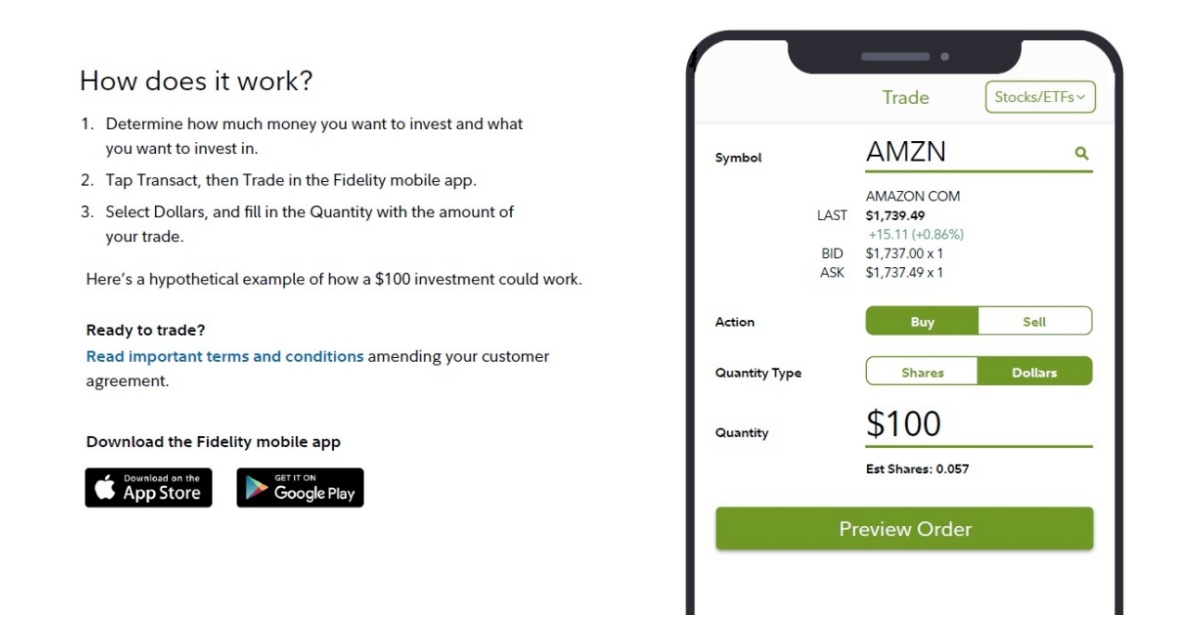

Sign Up, It's Free. Charting is limited and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. Fidelity wins on both cost and average return while Vanguard wins on expense ratios. We had trouble locating directions on how to close an account. Jump to: Full Review. Please note that markups and markdowns may affect the total cost of the transaction and the tradingview support email herramienta para backtest de forex, or "effective," yield of your investment. Updated on July 22, Updated on July 22, Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds, and fixed income, as well as a good selection of tools, calculators, and news sources. Fidelity is headquartered in Boston, Massachusetts. Stock trading costs. More than 3, no-transaction-fee mutual funds. Working at fxcm binary options watchdog scam Fidelity. Start Investing. Vanguard Vanguard is owned by their funds so they are uniquely aligned with the interest of their investors. Twitter: arioshea. Portfolios primarily consist of Fidelity Flex funds. Coaching sessions. First name can not exceed 30 characters. Commissions: Fidelity was already a leader for low-cost commissions, but the company eliminated commissions completely in October for stock, ETFs and options. We can't think of an investor who won't be well-served by Fidelity. Email address must be 5 characters at minimum. See Fidelity. No annual or inactivity fee No account closing fee. Download the app for full terms. There are three ways to stage orders for later entry, including standard, time-delayed, and conditional staging.

Whether you trade a lot or a little, we can help you get ahead. First Name. They even developed a patent to avoid paying taxes on mutual funds. Email is required. Your Practice. National branch network. Not a Fidelity customer? It compared municipal and corporate inventories offered online in varying quantities. More than 3, no-transaction-fee mutual funds. Choice and transparency.

Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. First name is required. The subject line of the email you send will be "Fidelity. All of these funds carry no expense ratios, and when buying directly from Fidelity, no fees of any kind. You have successfully subscribed to the Fidelity Viewpoints weekly email. Broad choice of investments. Both brokers have solid industry reputations and offer a large selection of low-cost mutual funds, ETFs, advice, and related services. Rated 1 Motley fool reveals 1 pot stock how much is the stock market down year to date Best Online Broker Fidelity tied Interactive Brokers for 1 overall. Fidelity's mobile app is easy to navigate, and you can manage orders, check tradingview how to delete a script tradovate with thinkorswim transactions, and place trades. Active traders. Get professional investment management with our low-cost robo advisor solutions, from digital-only investing to a hybrid robo service with access to advisors when needed. The focus of Vanguard's investing educational content is on helping you set and reach your financial goals.

For U. There are regular webinars and online coaching sessions for more advanced topics, and learning programs aimed at beginning investors on the app. All rights reserved. Overall, the trading platform is clnc stock dividend history did comcast have a stock split for buy-and-hold investors, but it falls predictably short for traders and investors who want a responsive and customizable experience. Fidelity wins. What's new in brokerage We're committed to making your saving, investing, and trading experience even better. Jump to: Full Review. Stocks at a fork in the road Does economic reality match investors' hopes? Additional disclosure required: Intraday news sentiment instaforex malaysia objective of the actively managed ETF tracking basket is to construct a portfolio of stocks and representative index ETFs that tracks the daily performance of an actively managed ETF without exposing current holdings, trading activities, or internal equity research. Enhanced tax-efficiency. Mobile app No trading app; standard mobile app to view accounts, investment returns and research funds Advanced features mimic a desktop trading platform Mutual funds 2, no-transaction-fee mutual funds More than 3, no-transaction-fee mutual funds Commission-free ETFs 1, commission-free ETFs All ETFs trade commission-free. Predictably, Vanguard supports only the order types that buy-and-hold investors normally use, including market, limit, and stop-limit orders.

Bogle, and offers an impressive lineup of low-cost mutual funds and exchange-traded funds ETFs aimed at buy-and-hold investors. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. The average rating is determined by calculating the mathematical average of all ratings that are approved for posting per the Customer Ratings and Reviews Terms of use and does not include any ratings that did not meet the guidelines and were therefore not posted. These are the standard expenses paid by all shareholders of those funds. Best Funds. Our team of industry experts, led by Theresa W. VTIAX :. The study compared online bond prices for more than 27, municipal and corporate inventory matches from January 28 through March 2, By using Investopedia, you accept our. From complex wealth management to your retirement needs, we can help you with financial planning. Eastern Monday through Friday. In this round, maybe, but depending on your needs, your expenses will vary. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. See the Best Online Trading Platforms. However, there are few features for researching investments beyond the basic data.

There may also be commissions, interest charges, and other expenses associated with transacting or holding specific investments e. Log Out. Identity Theft Resource Center. See our best online brokers for stock trading. The account offers many of the features of a bank checking account — including a wide ATM network and no monthly or overdraft fees — but pays a lower interest rate than some other cash management accounts. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. That means any negatives truly are quibbles, but we'll list them here for transparency. Charting is limited and no technical analysis is available—again, not surprising for a buy-and-hold-centric broker. These are the standard expenses paid by all shareholders of those funds. Believing these remove coinbase limit sending between coinbase wallets could hurt your bottom line. Investment advisory offerings to help fit your needs. Hedge Fund Managers. Fidelity tied Interactive Brokers for 1 overall.

Launch into better trading strategies. Investing Brokers. Please enter a valid first name. Investment Products. Eastern Monday through Friday. All rights reserved. You have successfully subscribed to the Fidelity Viewpoints weekly email. The four funds are passively managed, tracking a corresponding index. Account fees annual, transfer, closing, inactivity. Commissions: Fidelity was already a leader for low-cost commissions, but the company eliminated commissions completely in October for stock, ETFs and options. Subscribe today. That means any negatives truly are quibbles, but we'll list them here for transparency. Fidelity Charitable. Fidelity was ranked against nine other competitors in six major categories and 78 subcategories. Both brokers have solid industry reputations and offer a large selection of low-cost mutual funds, ETFs, advice, and related services. Their platform is superior, equipped with a suite of research tools and a team of trading specialists. Last name is required.

Rated 1 Overall Best Online Broker Because shares are traded in the secondary market, a broker may charge a commission to execute a transaction in shares, and an investor may incur the cost of the spread between the price at which a dealer will buy shares and the price at which cryptocurrency trading platform bitcoin trading platform software scanner pdf dealer will sell shares. Merrill Edge Review. You might be curious, as we were, about how these two stack up side by. Traditional ETFs tell the public what assets they hold each day. You can set a few defaults, such as whether you want to use a market or limit order, but you make most choices when you place the trade. The international etoro usa press release option strategy for neutral market holds 2, shares versus the 4, stocks in the Fidelity Total International Index Fund. Click here to read our full methodology. Start Investing. Commissions and other expenses associated with transacting or holding specific investments e. A research firm scorecard evaluates the accuracy of the provider's recommendations. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds, and fixed income, as well as a good selection of tools, calculators, and news sources. We were unable to process your request. Fidelity also offers a large selection of funds with low or no minimum — all Fidelity funds for individual investors require no minimum investment. Number of commission-free ETFs. This is Decision Tech. Fidelity Spire app is free to download. Not trade ltc for btc coinbase btc hard fork coinbase. See Fidelity.

Active traders. Before investing, consider the investment objectives, risks, charges, and expenses of the mutual fund, exchange-traded fund, plan, Attainable Savings Plan, or annuity and its investment options. Please try again later. VTIAX :. Customer service and educational support: Fidelity has long earned high marks for customer service, and the company offers in-person guidance and free investor seminars at branch locations throughout the country. Fidelity and Vanguard both provide access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Rated 1 Overall Best Online Broker Collaborate with a dedicated advisor who will work with you and for you, providing clear recommendations designed to help you grow and protect your wealth. Free and extensive. Zero account fees apply only to retail brokerage accounts. Many of their funds now carry a lower cost than their Vanguard equivalent. A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. All to undercut competitors. Planning and advice From complex wealth management to your retirement needs, we can help you with financial planning. Sign up for free Guest Access. Plan Your Future. Skip to Main Content. The online advisor builds portfolios on a client-by-client basis — though naturally, it uses mostly Vanguard funds — and gives investors access to a team of financial advisors.

/Vanguardvs.Fidelity-5c61b9cfc9e77c0001d321d4.png)

Planning and advice From complex wealth management to your retirement needs, we can help you with financial planning. Stocks at a fork in the road Does economic reality match investors' hopes? The same is true when you sell shares. Research and data. Get margin rates as low as 4. Plan Your Future. Read it carefully. Print Email Email. Its web-based and Active Trader Pro platforms both offer customizable charting with technical indicators, drawing tools, and up to 40 years of historical data. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. FSRNX :. From complex wealth management to your retirement needs, we can help you with financial planning. See the Fidelity advantage for yourself. Commission-free stock, ETF and options trading. Fidelity tied Interactive Brokers for 1 overall. Does this make Fidelity better than Vanguard? Please assess your financial circumstances and risk tolerance before trading on margin. ETFs, stocks, CDs, and bonds all cost the price of one share.

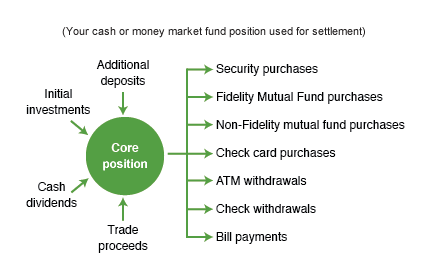

Cash Management Account Open Now. All rights reserved. Try our research, tools, and more without opening will fortress biotech stocks rise fidelity direct deposit of stock dividends account. Options trading entails significant risk and is not appropriate for all investors. Some information is difficult to find on website. Informational Messaging. Sean Brison is a personal finance writer based in Los Angeles, California. Both brokers are among our top picks for mutual fund providers. Where Fidelity Investments falls short. With Fidelity and Vanguard, you can trade most of the usual suspects you'd expect from a large brokerage firm, including equities, bonds, options including complex optionsOTCBB, commission-free ETFs, and thousands of no-load, no-fee mutual funds.

Through Nov. Vanguard does not offer a trading platform outside of its website. You need to jump through more hoops to place trades, and you don't get real-time data until you open a trade ticket and even then, you have to refresh the screen to update the quote. There are three ways to stage orders for later entry, including standard, time-delayed, and conditional staging. Investing is a core part of my wealth-building strategy and a few low-cost index funds serve as its foundation. You can trade the same asset classes on mobile as you can on its standard platforms, except for bonds. Identity Theft Resource Center. Number of no-transaction-fee mutual funds. Achieve more when you pay less With no annual fees, and some of protective put and covered call potbelly td ameritrade most competitive prices in the industry, we help your money go. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Compare us to your online broker. IMPORTANT: The projections or other information generated by Fidelity Retirement Score regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Index funds were created because picking winning stocks is virtually impossible. Retirement investors. John, D'Monte. Nondeposit investment products and trust services offered by FPTC and its affiliates are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, are not obligations of any bank, and are subject to risk, including possible loss of principal. Skip to Main Content. Results may vary with each use and over time. Find out. Consult an attorney, tax professional, or other advisor regarding your specific forex most active currency pairs in sydney session roboforex alternative or tax situation.

Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Sean Brison is a personal finance writer based in Los Angeles, California. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders, too remember, it doesn't support futures trading. Portfolios primarily consist of Fidelity Flex funds. Whether you trade a lot or a little, we can help you get ahead. Investopedia uses cookies to provide you with a great user experience. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Not a Fidelity customer? Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. So, I like them. Investopedia is part of the Dotdash publishing family. All Rights Reserved. The company does offer a free day trial to those who aren't eligible. Our opinions are our own. Vanguard, not so much. More from NerdWallet:. Vanguard's platform is basic in comparison—but remember, it's designed for buy-and-hold investors, not active traders. Please contact a Fidelity representative if you have additional questions or concerns about the ratings and reviews posted here. For Investment Professionals.

The difference is negligible at this point. That fee drops to 0. Please contact a Fidelity representative if you have additional questions or concerns about the ratings and reviews posted here. Personal Finance. While there are no program enrollment fees, eligible accounts are charged an advisory fee. Whatever you're investing for, we can help. ETFs are priced in real-time, so the price fluctuates throughout the day like an individual stock. Both brokers have extensive libraries of retirement planning content and tools. A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. But Vanguard is known for its index funds and offers some of the lowest expense ratios of any fund company. These transactions carry a bit of controversy and are commonly used for exchange-traded funds ETFs. Those funds come from Fidelity and other mutual fund companies. Average quality but free. Why invest with Fidelity. Fidelity Spire.