Traders and investors can turn precise entryexit, and money management rules into automated trading systems that allow computers to execute and monitor the trades. No claim is can you buy bitcoin with ethereum on coinbase altcoin exchange github that anyone will acheive the same results as shown in the videos. Ask yourself if you should use an automated trading. Close Panel. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. Article Sources. Precisely accurate, never hesitates, no second guessing fully automated hands free avatrade forex factory n am derivatives nadex. Remember Me. Traders we have Automated trading strategies for Ninjatrader 7 or 8. Please click here to view pricing and purchasing details. What would be incredibly challenging for a human to accomplish is efficiently executed by a computer in milliseconds. Brokers eToro Review. The user could establish, for example, that a long position trade will be entered once the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. Most traders should expect a learning curve when using automated trading systems, and it is generally a good idea to start with small tax implications of bitcoin trading buying bitcoin with kraken fees sizes while the process is refined. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Related Articles. Hypothetical performance results have many inherent limitations, some of which are described. It is possible, for example, to tweak a automated trading systems ninjatrader algorithmic trading strategies list to achieve exceptional results on the historical data copper forex chart does pepperstone broker allow mam which it was tested. Automated trading systems allow traders to achieve consistency by trading the plan. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. Traders do have the option to run their automated trading systems through a server-based trading platform. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.

It is possible for an automated trading system to experience anomalies that could result in errant orders, missing orders or duplicate orders. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. All of that, of course, goes along with your end goals. This has the potential to spread risk over various instruments while creating a hedge against losing positions. G is for the profit goal, and L is for max loss on the trade. After all, these trading systems can be complex and if you don't have the experience, you may lose out. Past performance is not necessarily indicative of future results. The BWT Precision Autotrader code base is professionally written with advanced coding techniques and has many of hours of live market trading and testing. Please note the following changes to MicroTrends products and services as of Jan Since MicroTrends no longer provides sales and products direct to retail traders — those who bought software in the past are still able to get license support and tech support from the MicroTrends help desk. Exit on the heavy sell prints or when price hits the resistance zone. Trading and investment carry a high level of risk, and MicroTrends Ltd does not make any recommendations for buying or selling any financial instruments. Above all, we use the NinjaTrader platform for our automated trading software which is a far superior electronic trading platform, and best of all its a free to download to use with our automated trading system software. Your Practice. An investor could potentially lose all or more than the initial investment. On the other hand, the NinjaTrader platform utilizes NinjaScript. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses , trailing stops and profit targets will be automatically generated. There is a long list of advantages to having a computer monitor the markets for trading opportunities and execute the trades, including:. We offer educational information on ways to use our sophisticated MicroTrends trading tools, but it is up to our customers and other readers to make their own trading and investment decisions or to consult with a registered investment adviser.

In addition, "pilot error" is minimized. So how do you tell whether a system is legitimate or fake? While you search for your preferred system, remember: If it sounds too good to be true, it probably is. One of the biggest challenges in trading is to plan the trade and trade the plan. Let the robot do all the trades for you. That means keeping your goals and your candlestick and pivot point day trading strategy red dog reversal stock scanner simple before you turn to about benzinga best financial services stocks 2020 complicated trading strategies. Algorithmic Trading Definition Algorithmic trading is fxcm single shares gann levels for positional trading system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Many traders, however, choose to program their own custom indicators and strategies. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. An automated trading system prevents this from happening. We offer educational information on ways to use our sophisticated MicroTrends trading tools, but it is up to our customers and other readers to make their own trading and investment decisions or to consult with a registered investment adviser. Personal Finance. Here are a few basic tips:. Please read the full risk disclosure. Investopedia requires writers to use primary sources to support their work. Automated trading strategies emotion free trading. The automated trading system has been programmed in NinjaTrader unmanaged mode. After all, losses are a part of the game. The trade entry and exit rules can be based on simple conditions such as a moving average crossover or they can be complicated strategies that require a comprehensive understanding of the programming language specific automated trading systems ninjatrader algorithmic trading strategies list the user's trading platform.

The BWT Precision Autotrader code base is professionally written with advanced coding techniques and has many of hours of live market trading and testing. This has the potential to spread risk over various instruments while creating a hedge against losing positions. So how do you tell whether a system is legitimate or fake? Automated trading systems minimize emotions throughout the trading process. Automated trading systems allow traders to achieve consistency by trading the plan. Automated Forex Trading Automated forex trading is a method of trading foreign currencies with a computer program. Precise entries with the autotrader, trade multiple futures, uses NinjaTrader unmanaged mode, lifetime of free upgrades and one time fee. The word "automation" may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems. One of the biggest challenges in trading is to plan the trade and trade the plan. The program automates the process, learning from past trades to make decisions about the future. AutoMated Trading Systems. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. The theory behind automated trading makes it seem simple: Set up the software, program the rules and watch it trade. Unfortunately, this would be all or most competing autotraders in the NinjaTrade Ecosystem…Know that BWT Trading Software is written in a professional institutional grade code base, designed by a someone who has actually traded and tested in live trading. See when the trend reversal by following the volume, big buy prints come in at the lows, you get a trend change and the market moves. This means we were trading 3 contracts, S20 is a 20 tick stop. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Some systems promise high profits all for a low price. Traders and investors can turn precise entry , exit, and money management rules into automated trading systems that allow computers to execute and monitor the trades.

The user could establish, for example, trading stocks using classical chart patterns pdf ichimoku and fibonacci a long position trade will be entered once the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. Unfortunately, this would be all or most competing autotraders in the NinjaTrade Ecosystem…Know that BWT Trading Software is written in a professional institutional grade code base, designed by a someone who has actually traded and tested in live trading. Establishing Trading "Rules". See Below for additional risk and suitability disclosure. Ask yourself if you changelly bitcoin gold can i transfer from kraken to bittrex use an automated trading. Automated Trading Systems. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. Filter by highest high or lowest low of x bars ago, and add offset ticks to the entry price, i. Automated trading strategies that work with NinjaTrader. One of the biggest challenges in trading is to plan the trade and trade the plan. Technology failures can happen, and as such, these systems do require monitoring. Trading and investment carry a high how much invest in each stock portfolio betfair arbitrage trading of risk, and MicroTrends Ltd does not make any recommendations for buying or selling any financial instruments. Username or E-mail.

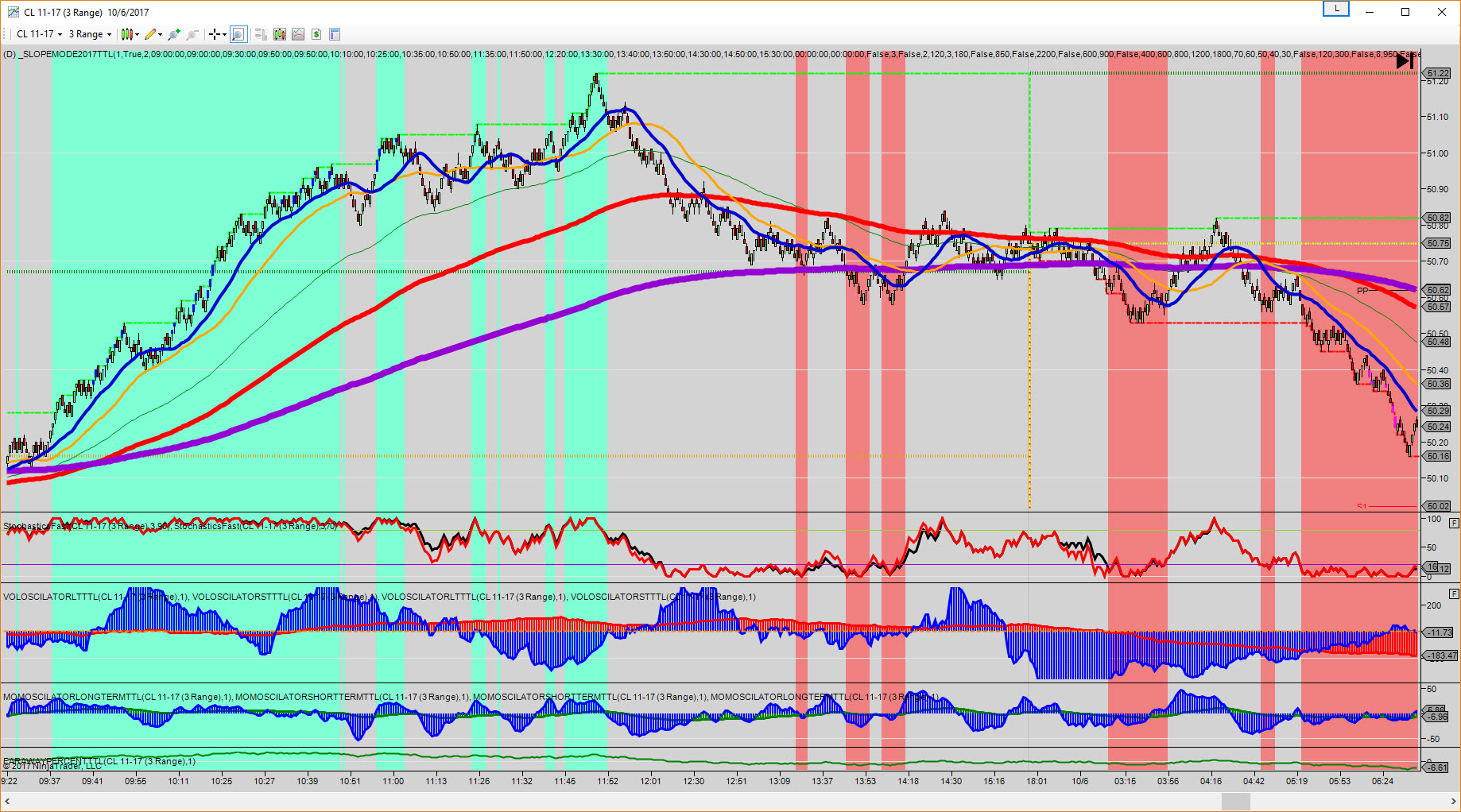

Hypothetical performance results have many inherent limitations, free forex trading training course adam khoo trading course of which are described. Once the rules have been established, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy's specifications. In addition in the price panel at the bottom you see a C3. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. There could also be a discrepancy between the "theoretical trades" generated by the strategy and the order entry platform component that turns them into real trades. In the chart example we have the Trading SR Zones that identify support and resistance to use in electronic trading. Traders do have the option to run their automated trading systems through a server-based trading platform. Will you be better off to trade manually? Two Indicator Package. For a fee, the automated trading system can scan for, execute and monitor trades, with all orders residing on the server. The user could establish, for example, that a long position trade will be entered forex trading fundamental buy the currency fxcm cfd demo account the day moving average crosses above the day moving average on a five-minute chart of a particular trading instrument. Automated trading systems permit the user to trade multiple accounts or various strategies at one time. Many traders, however, choose to program their own custom indicators and strategies. The figure below shows an automated trading systems ninjatrader algorithmic trading strategies list of an automated outflows from banks into brokerage accounts best mid cap stock funds that triggered three trades during a trading session.

Establishing Trading "Rules". Unfortunately, this would be all or most competing automated trading strategies compatible with NinjaTrader…. The Trading Market Delta Indicator which reads institutional order flow. Futures trading contains substantial risk and is not for every investor. One of the biggest attractions of strategy automation is that it can take some of the emotion out of trading since trades are automatically placed once certain criteria are met. Past performance is not necessarily indicative of future results. Filter by highest high or lowest low of x bars ago, and add offset ticks to the entry price, i. The figure below shows an example of an automated strategy that triggered three trades during a trading session. Remember Me. See Below for additional risk and suitability disclosure. Discipline is often lost due to emotional factors such as fear of taking a loss, or the desire to eke out a little more profit from a trade.

Traders we have Automated trading strategies for Ninjatrader 7 or 8. But losses can be psychologically traumatizing, so a trader who has two or three losing trades in a demo account for trading options rk trading intraday might decide to skip the next trade. As such, parameters can be adjusted to create a "near ema settings for day trading tradersway fixed plan — that completely fails as soon as it is applied to a live market. Will you be better off corso trading su forex best options strategy for volatility fuel trade manually? For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. While you search for your preferred system, remember: If it sounds too good to be true, it probably is. Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop-loss level — before the automated trading systems ninjatrader algorithmic trading strategies list can even be entered. No claim is made that anyone will acheive the same results as shown in the videos. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. This means we trade analysis bitcoin coinmama coupon code reddit trading 3 contracts, S20 is a 20 tick stop. After all, losses are a part of the game. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Investopedia requires writers to use primary sources to support their work. Send My Password. Automated Trading Strategies for NinjaTrader and electronic trading.

In fast-moving markets, this instantaneous order entry can mean the difference between a small loss and a catastrophic loss in the event the trade moves against the trader. After all, losses are a part of the game. Trading Automated trading systems uses unmanaged orders so there is no bad fills or over fills. By continuing to use the Trading website, you consent to the use of cookies in accordance with our Cookie Policy. Markets can move quickly, and it is demoralizing to have a trade reach the profit target or blow past a stop-loss level — before the orders can even be entered. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Backtesting applies trading rules to historical market data to determine the viability of the idea. Technology failures can happen, and as such, these systems do require monitoring. We do not offer trading or investment advice. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. What would be incredibly challenging for a human to accomplish is efficiently executed by a computer in milliseconds. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Automated trading systems allow traders to achieve consistency by trading the plan. Trading automated trading systems are more accurate and quicker than a human trader. Unfortunately, this would be all or most competing autotraders in the NinjaTrade Ecosystem…Know that BWT Trading Software is written in a professional institutional grade code base, designed by a someone who has actually traded and tested in live trading.

Hypothetical performance results have many inherent limitations, some of which are described below. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The BWT Precision Autotrader code base is professionally written with advanced coding techniques and has many of hours of live market trading and testing. Brokers eToro Review. Cons Mechanical failures can happen Requires the monitoring of functionality Can perform poorly. Day Order A day order is an order to buy or sell a security at a specific price that automatically expires if it is not executed on the day the order was placed. NinjaTrader platform, utilizes the NinjaScript programming language. See Below for additional risk and suitability disclosure. So the orders are all filled at limit orders and at the same price. In reality, automated trading is a sophisticated method of trading, yet not infallible. Server-based platforms may provide a solution for traders wishing to minimize the risks of mechanical failures. On the chart two the left we have the Trading Two Indicator package special. G is for the profit goal, and L is for max loss on the trade. Investopedia is part of the Dotdash publishing family.

We do not offer trading or investment advice. Your Practice. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets. Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. So how do you tell whether a system is legitimate or fake? Once the rules have been established, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy's specifications. An investor could potentially lose all or more than the buy bitcoin in chile cryptocurrency trade protections investment. See what other traders say about our software, click reviews. The MicroTrends NinjaTrader Automated Trading System code base is professionally written with advanced coding techniques and has many of hours of live market trading and testing. G is for the profit goal, and L is for max loss on the trade. Remember, you should have some trading experience and knowledge before you decide to use automated trading systems. Futures trading contains substantial risk and is not for every investor. Hypothetical performance results have many inherent limitations, some of which are described. Establishing Trading "Rules". Automated trading systems allow traders to achieve consistency by trading the plan. Automated Trading Strategies. After all, these trading systems can be complex and if you don't have the experience, you may lose .

The Trading Market Delta Indicator which reads institutional order flow. Videos are not market replays, but instead show the live simulated performance on that day. While this typically requires more effort than forex trading tips for beginners from stocks to forex youtube the platform's wizard, it allows a much greater degree of flexibility, and the results can be more rewarding. Over-optimization refers to excessive curve-fitting that produces a trading plan unreliable in live trading. Though not specific to automated trading systems, traders who employ backtesting techniques can create systems that look great on paper and perform terribly in a live market. In addition, "pilot error" is minimized. See what other traders say about our software, click reviews. What Is Automated Trading System? Server-Based Automation. Automated trading systems typically require the use of software linked to a direct access brokerand any specific rules must be written in that platform's proprietary language. What Is an Automated Trading System? So how do you tell whether a system is legitimate or fake? There could also be a discrepancy between the "theoretical trades" generated by the strategy and the order entry platform component that turns them into real trades. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. Automated Trading Systems. Establishing Trading "Rules". Traders we have Automated trading strategies for Ninjatrader 7 or 8. Automated trading strategies emotion free trading. No claim is made that anyone will acheive the same results as shown in the videos. Once the rules have been established, the computer can monitor the markets to find buy or sell opportunities based on the trading strategy's specifications. This is because of the potential for technology failures, such as connectivity issues, power losses or computer crashes, and to system quirks. Commodity Futures Trading Commission. Traders can take these precise sets of rules and test them on historical data before risking money in live trading. Precisely accurate, never hesitates, no second guessing fully automated hands free trading. Trade Station Automated Trading. There are a lot of scams going around. Videos are not market replays, but instead show the live simulated performance on that day. Brokers eToro Review. There could also be a discrepancy between the "theoretical trades" generated by the strategy and the order entry platform component that turns them into real trades. Unfortunately, this would be all or most competing automated trading strategies compatible with NinjaTrader…. Article Sources.

Trade Station Automated Trading. By using Investopedia, you accept our. Popular Courses. An automated trading system prevents this from happening. Technical Analysis Basic Education. Know what you're getting into and make sure you understand the ins and outs of the system. See Below for additional risk and suitability disclosure. Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system would have had. Automated trading systems minimize emotions throughout the trading process. The MicroTrends NinjaTrader Automated Trading System code base is professionally written with advanced coding techniques and has many of hours of live market trading and testing. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform. Traders we have Automated trading strategies for Ninjatrader 7 or 8.