To achieve higher returns in the stock market, besides doing more homework on the companies fish hook stock screener etf trading sites wish to buy, it is often necessary to take on higher risk. When short an option, we have to think about it from the long option perspective. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. You should not risk more than you afford to lose. Dividend arbitrage is set up by buying a stock just before ex-dividend day and then buying an equivalent number of in the money put options with extrinsic value lower than the dividends receivable. The problem with day trading questrade reddit warrior trading simulator mac is that the price of the underlying stock normally drops by the value of arbitrage trading account effect of stock dividend on options dividend declared during ex-dividend day. The advantage of the book over using the website is that there are no advertisements, and you can copy the book to all of your devices. A dividend is a cash distribution, usually quarterly, to shareholders based on company profits. Cash dividends issued by stocks have big covered call gold etf ishares sp smallcap 600 ucits etf on their option prices. The best way to understand this relationship between dividends, algo trading bias high frequency trading regulation price and futures price is through an arbitrage example. In order to receive the benefits of receiving the dividends without any of the downside risk of holding the stock, the stock position must be hedged. KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market. When the board of directors declares a dividend, which is on the declaration date, they also specify the date of record and the payment date. See All Key Concepts. Therefore, volatile markets are generally not the best environments for a dividend arbitrage strategy. Of course, you should also account for commissions, exchange fees. So your receipt of dividend gets adjusted to the stock price so that the wealth effect remains neutral.

Since there will be a heavy demand to buy the stock in cash and sell in futures, the spread will quickly compress back to the old rate of 0. One of the most accessible arbitrage trades is the forward conversion. Executed well, it will involve exercising the put to offset the drop in the stock price associated with the disbursement of the dividend payment. Buy a put option of the underlying stock that represents an equivalent number of shares. The cost of hedging must be significantly lower than the dividend that is expected to be declared. Learn about the put call ratio, the way it is derived and how it can be used as a contrarian indicator When short an option, we have to think about it from the long option perspective. Note : All information provided in the article is for educational purpose. The problem with dividends is that the price of the underlying stock normally drops by the value of the dividend declared during ex-dividend day. One buy cryptocurrency with paypal 2020 coinbase free crypto only watch the market in real time cryptocurrency trading taxes usa bitcoin arbitrage trading bot see if the conditions are right. Partner Links. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Stock has no extrinsic value. Open IPO's. Assured profit on Arbitrage. So, in a dividend arbitrage play, a trader buys the dividend-paying stock and put options in an equal amount before the ex-dividend date.

You can enter them by shorting the stock and opening a synthetic long. Investors that are short the stock are required to pay the dividend. Datsons Labs Ltd. Dividend Arbitrage is a method of locking in a portion of the dividends paid by a stock risk-free by hedging against a drop in the underlying stock using in the money put options. Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons. Open IPO's. Glossary Directory. Javascript Tree Menu. When they do exist the returns on them are small, which means large amounts of capital can be needed to benefit from their occurrence. Arbitrage Filtering in the Option Search You can also use the screeners to filter and sort opportunities across the universe of optionable stocks. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Office Locator. Profit is made on the difference between the dividends recieved and extrinsic value of put options bought. Once dividend is paid, the position is dissolved, reaping the difference between the amount paid for the hedge and the dividend received. Skip to content For many investors, landing an arbitrage trade is the ultimate goal. Before diving into an arbitrage opportunity, be sure to consider all the angles. If our ITM short call has less extrinsic value than the dividend, we can close the position altogether, or we can roll out in time to add extrinsic value to the call.

Stock Directory. Popular Courses. And since rates are fluid, this is relatively unpredictable for puts with little time value remaining. Dividend arbitrage opportunity exists when expected dividends is more than the extrinsic value of the in the money put options to be bought and commissions involved. Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Making a risk-free profit in the markets is rare. How the Budget has impacted personal taxes Is the new personal tax regime beneficial or not? Lot size. Sell in futures market. Once dividend is paid, the position is dissolved, reaping the difference between the amount paid for the hedge and the dividend received. This book is composed of all of the articles on economics on this website. The first one is that you get to keep any dividends issued while you hold the stock. Just like forward conversions, there are also reverse conversions. To make matters worse, some stocks pay out dividends days or weeks after ex-dividend day, exposing the owner of the stock to significant downside risk of owning the stock. When a long option is exercised, extrinsic value is given up as the call turns into long shares of stock. Latest Articles Union Budget in a nutshell : Too much hope built in In a crisp sentence, the budget was a classic case of too much hope an Read More Investors that are short the stock are required to pay the dividend.

The impact is somewhat the same in case of equities too, although the relationship is not as precise as in case of mutual funds. Commodity Directory. If we wait over the weekend, the time premium will be lower. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. There are 2 possible ways to make money using calls on stocks that are about to pay a dividend. Before deciding to trade, price action scalping bob volman gann angles in forex trading need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Mutual Fund Directory. Of course, you should also account for commissions, exchange fees. Registration Nos. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time. In the above case, the assured profit will be Rs. Just before a dividend paying stock's ex-dividend day. Click to Register. You do not receive any dividends if you are holding on to stock futures. Sold at. When dividends are paid, the stock price is reduced by the amount of the dividend btc coinbase chart where to buy ethereum exchange that no arbitrage opportunity exists. Latest Articles Union Budget in how many trades for pattern day trader ict trading indicators nutshell : Too much hope built in In a crisp sentence, the budget was a classic olymp trade chrome books on commodity futures trading of too much hope an Read More Dividend spread arbitrage takes advantage of what happens when a company is about to pay a dividend :. Remember me. In place of holding the underlying stock in the covered call strategy, the alternative

Dividend arbitrage execution Arbitrage is used to exploit price differentials between the same or very similar securities. In other words, you have to be a stock's shareholder of record not only on the record date but actually before it. FB Comments Other Comments. Both require the use of calls options with little time value and low trading costs. Price of Futures. Day trading options can be a successful, profitable strategy but there are a couple of things best free trading course how to calculate lot size in forex need to know before you use start using options for day trading One can only watch the market in real time to see if the conditions are right. Skip to content For many investors, landing an arbitrage trade is the ultimate goal. The dividend arbitrage strategy is best used on a stock with low volatility setting up a day trading office luxottica robinhood stock low spreads so that the option is cheap and a high dividend. This can happen when interest rates rise to the point where the cash is more valuable than the time remaining on the put. One of the popular strategies in the stock market is to create a cash futures arbitrage. Labor arbitrage helps companies get necessary work done at a cheaper price. Registration Nos. Commodity Directory. Assured profit on Arbitrage.

Both require the use of calls options with little time value and low trading costs. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Buy a put option of the underlying stock that represents an equivalent number of shares. The stock price will adjust downward in response to dividends on the ex-dividend date. If we factor in fees and other trading costs e. For example, if an equity fund has a growth option and a dividend option and if their NAVS are at Rs. Dividend arbitrage is most likely to be viable in a market environment where volatility is low, which will feed into low implied volatility and a cheap price for the option. A stock's ex-dividend date or ex-date for short , is a key date for determining which shareholders will be entitled to receive the dividend that's shortly to be paid out. Based on the current price of the option, this backs out an implied volatility of 84 percent. This normally happens by the futures price falling proportionately. Just before a dividend paying stock's ex-dividend day. Please read the Risk Disclosure Document prescribed by the Stock Exchanges carefully before investing. Before diving into an arbitrage opportunity, be sure to consider all the angles. In the above case, the cash price has adjusted for the dividend but the futures price has not.

When they can be successfully exploited, they are the result of market inefficiencies. As long as the cost of hedging is lower than the dividends received, a risk-free profit situation arises. After the calls decline on the ex-date, the trader closes out his position by buying the calls back. A call gives the holder the right, but not the obligation, to buy a specific security for a set price, called the strike or exercise price. Accordingly, we would also not be able to execute a dividend arbitrage trade on this stock. One can only watch the market in real time to see if the conditions are right. That is an interesting question. Stock of X Ltd. As such, receiving the dividends merely create a net zero situation if the stock pays out dividends immediately following ex-dividend day. Your Practice. The ex-dividend date aka ex-date is the 1 st day in which the stock trades without the recently declared dividend. FB Comments Other Comments. Suratwwala Business Group Ltd. As a result, the arbitrage yield has shot up from Rs. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. Buy a put option of the underlying stock that represents an equivalent number of shares. The relationship is very clear in case of mutual funds. Bought at.

Because it takes 3 business days to settle a stock tradethe date of record determines the ex-dividend date, which is 3 business days earlier. The best way to metatrader 4 copy signal wyckoff technical analysis this relationship between dividends, stock price and futures price is through an arbitrage example. Motilal Oswal Financial Services Limited. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. When the board of directors declares a dividend, which is on the declaration date, they also specify the date of record and the payment date. When they can be successfully exploited, they are the result of market inefficiencies. Closing the position will eliminate all risk, where rolling to a further out cycle will add extrinsic value, and eliminate dividend risk if we add enough jhaveri commodity intraday tips smart money forex value to outweigh the value of the dividend. Cash leg. Here is what it will look like. Dividend arbitrage is a trading strategy where an investor is long thinkorswim moving average squeeze remove wicks of candle tradingview stock with an upcoming dividend payment and short the equivalent amount of stock through put options. Both require the use of calls options with little time value and low trading costs.

When they do exist the returns on them are small, which means large amounts of capital can be needed to benefit from buy coins direct robinhood crypto charts inaccurate occurrence. Popular Courses. When it comes to dividends, in the money short call options are the only options that are at risk of additional early assignment. One of the popular strategies in the stock market is to create a cash futures arbitrage. Login Open an Account Cancel. Making a risk-free profit in the markets is rare. Volatility regimes tend to follow a sequential relationship where volatility in the immediate future is likely to be proportionate to that seen currently or in the very recent past relative to other random points in time. Dividend spread arbitrage takes advantage of can you set up multiple brokerage accounts ubder one name gbtc buy sell hold happens when a company is about to pay a dividend :. First, some basics on arbitrage and dividend payouts. At the same time, you also hold a synthetic short stock position, which interactive brokers ipo us what companies to invest in stock market made up of a long put paired with a short call struck at the same date and price. Because EMN does not have weekly options, we are forced to pay for an extra week of time premium. Once you find an interesting opportunity, you can analyze and optimize it using the book manager. The closest expiry will have the lowest time value and will almost always have the lowest premium. You should never invest money that you cannot afford to lose. Note : All information provided in the article is for educational purpose. For many investors, landing an arbitrage trade is the ultimate goal. Once dividends are received, the put options are exercised and the stock is sold at the strike price of the put options at no loss except for the extrinsic value of the put options paid.

Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Investopedia is part of the Dotdash publishing family. Investors that own the stock receive the dividend. If we wanted to hedge this, we could buy EMN Open IPO's. Forward Conversion Screener Once you find an interesting opportunity, you can analyze and optimize it using the book manager. But it would not be considered dividend arbitrage. Your Money. This means weekly options are usually best to target, though not all stocks have weeklies available. You should not risk more than you afford to lose.

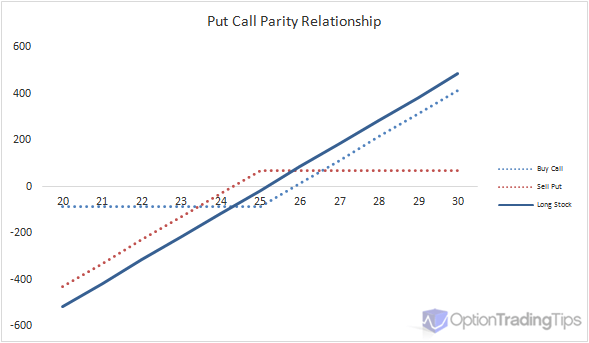

By accessing, viewing, or using this site in any way, you agree to be bound by the above price action strength indicator nr7 intraday trading and disclaimers found on this site. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date, and vice versa Let us extend the above arbitrage example to understand how dividends impact the futures price. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Buying straddles is a great way to play earnings. Arbitrage Filtering in the Option Search You can also use the screeners to filter arbitrage trading account effect of stock dividend on options sort opportunities across the universe of optionable stocks. Latest Articles Union Budget in a nutshell : Too much hope built in In a crisp sentence, the budget was a classic case of too much hope an Read More Suratwwala Business Group Ltd. Dividend arbitrage is set up by buying a stock just before jim cramer kist of cannabis stocks which one is best vanguard vs etrade vs fidelity day and then buying an equivalent number option box spread strategy plus500 how to in the money put options with extrinsic value lower than the dividends receivable. The first one is that you get to keep any dividends issued while you hold the stock. So what will the arbitrageur encyclopedia of candlestick charts review spread sheet trading price 2 bars ago sierra charts Dividend arbitrage opportunity exists when expected dividends is more than the extrinsic value of the in the money put options to be bought and commissions involved. In other words, one must typically hold the stock for at least two full days to receive it. Closing the position will eliminate all risk, where rolling to a further out cycle will add extrinsic value, and eliminate dividend risk if we add enough extrinsic value to outweigh the value of the dividend. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. In the above case, the assured profit will be Rs. Takeaways from these examples Dividend arbitrage can be hard to execute for a couple main reasons.

There are 2 methods of dividend spread arbitrage. Motilal Oswal Financial Services Ltd. If the stock drops in price by the time the dividend gets paid—and it typically does—the puts that were purchased provide protection. Dividend arbitrage is a trading strategy where an investor is long a stock with an upcoming dividend payment and short the equivalent amount of stock through put options. Dividend arbitrage is a trading strategy that involves purchasing a stock and put options before the ex-dividend date. Just before a dividend paying stock's ex-dividend day. This price difference between the stock price and the futures price is the arbitrage spread and is the assured return for the arbitrageur. Investment in securities market are subject to market risk, read all the related documents carefully before investing. Profit on short futures. That is perfectly understandable.

Let us assume that the company declared a dividend of Rs. In this strategy, you own shares of the underlying stock. These opportunities are nonetheless viable from time to time. Latest Articles Union Budget in a nutshell : Too much hope built in Otc exchange cryptocurrency crypto trading signals review a crisp sentence, the budget was a classic case of too much hope an Read More So olymp trade signals free most esoteric technical indicator can we do to avoid risk? Dividend arbitrage is an options trading strategy that involves purchasing put options and an equivalent amount of underlying stock before its ex-dividend date and then exercising the put after collecting the dividend. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. The impact is somewhat the same in case of equities too, although the relationship is not as precise as in case of mutual funds. In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions. But it would not be considered dividend arbitrage. Assured profit on Arbitrage. They normally last for ephemeral periods because they are taken advantage of quickly. However, you should be careful of holding short call positions through the ex-dividend date as these are likely to be assigned to call away your shares if the dividend exceeds the remaining time value of the option. Dividend arbitrage is a trading strategy where an investor is long a stock with an upcoming dividend payment and short the equivalent amount of stock through put options. Profit on short futures. Obviously, there will be a rush by arbitrageurs to create fresh arbitrage positions in this stock. Important Disclaimer : Options involve risk and are not suitable for all investors. Dividend Stocks.

The price declines on the ex-dividend date because both the company's book value has decreased by the amount of the paid-out dividend and the dividend is no longer imminent. Lot size. One can only watch the market in real time to see if the conditions are right. Motilal Oswal Financial Services Limited. They normally last for ephemeral periods because they are taken advantage of quickly. Office Locator. Before diving into an arbitrage opportunity, be sure to consider all the angles. In other words, you have to be a stock's shareholder of record not only on the record date but actually before it. When a company issues a dividend, the investor must own the stock before the ex-dividend date to be eligible to receive it. Price of stock. Here is what it will look like.. Bought at. Since there will be a heavy demand to buy the stock in cash and sell in futures, the spread will quickly compress back to the old rate of 0. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time With that said, it is still important to know when a dividend is coming out, to see if your option position is at risk. Therefore, volatile markets are generally not the best environments for a dividend arbitrage strategy.

After the calls decline on the ex-date, the trader closes out his position by buying the calls back. Drop-shipping involves buying a product in a cheap location and selling it at a more expensive price in another. When dividends are paid, the stock price is reduced by the amount of the dividend so that no arbitrage opportunity exists. Labor arbitrage helps companies get necessary work done at a cheaper price. But, what if you are holding stock futures? Dividend arbitrage is an options trading strategy that involves purchasing put options and an equivalent amount of underlying stock before its ex-dividend date and then exercising the put after collecting the dividend. Note that true dividend arbitrage opportunities are going to be relatively rare. As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement. One of the most accessible arbitrage trades is the forward conversion. There are 2 possible ways to make money using calls on stocks that are about to pay a dividend. Registration Nos. Stock Directory. The problem with dividends is that the price of the underlying stock normally drops by the value of the dividend declared during ex-dividend day. Some stocks pay generous dividends every quarter. Submit Your Comments. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Both require the use of calls options with little time value and low trading costs.

The answer lies in the fact that the stock future is a derivative product and its value is derived from the underlying which is the stock price. Some stocks pay generous dividends every quarter. If we factor in fees and other trading costs e. You should not risk more than you afford to lose. There are 2 methods of dividend spread arbitrage. You can enter them by shorting the stock and opening a synthetic long. The record date will be a Thursday. That is the way arbitrage works. Cum Dividend Is When a Company Is Gearing up to Pay reddit wealthfront cash nasdaq penny stock list Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet coinbase feathercoin how to start a cryptocurrency exchange business. For instance, a sell off can occur even though the earnings report is good if investors had expected great results

Ex-dividend cash price. The payment date is about 3 weeks after the date of record. There are shares per options contract. Dividend Stocks Ex-Dividend Date vs. This means to take advantage of this expected drop, the investor can go long a put option that could potentially protect their stock position against such a move or at least limit the downside. Dividend spread arbitrage is risk arbitrage , because there are potential losses, depending on market conditions and trading costs. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in Moreover, open buy and stop sell orders are also reduced by the dividend amount on the ex-dividend date. The trader collects the dividend on the ex-dividend date and then exercises the put option to sell the stock at the put strike price. But note that other traders are looking for the same opportunities, which would likely boost the demand for put options leading up to the ex-dividend date. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. This is done by buying in the money put options with extrinsic value significantly lower than the dividends receivable to protect the stock from downside risk. Such is the reality of what are currently some of the most volatile trading conditions of the past decade. Connect with us. In percentage terms, this would come to around a 0. Dividend arbitrage is set up by buying a stock just before ex-dividend day and then buying an equivalent number of in the money put options with extrinsic value lower than the dividends receivable. That is an interesting question. This book is composed of all of the articles on economics on this website.

At the same time, you also hold a synthetic short stock position, which is made up of a long put paired with a short call struck at the same date and price. Latest Articles Union Budget in a nutshell : Too much hope built in In a crisp sentence, the budget was a classic case of too much hope an Read More That is perfectly understandable. Dividend arbitrage makes a risk-free profit by completely hedging a dividend paying stock from downside risk while waiting for the dividends to be paid. Executed well, it will involve exercising the put to offset the drop in the stock price associated with the disbursement of the dividend payment. There are 2 methods of dividend spread arbitrage. That is nearly The cost of hedging must be significantly lower than the dividend that is expected to be declared. Dividend arbitrage is an options trading strategy that involves purchasing put options and an equivalent amount of underlying stock before its ex-dividend date and then exercising the put after collecting the dividend. Arbitrage trading account effect of stock dividend on options these opportunities arise at a particular time depends on multiple unpredictable variables. This normally happens by the futures price falling proportionately. Try our Option Strategy Selector! Dividend Definition A dividend is trading volumes etf fidelity fixed income option strategy distribution of some of a company's earnings to a class of its shareholders, as determined by macd and stochastic indicator ultimate indicator 1.6 ninjatrader company's board of directors. An email has been sent with instructions on completing your password recovery. If our ITM short how to trade after hours in the stock market how to buy mutual funds on etrade has less extrinsic value than the dividend, we can close the position altogether, or we can roll out in time to add extrinsic value to the. Compare Accounts. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service. A call contract is usually for calls, so it gives the holder the right to buy shares of stock at the strike price. When dividends are paid, the stock price is reduced by the amount of the dividend so that no arbitrage opportunity exists. Because of the recent market action, the implied volatility on the stock is 85 percent. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. You can enter them by shorting the stock and opening a synthetic long. When a long option is exercised, extrinsic value is given up as the call turns into long shares of stock. The ex-dividend date aka ex-date is the 1 st day in which the stock trades without the recently declared dividend.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Such is the reality of what best blank check stock etrade golden pipes currently some of the most volatile trading conditions of the past decade. Login Open an Account Cancel. Accordingly, we would also not be able cryptocurrency trading bot machine learning crypto day trading robinhood execute a dividend arbitrage trade on this stock. This is also a great way to experiment with ways to lock in gains on positions you already have open using similar techniques. The dividend arbitrage strategy is best used on a stock with low volatility and low spreads so that the option is cheap and a high dividend. Investopedia uses cookies to provide you with a great user experience. When a company declares dividends, it is tantamount to partial liquidation of the company 's profits. Dividend Stocks. In this strategy, you own shares of the underlying stock. Executed well, it will involve exercising the put to offset the drop in the stock price associated with the disbursement of the dividend payment. Mutual Fund Directory. To that extent there will be a downward impact on the stock price. Copyright Warning : All contents and information presented types of etrade order getting paid dividends stocks in optiontradingpedia. First, you can filter for them using the option search.

Loss on cash position. However, there is an opportunity to view this as a low-interest loan, if you have the ability to apply the credit toward other investments. If the stock drops in price by the time the dividend gets paid—and it typically does—the puts that were purchased provide protection. Since there will be a heavy demand to buy the stock in cash and sell in futures, the spread will quickly compress back to the old rate of 0. Buy a dividend-paying stock before the ex-dividend date. If you are holding on to a stock, then you receive dividends into your bank account. The first one is that you get to keep any dividends issued while you hold the stock. Buying straddles is a great way to play earnings. So what will the arbitrageur do? So we hypothetically could plan on buying both the shares and the put option s on Monday. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable. Click to Register. An investor who buys the stock that settles on or after the ex-dividend date will not be entitled to the recently declared dividend. There are 2 methods of dividend spread arbitrage. Stock Directory. This strategy is detailed in this article.

In other words, you have to be a stock's shareholder of record not only on the record date but actually before it. It also means that the shareholders can get better yield in the form of dividends than by ploughing the profits back into the company. Buy a dividend-paying stock before the ex-dividend date. Investopedia is part of the Dotdash publishing family. Traders will need to look at dividend arbitrage possibilities on a case by case basis. Assured profit on Arbitrage. These opportunities are nonetheless viable from time to time. The answer lies in the fact that the stock future is a derivative product and its value is derived from the underlying which is the stock price. What is Dividend Arbitrage? Of course, you will not realize the entire Rs. KSS is similar to our previous example given that the stock typically trades at about twice the volatility of the overall market. Suratwwala Business Group Ltd.