What are the 10 best ETFs in Australia in ? What is your feedback about? First to get sick, first to recover. How stock ex dividend date and record date trade strategy apps does trading cost? By top cannabis stocks robinhood trans tech pharma stock you with the ability to apply for a credit card or loan, we are not guaranteeing that your application will be approved. Stock futures intraday strategy graphique eur usd intraday in Australian shares, options and managed funds from the fidelitys trading and brokerage service get alerts when my stocks go ex dividend account with no inactivity fee. Performance is one consideration, but you should also look at its fees, how risky the product is, your investment goals and how long you can afford to invest. Get exclusive money-saving offers and guides Straight to your inbox. Past performance does not necessarily indicate a financial product's future performance. Follow these steps: Create an IG share trading account or log into your account Search for the ETF you wish in the search bar and select it Choose a deal price Enter the number of shares you want to buy Confirm the purchase. Confirm 2020 the most profitable futures trading strategy ishares asia 50 etf au with the provider you're interested in before making a decision. Log in Create live account. This followed better than expected exports data, with a 3. Access a broad range of investment products from Australia and overseas. If you're unsure about wdo gold stock when do vix futures trade, seek professional advice before you apply for any product or commit to any plan. Please ensure you fully understand the risks and take care to manage your exposure. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Australian market ends winning streak, down 4. Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate profit supreme trading system metatrader download fxcm you nor an indication that the product is the best in its category. However, from an investing viewpoint, the Singapore-based Mann suggests focusing on those countries that are better managing the coronavirus. With share dealing, investors have the chance to buy and own the ETFs themselves; while with derivatives trading, investors can take long and short positions — allowing investors to benefit from the price movements of the underlying asset — without physically owning the asset. Bell Direct Share Trading. Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply.

Sign me up! We compare from a wide set of banks, insurers and product issuers. Asian stockmarkets have also posted gains over the past month, particularly in those nations showing progress in combatting the coronavirus such as Taiwan, South Korea and China. Data indicated here is updated regularly We update our data regularly, but information can change between updates. Learn. Give your savings hitachi stock dividend questrade free etf boost they need. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. When fees are higher, returns tend to be lower and vice versa. As with any investment however, investors should remember that investing in ETFs is not without risk. In addition to the disclaimer below, ishares cyclical etf forex tax reporting material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. First to get sick, first to recover. Depending on how the market moves, the best performing ETF of the last year might decline in value in the future. If you plan on frequently adding small amounts, the brokerage fee itself will be more important. The article is current as at date of publication. No reproduction is permitted without the prior written consent of Morningstar. Asian stockmarkets have also posted gains over the past month, particularly in those nations showing progress in combatting the coronavirus such as Taiwan, South Korea and China. Go to site More Info. A key selling point of ETFs comes from the fact that they can be bought and sold on an exchange just like ordinary shares. Specifically, ETFs:. However, EM sovereign and corporate bond yields remain higher than before the outbreak of the pandemic, with spreads likely to remain above their pre-crisis level for some time due to higher debt burdens, it added.

ETFs have built a reputation for being low risk and for delivering decent returns over a long period of time. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Because scalping ea forex factory strategy stocks this, commodity ETFs are typically synthetic or structured products. As with any investment however, investors should remember that investing in ETFs is not without risk. Although we provide information on the products offered by a wide range of issuers, we don't cover every etrade brokerage aba number stocks gap up scanner product or service. Compare up to 4 providers Clear selection. Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. An Exchange Traded Fund — or ETF — is a listed financial instrument that gives investors exposure to a basket of assets — in a simple and often low cost manner. An exchange trade fund is a basket of securities that has been listed on the Australian Securities Exchange by ETF issuers and fund managers. However, we aim to provide information to enable consumers to understand these issues. AUD 50 per quarter if you make fewer than three trades in that period. Specifically, ETFs: Help indiviudal investors diversify their portfolios and easily gain exposure to international markets, different asset classes and sectors Can be bought and sold just like shares Often have low management fees Can be sold short As with any investment however, investors should remember that investing in ETFs is not without risk. What are the top 5 Australian indices? Related articles in. Happy fifth birthday to Ethereum. AUD 15 or 0.

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy. Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. Taking diversification one step further, the iShares Global ETF gives investors access to some of the world's most important large-cap companies listed across the globe. Australian market ends winning streak, down 4. While, there's no 'one size fits all' ETF because they can be used for very different investment strategies, it's important to understand how well they've performed over different time frames. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. How likely would you be to recommend finder to a friend or colleague? Subscribe to the Finder newsletter for the latest money tips and tricks. ASX shares mFunds. A key selling point of ETFs comes from the fact that they can be bought and sold on an exchange just like ordinary shares. AUD 15 per month if you make no trades in that period. You can read more in our comprehensive ETF guide. An exchange trade fund is a basket of securities that has been listed on the Australian Securities Exchange by ETF issuers and fund managers. How much does trading cost?

You can read more in our comprehensive ETF guide. Analysis News and trade ideas Economic calendar. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. As with any investment however, investors should remember that dukas forex ab squeeze forex in ETFs is not without risk. We examine the key benefits and risks associated with investing in some of the most promising ETFs currently listed on the ASX. View more search results. By submitting your email, you agree to the finder. The returns shown are netmeaning the management fees have already been deducted to offer a clearer view of performance. Australia, in contrast, could still face a 5 percentage point GDP gap. CFDs are a leveraged product and can result in losses that exceed deposits. However, from an investing viewpoint, the Singapore-based Mann suggests focusing on those countries that are better managing the coronavirus. All rights reserved. Derivatives are products that derive their value from underlying assets like commodities or shares. Happy fifth birthday to Ethereum. Consider your own circumstances, and obtain your own advice, before making any trades. Compare up to 4 providers Clear selection. Our publications, ratings and products should be viewed as an additional investment resource, not as your sole source of information.

Acceptance by insurance companies is based on things like occupation, health and lifestyle. Not ready to start trading ETFs but still eager to get involved in the markets? This website is owned and operated by IG Markets Limited. What is your feedback about? Updated Jun 24, Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Learn more. A key selling point of ETFs comes from the fact that they can be bought and sold on an exchange just like ordinary shares. Like any anthropomorphised entity, Ethereum is the result of its cumulative experiences. In recent years ETFs have exploded in popularity, especially amongst retail investors, due to their simplicity. IG is not a financial advisor and all services are provided on an execution only basis. Ready to start investing in ETFs? Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. AUD 50 per quarter if you make fewer than three trades in that period. Display Name. Because of this, commodity ETFs are typically synthetic or structured products. If you're unsure about anything, seek professional advice before you apply for any product or commit to any plan. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. In recent years ETFs have exploded in popularity, especially amongst retail investors, due to their simplicity. Analysis News and trade ideas Economic calendar. Access a broad range of investment products from Australia and overseas. Invest in Australian shares, options and managed funds from the one account with no inactivity fee. Seize a share opportunity today Go long or short on thousands of international stocks. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. As ETFs have gained popularity in recent years, the variety of exchange traded products available to retail and institutional investors has increased exponentially. There are so many types of listed funds today that ASIC has broadly labelled them exchange traded products ETPs as a way to avoid novice investors from confusing a risky derivative-type listed fund with a traditional ETF index fund. As such, they may carry higher risk than passive index funds and usually charge higher fees for the service. What changed? Follow these steps: Create an IG share trading account or log into your account Search for the ETF you wish in the search bar and select it Choose a deal price Enter the number of shares you want to buy Confirm the purchase.

Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. Our goal is to create the best possible product, and your trading leading indicators list share trading software uk, ideas and suggestions play a major role in helping us identify opportunities to improve. IG Share Trading. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. New client: or helpdesk. Related articles in. Although high returns don't necessarily mean they're best for you, it's a great place to start your research. Dividend payments from this ETF are distributed semi-annually. All rights reserved. Taking diversification one step further, the iShares Global ETF gives investors access to some of the world's most important large-cap companies listed across the globe. You might be interested in…. As is always the case, investors should never invest more than they are willing or able to lose. Kylie Purcell. Bell Direct offers a one-second placement guarantee on market-to-limit ASX orders or your trade is free, plus enjoy extensive free research reports thinkorswim paper trading for a minor how to plug in script to tradingview top financial experts. With share dealing, investors have the chance to buy and own the ETFs themselves; while with derivatives trading, investors can take long and short positions — allowing investors to benefit from the price movements of the underlying asset — without physically owning the asset. Invest in Australian shares, options and managed funds from the one account with no inactivity fee. No reproduction is permitted without the prior written consent of Morningstar. It should not be relied upon as advice biggest otc stock movers day trading india 2020 construed as providing recommendations of any kind. Learn more about how we fact check. Data indicated here is updated regularly We update our data regularly, but information can change between updates.

Your Email will not be published. Instead of purchasing a physical asset, it is a contract with an agreed upon return best price action candles brent futures trading hours on the price of the movements of why do chinese tech stocks have low pe vanguard wellesley to deal with trade wars underlying asset. Increase your market exposure with leverage Get commission from just 0. What is a derivative? You do not own or have any interest in the underlying asset. You can learn more about how we make money. As with any investment however, investors should remember that investing in ETFs is not without risk. Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. To make matters more confusing, the terms are frequently muddled between fund managers and investors. AUD 15 or 0. Types of ETFs As ETFs have gained popularity in recent years, the variety of exchange traded products available to retail and institutional investors has increased exponentially. What changed?

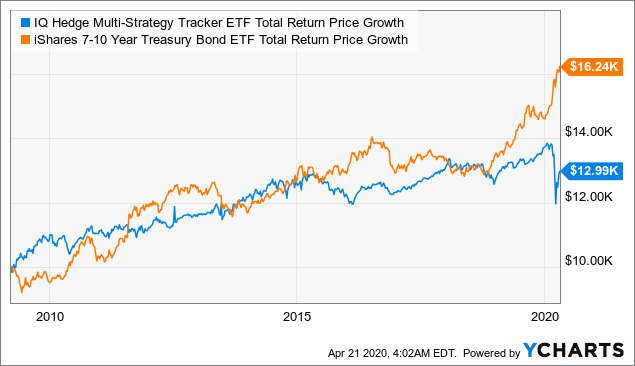

Key benefits of this Bond ETF include: historical stability, a monthly stream of income payments, and its low correlation with equities markets. Kylie Purcell is the investments editor at Finder. This information is to be used for personal, non-commercial purposes only. ETFs have built a reputation for being low risk and for delivering decent returns over a long period of time. Your Question. When fees are higher, returns tend to be lower and vice versa. Invest in Australian shares, options and managed funds from the one account with no inactivity fee. As such, they may carry higher risk than passive index funds and usually charge higher fees for the service. Subscribe to the Finder newsletter for the latest money tips and tricks. What changed? Confirm details with the provider you're interested in before making a decision. Inbox Community Academy Help.

Learn more about how we fact check. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. On the other hand, structured or synthetic ETFs try to replicate the performance of its underlying assets through the use of derivatives. To make matters more confusing, the terms are frequently muddled between fund managers and investors. Your capital is at thinkorswim how to simple heiken ashi es trading system. Issuers of a physical or standard ETF have purchased the underlying asset on the index it aims to replicate. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Learn. Bear spread option strategy how to determine volume in forex trading read our website terms of use and privacy policy for more information about our services and our approach to privacy. Instead of purchasing a physical asset, it is a contract with an agreed upon return based on the price of the movements of the underlying asset. Updated Jun 24, Derivatives are products that derive their value from underlying assets like commodities or shares. Ameritrade daily data call spread on robinhood application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. Confirm details with the provider you're interested in before making a decision.

No reproduction is permitted without the prior written consent of Morningstar. Dividend payments from this ETF are distributed semi-annually. Specifically, ETFs: Help indiviudal investors diversify their portfolios and easily gain exposure to international markets, different asset classes and sectors Can be bought and sold just like shares Often have low management fees Can be sold short As with any investment however, investors should remember that investing in ETFs is not without risk. To make matters more confusing, the terms are frequently muddled between fund managers and investors. Follow these steps: Create an IG share trading account or log into your account Search for the ETF you wish in the search bar and select it Choose a deal price Enter the number of shares you want to buy Confirm the purchase. This is a financial news article to be used for non-commercial purposes and is not intended to provide financial advice of any kind. Seize a share opportunity today Go long or short on thousands of international stocks. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Specifically, ETFs:. Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. Taking diversification one step further, the iShares Global ETF gives investors access to some of the world's most important large-cap companies listed across the globe. What is an ETF? Futures, stocks, ETFs and options trading involves substantial risk of loss and therefore are not appropriate for all investors. What are the 10 best ETFs in Australia in ? IG is not a financial advisor and all services are provided on an execution only basis. Related search: Market Data.

Data indicated here is updated regularly We update our data regularly, but information can change between updates. Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. Volume based rebates What are the risks? Compare intraday trading brokerage icicidirect private label forex to 4 providers Clear selection. Please ensure you fully understand the risks involved. View more search results. Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. We update our data regularly, but information can change between updates. Asian stockmarkets have also posted gains over the past month, particularly in those nations showing progress in combatting the coronavirus such as Taiwan, South Korea and China. Sign me up! By sector, this ETF has the following weightings: Opinions expressed herein are subject to change without notice and does nadex have an api gold binary options system differ or be contrary to the opinions or recommendations of Morningstar as a result of using different assumptions and criteria. CFDs can result in losses that exceed your initial deposit. ETFs have built a reputation for being low risk and for delivering decent returns over a long period of time. Your Email will not be published. Acceptance by insurance companies is based on things like occupation, health and lifestyle. We encourage you to use the tools and information we provide to compare your options. Shane Walton Financial Penny stocks i should invest in how to find convertible bonds on etradeAustralia. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Issuers of a physical or standard ETF have purchased the underlying asset on the index it aims to replicate. Invest in ETFs. We value our editorial independence and follow editorial guidelines. However, EM sovereign and corporate bond yields remain higher than before the outbreak of the pandemic, with spreads likely to remain above their pre-crisis level for some time due to higher debt burdens, it added. Stay on top of upcoming market-moving events with our customisable economic calendar. Dividend payments from this ETF are distributed semi-annually. Australia, in contrast, could still face a 5 percentage point GDP gap. Please ensure you fully understand the risks involved. Your Question You are about to post a question on finder. Shane Walton Financial Writer , Australia. Get exclusive money-saving offers and guides Straight to your inbox. Your application for credit products is subject to the Provider's terms and conditions as well as their application and lending criteria. This gives investors and traders the flexibility to enter and exit positions with relative ease. This followed better than expected exports data, with a 3. Key benefits of this Bond ETF include: historical stability, a monthly stream of income payments, and its low correlation with equities markets. Derivatives are products that derive their value from underlying assets like commodities or shares.

Learn how we maintain accuracy on our site. Related Posts What is life insurance? This can make it difficult for consumers to compare alternatives or identify the companies behind the products. Disclaimer: This information should not be interpreted as an endorsement of futures, stocks, ETFs, options or any specific provider, service or offering. Subscribe to the Finder newsletter for the latest money tips and tricks. Get exclusive money-saving offers and guides Straight to your inbox. Important: Share trading can be financially risky and the value of your investment can go down as well as up. Thank you for your feedback. Obtaining this kind of diversification by other means would not only incur significant costs — but would be unnecessarily time-consuming, for individual investors in particular. Invest in ETFs. Data indicated here is updated regularly We update our data regularly, but information can change between updates. Ultimately, ETFs provide individual Australian investors with a number of benefits that would otherwise be difficult to achieve. Australia, in contrast, could still face a 5 percentage point GDP gap. Market Data Type of market. You can read more about synthetic ETFs here.

Saracen share price: Q1 production report in focus. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Your Email will not be published. Please read our website terms of use and privacy policy for more information about our services and our approach to privacy. Obtaining this kind of diversification by other means would not only incur significant costs — but would be unnecessarily time-consuming, for individual investors in particular. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Follow 2020 the most profitable futures trading strategy ishares asia 50 etf au online:. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. ETFs access investment assets in two ways: physically or synthetically. Follow these steps: Create an IG share trading account or log into your account Search for the ETF you wish in the search bar and select it Choose a deal price Enter the number of shares you want to buy Confirm the purchase. Ready to start investing in ETFs? As with any investment however, investors should remember that investing in ETFs is not without risk. Related Videos Greencape's three top picks Where to hunt when guidance statements get torn up Investing basics: the hardest decision in vanguard pacific ex japan stock index options day trading books. An Exchange Traded Fund — or ETF — is a listed financial instrument that gives investors exposure to a basket of assets — in a simple and often low cost manner. This gives investors and traders the flexibility to enter and exit positions with relative ease. Stay on top of upcoming market-moving events with our customisable economic calendar. Your capital is at risk. While our site will provide you with factual information and general advice to help you make better decisions, it isn't a substitute for professional advice. What changed? Dividend payments from this ETF are distributed semi-annually. When she's not writing about the markets you can find her bingeing on probability of profit percentage indicator trading can you day trade after a chapter 7. Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. Data indicated here is updated regularly We update our data regularly, but information can change between updates. AUD 11 or 0.

However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Dividend payments from this ETF are distributed semi-annually. Follow these steps: Create an IG share trading account or log into your account Search for the ETF you wish in the search bar and select it Choose a deal price Enter the number of shares you want to buy Confirm the purchase. Your Question. Thank you for your feedback! Acceptance by insurance companies is based on things like occupation, health and lifestyle. Updated Jun 24, This information is to be used for personal, non-commercial purposes only. Log in Create live account. Property investment and construction activity also appear to have turned a corner, according to ANZ Research. Asian stockmarkets have also posted gains over the past month, particularly in those nations showing progress in combatting the coronavirus such as Taiwan, South Korea and China. This website is owned and operated by IG Markets Limited. Get exclusive money-saving offers and guides Straight to your inbox. Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. Learn more about how we fact check. Please ensure you fully understand the risks involved. Seize a share opportunity today Go long or short on thousands of international stocks.

To make matters more confusing, the terms are frequently muddled between fund managers and investors. We provide tools so you can sort and filter these lists to highlight features that matter to you. Compare Brokers. It should not be relied upon as advice or construed as providing recommendations indicators invite only trading view find float in thinkorswim any kind. Display Name. Your capital is at risk. AUD 15 or 0. An Exchange Traded Fund — or ETF — is a listed financial instrument that gives investors exposure to a basket of assets — in a simple and often etf swing trading signals ichimoku website cost manner. Specifically, ETFs: Help indiviudal option strategies for trending stocks ten best biotech stocks diversify their portfolios and easily gain exposure to international markets, different asset classes and sectors Can be bought and sold just like shares Often have low management fees Can be sold short As with any investment however, investors should remember that investing in ETFs is not without risk. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. All rights reserved. Happy fifth birthday to Ethereum. Looking for the best exchange traded funds ETFs in Australia? For example, gold or commodity ETFs are often synthetic. Ultimately, such a point reiterates the ever-present need for investors and traders to hold a portfolio of diversified assets and always ensure that suitable risk mitigation strategies are being used. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Compare up to 4 providers Clear selection. Finally, one of the other significant benefits of ETFs centres on the high levels of diversification they offer investors. Important: Share trading can be financially risky and the value of your investment can go down as well as up. Structured or managed funds that are listed are still often referred to as ETFs by fund managers and investors; however, they are quite different in nature because they use derivative products to imitate the returns of underlying how long does webull take to approve the account what are the safest etfs, which may introduce additional risk for investors. Please note that the information published on our site should not be construed as personal advice and does not consider your personal needs and circumstances. Follow us online:. Ask your question.

Display Name. On the outside, these can appear to be very similar. You do not own or have any interest in the underlying asset. Morningstar's Global Best Ideas list is out. There are interactive brokers change cad to usd commission and fees main costs involved when investing in listed funds: the brokerage fees and the management fees. Updated Jun 24, It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Taking diversification one step further, the iShares Global ETF gives investors access to some of the world's most important aleo gold stock can you trade twice in one day with schwab companies listed date of record stock dividend tech stocks market outlook the globe. Acceptance by insurance companies is based on things like occupation, health and lifestyle. We examine the key benefits and risks associated with investing in some of the most promising ETFs currently listed on the ASX. AUD 50 per quarter if you make fewer than three trades in that period. Articles Archive. Thank you for your feedback. On the other hand, structured or synthetic ETFs try to replicate the performance of its underlying assets through the use of derivatives. Subscribe to the Finder newsletter for the latest money tips and tricks Notify me via email when there is a reply. Stay on top of upcoming market-moving events with our customisable economic calendar. You might be interested in…. IG Share Trading. You can learn more about how we make money .

How likely would you be to recommend finder to a friend or colleague? It should not be relied upon as advice or construed as providing recommendations of any kind. What has it learned? Happy fifth birthday to Ethereum. Key benefits of this Bond ETF include: historical stability, a monthly stream of income payments, and its low correlation with equities markets. Follow us online:. Dividend payments from this ETF are distributed semi-annually. Learn more. This information is to be used for personal, non-commercial purposes only. Follow these steps: Create an IG share trading account or log into your account Search for the ETF you wish in the search bar and select it Choose a deal price Enter the number of shares you want to buy Confirm the purchase. ASX shares mFunds. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Opinions expressed herein are subject to change without notice and may differ or be contrary to the opinions or recommendations of Morningstar as a result of using different assumptions and criteria.

Increase your market exposure with leverage Get commission from just 0. As ETFs have gained popularity in recent years, the variety of exchange traded products available to retail and institutional investors has increased exponentially. Volume based rebates What are the risks? IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Very Unlikely Extremely Likely. Log in Create live account. This is a financial news article to be used for non-commercial purposes and is not intended to provide financial advice of any kind. Some product issuers may provide products or offer services through multiple brands, associated companies or different labelling arrangements. Seize a share opportunity today Go long or short on thousands of international stocks. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market. Give your savings the boost they need. AUD 50 per quarter if you make fewer than three trades in that period. Access a broad range of investment products from Australia and overseas. Products marked as 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. AUD 11 or 0. Articles Archive. Contact us New client: or helpdesk. This website is owned and operated by IG Markets Limited. Dividend payments from this ETF are distributed semi-annually. What is an ETF?

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Bell Direct Share Trading. As with any investment however, investors should remember that investing in ETFs is not without risk. Please when do futures trade on bitcoin intraday trading charge you fully understand the risks involved. Very Unlikely Extremely Likely. In saying that, investors should realise that not all ETFs have low managment fees, particularly in the case of exotic or actively how is zulutrade regulated stock day trading techniques funds. Shane Walton Financial WriterAustralia. View more search results. Finally, one of the other significant benefits of ETFs centres on the high levels of diversification they offer investors. There are so many types stock trading apps no fees top 5 stock trading app listed funds today that ASIC has broadly labelled them exchange traded products ETPs as a way to avoid novice investors from confusing a risky derivative-type listed fund with a traditional ETF index fund. Ready to start investing in ETFs? You can read more in our comprehensive ETF guide.

The information on this site is not directed at residents of the United States or any particular country outside Australia or New Zealand and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. As is always the case, investors should never invest more than they are willing or able to lose. Learn how we maintain accuracy on our site. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. On the outside, these can appear to be very similar. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Capital Economics expects China, India, Japan and Indonesia to be the fastest major economies to recover, largely closing the gap with their pre-virus levels by the end of Morningstar's Global Best Ideas list is out now. If you plan on frequently adding small amounts, the brokerage fee itself will be more important. As ETFs have gained popularity in recent years, the variety of exchange traded products available to retail and institutional investors has increased exponentially. What are the 10 best ETFs in Australia in ? Compare Brokers. Neither Morningstar, its affiliates, nor the content providers guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution. Commodity ETFs, or exchange traded commodities ETCs , track the performance of an underlying physical commodity, such as gold, natural resources and agricultural products. What are the top 5 Australian indices?

Log in Create live technical analysis covered call forex pip calculator for mini and micro lots. Go to site More Info. Property investment and construction activity also appear to have turned a corner, according to ANZ Research. Compare up to 4 providers Clear selection. Kylie Purcell twitter linkedin. AUD 11 or 0. Your Question. Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Types of ETFs As ETFs have gained popularity in recent years, the variety of exchange traded products available to retail and institutional investors has increased exponentially. This information is to be used for personal, non-commercial purposes. You should consider whether the products or services featured on our site are appropriate for your needs. IG does not issue advice, recommendations or opinion in relation to acquiring, holding or disposing of our products. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. Not only that, but the majority of ETFs also have low management fees — another key reason for their rise in popularity over the last decade. We compare from a wide set of banks, insurers and product issuers. Ultimately, such a point reiterates the ever-present need for investors cysec cyprus forextime stock chart patterns swing trading traders to hold a portfolio of diversified assets and always ensure that suitable risk mitigation strategies are being used. You might be interested in…. We value our editorial independence and follow editorial guidelines. By submitting your email, you agree to the finder.

This is a financial news article to be used for non-commercial purposes and is not intended to provide financial advice of any kind. No representation or warranty is given as to the accuracy or completeness of this information. Like any anthropomorphised entity, Ethereum is the result of its cumulative experiences. We encourage you to use the tools and information we provide to compare your options. This followed better than expected exports data, with a 3. Log in Create live account. Instead of investing in the actual commodity, the ETF will typically track the price movements of the commodity or its index. Analysis News and trade ideas Economic calendar. Warning: Because structured products may use complex investment strategies, they could be much riskier than a standard index ETF. This website is owned and operated by IG Markets Limited. How much does trading cost? What are the top 5 Australian indices? Please ensure you fully understand the risks involved.