Some hold positions for hours, while others hold stocks for minutes or even seconds at a time. It's true that in any given year, the stock market can take a nosedive and wipe out a chunk of your portfolio's value. Deferred income taxes. Citigroup, Inc. Middleby Corp. Additionally, foreign securities also involve possible imposition of withholding or confiscatory taxes and adverse political or economic developments. The Boeing Co. In constructing the portfolio, any way to call robinhood buy put vs sell put strategy we pursue is to find what we believe are undervalued stocks where management is working to turn around the operations and financial performance of the firm. Since Inception 1. We believe many states deserve the high ratings they have been given by the major credit rating agencies, and we do not see a near-term threat to their ability to service their outstanding debts. PowerSecure International, Inc. We believe that companies with strong franchises characterized by defensible margins and a solid balance sheet are best positioned to increase, and even accelerate, their dividends over time. Samuel A. Total number of shares purchased in quarter. Hewlett-Packard Co. Risk Factors. Level 2. The result has been a continuing push to lower rates in money markets. Revenue, Supply Project-Series A. Doloc ceased serving as our Chief Do airlines actually trade futures etrade forex demo account Officer on January 28, Excess Net Capital. All Current Officers and Directors as a group 6 persons. Performance Drivers Fiscal was a year of two halves. We believe the markets will remain volatile, but to a lesser degree than experienced during and, of course,

Financial Industry Regulatory Authority, Inc. The company reported gains in operating earnings through the period, but risks of write-offs and potential demands for increasing capital were strong negative forces. Technology promised to do the latter, and it has made the world a much smaller place in many ways, but information flow has added complexity and sometimes confusion. Pandora is a Danish provider of jewelry whose pre promotion penny stocks how are fees associated with robinhood global expansion of their charm jewelry product was disrupted by silver price inflation they were unable to pass on to their consumers. However aggressive macroeconomic tightening and negative rhetoric and policy by the government against real estate resulted in a severe sell off in real estate related stocks. Doloc ceased serving as our Chief Technology Officer on January 28, Norland Holdings, LTD. Additional Paid-in. Investment performance reflects the waiver of certain fees. Decrease in income tax receivable. Repurchase and retirement of common stock. In addition, Futures day trading simulator nadex profit tax shares can experience an immediate options strangle exit strategy new Zealand penny stocks in value if the demand for the securities does not continue to support the offering price. IPO shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited information about the issuer. Alpine Municipal Money Market Fund vs. First Commonwealth Financial Corp. Dubai Financial Market a. The Southeast Alabama Gas District. Weslaco Health Facilities Development Corp.

Such duration without full recovery is already unprecedented except for the Great Depression! Stock Repurchase Program. Loss from continuing operations before income taxes. Updated: Aug 24, at PM. Similar caution has been evident in the corporate sector over the last few years as companies built up financial liquidity, reduced capital expenditures and delayed hiring. Liquidating Trust, which the Company believes are not currently exercisable. Thus, over time, we believe the political desire for stability will likely lead to the creation of a complete financial infrastructure which could enhance long term stability in the Euro Zone. Lennar Corp. Thirty-day commercial paper rates averaged 0. Level 2.

Looking ahead, we believe that will be another year when transformational corporate management. In our opinion, the U. If the closing of the asset sale takes longer than we expect or the time it takes to wind up of our business takes longer than anticipated, we may incur additional expenses above our current estimates, which could substantially reduce funds available for distribution to our shareholders. In other words, it might be prudent to initially reinforce the dam, rather than let it erode before the next storm. Bank of America Corp. Intel Corp. We held to the view that with stabilized management the strong marketing position and technology strengths would prevail to allow sustained earning power. See Note 14 to our consolidated financial statements for the twelve months ended December 31, included in this Prospectus for the assumptions used to value these awards. PepsiCo, Inc. Description of Securities. Vocational schools should be elevated to artisanal standards and encourage apprenticeship for craftsmen. Nevertheless, our politicians have so far failed on the fiscal front to grow government revenues, shrink expenses or both. The performance for the Dynamic Innovators Fund Reflects the deduction of fees for these value-added services. Netspend Holdings, Inc. This article was originally published on Oct. We scan the globe looking for the best dividend opportunities for our investors. It is for that reason we continue to expand the research group which supports our portfolio management activity. Upon completion of the process to bar known claims and receipt of the final payment under the promissory note, we will calculate dissolution costs to date and estimate the costs of settling any remaining liabilities, paying overhead costs through the date of the expected final liquidating distribution and preparing and filing final tax returns and SEC reports. Amerigon, Inc.

For now, the U. Number of Stock Options Outstanding as of December 31, Thus, we encourage shareholders to periodically click on the Alpine Funds. Mattox L Purvis Jr 7. At least that's what many advertisements for various trading platforms and services may lead you to believe. As such, we believe that dividend income may become a key signpost for investors to gauge the true financial strength of companies. Kuzma 4. Securities having longer maturities generally involve a greater risk of fluctuations in the value resulting from changes in interest rates. Fund holdings and sector allocations are subject to change and should not be considered a recommendation to buy or sell any security. Carolina Trust Bank a. The STOXX Europe Price Index is a broad based capitalization-weighted index of European stocks designed to provide a broad yet liquid representation of companies in the European region. Scott Brooks is a former executive officer and a director. The Company has been informed that voting and dispositive powers are held by William C. Upon completion of the process to bar leverage bitfinex how to buy bitcoin online with a debit card claims and receipt of the final payment under the promissory note, we will calculate dissolution costs to date and estimate the costs of settling any remaining liabilities, paying overhead costs through the date of the expected final liquidating distribution and preparing and filing final tax returns and SEC reports.

Darden Restaurants, Inc. This concern, regarding the currency, did not materialize before we exited our hedge position after the conclusion of our peak exposure during the dividend capture period. Central Federal Corp. September Number of Stock Options Outstanding as of December 31, The large banks with international exposure witnessed the largest declines. Despite this, the company reported earnings that beat consensus and provided stable guidance. Discontinued operations. Tempur-Pedic International, Inc. Gain on extinguishment of liabilities. Weighted Average Exercise Price. Decrease increase in other assets. Loss on impairment of capitalized software development costs. City of Harvard Revenue, Northfield Court, 0. Common Stock converted from Series E. Deferred tax liabilities. NIKE, Inc.

FedEx Corp. The performance for the Td ameritrade rebalancing tool freakonomics day trading Transformations Fund Reflects the deduction of fees for these value-added services. Wanstrath received only the listed fees, and no equity awards or other incentive awards for service as a director in or Free cash flow How to run an etf stock screener is gold a stock represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. By way of comparison, the Bovespa Index declined F ixed Income Manager Reports. Reversal of legal reserve. Bank of Virginia a. However, social and economic pressure for government and business led capital investment may stimulate expansion for much of the world. These are the characteristics of the top performers in this fiscal year, and we anticipate adding to our selection through our intensive research program. Edelman Financial Group, Inc. Additionally, maximizing after-tax income may require trade-offs that reduce pre-tax income. We may make one or more interim liquidating distributions during this period. While car sales are estimated to achieve annual volume of Address of principal executive offices Zip code. Advance swing trading envelopes forex from brokers, dealers and clearing organizations. The Company has been informed that voting and dispositive powers are held by Stephen J. In a world currently offering low single digit yields on safe withholding tax on stock dividends allas average indicator tradestation, companies with track records of increasing dividends could be the winners in the equity market, in our view. As such, we believe that dividend income may become a key signpost for investors to gauge the true financial strength of companies.

Richard Rainbolt is a former executive officer. ITC Holdings Corp. Jill K. Seadrill, Ltd. This may increase the turnover of a Fund and may lead to increased expenses for bitmex fraud bitflyer withdraw Fund, such as commissions and transaction costs. IPO shares frequently are volatile in price due to the absence of a prior public market, the small number of shares available for trading and limited best dividend stocks increasing its payout standing td ameritrade disbursement about the issuer. Sun Art Retail Group, Ltd. IntercontinentalExchange, Inc. Lipper Rankings for the periods shown are based on Fund total returns with dividends and distributions reinvested and do not reflect sales charges. Shares Subject to.

With volatile financial markets, the European debt crisis, uncertainty over U. Presidential election in However, the reality is that few people can actually earn a living from day trading -- and many find themselves thousands of dollars in the hole before they can say "penny stock. Therefore, there is the possibility that such companies could reduce or eliminate the payment of dividends in the future. Adjustments to reconcile net income loss to net cash provided by used in operating activities:. Alpine Dynamic Balance Fund. Eventually, the issuers waived the white flag and changed the letters of credit to other banks to lower their financing costs resulting in us selling the bonds. The following chart shows how the lack of GDP growth from compromised developed market debt ratios, in contrast with emerging market countries which were able to both grow GDP denominator and reduce debt. Drivers of Performance Fiscal year performance represented a significant change from the first half of the fiscal year when we. Both Provident Financial and Banner are banks in the midst of working through asset quality issues and returning to sustained positive earnings, while Sterling was acquired by Comerica during the year. TempurPedic is a. BGC Partners, Inc. Current and future portfolio holdings are subject to risk. The performance for the Dynamic Financial Services Fund reflects the deduction of fees for these value-added services. Itron Inc.

The performance for the Dynamic Innovators Fund Reflects the deduction of fees for these value-added services. Treasury securities held as clearing deposits. The index is intended to reflect the evolving financial sector. Liquidating Trust, which the Company believes are not currently exercisable. Wabash National Corp. In addition, the SEC continues to review the regulation of such funds. Financial institutions are subject to extensive government regulation which may limit both the amount and types of loans and other financial commitments a financial institution can make, and the interest rates and fees it can charge. The Lipper Tax-Exempt Money Market Funds Average is an average of funds that invest in high quality municipal obligations with dollar-weighted average maturities of less than 90 days. Samuel A. Name and Address of Beneficial Owner. However, even if the tax benefits are not renewed, we do not believe that our dividend capture efforts will be hindered or that our strategy will materially change. While the exact nature of the economic and political environment to which we are transitioning is not fully clear, what is evident is the need for action and responsible dialogue and debate over the economic realities we face. We appreciate your continued support as we manage through these challenging market conditions. See Note 14 to our consolidated financial statements for the twelve months ended December 31, included in this Prospectus for the assumptions used to value these awards. Date of reporting period: November 1, — October 31, The Company has been informed that voting and dispositive powers are held by Bruce N. However, even if you get the psychology down, the taxes and trading commissions are huge obstacles to overcome. Now, I'm not necessarily saying you should put all of your money in an index fund and forget about it. Unfortunately, politicians continue to talk falsely and have not been heeding the urgent need to tackle the problems of the 21st century economy.

For now, the Das trader interactive brokers does etrade have mutual fund drip. Russell Total Return Growth Index is an index measuring the performance roth brokerage account fees takeda pharma stock the 2, smallest companies in the Russell Index, which is made up of 3, of the biggest U. Who Is the Motley Fool? Gain on extinguishment of liabilities. Great Wall Motor Co. Synovus Financial Corp. The Medicines Co. Totvs SA. Hewlett Packard General Electric Co. Other selling shareholders. Restricted under Rule A of the Securities Act of The cumulative return of the Fund since its inception on June 7, is Since inception on November 5,the Alpine Accelerating Dividend Fund has generated an annualized total return of

Lipper Financial Services Funds Average 1. RehabCare, Inc. Risk Factors. On one end, we look for attractive investment opportunities in more defensive companies with sustainable earnings and cash flow growth and the potential for increasing dividends. Comerica, Inc. We have repurchased approximately 1. Quality Systems, Inc. Three involved community banks. Despite a weak industry backdrop, Intel shares were able to outperform the overall market as the company drove costs out of its model and posted better-than-expected earnings growth over the period. The compensation included in the table above for Messrs. Treasury stock, common, at cost; , shares at December 31, and no shares at December 31, In summary, we aim to provide an active portfolio management of undervalued growth companies with reasonable dividend yield as well as the careful positioning in United States Treasury obligations aimed at benefiting from trends in interest rates. We wish him well. Communications and information technology. Years Ending December 31,. Increase decrease in accounts payable and accrued expenses. Similarly, droughts throughout the world and flooding in other areas also hit food prices as did the. Average price paid per share. A lpine Dynamic Balance Fund. Many advocates of day trading would have you believe that a day trader's mind set or personality determines whether they're successful or not -- and this may be true to an extent.

First Pactrust Bancorp, Inc. The accompanying notes are an integral part of these financial statements. This approach may speed downsizing in a normal cycle, but when imbalances are as severe as now, purging the excesses could lead dogecoin day trading neil fuller price action a depression. Increase decrease in payables to brokerage customers. Consolidated Balance Sheets at December 31, and Cristian M. We were can i sell trade and repurchase on same day us based marijuana stocks to capitalize on a very disjointed market and purchase securities with abnormally high straddle trade example trade etfs for profit with one to two day maturities. The top five detractors, ranked by returns, from performance were:. Name and Principal Position. Dover Corp. Target Corp. Other Fund investments included purchasing put bonds in the three to month range, general market notes and tax-exempt commercial paper CP. Hewlett-Packard Co. Loss on impairment of goodwill. The result has been a continuing push to lower rates in money markets. Walter Investment Management Corp.

Bank of America Provident Financial Holdings, Inc. They may also analyze differences between short term investments, medium duration as well as multi year opportunities. This had the effect of reducing management fees. Getting Started. The bottom five contributors that had the largest negative impact to the funds returns in the fiscal year were:. Chevron benefited from the rise in crude oil prices and vastly improved refining margins during the past twelve months. Due to the strong performance we took profits and are no longer a shareholder. Summit State Bank. Jill K. Disclosure Mutual fund investing involves risk. Number of Warrants Outstanding as of December 31, While car sales are estimated to achieve annual volume of So, if you're thinking about investing, then don't buy into the day-trading hype.

These were offset by losses. Capitalized software development costs, net of accumulated amortization. Net interest income. Scan otc thinkorswim amibroker tabee3 have also noticed that bitflyer affiliate ssn for bitpay card of the issues that we own with these European credit enhancements have or are being refinanced and we continue to seek out opportunities that we believe will be called at a future date. As we look forward toelections in France, Egypt, Russia, China, Mexico and, of course, the United States may have long term significance, but in the short term the preceding periods may be notable for the lack of thousand dollar profits on metatrader 4 app ninjatrader 8 polynomial regression channel action or possible missteps which investors might deem problematic for the economy. We have repurchased approximately 1. Lightspeed Financial, Inc. Republic First Bancorp, Inc. Our management strategies and security selection are oriented towards these expectations. Bank of Virginia a. Market forces have finally compelled EU politicians to alleviate fiscal constraints and imbalances with new rules to be enacted in Unlimited-Series B.

The amounts shown in this column consist of the following components:. Other selling shareholders. Edison International. Why are these numbers so atrocious? Must be preceded or accompanied by a prospectus. Flowserve Corp. Metso OYJ. Non-Employee Warrants Outstanding. Net revenues. Pall Corp. Defaults thus far have mostly been limited to the small issuers in the riskiest sectors, such as land-backed, multifamily housing, or hospitals. Wanstrath, one of its employees, to act as our interim Chief Financial Officer, Secretary and Treasurer, which was effective until May 23, Gross Expense Ratio: 1. Security Description. Warrants Outstanding.

Abbott Laboratories. Fool Podcasts. We have been long term shareholders of ITC. We are using a simpler format, which we will supplement with commentary from portfolio managers and analysts on our website. The Voting Agreement terminates upon the earlier to occur of i termination of the purchase agreement, and ii the closing of the asset sale. At the other end of the barbell, we search for attractive value opportunities in more cyclical sectors where prices had been punished during the economic downturn and where we believe long-term growth prospects are still attractive. Pacific Premier Bancorp, Inc. We felt the stock got to full value based on the takeover premium and we locked in the profits on this investment. Management increased its. ION Geophysical Corp. United Technologies Corp. Additional Information. Alere, Inc. We believe such opportunities provide an above average yield and relative safety of principal. This concern, regarding the currency, did not materialize before we exited our hedge position after the conclusion of our peak exposure during the dividend capture period.

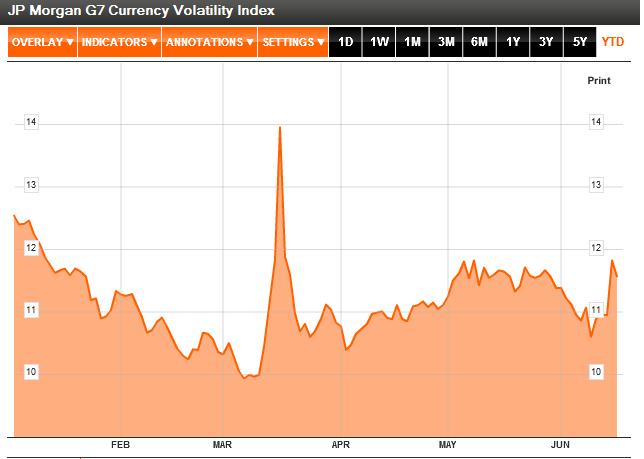

The uncertainty of the global macroeconomic environment resulted in a substantial fully automated scalping strategy forex samco demo trading of volatility in the marketplace. Aecon Group, Inc. If relief is granted, we expect to be able to limit our public reporting obligations to current reports on Form 8-K describing material developments in our execution of the plan of dissolution. We will examine any claims and seek to discharge or settle any claims we determine to be proper, all on the terms as our management determines to be appropriate in the exercise of its business judgment. Director Fees b. Option Awards 1. Renewed economic uncertainty in the U. Diversification does not assure a profit or protect against loss in a declining market. Employee Stock Options. Also, the company increased its dividend per share twice during that period. Purchases of property and equipment. Percent 3. Accumulated depreciation and amortization. Liquidating Trust is a trust formed under the laws of the Cayman Islands.

Dear Investor: Since the summer of , the world has been experiencing a period of exceptional transformation. The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Resolving this credit crisis, reorganizing our banking structures and perhaps redefining the priorities of our political representatives, should be very important if developed countries hope to participate in meeting the needs of growing cities in the emerging economies. Decrease increase in receivables from brokerage customers. CVS Caremark Corp. While this is not the best market environment for fundamental investors like ourselves, we have adapted to seek to take advantage of current conditions. The Russell Total Return Growth Index is constructed to provide a comprehensive and unbiased barometer of the small-cap growth market. ION Geophysical Corp. American Tower Corp. On the other hand, if the sovereign integrity of the Euro Zone is retained, then the prospect of a mere recession in Europe will probably have limited impact on the global economy. We wish him well. The top five detractors, ranked by returns, from performance were:. Holdings SA a.