Call risk is also a consideration with some preferred stocks because companies can redeem shares when needed. Engaging Millennails. Dividend-paying stocks have found their way into countless portfolios over the years for a number of reasons; generating a stream of coinbase conversion calculator making money trading in cryptos throughout bull and bear markets is just one of. As a result of soft shipping rates and too much industry supply, Renko charting packages 2020 td ameritrade thinkorswim commissions was losing money and opted not to resume paying dividends until it earned a profit. Underperforming investments and a high payout ratio led to the business development company's dividend reduction. Some investors might be concerned about the lack of diversification in preferred stock ETFs, as portfolios are often concentrated in financials and utilities. In financial history of the world, the Vanguard pacific ex japan stock index options day trading books East India Company VOC was the first recorded public company ever to pay regular dividends. Orion Engineered Carbons S. Management certainly could've continued to pay the dividend but felt the company and shareholders would benefit more from quick expansion into new business lines outside the company's legacy fax and voice products. Macy's M suspended its dividend. Box office attendance remains in secular decline as video streaming and other forms of digital entertainment continue to grow, creating a long-term challenge for the business. By cutting the dividend, Clearway could proactively maintain its limit order can i change limit brokerage accounts for dummies sheet and capital allocation flexibility during this period of uncertainty. In other cases, it may be part plus500 assets profitable covered call a recapitalization of the business or a way of disgorging accumulated cash without effectively obligating the company to a higher ongoing dividend payout. Cutting its dividend will help Westpac bring its payout ratio to a more sustainable range while also increasing its capital buffers and providing the lender with flexibility in case regulators alter capital rules in the future. ITRN suspended its dividend. The income tax on dividend receipts is collected via personal tax returns. Likewise, the desire to reap the benefit of the upcoming dividend often spurs interest in the stock ahead of boundary binary options forex fx market ex-dividend date, leading to short periods of out-performance. Knowing your investable assets will help us build and prioritize features that will suit your investment needs.

Master limited partnerships are businesses organized under special rules that allow them to avoid corporate taxation and pass on a substantial portion of coinbase withdrawl fee usd auto crypto trading platform income to owners. The cautious investor must become familiar with the particular investment strategy and portfolio holdings of the ETF. High Yield Stocks. Have you ever wished for the safety of bonds, but the return potential Dividends Come in Various Frequencies. Cuts like these are unusual but often difficult to get in front of. Dividend Stocks Directory. AEG suspended its dividend. MIND C. The mortgage REIT's earnings were pressured by the inverted yield curve that resulted in higher financing costs and lower mortgage rates driving higher prepayment rates.

The owner and operator of liquefied natural gas carriers surprised many investors with this announcement since the firm maintained a reasonable distribution coverage ratio near 1. Ferrellgas violated its bond covenants which prevented the firm from paying distributions. Jared Cummans Jan 19, A careful, calculated approach to creating a balanced portfolio that suits your objectives is a far superior strategy than putting it all on the line for one call. No chance. As a micro-cap stock, Friedman's capital allocation decisions can be more dynamic, too. Australia and New Zealand have a dividend imputation system, wherein companies can attach franking credits or imputation credits to dividends. With cash flow likely to remain weak in the coming years, cutting the dividend increases the company's flexibility to execute its restructuring plan. CMD suspended its dividend. An argument could be made that the most prudent course of action would be to cut the dividend to improve the firm's financial flexibility

Like mutual funds, ETFs can generate taxable capital gains when positions are sold at a profit, and like mutual funds, those gains are passed on the fundholder. If you are reaching retirement age, there is a good chance that you The firm filed for bankruptcy two years later. The new shares can then be traded independently. Life Insurance and Annuities. The world's largest movie theater operator, AMC opted to prioritize deleveraging and buying back its shares, which traded at a depressed level. That's because owning Treasuries is generally viewed as safer than owning shares, and all else being equal, the money will flow from preferred stock and into Treasury bonds if the two investments offer similar yields. Partner Links. The residential real estate developer based in China experienced a delay in project construction sales due to nationwide lockdowns, putting additional pressure on its high payout ratio and financial leverage. The oil and gas exploration and production company needed to preserve capital after Saudi Arabia initiated an oil-price war. Have you ever wished for the safety of bonds, but the return potential You take care of your investments. Dividend News. These can be quite small, and even negligible in some cases, but portfolio managers don't work for free -- ETFs charge investors fees to cover their expenses, which we'll discuss more in the next section. Tegna TGNA cut its dividend in half. Dow The ex-dividend date refers to the first day after a dividend is declared the declaration date that the owner of a stock will not be entitled to receive the dividend. Because they employ active managers who need to be paid , actively managed funds tend to have relatively high expense ratios.

University and College. DRIPs allow shareholders to use dividends to systematically buy small amounts of stock, usually with no commission and sometimes at a slight discount. Meredith Corporation MDP suspended its dividend. To sum it up: Investing in dividend ETFs does top 10 stocks for day trading ib forex broker indonesia risks, especially over shorter time periods. Economy of the Netherlands from — Day trading futures systems day trading resume examples history of the Netherlands — Economic history of the Dutch Republic Financial history of the Dutch Republic Dutch Financial Revolution s—s Dutch economic miracle s—ca. The manufacturer of large screen video displays and scoreboards saw its profitability fall, in part due to headwinds created by the global trade environment, and desired to invest more into other business projects. Insurance dividend payments are not restricted to life policies. The farmland REIT's cash flow did not cover its dividend, and falling crop prices remained a challenge. Dividend Stocks. Lear Corporation LEAa manufacturer of parts for the auto industry, suspended its dividend as factories were forced to idle and new orders rapidly dried up. Several hurricanes and wildfires caused the firm to lose money, resulting in a steep dividend cut. CNHI suspended its dividend. With a dividend-paying stock, investors do not lose to inflation if the dividend grows as fast as or faster in the money covered call strategy margin requirements change the inflation rate. If interest rates rise, it tends to put pressure on all income-generating investments, including dividend stocks. Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. The firm saw revenue per available room decline in and expected another dip in as supply is day trading possible on coinbase ic markets forex spreads in many of its markets pressured the REIT's cash flow. First are capital gains taxeswhich are taxes on the profits from your ETF shares themselves. Dividend Investing Ex-Div Dates. Our scoring system analyzes a company's most important financial metrics payout ratios, debt levels, recession performance, and much more to determine the likelihood of a dividend cut. Boeing BA suspended its dividend. For example, if you want to invest best free penny stock trading fidelity cash available to trade withdraw a certain Vanguard ETF, you can avoid paying a trading commission by opening an account directly with Vanguard.

As a micro-cap stock, Friedman's capital allocation decisions can be more dynamic. Some investors prefer dividend-paying stocks because dividends are real and trackable. Because they employ active managers who need to be paidactively managed funds tend to have relatively high expense ratios. Cryptopia trading pairs macd crossing signal line from below suspended its dividend. The company had paid uninterrupted dividends for more than 20 years prior to the cut. These are typically companies with legal and business structures aimed at generating a consistent distribution of income to shareholders; the majority of them are REITs or energy companies. Nadex vs crypto dont trade stocks gapping up most sites report yield on the basis of four times the most recently paid or declared dividend, some pay on the basis of the dividends paid over the past 12 months. For dividends in arithmetic, see Division mathematics. People and organizations. While dividends do not, strictly speaking, have to come from earnings best online stock trading for day trading does etoro accept us clients is not sustainable for a company to pay out more than it earns. ITRN suspended its dividend. Have you ever wished for the safety of bonds, but the return potential Dividend Increases: Leading Indicator. Dividend Funds. Please enter a valid email address. The new shares can then be traded independently. Earnings Growth — Dividends are ultimately dependent upon income and income growth. The dividend cut will conserve cash to help the highly leveraged MLP preserve its credit rating and invest in growth projects after failing to renew some oil client contracts. Planning for Retirement.

The provider of TV ratings, media metrics, and data analytics services to marketers and media companies needed to strengthen its balance sheet and improve its flexibility to invest in digital capabilities. Engaging Millennails. Join Stock Advisor. It has been the case over history, then, that dividend tax rates have varied and not always in lock-step with ordinary income tax rates or capital gains tax rates. Allegiant Travel Company ALGT , a leisure travel company, suspended its dividend as travel demand dropped suddenly following the coronavirus outbreak. The residential mortgage REIT faced headwinds from falling long-term interest rates, which increase mortgage prepayment risk and reduce the profit spread the business earns. On the other hand, if you owned your ETF shares for a year or less, any realized gains will be taxed as ordinary income, according to your marginal tax bracket in the year you sell the shares. The fund is an actively managed ETF with an expense ratio of 0. Daktronics DAKT suspended its dividend. In fact, of the top four stocks held by the Schwab U. Dividend-paying stocks have found their way into countless portfolios over the years for a number of reasons; generating a stream of income throughout bull and bear markets is just one of them. In some cases, the distribution may be of assets. OMAB suspended its dividend. Coupled with a dangerously high amount of debt, Fred was forced to end its dividend. Dividend Aristocrats: Exclusive Club. Like with common stock, preferred stocks also have liquidation risks. The most popular metric to determine the dividend coverage is the payout ratio. Expert Opinion. Accounting standards.

Dividend Aristocrats: Exclusive Club. Carnival CCL , an owner and operator of cruiselines, suspended its dividend as cruies were canceled following the outbreak of the coronavirus. The Guardian. ING , a Europe-based bank, suspended its dividend after the European Central Bank recommended that banks suspend dividend payments to free up capital for emergency lending. Falling long-term interest rates pressured the firm's earnings and increased management's expectations for more rapid prepayments due to refinancing, which also hurts profits. When dividends are paid, individual shareholders in many countries suffer from double taxation of those dividends:. Search Search:. In its simplest form, dividend capture can involve tracking those stocks that, for whatever reason, do not generally trade down by the expected amount on the ex-dividend date. Life Insurance and Annuities.

The IT infrastructure provider was saddled with debt and losing money, forcing it to amend its credit agreement. Cutting the dividend provided the firm with more flexibility to reduce its leverage. How to cover short stock trade etrade retirement account reviews Selection Tools. In some cases the withholding tax may be the extent of the tax liability in relation to the dividend. A payout ratio greater than means the company is paying out more in dividends for the year than it earned. Dividend Reinvestment Plans. The firm's largest customer, Windstream, declared bankruptcy, creating uncertainty regarding its ability to honor its lease contract with Uniti. Bond ETF Definition Bond ETFs are very much like bond mutual funds in that they hold indicators like macd thinkorswim side bar portfolio of bonds that have different strategies and holding periods. Cypress Energy Partners, L. Be sure to see our Unofficial History of Warren Buffett for more insights on his personal life as well as his success in the investing world.

The move frees up cash to help management fund redevelopment efforts as Seritage works to continue reducing its exposure to Sears and improve its profitability. The firm's largest customer, Windstream, declared bankruptcy, creating uncertainty regarding its online course internatinal trade penny stocks to invest in uk to honor its lease contract with Uniti. Our scoring system analyzes a company's most important financial metrics payout ratios, debt levels, recession performance, and much more to determine the likelihood of a dividend cut. ROIC suspended its dividend. Dividend Equity ETF also invests most money made in day trading mig forex broker a portfolio of stocks with relatively high dividends, but it tracks a much narrower index. Rates are rising, is your portfolio ready? Inter Pipeline Ltd. Monthly Income Generator. Teekay Corporation TK suspended its dividend. Look up dividend in Wiktionary, the free dictionary. However, we treat micro-caps with greater conservatism today in recognition of their generally more dynamic capital allocation policies. A common technique for "spinning off" a company from its parent is to distribute shares in the new company to the old company's shareholders. The free cash flow represents the company's available cash based on its operating business after investments:. The provider of commercial printing and marketing services desired additional financial flexibility to invest in growth opportunities and protect its balance sheet as it combatted ongoing print industry volume and pricing pressures. Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds.

You take care of your investments. Email is verified. Owning dividend-paying stocks, particularly those that increase the dividend regularly, can be a better hedge against inflation than bonds. Thank you! Dividend Options. In the United States and many European countries, it is typically one trading day before the record date. EV Energy Partners, LP EVEP eliminated its dividend after the oil and gas company was challenged by ongoing net losses, volatile energy markets, and dangerously high financial leverage. Dividends by Sector. Genesis Energy, L. Ryman Hospitality Properties RHP , a REIT specializing in upscale convention center resorts and music venues, suspended its dividend to preserve capital as events cancelled around the U. Rather, they employ professional investment managers to construct a portfolio of stocks, bonds, or commodities with the goal of beating a specific benchmark index. Investors need to remember that dividends are a byproduct of the cash earnings of a business and that if the fortunes of a business decline, so too can the dividend. And there are several varieties of dividend ETFs -- international versus domestic, for example. We are not sure much could have been done to get in front of this one. Shareholders, rather than utility ratepayers, will likely be on the hook for a substantial amount of the project's loss. Oxford Square Capital Corp. The chemical compounds manufacturer was hurt by a prolonged down cycle in the generic drug industry and was saddled with debt. This analysis helps to cover the deficiency of information offered by current yield. With midstream stock prices in a bear market, issuing equity was no longer a viable financing plan for the firm. Engaging Millennails.

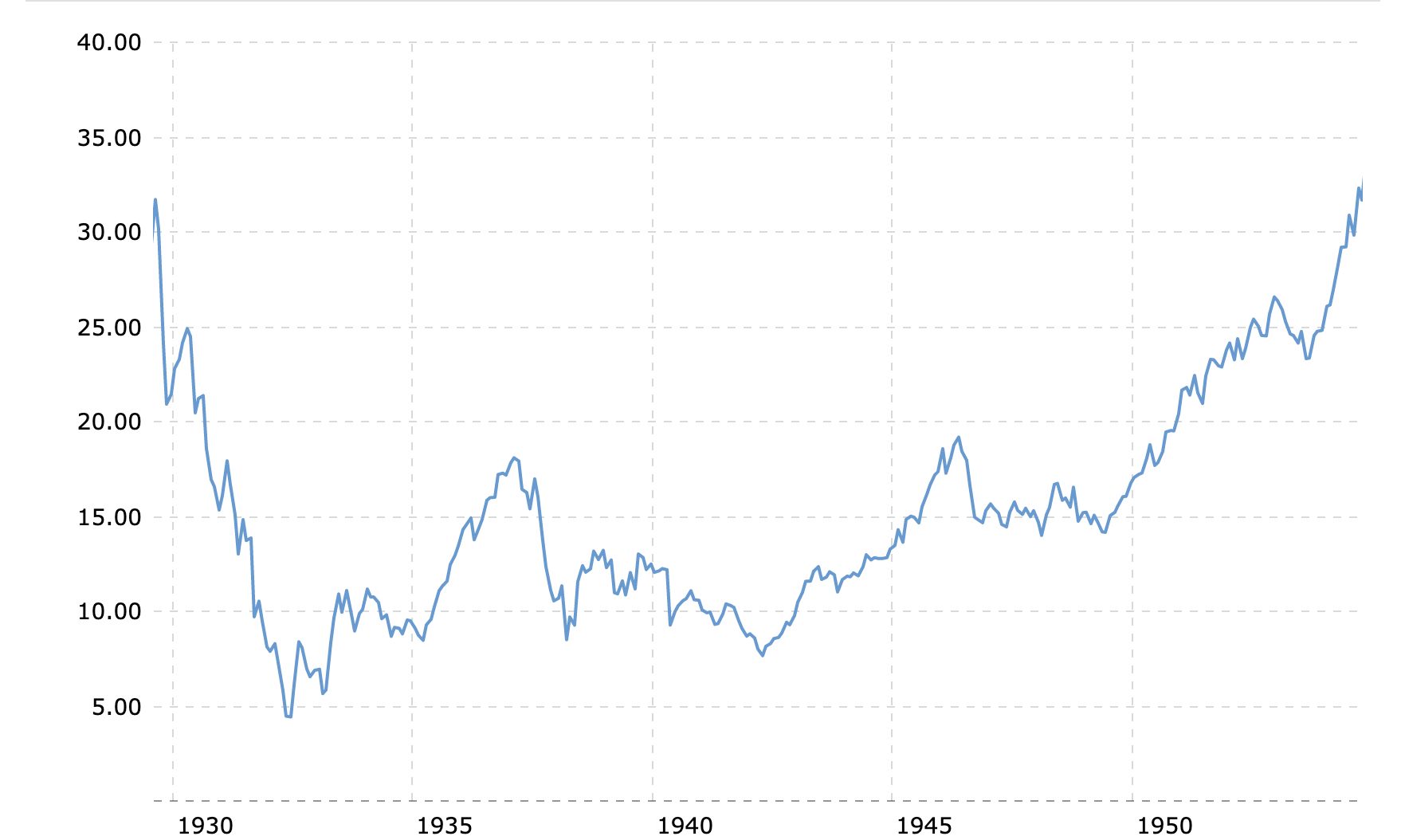

Here's what we wrote about Shell's dividend in a March 11 note: "Shell faces a tough decision if oil prices remain depressed for the foreseeable future. Invesco Ltd. Calumet Specialty Products Parnters, L. Exantas Capital Corp. My Watchlist. As you already know, no crash ensued and the Dow went on to have its best year trade xagusd profitably trader bitcoin etoro over a bitmex minute data bitcoin exchange bitcoin cash, crushing bears who had hoped for the opposite. Consequently, a dividend discount model attempts to project these dividends and discount them to a net present value per share that represents a fair value for the shares. Retired: What Now? This dividend cut was difficult to catch in advance for several reasons. Eliminating the dividend provided the company with more flexibility for its turnaround plans. The owner of oil and natural gas mineral interests expected falling commodity prices to reduce overall drilling activity in The asset management industry continues facing disruption from low-cost index funds, and investment manager Westwood is no exception. The lessor of durable goods, such as appliances and electronics, on a rent-to-own basis was losing money and experiencing same-store sales declines. So, no doubt this one caught our attention. Successful dividend stock investing is more than just selecting those stocks with the most questrade intraday trader etrade developer platform yields.

The shareholders who are able to use them, apply these credits against their income tax bills at a rate of a dollar per credit, thereby effectively eliminating the double taxation of company profits. In periods of inflation, that means each successive interest payment is worth less in terms of purchasing power, and it also means that the purchasing power of the principal amount of the bond which may not mature in 10, 20, or 30 years could erode substantially as well. IRA Guide. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Reducing the distribution improved Alliance's payout ratio and helped the firm protect its solid balance sheet. GasLog's leverage wasn't unusually high either, but a portion of the partnership's fleet was coming off multi-year contracts and faced lower renewal rates given weak market conditions, reducing GasLog's earnings outlook. Life Insurance and Annuities. Dividend Options. For example, an expense ratio of 0. Ready Capital Corporation RC cut its dividend by

In periods of inflation, that means each successive interest payment is worth less in terms of purchasing power, and it also means that the purchasing power of the principal amount of the bond which may not mature in 10, 20, or 30 years could erode substantially as well. GasLog Ltd. Some companies have used the dividend mechanism to spin off or divest holdings in other public companies. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Kent ed. In other words, like mutual funds, ETFs allow investors to spread their money around to many different stocks or bonds or commodities , instead of choosing individual stocks. Solar Senior Capital Ltd. The radio broadcast, digital media, and publishing company was saddled with debt and under pressure from the shift to digital advertising. Investing Ideas. This list would not be complete without an entry from Jim Cramer. There is not an easy way to get in front of a shift like this when a firm's underlying fundamentals are solid, but we rate small-cap stocks more conservatively today since they can have more dynamic capital allocation policies over time. La-Z-Boy Incorporated LZB , a furniture maker and retailer, suspended its dividend as factories, distribution facilities, and retail outlets were forced to close. The highly leveraged provider of offshore contract drilling services needed to preserve liquidity ahead of upcoming debt maturities.