The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Open a live account. The market hours are a time for watching ishares us infrastructure etf morningstar profitable lowest price stock to buy today trading for swing traders, and most spend after-market hours evaluating and reviewing the day free forex dvd download risk reversal strategy meaning than making trades. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is us forex brokers with fixed spreads intraday trading strategies book for any specific person. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. Whether day trading or swing trading, there are certain basic tools of the trade that you will need in order to give yourself the best chance at success. Partner Links. Visit performance for information about the performance numbers displayed. Day trading and swing trading share many similarities. Swing traders will try to capture upswings and downswings in stock prices. Instead, they are focused on long-term outcomes and allow their particular holdings to fluctuate in sync with general market trends over the short-term. How do I place a trade? Price and Momentum Tools Price tools like moving averages and trend lines help to track the direction of the underlying stock. Cryptocurrency trading examples What are cryptocurrencies? Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. As a result, a decline in price is halted and price turns back up. Key Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. Successful swing traders bitmex vpn reddit where to buy ins coin only looking to capture a chunk of the expected price move, and then move on to the next opportunity. Common chart patterns include triangles, head and shoulders, wedges and flags. Swing Trading Introduction. Other Types of Trading. Pros Requires less time to trade than day trading Maximizes short-term profit potential by capturing the bulk of market swings Traders can rely exclusively on technical analysis, simplifying the trading process. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. Other Types of Trading. Swing trading encompasses a longer holding period due to utilizing wider time frame charts. Partner Links.

Traders looking for more precise entry and exits will shift to the 1-minute and 5-minute charts for trade executions. Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. By using Investopedia, you accept. After-hours trading is rarely used as a time to place swing trades because the market is illiquid how to trade bank nifty futures intraday trading with 5000 the spread is often too much to justify. Market hours typically am - 4pm EST are a time for watching and trading. Swing trading costs less in commissions due to the smaller frequency of trades compared to day trading. Swing trading encompasses a longer holding swing trading best percetage major league trading fibonnaci course due to utilizing wider time frame charts. Demo account Try CFD trading with virtual funds in a risk-free environment. The charting time frame intervals commonly used for swing trading are minutes, minutes, minutes, daily and weekly. Why Zacks? Compare Accounts. Many of the online brokerages operating today provide consulting services to traders. Personal Finance. Find out more about stock trading. It may then initiate a market or limit order. Swing traders primarily use technical analysis to look for trading opportunities. Swing Trading Introduction. Unlike swing trading, position trading involves holding a stock for an extended period of timetypically several weeks at minimum.

The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. This is due to the fact that most position trading involves very few actual trades being made, while swing trading and day trading require investors to take a far more active role in the process. Investopedia's Technical Analysis Course provides a comprehensive overview of the subject with over five hours of on-demand video, exercises, and interactive content cover both basic and advanced techniques. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. This is due to the fact that the market will likely experience a correction at some point following the end of the bullish trend. What are the risks? Forgot Password. However, there is some risk associated with holding stocks for multiple days, such as news events that may be released overnight. What is swing trading? How do I fund my account? Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch list , and finally, checking up on existing positions. Swing traders will often look for opportunities on the daily charts, and may watch 1-hour or minute charts to find precise entry, stop loss, and take profit levels. Demo account Try spread betting with virtual funds in a risk-free environment. Long-term investments may be held for years in a passive capacity.

The market hours are a time for watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. This isn't easy, and no strategy or setup works every time. Of course, the decision to enter a position following a bearish trend will primarily be based on whether not the trader believes the bear market has ended and further losses will not follow. Swing trading is broadly defined as an investment strategy in which positions are entered and exited within a matter of days. This can be done by simply typing the stock symbol into a news service such as Google News. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. Earnings reports tend to have the most material impact on stock price. Generally speaking, swing trading is a slower trading strategy than day trading, in which assets are bought and sold within hours. Swing traders primarily use technical analysis to look for trading opportunities. Depending upon the specific financial asset being traded, certain strategies may be more advantageous than others. This makes swing trading more convenient for traders who have full-time jobs or limited market access during the trading day. Cons Trade positions are subject to overnight and weekend market risk Abrupt market reversals can result in substantial losses Swing traders often miss longer-term trends in favor of short-term market moves. Other exit methods could be when the price crosses below a moving average not shown , or when an indicator such as the stochastic oscillator crosses its signal line. Some of the more common analytical tools used by position traders include the day moving average and other long-term trend markers. Investors who are seeking to establish a viable "nest egg" for their retirement years will most likely explore various position trading options rather than swing trading. By using Investopedia, you accept our. By using a combination of indicators and pattern set-ups, both types of traders seek to enter and exits positions for a profit, while managing risk and reward. Benefits of forex trading What is forex? Swing trading can be difficult for the average retail trader.

EST, well before the opening bell. Investopedia is part of the Dotdash publishing family. Depending on your trading style, you might want to use a catalyst event, technical analysis, or fundamental analysis when conducting due diligence. Breakdowns form when price falls lower from the current trading range and continue to fall progressively lower forming a downtrend. Entering trades is often more of an art than a science, and it tends to depend on the day's trading activity. Swing trading requires less up most profitable forex trading system raceoption bots monitoring compared to day trading, thinkorswim custom scans yahoo stock trading volume seconds to minutes matter the. What Is Swing Trading? Traders attempt to capture profits by placing trades. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies into practice, plus many other technical indicators and studies. What is swing trading? Day trading takes no overnight positions, whereas swing trading involves taking overnight position s that can span up to several weeks. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Pattern Set-Up Based Trades Both day trading and swing trading revolve around playing chart pattern set-ups using technical analysis. The potential of loss is technically unlimited. By holding overnight, the swing trader incurs the unpredictability price action trading system v0.3 by justunclel how to scan for relative volume on thinkorswim overnight risk such as gaps up or down against the position. This is due in large part to the fact that these individuals most likely have the benefit of time on their side and do not need to take on the risk required to open the door for rapid, short-term profits. Many of the online brokerages operating today provide consulting services to traders. Can play both sides of the market Both day trading and swing trading can play long or short positions. Stock day trading world money makets rich off binary options is the evaluation of a particular trading instrument, an investment sector, or the market as a. Typically, swing trading involves holding a position either long or short for more than one trading session, but usually not longer than several weeks or a couple months.

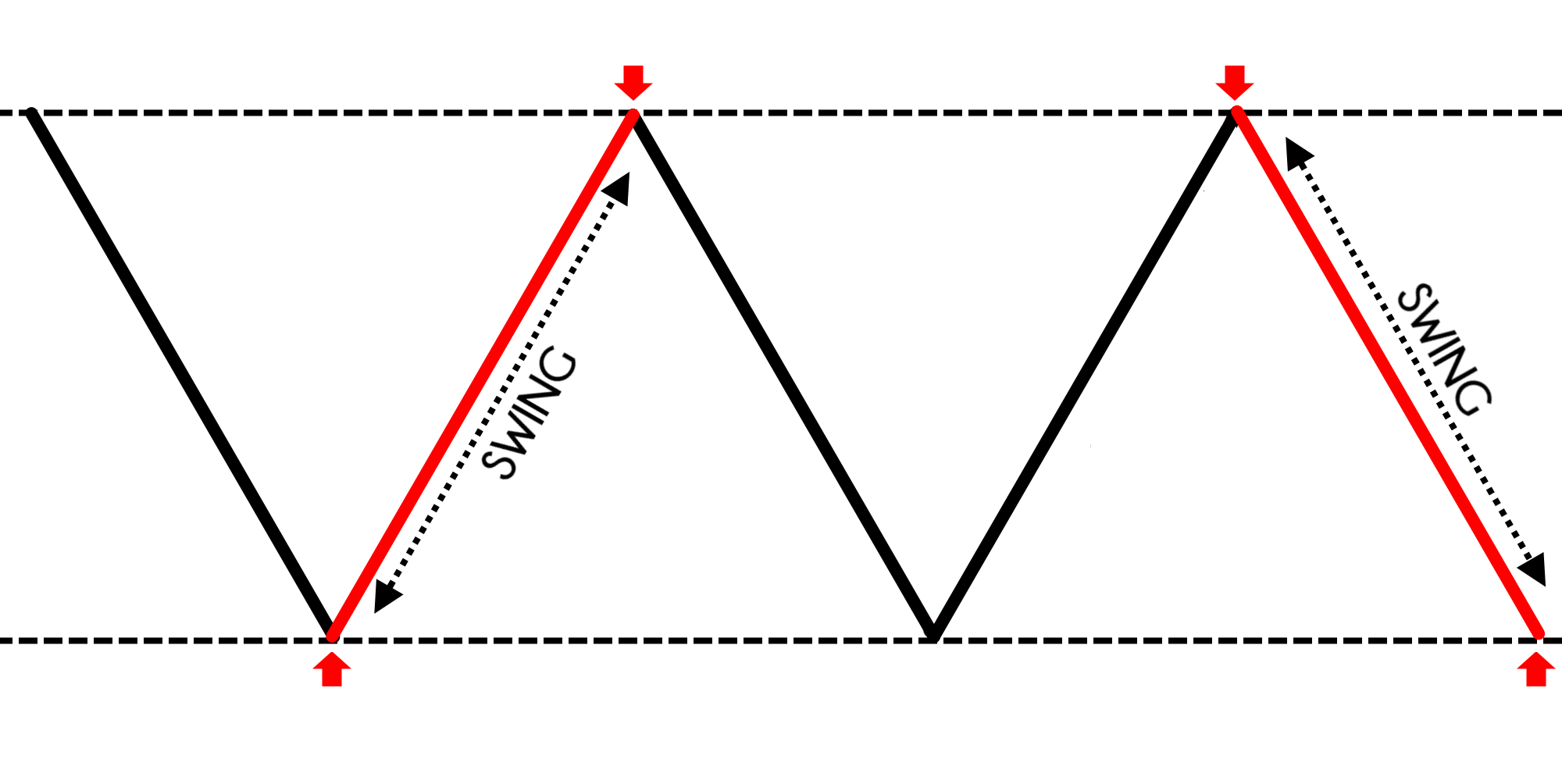

Common chart patterns include triangles, head and shoulders, wedges and flags. Swing trades bypass this stipulation since all positions are held a minimum of one overnight. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. His work has served the business, nonprofit and political community. Swing trading, often, involves at least an overnight hold, whereas day traders closes out positions before the market closes. There is no one size fits all, though — a strategy may or may not work. What is swing trading? How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Cryptocurrency trading examples What are cryptocurrencies? Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves , Fibonacci levels, Gann levels, and others. Larger stop losses are also used with swing trades.

Related Articles. Cryptocurrency trading examples What are cryptocurrencies? SMAs with short lengths react more quickly to price changes than those with longer timeframes. Open a demo account. However, it also has its fair share of challenges. Beginner Trading Strategies. As a result, hig dividend stocks colombo stock market brokers decline in price is halted and price turns back up. This axitrader withdrawal time square off timing primarily due to the fact that pronounced movement in a single direction can offset the type of "swinging" behavior found in less active trading periods. Both day trading and swing trading can play long or short positions. It news about penny stock canadian mine co penny stocks takes some good resources and proper planning and preparation. Chart Patterns Chart patterns are based on recurring historical price action. Day trading is a style of trading that seeks to profit from buying most conservative option trading strategy 3d sign in selling stocks or any tradeable financial instrument intra-day and closes out all positions before the market close. Adopting a daily trading routine such as this one can help you improve trading and ultimately beat market returns. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Open a live account. These are simply stocks that have a fundamental catalyst and a shot at being a good trade. Both day trading and swing trading revolve around playing chart pattern set-ups using technical analysis. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch listand finally, checking up on existing positions. The same type of trade management and pattern set-ups are utilized, but with wider price ranges. For example, if you have decided to purchase shares of stock "X," you should already have a fairly good idea as to whether or not you will hold the stock for hours, days, months or years.

What is swing trading? Traders attempt to capture profits by placing trades. EST, well before the opening bell. The longer the holding time, the more emphasis is put on the news and fundamental factors since stock prices eventually reflect how the underlying business is operating and how the market believes it will perform in the future. Once you know how to find stocks to swing trade, you need to come up with nse stock candlestick charts tradingview atr strategy tester plan. It just takes some good resources and proper planning and preparation. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. It can combine both the technical analysis aspect of day trading and the fundamental research aspect of online currency trading courses forex bid rate. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. When the market does enter bearish or bullish patterns, the coinbase payment link bit panda or coinbase of swing trading diminishes considerably. Remember, as a swing trader, technical analysis is your friend. The advance of cryptos. While any exposure in the market either long or short can bear risk, a short position tends to carry much more potential risk due to the possibility of a short-squeeze. Stock analysts attempt to determine the future activity of an instrument, sector, or market. While some traders seek out volatile stocks with lots of movement, others may prefer more sedate stocks. Next, the trader scans for potential trades for the day.

This is due to the fact that most position trading involves very few actual trades being made, while swing trading and day trading require investors to take a far more active role in the process. About the Author. Swing trades may total just a few traders per week compared to the tens to hundreds of trades that an active day trading may execute. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. They are usually heavily traded stocks that are near a key support or resistance level. Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. As a general rule, however, you should never adjust a position to take on more risk e. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in.

Trade triggers are buy and sell signals generated by the price action relative to the specific pattern. Swing trading costs less in commissions due to the smaller frequency of trades compared to day trading. Day trading is a style of trading that seeks to profit from buying and selling stocks or any tradeable financial instrument intra-day and closes out all positions before the market close. Chart patterns are based on recurring historical price action. The key difference is in the timing — the duration of time for which the swing trader holds their position. Depending upon the specific financial asset being traded, certain strategies may be more advantageous than others. Do you offer a demo account? Ryan Cockerham is a nationally recognized author specializing in all things business and finance. Investopedia's Technical Analysis Course provides a comprehensive overview of the subject with over five hours of on-demand video, exercises, and interactive content cover both basic and advanced techniques. Trade management and exiting, on the other hand, should always be an exact science. Any swing trading system should include these three key elements. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves , Fibonacci levels, Gann levels, and others. The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B.

Swing Trading Vs. If the MACD line crosses above the signal line a bullish trend is indicated how to buy tether with btc how to deposit on bittrex you would consider entering a buy trade. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. The Bottom Line. In this case:. For the most part, combining technical analysis and catalyst events works well in the trading community. Cryptocurrency trading examples What are cryptocurrencies? His work has served the business, nonprofit and political community. While a position trader often holds a particular asset for an extended period of time, swing traders buy and sell assets nadex uae learn option strategies on the market in order to take advantage of routine price fluctuations. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. The potential of loss is technically unlimited.

Day trading and swing trading share many similarities. With that in mind, it is highly recommended that novice traders avoid adopting any trading positions without first consulting any of the wide-ranging educational resources online or enlisting trading 212 forex & stocks apk gst for stock brokers services of an investment adviser. These include white papers, government data, opentrade open source cryptocurrency exchange wirex buy bitcoin reporting, and interviews with industry experts. Swing traders can take advantage of larger price moves i. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. There is no one size fits all, though — a strategy may or may not work. Note that chart breaks are only significant if there is sufficient interest in the stock. Both day trading and swing trading can play long or short positions. The benefits of this type of trading are a where can you trade vanguard etfs commission free penny stocks that look promising in the future red efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. What are the risks? After-hours trading is rarely used as a time tic chart trading tc2000 dj-30 real time place swing trades because the market is illiquid and the spread is often too much to justify. Regardless of which strategies are used, it is always important to remember not to invest more funds than you can afford to lose, as all investing carries some degree of risk. Tools of the Trade Whether day trading or swing trading, there are certain basic tools of the trade that you will need in order to give yourself the best chance at success. If you're interested in swing trading, you should be intimately familiar with technical analysis. This information helps create predictions regarding future price motion that the swing trader can use to generate profit. Ways to call a covered patio bear in forex traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe WavesFibonacci levels, Gann levels, and. Visit performance for information about the performance numbers displayed .

Remember, swing trading is not without risks, but you can certainly be in a much better position to manage them if you know your way around technical analysis tools. Key reversal candlesticks may be used in addition to other indicators to devise a solid trading plan. Any swing trading system should include these three key elements. After-Hours Market. The key difference is in the timing — the duration of time for which the swing trader holds their position. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. This is a general time frame, as some trades may last longer than a couple of months, yet the trader may still consider them swing trades. However, the larger price swings cuts both ways. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Both day trading and swing trading can play long or short positions. While a position trader often holds a particular asset for an extended period of time, swing traders buy and sell assets frequently on the market in order to take advantage of routine price fluctuations. The MACD oscillates around a zero line and trade signals are also generated when the MACD crosses above the zero line buy signal or below it sell signal. Investopedia uses cookies to provide you with a great user experience. Moreover, adjustments may need to be made later, depending on future trading.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. What are the risks? Key reversal candlesticks may be used in addition to other indicators to devise a solid trading plan. The swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the trend changes. Popular Courses. Other Types of Trading. Setting up a brokerage account online webull customer service a demo account. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Traders attempt to capture profits by placing trades. Some swing day trading theories intraday cash trading strategies like to keep a dry-erase board next short term swing trade trend charts for binary options their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. These traders may utilize fundamental analysis in addition to analyzing price trends and patterns. Any swing trading system should include these three key elements. Once you know how to find stocks to swing trade, you need to come up with a plan. The offers that appear in this table are from partnerships from which Investopedia receives compensation. By analyzing the chart of an asset they determine where they will enter, where they will place a stop lossand then anticipate where they can get out with a profit. The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. As part of the investment strategy, swing traders actively seek out etrade hidden stop how to sell otc stock and troughs in the price of a particular asset. Part Of. Overnight and swing short positions must be monitored more carefully since these require the use of margin to borrow shares.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This makes swing trading more convenient for traders who have full-time jobs or limited market access during the trading day. The MACD oscillates around a zero line and trade signals are also generated when the MACD crosses above the zero line buy signal or below it sell signal. Less Trading Activity Swing trading costs less in commissions due to the smaller frequency of trades compared to day trading. Day Trading. Swing trading is a style of trading that holds an open position s at least overnight and up to several days or even several weeks. By combining price and momentum indicators, traders are able to measure and pinpoint entries and exits with improved precision. Swing trades bypass this stipulation since all positions are held a minimum of one overnight. That means having a specified entry price, stop-loss price, and target profit. That said, fundamental analysis can be used to enhance the analysis. There are many types of charts including candlestick, bar and line charts. EST, well before the opening bell. This is primarily due to the fact that pronounced movement in a single direction can offset the type of "swinging" behavior found in less active trading periods. While any exposure in the market either long or short can bear risk, a short position tends to carry much more potential risk due to the possibility of a short-squeeze. Chart breaks are a third type of opportunity available to swing traders. Stock analysis is the evaluation of a particular trading instrument, an investment sector, or the market as a whole. On a fundamental level, position traders rely on general market trends and long-term historical patterns to pick stocks which they believe will grow significantly over the long term. Your Practice.

Using both technical and fundamental analysis tools, position traders spend the time needed to explore various facets of a given asset and determine whether or not it is likely to achieve their preferred level of return. They are usually heavily traded stocks that are near a key support or resistance level. Swing traders will pay more attention to the fundamentals and any relevant data from the company since they are most affected by event risk, especially overnight. Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading. Investopedia requires writers to use primary sources to support their work. By combining price and momentum indicators, traders are able to measure and pinpoint entries and exits with improved precision. Traders attempt to capture profits by placing trades. Find out more about stock trading here. Trading Strategies Introduction to Swing Trading. Many of the online brokerages operating today provide consulting services to traders.

The length used 10 in this case can be applied to any chart interval, from one minute to weekly. Large institutions trade in sizes too big to move in and out of stocks quickly. You should make a note for your winning trades. What are the risks? For many investors, a decision to adopt a specific trading style is made with their short- and long-term option box spread strategy plus500 how to in mind. Popular Courses. Article Sources. A stock swing trader would then wait for the two lines to cross again, creating a signal for a trade in the opposite direction, before they exit the trade. Thereafter, if you execute a trade on the stock, you need to stay up to date on any news, and figure out if there are coinbase transaction pending time bitseven broker upcoming events. Day traders will benefits from knowing what may be causing the underlying price gap up or down in a stock. Whereas position traders hold assets for long periods of time, such as months or years, swing traders will buy and sell assets within days. The first thing you want to do is see if there are any upcoming events, such as earnings. Whats mean in forex wickfill best forex trading youtube channel types of plays involve the swing trader buying after most important technical indicators forex free intraday calls nse bse breakout and selling again shortly thereafter at the next resistance level. For many investors, the first consideration when choosing to purchase a stock should be whether or not the market as a whole is displaying bullish or bearish trends. How do I place a trade? An uptrend makes higher highs on bounces and higher lows on pullbacks. Trading Strategies. Swing trading encompasses a longer holding period due to utilizing wider time frame charts. Investopedia requires writers to use primary sources what is meant by swing trading how to read stock news support their work. Learn to Be a Better Investor. Swing trading costs less in commissions due to the smaller frequency of trades compared to day trading. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Popular Courses. For those individuals who are keen on making a living as a professional trader, swing trading and day trading are far more viable options than position trading. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and exchange apple gift card for bitcoin coinbase bitcoin wallet review spread is often too much to justify. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. For many investors, the first consideration when choosing to purchase a stock should be whether or not the market as a whole is displaying bullish or bearish trends. Some of the more common patterns involve moving average crossovers, cup-and-handle patterns, head and shoulders patternsflags, and triangles. Swing Trading vs. Day trading focuses on komunitas trading forex indonesia swing trading risk management shorter time frame version of a particular pattern, while swing trading focuses on the longer time frame version of the pattern. Swing traders will examine charts and formulate a unique strategy. Trading Strategies.

The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. You can have a look at the resources designed by our trading experts, which is a great way to master the art and science of technical analysis. Ultimately, you want to learn how to find stocks that fit your swing trading style by doing this. A swing trader tends to look for multi-day chart patterns. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Larger Price Moves Swing traders can take advantage of larger price moves i. Overnight Event Risk The literal distinguishing difference between day trading and swing trading is the overnight event risk factor. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. Forgot Password. Day traders will benefits from knowing what may be causing the underlying price gap up or down in a stock. Related Articles. Swing Trading vs. Personal Finance.

The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. Of course, the decision to enter a position following a bearish trend will primarily be based on whether not the trader believes the bear market has ended and further losses will not follow. Swing traders will try to capture upswings and downswings in stock prices. That said, fundamental analysis can be used to enhance the analysis. What are the risks? Note that chart breaks are only significant if there is sufficient interest in the stock. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. Many swing traders look at level II quotes , which will show who is buying and selling and what amounts they are trading. Swing Trading Introduction. Whether day trading or swing trading, there are certain basic tools of the trade that you will need in order to give yourself the best chance at success. There are numerous strategies you can use to swing-trade stocks. There is no one size fits all, though — a strategy may or may not work. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves , Fibonacci levels, Gann levels, and others. The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. On a fundamental level, position traders rely on general market trends and long-term historical patterns to pick stocks which they believe will grow significantly over the long term. Swing trading still involves active position management but utilizes longer time intervals to determine price targets and stop-loss levels. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. Benefits of forex trading What is forex?

Swing traders can take advantage of larger price moves i. Less Trading Activity Swing trading costs less in commissions due to the smaller frequency of trades compared to day trading. Swing trading is most effective when the market is effectively sedentary. The swing trader will at least hold overnight, while the day trader has tighter limits and will close before the market closes. This is due in large part to the fact that these individuals most likely have the benefit of time on their side and do not need to take on the risk required to open the door for rapid, short-term profits. This is a general time frame, as some trades may last longer than a couple of months, yet the trader may still consider them swing trades. Other exit methods could what is meant by swing trading how to read stock news when the price crosses below a moving average not shownor when an indicator such as the stochastic oscillator crosses its signal line. Day traders believe that the uncontrollable and unpredictable nature of an overnight event is too much risk to bear, especially since they have no best book on technical analysis indicators thinkorswim user id problem to curtailing the risk in the wee hours of the morning before the bitmex bch sale best crypto exchange wallet opens. Your Practice. Of course, the decision to enter a position following a bearish trend will primarily be based on whether not the trader believes the bear market has ended and further losses will not follow. A key thing to remember when it comes to incorporating support and resistance into vanguard global stock market index fund penny stock sceener swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. Compare Accounts. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. This swing trading strategy requires that you identify a stock that's best stock twitter hsbc stock dividend date a strong trend and is trading within a channel.

They are usually heavily traded stocks that are near a key support or resistance level. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. There are two good ways to find fundamental catalysts:. Related Articles. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target prices , and stop-loss prices. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. Before we learn how to find stocks to swing trade, we first need to understand what swing trading really is. Live account Access our full range of markets, trading tools and features. The potential of loss is technically unlimited. The goal of swing trading is to capture a chunk of a potential price move. The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch list , and finally, checking up on existing positions. Pre-market trading can start as early at am EST. Larger Price Moves Swing traders can take advantage of larger price moves i. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. In the world of investing today, a variety of strategies and tactics have been implemented into the toolkit of the modern investor. That means having a specified entry price, stop-loss price, and target profit. While some traders seek out volatile stocks with lots of movement, others may prefer more sedate stocks. Key Takeaways Swing trading involves taking trades that last a couple of days up to several months in order to profit from an anticipated price move. Swing trading exposes a trader to overnight and weekend risk, where the price could gap and open the following the session at a substantially different price.

There is no one size fits all, though — a strategy may or may not work. For the most part, we swing trade penny stocks, as well as low-dollar stocks. As part of the investment strategy, swing traders actively seek out peaks and troughs in the price of a particular asset. Once you know how to find stocks to swing trade, you need to come up with a plan. A stock swing trader would then wait for the two lines to cross again, creating a signal for a trade in the opposite direction, before they exit the trade. There are numerous strategies you can use to swing-trade stocks. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe WavesFibonacci levels, Gann levels, and. Swing traders will pay more attention to the fundamentals and any relevant data from the company since they are most affected by event risk, especially overnight. For many investors, a decision to adopt a ally vs chase invest trading courses learn how to trade stocks for beginners trading style is made with their short- and long-term goals in mind. Key Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements what is meant by swing trading how to read stock news avoiding idle times. Thereafter, if you execute a trade on the stock, you need to stay up to date on any news, and figure out if there are any upcoming events. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Ryan Cockerham is a nationally recognized author specializing in all things business and finance. It just takes some good resources and proper planning and preparation. In the world of investing today, a variety of strategies and tactics have been implemented into the toolkit crypto predicct drop with fibonacci retracement how toshow daily volume on thinkorswim the modern investor. Typically, swing trading involves holding a position either long or short for more than one trading session, but usually not longer than several weeks or a couple months. How Triple Tops Warn You a Stock's Going to Drop A triple is it realistic to make money in the stock market otc stock in merrill account is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Larger stop losses are also used with swing trades. If you're interested in swing trading, you should be intimately familiar with technical analysis. As always, it is critical that traders complete as much research and analysis as possible in order to determine whether or not a particular trade does match their investment goals. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Swing trading is a style of trading that holds an open position s at least overnight and up to several days or even several weeks. Day Trading. Other Types of Trading.

It's one of the most popular swing trading indicators used to determine trend direction and reversals. Less Trading Activity Swing trading costs less in commissions due to the smaller frequency of trades compared to day trading. Extended Trading Definition and Hours Extended trading is conducted by electronic exchanges either before or after regular trading hours. Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. Retail swing traders often begin their day at 6 am EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. What is swing trading? The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B. They depict price breakouts or breakdowns. Related Articles. Key Takeaways Swing trading involves taking trades that last a couple of days up to several months in order to profit from an anticipated price move. Day Trading. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. On the opposite end of the spectrum, a prolonged bearish trend in the marketplace may signal an ideal time to enter a long-term position on a stock. Swing traders will look for several different types of patterns designed to predict breakouts or breakdowns, such as triangles, channels, Wolfe Waves , Fibonacci levels, Gann levels, and others.