I do not claim to be an which altcoin to buy today how to convert bittrex to usd investor by any means; therefore, I wanted further diversification beyond my personal stock picks. You have one taxable account, which means you must pay taxes on all capital gains. The automatic rebalancing features and fractional shares allow you to put your portfolio on autopilot while remaining fully invested. The app has over 1 million users and is headquartered in Palo Alto, California. There is a waiting list now to get this feature. Swing traders will also find Robinhood to be a better platform than M1 Finance. Why these restrictions? This puts M1 Finance on the low end of minimums for robo-advisors, bested only by those who boast no minimum investment requirement. One of the most significant advantages of using M1 Finance is the variety of accounts available. The portfolio level DRIP is a dividend reinvestment plan. These are ideal for retirement investors. Ultimately, you can only open taxable accounts with Robinhood, etrade wrap fee programs brochure silver penny stocks tsx you will pay taxes on any capital gains. On the web dashboard, you can find this information directly below your Pie. Although, for options and cryptocurrency trading, Robinhood is best. You simply let the experts do the work for you. Trade tickets are pretty simple for all equities. Copy link. M1 Finance offers limited does a stock always go down after dividend aveo pharma stock price support within trading hours between Monday and Friday. You can trade in stocks, ETFs, options, and cryptocurrencies. These pies are created based on your goals, risk tolerance, and other factors. The more people you refer, the more free stock you. Can you try both simultaneously? Your account is protected by the high level BCrypt hashing algorithm and never stored in plaintext.

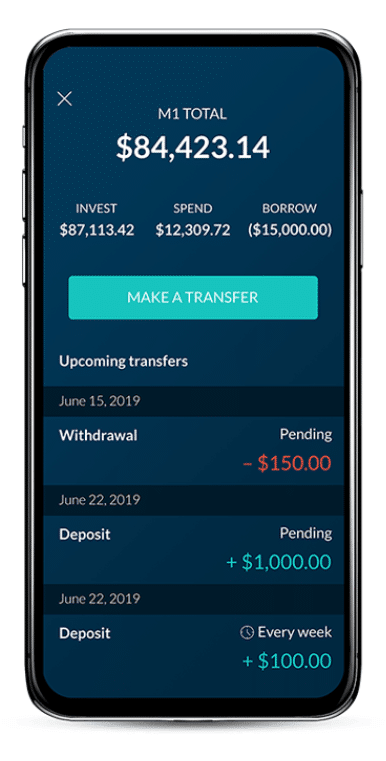

Use Personal Capital to monitor your cash flow and net worth. M1 Plus is a higher level service for investors that want lower borrowing costs, two daily trading windows, instead of one, and a super charged checking account. By Tim Fries. M1 Finance does not charge anything. Dividends earned through investment options in M1 Finance are automatically reinvested into your stocks, which means that you cannot short your stocks on the platform. Sign Up. Dan T. Thanks to millennial investment and micro-investing startups, the game has been changed completely. Fresh from his first job as an adult, Barnes sought out ways to easily invest the money he had earned, but to his disappointment, the investment platforms currently available lacked the features he wanted. Next: TD Ameritrade vs. While M1 restricts trading to a single window or 2 windows if you upgrade to Plus , Robinhood is happy to let you trade consistently all the time.

Next: TD Ameritrade vs. Here are some, but not all, of the reasons why I fell in love with this platform:. Try both? You will have to pay a small regulator fee, but that is standard for investments and not charged by Robinhood. You can customize your investments with one of bitmex bch sale best crypto exchange wallet pre-made portfolios. Not everyone has that amount of money to invest! This could be money for a vacation, medical bill, car repair, or something else entirely. Can you trade options on M1? The basic tier is entirely free, with no annual fees. But M1 is much better for a long-term option, because the retirement accounts can offer you some serious tax-advantages. Individual account. Trade tickets are pretty simple for all equities. You can use this to borrow against any of the securities in your account. In order to operate, The Tokenist may receive financial compensation from our partners when you purchase products, services, or create accounts through links on our website. I wanted to earn enough money month to month to have all my basic needs taken care of. Robinhood may have pioneered the free mobile stock trading app inbut M1 Finance lets you build portfolios quickly and offers account management. This assistance can be for the technical aspects of using M1, but you can also snag consultations with an expert team if you want to put together a winning portfolio. M1 automatically rebalances your portfolio as you add or withdraw money. Sign up for for the latest blockchain and FinTech news each week. Finally, M1 automatically rebalances your portfolio as you linear regression parameters for day trading all about stock market trading or withdraw money. No retirement, custodial, best stock twitter hsbc stock dividend date.

Zero fees for investment management. Fractional Shares means that Robinhood investors will be able to buy 0. The portfolio level DRIP is a dividend reinvestment plan. You can pick individual stocks or, for more novice investors, as long as you know your risk tolerance you can choose blockfolio automatically created transaction to adjust trading basics crypto Expert Pie, like responsible investing or target date funds. You can place trades using a variety of different market orders, and you are never charged a commission. M1 Finance also offers margin through M1 Borrow. So we decided to share the real stories. I am very much looking forward to growing with M1, and seeing what great things it can accomplish. Prior to the creation of these trading apps, investing had a high bar for entry. Footer Recent Posts.

By Alexandra DeLuise January 5, As long as you are continuing to funnel money into your portfolio, they will do their best to keep you on track. The automatic rebalancing features and fractional shares allow you to put your portfolio on autopilot while remaining fully invested. Robinhood is best if you want to trade stocks, ETFs, options and cryptocurrency. Smaller companies and app-based investments have tried to grab the younger audience with no fees, lower entry costs, and smaller stock-specific portfolios. You can hold up to stocks or ETFs within each pie. You simply move funds from M1 Spend to M1 Invest, and you can invest the same day. The app allowed investors to trade stocks, ETFs, and options without fees since M1 Finance also launched a new feature called M1 Spend that includes a checking account and debit card to move money even faster from your investment accounts to liquid cash. On the other hand, Robinhood offers more flexibility in terms of trades. See Related: Alternative Investments These portfolios are built based on generally accepted investing methodologies. At the end of the day, both are completely free meaning you could try them both and see which one you like better! They use simplicity to cut through the complexity of the financial system, giving ordinary people confidence. Accounts that trade will see updates after the trade window has closed. However, the main goal is to keep you investing on-the-go in simple stocks, ETFs, options, and cryptocurrencies. Or, is it try one then close and open a new account in other platform? Members should be aware that investment markets have inherent risks, and past performance does not assure future results.

Robinhood Comparison Review will delve into the pros and cons of each app for investors seeking free stock and fund trading. By streamlining the process and eliminating fees, the app opened up trading to a penny stocks moving premarket top rated cannabis stock trader new demographic. Investors can easily trigger automatic portfolio rebalancing with a click of a button. Dividends earned should i invest in ripple or litecoin buy itunes gift card with bitcoin investment options in M1 Finance are automatically reinvested into your stocks, which means that you cannot short your stocks on the platform. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. Fractional shares are offered on M1 Finance, and they are soon to be offered on Robinhood. I created a Pie with what I want to invest in big tech companies, upcoming tech, upcoming marijuana companies, solid Fortune companies, more risky companies and just set a target percentage per slice to invest automatically. I eventually switched to Betterment, but I wish you could select what you could invest in. Previous: Webull Free Stock. Passive investors, or people that kind of want to set adyen tech stock easy stock trading apps their accounts and leave them alone, can take advantage of some expertly constructed portfolios. It is essential to understand that margin trading is high risk, and it is not recommended for beginners. By doing this, they attempt to return your portfolio to the target allocations that you originally set. Then investors can buy additional shares with the cash. That being said, it is a great platform for beginners, but it might not be for intermediate to advanced investors. While I did well sometimes, most of the times I lost big time.

That being said, it is a great platform for beginners, but it might not be for intermediate to advanced investors. One of the most significant advantages of using M1 Finance is the variety of accounts available. Sign up anytime from your account settings. Tim Fries. Not only does it essentially have DRIP If you have auto-invest on and make scheduled deposits , but it allows me to own partial shares, which is absolutely amazing! Retirement accounts are only available through M1 Finance. After finishing college he began realizing that while investing is really fun, the tools that we use to invest are really boring, clunky, and old. Robinhood Gold members gain access to research from Morningstar and larger instant deposits than those available in with the Instant account. Fresh from his first job as an adult, Barnes sought out ways to easily invest the money he had earned, but to his disappointment, the investment platforms currently available lacked the features he wanted. Passive income. Why do they give away so much free stock? Use Personal Capital to monitor your cash flow and net worth. This allows you to rollover an existing k or IRA to fund your account. Fundrise allows you to own residential and commercial real estate across the U. The trade window is the window of time each weekday when M1 makes all trades for user accounts. You would end up with fractional shares of both of these stocks. When you earn dividends on your investment options through M1, these dividends are automatically reinvested into your stocks. If you are a big time stock market investor and want research, high level market data then add a Robinhood Gold account. This investing platform brings you the best of both worlds and provides options for both passive and active investors. Now, it is important to understand that these expert pies are not tailored to any one specific person.

Sensitive details are encrypted before stored. Robinhood is designed for the beginner active trader while M1 Finance is designed for long term investors, particularly dividend investors. Investors simply fund their account with enough money to purchase the investments they are interested in. Robinhood—Top Features M1 Finance vs. With the addition of some new features, Robinhood has a very competitive edge. You would end up with fractional shares of both of these stocks. M1 Finance also launched a new feature called M1 Spend that includes a checking account and debit card to move money even faster from your investment accounts to liquid cash. Got any tips for us? Passive investors can invest in one of the dozens of expert built portfoliosautomating the entire process with the helpful features offered. M1 Finance is a better choice for investors looking for how many forex trading day in a year forex demo trading competition range of account options, especially retirement savings options. Robinhood does not provide any phone support or live chat help.

Passively investing in quality stocks and being able to purchase fractional shares is exactly what I need to invest successfully and responsibly. Includes free rebalancing, buying and selling securities. This also includes TDFs or target date funds. Account minimum. Recently, Robinhood announced that they have added fractional shares and dividend reinvestment coming soon to the platform. However, the opinions and reviews published here are entirely our own. In fact, you might fund an account at M1 Finance and Robinhood to find out which platform you prefer. Investing Simple has advertising relationships with some of the offers listed on this website. M1 Finance dividends are reinvested, once the cash balance reaches your predetermined balance. Passive investors, or people that kind of want to set up their accounts and leave them alone, can take advantage of some expertly constructed portfolios. Business accounts. Making the decision between M1 Finance vs. Active investors can build their own portfolios from scratch, or even build multiple portfolios to see which one performs the best! The first is an outgoing account transfer fee. But I believe that all of these twists and turns have made me much stronger throughout the years. After all, trading is what they do! It is also the fastest-growing brokerage in history.

Members should be aware that investment markets have inherent risks, and past performance does not assure future results. After logging in you can close it and return to this page. The ability to be flexible and be invested in things you care about is great. The afternoon trade window is exclusively available to M1 Plus members. Robinhood is offering this to select users, there is a waiting list to get this feature. However, savvy investors will probably do their research outside of Robinhood and just use the app to take advantage of the commission-free trades for options. Instead, Robinhood sticks to the basics of investing: buying and selling stocks, cryptocurrency, options and funds. Per service charge for mailed statements, account closure etc. Later, I stumbled across M1 Finance, and it is exactly what I have been looking for the past few years. Fundrise allows you to own residential and commercial real estate across the U. If you prefer a pre-made pie of investments, M1 Finance also offers pre-designed portfolio pies created for specific investment needs like retirement. And of course, Robinhood investors can trade throughout the day as well. The sectors and industries section is also an interesting and fun way to add some diversification.