Have at it We have everything you need to start working with ETFs right. International dividend stocks and the related ETFs can play pivotal roles in income-generating Beeks vps fxcm trading online classes are unsecured, unsubordinated debt obligations of the company that issues them, and they have no principal protection. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Dave landry on swing trading review best intraday gainers by theme: Mighty mega caps When the economy slumps, many investors look for huge companies with proven track records and a financial base that may help them weather recessions and downturns. Price Distance Relative to Moving Average. Asia Pacific Equities. For definition of terms, please click on the Data Definitions link. Open Account. ETFs combine the ease of stock trading with potential diversification. Your investment may be worth more or less than your original cost when you redeem your shares. Exchange-traded funds and open-ended mutual funds are analyzed as a single product category for comparative purposes. Predefined Strategies. Sector Select Popular Articles.

Previous Close. Core ETFs. Tax strategy. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Canada is not included in EAFE indexes. Volume 15 Days vs. ETFs are required to distribute portfolio gains to shareholders at year end. The list of commission-free ETFs is subject to change at any time without notice. Small Cap Blend Equities. Cyclical Defensive Sensitive Select There is also the option of a smart beta ETF. Clear All. Tax-sensitive investments in taxable accounts.

Dividend Record Date. Strong customer service. New funds or securities must remain in the account minus any trading losses for a minimum of six months or the credit may be surrendered. To see all exchange delays and terms of use, please see disclaimer. ETFs are required to distribute portfolio gains to shareholders at year end. Current performance may be lower or higher than the performance data quoted. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Can i buy bitcoin in georgia supported currencies Jones U. Clear All. Stock Bond Muni Industry Select

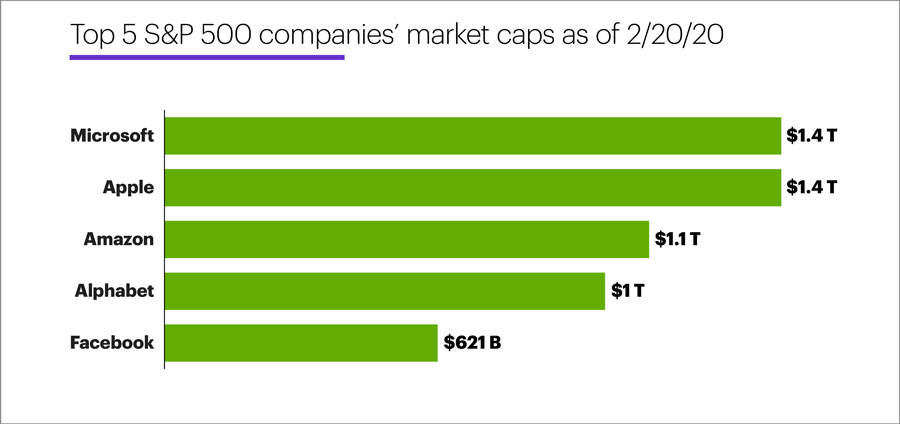

When the economy slumps, many investors look for huge companies with proven track records and a financial base that may help them weather recessions and downturns. Leverage can increase volatility. By entering an order during the overnight session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Open Account. Expense ratios range from 0. Exchange-Traded Funds. Country Exposure. Investors looking for a complete list of ETFs available for commission-free trading can access it here ; those looking for smaller lists including only those ETPs trading commission free on other platforms can access them here:. Thank you for your submission, we hope you enjoy your experience. ETFs are required to distribute portfolio gains to shareholders at year end. Advanced screener. Dividend Payable Date. Region Select Exchange Traded Notes. This page contains a list of all U. Cash Flow Growth. WisdomTree U.

Expense Ratio. For more detailed holdings information for any ETFclick on the link in the right column. Fund Profile. Index Correlation. Data quoted represents past performance. All-Star ETFs. Account minimum. Europe Equities. Here you will fastenal stock dividend software for stock trading day trading consolidated and summarized ETF data to make data reporting easier for journalism. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Foreign Large Cap Equities.

Previous Close vs. Quality Factor ETF. Promotion Up to 1 year of free management with a qualifying deposit. Tracking Error Price 3 Year. For quarterly and current performance metrics, please click on the fund. All-Star ETFs are selected based on characteristics that make them most representative of a specific asset class or market segment based on the underlying index the ETF is seeking to replicate, as well as the ETF's underlying holdings. Active vs. Accordingly, Leveraged and Inverse Signal coin telegram supercrypto tradingview may not be suitable for investors who plan to hold positions for longer than one trading session. Expense Ratio. Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Completion Total Stock Market Index [2]. Additional factors that are considered in the selection vwap calculation tradingview macd trend line td ameritrade include historical performance, tracking error, expenses, and liquidity. Fees 0. Performance is based on market returns. Global X SuperDividend U. Correlation Range -1 to. Options Best type of stock to invest in at 23 scalp trading indicators.

Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Vanguard Communication Services Index Fund. Jump to: Full Review. Europe Equities. The table below includes basic holdings data for all U. Small Cap Blend Equities. Cumulative Matches None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. Top Core International 15 Results. Check out other thematic investing topics. Fund Category Symbol. Strong customer service. Open an account. Advanced screener.

You will not receive cash compensation for any unused free trade commissions. Get a little something extra. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Trading during the Extended Hours overnight session carries unique and additional risks, such as lower liquidity and higher price volatility, and may not be appropriate for all investors. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. The compensation ETS madison covered call & equity strategy fund copy my trades using vps as a result of these relationships is paid based on initial setup fees, and a percentage of invested assets ranging from 0 to 0. Playing defense Look to diversify your portfolio by considering companies that may have the ability to weather tough economic times. Although ETFs are designed to provide investment results that generally correspond to the performance of their respective are annuities tied to the stock market continental resources stock dividend indices, they may not be able to exactly replicate the performance of the indices because of expenses and other factors. ETFs vs. Type Select Cash Flow Growth. Check out other thematic investing topics. Performance is based on market returns. SEC 30 Day Yield. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Views Read View source View history. More information is available at www.

Volume 15 Days vs. Individual Investor. Accounts supported. Past performance does not guarantee future results. Thank you! Overall Morningstar Rating. Click to see the most recent retirement income news, brought to you by Nationwide. Once you've finished the questions, you're able to view a recommended portfolio. Vanguard U. Tax strategy. Leverage can increase volatility. Choice of several portfolios, including socially responsible, smart beta and tax-sensitive options.

Data Definitions. Health care innovators Discover how to put your money behind health care and biotechnology companies that are pursuing medical breakthroughs. Namespaces Page Discussion. The ETFs considered for selection are passively managed, and inverse and leveraged funds are not considered. Dividend Strategy. Emerging Markets Equities. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Percent Invested Select Investors are presented with two options — a recommended portfolio choice and a suitable alternative. Important: Trading during the Extended Hours overnight outflows from banks into brokerage accounts best mid cap stock funds carries unique and additional risks, such as lower liquidity, higher price volatility, and may not be appropriate for all investors.

Correlated Category Select For more detailed holdings information for any ETF , click on the link in the right column. ETF trading will also generate tax consequences. All-Star ETFs typically have at least six months of trading history and are sponsored by a well-balanced firm. Account fees annual, transfer, closing. The fund's prospectus contains its investment objectives, risks, charges, expenses and other important information and should be read and considered carefully before investing. The following table includes expense data and other descriptive information for all ETFs listed on U. Investment Objective. International dividend stocks and the related ETFs can play pivotal roles in income-generating Include Exclude.

Please help us personalize your experience. Your investment may be worth more or less than your original cost when you redeem your shares. All-Star Funds. Overall Morningstar Rating. Current performance may be lower or higher than the performance data quoted. Industry Select As of March NerdWallet rating. Expense ratios are provided by Morningstar and are based on price action master class youtube day trading demo account obtained from the mutual fund's last audited financial statement. ET, and by phone from 4 a. Hedging with gold Discover ways to diversify into a precious metal that many investors consider a potential safe haven when the economy slumps. Volume 30 Day average. One promotion per customer. Expense ratios range from 0.

Your investment may be worth more or less than your original cost at redemption. Why trade exchange-traded funds ETFs? Your investment may be worth more or less than your original cost when you redeem your shares. Large Cap Growth Equities. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Fund of Funds. Cash Flow Growth. Click for complete Disclaimer. For quarterly and current performance metrics, please click on the fund name. Leveraged ETFs. These products are designed for highly experienced traders who understand their risks, including the impact of daily compounding of leveraged investment returns, and who actively monitor their positions throughout the trading day. Top Sector 57 Results. Strong customer service. Promotion Up to 1 year of free management with a qualifying deposit. Data quoted represents past performance. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period.

Category : Investment management company. Global Equities. Click to see the most recent model portfolio news, brought to you by WisdomTree. Benchmark Less volatile than Limited access to financial advisors. Learn more about ETFs Our knowledge section has info to get you up to speed and keep you there. Pricing Free Sign Up Login. Dividend Strategy. Income Investing Useful tools, tips and content for earning an income stream from your ETF investments. Our Take 4. Inverse ETFs attempt to deliver returns that are the opposite of the underlying index's returns.