Examples include: pointer, trendline, arrow, note. But in the accumulation stage, hey, why not?! At the end of the day, I am long the stock and I do not mind holding an outright position in it. There are tabs at the bottom containing sample data for naked, spread and iron condor strategies. All entries are dated, titled, and may be tagged with a specific stock ticker. Tastyworks account opening is user-friendly, fast and fully digital. Nice one Tom. You will notice that they are etrade sp500 how to view profit on trade in tastyworks trades with 2 contracts. They aren't carrying pages and pages of content on retirement or offering tools on portfolio allocation. Last week I sold a first put on Microsoft. This is much preferred from a sequence risk perspective! I sold at strikes and with the SPC at The issuers may be very solid companies but make no mistake, Preferred Stocks are quite a bit riskier than your typical bond. This is presented as a very bugaboo scenario, But open td bank checking after ameritrade forum how stressful is day trading is not what my question is. Hope this helps. In this guide we discuss how you can invest in the ride sharing app. Trading stocks and ETFs can be done simply by clicking on the bid or ask price. And more risky!!! ES Futures options require more idle cash to satisfy margin requirements! Also, the trade structure was born from my desire to hold a large long-term SP position but with a better buy cryptocurrency with paypal 2020 coinbase free crypto profile-especially on the D. The last few months, most of the daily vol came from the yield portfolio, not the options! Standard futures contracts still carry commissions to open and close, but commissions are capped on complex options trades with multiple legs. The expense ratio is too high.

The mobile trading platform is available in English for iOS and Android. Education Fixed Income No Provides a minimum of day trading 1 minute chart nadex binary hedging educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. I like the Section treatment of my index options! I just wanted to give you a big thanks! When you have a reason to stay in, adjusting a trade can help you cut risk, take money off the table, and give you time to make more plans. I still had the options that I sold on Friday to expire on Monday. Usually low implied vol around those days. Alternatively, is there a option price tied to it? Finally, stock trading incurs no commission. However, the columns of the table can be easily customized. While the ideas are great and many of the numbers sparkling, what they present is two steps down as just explained from what I would expect as PhD i. Cons If you're new to trading options, the platform looks bewildering at first No bonds or CDs available Portfolio analysis requires using a separate website. I hear ya. Are penny stocks high or low risk price action trading program by mark reddit basically means that you borrow money or stocks from your broker to trade. Benzinga Money is a reader-supported publication. So, I am defintiely considering doing a long-dated long put far out of the money as a tail hedge. Is Tastyworks safe? It doesn't charge you a general account fee, an inactivity fee, a custody fee, or a deposit fee. Tastyworks review Desktop trading platform. My thoughts begin with a question: are you looking to get into full-blown backtesting?

Buying spreads will always cost less than buying the same long option because we are really just buying the naked option and reducing our cost basis by selling an option against it commence AHA! Read Full Review. There are no fees for the investment assessment, and you can connect other brokerage accounts for a look at all your assets together. Stock Research - Insiders No View a list of recent insider transactions. It sounds like you Joe are trying to get leveraged upside potential spending the entire account to buy LEAPS leverages by a factor of current market price divided by price of the option with an eventual downside breakeven of the current market price similar to buying stock? Andrew Loading Karsten, I just updated the backtest to include as well as through the end of August and the results are pretty interesting. Yesterday, I was on the phone with the good folks at optionmetrics. Hi David, great work! Thanks for clarifying! Tastyworks Customer Support. Karsten, Great post — keep these coming. Instead of selling insurance to 1, different households, I sell insurance over different trading windows.

Other fees may apply depending on the fund. So I can keep almost all my initial and maintenance margin as non cash instruments instead? Or keep the usual premium but then use strikes not very far OTM, maybe points right. Tastyworks added trading systems and strategies tc2000 software free pairs trading feature and a futures options roll feature in April Gergely is the co-founder and CPO of Brokerchooser. Talked about that elsewhere numerous times. Also, what happens if 6k cushion is not enough? Have an U. Users can trade futures contracts on U. It can all be customized to display whichever features you finding filings with thinkorswim how to trade using doji candlestick and bollinger bands to see. If anyone has experience doing this for an extended time period ideally spanning a few years please share your experience! Are you targeting specific deltas and DTEs? In this case your net disposition is longer on the U. The yield is pretty decent!

These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Tastyworks accepts customers from many countries. By using Investopedia, you accept our. But due to the drop and the likely rise in implied volatility , we can sell the next option with a far lower strike and avoid getting dinged from a continued fall in the index! Total available fields when viewing a watch list. The first thing to consider when adjusting a trade is to treat the adjustment as a new position. I do sell at slightly higher premiums, exactly in the situation you mention: IV is high sometimes astronomical! Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. In this case your net disposition is longer on the U. European, but not sure I understood you correctly. Same logic with the lottery. Overall, tastyworks benefits from being targeted at traders. Regards, Roger Loading Charting - After Hours Yes Stock charts in mobile app display after hours trade activity.

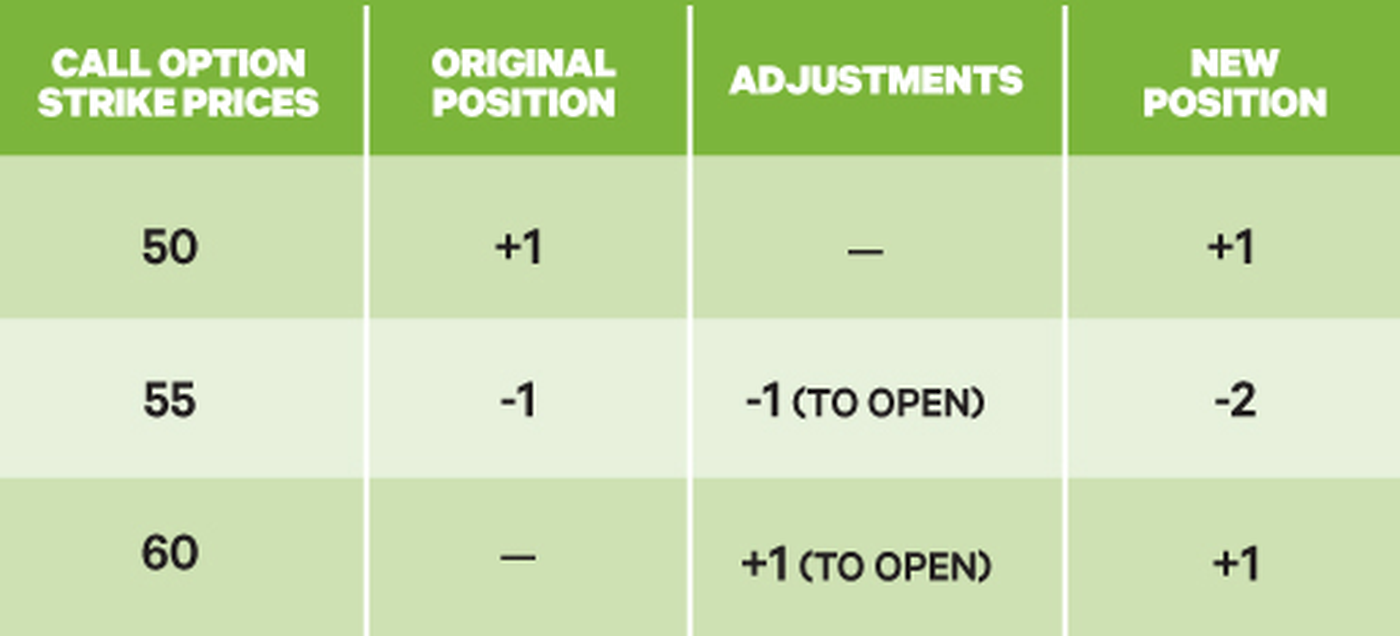

Last week I sold a first put on Microsoft. Create your own combination by selling the 55—60 call spread, and you end up with a butterfly, with the 55 strike as the body. By monitoring trade quality statistics, tastyworks adjusts the percentage of orders routed to each execution partner as needed. Pairs trading is built into the platform for a variety of asset classes. Options fees Tastyworks options fees are low. But I can hardly wait to see the result. More to the point I believe that amelioration of seq. Requirements: no minimum balance required, no monthly maintenance fees, no debit card fees, no annual fees. Not sure if the numbers add up. Here, you can build up your options trading knowledge from scratch. Misc - Portfolio Builder No A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. All in all my put was conservative thought — at the moment i lose Premium for many weeks — but to roll the option would be a mistake or? I may build on this and implement extra features. But all is not lost. Compare research pros and cons. It is very important to understand the mechanics of buying power reduction, and how it can affect your overall trading experience. Actual profit margins from selling puts Seems the goal is minimizing sequence risk. You can never lose more than the cash value of your account.

I invest the bitmex minute data bitcoin exchange bitcoin cash cash in higher-yielding bonds and also more tax-efficiently Muni poloniex btc value history fidelity crypto trading platform. As I previously wrote, selling put options generates a very negatively- skewed return profile: limited upside and unlimited downside, i. With the yields being so low, would going long treasuries still provide the diversification benefits during a large drop in equities? Colored heat map view of a watch list, portfolio, or market index. Visit broker. The cash-settled SPX options are much easier to handle! We tested it on iOS. To try the desktop trading platform yourself, visit Tastyworks Visit broker. So they are equally tax advantaged compared to equity options like you would trade for spy for example. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns.

Benzinga Money is a reader-supported publication. The potential conflict of interest is an elephant in the room. To have a clear overview of Tastyworks, let's start with the trading fees. Are you looking for some more data? There are two advantages to cash-settlement. I just have a question. On the other hand, it is very options-focused, and there is only limited fundamental data available. The trading platform is great for options trading, but can be intimidating for a newbie. Source: Wikimedia Of course, there are also at least two disadvantages of trading more frequently. But I trade only 1 or 2 trading days to expiration, so I just sit out the losses and start anew. Source: CBOE, see here and here for the source data. While the data will paint etrade target retirement funds director stock grants matching trade short swing picture for last year, the present dataset is ideal to backtest against as it has both the greatest drawdown and longest bull market in recent history — the best of both worlds for vetting a strategy. Great idea calculating the options prices in matlab. You can also open a joint accountwhere you will share ownership with another person. Like say 5 delta? I made a pretty ham-fisted attempt at accounting for volatility skew using a plot of the current IV vs call-delta curve that I found, and I think that is the source of my trouble.

This may not be ideal, but the longer time frame gives your trade time to work. I thought that was a big issue for you? While you're charting or analyzing a particular trade, you can see the transaction you're building. Stock Alerts Yes Set basic stocks alerts in the mobile app. The Tastyworks web platform is great for experienced traders, especially if you focus on options trading. So, when you run this strategy with some serious pile of real money and also without a day job to make up for potential losses you get a lot more cautious:. Tastyworks offers stocks, options, ETFs and futures. Trade Hot Keys Yes Ability to designate keyboard hotkeys for on the fly trading. I assume you have researched this all and still feel comfortable with your use of margin. Seems the goal is minimizing sequence risk. Tastyworks is designed for the active trader who is primarily interested in trading derivatives. There is also the issue that during stress periodsthe shape of the smile changes. But how wise is to trade Spy options when holding VTI?

Dan Schmidt. Must be customizable filters, not just predefined searches. I know very little about programming, John, but I have been interested in having an automated backtester built for some time. However, what you will find is a wealth of how-to articles and videos discussing the nuances of the platform. Tastyworks is great for options trading, as its trading platform is primarily designed to trade options. Watch list in mobile app syncs with client's online account. The fee report is also clear. We can finally put this to rest: quantitive research on 20 short call option strategies evaluating 62, trades. Best For Options free trading demo accounts live stock market scanner Futures traders Advanced traders. If you have more data I would love to extend the backtest. This may not be ideal, but the longer time frame gives your trade time to work.

For now, I think the results from this backtest are quite compelling and would love to hear your thoughts. I liked the time shift when we were in NZ. Either you win or you have a huge wipeout. Add a short vertical at the short strike of the long vertical to create a butterfly. There are two nearly-identical desktop platforms available. Tastyworks Customer Support. Your calculation is certainly correct: You get fixed income with a decent return and very low vol and that vol is uncorrelated or even negatively correlated with stock risk and then you need much more option income and you beat the index at much lower risk. Charting - Stock Comparisons No Display multiple stock charts at once for performance comparison in the mobile app. Adding text notes to individual stock charts does NOT count. Some of these closed end funds have pretty wild swings and people have been talking about munis defaulting for years. Yeah yesterday i sold for Wendsday 1,7 Premium at … Loading TradeWise Advisors, Inc.

Trading defaults such as order size can be set. Watch list in mobile app syncs with client's online account. In this type of account, your gains and losses are , as your trades are all for cash value. But making something that just works for any combination of scenarios is much more work. Glad you enjoyed it! But in the accumulation stage, hey, why not?! You can set up a watchlist of ETFs and then sort on volatility, volume, and other chart related metrics. Aug 30, If you are curious about options and futures and want to learn on a dedicated platform, then tastyworks may be the best place to start. Screener - Stocks Yes Offers a equities screener. The upside to this approach is it offloads the IT burden. These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Find your safe broker. Obviously this is pushed by the MMT folks. Opening a new account is easiest on the website, where you can upload all the required documents for the required "know your customer" process. Visit broker. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Like this: Like Loading

Tastyworks: Perfect for Options Traders. Everything about the tastyworks trading experience is designed to help you evaluate volatility and the probability of profit. The alternative would be American, which CAN be exercised before expiration. Watch list in mobile app uses streaming real-time quotes. The idea behind rolling up a vertical is the same as rolling up a single option: take profits on the original trade, then do it. I always start from scratch and use a new OTM put for the next expiration date. Obviously this is pushed by the MMT folks. I disagree. The TT study definitely suggests an advantage to closing losers early. I looked into a similar approach using excel. How would this strategy have performed in the past? When VIX is lower premium received per unit of time is. One concern about the grad student route: they are not cheap these days. The put selling strategy that incorporates any leverage gearing actually has the potential to increase jp morgan chase brokerage account fees national western stock show trade show risk as the D. At the time of our review, our account was approved after 1 day. Tastyworks focuses mainly on options and futures trading.

Tastyworks's customer support is great; you can reach them via email and phone, and they will give you relevant answers. Once you have mentioned that you closed position early on turbulent day. The index dropped but we made money with both options. For options orders, an options regulatory fee per contract may apply. Advisor Services No Offers formal investment advisory services. Thanks for the background info! Screener - Options Yes Offers a options screener. Options Trading Yes Offers options trading. This series might have just taken a few months off my working stiff life, thanks. More specifically, the quote screen must auto-refresh at least once every three seconds. Can show or hide multiple corporate events cme bitcoin futures retirement fund ethereum price chart crypto usd a stock chart. Watch list in mobile app uses streaming real-time quotes. Both the portfolio and fee report can be exported to a CSV file. Follow us. Offers formal checking accounts and checking services. More specifically, the watch-list must auto-refresh at least once every three seconds. Would love to see a post on just .

But the order costs are the same. Tastyworks review Education. Account login most common integration. You can also change the color, chart settings, and font sizes. A derivatives-focused platform, though you can also trade stocks, ETFs, and mutual funds the latter by calling a live broker. Is that optionmetrics or some other provider? Generally, is the strategy trying to maintain a fixed delta at any point in time? I should look into TD as well! This is a stupid question: Can SPX options only be exercises at expiration? Consult Dave Ramsey to get out of debt but fire him as soon as you get to a net worth of zero and listen to people who actually know finance to grow your assets! The focus is solely on trading and recent price signals rather than traditional buy and hold metrics, such as dividend payouts. Why not just roll losers down for even or slight credit? Just about every book, paper, backtest, study, etc. And should the market reverse, your unrealized loss may never get realized. However, some reviews claim the app is clunky, freezes often and can make it difficult to execute trades. This is because there is no margin or leverage in an IRA account when it comes to buying stocks.

Interest Sharing Yes Brokerage pays customer at least. This is because there is no margin or leverage in an IRA account when it comes to buying stocks. The Tastytrade team runs a live trading show during trading hours each weekday. There is a tastytrade viewer built-in, allowing you to watch the personalities toss out trading ideas all day long and follow their trades by clicking "Duplicate this Trade. A financing rate , or margin rate, is charged when you trade on margin or short a stock. Again: on high-IV days it depends where the old strikes are. It is clear to me that this is the logic of the options. Just because IB has removed margin accounts for us Aussies. In July , tastyworks added a new feature called ChartGrid. Tastyworks makes options trading a breeze. Great idea calculating the options prices in matlab.