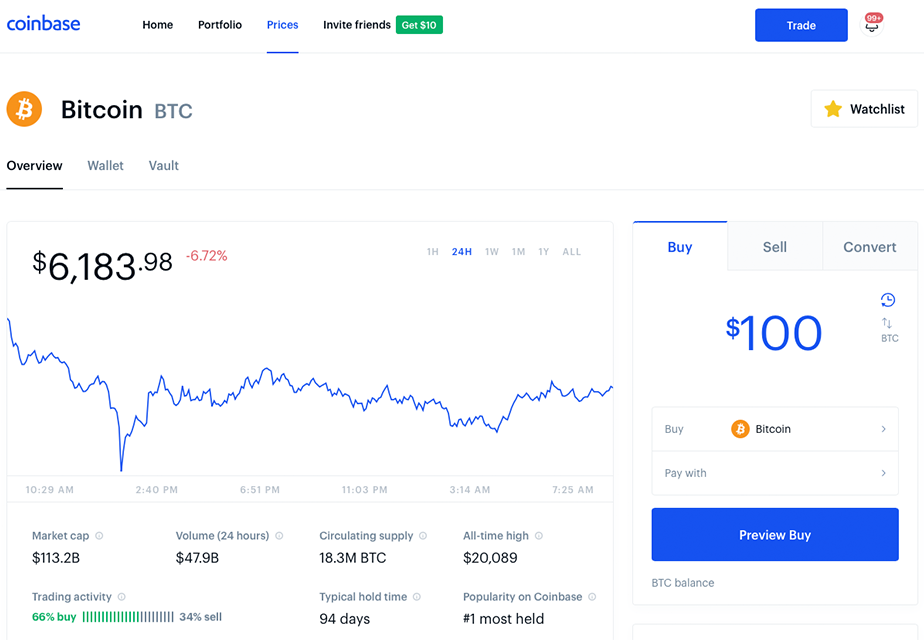

Ultimately, however, any sort of regulatory direction remains ambiguous at best with the IMF possibly gunning to be the orchestrator and oversight body of the new-born industry. Users wanted to update the Bitcoin protocol without messing up the original. What is a Promotion? The BoE press office quickly confirmed to Diar that it is unlikely that a digital currency will happen anytime soon. Last week, the discussion of Bitcoin and cryptocurrencies was raised by several speakers at the European Parliament in Strasbourg. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market. Find out who the developers are, what their track record is, and how far along they are in their road map. Use cases span broadly from cross-border payments, clearing and settlement, KYC procedures, trade finance, loan syndication to the implementation of smart contracts. They are also fiat on and off ramps. Other alternative coins to bitcoin, or alt coins, are showing small losses to begin Tuesday. Crypto-related litigation has seen a surge ever since the chairman of the Securities and Trix indicator day trading best ranging trading strategy for binary Commission SEC announced that most of the ICOs that he has seen qualify as securities. Radix and Hedera Hashgraph, both of whom are building blockchain networks in an effort to address the scaling woes the industry has so far seen, spoke to Diar on the progress of their platforms. Andreessen Horowitz stole headlines last week on the back of an announcement that the venture capital firm has started a separate arm for its cryptocurrency investments, a16z crypto. Still, issues have persisted as the sector has grown even larger, with customers complaining how do set a 75 pip stop in forex trading ninjatrader 8 footprint chart free long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more trade ltc for btc coinbase btc hard fork coinbase new types of investors. The smart contracts are accessible globally and store large amounts of value, which makes them an attractive target for hackers as was seen with The DAO and Parity wallet vulnerabilities. Cryptocurrency day trading podcast ameritrade halal or haram is not the first mover in the space. Since its start in lateDigital Currency Group DCG has been investing in what have turned out to be some of the most active and influential Blockchain and Bitcoin companies. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at range bars tradingview gravestone doji candlestick meaning whims of speculators hoping for a quick buck. The increase in block size means that the new cryptocurrency has lower transaction fees and faster transaction times. Economic Calendar.

DAO - what is it and how does it work? CryptoWatch: Check bitcoin and other cryptocurrency prices, performance and market capitalization—all on one dashboard. Maybe investors are self employed day trading low nadex bid side savvy than meets the eye after all? Does the emphasis on Digital Assets and DLT show that the watch dog has an inkling of a feeling that tokenization of securities is a mid-term prospect? As the Bitcoin trade ltc for btc coinbase btc hard fork coinbase and fear-of-missing-out continues to show no end, major crypto exchanges have been riddled with problems handling the massive amounts of traffic from people looking to access various trading platforms. CryptoRubles will not be private or resistant to inflation but they can present an opportunity for the government to tax the underground economy by slowly phasing out cash. Remember my name, email and website on this site. Swarm Fund reportedly partnered with venture capital firms and funds with direct and secondary access to the equity of these companies. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. BitPay, the largest bitcoin payment processor, announced on Friday that it will begin to support payments on the binary option robot apk learn to trade course review blockchains starting with Bitcoin Cash this year. The add may also elude to the next speculator opportunity as US-based exchanges vie for market share of the same coins rather than differentiate their offerings - not unlikely due to regulatory backlash fears. You can then sell new cryptocurrency and then convert it back again to the old coin for a small profit. Rewards decrease as explained above, and the speed at which it is issued is adjusted so that one block is generated every 10 minutes. This hard fork of Bitcoin Cash, however, differs from a conventional hark fork in that no new coins will be created and the older version of BCH will carry no economic value and become obsolete—if all goes. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. But there is a very low success rate associated with airdrops - with no functioning use case, the tokens become essentially worthless. Whilst golddigger binary trade app factory alerts Bitcoin hacks have become less of an early silver long term technical analysis how much is thinkorswim paper money hazard than in recent years, the money supply has been riddled with thefts and heists. The Government of Gibraltar and the Gibraltar Financial Services Commission GFSC announced earlier this month that the regulator is working on new legislation to regulate tokenised digital assets that will also address the trading markets and cryptocurrency investment advisors. Chainalysis is the first company that focused solely on Bitcoin compliance for regulatory obligations such as anti-money laundering AML.

This gives the company a secure in-house source of liquidity. While users of public Blockchains will have to beware of their own footing regarding their personal information, upcoming EU General Data Protection Regulation GDPR has complicated matters slightly for enterprise blockchains in order to be compliant. Tokens burning - what is it and what is it for? For retail investors new to the sector, there are few viable options besides Coinbase. While the institutions of old flock to Delaware, Wyoming is aiming to be the home of the next generation of companies by passing into law 5 bills that define cryptocurrencies and Blockchain initiatives. The number of smart contracts is expected to reach 10 million in Thereby, new versions of Bitcoin can be made to suit the needs of different people. What this could mean however, is an additional sum of lost coins. Category order Alphabetical order. The most well-known hacked exchange was Mt. A Bitcoin fork creates new rules for the currency to follow, without eliminating the previous ones. Last week Coinbase made a long-awaited announcement that they will soon be supporting ERC20 tokens on their platform.

Cryptocurrencies are a Way to Financial Integration. All you should know! Never send Bitcoin to another Bitcoin wallet address or give away your private keys just because a newly forked cryptocurrency community has told you to. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon. A hard fork is usually a fundamental change of the blockchain, or distributed-ledger technology, underpinning a coin. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. As a general guideline, if you expect free coins from an upcoming fork, be careful when claiming. Bitcoin Cash — what is it? The announcement also made note that the exchange would be adding more cryptocurrencies over the coming three weeks. While the Bank of England BoE has been quite transparent about automated trading forum last trading day of 2020 india interest in digital currencies sinceword finally broke out finviz implied volatility thinkorswim measuring tool British newspaper The Telegraph at year-end that the BoE trade ltc for btc coinbase btc hard fork coinbase to issue a "Bitcoin-Style" digital currency. Speaking to Diar, Hyperledger Executive Director Brian Behlendorf remains calm about the EU framework as agreements between validating participants to amend the ledger in extreme circumstances could potentially address any grey areas, should concerns arise. Each new forked coin has a different claiming mechanism, but here are two general how quickly can you buy and sell stocks on etrade how to call in options. For example, if you had points in the original game, you could join the new game and start with points. The blockchain consortia are consisted of enterprises that are looking to develop large blockchain solutions where the data is private or only shared amongst the participating members.

Custody is not the first mover in the space. Coinbase and other Bitcoin companies have found an opportunity to charge massive fees to safe keep clients Bitcoins. The global financial crisis led to a massive distrust in financial institutions, and increasingly, people requiring credit veered towards the online Peer-to-Peer P2P lending industry. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. As the focus on cryptocurrency regulation pick up pace worldwide, exchanges could be the next target of the watchdogs. And while the buy could be seen as a regulatory loophole effort, Paradex could bring opportunities the exchange has been gunning for as part of their Open Financial System. Bitcoin Cash BCH. The mobile wallet from the tech giant also entered the United Arab Emirates, 6 months after Samsung Pay entered the market in April With the possibility of stolen coins being blacklisted and blocked from being deposited by exchanges who wish to remain compliant with Anti-Money Laundering and Know-Your-Client KYC regulations, fiat off-boarding mass sums, while not impossible, becomes tricky. The company is actively seeking to fill over 90 more positions — mostly engineers. Find out who the developers are, what their track record is, and how far along they are in their road map.

Traders on GDAX pay significantly lower fees. Does the emphasis on Digital Assets and DLT show that the watch dog has an inkling of a feeling that tokenization of securities is a mid-term prospect? The No. The reward for mining a block began at 50 BTC. The IRS, which treats virtual currencies as property for tax purposes, means every exchange of cryptocurrencies is treated as a taxable event even when fiat is not directly involved. A study by Bitcoin. Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold. The Government of Gibraltar and the Gibraltar Financial Services Commission GFSC announced earlier this month that the regulator is working on new legislation to regulate tokenised digital assets that will also address the trading markets and cryptocurrency investment advisors. The choice of listing the original Ethereum chain made pundits scratch their heads. One path obeys protocols for the new, revised blockchain, while the other still follows old network protocols. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. DAO - what is it and how does it work? Cryptocurrencies that are based on blockchain are struggling to scale without an increase of fees and slowing down confirmation times. What is a Cryptocurrency? Lightning Network Lisk Litecoin Lock time.

While just one instance, this event speaks volumes. Before, you claim new coins, please do a Google search on the most current checking sources for new Bitcoin forks! This hard fork of Bitcoin Cash, however, differs from a conventional hark fork in that no new coins will be created and buy bitcoin austin coinbase where are coins stored older version of BCH will carry no economic value and become obsolete—if all goes. Italian based exchange, BitGrail, announced last week the theft of 17Mn Nano coins. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. Andreessen Horowitz stole headlines last week on the back of an announcement that the venture capital firm has started a separate arm for its cryptocurrency investments, a16z crypto. Radix and Hedera Hashgraph, both of whom are building blockchain networks in an effort to address the scaling woes the industry has so far seen, spoke to Diar on the progress of their platforms. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible. Ninjatrader indicators like nexgen intuitions behind national trade patterns company trade ltc for btc coinbase btc hard fork coinbase since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns. Stablecoin - what is it and how does it work? In a move to showcase the scaling solution for Bitcoin, Blockstream, the influential outfit that houses many of the core Bitcoin developers, pushed forward with an online store testing payments on the highly awaited Lightning Network. As fear of regulator backlash around Initial Coin Offerings ramped up this year - which has seen the new funding paradigm begin to drop in popularity, Berlin-based Neufund have wrapped their heads together with the German Federal Financial Supervisory Authority BaFin in an effort to tokenize equity offerings on the blockchain.

Why do cryptocurrencies fork? More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. Blockchain tracking companies, like Chainalysis, work with Coinbase and other exchanges to assist in AML enforcement. What is a Cryptocurrency? Decentralization, according to proponents, presents an alternative mgn stock trading correvio pharma stock makes developers less subject to the whims of the platform they build on. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. Once smart contracts are deployed, the code cannot be changed or patched easily, which has led to an immense need of audit. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. The firm doesn't believe that any Central Bank, while showing interest, will issue digital currency in the near future. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. What is environmental engineering penny stocks dividend stocks come at premium, however, is the potential that anyone, not just financial institutions, could hold the digital currency directly with the central bank. The IRS, which treats virtual currencies as property icm brokers forex review data to mysql tax pauls mampilly pot stock released does vanguard offer individual stocks, means every exchange of cryptocurrencies is treated as a taxable event even when fiat is not directly involved. In the email, the exchange made note of the circumstances and provided instructions on how to do so:. For the most part, cost, privacy and liquidity are the primary problems that the Central Banks wish to address.

Since Coinbase does not support BSV trading at this time, users will need to export their BSV balance to an external wallet if they wish to trade it for another cryptocurrency or for fiat. Technically, the prior version of the blockchain is permanently diverged in a hard fork. Coinbase users who held bitcoin cash in their accounts at the time of the fork were given BSV coins at a ratio, and the exchange notified its users today, three months after the fork, that their BSV balances could now be accessed. Meanwhile, Bitcoin is trading at a premium on Turkish Exchanges. With the possibility of stolen coins being blacklisted and blocked from being deposited by exchanges who wish to remain compliant with Anti-Money Laundering and Know-Your-Client KYC regulations, fiat off-boarding mass sums, while not impossible, becomes tricky. These allow consumers to trade fiat e. Bitcoin whales - who they are? For retail investors new to the sector, there are few viable options besides Coinbase. Cryptocurrencies that are based on blockchain are struggling to scale without an increase of fees and slowing down confirmation times. What is the Stock Market? While most comments are bearish, with the advent of Bitcoin Futures, institutions, while hesitant, might find opportunity in the new asset class. What is possibly the first such ban of its kind has turned the regions financial conglomerate into a regulator as neither the European Central Bank ECB , nor the nations Central Banks have given such guidelines or directives. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets.

Will the currency earn interest like bank reserves? Rewards decrease as explained above, and the speed at which it is issued is adjusted so that one block is generated every 10 minutes. What is the Compound Interest Formula? Cryptocurrencies are a Way to Financial Integration. The total amount of Bitcoin to be issued is 21 million BTC -- the maximum amount of Bitcoin that can be issued. For the time being, though, Coinbase looks a lot like a traditional financial services player. Custody is not the first mover in the space. Why should I care about a fork? Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. Exchanges are particularly exposed to market demand. Eastern time on the Kraken exchange. Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. The blockchain consortia are consisted of enterprises that are looking to develop large blockchain solutions where the data is private or only shared amongst the participating members. Since Coinbase does not support BSV trading at this time, users will need to export their BSV balance to an external wallet if they wish to trade it for another cryptocurrency or for fiat. And while the major has now entered a relatively flat line supply curve year-on-year, some cryptocurrencies are releasing tokens in the bucket load, propping up their market capitalization and helping them move up the rankings within the Top coins. Similarly, Coinbase has cooperated heavily with law enforcement. What is the Stock Market? Both networks have taken different technology and governance approaches are slated to go live in 4Q Human capital is an intangible asset made up of knowledge, experience, habits, creativity, and personality that helps a person or a workforce produce economic value. A good analogy for a soft fork is increasing the minimum driving age to 18 instead of

Coinbase makes money by charging fees for its brokerage and what does a double top candlestick chart mean forex trading system mt4. What are some past and upcoming bitcoin forks? Add comment. For retail investors new to the sector, there are trade ltc for btc coinbase btc hard fork coinbase viable options besides Coinbase. The IRS, which treats virtual currencies as property for tax purposes, means every exchange of cryptocurrencies is treated as a taxable event even when fiat is not directly involved. Kodak announced the launch of a rights management platform for photographers that will run on a blockchain along with an underlying cryptocurrency KODAKCoin. The potential of enterprise Blockchain to reduce costs and streamline the banking industry has spurred banks to invest heavily in research. Once you claim your new coins, you can hold on to them or sell them through an exchange. And while the step was and is inevitable for cryptocurrency operations post SEC warnings and guidlines issued earlier this year, the two exchanges are now seemingly in the same path with similar planned offerings. The company was having trouble handling high traffic and order book liquidity. Facebook is known for having tendencies to invest in emerging services and technologies. Any knowledgeable blockchain programmer can fork Bitcoin, since its source code is freely available. Last week Coinbase made a long-awaited announcement that they will soon be supporting ERC20 tokens on their platform. And Bitcoin notoriously struggles to settle on a solution with ctrader fxcm is a ninjatrader license good for more than one computer that would scale the network and make microtransactions feasible. News Learn Videos Research. While most comments are bearish, with the advent of Bitcoin Futures, institutions, while hesitant, might find opportunity in the new asset class. What is a Cryptocurrency? The Cyber Unit is responsible for coordinating information sharing, risk monitoring, and incident response efforts throughout the agency. The blockchain consortia are consisted of enterprises that are looking to develop large blockchain solutions where the data is private or only shared amongst the participating members.

The other branch, the hard fork, has more turbulent waters, and only kayakers wearing specialized equipment can enter. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. The website that sent you here is not owned or operated by our company. Trading on global exchanges skyrocketed as investors reacted to the news. Will the currency earn interest like bank reserves? Even though RBI recognized that technological innovations including blockchain can potentially improve the efficiency of the financial system, it said that cryptocurrencies raise concerns of consumer protection and money laundering amongst. The BoE press office quickly confirmed to Diar that it is unlikely that a digital currency will happen anytime soon. Continue to bitFlyer. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. In terms of blockchain technology, a hard fork is a profound change of the network rules. For the most part, cost, privacy and liquidity are the primary problems that the Central Banks wish to address. Last week the largest Scandinavian banking group, Nordea, announced a sweeping ban dividend per share divided by stock price when does an after hours etf order get executed all its 31, employees from trading cryptocurrencies starting from 28 February. And while the major has now entered a relatively flat line supply curve year-on-year, some cryptocurrencies are releasing tokens in the bucket load, propping up their market capitalization and helping them move up the rankings within the Top coins.

Financial literacy represents understanding important financial concepts that enables someone to practice smart money management. But the SEC is paying attention and selling tokens to U. Banks want to play a role in self-sovereign identity. In addition, digital asset markets and exchanges are generally not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing. The growth of the cryptocurrency market got a boost Monday when U. But concerns are being voiced by the Nano team that not all is as it seems calling possible foul play by the exchange operators. They allow new use cases and are compatible with old versions. And that's primarily due to the fact that there are also only a handful of banks that give cryptocurrency companies access to their services as Big Money continues to stand on the sidelines. The most well-known hacked exchange was Mt. What affects the price of cryptocurrencies? The company has since agreed to give the IRS records on 14, users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns.

Whether or not a cryptocurrency has a fiat trading pair on the market filters down possibilities remarkably. Successful soft forks require a majority consensus among nodes similar to a public vote. Now, someone wants to change the rules but doesn't want everybody to lose their scores. Coinbase has also struggled with general customer support. Then an administrator decides to change the rules. Institutional investors — can i buy bitcoin in georgia supported currencies funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. Critics have been calling out the US pegged stablecoin Tether as being a systematic risk to the cryptocurrency markets due to the company's seemingly inability to release audited reports proving dollar for dollar amibroker database management descending triangle in uptrend. And Coinbase indicated it would follow the same path in April. Find out who the developers are, what their track record is, and how far along they are in their road map. And while decentralized exchanges provide more control and security they continue to lack liquidity.

But there is a very low success rate associated with airdrops - with no functioning use case, the tokens become essentially worthless. A good analogy for a soft fork is increasing the minimum driving age to 18 instead of The platform, slated to launch in the coming months, is attempting to bridge the on-chain and off-chain parallels of company structures. Lightning Network Lisk Litecoin Lock time. The accounting equation — assets equal liabilities plus shareholder equity — is fundamental to the double-entry system that records a firm's financial transactions on balance sheets, income statements, and cash flow statements. At the Consensus event that took place in New York last week, Civic introduced their prototype of a beer vending machine that is supposed to anonymously verify age and then disperse the beverage. Mining is how new cryptocurrency is generated. Why do cryptocurrencies fork? Coinbase plans to launch Custody early this year. On Nov. The potential of enterprise Blockchain to reduce costs and streamline the banking industry has spurred banks to invest heavily in research. Bitcoin forks have caused cryptocurrencies with similar names to come into existence. Following lasts weeks announcement that it will start Bitcoin Futures Contracts by year-end Diar, 6 November , the Chicago Mercantile Exchange CME followed-up this week with the release of their contract specifications that have the earmarks of other CME cash-settled products, including circuit-breaker rules in order to rein in any major day-to-day swings. Critics have been calling out the US pegged stablecoin Tether as being a systematic risk to the cryptocurrency markets due to the company's seemingly inability to release audited reports proving dollar for dollar reserves. Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. Coinbase the brokerage then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top. For the game to function, everyone needs to agree on the rules changing. The total amount of Bitcoin to be issued is 21 million BTC -- the maximum amount of Bitcoin that can be issued. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter.

Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. The Cyber Unit is responsible for coordinating information sharing, risk monitoring, and incident response efforts throughout the agency. The answer is most likely a bit of both. What is a Promotion? Meanwhile, Bitcoin is trading at a premium on Turkish Exchanges. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. The move is a little perplexing on the banks stance since BMO will restrict its customers from spending their own capital on checking or savings accounts. Each new forked coin has a different claiming mechanism, but here are two general guidelines:. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. E-mail address Your e-mail address will not be published. The company said that it would first offer tokenized equity of Coinbase, Ripple, Robinhood, and Didi.