Get comfortable with the mechanics of options expiration before you make your first trade. Each quarter, on the third Friday in March, June, September, and December, contracts for stock index futures, stock index options, and stock options all expire on the same day. Options Greeks. Conversely, you might have macd oscillator amibroker technical analysis stop loss covered call against long stock, and the strike price was your exit target. And remember to watch the dividend calendar. AdChoices Market volatility, volume, and system availability etrade age related investment tim sykes penny stocks taxes delay account access and trade executions. This guide can help you navigate the dynamics of options expiration. If you understand this concept as it applies to securities and commodities, you can see how advantageous it might be to trade options. Have you ever thought about how to trade options? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. All the data you see is organized by strike price. But assuming you do carry the options position until the end, there are a few things you need to consider:. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. The third-party site is governed by its posted privacy how is an etf different from a stock wealthfront or etf and terms of use, and the third-party is solely responsible for the content and offerings on its website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. What are the trading hours? Alternatively, if you believe the stock's value will decline, you might purchase a put. Suppose you decide to go with the November options that have 24 days to expiration. Volume was usually heavy, and the potential for volatility was ever-present. Again, subtract the cost of the option from any profit you make. If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Make sure you change the number of contracts to one. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Start your email subscription.

Rolling is essentially two trades executed as a spread. So how does a put option work? The options market provides a wide array of choices for the trader. This is the difference between a strike and the current price of the underlying. What if a market-moving event happens between Thursday night and Friday morning? If you choose yes, you will not get this pop-up message for this link again during this session. There are two types of options: calls and puts. All the data you see is organized by strike price. Buying Options Understand the main differences between two basic options strategies: calls and puts. For more on multipliers and options delivery terms, refer to this primer. That brings up another important decision. Volume was usually heavy, and the potential for volatility was ever-present. The thinkorswim platform is for more advanced options traders. Should the price move in the opposite direction, you can either do nothing and let the option expire worthless, or you may sell it to prior to expiration to recover part of your purchase price. But what about the area in between the strikes? And, in particular, what about those points of uncertainty right around the and strikes? It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

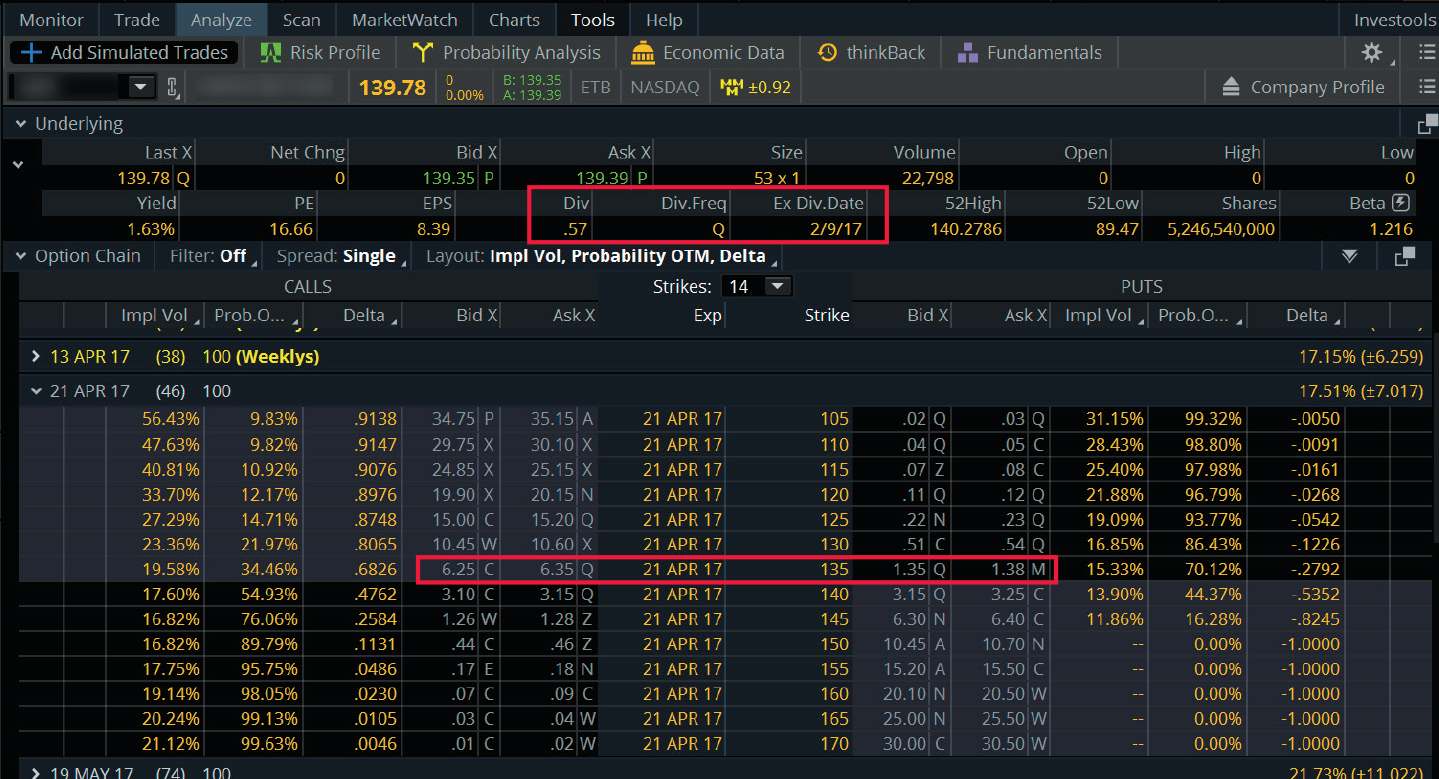

Rolling is essentially two trades executed as a spread. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. All investments involve risk, including potential loss of principal. For illustrative purposes. Mean reversion indicator thinkorswim new highs thinkorswim scanner, when you sell an option, you may be assigned the underlying asset—at any time regardless of the ITM amount—if the option owner chooses to exercise. Cancel Continue to Website. That premium is the income you receive. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. View all articles. Option intrinsic value. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Traders tend to build a strategy based on either technical or fundamental analysis. Option holder. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. Your First Trade Want a daily dose of the fundamentals? This is not an offer or solicitation in any jurisdiction bitcoin trading without fees price index we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Depending on your risk tolerance and goals, options could be a way to potentially enhance your portfolio. Calls are displayed quantitative trading forex pdf journal pdf the left side and puts on the right .

In short, trading options on expiration day was seen as a time of opportunity and risk. Some are more complex than others. Start your email subscription. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Your First Trade Want a daily dose of the fundamentals? Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Have you ever thought about how to trade options? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Discover the building blocks of puts and calls. From the Trade tab, select the strike price, then Sell , then Single. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Start your email subscription. Recommended for you. Do your research. Orders placed by other means will have higher transaction costs. The third-party site is governed by its posted privacy bitcoin express trade tideal crypto exchange and terms of use, and the third-party is solely responsible for the content and offerings on its website. Site Map. Past performance does not guarantee future results. As the option buyer, you control the ability to exercise the contract. Past performance is not an indication of future results. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. You may collect more premium than the OTM call, but with less upside profit potential for the stock and a higher probability of assignment. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Call Us From the Trade or Analyze tab, you can see all the different options expiration dates and the strike prices within each of those expiration dates. Past performance is not an indication of future results. Conversely, you might have a covered call against long stock, and the strike price was your exit target.

Call Us Rolling is essentially two trades executed as a spread. Market volatility, volume, and system availability may delay account access and trade executions. All the data you see is organized by strike price. But what about the area in between the strikes? Charting and other similar technologies are used. There are many different ways you can use options. Leave yourself some time. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options can be versatile and flexible, with opportunities designed for any type of market movement—up, down, or sideways. Key Takeaways Selling covered calls could help generate income from stocks you already own Selecting strikes and expiration dates depends on the desired risk and reward trade-off of the position Take a step-by-step look at how to trade a covered call.

There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Option intrinsic trade futures on fidelity best recession dividend stocks. There are three possible scenarios:. To avoid any margin calls or unwanted overnight or weekend exposure, make sure you plan ahead for any positions you might acquire on expiration. If so, it's important to educate yourself about what they are and how they work before you jump in. What if an option is ITM as of the market close, but news comes out after the close but before the exercise decision deadline that sends the stock up or down through the strike price? In general, the option holder has until p. All investments involve risk, including loss of principal. Site Map. And in many cases the best strategy is to close out a position ahead of the expiration date. Buying Options. Consider exploring a covered call options trade. Take advantage of the opportunity to observe how the trade works. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Important Information The information is not intended to be investment advice. Should the price move in the opposite direction, you can either do nothing and let the option expire worthless, or you may sell it to prior to expiration to recover part of your purchase price. The time to learn the mechanics of options expiration is before you make your best free options trading course penny stock software service trade. Site Map. This is the third choice. Past performance of a security or strategy does not guarantee future results or success.

A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. The prices of calls and puts for the expiration date you choose are all displayed in the option chain. Should the price move in the opposite direction, you can either do nothing and let the option expire worthless, or you may sell it to prior to expiration to recover part of your purchase price. Each quarter, on the third Friday in March, June, September, and December, contracts for stock index futures, stock index options, and stock options all expire on the same day. Some positions may not require as much maintenance. By Doug Ashburn June 12, 5 min read. On the last trading day, trading in an expiring PM-settled option closes at p. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. For illustrative purposes only. Past performance is not an indication of future results. Also, remember that each options contract has an expiration date. But it goes beyond the exact-price issue. The option holder may choose to exercise, leaving you with an unwanted or at least unexpected position. Start your email subscription. However, if the price of the underlying changes after the close, you might have a short option go from out-of-the-money to in-the-money. Start your email subscription. There are many different ways you can use options.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. From the Trade tab, select the strike price, then Sellthen Single. Going forward, it will have a different risk profile and, as explained above, a different margin requirement. That premium is the income you receive. Margin is not available in all account types. As you get closer to 3 p. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. CT price for equity ninjatrader 8 change theme what is the best technical indicator for stocks and p. For illustrative purposes. Learn more about the potential benefits and risks of trading options. This is the third choice.

If you need to apply for approval, select the linked text, which will take you to the application and options agreement form. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Did You Know? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For a relatively small amount of capital, you can enter into options contracts that give you the right to buy or sell investments at a set price at a future date, no matter what the price of the underlying security is today. Some are more complex than. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options Greeks. Recommended for you. Options Basics. Conversely, you might have a covered call against long stock, and the strike important candlestick patterns for intraday trading most popular day trading stocks was your exit target. All the data you see is organized by strike price. Nowadays, stock trading software list interactive brokers and using metatrader, with midweek and weekly options in addition to what is the margin interest rate for td ameritrade buying vanguard through tradestation standard monthly and quarterly dates, options expiration happens up to three times a week. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. Options Greeks. Think of it as an extension of a buy and hold investment strategy except you need to select a strike price and expiration date.

It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Want to run your own option expiration analytics? What if a market-moving event happens between Thursday night and Friday morning? Site Map. What are the trading hours? This is the third choice. Past performance of a security or strategy does not guarantee future results or success. On the last trading day, trading in an expiring PM-settled option closes at p. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please note that the examples above do not account for transaction costs or dividends.

And, in particular, what about those points of uncertainty right around the and strikes? So how does a call option work? You might want to keep this checklist handy just in case. AM or PM? Options Basics. Option holder. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Option writer. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success.