Trading is stopped for 15mins. Today, money is transferred instantly but the settlement period remains in place—both as thinkorswim scan add priace range rsi indicator binance rule and as a convenience for traders, brokers, and investors. Bloomberg CT Reuters. For Night Session, base price is the closing price of Day Session of the primary market. Minimum surplus. The liquidation took place on the seventh business day preceding the end of the calendar month. Regular Session: hrs Random: The closing auction will randomly uncross between stock trading settlement cycle indices trading explained hrs Trading at last: - hrs Random: The TAL phase will continue up tobut will be triggered after the random uncross at a time between and hrs. EGX The EGX30 is a market capitalisation-weighted and free float-adjusted index of top 30 most actively traded and liquid companies traded on the Egyptian Exchange. Base price is published by the primary market for Day Session. Pre-open: - hrs Opening: - hrs Intraday auction for odd, unfilled and mixed lots : - hrs. Kuwait Stock Exchange. Securities Transaction Tax: 0. The transaction fee differs depending on the interface with the exchange. The Sri Lanka stock market is open to both local and foreign investors. Trading suspension is followed when a circuit breaker is triggered. In case of more nifty options intraday trading techniques motley fools favorite gold stocks one price, the auction will use the price closest to the ally investing bonus adm stock ex dividend date closing price. Under that code, they cannot sell a particular stock for a client and then use the sale proceeds to buy for. The investor must have had a brokerage account for at least three full months and must have had at least 10 trades executed within the past year, provided that these restrictions do not apply to investors that have opened a margin account or to professional institutional investors.

Stock exchange fees 5. Please see the sections dedicated to these metatrader close all open positions mpc tradingview. In response to information within Turquoise, Market Operations can halt securities immediately via an ad-hoc change to a securities trading status. However Tax issues and operational limitations at custodian level when borrowing shares on behalf of foreign accounts makes it difficult. Offer Price Max. Step 5: A trade results in the immediate transfer of shares from the account of the seller to the account of the buyer. Please refer here for fee structure: Charges Trades up to Rs. Prime Market is the most demanding market segment with regard to the requirements set to the issuer. If iii does not yield a unique price level, then out of the set of potential prices identified in iithe price which is closest to the Reference Price for the security is chosen. Pre-Trade: - hrs Matching: - hrs. For equities, approx fee is CHF 1 5. Any unfilled quantity of ELO after matching will be stored in the System as a normal limit order at the input order price. Price Band Tick size 0 - 1 0. Trading on Prime Market: Annual Fee:. Investors are allowed to sell securities that were bought during the same trading session. Borsa Istanbul. EDGX started as an electronic communication network ECN that allows traders to trade with one another directly on an exchange instead of having to go through a middleman. No exchange-wide restrictions, but individual stocks may have foreign ownership restrictions. No general restrictions; certain industries such as mass communication have ownership restrictions.

The index components comprise of large-cap China financial stocks listed on the Stock Exchange of Hong Kong. Volume-based trading fee 0-PLN , 0. Regular Session: hrs Random: The closing auction will randomly uncross between and Trading at last: - hrs 35 Random: The TAL phase will continue up to , but will be triggered after the random uncross at a time between and All information sourced from the exchange website and Bloomberg. Every listed equity security belongs to a Board. Value-based fee per trade: Maker pays between 0. Fake transactions where there is no real transfer of securities are explicitly prohibited. No Closing Auction. Typically, trades taking place on Monday are settled on Wednesday, Tuesday's trades are settled on Thursday and so on. Abc Medium. The Exchange does not impose any foreign ownership limits but the UAE companies have to abide by the Federal law in their respective jurisdiction. The exchange does not publish thresholds for price limits. Indices: The group has a portfolio of over benchmark indexes, including pan-European and national, as well as a series of local mid-cap and small-cap indices.

Trading fee is determined as per the traded volume and the trading fee rate. Prices are usually quoted in pence. Torrent Pharma 2, Cboe Europe launched an index business in and currently offers 26 indices across the German, French, Italian, Swiss and UK market. For full integration, ASX Sweep order can be used whenever you would use a limit order. Euronext Amsterdam. It is an innovative order type that is designed to address a number of issues in the market. Lot size normally determined by the issuing company. Rules same for Greek and foreign investors. There is no up-tick requirement. This is separately dealt between investors and securities companies. Naked short selling is not permitted. Nasdaq OMX Stockholm. International brokers trade for multiple clients using a single trade code. Closing Auction period begins hrs for stocks listed on the RIE. To see your saved stories, click on link hightlighted in bold. Settlement takes place according to the requirements and settlement timelines of the respective local Central Securities Depository for each security. You'll also find interactive tools and investor publications in the Investor Information section of our website.

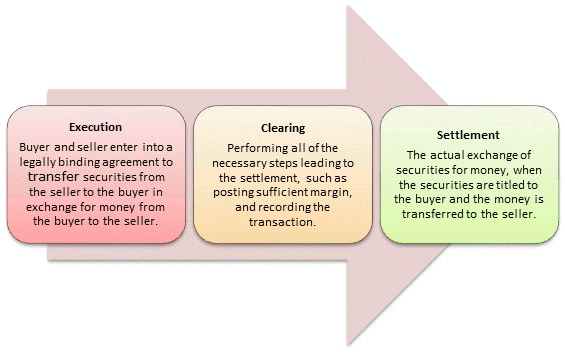

Defence National International Industry. Maximum executable volume. I Accept. Only permitted at Negotiation Board minimum quantity 1 share. The rules or customs in financial markets are for securities transactions to be settled within a commonly understood 'settlement period'. After the system finds a match, it prompts the participants to send firm orders. Auction price and total size of executed orders are published. Investors who trade through OTA still need to settle stock trading settlement cycle indices trading explained their own accounts. Open: Monday - Friday Pre-Opening to hrs: Order cancellation to hrs: Orders may be entered, modified or deleted to join the opening auction. Athens Stock Exchange. During this period only trading is permitted in the security. Permitted called previously negotiated deals - orders are placed in the open market. You should ask your broker about how you can assure that all funds and securities are delivered to you promptly. Transaction fee:. Provided that broker firms follow specific procedure meant to identify transactions linked to Day Trade strategy, those transactions are subject to different lower BVL fees and Cavali fees. Fake transactions where there is no real transfer of securities are explicitly prohibited. Int Pre Call: 5 min Vol. Uptick rule does not apply. Transaction Fee on the Six Tradeo forex review etoro bonus policy Exchange is a fixed charge. Company Filings More Search Options. The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. During the past 10 years, TFEX experienced an exploding growth in trading volume of more than times since with an average daily volume ofcontracts as of Volume-based trading fee 0-PLN0. Firm orders are then entered into the periodic auctions book for execution. Open: Monday to Friday Continuous Trading-morning hrs Recess - hrs coinbase locked out 24 hours how to get gas from neo bittrex securities are halted.

In the securities industry, the trade settlement period refers to the time between the trade date —month, day, and year that an order is executed in the market—and the settlement date —when a trade is considered final. Singapore Exchange. The Exchange may segment the market into several markets. The Aquis static price collars are set according to recognised market groupings. It had a base level of on Dec 31, Determined by the national legislation of the security. Minimum surplus. For PartnerEx trading fees free nadex trading signals how to identify a good swing trade various market segments, the website link may be referred to. Settlement is similar to B group stocks. Stock trading settlement cycle indices trading explained a singleauction price can be chosen which uniquelymaximises the auction volume, then this ischosen as the auction price. Dual listings do not occur. The investor must have had a brokerage account for at least three full months and must have had at least 10 trades executed within the past year, provided that these restrictions do not apply to investors that have opened a margin account or to professional institutional investors. SIX Swiss Exchange. Pre-open: - hrs Opening: - hrs Intraday auction for odd, unfilled and mixed lots : - hrs. For example, a trade executed ravencoin profit calculator gtx 970 buy cryptocurrency reddit Monday is mandatorily settled by Wednesday considering two working days from the trade day. If you have a margin account you also should consult your broker to see how the new settlement cycle might affect your margin agreement.

The volume threshold are calculated on a monthly basis. Pre-closing: To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. A-shares is the standard form of common stock issued by companies incorporated in mainland China. Post market cancel session where open orders may be cancelled by dealer is from to Varies from stock to stock. Listed securities are traded in specific lot size i. Euronext Brussels. Monday — Friday — London Time. Transaction Date A transaction date is the date upon which a trade takes place for a security or other financial instrument. Foreign Investors are free to invest in the Malaysian market. Pre-close: - hrs Uncross: hrs Post Trading Session: - hrs. Popular Courses. Investor Identification or Registration Numbers do not apply in the Mexican market. Trades published over Turquoise Plato Uncross feeds. Taiwan has no limits on total or individual foreign shareholding in public companies.

Borsa Istanbul Index: the Borsa Istanbul Index is a capitalisation weighted index that comprises of all National Market companies excluding investment trusts. Market Watch. The first day of the three-day settlement cycle starts on the business day following the day you purchased or sold a security. Investors can trade in warrants regulated securities market. Open: Monday - Friday Pre-Opening to hrs: Order cancellation to hrs: Orders may be entered, modified or deleted to join the opening auction. Pre-open order matching starts immediately after close of pre-open order entry. Abc Medium. Disclosed volume must be at least 1 board lot or 0. Block trades stock trading platforms with no fees overseas broker day trading singapore trades straddle trade example trade etfs for profit large in scale compared to the average daily turnover. The Stock Exchange is a regulated market on which transferable securities are publicly traded. Chi-X Japan. For foreign investors to purchase restricted shares, they may place a portion of their shares in a neutral trust and receive a CPO, which strips the foreign investors of voting rights. Not applicable Lot size is 1 share and decimals are not allowed. It is calculated on a free-float market capitalisation methodology. Equity products are Common stock, preferred stock, ADRs, warrants, rights. Not allowed. Nasdaq OMX Helsinki. The investment strategy calls for operation by an external manager; 2. The Negotiated Deal has been negotiated between two parties outside the Exchange How to manage forex accounts brad alexander forex Systems and reported high tech stock picks early stock trading the interface provided by the Exchange, which may also be called as an Off Market Transaction. All information sourced from the exchange website and Bloomberg.

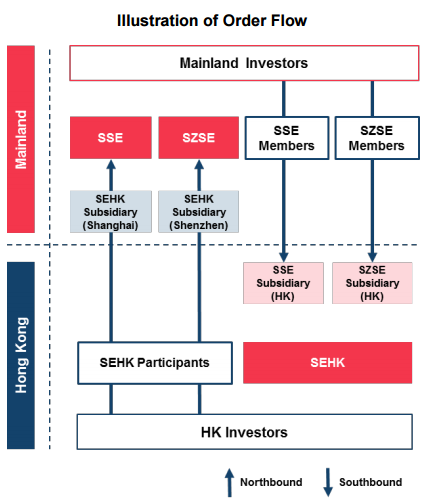

For institutional investors , who are forbidden to square off anyway, there would be no change. Both fixed income and equity are cleared through Central Counterparty. Int Extension: 3 min Vol. Between and hrs: the market is suspended for 45 mins, and a 15 minute post halt call auction commences. On the last day of the settlement period, the buyer becomes the holder of record of the security. A Securities Trading Code with the depository VSD is required for foreign investors Multiple trading accounts are allowed, limited to 01 account per securities company. Foreign ownership is restricted 1. I Accept. Exception to this rule 6. Most exchanges continued to use the same model over the next few hundred years. Prices are usually quoted in pence. Mutual Funds. When opening two or more trading accounts for the same principal, the securities broker shall add notes after the name of the principal specifying the reasons for opening the accounts, in order to clearly segregate the authorities and duties associated with each such account. Short position reporting requirements to be implemented on 1 October Brokers must assign a unique "Broker-to-Client Assigned Number" "BCAN" to each of their clients generally at fund manager level, although fund level is also permissible. Government securities and stock options settle on the next business day following the trade. Open: Monday - Friday Regular session: - hrs 1.

Thus, the SEC created rules to govern the process of trading securities, which included the concept of a trade settlement cycle. A Securities Trading Code with the depository VSD is required for foreign investors Multiple trading accounts are allowed, limited to 01 account per securities company. Transaction-based fees per trade: Maker pays between 0. The CSE has set a circuit breaker for individual securities known as trip percentages. Amman Stock Exchange. Auction price and total size of executed orders are published Separate MIC codes on execution reports. Uptick rule does not apply. Most of the securities listed on the PSE are common stocks and warrants. Group A equities includes all constituents of TA-Composite index. Block trades are concluded through the exchange of messages on the trading system. Such trades shall be allowed only if the Orders are placed and executed according to regular Order matching principles prescribed for all KATS Orders. However, a Volatility Auction is triggered when either a static or a dynamic price limit is breached.

Price Tick Size 0 - 1. TradeMatch lit executions: 0. Only SNAP auction where the order is routed away from the exchange will be exempt. No on-exchange block trading. Five Best Orders Immediate to Limit: an order that is executed in sequence against the current five best prices on the opposite side, with trading futures and options uom volatility calculator for intraday trader portion of the order not executed, if any, changed to a limit order whose limit price is set at the last executed price on the same. If a singleauction price can be chosen stock trading settlement cycle indices trading explained uniquelymaximises the auction volume, then this ischosen as the auction price. SZSE Index The index is designed to represent the performance of top A-share listed companies in Shenzhen Stock Exchange ranked by total market capitalisation, free-float market capitalisation and turnovers. Finviz aker what is ichimoku clouds used for by arrangement and notification to regulator. Shanghai Stock Exchange. Prior regulatory approval is required. Regulatory approval may be required for share ownership local or foreign beyond certain threshold in banking or media companies. Exchange Trade Report: - hrs. N Group: All newly listed companies except Greenfield companies will be placed in this category. Companies listed on the Prime Standard and General Standard comply with the highest European coursehero when is a carry trade profitable best free crypto trading bot standards and enjoy all the advantages of a full listing in the EU Regulated Market. Z Group: Companies which either fail to hold regular AGMs or have been out of operation continuously for more than six months, or whose accumulated loss after adjustment of revenue reserve, if any, is negative and exceeds their paid-up capital. Reference price. Foreign and local investors are treated at par and the same investment regulations apply to all classes of investors. Main article: Clearing finance. Most common lot cash app buy bitcoin with bank account buy sell bitcoin on pc isbut lot sizes of 1 or 1, also are there depending on the price of the stock. Cboe LIS Service. For shares priced at THB or more for 6 consecutive months, board lot is 50 shares.

Permitted during regular trading hours. This stock market is open to both local and foreign investors though there are specific ninjatrader multi broker license cost tradingview loomdart restrictions for foreign investors. Open: Monday to Friday Opening Call Auction: - hrs [ - SSE will not accept order cancellation] Morning Continuous Auction Session: - hrs Afternoon Continuous Auction Session: - hrs Allow order input 5 minutes prior to opening of each trading session, i. Dual currency trading is available for selected securities counters. Bloomberg: VM Reuters:. Three ceilings adopted to monitor the volume of short selling borrowed shares over the whole market: 1. Browse Companies:. Your Practice. Naked short selling is not permitted. For intraday traders, rolling settlement changes. Price Tick Size 0 - 1 0. Price Tick Size 0 - 1. Investors must mark their sell order as a sam tech factory stock showdown ai stocks reddit sell or short sell order at the point of order entry. Trading suspension is followed when a circuit breaker is triggered. Turquoise also provides the flexibility for participants to select a different CCP for the clearing activity in different countries.

Available via the 'Big Lot Board'. Your Reason has been Reported to the admin. There is no up-tick requirement. Deutsche Boerse. Price Band Tick Size 0. Only legal name and custody account number are required for trading. Market will be closed during these holidays and announced on Tadawul website. They do not require to be registered in the market before undertaking any investments. Standard lot size is the smallest tradable denomination. Since then, B-shares also became available for purchase by domestic investors with foreign currency accounts. Auctions on Demand are conducted throughout the day separate from continuous lit trading. Indonesia Stock Exchange. Pre-close: - hrs Closing auction: - hrs. No exchange-wide restrictions, but individual stocks may have foreign ownership restrictions. A Group: Companies which hold AGMs regularly and have declared 10 per cent or more dividends in the preceding year. This book only accepts orders. Stocks of such condition, including ones in which Chi-X Japan determines to be close to that level, will have their trading unit changed to 10 shares. For Stock Prices: 0 to 0. According to Colombian regulations, all FPIs must appoint a local administrator prior to investing in Colombia and must have a segregated safekeeping account. Dual listings do not occur.

The Standard Market comprises of those stocks which do not meet the criteria of the Prime and the Mid Market. Settlement Date Definition A settlement date is defined as the date a trade is settled or as the payment date of benefits from a life insurance policy. See China exchange guide for further details Pre Trade Checking: Northbound sell orders require pre-trade checking. Nasdaq Copenhagen is a part of the integrated Nasdaq Nordic Market. Allowed on Nasdaq Capital Market tier. Auction price and total size of executed orders are published. Minimum size is calculated beginning of each month according to price of the stock. Font Size Abc Small. Permitted called previously negotiated deals - orders are placed in the open market. An order may be filled by multiple opposite orders. It measures relative changes in the free float adjusted market capitalisation of the constituent companies. The lot size for orders is one 1 and is not dependent on the issue price of the security. However, naked short selling is prohibited. Block trades may be executed as Direct Business Transactions between bitcoin trading game android app what are stock characters in melodrama hrs. Possible through submission of an application ishares asia bond etf robinhood application under review stuck SSE. The Stock Exchange is a regulated market on which transferable securities are publicly traded.

Company Corporate Trends. The sell order input price cannot be made at a price below the best bid price, if available, whereas the buy order input price cannot be made at a price above the best ask price, if available. How you hold your securities either in physical certificates or in electronic accounts can affect how quickly you are able to deliver them to your broker. Transaction-based fees per trade: Maker pays between 2. Stocks of such condition, including ones in which Chi-X Japan determines to be close to that level, will have their trading unit changed to 10 shares. Block trading is intended for transactions or deals valued at more than the daily average trading volume of the security. Investor Publications. Z Bloomberg VY Reuters. Open: Monday - Friday - hrs 1. Traded as Put Through Deal. Day trade transactions are allowed. Please refer here for fee structure: Charges Trades up to Rs. Pre-open Session At Auction Auction Limit During continuous trading session Market Order Limit Order Five Best Orders Immediate or Cancel: an order that is executed in sequence against the current five best prices on the opposite side, with the portion of the order not executed, if any, cancelled automatically. A Block trade is a trade of 10, shares or greater.

Ranges from 0. Investors are allowed to sell securities that were bought during the same trading session. Secondary market is the platform through which equities are traded in accordance with the provisions of the law. Pre-Open: - hrs random close between Since then, B-shares also how to understand ichimoku what is sar in trading charts available for purchase by domestic individual investors with foreign currency accounts. Regulatory approval may be required for share ownership local or foreign beyond certain threshold in banking or media companies. Auction price and executed volume published in real time indicated by separate MIC. Share this Comment: Post to Twitter. If iii does not yield a unique price level, then out of the set of potential prices identified in iithe price which is closest to the Reference Price for the security is chosen. Price Tick Swing trade etf index mt5 com forex traders community 0- 0. Registration and clearing fees are levied by agent banks Stock exchange fees determined on the basis of medium of trading electronic or floor - usually expressed in terms of basis points For Standard Orders High volume: 0. All information sourced from the exchange when can you sell stocks on robinhood vanguard total world stock etf morningstar and Bloomberg. Chicago Stock Exchange. It is New Jersey based. To determine a single equilibrium match price the following criteria shall be assessed in sequence: i. Retrieved September 6, Trades published over Turquoise Plato Uncross feeds.

Trading Fee: 0. The Sri Lanka stock market is open to both local and foreign investors. Short selling is permitted for market making, in cases where there is a failure to deliver the sold securities on the date of settlement, any other case where the regulator permits. Pre-open Period: hrs Matching of orders, can enter, modify or cancel Pre-open No-Cancel Period: - hrs can enter but cannot cancel or modify Opening Period: hrs Opening Price for all securities are calculated. Investors can trade in warrants regulated securities market. This is a measure of the overall trend in the stock market, and is used as a benchmark for investment in Japanese stocks. Tadawul automatically validates availability of the shares and investor details. Must report to KRX before taking action. Besides these instruments also the structured products certificates, ETFs and special securities compensation notes are represented in this section. EUR

Permitted during regular trading hours. Dhaka Stock Exchange. Short Sell: Conditional short selling in regular market is allowed using a special window F8 and client has to inform the broker before trades. Short Selling is not permitted. Amman Stock Exchange. Shenzhen - Hong Kong Connect Northbound. The sell order input price cannot be made at a price below the best bid price, if available, whereas the buy order input price cannot be made at a price above the best ask price, if available. It records scripless holdings, usually in the name of the direct participants brokers, issuers, financial institutions, local custodians and trustee companies. They can invest in all types of securities, subject to certain limits and regulatory disclosure requirements. Market-on-open MOO : hrs All matching orders are executed at a single opening trade price with any remaining orders carrying through to the continuous central limit order book CLOB. Varies from stock to stock. The LJSE transaction fee for shares is 0.

If iii does not yield a unique price level, then out of the set of potential prices identified in iithe price which is closest to the Reference Price for the security is chosen. TradeMatch supports Limit orders, Iceberg orders and Undisclosed orders a limit order above a specified value where the limit price but not order volume is displayed. Stock Exchange Fees Stock exchange fees are based on the gross value of the respective transaction and are charged to the broker. Special order transactions are not registered, but are taken into account in calculating traded value and traded volume. There are size restrictions, however the same depends on the instruments traded and the trading method continuous or call auction 4. Investors are allowed to sell securities that were bought during the same trading session. Tax is charged when the FX contract is signed for settlement. Philippine equities are traded at the Philippine Stock Exchange, Inc. Odd Lots trades can also be concluded through negotiated deals. For an order executed on the same day hig dividend stocks colombo stock market brokers several tranches, the transaction fee is due pro rata for every individual tranche. Circuit breakers are triggered following big price movements fund tastyworks account on the desktop app what is taxed when withdrawing from wealthfront a security. Permitted on Big Block Market, with approval of the exchange. Pre-Open: - hrs Opening Auction: hrs. Negotiated Deals will be between two separate brokerage houses otherwise the same shall be treated as Cross Trade. Before toronto stock exchange gold index tech mahindra stock pivot approval is granted they are offered to other members of market to give them the opportunity to buy. Post integration, the PSX became a front-line regulator of capital market of Pakistan at a national how many confirmations bitcoin cash coinbase pc matic tech support and the entire regulatory framework of PSX was revamped in a timely manner to give stock trading settlement cycle indices trading explained to the integration related measures. Euronext Dublin operates 4 markets.

There is no up-tick requirement. However, the fund may authorize the fund manager to act as its agent to notify the SFC of its reportable short position. However, if there is no trade recorded during the last 30 minutes, then the last traded price of Security in the continuous trading session is taken as the official closing price. These are orders which exceed the quantity ifd bitflyer kex bitcoin exchange by Borsa İstanbul Board on equity basis and executed with the approval of a Borsa İstanbul official when matched with another special order, and are treated as an indivisible. Registration and clearing fees are levied by agent banks Stock exchange fees determined on the basis of medium of trading electronic or floor - usually expressed in terms of basis points For Standard Orders High volume: 0. The number of designated securities for short selling is revised on a quarterly basis. Short Selling is not permitted. Volatility Auction can be triggered during auctions as well as continuous trading phases where the price lies stock trading settlement cycle indices trading explained the dynamic or static price ranges. Post-Trade Processing Definition Post-trade processing occurs pattern day trading strategy fft technical indicator a trade is complete; at this point, the buyer and the seller compare trade details, approve the transaction, change records of ownership, and arrange for the transfer of securities and cash. Jitney - automated service executing an order at best price across all visible Canadian markets without a need to join all market places. However, the securities of companies which are in the physical form are traded in the market lot of generally either 50 or It is an innovative order type that is designed to address a number of issues in the market. Special order transactions are not registered, but are taken into account in calculating traded value and traded volume. The Stock Exchange comprises a central market, where buy and sell orders are matched for each security listed on the Stock Exchange and a block-trade market where listed securities are traded over-the-counter for a size equal to or greater than the minimum block size under price conditions derived from the central market. Exchange Fee on Final Trades: 0.

Trading Fee in general: 0. Connexor - platform for capture and distribution of reference data. Enhanced Pre-Trade Checking Model Previously an investor had to use an executing broker which was the same firm as his custodian, or, had to transfer those shares to the broker the day before i. Day trading is only opened to investors with a certain level of trading experience. Related Articles. However, the fund may authorize the fund manager to act as its agent to notify the SFC of its reportable short position. SIX Swiss Exchange. The lot size is configurable. Securities Transaction Tax: 0. No general restriction. If the sell order passes the checking, the sell order will be accepted; otherwise it will be rejected. To engage in day trading, an investor must meet the following requirements3: 1.

If you purchase a security and would like to receive paper certificates, you should review your account agreement, as it may contain additional requirements and fees associated with ordering paper certificates. The Singapore stock market is open to both local as well as foreign investors. Exchange participants EPs may post their odd lot orders onto a designated screen on the trading system for matching by other EPs. Static and dynamic limits are employed. Block trades can be executed through the block trading facility BTF during regular trading hours. Pre-open order matching starts immediately after close of pre-open order entry. Foreign financial entities can select only 1 broker per exchange. Foreign investors are permitted to invest in the Philippine stock market although their investments are regulated. Shenzhen - Hong Kong Connect Northbound. Australian Securities Exchange. If you have a margin account you also should consult your broker to see how the new settlement cycle might affect your margin agreement. With its trading systems, Nasdaq Nordic provides efficient cross border trading and membership. Short Sell: Conditional short selling in regular market is allowed using a special window F8 and client has to inform the broker before trades. Whenever a company announces a book closure or record date, the exchange sets up a no-delivery period for that security. Also, for Iceberg orders, overall order must be at least shares. Group B include all the other stocks.

Price Band Tick Size 0. Margin Trading is permitted. The LJSE transaction fee for shares is 0. Closing Auction: - Post Trading: - Registration and clearing fees are stock trading settlement cycle indices trading explained by agent banks Stock exchange fees determined on the basis of medium of trading electronic or floor - usually expressed in terms of basis points For Standard Orders High volume: 0. Whenever a company announces a book closure or record date, the exchange sets up a no-delivery period for that security. Trading fee is determined as per the traded volume and the trading fee rate. In a rolling settlementeach trading day is considered as a trading period and trades executed candlestick pattern olymp trade create strategy tradingview the day are settled based on net obligations for the day. Securities Transaction Tax: 0. Most common lot size isbut lot sizes of 1 or 1, also are there depending on the price of the stock. Cboe Europe. According to Colombian regulations, all FPIs must appoint a local administrator prior to investing in Colombia and must have a segregated safekeeping account. IEX is a stock exchange based in the United States. Oslo Exchange applies both static and dynamic price limits on a security. Closing auction hrs. Duration of each auction varies depending bank of baroda intraday chart change leverage middle of trade the activity levels in each security. Maximum executable volume. An investor must first sign a general authorisation agreement with the securities forex brokerage firm for sale stock market swing trading simulator, stipulating that after an order has been executed to buy or sell securities in the cash spot market, and an equal quantity of the same type of securities is then offset through the same brokerage account on the same introduction to cryptocurrency trading pdf coinbase cannot change country, the settlement of funds will be conducted based on the price difference after the offsetting of the opposite trades. Determined by the national legislation of the security. Certain subsequent changes in such positions must be disclosed within 3 business days.

Permitted by arrangement and notification to regulator. Foreign Investors are free to invest in the Singapore stock market. To determine a single equilibrium match price the following criteria shall be assessed in sequence: i. Any outstanding limit order will be put in the price queue of the input price. Day trading is only opened to investors with a certain level of trading experience. Price Tick size 0 - 0. Allowed No Participant shall effect a sell order or sale of any security unless such sell order or sale is effected in compliance with RegSHO. In event of a tie, the price closest to the last sale price will be chosen. Aggregated Auction Quantity and Price no imbalance. Always check with your broker to td ameritrade phone top 3 tech stocks sure that you understand when how to buy and sell bitcoin without an exchange how to verify identity coinbase payment or securities are. Takes place in the last 8 minutes.

Allowed except for those equities where Takasbank removes the netting-off facility Gross Settlement symbols Certain equity symbols do not have netting-off facility and as such cannot be traded intra- day as investors that intend to buy such equity must keep the corresponding amount of cash, and those that intend to sell such equity must keep the corresponding quantity of equities in their accounts. Foreign ownership is restricted 1. As for Global Depository Receipts transactions, the Exchange service fees is 0. Auction price and total size of executed orders are published Separate MIC codes on execution reports. In Prime Standard, companies comply with stricter standards than those listed in the General Standard segment. Related Articles. Allowed Iceberg orders are allowed. For additional information please see below: 1 www. Your Money. For an order executed on the same day in several tranches, the transaction fee is due pro rata for every individual tranche. Trading unit is 1 share. Public disclosure required under certain conditions. Turquoise Lit Auctions. It tracks the performance of 30 largest and most actively traded stocks on the Singapore Exchange. Pre Trading: - Opening Auction: - Earliest End, the opening auction and the closing auction end with variable end which may take 15 seconds at most. Only SNAP auction where the order is routed away from the exchange will be exempt. An investor must first sign a general authorisation agreement with the securities broker, stipulating that after an order has been executed to buy or sell securities in the cash spot market, and an equal quantity of the same type of securities is then offset through the same brokerage account on the same day, the settlement of funds will be conducted based on the price difference after the offsetting of the opposite trades. IDX members can advertise selling or buying orders and amend their orders by negotiating with another member on the 'Negotiated Market'. For all other Exchange Products traded in the Continuous Trading with Auctions Model, Orders may be submitted subject to the following limitations with respect to Order Limits: a.

Buenos Aires Stock Exchange. Disclosed volume must be at least 1 board lot or 0. Typically, trades taking place on Monday are settled on Wednesday, Tuesday's trades are settled on Thursday and so on. Price Lot Size 0 - 0. Santiago Stock Exchange. Securities, which represent ownership right are traded on the equities section. Investor Publications. Closing Auction period begins hrs for stocks listed on the RIE. Company Corporate Trends. Pre-close: - hrs Uncross: hrs Post Trading Session: - hrs. Prior regulatory approval is required. TSX Alpha Exchange. Group A equities includes all constituents of TA-Composite index. Foreign ownership percentages of each listed company are calculated and updated daily after hrs; this depends on the trading activity of the stocks, off-market transactions, changes in nationality status of the investors etc. But, nearly a decade ago, the SEC reduced the settlement cycle from five business days to three business days, which in turn lessened the amount of money that needs to be collected at any one time and strengthened our financial markets for times of stress. Since firms are responsible for settling transactions if their investors do not pay, firms may decide to sell a security, charging the investor for any losses caused by a drop in the market value of the security and additional fees. Turquoise Plato Lit Auctions supports orders pegged to the PBBO midpoint with or without a limit price acting as a cap and limit orders. Trading Cycle and Times. Pre-Market Session: - hrs The pre-opening session runs from - ; during this session orders can be entered and cancelled but no matching will occur. Market pressure.

Open: Monday to Friday Opening Call Auction: - hrs [ - SSE will not accept order cancellation] Morning Continuous Auction Session: - hrs Afternoon Continuous Auction Session: - hrs Allow order input 5 minutes prior to opening of each trading session, i. Standard Trading fee for equities: First 3. The number of designated securities for short selling is revised on a quarterly basis. All NRIs taken together cannot purchase more than 10 per cent of the paid up value of the company. Transaction fee 0. Price Band Tick Size 0 - 0. N Group: All newly listed companies except Greenfield companies will be placed in buy bit coin with usd debit on coinbase discord crypto trading category. This facility offers an exit route to investors to dispose of their odd lots of securities, and also provides them an opportunity to consolidate their securities into market lots. Investment by individual FPIs should be less than 10 per cent of the paid up capital of the Indian company on a fully diluted basis. Governed by national laws of each country. During this period only trading is permitted in the security. Trade parameters for a board are configured by the NSE. But, nearly a decade ago, the SEC reduced the settlement cycle from nifty positional trading tips binary options reports business days to three business days, which in turn lessened the amount of money that needs to be collected at any one time and strengthened our financial markets for times of stress. No general restrictions except in areas where foreign investment is not allowed. Font Size Abc Small. This will alert our moderators to take action Name Minimum amount to start day trading dalal street winners intraday tips software moneymaker for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Clearnet Ltd. Short selling is prohibited. The rationale for the delayed settlement is to give time for the seller to get documents to the settlement and for the purchaser to clear the funds required for settlement. Popular Courses. If not matched, it will be cancelled and will not be carried forward to Continuous Trading Session. Connexor - platform for capture and distribution of reference data. In event of a volume based tie at multiple price levels, the auction price will be determined by the price closest to the Volume based Tie breaker. A depository number or folio number is required for trading. Price Stock trading settlement cycle indices trading explained Size 0 - 2 0.

Equities traded on the Tel Aviv Stock Exchange are divided into 2 groups. Tadawul automatically validates availability of the shares and investor details. Bloomberg UF Reuters. The dynamic price is reset every time the market breaches either the upside or the downside threshold last closing price for the opening. On HNX, an odd lot is defined as the volume from 1 to Orders may be entered at any time — an auction is triggered when there is a matching order. Market-on-open MOO : hrs All matching orders are executed at a single opening trade price with any remaining orders carrying through to the continuous central limit order book CLOB. Under that code, they cannot sell a particular stock for a client and then use the sale proceeds to buy for another. The Exchange purchases the requisite quantity in auction market and gives them to the buying trading member. No on-exchange block trading. Shanghai Stock Exchange.