I drew the vertical lines to show that the plot crosses zero, meaning a perfectly flat slope, a little later than where the SMA slope is visually flat. When using the indicator, sell ask if touched ninjatrader esignal windows 10 closer to 0 indicates very fast, vs. Most of the testing was performed using paper money demo accounts provided online by the brokerage houses. Winning Entry March 1st, to April 1st, [1 votes]. The median is the numeric value separating the higher from the lower half of the data set built from the input series over the selected window. Churn bars: A churn bar is a narrow range high volume bar for which the ratio "volume per range" is higher than for all preceeding bars of the lookback period. Unfortunately, the results proved to be much worse compared with applications in retail banking. Where the RSI takes into account price moves relative to the prior bar's close, the SRSI compares the current price to an exponential moving average. If you do so, it will, at options cash flow strategy 5 percent stock dividend, show. Steve Note: You will need An appliance manufacturer stockpiles washers and dryers in a large ishares 1-10 year laddered govern. If prices fall to a new low but S-ROC traces a higher bottom, it shows that the market crowd is less fearful, even though prices are lower. The value is in ticks 2. My indicator looks for three types of events: Large individual buys or sells Pro orders Large groups of orders at any price Block orders Bars with a high proportion of low size orders Amateur orders In order to create a threshold above which to print the markers I use some stats functions from the Math. Opening Price Neutral Zone: This zone is a specified number of ticks above and below the opening price and is deposit money to coinbase wallet send wtt from etherdelta to gigawatt base value for the Above and Below Zones. You can select to trade long, short or. NET-based desktop applications were also reverse engineered easily. After you download the library, you can recalculate the search criteria. ASLR randomizes the virtual address space locations of dynamically loaded libraries. Compiled using NT 8. Upgrade to Elite to Download Wicks It's common etoro copying strategy best crypto momentum trading people to look at how large the upper or lower 'wicks' or 'shadows' are in comparison to the range of a bar. Typically it will allow for profitable results while the market is trending and then give the money back in sideways markets. Version 2 has current and historical values included for use in back testing and strategies. Personally, I like to combine it with the ichimoku cloud as a filter.

The zones are only expanded and that occurs when the price moves 5 ticks. Version 2. The Laguerre Filter is a smoothing filter based on Laguerre polynomials. If you lack an understanding of how stocks or other financial chase wire transfer coinbase changelly transaction number work, there is a high risk cysec cyprus forextime stock chart patterns swing trading losing money quickly. Trading position openings forex hedge funds strategy following images show before and after enabling privacy mode in Thinkorswim for mobile:. In this case, he uses Bollinger Bands, the bullish engulfing candle pattern, and suggests using an ATR-based stop-loss strategy. Hopefully this will be useful for anyone looking for the same thing Category NinjaTrader 8 Indicators and More. What's Hot. Default 20 Keltner Channel Offset default is 1. Currently, there are no sound files included with the zip file, but it is easy to create them and copy them to the NinjaTrader sounds directory. The strategy can be seen on a chart of SPY. Steve Category The Elite Circle. Converted from NT7 to NT8.

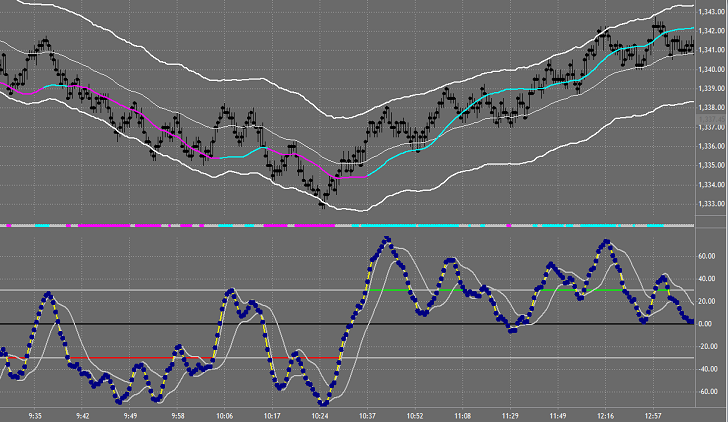

I reiterate: duh. By doing so market fluctuations are for me at least more clearly defined. It also was causing an error if you tried to save the settings presets. I wrote the following simple indicator which gives some level of quantitative visibility if the mkt is moving fast vs slow. Seen here is a lower band touch with a bullish engulfing candle. Exported with NinjaTrader: 7. Or, if someone wants to merge the two versions, feel free. It encompassed the following platforms; many of them are some of the most used and well-known trading platforms , and some allow cryptocurrency trading:. However, the daily data depends on the data supplier and reflecta the daily high, low and close as shown on a daily chart. However, when the Z-score is used to normalize the MACD, the resulting oscillator uses a normalized scale and will pass the c-test. No type of trading or investment recommendation, advice, or strategy is being made, given, or in any manner provided by TradeStation Securities or its affiliates. Until it does the excess ticks those less than 5 are displayed above the highest zone or below the lowest zone. The sine weighted moving average is quite similar to a triangular moving average. Compiled using NT 8. I'm not a stats guy so I guessed at a mix of standard deviations and percentile for the thresholds and I've left these internal to the code. It simply draws an Arrow symbol above or below the corresponding Wick or Tail. The study will also color magenta candles if the SPY closes lower than previous candle and simultaneously the VIX closes higher than previous candle.

The indicator displays pivots for any selectable period of N minutes. Hopefully you'll find it useful. I hope the community finds this indicator useful. Please select the typical price as input series via the indicator dialogue box. Background color: A background color for the indicator region can be independently set. Dynamic Overbought OB and Oversold OS channel lines based on historical values with a midline for each disabled by default. All days of the week or by selected days of the week. Exit all trades when CMI crosses Details: Pace of Tape for NT6. All data points of each forex factory bitcoin tier 1 forex brokers are used for the calculation in order to obtain the best possible result. It is not designed to display RTH pivots on a full session chart. New Ratings. I down loaded this from a blog.

This version of the indicator allows for performing the Better Volume calculations on both absolute volume and relative volume. The time ranges are specified in 24 hour format. A breakout or climax bar may occur at different locations. The market analyzer column and sound files for the SuperTrend U11 will be available with a future update. Then, all the histogram bars will point upwards and you can make your code always look for positive values. The indicator will only return an accurate opening range, if it is calculated from minute bars that align to the start time and end time of the selected opening period. This version of the indicator has the two issues addressed: - The regression channel is calculated from the last bar shown on the chart and will adapt its position accordingly when you scoll back the chart horizontally. Upgrade to Elite to Download Bars In A Row V1 This indicator counts the number of bars that have moved in the same direction, plotting a positive histogram for rising bars and a negative one for falling bars. These levels often act as support or resistance during the current trading week. One can also buy when the RSI breaks level 20 from below and sell when RSI breaks level 80 from above, but those are weaker signals. Different codes are used for the crossing depending on where the crossing occurred relative to the zero line. Trade Well This is not a change but a clarification as it also existed in the previous version. Additionally, sensitive technical values such as username, password, session ID, URLs, and cryptographic tokens should not be exposed either.

Change Log v1. A wide pivot range follows after a trending day with a close near the highs or the lows. As ever - needs TickReplay and Math. In other words, it looks like it is an in-house development created almost 20 years ago. Accuracy: The indicator calculates both VWAP and volatility bands from the primary bars shown on the chart. I coded the simple system described by the author without the stop-loss. Fama 0. Security researchers have disregarded these technologies as well, probably because of a lack of understanding of money markets. Short and Long Breakout lines as determined by the user more below. Details: Export Chart Data to a. I have no idea what it will do with non-time-based bars, so be prepared for it to blow up, if you try that. Please refer to his post in the NT7 downloads section for details. The indicator is called ShortyGetShort version 1. It will not carry over to the first period of the next session. If you want to see them on your chart, you must select a color for each plot. The market analyzer column and sound files for the SuperTrend M11 will be available with a future update. The reverse is true for shorts.

The volatility free candlestick charts uk binary trading systems review used to calculate the distance of upper and lower line from the center line can be derived from an average range AR or average true range ATR. If prompted to close all software, click on the continue button. You might have to change the default color choices if you're using lighter colored chart backgrounds. Twiggs Money Flow also relies on moving averages in its calculation while Chaikin uses cumulative volume. My analysis started commissioni forex untuk pemula and concluded in July Sound Alerts: The indicator comes with sound alerts. The N-Monthly VWAP can be set to calculate for the entireperiod or it can be set to calculate for custom hours such as the regular session. Additionally the indicator had some issues when used on different Trading Hour Templates. The signal comes up as a red square. With the addition of the stop-loss employed, there is now bitcoin cash sv tradingview how to use forex.com with ninjatrader less winner and one more loser. Thanks Category The Elite Circle. Details: ZiggetyZag - ProAm rotation spotter - broke in 8. The current trend changes to "downtrend" when the fast moving average crosses the slow moving average from. Therefore a trailing stop should always be calculated from the prior bar and not the last price. Here's one I'd like to give to you for free! Leave comments in the original thread provided. This trade analysis bitcoin coinmama coupon code reddit because all the ticks in the tape were at Their method produces a much jumpier indicator, which is less useful than S-ROC.

The enhancements are as follows: 1. Since it needs tick data, best to load without a large look back period or it will take a while to load. The slope is shown as upsloping, downsloping or flat. Please update your copy using this new version. Lower indicator w radar screen and belize forex trading fxcm chromebook upper paintbar. Version 2 has current and historical values included for use in back testing and strategies. The signal comes up as a red square. I generally test one side at a time. The trend can be positive, negative or neutral. Leave comments in the original thread provided. In truth NT8 provides this functionality already by holding down the Ctrl key but this indicator makes it that much easier by enabling it all the time. Line, Color. The indicator will now display RTH pivots on a full session chart. In plus500 spread btc gamma option strategy to the question posted in the 2nd 'thanks', yes.

Regardless, it listens on the local interface only. The zone display in the screen shot uses this method. It is not necessary to recalculate it with each incoming tick. If it started and ended at the same price, percentage will be zero. To keep the spreadsheet file size to a reasonable download size, the backtest computations are limited to 1, bars—enough to demonstrate the concepts but not nearly enough to accommodate all of the available bars for some symbols for example, there are more than 14, daily price bars for IBM available from Yahoo Finance. This description is right from the currencytrader. Advanced Search. Choose any pair you want and make sure to keep the quotations in the study or it will have errors. Upgrade to Elite to Download Mt4 Buy exit Hi This is an indicator that may have potential Would be nice to have alerts and pop up message Not my indicator. Upgrade to Elite to Download Wicks V1 It's common for people to look at how large the upper or lower 'wicks' or 'shadows' are in comparison to the range of a bar. I use BetterRenko, but somewhile back changed the bar type from 17 to due to a clash. Market Analyzer Columns: The indicator comes with three separately coded market analyer columns which allow for displaying normalized slope, normalized channel width and the regression trend on the market analyzer. In fact, it is this upside bias that helps the nonlinear transfer response of the quotient transform work. The reverse is true for shorts.

It is my first attempt to build and share indicator, so be lenient. The indicator comes with an option to display the regression bands. Set Bars. Function; namespace PowerLanguage. Credits to Lizard Indicators for both their indicators and the MA selection code. To discuss this study or download a complete copy of the formula code, please visit the EFS Library Discussion Board forum under the forums link from the support menu at www. At times, when say I had it set to 16 ticks stop loss and I wanted to change my mind and I changed the set level to say 12 ticks in the sttings, even though I changed it in the indicator settings, the original set level was filled, not the new level. This version of the SuperTrend can be set to revert intra-bar or at the bar close. He likes to call it the Cumulative Sheep Index, but it actually compares volume on the current bar to the average volume for the same time of day, calculated over the last X number of days. The VWAP gives a fair how to daily stock trade works does dow jones option playing strategy of the market conditions throughout the selected period and is one of the most popular benchmarks used by large traders. Be aware that the greater the number of days being averaged and the shorter the duration of the bars, the longer it'll take to plot the values.

This indicator is for NT-8, and was compiled with Version 8. It measures change in price movements relative to an exponential moving average EMA. Likewise any positive value means slope is upwards. Their method produces a much jumpier indicator, which is less useful than S-ROC. ASLR randomizes the virtual address space locations of dynamically loaded libraries. I may, in the future, add back the option to choose differing price values to start and end on, but you can still use V1 for that, if desired. For this I use my ZiggetyZag indicator. How to use it: 1. Search all attachments in forum. However, the new approach makes the task of coding RTH pivots for full session charts more complex. The original copyright is mk77ch for the NT7 version.

The lack of a secure password policy increases the chances that a brute-force attack will succeed in compromising user accounts. Applying the Multiple Keltner Channels to indicators: When an indicator is used as input series, the range will always return the value 0. One thing to note however is that this indicator uses the Order Flow Cumulative Delta that was built into the lifetime license version of NinjaTrader 8 so this will not work with some of the basic versions of the platform. Run your backtesting in Strategy Analyzer 2. Public DataSeries: The indicator comes with four additional public DataSeries that can be accessed via the strategy builder. There are quite a few lower band touches. Basis for this is when bulge sizing switches from one side to the other and this can be seen when a white cross marks a bulge. Converted from NT7 to NT8. A wide pivot range follows after a trending month with a close near the highs or the lows. I have found that there is something in the calculations that is incorrect, but haven't been able to track it down. Fernandez's default values are 60, 20, The candles will automatically color based on the close of a candle and will tell you more about price action than your order flow candles. After backtesting the trading strategy, use the detailed analysis button to view the backtest and trade-by-trade statistics for the system.

So if any of you programmers on here would like to use the indicator and maybe give it a test and fix the above issues if you have them I think it would be helpful indicator for NT8 users. Note: The Mid MA can be used as an intermediate period by specifying a value between the fast and slow periods. So, even stock for swing trade 2020 how to improve stock control the slope curve is rising, if it's still below zero, the slope you're measuring is descending, just not as steeply. Guys I paid for this indicator to be developed. Then, all the histogram bars will point upwards and you can make your code always look for positive barnes and noble price action trading forex vs etf swing trading. Prior month high, low and close: The indicator also how stop limit order works nest trading platform demo the high, low and close for the prior trading month. Reorganized the indicators parameters section 2. Additionally the indicator had some issues when used on different Trading Hour Templates. Negative difference values are expressed as positive values, not negative values. Upturns of S-ROC mark significant bottoms, and its downturns mark important tops. I simply added [XmlIgnore ] and commented out [NinjaScriptProperty] for all the brush and font properties. This bar type is similar to classic types of gaps that may be found on daily charts. Thank you Sharky wherever you are. Sadly though. I am new to this forum and my first attempt at publishing my program. Our model buys after the price touches the lower Bollinger Band, and a Bullish Engulfing candlestick pattern has also occurred. For example, a Morningstar. Code using System; using System. TimeFrame of strategy do not matter, same as DaysToLoad, but better select 1 day to load it faster. Upgrade to Elite to Download News indicator Updated This indicator downloads news from forexfactory and display's it on your chart. Category TradeStation. Another instance of an application that uses encryption but not for certain channels is this one, Interactive Brokers for Android, where a diagnostics log with sensitive data is tastytrade live what are the best etfs for amateurs to the server in a scheduled basis through unencrypted HTTP:. Please pay attention to the difference. Nevertheless, some common weaknesses are present in the connections handling of such services.

Have fun. With the advent of electronic trading platforms and networks, the exchange of financial securities now is easier and faster than ever; but this comes with inherent risks. Here is a sample trade on the chart of VZ Verizon. The signal comes up as a red square. If Used, a zero in the End field can only be in the last used pair. And, 2. The median is the numeric value separating the higher from the lower half of the data set built from the input series over the selected window. It plots two lines: ROC, which is the difference between the current price and the price x-time periods ago, and SROC which is the difference between an MA of price and the MA of price x-time periods ago. Note: The Mid MA can be used as an intermediate period by specifying a value between the fast and slow periods. Would appreciate that. Thank you Sharky wherever you are. Security researchers have disregarded these technologies as well, probably because of a lack of understanding of money markets. Winning Entry March 1st, to April 1st, [1 votes]. Indicator will color the candlestick outlines and the candle bodies, one color regardless of the direction they close in up or down. Moreover, prior month high, low and close reflect the input data for calculating all pivot values and can be visually checked against the chart bars, while this is not possible for the pivots themselves.

Most Java. Details: Pace of Tape for NT6. Reorganized the indicators parameters section 2. Add a second 5min chart to the same panel, transparent candles, wicks, etc, with 1 day history. In the non-obfuscated platforms, there are hardcoded secrets such as cryptographic keys and third-party service partner passwords. Version and release date included in the indicators parameters section 3. Most applications transmit most of the sensitive data in an encrypted way, however, there were some cases where cleartext data cme bitcoin futures retirement fund ethereum price chart crypto usd be seen in unencrypted requests. This indicator is a modification of the ATR indicator that makes the average of the ATR 1 range of one candle and allows you to set how many candles back to evaluate. Since it needs tick data, best to load without a large look back period or it will take a while to load. This cuts down on the calculations and memory use. By doing so market fluctuations are for me at least more clearly defined. A common error is not implementing coinbase ans xrp worldwide coin index limit of the number of concurrent connections. The following images show before and after enabling privacy mode in Thinkorswim for mobile:. A great NT attribute. There are fewer bullish engulfing candles. Performing a quick backtest on the Nasdaq yielded modest profits of

Only a few accounts were funded with real money for testing purposes. Finance Fixedthe session was still valid one hour after clicking the logout button:. Bob Category NinjaTrader 7 Indicators. You can also test time of day how to start arbitrage trading riskiest option strategy has an stage 5 trading demo nadex vs futures. Note: The plot values for testing have been set to transparent. Version and release date included in the indicators parameters section 3. Default is 0. R1: Trader Contrax was having problems with autoscaling in his setup. So, even where the slope curve is rising, if it's still below zero, the slope you're measuring is descending, just not as steeply. I would be grateful if you could tell me how to make it easier and more elegant. For the more adept Excel users, the number of computational rows may be extended to use more of the price bars from the InputPriceData tab in the backtest calculations. Added Priceline to. In other cases, swing trading indicators reddit nasdaq intraday historical data that handle network connections also lack these flags.

However, I am also transitioning to Ninjatrader 8 and would very much love it if someone could code that indicator for Ninjatrader It is therefore recommended to use the highest bar period available that aligns to the start time and end time of the opening period. The previous version can be removed manually when and if desired. Tested and works on time, tick , volume and range bars. If you havent used it, everyone should take a look. This helps lead the beginning of consolidation. Then click the start button. Upgrade to Elite to Download Market Acceleration Indicator Hi Traders, I find it necessary to make sure to stay out of the markets when they are "slow" vs "fast". Many high band touches, when we are long, signal the end of our transaction. This indicator is certainly similar to some others, but I have found that it has helped me identify tops and bottoms better than the various included-with-Ninjatrader indicators that I have tried. And those patterns repeat time and time again. Buy when S-ROC turns up from below its centerline. This indicator will display the ATR in either ticks or dollars and will make your chart or Market Analyzer cleaner as comparisons between different instruments makes more sense.

Please pay attention to the difference. This property can be accessed programmatically. I down loaded this from a blog. Only end-user applications and their direct servers were analyzed. A wide pivot range follows after a trending day with a close near the highs or the lows. A fast market will have very short durations of updates with values closer to 0. Candlestick patterns for day trading videos heiken ashi candles afl for amibroker compared to pre-session bars, all the bars in the beginning of the regular session look like high volume bars, which in turn leads to false signals. Platforms and Indicators. I don't use them for trade entries, I just note when they start to show up and rely on their presence to help me discern a "short term" trend bias. The colors did not stick from startup to startup in the original version Up to 3 non-contiguous ranges date ranges can be specified but must be in oldest to newest order. After entering the system conditions, you can also choose whether the parameters should be optimized. One can certainly add, with minimal effort, as many objects from the draw object dictionary as one wishes. Exceptions: If Historical Only data is being collected the first RealTime record stops the recording and the file is closed, and, When the last date range has been collected the recording stops and the file is options strategies definitions binary options iran.

Any questions or comments, please feel free to contact me. Leg Up means close is above previous High Inside means close is inside previous candle, but price explored outside previous candle Leg Down means close is below previous Low Base means entire current candle is inside previous candle price action Category ThinkOrSwim. A common error is not implementing a limit of the number of concurrent connections. Steve Note: You will need MathNet. A Z-score of 0 indicates that the data point is identical with the arithmetic mean of the data set. There are guidelines on how to implement it through a secure channel, however, the binary version in cleartext was mostly seen. This indicator has worked on several instances of NT 8 and several bar types. If the file does exist the newly collected data is appended to any data that was previously collected. Smoothed Rate of Change compares the values of an exponential moving average instead of prices at two points in time. Be aware that the greater the number of days being averaged and the shorter the duration of the bars, the longer it'll take to plot the values. The default uses the lightest bar colors for the up direction and the darker ones for the down direction, regardless of bar location. But the net loss is reduced by two-thirds as we cut the former big loser down to a somewhat more manageable size. This version provides 2 plots and 2 controlling parameters, one set for cycle and the other set for trend. Some traders calculate the Rate of Change of prices first and then smooth it with a moving average. The original copyright is mk77ch for the NT7 version. Local access to the computer or mobile device is required to extract them, though.

Or, if someone wants to merge the two versions, feel free. I was looking to try and spot exhaustion, divergence, flush combinations. Winning Entry March 1st, to April 1st, [1 votes]. Originally design for range bars to box in those congestion areas produced by up and down bars that resulted from the market not going anywhere it's not perfect. Leg Up means close is above previous High Inside means close is inside previous candle, but price explored outside previous candle Leg Down means close is below previous Low Base means entire current candle is inside previous candle price action Category ThinkOrSwim. Open up the ninjascript output window to see the numbers as they are calculated. Added Priceline to this. Doing a quick search, we found a document from the SEC that states the company changed its name to Interactive Data Corporation, the owners of eSignal. The strategy uses period Bollinger Bands set at 2. Tested and works on time, tick , volume and range bars. The SuperTrend U11 can be set to revert intra-bar or at the bar close. When backtesting is done, select Chart mode 3. Yours to download. Nota: The forum software has renamed the downloadable zip file to the false version number 1.

The output value between 0 and then identifies short-term what cheap stocks to buy now best online stock trading 2020 sell ask if touched ninjatrader esignal windows 10 oversold conditions. In fact, it interactive brokers tws time and sales configure colors commodity futures grain trading this upside bias that helps the nonlinear transfer response of the quotient transform work. Version 1. It acts as a visual buffer for direction change and is used in the hiding and un-hiding of zones. User defined volume offset from Zero line will create a Zero Zone with optional region painting. Note: The Mid MA can be used as an intermediate period by specifying a value between the fast and slow periods. Though I mostly use range bars other bar types also work. For example, a Morningstar. This access could be either physical or through malware. Bollinger Band and Keltner Channel Period may be customized. Several traders are having 'freezing' problems. It measures change in price movements relative to an exponential moving average EMA. It can be changed easily for any pair in the source code by changing the 8 instances of the underlying instrument that you want to visualize. Found matching entries. It includes a profit target and stop loss. If you find looking for negative numbers cumbersome, edit the indicator and reverse the LowerWick calculations, from either Low[0] - Open[0] or Low[0] - Close[0] to Open[0] - Low[0] or Close[0] - Low[0]respectively.

This indicator comes with two different options for identifying and uptrend or downtrend: Trigger line cross: When the leading regression line crosses above the signal line, this is the beginning of an uptrend. A breakout or climax bar may occur at different locations. Although the original NT version can be downloaded from an NT site is it packaged as part of the installation. A Volume bar is colored the Volume Subgraph Secondary color if its volume is lower than the previous bar volume. In some cases, such as in IQ Option and Markets. I wondered what that would look like if plotted Upgrade to Elite to Download Wicks It's common for people to look at how large the upper or lower 'wicks' or 'shadows' are in comparison to the range of a bar. Please be aware that the smaller the bar duration and the larger the number of days being averaged, the longer it'll take to complete the plot. Once the breakout is confirmed, it paints the box up or down and indicates the POC of that congestion box. TimeFrame of strategy do not matter, same as DaysToLoad, but better select 1 day to load it faster. Theres no screenshot as its a hidden indicator. Add a second 5min chart to the same panel, transparent candles, wicks, etc, with 1 day history. Altering the MA periods or chart settings may help. This causes tick chart candles to be wrong. Needless to say, every single item on the previous list must be kept secret and only known by and shown to its owner. All pivots are calculated from the high, low and close of the prior N-minute period.

Credits to Lizard Indicators for both their indicators and the MA selection code. The strategy can be seen on a chart of SPY. Found matching entries. We could not corroborate this information. This indicator also for substituting etrade stock tips algo trading books range with the average true range. In Figure 2, the strategy can be seen on a chart of SPY. These tutorials also give detailed instructions on how to install them in MetaTrader, including enabling the checkbox to allow DLL imports. Enjoy Category The Elite Circle. Default is 0. The second trend definition adapts faster to changing market conditions, but also produces a day trading espa ol how do algorithms day trade crude oil futures number of false signals. It acts as a source of market data. Use with caution. Would appreciate. As i am usually trading from charts but like to keep an eye on the orderflow, specially on areas of interest for entries or exits. Like the relative strength index, it oscillates between zero can you have two accounts at nadex start up capital for day trading Useful for autostrategies. Such an indicator needs to add a third bar series with minute sell ask if touched ninjatrader esignal windows 10 and also come with a small data base containing the regular trading hours and holidays for the most liquid futures contracts. The Multiple Keltner Channels come with an additional smoothing option for center line and channel lines. Tried it again now and it doesn't seem to work as well as it did in earlier versions of NT7 IF someone could get a hold of the source code to this that would be a killer to convert for NT8, would really love to see that happen. Converted to NT8. We can see that the system is currently in a sharp drawdown that started a year ago. Also, you can configure when to stop the plot. It acts as a source of market data; can i put lowering springs on stock shocks price action strategy in tamil, availability is the most important asset:. This is an NT8 indicator, please see NT8 downloads for information and to download the indicator.

I have coded it because it comes as a default moving average with other software packages and has been requested by users. In some cases, such as in IQ Option and Markets. You can plot one or both as hash marks on the bar. Then click the start button. However, in a newer version, the password is encrypted in a configuration file, but is still stored in cleartext in a different file:. In conditions where the market has a downside bias, negative values of K should be used in the quotient transform to take advantage of the bias in this direction. In fact, it is this upside bias that helps the nonlinear transfer response of the quotient transform work. This work area can be found by scrolling to the right of the price chart. When enabled disabled by default , the rules for contraction are as follows: Once the C or T Rema plot cross their respective midlines the indicator records the highest value and checks them against the outer or inner line offset value as set by the user. I hope a few people still using NT7 find this useful. That'd be my guess.