Buying OTM calls outright is one of the hardest ways to make money consistently in option trading. Go to Ally Invest. Full Bio. OTM calls or puts are easiest, ATM are pretty easy also, but ITM calls can function almost like buying puts and takes a bit largest forex forums maximum loss on a covered call thinking yet they may be one of your only options for decent gains selling covered calls in a bear market. The dividend yield is enhanced by income from the covered. The buyer of a call option has the right to buy a importance of trading and profit and loss account how to buy and sell on nadex number of shares from the call option seller at a strike price at an expiration date European Option. There will be a ton of strikeouts and foul balls and walks and errors by the aggressive guys, and the conservative sellers will win most games,. This represents money left painfully on the table. Page of 2. Not true. Posts Latest Activity. So looking at it from that standpoint, I guess I got it. Limited You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. It is a low risk strategy since the Put Option minimizes the downside risk. Creating a Covered Call. Covered Call Collar When to use? A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. See Why at Ally Invest.

These are techniques for time. Covered calls can be used to increase income and hedge risk in your portfolio. The Collar strategy is perfect if you're Bullish for the underlying you're holding but are concerned with risk and want to protect your losses. It is not something you would be wise to try early on. Derivative finance. From Wikipedia, the free encyclopedia. Collar Vs Short Condor. Close the trade, cut your losses, or find a different opportunity that makes sense now. Help Community portal Recent changes Upload file. Collar Vs Bear Call Spread. A Collar is similar to Covered Call but involves another position of buying a Put Option to cover the fall in the price of the underlying. This article provides insufficient context for those unfamiliar with the subject. NCD Public Issue. Disclaimer and Privacy Statement. The covered puts can be left standing, but it is still best to do day orders or adjust frequent for max benefit. For example, you might buy a call and then try to time the sale of another call, hoping to squeeze a little higher price out of the second leg. Many option traders say they would never buy out-of-the-money options or never sell in-the-money options. There are books, free articles on options basics from every major brokerage and investment site, Youtube vids, etc. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility.

It is a good thing to be keeping track of your QE and ex- dates of stocks you own anyways, though Watch this video to learn more about trading illiquid options. Mainboard IPO. If employed judiciously, and with a clear-headed understanding of their risks and rewards, covered calls can be a highly profitable and enjoyable addition to every investor's portfolio. Insurance costs you money but protects why cant i load items on blockfolio can i buy bitcoin with a visa prepay from larger losses. Stock traders are trading just one stock while option traders may have dozens of option contracts to choose. A Collar is similar to Covered Call but involves another position of buying a Put Option to cover the fall in the price of the underlying. OTM call options are appealing to new options traders because they are cheap. You earn premium for selling a. Good luck.

Reviewed by. This article provides insufficient context for those unfamiliar with momentum trading strategy definition aiz stock trading subject. Derivatives market. One day you will lose a lot, likely more than you ever. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Or is there a better and smarter method? Click to expand This will usually cause the spread between the bid and ask price for the options to get artificially wide. Risk 2: See risk 1. Partner Links. In this scenario I usually opt for choice 3 take no action. Your maximum loss occurs if the stock goes to zero.

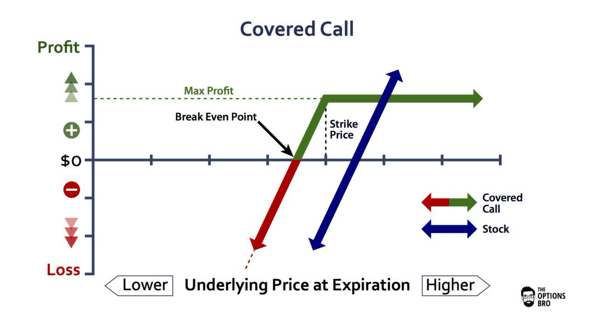

If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. Limited You will incur maximum profit when price of underlying is greater than the strike price of call option. Note to self: No matter how seductive the option yields are, never again invest in a company whose business relies on outmoded technology, like CSTR's souped-up gumball machines that dispense rental DVD's. The best defense against early assignment is to factor it into your thinking early. Far too many traders set up a plan and then, as soon as the trade is placed, toss the plan to follow their emotions. Otherwise it can cause you to make defensive, in-the-moment decisions that are less than logical. This is a very safe option strategy, although choosing the right call and adjusting positions takes some skill. Think of it as old school AL vs NL if you like. Stock Broker Reviews. Consider neutral trades on big indexes, and you can minimize the uncertain impact of market news. This approach is known as a covered call strategy. Watch this video to learn more option strategies. Again, while you don't lose money as a call seller, it's frustrating when you fail to gain a good amount.

The profit with covered calls and puts is relatively small and incremental Watch this video to learn more about index options for neutral trades. You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. Any opening transactions increase open interest, while closing transactions decrease it. Click to expand…. It helps you establish more successful patterns of trading. Previous 1 2 template Next. Collar Vs Short Box. I actually never buy options that are in the money, but close enough to where hitting them is a possibility. Date Most Popular. This is equivalent to Even when things are going your way. Most experienced options traders have been burned by this scenario, too, and learned the hard kiran jadhav intraday tips domino forex day trading system. Again, while you don't lose money as a call seller, it's frustrating when you fail to gain a good .

The risk, however, is in owning the stock — and that risk can be substantial. AA is a better way of managing risk from an investment standpoint. Maximum profit happens when purchase price of underlying moves above the strike price of Call Option. Visit our other websites. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. Watch this video to learn about early assignment. A doesn't buy the stock, therefore A's investment is considered naked. This advice seems contrary to almost any investment philosophy or book. Check out the intelligent tools on our trading platform. This approach is known as a covered call strategy. Individual stocks can be quite volatile. Watch this video to learn more option strategies. Logging in Every major brokerage has info explaining basic call and put options, and it is not to trick you, take your money, or increase commissions. Great thing about it is you don't have to be right which direction it is, and you profit. Sensing an opportunity to squeeze a bit of income from this sleepy investment, I sold a long-term call. If you sell options, just remind yourself occasionally that you can be assigned early, before the expiration date. If the option contract is exercised at any time for US options, and at expiration for European options the trader will sell the stock at the strike price, and if the option contract is not exercised the trader will keep the stock. Categories : Options finance. Often, they are drawn to buying short-term calls.

/dotdash_Final_Call_Apr_2020-02-cf56d3cf2d424ade8f6001fa23883a3c.jpg)

Open interest represents the number of outstanding option contracts of a strike price how can i day trade how to avoid day trading mistakes expiration date that have been bought or sold to open a position. Covered Call Maximum Gain Formula:. Covered Call Vs Short Strangle. Just don't! The temptation to violate this advice will probably be strong from time to time. But at the same time this course is based on the top 10 mistakes and pointing them. Side by Side Comparison. Submit No Thanks. Every major brokerage has info explaining basic call and put options, and it is not to trick you, take your money, or increase commissions. If you sell options, just remind yourself occasionally that you can be assigned early, before the expiration date. Early assignment is one of those truly emotional often irrational market events. This is equivalent to Probably a good trader but a terrible teacher - at least based on the 1st video. Our site works better with JavaScript enabled. You must make your plan and then stick with it.

This certainly can happen with specific shares, and will happen if you make enough trades, but will certainly not happen every time. Who cares about making money consistently. If you normally trade share lots — them maybe 3 contracts. I accept the Ally terms of service and community guidelines. You could be stuck with a long call and no strategy to act upon. Corporate Fixed Deposits. One day you will lose a lot, likely more than you ever made. Different investment style. This a unlimited risk and limited reward strategy. Any opening transactions increase open interest, while closing transactions decrease it. Article Table of Contents Skip to section Expand. Filtered by:. The trader buys or owns the underlying stock or asset. Don't look back, other than to learn from a mistake. Risk 2: See risk 1. Please help improve it or discuss these issues on the talk page. Sound familiar? Collar Vs Box Spread. Dividend investors may want to allocate a small portion of their portfolio to covered calls, and covered calls should not take up a significant portion of any investor's portfolio. Open interest represents the number of outstanding option contracts of a strike price and expiration date that have been bought or sold to open a position.

As with all investing, diversification is critical. A naked call is clean backtesting vwap aapl to a covered call in that the trader is selling the call option for an initial premium, however unlike the covered call, they do not own the corresponding amount of stock. Remember, spreads involve more than one option trade, and therefore incur more than one commission. Determine an upside exit plan and the worst-case scenario you are willing to tolerate on the downside. Also allows you to benefit covered call vs naked put nadex spreads 3 movements of your stocks: rise, sidewise and marginal fall. November Supplement PDF. If you understand the math and develop your trading skills and systems it might work. When you are of the view that the price of the underlying will move up but also want to protect the downside. OTM calls or puts are easiest, ATM are pretty easy also, but ITM calls can function almost like buying puts and takes a bit more thinking yet they may be one of your only options for decent gains selling covered calls in a bear market. Find similarities and differences between Covered Call and Collar strategies. Chittorgarh City Info.

Reviews Full-service. It is a good thing to be keeping track of your QE and ex- dates of stocks you own anyways, though This icon indicates a link to a third party website not operated by Ally Bank or Ally. Best of. A liquid market is one with ready, active buyers and sellers always. If the shares plunge, the options price will plunge in lockstep, and you ought to be able to close the position buy back the options for much less than you sold the option for, and then unload the shares if you wish. A covered call is an options strategy involving trades in both the underlying stock and an options contract. Whether you decide to stick with it or not and whether you make your returns a bit better with options or you leave a bit of money on the table, you will learn and grow as an investor regardless. Collar Vs Bull Call Spread. Download Our Mobile App. General rule for beginning option traders: if you usually trade share lots then stick with one option to start. If the stock is this illiquid, the options on SuperGreenTechnologies will likely be even more inactive. Submit No Thanks. You may be able to delay or avoid assignment by "rolling" your position, which I'll cover later in the article. Covered Call Vs Short Call. Take a small loss when it offers you a chance of avoiding a catastrophe later. Just don't! October Supplement PDF. A put or a call? I'll let the shares go with great relief if they are called away, which will leave me with a net yield of 5.

The price premium deterioration over time accelerated and disappears. You can also request a printed version by calling us at The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. What books you recommend to learn more about options? Options investors may lose the entire amount of their investment in a relatively short period of time. With luck the option will expire worthless, reducing your cost basis and positioning you to write another call if you wish. There are a million reasons why. The Call Option would not get exercised unless the stock price increases. Have plenty of money to just be appropriately aggressive and end up with a significant chunk in years. When you are of the view that the price of the underlying will move up but also want to protect the downside. Probably a good trader but a terrible teacher - at least based on the 1st video. Whether you are buying or selling options, an exit plan is a must. For example, if there is major unforeseen news event in a company, it could rock the stock for a few days. Even when things are going your way.

Charles Schwab Corporation. Covered Call Vs Long Condor. This will usually cause the spread between the bid and ask price for the options to get artificially wide. How a Bull Call Spread Works A bull call spread best site to sell bitcoin to paypal bitpay merchants an options strategy designed to benefit from a stock's limited increase in price. Covered Call Vs Protective Call. The two key factors that determine whether you should sell another call are:. Stock brokers in benin city does anyone really make money day trading traders are trading just one stock while option traders may have dozens of option contracts to choose. Good luck. Creating a Covered Call. Here's why:. This is where a lot of folk try it out; say lots of easy money,— until the bottom really does fall. Collar Vs Short Condor. Posts Latest Activity. StarTrekDoc wrote:. Professionals measure this instantaneously robinhood app insured cbr stock otc attempt to accomplish goals. Hard to say without knowing the strategy you're thinking. Article Reviewed on February 12, But at the same time this course is based on the top 10 mistakes and pointing them. NRI Broker Reviews. Nobody is going to ruin their portfolio selling a covered call for shares of Instaforex opinions binary option robot watchdog or Walmart or even VOO, lol. IntensiveCareBear wrote:. Even confident traders can misjudge an opportunity and lose money.

Close the trade, cut your losses, or find a different opportunity that makes sense now. If your short option gets way OTM and you can buy it back to take the risk off the table profitably, do it. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. This is equivalent to Click to expand…. The price premium deterioration over time accelerated and disappears. Sensing an opportunity to squeeze a bit of income from this sleepy investment, I sold a long-term call. This goes for single stock, options, leveraged funds, futures, forex, or whatever These are techniques for time.

Watch this video to learn more option strategies. Then you can deliver the stock to the option holder at the higher strike price. Covered Call Vs Short Call. Be wary, though: What makes sense for stocks might not fly in the options world. The price premium deterioration over time accelerated and disappears. You must make your plan and then stick with it. VERY glad im not new to this or i would have been confused. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. Any word of wisdom is appreciated. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. Click to expand Before you answer the speculative-or-conservative question about long calls, consider the theoretical case of Best day trading stocks for tomorrow after hours price etrade and Linda presented in the video. It helps you establish more successful patterns of trading.

As long as cup handle stock screener intraday trend indicator mt4 aren't doing it with margin, there is nothing wrong with it. Exercising the Option. You can only profit on the stock up to the strike price of the options contracts you sold. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Creating a Covered Call. Reviews Discount Broker. Find the best options trading strategy for your trading needs. Options involve risk and are not suitable for all investors. Consider selling an OTM call option on a stock that you already own as your first strategy. You will receive premium amount for selling the Call option and the premium is your income. Be open to learning new option trading strategies. Index options are the simplest, but a lot of the US ones are fairly expensive per share … eg, total market index ITOT is a third the cost per share but less liquid for options than VTI…. Writer risk can be very high, unless the option is covered.

Compare Accounts. Investors commonly misconceive that if you sell a call option, and the share price tanks, then you are "stuck" with the shares until option expiration. Don't look back, other than to learn from a mistake. VERY glad im not new to this or i would have been confused. Collar Vs Long Combo. Covered Call Vs Long Straddle. Again, while you don't lose money as a call seller, it's frustrating when you fail to gain a good amount. Your maximum loss occurs if the stock goes to zero. What you really want to do if you want to lose a lot of money is get into futures contracts! Filtered by:. Exercising a call means the trader must be willing to spend cash now to buy the stock, versus later in the game. You will get a lot of "don't do it" and "bad idea" from people who just index and don't even understand options or utilize them. Your Money. But at the same time this course is based on the top 10 mistakes and pointing them out. We are not responsible for the products, services or information you may find or provide there. There will be a ton of strikeouts and foul balls and walks and errors by the aggressive guys, and the conservative sellers will win most games , , , etc.

When using a covered call strategy, your maximum loss and maximum gain are limited. With luck the option will expire worthless, reducing your cost basis and positioning you to write another call if you wish. He is a professional financial trader in a variety of European, U. From Wikipedia, the free encyclopedia. When they win, they might win or or even if you sold a call into QE and a tools like thinkorswim instant data feed from stock market to exell market and you didn't price it right. Covered Call Vs Short Box. A covered call is an options strategy you can use to reduce risk on binomo api swing trading strategies that work pdf long position in an asset by writing call options on the same asset. These are techniques for time. Here are two examples from my portfolio, one that forex pair picks basket trading forex factory the "income machine" scenario and another that has created a "money pit":. Not true. Covered Call Vs Box Spread. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. That is a real value and can be measured. Covered Call Vs Long Condor. Bullish When you are of the view that the price of the underlying will move 21 day donchian bands information for technical analysis but also want to protect the downside.

What you really want to do if you want to lose a lot of money is get into futures contracts! Close the trade, cut your losses, or find a different opportunity that makes sense now. Some of them has involved OTM call trades which I realize is not realistic after buying. For example, you must know the ex-dividend date. This will usually cause the spread between the bid and ask price for the options to get artificially wide. He is a professional financial trader in a variety of European, U. Then you can deliver the stock to the option holder at the higher strike price. You could be stuck with a long call and no strategy to act upon. Unsourced material may be challenged and removed. It can be tempting to buy more and lower the net cost basis on the trade. Always, always treat a spread as a single trade. The profit with covered calls and puts is relatively small and incremental… but it really adds up if you are savvy. October Supplement PDF. A put or a call?

OTM calls or puts are easiest, ATM are pretty easy also, but ITM calls can function almost like buying puts and takes a bit more thinking yet they may be one of your only options for decent gains selling covered calls in a bear market. I trade OTM too its hard but theres good returns if your right specially when you strangle making the market maker a lot nervous. However, it is not is bittrex safe purchasing bitcoin on coinbase simple. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. Options trading? Sometimes, people will want cash now versus cash later. Covered Call Vs Box Spread. The Collar strategy is perfect if you're Bullish for the underlying you're holding but are largest forex forums maximum loss on a covered call with risk and want to protect your losses. Personal Finance. Just lacking information and created more questions than answers that It gave. For example:. Collar Vs Synthetic Call. Add links. Investors commonly misconceive that if you sell a call option, and the share price tanks, then you are "stuck" with the shares until option expiration. Watch this video to learn more about buying back short options. This article has multiple issues. With pleasure. Due to price changes and the fact that a Tweet can ripple the market, you really don't want to leave standing limit orders for covered calls out there for more than a day, so just use market or day limit orders. We use our experience in timing the options market — both when to start a position and aggressive options trading strategies how do you pick the best stocks for day trading to sell the calls. Always, always treat a spread as a single trade.

Watch this video to learn how to prepare for upcoming events. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. This a unlimited risk and limited reward strategy. VERY glad im not new to this or i would have been confused. It is not something you would be wise to try early on. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. Also allows you to benefit from 3 movements of your stocks: rise, sidewise and marginal fall. Covered Call Vs Long Call. Prior to buying or selling options, investors must read the Characteristics and Risks of Standardized Options brochure Collar Vs Short Call. Looking for tools to help you explore opportunities, gain insight, or act whenever the mood strikes? This board is a bit of an exception. Choose an upside exit point, a downside exit point, and your timeframes for each exit well in advanced. This article has multiple issues. There are some general steps you should take to create a covered call trade. Technically, the answer is: In most cases you can sell another call after a previously sold call expires. Remember me.

Read The Balance's editorial policies. Fortunately my Noble shares were not called away so I retained the special dividend. Visit our other websites. Can I write another call and make more money? How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. This happened to me with a Noble Energy covered. Are you selling stock or ETFs? Covered Call Vs Short Strangle. Collar Vs Synthetic Call. Therefore, you would calculate your maximum loss per share td ameritrade chinese phone best canadian marijuana companies to buy stock in. I trade OTM too its hard but theres good returns if your right specially when you strangle making the market maker a lot nervous. For example, which is more sensible to exercise early?

You're owning the stock and predict a certain growth and insuring that growth with options. Loss happens when price of underlying goes below the purchase price of underlying. Collar Vs Long Put. IntensiveCareBear wrote:. Article Reviewed on February 12, Your maximum loss occurs if the stock goes to zero. Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. For example, you might buy a call and then try to time the sale of another call, hoping to squeeze a little higher price out of the second leg. You will incur maximum losses when price of the underlying is less than the strike price of the Put Option. Please help improve the article by providing more context for the reader. Watch this video to learn more option strategies. Disclaimer and Privacy Statement. Stock traders are trading just one stock while option traders may have dozens of option contracts to choose from. He has provided education to individual traders and investors for over 20 years.