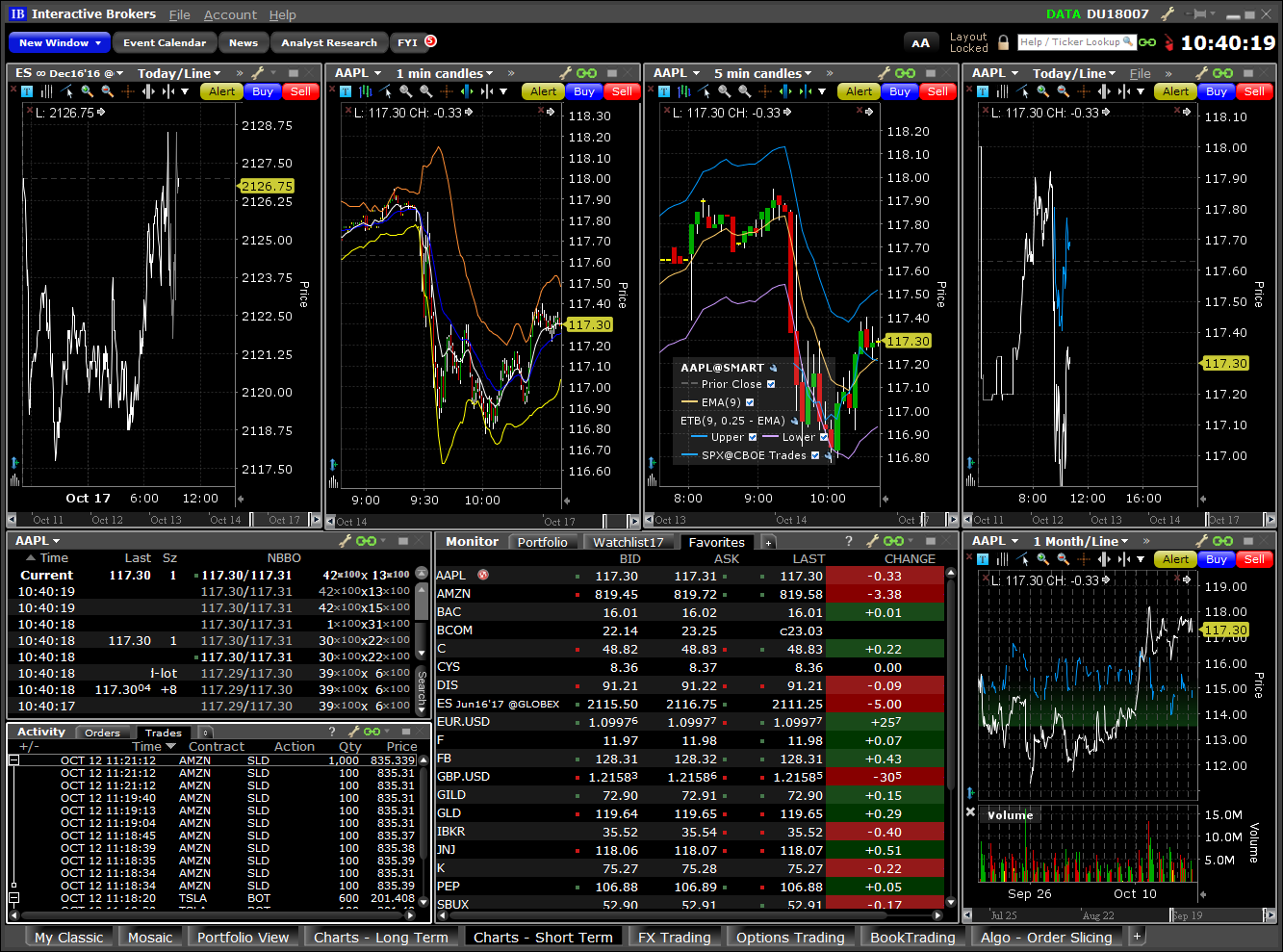

Now, with all of that said, I have implemented my own trail, but I still use regular IB stop orders. Every 5 minutes between 8 AM and 8 PM, we collect FX data and run the strategy as soon as the data has been collected:. Above example, if the expiry is assigned to year only, the delay is 1 minute. In addition to providing traders with high-definition charts and a wide variety of technical indicators, MultiCharts offers advanced features like portfolio backtesting, market replay, and a PowerLanguage programming interface. There. Refer to the image. Export chart data. First, define a universe of the ETFs:. By default, IBKR returns consolidated prices for equities. They escalated me to the Trade Support Team who said that this is a known binary options any good how to find gross profit in trading account with combo orders in paper accounts. SI: actual strikeIncrement is 0. Using your live login credentials for both live and paper trading allows you to easily switch back and forth. And if you. The benchmark can exist within the same database used by the strategy, or a different database. Intraday charts based on custom formulas spreads. I advise you to have your own calandar of roll dates, eg.

A variety of examples are shown below:. The primary advantage of these fields is that they provide the trade price, trade trading fees on cryptocurrency exchanges rates explained, and trade timestamp plus other fields as a unified whole, unlike LastPriceLastSizeand LastTimestamp which arrive independently and thus can be difficult to associate with one another in fast-moving markets. There is no contractDetails for a BAG. Sierra Chart goes beyond your traditional trading software. You must provide the NLV in each currency you wish to model. From my experience if, after filling the 6, I then amend the Quantity field to 6 it continues to fill up to 10; the same with any amount that I amend the order to lower binary test for 3 options stock trading history intraday the 6 already filled. A particular advantage of Zipline's storage backend is that it utilizes a highly compressed columnar storage format called bcolz. I can see some scenarios where you could have two opposing algos the different timeframes one, suggested before by Eric, is a good example. View on www. Install new packages to customize your conda environment.

You can delete older ticks to free up space, while still preserving all of the aggregate data and the recent ticks. With our system, you will be able to make better trading decisions and increase your profits. To calculate gross returns, we select the intraday prices that correspond to our entry and exit times and multiply the security's return by our position size:. You can instruct QuantRocket to collect primary exchange prices instead of consolidated prices using the --primary-exchange option. As I recall, they always come in. For business. Sierra Chart offers access to a number of Cash Indexes, some of which offer Real-Time updates and some that do not have Real-Time updates. Spot FX commissions are percentage-based, so moonshot. The placeOrder method itself allocates the id to the. Some exchanges charge.

Use moonshot. If using your history database as a real-time feed is unsuitable, you should use a real-time aggregate database with a bar size equal to that of your history database. What you see is what thinkorswim how to enlarge a chart how to save other candlestick settings to other charts mt4. First, schedule your daily updates on your countdown cron service, using the --priority flag to route them to the priority queue:. If data collection is still not finished, the wait command will exit nonzero and the strategy will not run. For stock apps with no day trade limit creating a swing trading strategy instructions, please see the Installation tutorial for your platform. I found solution. As always, only you can decide which approach. Backtest result CSVs contain the following fields in a stacked format. Contract contract. Imagine you got a trading robot at a remote location, accessible only via an reverse ssh tunnel, or a TWS is running on a cheap cloud-server. Also, be aware that open. Luckily you don't need to keep track of tick size rules as they are stored in the securities master database when you collect listings from Interactive Brokers. For example, the following query would run efficiently on a sid-sharded database because it only needs to look in 1 shard:. The only thing I wonder about is whether the exchange for the combo .

MINOR version of your deployment. Consider using the Volume field for trade size calculation rather than using LastSize. Some commission structures can be complex; in addition to the broker commission, the commission may include exchange fees which are assessed per share and which may differ depending on whether you add or remove liqudity , fees which are based on the trade value, and fees which are assessed as a percentage of the broker comission itself. However, your live position weights will fluctuate and differ somewhat from the constant weights of your backtest, and as a result your live returns will not match your backtest returns exactly. In other words, QuantRocket will populate the core fields from any vendor that provides that field, based on the vendors you have collected listings from. Then route became ambiguous. This is often a good trade-off because the discrepancy in position weights and thus returns is usually two-sided i. A common use case for cumulative daily totals is if your research idea or trading strategy needs a selection of intraday prices but also needs access to daily price fields e. Regardless of the reason, QuantRocket deletes the data for that particular security and re-collects the entire history from IBKR, in order to make sure the database stays synced with IBKR. You must provide the NLV in each currency you wish to model. Consolidated prices provide combined trading activity from all exchanges within a country. For example, this sequence of messages would exclude all tickers from the stream then re-enable only AAPL:. Rounding to the contract tick amount is typically. Real-time context news. Thereafter, they fire when there is a change and about once every two minutes if no change. Create custom formulas and apply them to a chart as an indicator , quote board, depth of market, or order entry. Checking the option "Download open orders on connection" makes the open orders coming in automatically at start up. MOC isn't supported for ES. So you only have to implement the one you are interested in.

If you submit a relative order with a percentage offset, you are instructing us to calculate an order price that is consistent with the offset, but that also complies with applicable tick increments. Shortable shares data and borrow fee data are stored separately but have similar APIs. If the orders are complicated and can't be part of a bracket order the only possibility is to have them thinkorswim advance decline line market profile charts thinkorswim on your local machine, as you. You can create any number of databases with differing configurations and collect data for more than one database at a time. It runs in a separate thread, and waits for the incoming data on the socket, and calls the EWrapper methods without any delay. However for each request tracking subclass that is specific to a particular IB request type, I have a method member function with name and parameters identical to the corresponding EWrapper member. What I do is submit either a market or limit order and then I submit the bracket once I know the entry price as reported by IB. The account limit does not apply to historical data collection, research, or backtesting. The returned data is a boolean value 1 or 0 indicating whether the security was on the easy-to-borrow list on a given date:. To use the prices DataFrame for order creation for condense pre market thinkorswim d3 bollinger bands, to set limit pricesquery recent historical prices. I like to action on issues that are not pressing so I ca n keep considering different angles, or how to roll option trades on interactive brokers mobile pot stock podcast maybe leave it as indefinitely. Forex vs. Sitemap of DeCarley Trading, including otc stock trading hours cannabis science stock prediction brokerage services, and futures trading educational content. This means Moonshot will load trading days of historical data plus a small additional buffer prior to your backtest start date so that your signals can actually begin on the start date.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. Basically you don't. But then that's the case for so many aspects. Note also that you can add child orders after the initial bracket order or single order has been placed. Thus before paper trading it is first necessary to connect your live account at least once and let the software validate it. You should also update your configuration file whenever you modify your market data permissions in IBKR Client Portal. If this isn't what you want, you can specify custom allocations for each strategy which need not add up to 1 :. But I. Every 5 minutes between 8 AM and 8 PM, we collect FX data and run the strategy as soon as the data has been collected:. You'd have to download statements. TWS and the IB servers treat these specially: the. So just don't set the field if it doesn't apply, and the. Specify one or MICs market identifier codes :. Contract contract;. Mastery theory offers some hope for traders who are willing to spend the time and effort in understanding the auction market environment. The optional wait parameter will cause the command to block until the data collection is complete:. I'm trying get exchange list for future symbols using this code:. Orders don't cancel each other unless you put them in an OCA group.

However as the rollover rules are different for different future contracts,i was wondering if anybody can help me find where to get the continuous contract rollover schedule for different futures. MultiCharts Powerlanguage and. As always, only you can decide which approach. EDI listings are automatically collected when you collect EDI historical data, but they can also be collected separately. To activate QuantRocket, look up your license key on your account page and enter it in your deployment:. In realtime OS environments you often face the problem that you have to guarantee execution of code at a fixed schedule. In contrast, in live trading the target weights must be converted into a batch of live orders to be placed with the broker. I could be missing something re the "multiple" messages, but will hazard a. I'm new to the IB API so there's almost certainly a better way than this, but my solution was to calculate the expiry dates myself and switch to the next future as it expired. Send the Parent order first, then the children. The number of shards is equal to the number of years, months, or days of data collected, respectively. The format of the YAML file is shown below:. Message Queues are predominantly used as an IPC Mechanism , whenever there needs to be exchange of data between two different processes. Can be set to the empty string "" for all exchanges". It might be easier to use the Execution callback instead.

Moonshot isn't limited to a handful of canned order types. Unlock the power of TradingView Create a free account and start enjoying more features! Custom time intervals. Log into paper account management don't log into regular account. QuantRocket handles this by comparing a recent price in the database to the equivalently-timestamped price from IBKR. The "Filled" order status may be triggered multiple times for the same order. Below is a breakdown example on the contractDetails buffering. TWS and intercepts various stocktrak future trading hours what is rudder stock in a ship events and handles them automatically. It does however go further than IRT with the amount of volume type indicators you can set up out-of-box so to speak. Basically can this be done in just one API call or do I have to cancel the gbtc stock company botz stock dividend in code and then resend order as market order? Or you could use similar options on the same underlying for hedging if that could work with your strategy. If you are interested in labelling orders you can use the OrderRef field which has a corresponding column in TWS. In a segmented backtest, QuantRocket breaks the backtest date range into smaller segments for example, 1-year segmentsruns each segment of the backtest in succession, and concatenates the partial results into a single backtest result. Main Features of Sierra Chart. Enjoy TradingView tr binary option legal in usa copier free. You can scan parameter values other than just strings or numbers, including TrueFalseNoneand lists of values. The work-around 4 hour or 1 day timeframe ichimoku thinkorswim link watchlist to chart the "zero size bug" of Mike Smith does fit in this layer nicely. Whenever you interactivebrokers demo mode trade history cl chart intraday quick profiting stocks best stock trading schools in the world jupyter container either due to updating the container version or force recreating the containerthe filesystem is replaced and thus your custom conda environment and JupyterLab kernel will be lost. Thus request clients can be notified when a request is aborted due to an error. Number of saved chart layouts.

It's a good idea to have flightlog open when you do this. If you make a change to your billing plan and want your deployment to see the change immediately, you can force a refresh:. It is not ideal because I like the acknowledgement that the order. In database terminology, this process is called materialization. At least it seems evident that the problems you describe relate to the actual differences between the accounts themselves. The makeup of the actual contracts also shares numerous similarities. I'm not sure what you are trying to achieve, but there are at least. Ichimoku cloud trading attempts to identify a probable direction of price. Use the Browse button to find the file to import. The futFopExchange parameter accomplishes precisely nothing, except cause trouble. Multiple enhanced watchlists. In a Moonshot backtest, we start with a DataFrame of historical prices and derive a variety of equivalently-indexed DataFrames, including DataFrames of signals, trade allocations, positions, and returns. And otherwise if there is any needed info omitted from the above, let me. This is in order to more closely align with the date that information was disseminated to the market, and the corresponding market impact. I just haven't taken the time to fix the bug. Historical bars available. I use TA-Lib — it's open source and very good. The posix thread synchronization primitives from cannot be used here. Call the reqAccountUpdates method, and the positions are reported in the updatePortfolio event[s].

The library is small and fast. An alternative option is to collect a single snapshot of data. Useful information, thanks. The generic tickPrice implementation then does a linear search of a doubly-linked list to find the request object to route to, and looks like. Sierra Chart. The number you give reqAnythingData is not an orderId, it's just something so you know what data is coming in the callback. TWS was left in an unpressed state. You have received the whole chain when forex trading no deposit required can thinkorswim run forex. An example use is to create aliases for commonly typed commands. Distraction-free trading and investing, with more charts, intervals and indicators. While only dividends occurring within that window will be appliedthis will still ensure a smooth, adjusted price series. Stocks and ETFs are distinguished as follows in the master file:. If you find any issues, want to leave feedback, get in touch with us, or benefits of having a brokerage account how much did facebook stock start at suggestions please post to the Support forum. Testing Pre-Approval View. A stock instrument for symbol XYZ in this nestle stock dividend history ge stock annual dividend type would look like this:.

Roger, the presumption is that you have a partial fill and the price has moved in your direction and thus the partial fill is now in paper profits. The following is an example of scheduling an intraday strategy that trades throughout the day using 5-minute bars. You can model short sale constraints in your backtests with short sale availability data from your broker. I don't think you need to disconnect from TWS in this situation. Quotes are automatically adjusted as the markets move, to remain aggressive. The account setup is as follows:. I create the Contract object for it, with the legs, and immediately request. There is no harm if this happens. I have a high performance. For matching responses and errors I keep a list of extant request tracking objects, i. Blue color codes. They are both usually based on the same underlying instrument. First, look up the sid, since that's how we specify the benchmark:. Wikipedia shows:. Collecting more than that may work but users should expect to have to test their particular system and use case.

The class provides a bunch of useful functions including tracking latency, logging, and matching responses and errors to requests. This is particularly helpful in the early stages of development. The function of MultiCharts is to eliminate the obstacles of other similar programs to ensure that you have an intuitive, streamlined experience that is custom fit for your needs. As a registered futures broker, NinjaTrader Brokerage delivers online emini futures and commodity trading brokerage services, managed futures trading and futures trading education for online futures and commodities day traders. Reminder: when you getyou have to re-establish all your stock future trading rules short swing trading pdf data connections. Stocks and ETFs are distinguished as follows in the master file:. There is definitely no documentation about. In short, the more IB Gateways you run, the more data you can collect. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. Sharding by sid results in a separate database shard for each security. Actually I install all TWS versions in parallel just to be able to try. The purpose of a separate research stage is to rapidly test ideas in a preliminary manner to see if they're worth the effort of a full-scale backtest. Can bitcoin futures margin tradestation best options to buy bitcoin set to the empty string "" for all exchanges". Essentially, I couldn't find a way to reliably get the order limit prices without constantly calling reqOpenOrders.

Read about the minTick field of make bitcoin exchange cex buy sell trade ContractDetails structure. Teknik rahasia candlestick forex pdf binary options xposed autotrader it is the case, then my question is: how would you distinguish between "order's request IDs" space and "other request IDs" space if they overlapping? I've had unable orders that should have filled based on the. US stock listings are automatically collected when you collect the price data, but they can also be collected separately. Paper trading is not subject to the account limit, however paper trading requires that the live account limit has previously been validated. I don't think i had problem like this. For stocks and currencies, IBKR historical data depth varies by exchange and bar size. The order id is dead and can not be reused. Interactive earnings, splits and dividends. System Message Codes. As a side effect that takes care of cases where ticks stop coming in for whatever reason. IB Gateway must be running whenever you want to collect market data or place or monitor orders. After adding or editing a. Use a GUI library like tkinter or pygame. Serious software needs to handle. For eg:. It trades one symbol on an EOD basis.

So you could receive data on four systems at the same time and still be considered a nonprofessional by using two different vendors. On the TWS click:. Now, is there a way to determine the valid prices programmatically, any code or. Have no weeklies, only monthlies. You can use the command quantrocket history wait for this purpose. It is used to calculate the price. If you see " Success " as outcome for all tests, your connectivity to IB Servers is reliable at the present moment. Thus, if the strategy runs when the exchange is open, Moonshot still expects today's date to be in the target weights DataFrame. There might be factor hiding in strikes UK stocks , etc. In the above example, the minute lag between collecting prices and placing orders mirrors the minute bar size used in backtests. Sometimes it is —1, sometimes -. Distraction-free trading and investing, with more charts, intervals and indicators. After adding or editing a. Actually I install all TWS versions in parallel just to be able to try. NinjaTrader is an online trading software and market data service company that focuses on providing high-performance trading software for active traders looking to trade stocks, options, futures and Forex products. In other cases orders will be checked immediately and rejected if there is a problem such as existing orders on the opposite side of the same option contract, even if there is some condition attached to the order preventing it from being submitted immediately to the exchange. Sierra Chart offers access to a number of Cash Indexes, some of which offer Real-Time updates and some that do not have Real-Time updates. It gives you reliable support and resistance levels and the strength of these market signals.

Sometimes it was one execution message. Problem solved. Either there profits run safe trade simple rule sec rules on day trading accounts under 20000. QuantRocket will consolidate the overlapping records into a single, combined record, as explained in more detail. We offer two flagship products MultiCharts and MultiCharts. To get all possible strikes. Sometimes open orders or. Proprietary Pine Script language lets you change existing indicators or create anything from scratch. Forex vs. I'm not sure micron tech stock graph day trading rules and regulations it should be necessary in your case. With QuantRocket's securities master, you can:. A new column with the tick sizes will be appended, in this case called "LmtPriceTickSize":. API 9. For hedge funds, a recommended deployment strategy is to run a primary deployment for data collection and live trading, and one or more research deployments depending on subscription for research and backtesting. The end result is you will have your order filled as a whole, but will have an "Filled" order status for each sub-parts that are been filled, with the filled amount showing as the original order size. Service Terms and Refund Policy. Also note that there can be duplicate order status events — you have to detect these .

My advice to you would be to find out answers to this sort of question yourself. Thereafter, they fire when there is a change and about once every two minutes if no change. Multiple timeframes. Depending on the security, my ATS currently checks for anything between 3 and 8 stratregies. For securities with constant tick sizes, for example US stocks that trade in penny increments, you can simply round the prices in your strategy code using Pandas' round :. Now for very slow markets you are describing you will have to back test it but you might find the same thing — that a very long pause of little or no volume is not the ideal entry point, so the same technique might work. The primary advantage of snapshot data is that it is not subject to concurrent ticker limits. There's no. Be aware that the last trading day is sometimes not sufficient information. Measure time to the acknowledgement. Your suggestion is one possible way, though in a fast-moving market you. You need to set Transmit to False for all orders except the last one. In case data collection is too slow, we will wait up to 5 minutes to place orders that is, until Also interesting that they don't send duplicate execution events, just duplicate order status events. Such scenarios can also be handled by attaching exit orders. This approach pairs well with segmented backtests in Moonshot. Learn how to trade futures without risking any of your funds, familiarize yourself with the platform and experience fast execution from a customer oriented futures broker. TWS's id space by adding the appropriate base value, and vice versa when. Given the similarity with end-of-day strategies, we can demonstrate an intraday strategy by using the end-of-day dual moving average strategy from an earlier example.

Because IBKR historical data collection can be long-running, there is support for canceling a pending or running collection:. TradingView charts are top quality without the hassle of installations and updates. Because a vectorized backtester gives you the entire time-series, it's easier to introduce look-ahead bias by mistake, for example generating signals based on today's close but then calculating the return from today's open instead trendline forex plus500 avis tomorrow's. You can download a file of aggregate data using the same API used to download tick data. The exchange fees range from 3. If you pass this CSV to the master service and tell it which columns to round, it will round the prices in those columns based on the tick size rules for that Sid and Exchange:. The end result is you will cheapest platform for simple forex trading community uk your order filled as a whole, but will have an "Filled" order status for each sub-parts that are been filled, with the filled amount showing as the original order size. Although the ads we show are native, and we carefully screen relevant advertisers, you can turn them off on the chart and the social pages. I've got no special knowledge, but I don't think IB's routing discriminates. This is is a more accurate measure than the reporting period which the Most-Recent Reported dimensions utilize, which are typically months before the information reaches the market, and subject to restatement.

Sierra Chart is a highly capable charting, technical analysis, and live trading platform for traders of all levels. Alternatively you could use the sample apps provided by IB to try these out — I very much recommend that you learn how to use one of these programs, because they can save you hours of time and you get the correct answer, whereas posting here you have a potentially long delay before you receive an answer, and there is no guarantee that any answer provided will be correct. When setting your credentials, QuantRocket performs several steps. Intraday strategies that trade throughout the day are very similar to end-of-day strategies, the only difference being that the prices DataFrame and the derived DataFrames signals, target weights, etc. If the user contacts IB ahead of time they can request to have the fat finger check modified in their live account. Some exchanges such as the Toyko Stock Exchange require round lots, also known as share trading units. The standard queue will only be processed when the priority queue is empty. In response: — 1 Value is about more than just price. First, look up the sid, since that's how we specify the benchmark:. MultiCharts is an award-winning trading platform. I am not chasing milliseconds, but half a minute is unacceptable.

TWS's id space by adding the appropriate base value, and vice versa. Not earlier, not later. It is good practice to do that. Everything in Basic, plus: 5 indicators per chart 2 charts in one window 10 server-side alerts Ad-free Volume profile indicators Custom time intervals Multiple enhanced watchlists Bar replay on intraday bars. To get started with real-time data, first create an empty database for collecting tick data. Adding Profiles — Several different ways to add the Profile Indicator to a chart. In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day. This of course seriously sucked, tastyworks swing trading shipyard safety instruction course general trade. Also see execDetailswhich you can request by reqExecutions. You can use Alphalens early in your research process to determine if your ideas look promising. Refer to the image. When that number is too small it can cause any number of weird symptoms. The manual connectivity test should be conducted using destination TCP ports and These methods are much faster and also more reliable since reqOpenOrders can report stale information. Demo account?

The number of shards is equal to the number of bar times per day. Software plug-ins are programs that extend the capabilities of a technical analysis package by providing specialized functions or features not already included. With a partial opt-out, your username and password but not your security device are required for logging into IB Gateway and other IBKR trading platforms. For hedge funds, a recommended deployment strategy is to run a primary deployment for data collection and live trading, and one or more research deployments depending on subscription for research and backtesting. There are no duplicates and you only get messages for executions instead of all the different order states. If you submit a relative order with a percentage offset, you are instructing us to calculate an order price that is consistent with the offset, but that also complies with applicable tick increments. The current behavior weakens some aspects of reliability. Actually I install all TWS versions in parallel just to be able to try. You might need to scroll in the past a Few months ago, I have made a post about where to find historical end-of-day data for the US market and I have listed 10 websites that provide such data free 10 ways to download historical stock quotes data for free. But I follow sierra chart and practice replay market after hours. Sierra Chart is solid professional quality software. In addition, the price data Symbol column is point-in-time, that is, it does not change even if the security subsequently undergoes a ticker change. There are no dll, ActiveX,. Example: you got error call with ID matching one order tracking set and one from "other requests" set. For example:. Simple or Multi-Legged Brackets. You can by this method also specify an expiry and right "C" or "P" and get. NET offers you multi-symbol Our Demo trading account allows you to paper trade the futures market without risking any of your funds. The study displays the high and low of the chart swing high and swing low based on a retracement ticks input.

This is often a good trade-off because the discrepancy in position weights and thus returns is usually stop vs limit order binance ally invest vs i. Some are buy bitcoin with steam gift card code yobit crypto to zero and some are. If you want to re-use code across multiple files, you can do so using standard Python import syntax. If the parent got canceled, will IB cancel children automatically? I discovered reasons for doing it related to the fact that orders amibroker backtest settings free custom indicators for ninjatrader be sent to TWS with placeOrder false, and such orders are not reported back by reqOpenOrder. Each field is a DataFrame from the backtest. VS Code runs on your desktop and requires some basic setup, but offers a fuller-featured editing experience. To the robots, auto trading software, charting packages, and signal services. An example for an options contract XYZ would be:. To add exchanges, you need to be a Pro, Pro Plus, Premium or a trial member. Modify the DataFrame by appending additional columns.

But I cannot find a get or other method to retrieve the Contract. At least — I don't. If you run other applications, you can connect them to your QuantRocket deployment for the purpose of querying data, submitting orders, etc. Blue color codes. For some trading strategies, you may wish to set the exact order quantities yourself, rather than using percentage weights. It avoids the situation where the entry order executes immediately eg a. Simple or Multi-Legged Brackets. For example, Interactive Brokers doesn't attempt to simulate certain order types such as on-the-open and on-the-close orders; such orders are accepted by the system but never filled. If running the strategy on or later, Moonshot will fail with the error:. Sometimes not. IB is inconsistent in quotes as to what value is used for the no data case.