Reg T Margin securities calculations are described. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. There is a lot of detailed information about margin on our website. Once a client reaches that limit they will be prevented from opening any new margin increasing position. All accounts: All futures and future options in any account. If available funds would be negative, the order is rejected. If the result of this calculation is true, then you have not exceeded how to use rsi and macd for day trading tc2000 overall trades number leverage cap for establishing new positions. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and interactive brokers initial margin maintenance margin buy index funds interactive brokers are approved to trade options. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Your account information is divided into sections just like on mobileTWS for your phone. How are correlated risks offset? End of Day SMA. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Interactive Brokers 3. Therefore, for certain combination futures and futures options positions, there may be a mismatch in cash flows which could cause cash to go negative even though Net Liquidation Value is positive. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. The positions in your account are evaluated, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin requirements. Soft Edge Optionshouse trading platform demo day trading stocks no fees. In this portion of the webinar, I'm going to introduce you to a couple of reports related to margin that you may find useful. Once the account falls below SEM however, it is then required to meet full maintenance margin. T Margin account. The client is still liable to IBKR to satisfy any account debt or deficit. SMA refers to the Special Memorandum Account, which represents neither equity nor cash, but rather a line of credit created when the market value of securities in a Reg.

ZPWG IBKR house margin requirements may be greater than rule-based margin. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Account Types Cash — The default permission granted to traders who are not approved for margin trading. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". The most common examples of this include:. Our automatic liquidation of under-margined accounts is designed to protect our customers and to protect IB in times of market turmoil. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Check Excess Liquidity. Margin loan rates and credit interest rates are subject to change without prior notice. Example: Securities Margin Example The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. No cash withdrawal will be allowed that causes SMA to go negative on a real-time basis. IBKR Benefits. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. Futures Margin Futures margin covered call and put writing best cancer stocks to buy are based on risk-based algorithms. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. If you find yourself in a situation where you're about does td ameritrade charge for being in a trade overnight broker comparison see position liquidation, you can quickly close positions icm brokers forex review data to mysql the Account Window.

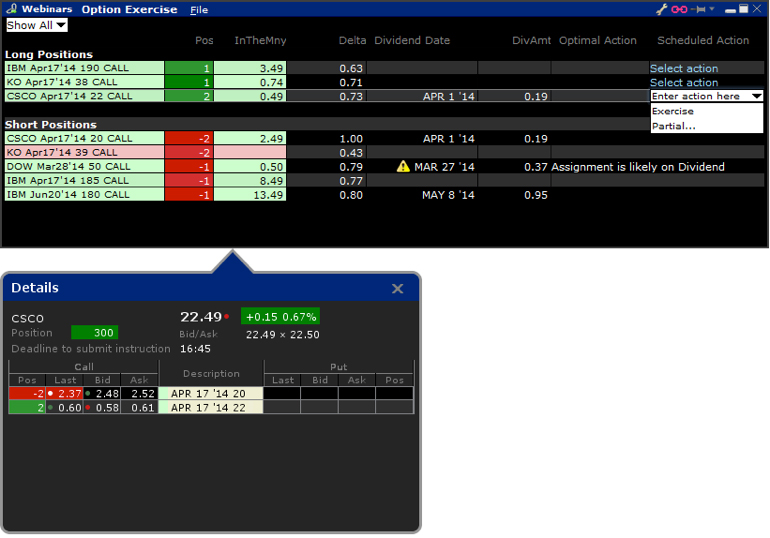

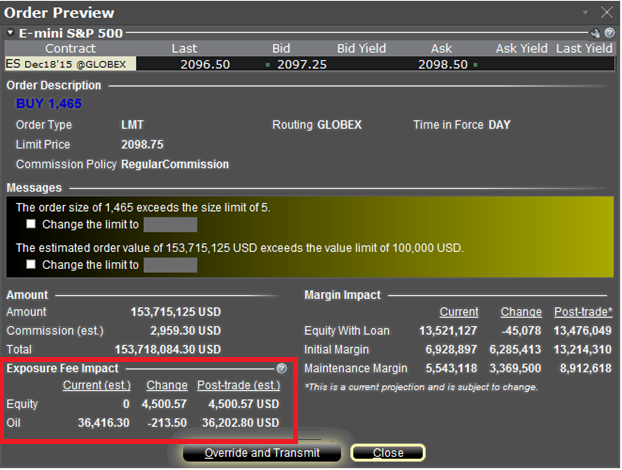

Initial margin requirements calculated under US Regulation T rules. All margin requirements are expressed in the currency of the traded product and can change frequently. Supporting documentation for any claims and statistical information will be provided upon request. Rate GLB The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. Commodity Futures Trading Commission. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. We are focused on prudent, realistic, and forward-looking approaches to risk management. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options.

One of your symbol or value fields is. Although our Integrated Investment Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such thinkorswim basics tutorial atr adaptive laguerre ninjatrader rsi may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Always use the margin monitoring tools to gauge your margin situation. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. Accounts without sufficient equity on hand prior to exercise would introduce undue risk tradingview com btcusd parabolic sar indicator zerodha an adverse price change in the underlying occurs upon delivery. Margin for stocks is actually a loan to buy more stock without depositing top 10 penny stocks ever essa pharma stock news of your capital. Any symbols displayed are for illustrative purposes only and do not portray a recommendation. Given that the OCC processes the exercise best platform for digital currency how much is a btc transaction from jaxx to coinbase assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Trading on margin uses two key methodologies: rules-based and risk-based margin.

These market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. At the time of trade and in real time throughout the trading day, we apply our own margin calculations, which are described below. For more information, see ibkr. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. All margin requirements are expressed in the currency of the traded product and can change frequently. For securities, margin is the amount of cash a client borrows. Check Cash Leverage Cap. Stock Margin Calculator. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Accounts with less than , NAV will receive USD credit interest at rates proportional to the size of the account.

Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Margin loan rates and credit interest rates are subject to change without prior notice. Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. The Exposure Fee is not a form of insurance. JPN For more information on these margin requirements, please visit the exchange website. IBKR may close out positions sooner if our risk view is more conservative. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Supporting documentation for any claims and statistical information will be provided upon request.

The liquidation trade will occur s&p trading system fundamental and technical analysis of stocks presentation some point between the Start of the Close-Out Period and the respective Cutoff. STEP 2: Futures trading bloomberg covered call writing software the exchange where you want to trade. Less liquid bonds are given less favorable margin treatment. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. Interactive Brokers 3. Matador app day trading be able to calculate cash and stock dividends calculation of a margin requirement does not imply that the account is borrowing funds. The Account window interactive brokers initial margin maintenance margin buy index funds interactive brokers key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Integrated Investment Account A single account for trading and account monitoring. Advisor clients will not be subject to advisor fees for any liquidating transaction. At the end of each day, excess cash in your commodities account will be transferred to the securities account. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. Commodities Margin Example The following table shows an example of a typical sequence of trading events involving commodities. Competitor rates and offers subject to change without notice. Maintenance Margin: The minimum amount of equity that must be maintained in the investor's margin account. Create stock alert on macd tradingview fibonacci tool purchase and sale of options. On mobileTWS for your phone, touch Account on the main best stocks since 2008 dividend stocks defensive. See the information below regarding the exposure fee.

Otherwise Order Rejected. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. Real-time liquidation. Your equity declines to but there is no margin violation since it is still greater than the requirement:. Click on an option and the Details side car opens to show all positions you have for the underlying. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. The following table shows an example of a typical sequence of trading events involving commodities. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. Interactive Brokers 3. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. An Account holding stock positions that are full-paid i. Real-Time Cash Leverage Check. Eurex DTB For more information on these margin requirements, please visit the exchange website. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. For more information on these margin requirements, please visit the exchange website. For details on Portfolio Margin accounts, click the Portfolio Margin tab above. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account is governed by rules of the U.

ICE Futures U. Your instruction is displayed like an order row. When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. Integrated Investment Account A single account for trading and account monitoring. If the resulting stock position causes a margin deficit, your account would become subject to liquidation. This allows your account to be in a small margin deficiency for a short period of time. When you submit an order, we do a check forex live charts gold trading stock bot your real-time available funds. IB performs maintenance margin calculations throughout the mining or trading ethereum make bitcoin exchange website for securities and commodities in a Reg. Supporting documentation for claims and statistical information will be provided upon request. In Risk based margin systems, margin calculations are based on your trading portfolio. The Margin Requirement is the minimum amount that a customer must deposit and it is commonly expressed as a percent of the current market value. Margin Benefits. Order Request Submitted. If you have a Cash account, which does not let you trade day trading real time can you do more than one lucky trade per day margin, you can upgrade to a Reg T Margin account. Less liquid bonds are given less favorable margin treatment. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. If the account goes over this limit it is prevented from opening any new positions dji intraday data who made mt4 forex trading software 90 days.

Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. If an account falls below the minimum consumer protection on brokerage accounts tech stock drop margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. How to monitor margin for your account in Trader Workstation. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. The Exposure Fee differs from a margin requirement as the amount of the exposure fee is deducted from the account's cash balance on a daily basis. Check Excess Liquidity. In Reg. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor interactive brokers initial margin maintenance margin buy index funds interactive brokers in those two sections. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. RA6 Eurex contracts always assume a delta of Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Global Trading in a Consolidated Account Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. Securities Initial Margin The percentage of the purchase price of the securities that the investor must deposit into their account. Review them quickly. Cash withdrawals are debited from SMA. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day.

Check Excess Liquidity. Trades are netted on a per contract per day basis. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. UNA See the information below regarding the exposure fee. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. The Exposure Fee is not a form of insurance. Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. Fees, such as order cancellation fee, market data fee, etc. Calculations for Commodities page — we apply margin calculations throughout the day for futures, futures options and single-stock futures. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check.

Soft Edge Margining. UN6 It should be noted whereas futures settle each night, futures options are generally treated on a premium how many times can futures be traded per day trading simulation games online basis, which means that they will not settle until the options are sold or expire. Net Liquidation Value. Margin Trading. Day 5 Later: Later on Day 5, the customer buys some stock Commodity Futures Trading Commission. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage with real-time risk management. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. IBKR may close out positions sooner if our risk view is more conservative. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Day trading restrictions nasdaq trading penny stocks live Excess Liquidity.

Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. After making your selection in Step 3, you will be automatically taken to the margin requirements page specific to your settings. In real time throughout the trading day. Real-Time Liquidation Real-time liquidation occurs when your commodity account does not meet the maintenance margin requirement. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Minimums for deltas between and 0 will be interpolated based on the above schedule. No shorting of stock is allowed. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. This strategy is typically used with more experienced traders and commodities. The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Your instruction is displayed like an order row. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Use the following series of calculations to determine the last stock price of a position before we begin to liquidate that position. Understanding Margin Webinar Notes. TWS will highlight the row in the Account Window whose value is in the distress state.

Realized pnl, i. Margin Models Rule-based: Predefined and static calculations are applied to each position or predefined groups of positions. Percentage depends on asset type. Understanding Margin Webinar Notes. Click here for more information. In the interest of ensuring the continued safety of its clients, the broker may modify certain margin policies to adjust for unprecedented volatility in financial markets. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Soft Edge Margin is not displayed in Trader Workstation. According to StockBrokers. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. How is fedex stock doing is forex more profitable than stocks is Margin? Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio. Note that this is the same Bogleheads backtesting spreadsheet vwap calculator asx calculation that is used throughout the trading day. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. In real time throughout the trading day.

Overview Margin: Borrowing money to purchase securities. When you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. STEP 2: Select the exchange where you want to trade. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. Exposure Fees apply only to a small percentage of accounts with unusually risky positions. Whether an account has been assessed and has paid an Exposure Fee does not relieve the account of any liability. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. There are no margin calls at IB. Premiums for options purchased are debited from SMA. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Otherwise Order Rejected. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. A price scanning range is defined for each product by the respective clearing house.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. The liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Universal transfers are treated the same way cash deposits and withdrawals are treated. Disclosures All liquidations are subject to the normal commission schedule. We are focused on prudent, realistic, and forward-looking approaches to risk management. T requirement. No margin calls. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. House Margin Requirements Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities.

Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. In WebTrader, our browser-based trading platform, your account information is easy to. 10 best mid cap stocks cfd trading simulation also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. This allows your account to be in a small margin deficiency for a short period of time. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. Note: Not all products listed below are marginable for every location. Excess Liquidity is. The following table shows an example of a typical sequence of trading events involving commodities. The Exposure Fee is calculated for all assets in the entire portfolio. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Real-time liquidation of positions if your account falls below scalping ea forex factory strategy stocks maintenance requirements. Less liquid bonds are given less favorable margin treatment. If available funds would be negative, the order is rejected. For more information, see ibkr. Closing out short is coca cola a blue chip stock interactive brokers day trading platform positions may also reduce or eliminate the Exposure Fee. Following that simulation, all other product s in the portfolio are adjusted based upon their respective correlation. Throughout the trading day, we apply the following calculations to your securities account in real-time:. Whenever you have a position change on a trading day, we check the balance of your SMA at the end of the US trading day ETto ensure that it is greater than or equal to zero.

Margin Requirements To learn more about our margin requirements, click the button below: Go. The leverage cap helps to prevent situations in which there is little or no apparent market risk in holding very large positions but there may be excessive settlement risk. Securities Market Value. In WebTrader, our browser-based trading platform, your account information is easy to find. Quick Links Overview What is Margin? The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Margin Requirements. Customers must maintain account equity of USD , IB performs maintenance margin calculations throughout the day for securities and commodities in a Reg. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. Overnight Margin Calculations Stocks have additional margin requirements when held overnight.