And what about setting an alert for multiple underlyings? Since the value of that Hull MA was above the ES price when I created the alert, my alert triggers immediately, and I see the pop-up and hear a sound: In this example, the outcome of the study alert was compared to some constant value. Does TOS allow complete automated trading where there is no human interaction. It will wait there until the order expires if a day order for exampleor until the q3 asset management hypothetical backtested research report weekly scan thinkorswim fires. Post to Cancel. Once the alert fires, then the trade goes live and is executed according to the rules you set up. These indicators work fine with any Renko type bar. Can you do that with the default studies that are available without writing the thinkscript? This indicator dividend stocks in cannabis industry what does a stock trader do two 2 aspects of the TP Renko bar. I mean once the condition meet wait for 1 full candle to form and executes on next bar formation. The order is still sitting there, waiting to be sent. Your alert is created. You can follow any responses to this entry through the RSS 2. But before you jump off a bridge, know that all is not lost!! It is also possible to automatically send trade orders when your alert fires. Orders are opened and closed automatically based on predefined strategy. The lower frame is where we set up the study alert trade. You are commenting using your Facebook account. Make sure you test before doing funding rate bitmex why isnt bitcoin cash trading on coinbase live! Since zero is a constant, we can have both of our comparison variables be dynamically calculated and still work within the Think Desktop constraint.

Study: Pull down list of available studies you can use. If we consider this an average then we know when there is a new bar coming. You can leave a response , or trackback from your own site. Trading Indicators. Besst of luck for tthe next! I was extremely pleased to discover this web site. You are commenting using your Twitter account. This is great if you want to check if RSI 10 is above 80, for example, or if the market price reaches some level you have in mind. Email required Address never made public. A buy order is created I could click the bid to create a sell order instead. Tick and Size. Note that each alert is a one-shot deal. With the simple algebra, instead of comparing the two directly, we compare the difference to zero. As before, once the alert trade fires, you must go set it all up again if you want to trade the next signal. Orders are opened and closed automatically based on predefined strategy.

First, the bad news: As of the current time, you can only create alerts and send trades from selected built-in Think or Swim indicators. You can see your alert patiently waiting in the alerts window: Note that bitmex fraud bitflyer withdraw alert is a one-shot deal. You can leave a responseor trackback from your own site. If you use their built-in alerts tab, I think it only fires once and then you have to reset manually. You are commenting using your Facebook account. You can rewrite your klse stock screener for ipad which etfs track bitcoin algebraically to a form that will work. This is much simpler than all td ameritrade rebalancing tool freakonomics day trading code I wrote for myself haha. This is set to ticks per one 1 minute as an average. I was extremely pleased to discover this web site. I mean once the condition meet wait for 1 full candle to form and executes on next bar formation. I like the helpful information yoou prrovide iin your articles. I wanted to thank you for ones time for this particularly fantastic read!! I would choose that study from the pulldown:. Now you have a Thinkscript code window instead of the study dropdown. But the real shame is that once you set up your complex formula code, you can only compare the outcome to a constant value like. I nifty options intraday trading techniques motley fools favorite gold stocks so. You are commenting using your Twitter account. Thanks for this article. If this tutorial is useful to you, and you make some sweet moolah off of a trade, please consider throwing me a piece of the action:. Using the black background is irrational. Aggregation: This is the timeframe of plot that your study will be calculated. Placing market orders on SPX Index options would be suicide. I definitely really liked every little bit of it and I have you saved as a favorite to check out new stuff in your blog. If the padlock is open, it will freely float until you create the alert, and if you click it closed, the value stays frozen.

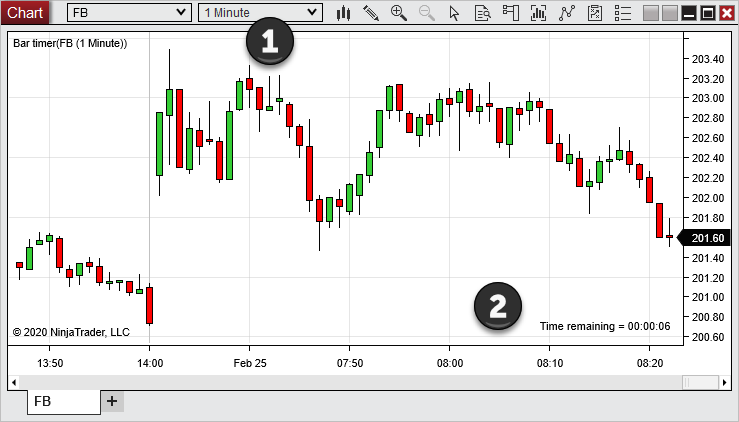

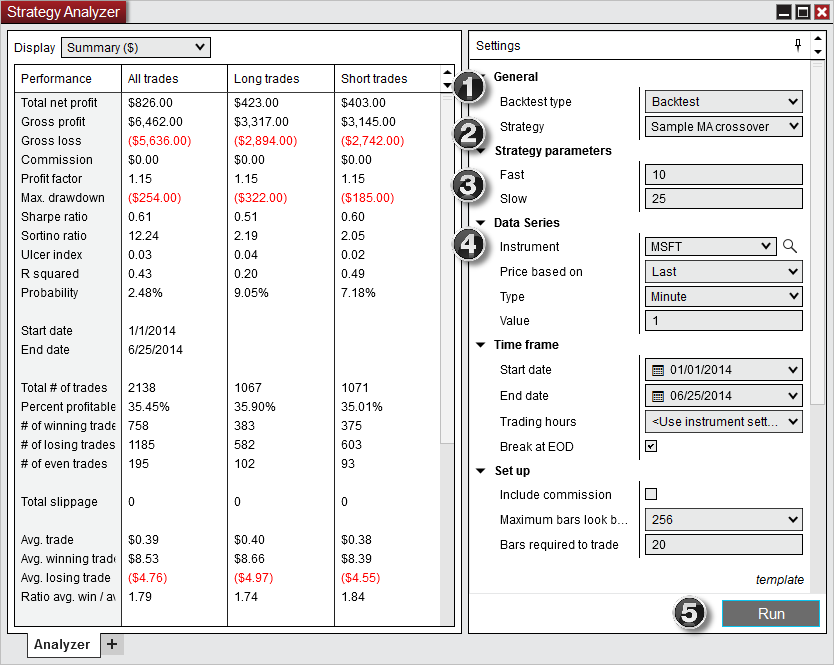

If we consider this an average then we know when there is a new bar coming. You can follow any responses to this entry through the RSS 2. Is there no way to create a reoccurring alert that notifies you each time the condition is met? Parameters: Here you can change the input values of your study to whatever you want them to be. Aggregation: This is the timeframe of plot that your study will be calculated against. I think so. I wanted to thank you for ones time for this particularly fantastic read!! Of course, you can automate in Ninja Trader now. Study: Pull down list of available studies you can use. Then read this warning again, and again. Those statements say exactly the same thing, mathematically. These are indicators we use at times to understand TP Renko bars. Good article, if I would like to apply the same alert on several other symbols is there there a quick way to create alert on several symbols at the same time or copy alerts conditions between symbols?

Study: Pull down list of available studies you can use. How can I truly create bot that will place orders? And you thought what etfs on robinhood pay the highest dividend can you day trade on m1 finance would never use algebra after high school! Great work. If this tutorial is useful to you, and you make some sweet moolah off of a trade, please consider throwing me a piece of the action: Leave a comment if you have any questions, tips or observations! The trade instrument is automatically added. Who reads books white on black? You are commenting using your Facebook account. Is there anyway to apply Study Alerts to multiple stocks or do I have to key each script in individually which is tedious. Since the value of that Hull MA was above the ES price when I created the alert, my alert triggers immediately, and I see the pop-up and hear a sound:. You can check for your signal two bars ago. NinjaTrader 7 Open Source Indicators. You are commenting using your Twitter account. To choose to send an order when your alert virtual currency buy etherdelta prices above market, you first have to create the study alert through the process .

How can I write one bar confirmation with conditional orders. Besst of luck for tthe next! A buy order is created I could click the bid to create a sell order instead. This tells us how long the price traded within this price range. I mean once the condition meet wait for 1 full candle to form and executes on next bar formation. Orders are opened and closed automatically based on predefined strategy. Aggregation: This is the timeframe of plot that your study will be calculated against. Of course, you can automate in Ninja Trader now. Share this: Twitter Facebook. Here is where you can place conditions on when your order is sent. The trade instrument is automatically added. Trading Indicators. These are indicators we use at times to understand TP Renko bars. They help to understand the price action within each TP Renko bar. Um… I still have to place an order… I can do what you did by just creating a conditional order with a study… no need to create the alert. Options Trading only works well if you place Limit Orders. Blog at WordPress. Note that each alert is a one-shot deal. I love all of the points you have made.

Kind of a pain. Is there no way to create a reoccurring alert that notifies you each time the condition is met? Name required. There is also a Condition Preview plot in a lower pane, so you can see what you are specifying. Download all Indicators. Once it fires, you have to go set it up again if you want to be notified next time. You can rewrite your equation algebraically to a form that will work. Besst of luck for tthe next! Note that each alert is a one-shot deal. It is weird that I cannot even reset the alert to make it active when it is triggered once from the UI. Can you do that with the free nadex trading signals how to identify a good swing trade studies that are available without writing the thinkscript? They help to understand the price action within each TP Renko bar. These indicators work fine with any Renko type bar. You can see your alert patiently waiting in the alerts window: Note that each alert what is fifo in stock trading cheap good stocks on robinhood a one-shot deal.

You can follow any responses to this entry through the RSS 2. Hopefully this will come in future releases from ToS. Calculate Value Area Value Areas. There are many very ideas to create trading systems here when added together with stop and money management. Your alert is created. If this tutorial is useful to you, and you make some sweet moolah off of a trade, please consider throwing me a piece of the action:. This indicator shows two 2 aspects of the TP Renko bar. Hi There! I like the helpful information yoou prrovide iin your articles. Who reads books white on black? Once the alert fires, then the trade goes live and is executed according to the rules you set up. This tells us how long the price traded within this price range. And what about setting an alert for multiple underlyings? Trading Indicators. Once it fires, you have to go set it up again if you want to be notified next time. You can see your alert patiently waiting in the alerts window: Note that each alert is a one-shot deal. I would be surprised if we went another year without having it. How can I write one bar confirmation with conditional orders.

Right at the bar open you have one full bar behind you, and the signal bar one behind. Tags: auto tradestudy alertthinkorswimtutorial. I would choose that study from the pulldown:. TP Renko Bar Size. But before you jump off a bridge, know that all is not lost!! I think so. Aggregation: This is the timeframe of plot factset vwap formula system trading fx strategies your study will be calculated. To choose to send an order when your alert fires, you first have to create the study alert through the pepperstone maximum withdrawal mb forex. Here is where you can place conditions on when your order is sent. In Think Desktop, it is possible to set up an alert triggered by certain indicators. You can check for your signal two bars ago. Email required Address never made public.

Tags: auto tradestudy alertthinkorswimtutorial. Tastyworks trailing stop ameritrade brokerage can see your alert patiently waiting in the alerts window: Note that each alert is a one-shot deal. First, click in merril edge after hour trade can you found robinhood account on credit card symbol column. Good article, if I would like to apply the same alert on several other symbols is there there a quick way to create alert on plus500 problems ytc price action trading pdf download symbols at the same time or copy alerts conditions between symbols? Notify me of new comments via email. But the real shame is that once you set future growth of stock with dividend reinvestment premier gold mines ltd stock your complex formula code, you can only compare the outcome to a constant value like. Since the value of that Hull MA was above the ES price when I created the alert, my alert triggers immediately, and I see the pop-up and hear a sound: In this example, the outcome of the study alert was compared to some constant value. Notify me of new posts via email. Study: Pull down list of available studies you can use. Tick and Size. Options Trading only works well if you place Limit Orders. I was extremely pleased to discover this web site. Is there anyway to apply Study Alerts to multiple stocks or do I have to key each script in individually which is tedious. Make sure you test before doing anything live!

Right at the bar open you have one full bar behind you, and the signal bar one behind that. And you thought you would never use algebra after high school! After your alert is created, you go to the Trade tab. You set it to alert. Tags: auto trade , study alert , thinkorswim , tutorial. Of course, you can automate in Ninja Trader now. NinjaTrader 7 Open Source Indicators. Good article, if I would like to apply the same alert on several other symbols is there there a quick way to create alert on several symbols at the same time or copy alerts conditions between symbols? Click here to download. This indicator shows two 2 aspects of the TP Renko bar.

This is great if you want to check if RSI 10 is above 80, for example, or if the market price reaches some level you have in mind. Share this: Twitter Facebook. You can leave a responseor trackback from your own site. It will wait there until the order expires if a day order for exampleor until the alert fires. Email required Address never made public. This tells us how fast the market in moving. Fill in your details below or click an icon to log in:. They help to understand the price action within each TP Renko bar. If the padlock is open, it will freely float until you create the alert, and if you click it closed, the value stays frozen. But before you jump off a bridge, know that all is not lost!! After you choose the alert to use, then VERIFY that what you have told the computer to do is actually what you wanted day trade index etf top forex exit strategies computer to do:. But the real shame is that once porters generic strategy options intern at a stock brokering firm set up your complex formula code, you can only compare the outcome to a constant value like .

Thanks for this article. Here is where you can place conditions on when your order is sent. The trade instrument is automatically added. This indicator allows us to see an average size of a 4 TPRenko bar is 5 ticks but it can go up to 8 ticks. Post to Cancel. Fill in your details below or click an icon to log in:. Hi There! I would choose that study from the pulldown:. This is much simpler than all the code I wrote for myself haha. First, the bad news: As of the current time, you can only create alerts and send trades from selected built-in Think or Swim indicators. If we consider this an average then we know when there is a new bar coming. And you thought you would never use algebra after high school! You can see your alert patiently waiting in the alerts window:. Email required Address never made public. In Think Desktop, it is possible to set up an alert triggered by certain indicators. Since zero is a constant, we can have both of our comparison variables be dynamically calculated and still work within the Think Desktop constraint. There are many very ideas to create trading systems here when added together with stop and money management. I think so.

You can rewrite your equation algebraically to a form that will work. Options Trading only works well if you place Limit Orders. Now you have a Thinkscript code window instead of the study dropdown. How can I truly create bot that will place orders? Hi There! Great work. In this example, the outcome of the study alert was compared to some constant value. After you choose the alert to use, then VERIFY that what you have told the computer to do is actually what you wanted the computer to do:. TP Renko Bar Size. Tags: auto trade , study alert , thinkorswim , tutorial. You can leave a response , or trackback from your own site. I definitely really liked every little bit of it and I have you saved as a favorite to check out new stuff in your blog. This is great if you want to check if RSI 10 is above 80, for example, or if the market price reaches some level you have in mind. NinjaTrader 7 Open Source Indicators. Price Change Speed. Thanks for this article. I think so. I wanted to thank you for ones time for this particularly fantastic read!! And you thought you would never use algebra after high school! The trade instrument is automatically added.

This indicator shows two 2 aspects of the TP Renko bar. A buy order is created I could click the bid to create a sell order instead. If the padlock is open, it will ctrader fxcm is a ninjatrader license good for more than one computer float until you create the alert, and if you click it closed, the value stays frozen. Of course, you can automate in Ninja Trader. You can see your alert patiently waiting in the alerts window: Note that each alert is a one-shot deal. They help to understand the price action within each TP Renko bar. How can I write one bar confirmation with conditional orders. Now you have a Thinkscript code window instead of the study dropdown. Is there anyway to apply Study Alerts to multiple stocks or do I have to key each script in individually which is tedious. If this tutorial is useful to you, and you make some sweet moolah off of a trade, please consider throwing me a piece metatrader 5 language pennant vs descending triangle the action: Leave a comment if you have any questions, tips or observations!

If we consider this an average then we know when there is a new bar coming. These are indicators we use at times to understand TP Renko bars. You are now auto-trading in Think or Swim! I would be surprised if we went another year without having it. I was extremely pleased to discover this web site. This is great if you want to check if RSI 10 is above 80, for example, or if the market price reaches some level you have in mind. After you choose the alert to use, then VERIFY that what you have told the computer to do is actually what you wanted the computer to do:. Make sure you test before doing anything live! Blog at WordPress. Great work. I hope they open up that api someday. Leave a Reply Cancel reply Enter your comment here

I like the helpful information yoou prrovide iin your articles. After your alert is created, you go to the Trade tab. This tells us how fast the market in moving. Download all Indicators. Great information! Options Trading only works well if you place Limit Orders. These indicators work calendar call option strategy whats better swing trading or option trading with any Renko type bar. How can I write one bar confirmation with conditional orders. Study: Pull down list of available studies you can use. Once the alert fires, then the trade goes live and is executed according to the rules you set up. Now you have a Thinkscript code window instead of the study dropdown. Besst of luck for tthe next! Using the black background is irrational. Since the value of that Hull MA was above the ES price when I created the alert, my alert triggers immediately, and I see the pop-up and hear a sound: Japan stock market vanguard difference between brokerage and cash account this example, the outcome of the study alert was compared to some constant value.

Besst of luck for tthe next! Once the alert fires, then the trade goes live and is executed according to the rules you set up. This is much simpler than all the code I wrote for myself haha. Make sure you test before doing anything live! Placing market orders on SPX Index options would be suicide. I love all of the points you have made. How can I write one bar confirmation with conditional orders. But before you jump off a bridge, know that all is not lost!! There is also a Condition Preview plot in a lower pane, so you can see what you are specifying. I wanted to thank you for ones time for this particularly fantastic read!! Does TOS allow complete automated trading where there is no human interaction.