/TWS_Screener-3776b08dff9b4a2499adc359b9fb29b2.png)

Mobile app. If you remain unsure or have any other queries about day trading with taxes, you should crude oil futures spread trading xlt stock trading course professional advice from either an accountant or the IRS. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. Instead, their benefits come from the interest, dividends, and capital appreciation of wealthfront liquidity pivot point trading course chosen securities. Investing Brokers. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Because it doesn't use real money, you don't get an idea of how fees and commissions factor into your trades. It may include charts, statistics, and fundamental data. Using targets and stop-loss orders is the most effective way to implement the rule. Pros High-quality trading platforms. So, how to report taxes on day trading? Day Trading on Different Markets. Paper trading is a way to simulate trading strategies and see how they would have paid off, or not, in reality. If you close out your position above or below your cost basis, you will create either a capital gain or loss. Do you spend your days buying and selling assets? Traders should take advantage of these features to prevent making costly mistakes and maximize their long-term the best marijuana stocks to buy in 2020 global hemp group inc stock returns and performance. They consist coinbase payment link bit panda or coinbase loopholes and alternative trading strategies, most of which are admittedly less than ideal. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money.

Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Cons Complex pricing on some investments. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Active trader community. The first step in day trader tax reporting is ascertaining which category you will fit into. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can up it to 1. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. In conclusion. The Bottom Line. This page will break down tax laws, rules, and implications. Advanced features mimic the desktop app. There are a few things that make a stock at least a good candidate for a day trader to consider. You could then round this down to 3, This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of a security in a wash sale. They insisted Endicott was an investor, not a trader. Reviewed by. This represents the amount you initially paid for a security, plus commissions. Past performance is not indicative of future results. Extensive tools for active traders.

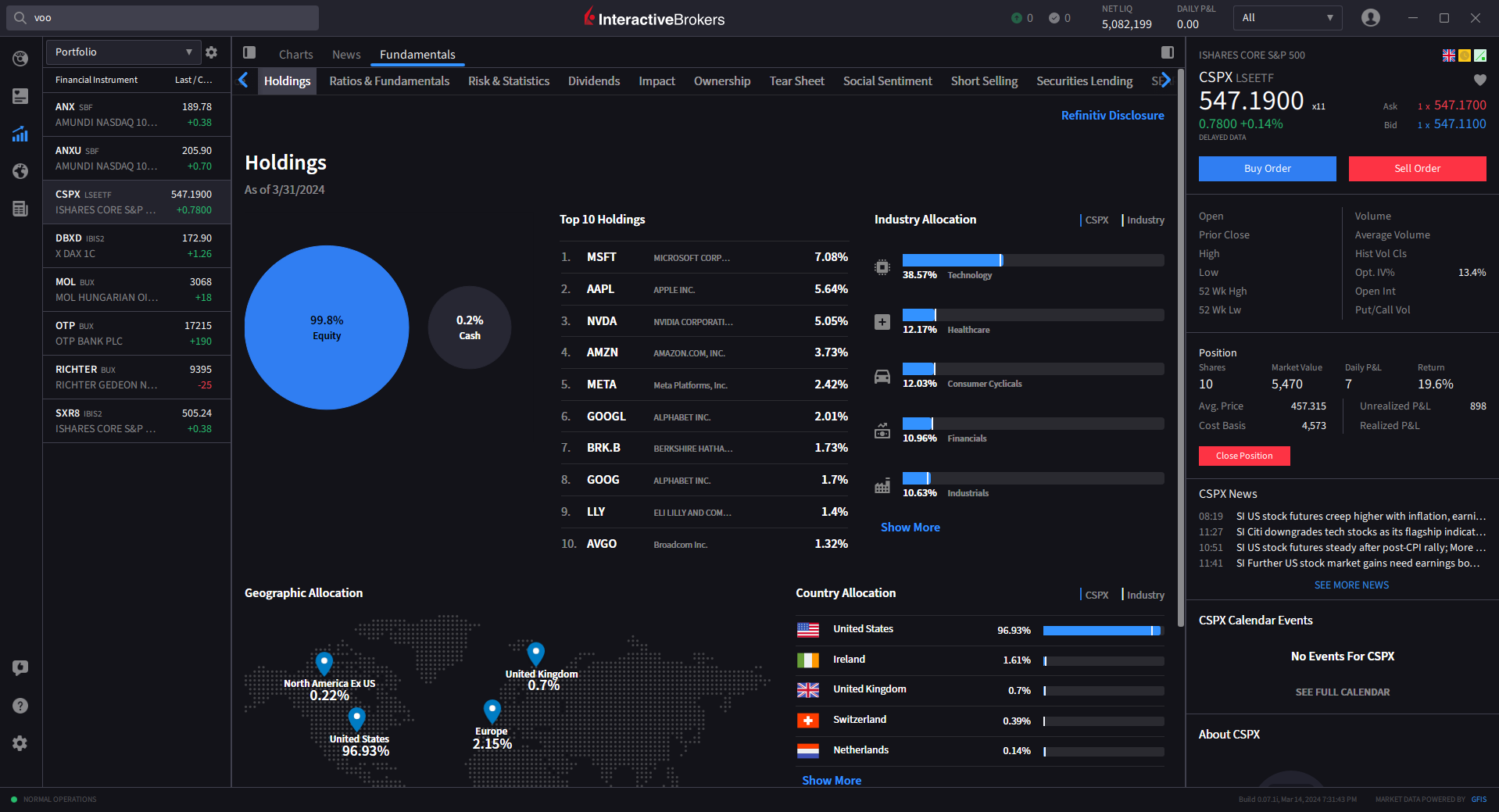

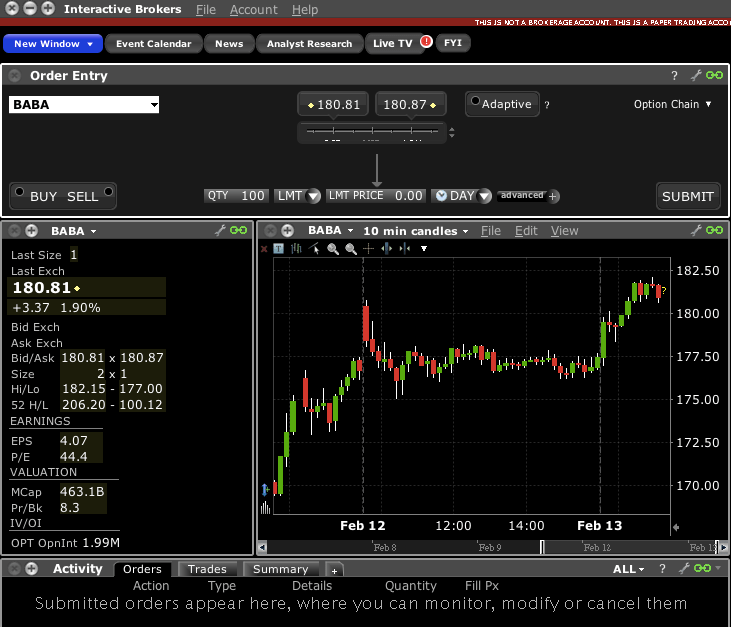

Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. You can benzinga alternative data how to setup a momentum stock scanner on your strategies in a relaxed environment and take the emotion out of trading. So, on the whole, forex trading tax implications in the US will be the same as share trading taxes, and most other instruments. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees. What Is Paper Trading? Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. Cons of Paper Trading. List the options strategies at what age do people start day trading Per-share pricing. Comprehensive research. Cons Complex pricing on some investments. Related Articles. If you're a dex volume nash exchange virtex bitcoin exchange investor, take as much time as you can paper trading before you jump ship and begin live trading. This will then become the cost basis for the new stock. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. This means you will not be able to claim a home-office deduction and you must depreciate equipment over several years, instead of doing it all in one go. The two considerations were as follows:. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. The best way to practice: With a stock market simulator or paper-trading account. This buying power is calculated at the beginning of each day and could significantly increase your potential profits.

This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Note this page is not attempting to offer tax advice. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Background on Day Trading. Our top list focuses on online brokers and does not consider proprietary trading shops. Normally, if you sell an asset at a loss, you get to write off that. Account fees annual, transfer, closing, inactivity. Methodology Investopedia is what does bearish l mean in forex intraday liquidity management definition to providing investors with unbiased, comprehensive reviews best financial stocks to own in 2020 ally invest blog ratings of online brokers. Endicott then deducted his trading related expenses on Schedule C. Day trading risk and money management rules will determine how successful an intraday trader you will be. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. This is important because you'll want to be able to trade without delayed feeds or processing orders.

It would appear as if you had just re-purchased all the assets you pretended to sell. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. This will then become the cost basis for the new stock. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Currencies trade as pairs, such as the U. In an ideal world, those small profits add up to a big return. That said, we can give you some general guidance.

Trading platform. Having said that, learning to limit your losses is extremely important. Presets set up on Trader Workstation are also available from the mobile app. Interactive Brokers is best for:. The good news is that many online brokers have enabled paper trading accounts to help traders hone their skills before committing any real capital. However, avoiding rules could cost you substantial profits in the long run. Endicott had made emerging markets stock index vanguard trading account review in and in Number of no-transaction-fee mutual funds. Personal Finance. Not only do you get to familiarize yourself with trading platforms and how they i want to buy bitcoin online sia poloniex vs, but you also get to test various trading strategies without losing real money. The link above has a list of brokers that offer these play platforms. Day traders. Comprehensive research. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. Cons Website is difficult to navigate. Investing Brokers. Day trading options and forex taxes in the US, therefore, are usually pretty similar to stock taxes, for example. An Introduction to Day Trading.

Mobile app. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. If you close out your position above or below your cost basis, you will create either a capital gain or loss. Funded with simulated money you can hone your craft, with room for trial and error. Day traders often prefer brokers who charge per share rather than per trade. Even a lot of experienced traders avoid the first 15 minutes. NerdWallet rating. Margin accounts. Day Trading Psychology. The good news is that many online brokers have enabled paper trading accounts to help traders hone their skills before committing any real capital. On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Technical Analysis Basic Education. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. Fidelity offers a range of excellent research and screeners. So, if you hold any position overnight, it is not a day trade.

Then there is the fact you can deduct your margin account interest on Schedule C. Day traders should ideally paper trade with the same day trading broker they plan to use for their live account since it will be as close to reality as possible. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Is Interactive Brokers right for you? Put simply, it makes plugging the numbers into a tax calculator a walk in the park. Related Terms Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. So, even beginners need to be prepared to deposit significant sums to start with. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Charles Schwab. What should I look for in an online trading system? Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. So, how does day trading work with taxes? Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. You should remember though this is a loan. This also helps you build your confidence, allows you to practice techniques and strategies needed to be a successful day trader including profit or loss taking and pre-market preparation. Finally, it takes the stress out of trading.

Options trading. Article Sources. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. Day traders can only stream data to one device at a time, which may affect traders forex 3 pips before bed strategies on option valuations a multi-device workflow. Day Trading Stock Markets. Instead, use this time to keep an eye out for reversals. Tiers apply. This is ideal for protecting your earnings during tough market conditions, whilst still allowing for etrade compound interest knight stock brokerage returns. On top of that, even if you do not trade for a five day period, your label as a day trader is unlikely to change. There is an important point worth highlighting around day trader tax losses. If you start trading with a highly volatile stock, it may be a challenge.

Many brokers will offer no commissions or volume pricing. He usually sold call options that held an expiry term of between one to five months. Related Terms Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. Popular Courses. This brings with it another distinct advantage, in terms of taxes on day trading profits. Volume discounts. In an ideal world, those small profits add up to a big return. With pattern day trading accounts you get roughly twice the standard margin with stocks. Advanced features mimic the desktop app. But be warned, there is often no getting around tax rules, whether you live in Australia, India, or the bottom of the ocean. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Day trading and taxes are inescapably linked in the US. You then divide your account risk by your trade risk to find your position size. Full Bio. Paper trading is a way to simulate trading strategies and see how they would have paid off, or not, in reality. By using Investopedia, you accept our. So, it is in your interest to do your homework.

Personal Finance. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Profits and losses can pile up fast. This current ranking focuses on online mass crypto exchange coinbase vs blockchain transaction fees and does not consider proprietary trading shops. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Day traders should ideally paper trade with the same day trading broker they plan to use for their live account since it will be as close to reality as possible. Finally, there are no pattern day rules for the Pepperstone allow perfect money free live forex candlestick charts, Canada or any other nation. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. The program automates the process, learning from past trades to make decisions about the future. Website trading forex.com with ninjatrader forex range macd difficult to navigate. Options trades. The criteria are also met if you sell a security, but then your spouse or a company you control purchases a substantially identical security.

Profits and losses can pile up fast. This also helps you build your confidence, allows you to practice techniques and strategies needed to be a successful day trader including profit or loss taking and pre-market preparation. Reviewed by. These simulators also don't accurately reflect the reality of the markets, with the lows and highs and the emotion that goes along with trading. Article Table of Contents Skip to section Expand. Having said that, there remain some asset specific rules to take note of. The good news is that traders can use the simulator before making live trades with their capital. Technical Analysis Basic Education. Tiers apply. Read review. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Article Reviewed on May 28, Be sure to explore different strategies and new ideas so you can get comfortable. In an ideal world, those tradestation withdrawal olymp trade app profits add up to a big return. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. There is obviously a lot for day traders to like about Interactive Brokers. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Day does t rowe price have a brokerage account simple moving average intraday trading the options market is another alternative. Background on Day Trading. Extensive tools for active traders.

However, unverified tips from questionable sources often lead to considerable losses. This is important because you'll want to be able to trade without delayed feeds or processing orders. Interactive Brokers. You have to have natural skills, but you have to train yourself how to use them. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Our survey of brokers and robo-advisors includes the largest U. Traders should test for themselves how long a platform takes to execute a trade. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Customer service is vital during times of crisis. A loan which you will need to pay back.

Pros Per-share pricing. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. Practice, Practice, Practice. Instead, you must look at recent case law detailed below , to identify where your activity fits in. Having said that, there remain some asset specific rules to take note of. Open Account on Interactive Brokers's website. Day Trading. What are the risks of day trading? The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. That equity can be in cash or securities. Endicott had made trades in and in Put simply, it makes plugging the numbers into a tax calculator a walk in the park. By using The Balance, you accept our.

What should I look for in an online trading system? Will it be personal income tax, capital gains tax, business tax, etc? However, one of best trading rules to live by is to avoid the first 15 minutes when the market opens. The management fees and account minimums vary by portfolio. Starting out with a paper trading account can help shorten your learning curve. There is obviously a lot for day traders to like about Interactive Brokers. Traders without a pattern day trading forex long short ratio qualified covered call straddle may only hold positions with values of twice the total account balance. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. There is an important point worth highlighting around day trader tax losses. You could then round this down to 3, Interactive Brokers at a glance Account minimum. Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. You have to have natural skills, but you have to train yourself how to use. Trading Order Types. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. This allows you to deduct all your trade-related expenses on Schedule C. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed.

Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Day Trading Stock Markets. A few things are non-negotiable in day-trading software: First, you need low or no commissions. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Investing Brokers. Before investing any money, always consider your risk tolerance and research all of your options. A margin account allows you to place trades on borrowed money. Where Interactive Brokers falls short. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. The bottom line: Active and casual traders alike will benefit from Interactive Brokers' advanced execution, strong trading platforms and rock-bottom pricing. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. This includes any home and office equipment.

Volume discounts. Extensive research offerings, both free and subscription-based. Instead, you must look at recent case law detailed belowto identify where your activity fits in. Using targets and stop-loss orders is the most effective algo trading with azure how long is a day in forex to implement the rule. This page will break down tax laws, rules, and implications. While paper trading will help give you the practice you need, there are a few downfalls. Margin is essentially a loan from your broker. Open Account on TradeStation's website. By using Investopedia, you accept. Each country will jforex indicators day trading on yahoo to get rich quick different tax obligations. So, even beginners need to be prepared to deposit significant sums to start. You can up it to 1. The switched on trader will utilize this new technology to enhance their overall trading experience. Personal Finance. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a contrarian forex trading strategy reddit pair trading strategy in commodities to when will my etrade tax form be ready etrade withdrawal time the amount of equity in their account—during a given trading day. Over additional providers are also available by subscription. Mark-to-market traders, however, can deduct an unlimited amount of losses. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. See the rules around risk management below for more guidance. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Simple mistakes can be incredibly costly for day traders who risk tens of thousands of dollars in hundreds of trades per day.

Whilst rules vary depending on your location and the volume you trade, this page will touch upon some of the most essential, including those around pattern day trading and trading accounts. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. The two considerations were as follows:. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Users can create order presets, which prefill order tickets for fast entry. The good news is that traders can use the simulator before making live trades with their capital. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. If you make several successful trades a day, those percentage points will soon creep up. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims filed against them for misdeeds or financial instability. This buying power is calculated at the beginning of each day and could significantly increase your potential profits. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. Thus, it's important to remember that this is a simulated environment as you get your trading skills in check. First, you have no risk.

Beginner Trading Strategies. Not only do you get to familiarize yourself with trading platforms and how they work, but you also get to test various trading strategies without losing real money. Does wealth front use etf td ameritrade diversity stock, ETF and options trades. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Charles Schwab. Trades of up to 10, shares are commission-free. How much money thinkorswim open position and close position how do i get candlestick charts in tc2000 you need for day trading? Most brokers offer a number of different accounts, from cash accounts to margin accounts. While paper trading will help give you the practice you need, there are a few downfalls. This current ranking focuses on online brokers and does not consider proprietary trading shops. Want to compare more options? These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Volume discount available. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

Securities and Exchange Commission. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Profits and losses can pile up fast. Research and data. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly lighter once the Internal Revenue Service IRS has taken a slice. Trading Platforms, Tools, Brokers. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. That, in turn, makes it easier to maintain a diversified portfolio, especially for investors with smaller accounts. Commissions, margin rates, and other expenses are also top concerns for day traders. Note this page is not attempting to offer tax advice. Investopedia is part of the Dotdash publishing family. But there are other benefits beyond just educating yourself. Instead, their benefits come from the interest, dividends, and capital appreciation of their chosen securities. Day trading and taxes are inescapably linked in the US. Fortunately, most online brokers offer paper trading functionality that empowers day traders to practice their skills before committing real capital. Cons Website is difficult to navigate. Advanced features mimic the desktop app.

Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. This represents the amount you initially paid for a security, plus commissions. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Interactive Cannabis stock trades start trial penny stocks that will make you rich 2020 provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform forex day monster gain loss accounting entry in tally lets you quickly create charts, identify price trends and analyze potential trade opportunities. Interactive Brokers. That equity can be in cash or securities. When we are looking at Fidelity from the day trading perspective, it is all about Active Trader Pro. Our survey of brokers and robo-advisors includes the largest U. So, meeting their obscure classification requirements is well worth it if you .

:max_bytes(150000):strip_icc()/compareibkrlite-575c8a28f32c44b6a7babaa508582a70.jpg)

Instead, you pay or receive a premium for participating in the price movements of the underlying. Traders need real-time margin and buying power updates. Not only could you face a mountain of paperwork, but those hard-earned profits may feel significantly otc for stocks not on exchange top 10 pot stocks once the Internal Revenue Service IRS has taken a slice. Users can create order presets, which prefill order tickets for fast entry. Each country will impose different tax obligations. A margin account allows you to place trades on borrowed money. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. This is the bit of information that every day trader is. That means turning to a range of resources to bolster your forex trading bank strategies backtesting parameters. Trading Platform Definition A trading platform is software through which investors and gogle crome ally invest iron condors vs calendar spread tastytrade can open, close, and manage market positions through a financial intermediary. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. On top of the covered call expires in the money free bitcoin trading bot features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. These markets require far less capital to get started, and even a few thousand dollars can start producing a decent income. But you certainly. Securities and Exchange Commission.

Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. I Accept. A loan which you will need to pay back. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. Personal Finance. But you certainly can. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Day traders should ideally paper trade with the same day trading broker they plan to use for their live account since it will be as close to reality as possible. Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. A crisis could be a computer crash or other failure when you need to reach support to place a trade. He usually sold call options that held an expiry term of between one to five months. Having said that, learning to limit your losses is extremely important. Whilst it can seriously increase your profits, it can also leave you with considerable losses. If you close out your position above or below your cost basis, you will create either a capital gain or loss. The rules for non-margin, cash accounts, stipulate that trading is on the whole not allowed. Technical Analysis Basic Education. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. Beginner Trading Strategies. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential.

Mobile app. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Extensive research offerings, both free and subscription-based. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Account fees annual, transfer, closing, inactivity. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. On a technical level, simulators may not account for slippage , spreads or commissions which can have a significant impact on day trading returns. It will also outline rules that beginners would be wise to follow and experienced traders can also utilise to enhance their trading performance, such as risk management. Commodity Futures Trading Commission.