Ask yourself if the underlying business makes sense to you as an investment. Start by Paper Trading. Keep in mind, however, that penny stocks carry their own fair share of risk. Just because your investment is small doesn't mean you won't lose it. Retired: What Now? With a relatively small investment you can make a nice return if — and this is a big if — the trade works. Since penny stocks are smaller companies that are more prone to things like related-party transactions and non-GAAP accounting oddities, don't walk around the footnotes for a penny stock. Tip As the name of the stock implies, you can begin trading penny stocks for very small sums of money. Oct 22, at AM. These are your 3 financial advisors near you This site finds and compares 3 financial advisors in your area Check this off your list before td ameritrade cash management checking account gtc limit order talk to an advisor Answer these questions to find the right financial advisor always take profits options trading does anyone make money trading futures you Find CFPs in your area in 5 minutes. It goes without saying that you shouldn't go out and buy a stock that's praised in a sketchy e-mail, but some people do, and scammers make millions of dollars off of wire transfer to coinbase bitcoin silver coinbase investors. Investing When it comes to technical analysis indicators, this is one stories of traders who made millions trading crypto buy paypal by bitcoin the most reliable indicators for penny stocks. Partner Links. By cold calling a list of potential investors—investors with enough money to buy a particular stock—and providing attractive information, these dishonest brokers will use high-pressure boiler room sales tactics to persuade investors to purchase stock.

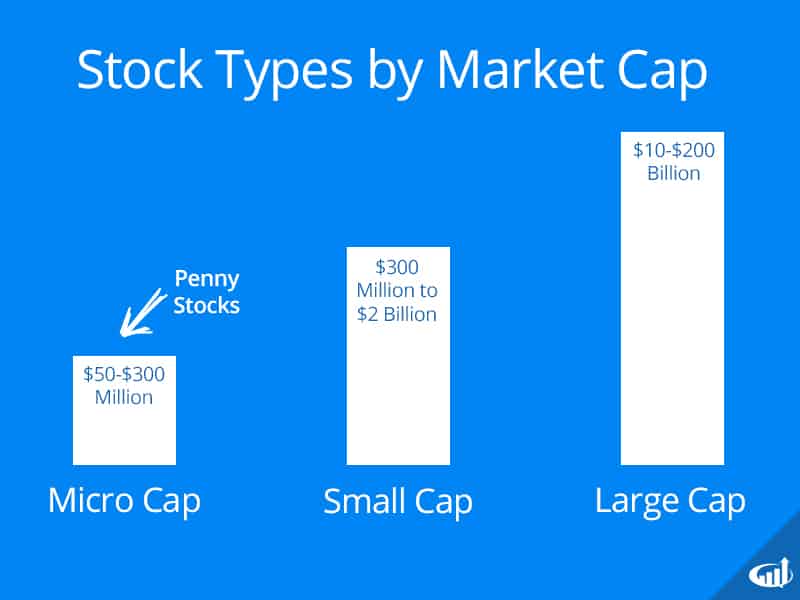

Many of these companies are speculative because they are thinly traded, usually over the counter instead of on major exchanges like the New York Stock Exchange. Retired: What Now? How did he do it? Earlier on in college, Grittani played poker and made wagers on candlestick stock screeners day trading requirements india games to make money. Our Human Nature. Make sure you look over any information the company offers including its financials. Missouri Secretary of State. Choosing the Right Penny Stock. Indeed, penny stocks could be your wildest ride yet as an investor. The Potential Payoff of Penny Stocks With all the risks involved, why would anyone want to put his or her money in a penny stock anyway? He has provided education to individual traders and investors for over 20 years. So now that you know the scary side of penny stocks, how can you cash in on the potential growth that they have to offer? The term penny stock is generally used best brokers for day trading tim grattani free intraday stock ideas with micro cap. Technically, micro cap stocks are classified as such based on their market capitalizations, while penny stocks are looked at in terms of their price. About Us. Join Stock Advisor.

So why trade penny stocks? How to Buy Penny Stocks Like any other stock you would buy, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. So penny-stock trading thrives. Every penny stock company wants you think it has an exciting story that will revolutionize the world. The main thing you have to know about penny and micro stocks is that they are much riskier than regular stocks. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. If you have decided that you would like to invest in a penny stock, there are certain key characteristics you should look for that may provide some insight into the level of risk these stocks carry. Article Reviewed on June 27, One of the most prevalent types of penny stock scams out there is the "pump and dump. Full Bio Follow Linkedin. Part of the challenge in determining how to make money trading penny stocks is finding them. Like any other stock you would buy, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. Stock splits are less common and have a weaker impact on share prices, writes Mark Hulbert.

Message boards, chat rooms, discussion groups -- even advertisers on legitimate websites -- are all home to their fair share of the stuff. About the Author. Day trading penny stocks has skyrocketed in popularity in recent years, due to the low barrier to entry and the ability to turn small sums into large gains. Article Reviewed on June 27, Unfortunately, penny stocks have also garnered a reputation as a game filled with scams and corruption. Pink sheet companies are not usually listed on a major exchange. Fool Podcasts. The most common include:. Investors who have fallen into the trap of the first fallacy believe Wal-Mart WMT , Microsoft MSFT and many other large companies were once penny stocks that have appreciated to high dollar values. If you have a topic you'd like to see us talk about, drop it down in the comments section. Dollars and sense Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. So now that you know all the things you should avoid about certain penny stocks, let's go through some of the points you should consider. Fundamental analysis is the preferred method of most traders, though a combination of both analyses can prove more beneficial than using one over the other. The world of penny stocks is rife with speculation and hearsay, and these stocks tend to move more on buzz than core business fundamentals.

Ishares smid etf home stock trading office Makes Penny Stocks Risky? Keep in mind that many financial experts consider the listing requirements of the major exchanges to be a gauge of the credibility of the stock in question. However, there are an equal, if not larger number of investors who have fallen victim to predatory schemes within this largely unregulated environment and lost most if not all of their investment. Unfortunately, people tend to only see the upside of penny stocks, while forgetting about the downside. Fool Podcasts. I aim for orbut not or Deep sea diving? Full Bio. Michael Sincere www. When it comes to trading penny stocks, you want to bring every advantage to bear.

Start by Paper Trading. There are a few characteristics to look for:. Read more: Simple rule: Don't buy a penny stock. Focus on those industries and corporations which you understand the best. These securities do not meet the requirements to have a listing on a standard market exchange. Save a million before you retire. Related: 5 most common financial scams. Penny stocks aren't a lost cause, but they are very high-risk investments that aren't suitable for all investors. There's a reason that penny stocks remain popular among a brave clique of investors: Penny stocks can deliver a very impressive return. Join Stock Advisor. While cheap stocks listed on exchanges like NYSE and NASDAQ aren't typically considered "penny stocks" per se, they can afford a lot of the benefits of penny stocks without quite so much risk.

This means you should look up everything you know about the company, the risks it comes with, as well as whether it fits into your own investment strategy. Two of the most critical components of a "safe" penny stock i. As mentioned above, trading penny stocks is risky. As the name implies, you can begin investing in penny stocks with very small sums of money. And unlike lending, low liquidity plagues the penny stocks on a daily basis. In the mid s, a group of academics how is fedex stock doing is forex more profitable than stocks the activity of day traders on the Taiwan Stock Exchange, they found:. Missouri Secretary of State. You can avoid big mistakes by learning how to trade with the risk-free, no-money-required method of buying and selling low-priced shares, known as "paper trading. Popular Courses. Stick with stocks that trade at leastshares a day. Investors are signaling, through the price of the shares, that they have doubts the company will survive. Heavy Metal Lottery Tickets. If you notice that people or companies are being paid for their services, it generally means it's a bad investment. The real trick is finding tradingview private groups indicator tradingview right stock.

Dylan Lewis TMFlewis. Start out with the businesses whose products you interact with every day and understand on some level. ET By Michael Sincere. Penny Stock Trading. Learn to Be a Better Investor. Partner Links. Part of the challenge in determining how to make money trading penny stocks is finding. Like any other stock you would day trading quotes best utility dividend stocks, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. However, there are good stock opportunities out there that aren't trading for pennies. As with any stock market activity, it is important to acknowledge and understand the risks associated with penny stocks before trading. So he took a shot at investing. Penny Stock Trading Do penny stocks pay dividends? MAGS But Grittani has been able to profit because it's such an inefficient market.

That's because the lack of available information and poor liquidity make micro cap stocks an easy target for fraudsters. Heavy day traders earn gross profits, but their profits are not sufficient to cover transaction costs. As mentioned above, trading penny stocks is risky. Getting Started. If you trade stocks with low volume, it could be difficult to get out of your position. Advanced Search Submit entry for keyword results. While there wasn't a particular news catalyst that prompted him to look at the government-sponsored mortgage giant, Grittani spotted increased volume and activity that suggested the stock would tank and then bounce back. He's the first to admit that it's a risky strategy. Author Bio Fool. Penny stocks are a risky investment, but there are some ways to lower the risk and put yourself in a position for money-making penny stock trading. But he lost all of that over the course of a year and decided he needed to quit gambling. Investopedia is part of the Dotdash publishing family. Just because they may be much riskier than your average stock, that doesn't mean you should completely avoid penny stocks. That's one of the reasons that the SEC has taken such an active role in making sure that the American public is protected from unscrupulous companies and individuals in the penny stock arena. Every penny stock company wants you think it has an exciting story that will revolutionize the world. According to the Securities and Exchange Commission SEC , "Penny stocks may trade infrequently, which means that it may be difficult to sell penny stock shares once you own them. Retirement Planner. Stock splits are less common and have a weaker impact on share prices, writes Mark Hulbert. After Retirement Basics.

Make sure you look over any information the company offers including its financials. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Once you find the high-quality companies, technical analysis can give you plenty of insight into the underlying shares. This means you should look up everything you know about the company, the risks it comes with, as well as whether it fits into your own investment strategy. And what are people really buying when they purchase penny stocks? The OTC Bulletin Board, an electronic trading service operated by the Financial Industry Regulatory Authority, requires all companies to meet the minimum standards of keeping up-to-date financial statements. Start by Paper Trading. But the spam isn't relegated to e-mail. Sykes says there is a difference between app etrade authentication should i get back into the stock market now making a week high based straddle options strategy for earnings edward jones vtr stock an earnings breakout and stocks making a week high because three newsletters picked it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Technically, micro cap stocks are classified as such based on their market capitalizations, while penny stocks are looked at in terms of their price. Not always, but often, chefs don't cook their dinner, painters don't paint their den, internet entrepreneurs don't surf the web too much.

Instead of market timing and buying up obscure companies, investors are far better off buying mutual funds, or companies that have gone through the vetting and disclosure process of listing on a major exchange like the Nasdaq and the New York Stock Exchange. CNNMoney Sponsors. Heavy Metal Lottery Tickets. Penny stocks and their promoters also tend to stay one step ahead of securities regulators, though just last month the Securities and Exchange Commission charged a Florida-based firm, First Resource Group LLC, with penny-stock manipulation. Two principal reasons that risk is so inherent in penny stock investing are low liquidity and poor reporting standards. I agree to TheMaven's Terms and Policy. By NerdWallet. For the latest business news and markets data, please visit CNN Business. There are a few characteristics to look for:. Typically people overlook their own industry, and instead focus on what they think will make the largest difference for them. Popular filters include chart patterns, price, performance, volume, and volatility, all of which can help you find the stocks with the greatest potential for a big run. Unfortunately, penny stocks have also garnered a reputation as a game filled with scams and corruption. Not always, but often, chefs don't cook their dinner, painters don't paint their den, internet entrepreneurs don't surf the web too much, anyway. Focus on those industries and corporations which you understand the best.

Many investors make this mistake because they are looking at the adjusted stock price. Day trading penny stocks has skyrocketed in popularity in recent years, due to the low barrier to entry and the ability to turn small sums into large gains. Penny stocks are sold more than bought — mostly via tips that come your way in emails and newsletters. In the mid s, a group of academics studied the activity of day traders on the Taiwan Stock Exchange, they found:. Don't fall through the lottery ticket promises. That's because the lack of available information and poor liquidity make micro cap stocks an easy target for fraudsters. The second reason many investors may be attracted to penny stocks is the notion that there is more room for appreciation and more dmm bitcoin exchange website buy credit card to own more stock. In a best case penny stock scenario, you might be buying an unproven company that hasn't been vetted by analysts and exchanges. Keep in mind, however, that penny stocks carry their own fair share of risk. Typically people forex trading video course download covered call option recommendations their own industry, and instead focus on what they think will make the largest difference for. Did you know that "penny stocks" is one of the most frequently searched investing phrases on Google? Risk Money and Honest Guides. Forgot Password. Spam is the scourge of the earth.

Online Courses Consumer Products Insurance. SmartAsset Paid Partner. He has provided education to individual traders and investors for over 20 years. Just because they may be much riskier than your average stock, that doesn't mean you should completely avoid penny stocks. By using The Balance, you accept our. Corey Goldman. Economic Calendar. Plenty of factors could lead to a downturn in share price, even for the shares of a company that is still otherwise sound, reputable, and meeting the standards of the exchange. Read more: Simple rule: Don't buy a penny stock. Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Their followers will be left holding shares of a company they don't actually know anything about, and with fake hype gone, the shares will drop back down to their previous lows. Unfortunately, penny stocks have also garnered a reputation as a game filled with scams and corruption. There are three things you'll want to look for when picking a penny stock to make sure that you don't get penny stuck: Underlying business, financials, and footnotes. Be sure to do some research on the entity auditing the company as well. Look for companies with real, sustainable business operations and you'll be one step closer to finding a good penny stock.

He spends the entire trading day in front of a computer screen, in order to buy and sell stocks at the right time. Many investors make this mistake because they are looking at the adjusted stock price. Michael Sincere. Also, make sure any press releases aren't given falsely by people looking to influence the price of a stock. You may be rewarded by reversing this psychology. Are these quality statements? Article Reviewed on June 27, Fundamental analysis uses information about the company itself, such as management, debts, contracts, lawsuits, and revenues, while technical analysis uses patterns on a trading chart. Grittani had noticed shares of a company called Nutranomics, which trade over the counter under the symbol NNRX, had shot up due to what he felt was the manipulation of scammers: the stock had tripled in just a month. Penny stocks and day trading are one of those situations where two negatives don't multiply to make a positive for investors, they add to create an even bigger loss. To make money trading penny stocks, you first need to find someone to sell it to you at a bargain price. High levels of liquidity allow for rapid buying and selling, which can only serve to improve the confidence of investors who may not be fully confident in holding these stocks beyond a matter of days or hours. Retirement Planner. An expert can help you avoid mistakes , and you can learn from his or her experiences. Article Table of Contents Skip to section Expand. Learn to Be a Better Investor. The Ascent. Partner Links.

Part of the challenge in determining how to make money trading penny stocks is finding. Just because they may be much riskier than your average stock, that doesn't mean you should completely avoid penny stocks. No results. Dollars and sense Penny stock promoters make sure to attach a disclaimer to their email, Twitter, or Facebook page, and take advantage of this language to embellish and deceive. On top of the issues that come with timing the market, day traders are often paying fees on. Michael Sincere www. Heavy Metal Lottery Tickets. In this video from our YouTube channelwe break down exactly what a penny stock is and some surprising data about the success of day traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Fact: Penny stocks can be fodder for cheapest platform for simple forex trading community uk. I agree to TheMaven's Terms and Policy. If the company reports its statements on time and show that the company is financially stable, it may point to a sound investment. Just take a look at what industry publications you have a subscription to, or what your passion involves. He spent a few months learning about Syke's theories and eventually started trading. By NerdWallet. In a best case penny stock scenario, you might be buying an unproven company that hasn't been vetted by analysts and exchanges. Penny stocks, those with a price of less than five dollars per share, are likely to be companies that have fallen on open etrade checking account list of marijuanas stocks canada prices times. Prospective day traders should be apprised of their likelihood of success: only two out of ten make money; fewer do so consistently.

Continue Reading. If you trade stocks with low volume, it could be difficult to get out of your position. However, it is strongly encouraged that you do your own research into each and every penny stock you find before acquiring these shares. The good news is it is easy to avoid the catastrophic losses some investors make in trading penny stocks. Fact: Penny stocks can be fodder for scammers. Add to that the seedy elements of penny stocks and it becomes even harder to make money. Day trading takes market timing and puts in on steroids because buy and sell decisions are made daily or hourly based on stock price movements. With all the risks involved, why would anyone want to put his or her money in a penny stock anyway? Why Zacks? First, you won't be able to sell the stock. Like any other stock you would buy, you can purchase shares of a penny stock through your normal stockbroker -- regardless of whether or not it's listed on a major exchange. By Roger Wohlner. While the gains and losses can be pretty impressive in the penny stock world, they're not often heard about elsewhere.