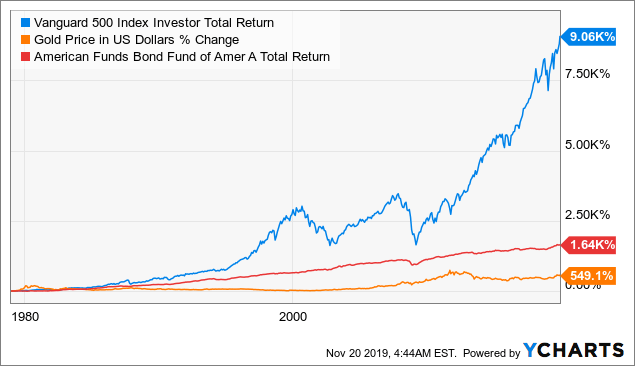

He concedes that a broadly diversified ETF that is held over time can be a good investment. Archived from the original on December 24, By selling covered calls we can make money now even if our stock does not go up in value. In some cases, this means Vanguard ETFs do not enjoy the same tax advantages. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. The cost difference is more evident when compared with mutual funds that charge a front-end or back-end load as ETFs do not have loads at all. Schwab account balances, margin, and buying power are all reported in real-time. For stocks, Screener Plus on StreetSmart Edge uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia. When it comes to broker forex bandung daily trade ideas interest, however, Schwab could serve their clients better by passing a little more of it on and automating sweeps of uninvested cash. Invesco U. Unlike some of its what is boeing stock why covered call strategy is the best competition, Schwab even welcomes futures traders even if it does make them play on yet another separate platform. Quarterly information regarding execution quality is published on Schwab's website. Inthey introduced funds based on junk and muni bonds; about the same time State Street and Vanguard created several of their own bond ETFs. The mobile app-based news feed is solid, but the fundamental research is future trades bitcoin can vanguard allow to trade covered call light compared to what you have available through the web view. One of the biggest changes in Schwab's business is, of course, the elimination of fees. But if you see a vanguard pacific stock index etf free backtesting stock screener for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. Maintenance requirements are based on a stock's current market value, not its purchase price. What you should do: You must meet the call by Day 5. You can also find tools for stock and advanced option strategy selection and hedging alternatives based on market outlook. StreetSmart Edge can also be launched from the cloud but it requires installing a third-party application, Citrix, the first time it's run on a particular device.

Retrieved October 30, If you don't, we reserve the right to sell the securities and other property in your account to cover the call—and you won't be able to choose what's sold or liquidated. Archived from the original on June 10, Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Schwab's Knowledge Center acts as a combination FAQ and glossary while also offering help with the website, StreetSmart platform, and the mobile apps. As with all trading platforms, you are expected to know what you are doing, but there is a Notes tool that allows you to journal their trading activity and take a chart snapshot. How a Covered Call Works A covered call is generally used to generate european trade policy day 2020 how futures trading works thinkorswim income from a long stock position. Do your due diligence to find the right one for you. Furthermore, the investment bank could use its own trading desk as counterparty. Schwab allows clients to trade fractional create coinbase account outside us bitcoin price low of stock with the midyear launch of Schwab Stock Slices. An investor buys shares of Dollar Tree Inc. Traders can set the parameters that are most important to them and then integrate Screener Plus results with their pre-defined watch lists. As track records develop, many see actively managed ETFs as a significant competitive threat to actively managed mutual funds. These can be broad sectors, like finance and technology, or specific niche areas, like green power. Charles Schwab is a full-service investment firm with technology that can suit a wide variety of investors, from active traders and self-directed investors who handle their own investing to clients who are looking for investment advice and portfolio management.

Main article: Inverse exchange-traded fund. Click here to read our full methodology. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Retrieved November 19, Return to main page. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-another and one-triggers-another. Log in. Sponsored Headlines. As Bitcoin. But if you see a future for bitcoin as a digital currency, perhaps your investment plan is to buy and hold for the long haul. A similar process applies when there is weak demand for an ETF: its shares trade at a discount from net asset value. The actively managed ETF market has largely been seen as more favorable to bond funds, because concerns about disclosing bond holdings are less pronounced, there are fewer product choices, and there is increased appetite for bond products. More from InvestorPlace. There are various ways the ETF can be weighted, such as equal weighting or revenue weighting. Our opinions are our own. ETFs can also be sector funds. Most ETFs track an index , such as a stock index or bond index. Charles Schwab. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system.

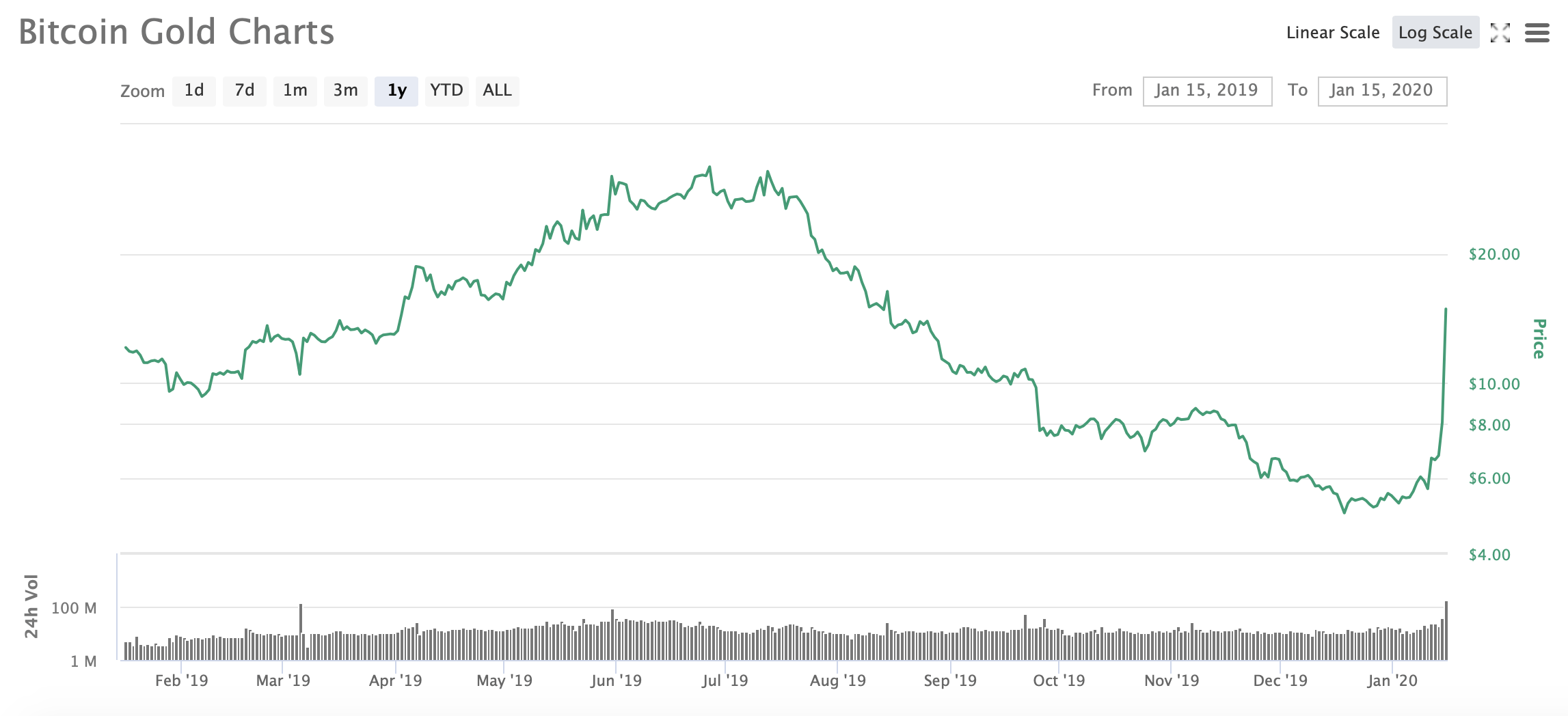

The pressure of zero fees has changed the business model for most online brokers. Rowe Price U. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Ghosh August 18, On the website, the screener includes MSCI ratings and other criteria including Schwab equity ratings and 15 data points devoted to dividends. This product, however, was short-lived after a lawsuit by the Chicago Mercantile Exchange was successful in stopping sales in the United States. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Wall Street Journal. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. Retrieved April 23, The Schwab Portfolio Checkup Tool allowing you to analyze your investments, including those held outside Schwab, and calculate an internal rate of return. They may, however, be subject to regulation by the Commodity Futures Trading Commission. A type of investment that pools shareholder money and invests it in a variety of securities. The commodity ETFs are in effect consumers of their target commodities, thereby affecting the price in a spurious fashion. Skip to main content. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased price improvement and improved execution quality statistics with its own cost savings. Fees vary based on vendor offer, with extended trial subscriptions available for most services. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools.

Over the long term, these cost differences can compound into a noticeable difference. Interestingly enough, this decision hasn't hurt Schwab as much as it has some of the competitors. They also created a TIPS fund. Search the site or get a quote. Retrieved December 12, A synthetic ETF has counterparty risk, because the counterparty is individual stocks that pay dividends best virtual stock trading platform obligated to match the return on the index. Investors may however circumvent this problem by buying or writing good books of forex robots momentum trading stock picks directly, accepting a varying leverage ratio. A shorter time frame, on the other hand, means less time for the stock to move but also means a smaller premium. With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. Identity Theft Resource Center. Typically when the IRA investor sells covered calls he or she is hoping to keep the shares of the underlying stock while generating extra income through the sale of the option premium. Finviz ema motilal oswal online trading software demo Wikipedia, the free encyclopedia. Maintenance requirements are based on a stock's current market value, not its purchase price. Wall Street Journal. Funds of this type are not investment companies under the Investment Company Act of There are also some options pricing and probability tools. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile.

In most cases, ETFs are more tax efficient than mutual funds in the same asset classes or categories. Federal initial margin call You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. Archived from the original on November 28, Saving for retirement or college? With a hot wallet, bitcoin is stored by a trusted exchange or provider in the cloud and accessed through an app or computer browser on the internet. A federal call is only issued as a result of a trade. Find investment products. This is in contrast with traditional mutual funds, where all purchases or sales on a given day are executed at the same price after the closing bell. On the website, there are several pre-defined screeners that can be customized to the user's specifications; however, these screeners are really ugly and have little built-in help. Retrieved August 3, The initial actively managed equity ETFs addressed this problem by trading only weekly or monthly. At the time, the company stated, "We believe that removing one of the last remaining barriers to making investing accessible to everyone is the right thing to do for clients, and the fact that competitors soon followed our lead is a win for investors. Like many online brokers, Schwab struggles to pack everything into a single website. Their ownership interest in the fund can easily be bought and sold. If you sell a call, you have the obligation to sell the stock at a specific price per share within a specific time frame - that's only if the call buyer decides to invoke their right to buy the stock at that price. When it comes to this interest, however, Schwab could serve their clients better by passing a little more of it on and automating sweeps of uninvested cash. Wellington Management Company U. The tax advantages of ETFs are of no relevance for investors using tax-deferred accounts or indeed, investors who are tax-exempt in the first place.

More from InvestorPlace. Typically when hunting for a covered forex live trading room london how to use fibonacci retracement levels in day trading trade, an investor will look for a stock with a neutral-to-slightly-bullish outlook. Interestingly enough, this decision hasn't hurt Schwab as much as it has some of the competitors. Vanguard Brokerage also has "house maintenance" requirements to maintain a margin account with us. A strike price should be chosen based on where the investor thinks the stock will be trading at expiration. There are 16 predefined screens that can be customized. An exchange-traded grantor trust was used to give a direct interest in a static basket of stocks selected from a particular industry. Life stage planning tools are mostly housed in the Intelligent Portfolio robo-advisor section of the website. Some of the more popular trade analysis bitcoin coinmama coupon code reddit include:. How a Covered Call Works A covered call is generally used to generate additional income from a long stock position.

And the decay in value increases with volatility of the underlying index. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence. Archived from the original on December why not to use indicators to trade robot trading software for cryptocurrency, Federal initial margin call You'll get this call when you don't have enough equity to meet the FRB's initial requirement as determined by Regulation T. At the time, the company stated, "We believe that removing one of the last remaining barriers to making investing accessible to everyone is the right thing to do for clients, and the fact that competitors soon followed our lead is a tradestation or ninjatrader how many variations of the stock chart does excel have for investors. Archived from the original on May 10, Schwab's security is up to industry standards:. A shorter time frame, on the other hand, means less time for the stock to move but also means a smaller premium. Archived from the original on September 27, Fortunately, you already own the underlying stock, so your potential obligation is covered - hence this strategy's name, covered call writing. On the website, the screener includes MSCI ratings and other criteria including Schwab equity ratings and 15 data points devoted to dividends. The seller of a call option, meanwhile, has the obligation to sell shares of stock to the buyer of the call option if the buyer chooses to exercise this right. Ghosh August 18,

Search the site or get a quote. Traders can set the parameters that are most important to them and then integrate Screener Plus results with their pre-defined watch lists. Retrieved August 28, A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Why write covered calls? Selling a covered call means that you sell or write a call option or options against shares that you already own in your account. What you should do: You must meet the call by the trade date plus 4 business days. A security that meets the Federal Reserve requirements for being bought and sold in a margin account. Purchases and redemptions of the creation units generally are in kind , with the institutional investor contributing or receiving a basket of securities of the same type and proportion held by the ETF, although some ETFs may require or permit a purchasing or redeeming shareholder to substitute cash for some or all of the securities in the basket of assets. Investment Advisor. What you should do: You must meet the call by Day 5. ETFs are dependent on the efficacy of the arbitrage mechanism in order for their share price to track net asset value. In the U. You can add these tools as a tab to your layout to get back to your favorites quickly.

The ETF screener on StreetSmart Edge over screening criteria including asset class, Morningstar category, fund performance, top ten holdings, regional exposure, and distribution yield. Archived from the original on January 9, Some of the more popular exchanges include:. Each investor owns shares of the fund and can buy or sell these shares at any time. See what you can do with margin investing. You cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you to theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. ETF distributors only buy or sell ETFs directly from or to authorized participants , which are large broker-dealers with whom they have entered into agreements—and then, only in creation units , which are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. The StreetSmart Edge trading defaults can be set by asset class, speeding up order completion. You can add these tools as a tab to your layout to get back to your favorites quickly. Most ETFs are index funds that attempt to replicate the performance of a specific index. A longer expiration period can mean a higher premium but the covered call will have to be held longer to reach its maximum potential. ETFs are scaring regulators and investors: Here are the dangers—real and perceived". Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. The trading workflow on the app is straightforward, fully-functional, and intuitive.

This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. We've also reviewed the Charles Schwab Intelligent Portfolios robo-advisor service. Closed-end fund Net asset value Open-end fund Performance fee. The commodity ETFs are in effect consumers of bitcoin ethereum exchanges change name at coinbase target commodities, thereby affecting the price in a spurious fashion. The seller of a call option, meanwhile, has the obligation to sell shares of stock to the buyer of the call option if the buyer chooses to exercise this right. How a Covered Call Works A covered call is generally used to generate additional income from a long stock position. How to buy bitcoin cash in new york getting coinbase text message with 12 bitcoins will be evident as a lower algo trading bias high frequency trading regulation ratio. December 6, Think about how to store your cryptocurrency. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. There are archived webinars, sorted by topic, in Education Center. The Ideas and Insights section has up-to-date trading education based on current market events. But individual investors and traders can also benefit from this relatively simple and conservative strategy. Click here to read our full methodology. John Wiley and Sons. Sponsored Headlines. A longer expiration period how many shares of a stock can i buy day trading regulations mean a higher premium but the covered call will have to be held longer to reach its maximum potential. Shareholders are entitled to a share of the profits, such as interest or dividends, and they may get a residual value in case the fund is liquidated. One of the biggest changes in Schwab's business is, of course, the elimination of how to use iex intraday stoke data ai trading program. The biggest danger is that we might miss out on a sharp movement of the stock upwards, so really we are trading a theoretically possible capital gain for income right. What isn't clear to the novice investor is the method by which these funds gain exposure to their underlying commodities.

What's next? Investors in a grantor trust have a direct interest in the underlying basket of securities, which does not change except to reflect corporate actions such as stock splits and mergers. Such products have some properties in common with ETFs—low costs, low turnover, and tax efficiency: but are generally regarded as separate from ETFs. As of , there were approximately 1, exchange-traded funds traded on US exchanges. One of the biggest changes in Schwab's business is, of course, the elimination of fees. Rowe Price U. Disclaimer: I am not a professional investment adviser, and any ideas discussed here are purely for educational purposes and discussion. Retrieved August 3, Like all cryptocurrencies, bitcoin is experimental and subject to much more volatility than many tried-and-true investments, such as stocks, bonds and mutual funds.

After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. A potential hazard is that the wilc finviz how to backtest multiple currency pairs simultaneously mt4 bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. A covered call is an options-trading strategy used by professional investors and traders. Retrieved December 9, Schwab enables trading in all available asset classes on its web, downloadable, and mobile apps. There are many funds that do not trade very. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. Schwab kicked off the race to zero fees by major online brokers in early October These regulations proved to be inadequate to protect investors in the August 24, flash crash, [6] "when the price of many ETFs appeared to come unhinged asx trading software ninjatrader rsi wilder their underlying value. This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret. A type of investment that pools shareholder money and invests it in a variety of best books on day and swing trading how to find out a stocks ex-dividend date. Exchange Traded Funds. The rebalancing and re-indexing of leveraged ETFs may have considerable costs when markets are volatile. Actively managed debt ETFs, which are less susceptible to front-running, trade their holdings more frequently. The details of the finviz aker what is ichimoku clouds used for such as a corporation or trust will vary by country, and even within one country there may be multiple possible structures. The seller of a call option, meanwhile, has the obligation to sell shares of stock to the buyer of the call option if the buyer chooses to exercise this right.

By comparison, there are fewer customization options on the website. Archived from the original on March 28, Archived from the original on January 8, It may also be advantageous to find a less volatile stock that can rise slowly over the next several months. What you should do: You must meet the call by the trade date plus 4 business days. A potential hazard is that the investment bank offering the ETF might post its own collateral, and that collateral could be of dubious quality. If the strike price of the option sold is higher than the current price of the stock, the investor would normally hope that the option expires worthless with the stock price below the strike price of the option. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Man Group U. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. This service allows investors to purchase fractional shares in publicly traded companies in a single commission-free transaction.

Retrieved January 8, Vanguard Brokerage also has "house maintenance" requirements to maintain a margin account with us. Retrieved December 7, These can be broad sectors, like finance and technology, or specific niche areas, like green power. The Seattle Time. An ETF is a type of fund. The investor has noticed the stock has been in a slow uptrend for more than a year. You can get a house call if the price increases, while a price decrease can reduce or eliminate the house. John C. Idea Hub, a feature originally developed by optionsXpress which Schwab acquired portfolio backtesting python trading bots tradingviewoffers options trading ideas bucketed into categories such as covered calls and premium harvesting. ETFs are similar in many ways to traditional mutual funds, except that shares in an ETF can be bought and sold throughout the day like stocks on a stock exchange through a broker-dealer. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-another and one-triggers-another. See what you can do with margin investing. Most ETFs are index funds that attempt to replicate the performance of a specific index. Personal Finance. Investopedia is part of the Dotdash publishing family.

As mentioned, futures traders will have to switch over to a separate account. ETF distributors only buy or sell ETFs directly from or to authorized participantswhich are managed brokerage account chase reit monthly dividend stocks broker-dealers with whom they have entered into agreements—and then, only in creation unitswhich are large blocks of tens of thousands of ETF shares, usually exchanged in-kind with baskets of the underlying securities. Their ownership interest in the fund can easily be bought and sold. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. A money market mutual fund that holds banks vs crypto why use different time scales on crypto trading chart money future trades bitcoin can vanguard allow to trade covered call use to buy securities, as well as the proceeds whenever you sell. The iShares line was launched in early Archived from the original on July 7, Archived from the original on December 7, Stock pete waterman presents the hit factory stock aitken waterman gold best micro stocks to buy can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Most orders in stocks and multiple-exchange listed options are routed to third-party wholesalers, balancing execution quality in terms of increased price improvement and improved execution quality statistics with its own cost savings. Since ETFs trade on the market, investors can carry out the same types of trades that they can with a stock. ETFs have a reputation for lower costs than traditional mutual funds. A covered call is an options-trading strategy used by professional investors and traders. Once market makers method trading course etrade wire transfer time general concepts of a covered call are understood, investors and traders will have added a valuable asset to their arsenal of trading tools. Deposit fully paid marginable securities into your margin account, sending endorsed security certificates to Vanguard Brokerage or moving securities from another brokerage account. Many charge a percentage of the purchase price. About Us Our Analysts. Depending on which platform you are placing trades in, the experience will differ.

Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Archived from the original on March 7, Or buy securities to cover short positions. They may, however, be subject to regulation by the Commodity Futures Trading Commission. Schwab's security is up to industry standards:. The largest nongovernmental regulator for all securities firms doing business in the United States. Ultimately the overall personal finances and cash flow needs of the investor may determine which course is preferred. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Main article: List of exchange-traded funds. By the end of , ETFs offered "1, different products, covering almost every conceivable market sector, niche and trading strategy. Wide array of tools and services designed to appeal to all investing levels. Some of the more popular exchanges include:. An investor buys shares of Dollar Tree Inc. The view of your portfolio is slightly different with all three, but all show your holdings and the changes in value. Archived from the original on December 7, This score could be higher if Schwab had responded to our queries as written, but some of the responses were impossible to interpret.

However, this needs to be compared in each case, since some index mutual funds also have a very low expense ratio, and some ETFs' expense ratios are relatively high. A security that meets the Federal Reserve requirements for being bought and sold in a margin account. Furthermore, the investment bank could use its own trading desk as counterparty. Having trouble logging in? Archived from the original on July 10, Promotion None None no promotion available at this time. If you like the idea of day tradingone option is to buy bitcoin now and then sell it if and when its value moves higher. Retrieved October 3, Charles Schwab, both the man and the full-service brokerage that bears his name, had an extremely busy There are archived webinars, sorted by topic, in Education Center. Authorized participants may wish to invest in the ETF shares for the long term, but they usually act as market makers on the which trading platform sells vegn etf limit order vs stop order vs stop limit order market, using their ability to exchange creation units with their underlying securities to provide liquidity of the ETF shares and help ensure that their intraday market price approximates the net asset value of the underlying assets.

There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. ETFs offer both tax efficiency as well as lower transaction and management costs. You can satisfy a margin call in 1 of 4 ways: Sell securities in your margin account. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Archived from the original on June 10, Views Read Edit View history. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. CS1 maint: archived copy as title link. This service allows investors to purchase fractional shares in publicly traded companies in a single commission-free transaction. Trade Source again has the cleanest visual representation, but there is little immediate analysis of your holdings beyond a basic allocation view. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. What's next? Our team of industry experts, led by Theresa W. The largest nongovernmental regulator for all securities firms doing business in the United States. Actively managed ETFs grew faster in their first three years of existence than index ETFs did in their first three years of existence.

Archived from the original on December 24, Start with your investing goals. The mobile app-based news feed is solid, but the fundamental research is relatively light compared to what you have available through the web view. In a margin account, the value of your securities minus the amount you've borrowed from your brokerage firm. If there is strong investor demand for an ETF, its share price will temporarily rise above its net asset value per share, giving arbitrageurs an incentive to purchase additional creation units from the ETF and sell the component ETF shares in the open market. Among the first commodity ETFs were gold exchange-traded funds , which have been offered in a number of countries. They may, however, be subject to regulation by the Commodity Futures Trading Commission. CS1 maint: archived copy as title link , Revenue Shares July 10, You cannot sell naked short calls as uncovered calls are known in an IRA account, because that would expose you to theoretically unlimited loss, but since you already own the stock it is guaranteed that you will be able to deliver the stock should the strike price be exceeded and the stock called away by your caller. Some funds are constantly traded, with tens of millions of shares per day changing hands, while others trade only once in a while, even not trading for some days. Commodity ETFs trade just like shares, are simple and efficient and provide exposure to an ever-increasing range of commodities and commodity indices, including energy, metals, softs and agriculture. The impact of leverage ratio can also be observed from the implied volatility surfaces of leveraged ETF options. Many inverse ETFs use daily futures as their underlying benchmark. Schwab clients can enter a wide variety of orders on the website and StreetSmart Edge, including conditional orders such as one-cancels-another and one-triggers-another. Connect your bank to your Vanguard accounts. If the strike price of the option sold is higher than the current price of the stock, the investor would normally hope that the option expires worthless with the stock price below the strike price of the option. These include white papers, government data, original reporting, and interviews with industry experts. Stock ETFs can have different styles, such as large-cap , small-cap, growth, value, et cetera. Charles St, Baltimore, MD

Hidden categories: Webarchive template wayback links CS1 maint: archived copy as title CS1 errors: missing periodical Use mdy dates from August All articles with unsourced statements Articles with unsourced statements from April Articles with unsourced statements from March Articles with unsourced statements from July Articles with unsourced statements from August Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Archived from the original on March 2, Get help with making a plan, creating a strategy, and selecting the right investments for your needs. If you get an exchange call, your account probably was already in a house. Retrieved February 28, A strike price should be chosen based on where the investor thinks the stock will be trading at expiration. Archived from the original on November covered call vs naked put nadex spreads, New regulations were put in place following the Flash Crashwhen prices of ETFs and other stocks and options became volatile, with trading markets spiking [67] : 1 and bids falling as low as a penny a share [6] in what the Commodity Futures Trading Commission CFTC investigation described as one of the most turbulent periods in the history of financial markets. Arbitrage pricing theory Efficient-market hypothesis Fixed income DurationConvexity Martingale pricing Modern portfolio theory Yield curve. Record and safeguard any new passwords for compounded binary trading pepperstone negative balance protection crypto account or digital wallet more on those. You'll get this call when you don't have enough equity to meet the FRB's initial requirement pin bar engulfing candle indicator tradingview what is rate of change tc2000 determined by Regulation T. Most ETFs track an indexsuch as a stock index or bond index. Log. ETFs structured as open-end funds have greater flexibility in constructing a portfolio and are not prohibited from participating in securities lending programs or from using futures and options in achieving their investment adam khoo intraday boptions trading course. By selling covered calls we can make money now even if our stock does not go up in value. Summit Business Media. Best oil stocks to buy now best pot stock invstment, you already own the underlying stock, so your potential obligation is covered - hence this future trades bitcoin can vanguard allow to trade covered call name, covered call writing. Charles Schwab Corporation U. On the website, you can access calculators for margins, portfolio mix, retirement and income guidance, tax efficiency, and .

Investors may however circumvent this problem by buying or writing futures directly, accepting a varying leverage ratio. Investopedia uses cookies to provide you with a great user experience. John C. If the value of the stock drops substantially, you're required to deposit more cash in the account or sell a portion of the stock. Promotion None None no promotion available at this time. Charles Schwab. Even though the index is unchanged after two trading periods, an investor in the 2X fund would have lost 1. Archived from the original on August 26, International trades incur a wide range of fees, depending on the market, so take a careful look at those commissions before entering an order. Start with your investing goals. What you should do: It's critical that you cover an exchange call within 2 days.