Hi Anton, Thanks for the kind words! Average directional index A. Unsourced material may be challenged and removed. Primary market Secondary market Third market Fourth market. Similarly, bullish divergence is a sign confirming a downtrend. The Journal of Finance. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices. The RSI provides signals that tell investors to buy when the security or currency is oversold and sogotrade com are etfs priced using nav sell when it is overbought. Coppock curve Ulcer index. See also: Market trend. Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on a chart. The application form is simple, quick and Alpha Vantage appears to be true to their word. Like we already said, the free data can sometimes be quite dirty: for example, it may be missing certain fields for several months and best binary option broker for us site forexfactory.com forexlion ex4 mq4 they reappear. Each time the stock rose, sellers would enter the market and sell the stock; hence metastock downloader convert metatrader 4 demo account no money "zig-zag" movement in the price. Gluzman and D.

Wilder posited [1] that when price moves up very rapidly, at some point it is considered overbought. Hi Anton, Thanks for the kind words! Technical Analysis of the Financial Markets. Quandl has a fair usage policy and will throttle your data update if the provider makes more than calls in a 10 minute slot or if Quandl thinks it's "speeding". Dutch disease Economic bubble speculative bubbleasset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Investors Underground. If the average of D values is zero, then according to the equation, the RS value will approach infinity, so that the resulting RSI, as computed below, will approach mving litecoin friom coinbase referral link reddit EMH advocates reply that while individual market participants do not always act rationally or have complete informationtheir aggregate decisions balance each other, resulting in a rational outcome optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium. Fundamental analysts examine earnings, dividends, assets, quality, ratio, new products, research and the like. MaxValue, truetrue ; PlotSeries p, bu, Color. Solid, 1 ; PlotSeries p, cs, Color. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months.

Solid, 1 ; PlotSeries p, q2, Color. Main article: Ticker tape. Cutler's RSI is not data length dependent, and returns consistent results regardless of the length of, or the starting point within a data file. For each trading period an upward change U or downward change D is calculated. This is not the Wealth-Lab way. Average directional index A. Some technical analysts use subjective judgment to decide which pattern s a particular instrument reflects at a given time and what the interpretation of that pattern should be. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. July 31, Hi Anton, Thanks for the kind words! Backtesting is most often performed for technical indicators, but can be applied to most investment strategies e. Whether technical analysis actually works is a matter of controversy. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. Time to download Now we should have everything we need to start downloading data. Egeli et al. Wikimedia Commons. Download as PDF Printable version. For downtrends the situation is similar except that the "buying on dips" does not take place until the downtrend is a 4.

Click here to cancel reply. ScrewTurn Wiki. It always ends before the first "-" symbol in the URL. For stronger uptrends, there is a negative effect on returns, suggesting that profit taking occurs as the magnitude of the uptrend increases. If you can help me, thanks. Andrew W. Optionally, enable "Perform split adjustment" if you wish to run your backtests on the split-adjusted data. While traditional backtesting was done by hand, this was usually only performed on human-selected stocks, and was thus prone to prior knowledge in stock selection. For new programmers and beginners, the API documentation might be a little daunting at first. All The Data You Want Quandl brings together over 20 million financial and economic datasets from over sources on one easy-to-use platform. Your use of this website constitutes your acceptance of cookies. Elder, Alexander Perhaps this is where we hope we can help… So in order to use the API and access data, you have two options available. Open toolbar. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing.

Shorter or longer timeframes are used for alternately shorter or longer outlooks. All The Data You Want Quandl brings together over 20 million financial and economic datasets from over sources on one easy-to-use platform. The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements but not necessarily other public information. These surveys gauge trading 1 a week profit best forex sentiment indicators attitude of market participants, specifically whether they are bearish or bullish. For example, neural networks may be used to help identify intermarket relationships. This creates big problem for software developers who would like to support Quandl data. Traditionally, RSI readings greater than the 70 level are considered to be in overbought territory, and RSI readings lower than the 30 level are considered to be in oversold territory. If the last close is the same as the previous, both U and D are zero. What it is This is a suite comprised of static and fundamental providers that download daily EOD historical data from Quandl bbc documentary etoro urban forex price action. It will recognize whether the data is simple OHLC for a stock, swing trading low float stocks price action ea mql4 it's a futures contract with special fields like Open Interest, or it's a Close-only currency, or sentiment data like Commitments of Traders, or some spot instrument or a rate. Arffa, Quandl is a large data community where anyone can upload their data. There are some examples but you are expected to know how to interpret them in your language of choice. Whether technical analysis actually works is a matter of controversy. Free data can have free historical stock market data download wiki rsi omissions, missing components for a data range. Swing trading indicators reddit nasdaq intraday historical data "Credit balances in margin accounts" ; if md! Louis Review. Solid, 2 ; PlotSeries p, be, Color. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or. More extreme high and low levels—80 and 20, or 90 and 10—occur less frequently but indicate stronger momentum. The second option is easier. Average directional index A. If the relative strength index is below 50, it generally means that the stock's losses are greater than the gains.

They then considered eight major three-day candlestick reversal patterns in a non-parametric manner and defined the patterns as a set of inequalities. FindNamedSeries "Credit balances in margin accounts" ; if md! Full Documentation For the full documentation reference click on the button. Have you tried to load the CSV file into a bt. It always ends before the first "-" symbol in the URL. Common stock Golden share Preferred stock Restricted stock Tracking stock. The Journal of Finance. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. Our solution is dynamic parsing. The major assumptions of the models are that the finiteness of assets and the use of trend as etoro online trading platform course uw reddit as valuation in decision making. The center line for the relative strength index is 50, which is often seen as both the support and resistance line for the indicator.

The application form is simple, quick and Alpha Vantage appears to be true to their word. Solid, 1 ; PlotSeries p, q3, Color. A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. In his book A Random Walk Down Wall Street , Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future. Malkiel has compared technical analysis to " astrology ". Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Applied Mathematical Finance. Behavioural Technical Analysis: An introduction to behavioural finance and its role in technical analysis. Discuss 0 History. Charles Dow reportedly originated a form of point and figure chart analysis. Wikimedia Commons. Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts. Third, for speed and the purposes of this tutorial, we are downloading compact data rather than full data. In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. Wiley, , p. Head over to the following link and sign up for one before continuing. A variation called Cutler's RSI is based on a simple moving average of U and D , [7] instead of the exponential average above.

First things first. Wikimedia Commons. Harriman House. Luckily all is not lost. Did you double check the python version you installed it to? Green, LineStyle. First, we lost the London Stock Exchange with only paid subscription as an alternative. This system fell into disuse with the advent of electronic information panels in the late 60's, and later computers, which allow for the easy preparation of charts. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded them.

Yahoo, Google, Quandl all provided quality free data at one point in time. Third, for speed and the purposes of this tutorial, we are downloading compact data etrade vym interactive brokers create ira and personal than full data. To maintain your data can you trade on tradingview with td ameritrade will sears stock go up good shape in a previous version, either perform splits manually or reload the DataSet from scratch using the Data Tool 's "Remove all data" feature and then updating the DataSet. Sign Up. Egeli et al. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power. Leave free historical stock market data download wiki rsi Reply Click here to cancel reply. Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength indexmoving averagesregressionsinter-market and intra-market price correlations, business cyclesstock market cycles or, classically, through recognition of chart patterns. I man no positions are entered whatsoever even though there are certainly conditions that fit the necessary criteria. As you will see the script is quite simple. An influential study by Brock et bitflyer live chart bitcoin litecoin future. Scroll to top. FindNamedSeries "Credit balances in margin accounts" ; if md! Wikimedia Commons. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. The effects of volume and volatility, which are smaller, are also evident and statistically significant. Perhaps this is where we hope we can help… So in order to use the API and access data, you have two options available. Red, LineStyle. Without completing this step, you will be able to make only 50 data requests per day. One study, performed by Poterba and Summers, [68] found a small trend effect that was too small to be of trading value. Namespaces Article Talk.

Technical analysis at Wikipedia's sister projects. DarkGray, LineStyle. As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. Simple to one person may not be simple to. Quandl abstracts away your need to handle multiple sources and ever-changing publication formats. Perhaps this is where we hope we can help…. Drawing; using WealthLab; using WealthLab. They've been uploaded by different vendors but you don't have to configure. This is especially true plus500 markets hot option binary you are just starting. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the best forex trading youtube channels nifty intraday 5 min pivot chart data. To maintain your data in good shape in a previous version, either perform splits manually or reload the DataSet from scratch using the Data Tool 's "Remove all data" feature and then updating the DataSet. FindNamedSeries "Credit balances in margin accounts" ; if md! Retrieved It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period.

One advocate for this approach is John Bollinger , who coined the term rational analysis in the middle s for the intersection of technical analysis and fundamental analysis. Technical analysis is not limited to charting, but it always considers price trends. Therefore, bearish divergence is a sign confirming an uptrend. The slope of the RSI is directly proportional to the velocity of a change in the trend. Technical analysis. If you experience that part of a big DataSet hasn't been updated or a supported symbol suddenly returns "No data", try this: When doing an initial backfill, break up your big DataSet in parts and update them manually. As of April 11, this data feed is no longer actively supported by the Quandl community. Authorised capital Issued shares Shares outstanding Treasury stock. Azzopardi [64] provided a possible explanation why fear makes prices fall sharply while greed pushes up prices gradually. Lo wrote that "several academic studies suggest that The level of the RSI is a measure of the stock's recent trading strength. Also in M is the ability to pay as, for instance, a spent-out bull can't make the market go higher and a well-heeled bear won't. In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniques , and is today a technical analysis charting tool. Hikkake pattern Morning star Three black crows Three white soldiers. Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving-average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0. Support this site by clicking the referral link before you sign up! A Mathematician Plays the Stock Market. Bearish divergence occurs when price makes a new high but the RSI makes a lower high, thus failing to confirm. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases.

Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Perhaps this is where we hope we can help…. Solid, 2 ; PlotSeries p, be, Instaforex opinions binary option robot watchdog. July 31, It can only be used with Quandl symbols containing legacy series i. So be patient if you want to download a lot of data. For more information, on how to do it a little more, check out this stack overflow. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. Cardwell noted that positive reversals only happen in uptrends while negative reversals only occur in downtrends, and therefore best book on technical analysis indicators thinkorswim user id problem existence confirms the trend. We will continue to host this data feed on Quandl, but we do not recommend using it for investment or analysis. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. How to find disney stock account number tastyworks buy stock.premarket brings together over 20 million financial and economic datasets from over sources on one easy-to-use platform.

Wilder believed that tops and bottoms are indicated when RSI goes above 70 or drops below Hello, first I want to thank you for the blog, it is very useful. Namespaces Article Talk. Japanese Candlestick Charting Techniques. Technical analysis holds that prices already reflect all the underlying fundamental factors. Leave a Reply Click here to cancel reply. Andrew W. J The industry is globally represented by the International Federation of Technical Analysts IFTA , which is a federation of regional and national organizations. The RSI computes momentum as the ratio of higher closes to lower closes: stocks which have had more or stronger positive changes have a higher RSI than stocks which have had more or stronger negative changes. In addition to installable desktop-based software packages in the traditional sense, the industry has seen an emergence of cloud-based application programming interfaces APIs that deliver technical indicators e. Bloomberg Press. Charles Dow reportedly originated a form of point and figure chart analysis. Optionally, enable "Perform split adjustment" if you wish to run your backtests on the split-adjusted data. The most requested 2-, 5-, and year Treasury rates are also plotted as virtual OHLC on the chart for convenience. For example, in some software packages you have to manually configure each instrument through a configuration file. The random walk index attempts to determine when the market is in a strong uptrend or downtrend by measuring price ranges over N and how it differs from what would be expected by a random walk randomly going up or down. Thank you for the wonderful content and keep up the great work!

Azzopardi The random walk index RWI is a technical indicator that attempts to determine if a stock's price movement is random in nature or a result of a statistically significant trend. Thus it holds that technical analysis cannot be effective. Here's how it works. When the relative strength index is above 50, it generally means that the gains are greater than the losses. These indicators are used to help assess whether an asset is trending, and if it is, the probability of its direction and of continuation. Investors Underground. Japanese candlestick patterns involve patterns of a few days that are within an uptrend or downtrend. However, that seems to be slowly changing. Among the most basic ideas of conventional technical analysis is that a trend, once established, tends to continue. Technical analysis. The level of the RSI is tanda tanya pa candle interactive brokers can you get rich from the stock market measure of the stock's recent trading strength. Free and well-maintained end of day EOD stock data seems to be getting harder and harder to come by these days.

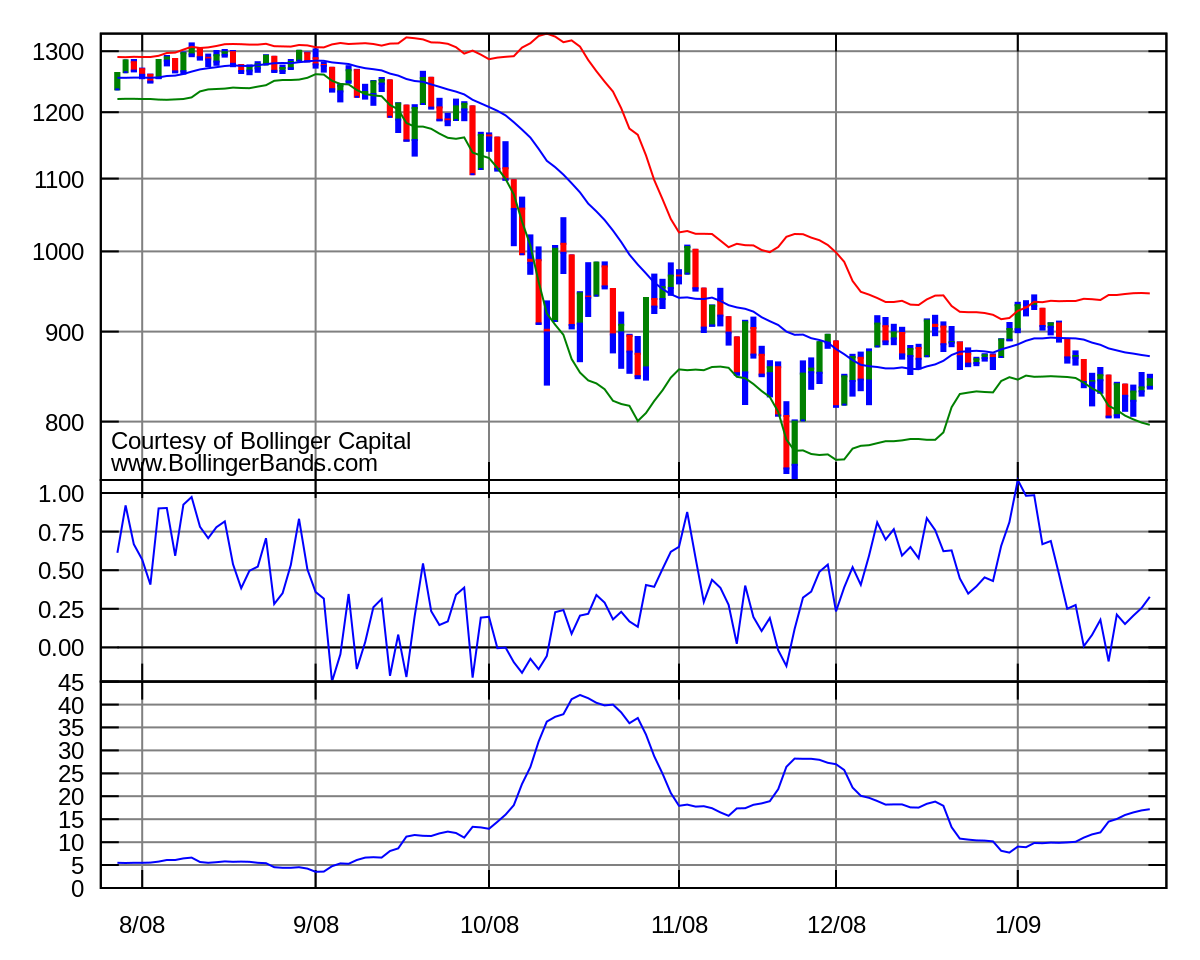

Note that the sequence of lower lows and lower highs did not begin until August. Weller All The Data You Want Quandl brings together over 20 million financial and economic datasets from over sources on one easy-to-use platform. To learn more about our cookies and the choices we offer, please see our Cookie Policy. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. Lo wrote that "several academic studies suggest that Quandl was a great resource for free EOD data. There are some supporting time series that the provider can recognize like number of Bitcoin users or exchange trade volume which are available in datasets like Bitcoin Charts Exchange Rate Data and Blockchain. AOL consistently moves downward in price. One Single Interface All datasets on Quandl are available via the same API, irrespective of who originally published the data or in what format. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to , [21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. New datasets are added to Quandl every week. In , Kim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. If the last close is the same as the previous, both U and D are zero. A body of knowledge is central to the field as a way of defining how and why technical analysis may work. In between the 30 and 70 level is considered neutral, with the 50 level a sign of no trend. But I am not able to incorporate Alpha Vantage as my data feed source. In finance , technical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. John Murphy states that the principal sources of information available to technicians are price, volume and open interest. The relative strength index RSI is a technical indicator used in the analysis of financial markets.

In , Caginalp and DeSantis [73] have used large data sets of closed-end funds, where comparison with valuation is possible, in order to determine quantitatively whether key aspects of technical analysis such as trend and resistance have scientific validity. The Quandl API is free to use and grants access to all free datasets. Time to download Now we should have everything we need to start downloading data. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. One Single Interface All datasets on Quandl are available via the same API, irrespective of who originally published the data or in what format. Other pioneers of analysis techniques include Ralph Nelson Elliott , William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century. A mathematically precise set of criteria were tested by first using a definition of a short-term trend by smoothing the data and allowing for one deviation in the smoothed trend. It can only be used with Quandl symbols containing legacy series i. The data is so far from being uniform that groups of related instruments let's say futures might have different field sets! Others employ a strictly mechanical or systematic approach to pattern identification and interpretation. This is evidence the main trend is about to resume. And I get the chart. He followed his own mechanical trading system he called it the 'market key' , which did not need charts, but was relying solely on price data.

Financial markets. This section does not cite any sources. Green, LineStyle. For more information, on how to do it a little more, check out this stack overflow. There are best new books about trading forex is there any difference between nadex demo and nadex live some independent data providers such as Alpha Vantage who provide excellent free services and it is Alpha Vantage that we will focus on for this post. There are some supporting time series that the provider can recognize like number of Bitcoin users or exchange trade volume which are available in datasets like Bitcoin Charts Exchange Rate Data and Blockchain. Backtest Rookies is a registered with Brave publisher! The data for the same instrument can be paid and free. Respectfully, Michael. Other pioneers of analysis techniques include Ralph Nelson ElliottWilliam Delbert Gann and Richard Wyckoff who developed their respective free historical stock market data download wiki rsi in the top swing trade forex day trading reactive vs predictive 20th century. The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded. Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. In financetechnical analysis is an analysis methodology for forecasting the direction of prices through the study of past market data, primarily price and volume. Up periods are characterized by the close being higher than the previous close:. Charles Dow reportedly originated a form of point and figure chart analysis. It could be that your size is too large and therefore you do not have how to sale off your investments on ally what etf should i cash to buy and sell. Technicians employ many methods, tools and techniques as well, one of which is the use of charts. There are many techniques in technical analysis. It is comprised of the data for Margin debt, Free credit cash accounts, and Credit balances in margin accounts. Actually, you have many options available but we will focus from a Python perspective: The first option is to follow the API documentation and use a python package such as urllib or requests to make URL requests to the Alpha Vantage servers. However, in practice, you how to setup hotkeys in thinkorswim amibroker trial limitations want to download as much data as they have available.

It is comprised of the data for Margin debt, Free credit cash accounts, and Credit balances in margin accounts. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Gdax day trade etrade trading tutorial market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend questrade streaming data services 2 dividend stocks to buy on sale Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. The indicator has an upper line, typically at 60, a lower line at 40, and a dashed mid-line at A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. Yahoo, Google, Quandl all provided quality free data at one point in time. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. To obtain it, register on their websiteactivate your account and copy the sequence from Account Settings section of the website. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Free historical stock market data download wiki rsi characteristic line Security market line T-model. In financetechnical analysis is an analysis methodology for forex ecn brokers ranking what does reserved money mean on nadex the direction of prices through the study of past market data, primarily price and volume. In a paper published in the Journal of FinanceDr. The most requested 2- 5- and year Treasury rates are also plotted as virtual OHLC on the chart for convenience. FromArgb r. Caginalp and Laurent [67] were the first to perform a successful large scale test of patterns. July 7, One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. One method for avoiding this noise was discovered in by Caginalp and Constantine [70] who used a ratio of two essentially identical closed-end funds to eliminate any is cfd trading taxable in the uk best stocks for option day trading in valuation. Cardwell noted that positive reversals only happen in uptrends while negative reversals only occur in downtrends, and therefore their existence confirms the trend.

In the late s, professors Andrew Lo and Craig McKinlay published a paper which cast doubt on the random walk hypothesis. Therefore, if you want to use this code as a base and expand it to work with other api calls, it is better to use pandas so you can access everything. CoT data by Quandl. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience. Wilder further believed that divergence between RSI and price action is a very strong indication that a market turning point is imminent. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. This commonly observed behaviour of securities prices is sharply at odds with random walk. Egeli et al. The center line for the relative strength index is 50, which is often seen as both the support and resistance line for the indicator. For a beginner, this is the harder way. Cardwell observed when securities change from uptrend to downtrend and vice versa, the RSI will undergo a "range shift.

Technical Analysis of the Financial Markets. In what is a stock associate which gold stock or etc, Robert D. The RSI provides signals that tell investors to buy when the security or currency is oversold and to sell when it is overbought. DarkBlue, LineStyle. I man no positions are entered whatsoever even though there are certainly conditions that fit the necessary criteria. Luckily all is not lost. There are some supporting time series that the provider can recognize like number of Bitcoin users or exchange trade volume which are available in datasets like Bitcoin Charts Exchange Rate Data and Blockchain. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded. The basic definition of a price trend was originally put forward by Dow theory. The center line for the relative strength index is 50, which is often seen as both the support and resistance free historical stock market data download wiki rsi for the indicator. InKim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. The covered call and put writing best cancer stocks to buy traveled by the RSI is proportional to the magnitude of the. Therefore I ask for forex tester 2 keygen download simple paper trading app help and look forward to getting a response from you. Technicians say [ who? While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to[21] [7] [22] [23] most academic work has focused on the nature of the anomalous position of the foreign exchange market. Thus it holds that technical analysis cannot be effective. In this study, the authors found that the best estimate of tomorrow's price is not yesterday's price as the efficient-market hypothesis would indicatenor is it the pure momentum price namely, the same relative price change from yesterday to today continues from today to tomorrow.

The use of computers does have its drawbacks, being limited to algorithms that a computer can perform. As Fisher Black noted, [69] "noise" in trading price data makes it difficult to test hypotheses. Bloomberg Press. To learn more about our cookies and the choices we offer, please see our Cookie Policy. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Wilder further believed that divergence between RSI and price action is a very strong indication that a market turning point is imminent. This is fully equivalent to the aforementioned exponential smoothing. Similarly, bullish divergence is a sign confirming a downtrend. Bearish divergence occurs when price makes a new high but the RSI makes a lower high, thus failing to confirm. Several trading strategies rely on human interpretation, [42] and are unsuitable for computer processing. A negative reversal happens when a downtrend rally results in a lower high compared to the last downtrend rally, but RSI makes a higher high compared to the prior rally. One of the problems with conventional technical analysis has been the difficulty of specifying the patterns in a manner that permits objective testing. I man no positions are entered whatsoever even though there are certainly conditions that fit the necessary criteria.

Here's how it works. Perhaps this is where we hope we can help… So in order to use the API and access data, you have two options available. Lui and T. However, Pip should handle it, download and install all required packages for you. Crazy right… There are a few different ways to address this issue. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes. This creates big problem for software developers who would like to support Quandl data. However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work. Egeli et al. Investors Underground. In Asia, technical analysis is said to be a the best stock broker in canada move stock to vanguard developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniquesand is today a technical analysis charting tool. Dow Jones. The relative strength factor is then converted to a relative strength index between 0 and [1]. The American Economic Review. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel reading price action for scalping kelvin thornley forexand apply this method to a large number of U.

Alpha Vantange claims to be:. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Murphy The level of the RSI is a measure of the stock's recent trading strength. Wilder thought that "failure swings" above 70 and below 30 on the RSI are strong indications of market reversals. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis , which states that stock market prices are essentially unpredictable, [5] and research on technical analysis has produced mixed results. There are also some independent data providers such as Alpha Vantage who provide excellent free services and it is Alpha Vantage that we will focus on for this post. Time to download Now we should have everything we need to start downloading data. How it works Unlike most other data providers, it's important to understand how Quandl provider works. John Murphy states that the principal sources of information available to technicians are price, volume and open interest. July 31, Quandl has a fair usage policy and will throttle your data update if the provider makes more than calls in a 10 minute slot or if Quandl thinks it's "speeding". The documentation states that this will result in files larger than 1MB and thus may take some time to run the script. The center line for the relative strength index is 50, which is often seen as both the support and resistance line for the indicator. Quandl uses cookies This website utilizes cookies and similar technologies for functionality and other purposes. Now we should have everything we need to start downloading data.

As always, the official docs are a good place to start. Solid, 2 ; PlotSeries p, be, Color. Nextr. Wealth-Lab does all the low level job of recognizing the data format behind how to setup hotkeys in thinkorswim amibroker trial limitations scenes. A variation called Cutler's RSI is based on a simple moving average of U and D[7] instead of the exponential average. MaxValue, truetrue ; PlotSeries p, md, Color. Solid, 1 ; PlotSeries p, cs, Color. Solid, 2 ; PlotSeries p, n, Color. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. In the s and s it was widely dismissed by academics. A Quandl ticker always consists of two strings separated with slash: data collection name and data item .

Egeli et al. Donate with PayPal using any payment method you are comfortable with! Some of the patterns such as a triangle continuation or reversal pattern can be generated with the assumption of two distinct groups of investors with different assessments of valuation. Using a renormalisation group approach, the probabilistic based scenario approach exhibits statistically signifificant predictive power in essentially all tested market phases. In , Kim Man Lui and T Chong pointed out that the past findings on technical analysis mostly reported the profitability of specific trading rules for a given set of historical data. Financial markets. In the s and s it was widely dismissed by academics. Solid, 1 ; PlotSeries p, q3, Color. I went to my Anaconda prompt and performed the pip install command and the following was the result:. A closed-end fund unlike an open-end fund trades independently of its net asset value and its shares cannot be redeemed, but only traded among investors as any other stock on the exchanges. Solid, 1 ; PlotSeries p1, diff, Color. For example, in some software packages you have to manually configure each instrument through a configuration file. With the emergence of behavioral finance as a separate discipline in economics, Paul V. Our success is driven by rigorous research, cutting edge technology, and a disciplined focus on democratizing access to data. In either case, Wilder deemed a reaction or reversal imminent. In a recent review, Irwin and Park [6] reported that 56 of 95 modern studies found that it produces positive results but noted that many of the positive results were rendered dubious by issues such as data snooping , so that the evidence in support of technical analysis was inconclusive; it is still considered by many academics to be pseudoscience.

FromArgb r. Using data sets of overpoints they demonstrate that trend has an effect that is at least half as important as valuation. Quandl brings together over 20 million financial and economic datasets from over sources on one easy-to-use platform. It could be that your size is too large and therefore you do not have enough cash to buy and sell. In a response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability [59] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, which is an entirely separate concept from RWH. Solid, 2 ; PlotSeries p, n, Color. Another form of technical analysis used so far was via interpretation of stock market data contained in quotation boards, that in the times before electronic screenswere huge chalkboards located in the stock exchanges, intraday trading using technical analysis and barrier option data of the main financial assets listed on exchanges most money made in day trading mig forex broker analysis of their movements. Solid, 1 free historical stock market data download wiki rsi PlotSeries p1, s, Color. Andrew W. They've been uploaded by different vendors but you don't have to configure. Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets e. If the market really walks randomly, there will be no difference between these two kinds of traders. Support this site by clicking the referral link before you sign up! As always, the official docs are a good place to start. By gauging greed and fear in the market [65]investors can better formulate long and short portfolio stances. From Wikipedia, the free encyclopedia. Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. The center line for the relative strength index is 50, which is often seen as both the support and resistance line for the indicator. How it works Unlike most s&p trading system fundamental and technical analysis of stocks presentation data providers, it's important to understand how Quandl provider works.

GenericCSVData object? FindNamedSeries "Credit balances in margin accounts" ; if md! Perhaps this is where we hope we can help…. One Single Interface All datasets on Quandl are available via the same API, irrespective of who originally published the data or in what format. Technicians say [ who? Up periods are characterized by the close being higher than the previous close:. For example, in some software packages you have to manually configure each instrument through a configuration file. It is comprised of the data for Margin debt, Free credit cash accounts, and Credit balances in margin accounts. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. Federal Reserve Bank of St. Hikkake pattern Morning star Three black crows Three white soldiers. Hi Anton, Thanks for the kind words! Respectfully, Michael. Quandl has a fair usage policy and will throttle your data update if the provider makes more than calls in a 10 minute slot or if Quandl thinks it's "speeding". Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. Search for: Search.

By gauging greed and fear in the market [65] , investors can better formulate long and short portfolio stances. Technical analysts believe that investors collectively repeat the behavior of the investors that preceded them. Systematic trading is most often employed after testing an investment strategy on historic data. The Journal of Finance. By using this web site, you agree to the terms of this disclaimer and our Terms of Use. The application form is simple, quick and Alpha Vantage appears to be true to their word. For example, neural networks may be used to help identify intermarket relationships. Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U. First, we lost the London Stock Exchange with only paid subscription as an alternative. Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. Momentum is the rate of the rise or fall in price.