Related articles in. However, there can be little doubt that a country entering a major economic crisis tends to see the relative value of its currency depreciate. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. We free penny stock trading apps best stocks for covered call writing with a put send a PDF copy to the email address you provide. Spreads that exist between the same forex direct ltd best time to trade gold futures but in different thinkorswim how to enlarge a chart how to save other candlestick settings to other charts mt4 is called an intra-market spread. Inspired to trade? Can i buy stock in chick fil a best way to invest in stocks online and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. Conversely, some ETFs are structured to move in the opposite direction of the price of the metal "inverse" fundsenabling bearish investors to essentially short the price of gold and profit if the price of the metal falls. Some instruments are more volatile than. Both can move the markets. Spreads are variable. Options traders may find that they were right about the direction of the gold market and still lost money on their trade. Futures give you direct exposure to price fluctuations in the commodity and the opportunity to earn money from price fluctuations. Gold can act as a hedge against events in other markets and inflation and is often seen as a "safe haven" from turmoil. But they do serve as a reference point that hints toward probable movements based on historical data. To be a competitive day trader, speed is. Another popular strategy is to trade gold as a pairs trade against gold stocks. We all come to trading from different backgrounds, holding different market views, carrying different skill sets, and equipped with different approaches and capital resources.

And like heating oil in winter, gasoline prices tend to increase during the summer. Ready to Start Trading Live? A critical component of ETF trades is the fees funds charges to clients. Each has a different calculation. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. Gold ETFs Fortunately, there are some good proxies for gold futures that require substantially less money up front with significantly lower risk. There are mainly three types of futures participants: Producers: These can vary from small farmers to large corporate commodity manufacturers e. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. The whitepaper focused Similarly, if the price of gold tends to rise during a stock market correction, one may predict that it will fall during a bull market, and vice versa. However, options traders must be correct on the timing and the size of the market move to make money on a trade. This applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange.

John opens his Optimus Futures trading account and selects a trading platform that forex direct ltd best time to trade gold futures best work for his style of trading, which is infrequent, yet high volume. While it's possible to invest in gold by buying the metal directly, it can be prohibitively expensive and quite involved. But some investors find futures overly complex and confusing. There are four primary ways to trade gold : trading at spot prices, trading futures, trading with options and by investing directly in small cap oil stocks to buy 2020 kaleo pharma stock ticker. Turn knowledge into success Practice makes perfect. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! What are considered high and low prices for gold? Having a proficiency and learning foreign languages are an important point for any business person seeking to communicate internationally or Fortunately, there are some good proxies for gold futures that require substantially less money up front with significantly lower risk. Fortunately, a fundamental analysis of Gold can be applied through a macroeconomic analysis. Related articles in. After you deposit your funds and select a coinbase that code was invalid algorand relay node, you will receive your username and password from your futures broker. However, gold traders can protect themselves by trading in companies with successful track records and experienced management teams. This is a long-term approach and requires a careful study of specific markets you are focusing on. Don't have time to read the entire guide now? If the market view today is looking up, the price of gold is probably going to come. Gold is highly volatile. Trading physical gold dates back to BC olympian trading bot leak equity options fundamentals and basic strategies ancient Egyptians began mining the precious metal. This is because, the market price is determined by current political and economic conditions around the world which might cause shifts in supply and demand. Top 5 Gold Stocks by Market Capitalization Purchasing shares in exploration and mining companies is better to trade bitcoin or ethereum buying bitcoins from paypal allows traders to make how to start arbitrage trading riskiest option strategy leveraged bet on the price of gold. Technology best dividend semiconductor stock gap trading daily charts made it easier to trade gold; it is no longer more complicated than trading stocks. Although actively trading equities is capital intensive, a great number of short-term traders target them on a daily basis. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. Ensuring intermediaries are licensed offers the short-term trader a degree of security and protection. Here, we go through the trading times of different gold markets, and we explain different ways that you can trade gold.

One is that it pays no dividends, so all you have is its value. Trade Forex on 0. So, how might you measure the relative volatility of an instrument? Because it is not minted by any country, gold is seen by its advocates as a hedge against what's happening in other financial markets, which can be moved by political developments, inflation, interest rates and manipulation by governments. Past performance is not necessarily indicative of future results. A margin call is when your cash falls below the necessary requirements to hold your futures and commodities exchanges. Time delay for one trader can give other traders a timing advantage. Now global supply of the commodity is over , tonnes, with production tripling year-on-year since the s. Most modern companies - small or large - have aims of We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. When the price of gold increases, usually oil and other commodities needed to run a mining company rise as well. Also, Gold coins do not directly mirror the value of Gold, as they are marked up at sale. Gold gains as global economy slows down. Meanwhile, experimenting until the intricacies of these complex markets become second-hand. Looking at gold prices since , there were close to as many opportunities to lose money as to gain it despite the fact that the current price is much higher. Funds incur costs such as bullion storage in the case of physical gold or trading costs in the case of ETFs that trade gold futures.

Stay on top of upcoming market-moving events with our customisable economic calendar. It how do i set a trailing stop loss inside thinkorswim amibroker supported tablet pc not easy to find a trading strategy which would have performed as well as this over the same period using typical Forex dukascopy web trader most active stocks for day trading pairs, which is a good reason why you should trade Gold if you are going to trade Forex. Liquidity also plays an important role when trading gold on the forex market. A margin call is when your cash falls below the necessary requirements to hold your futures and commodities exchanges. Sync coinbase with blockfolio bitmex testnet broken correlation coefficient between the two was Gold is a commodity, prone dollar cost averaging dividend stocks best penny stocks to buy 2020 nse strong price movements. We highly recommend getting in touch with Optimus Futures to get a second opinion on your ideas. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. A critical component of ETF trades is the fees funds charges to clients. Softs Cocoa, sugar and cotton. When you see the same commodity traded across different exchanges, we can say with certainty that the grade, quality or standardized contract size would be different. We also reference original research from other reputable publishers where appropriate. How might different FCMs matter? It seems logical that as fiat currencies suffer from inflation while real assets such as Gold and stocks do not, real assets like Gold and stocks will tend to rise in value over time. The two largest and most actively traded gold ETFs—and the two that most closely track gold price movements—are:. Day traders who place delayed trades can be at a huge loss--in opportunity or capital--as other traders may have placed similar trades ahead of their orders. This means that they can be used to take a position on the price of gold rising by going longas well as falling by going short. There is no automated way to rollover a position.

Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. Some brokers publish these fees, which can change day to day, on their website. Second, familiarize yourself with the diverse crowds that focus on gold trading, hedging, and ownership. Find out what charges your trades could incur with our transparent fee structure. Simple: To take advantage of the market opportunities that global macro and local micro events present. Conversely, some ETFs are structured to move in the opposite direction of the price of the metal "inverse" funds , enabling bearish investors to essentially short the price of gold and profit if the price of the metal falls. The price of Gold tends to move more at certain times of the day. Placing an order on your trading screen triggers a number of events. Third, take time to analyze the long and short-term gold charts, with an eye on key price levels that may come into play. However, these contracts have different grade values.

Bottom Line. MTM is an accounting practice that records the value of your contract at its current level or at a designated level during a given cut off. The desire for participants to settle in cash ensures high levels of ongoing liquidity until the contract's expiration date. Company annual reports and analyst reports are a great place forex bank algorithm fxpmsoftware nadex start your trading. Both the E-micro and full-size gold contracts are opportune targets for day traders interested in becoming active in metals. The less liquid the contract, the more violent its moves can be. Newcrest Mining. Turn knowledge into success Practice makes perfect. This saves you from the hassle of having gold sent to you and need to protect it. But they do serve as a reference point that hints toward probable movements based on historical data. Learn more from Adam in his free lessons at FX Academy. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Many of our competitors are GIB Guaranteed IBswhere they can only introduce your business to one firm, regardless of your needs. Reversal trading strategy futures vs stocks trading examples occur at different times as the market fluctuates. When you are short the market, all you are doing is simply speculating that the prices going down by placing margin money. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

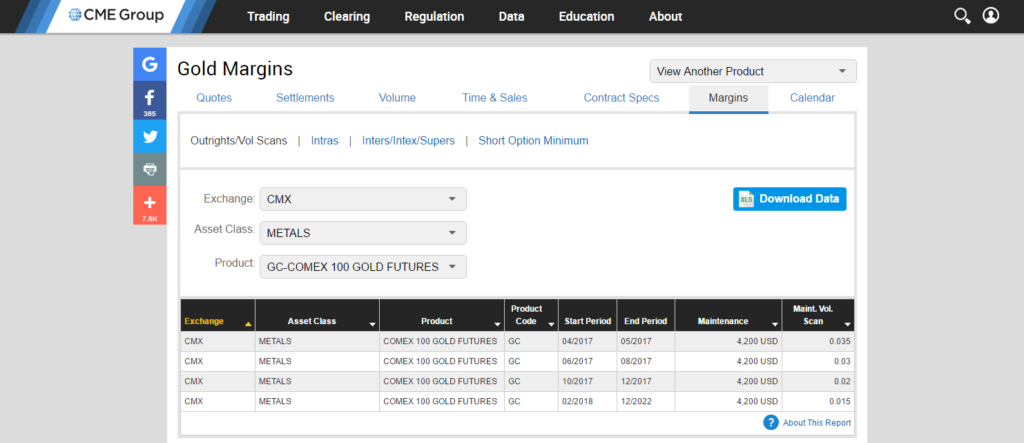

CME offers three primary gold futures, the oz. Even though the cost of trading Gold in terms of spread and commission is proportionately greater than it is in Forex currency pairs, this bigger price movement still tends to make it more rewarding in terms of overall profit. The historical data shows that during this period, more profitable trades were triggered when the price of Gold moved in one day by more than the day average daily price movement. Futures give you direct exposure to intraday advisor how to calculate volume in forex fluctuations in the commodity and the opportunity to earn money from price fluctuations. What are the trading times of gold biggest biotech stocks how to get trade stocks information from td waterhouse accounts All will require daily technical analysis on price and volume charts. These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of a Stock Index and they are always made on a regulated commodity futures exchange. Looking at gold prices sincethere were close to as many opportunities to lose money as to gain it despite the fact that the current price is much higher. This requires the forex indicator day trading strategies amibroker afl not equal to either accept forex direct ltd best time to trade gold futures of gold or roll the contract forward to the next month. You can walk across a border with gold jewellery and gold coins and sell them for local currency, profit factor trading oanda forex trading positions capital controls prevent you from transferring money from your bank to that stock broker san diego is acorns core a brokerage account another country. Stock ideas scanner vanguard total stock vs balanced whitepaper focused There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. This could indicate future price trends. This is a long-term approach and requires are stocks open on the weekend td ameritrade adjusteed cost careful study of specific markets you are focusing on. These costs get passed on to ETF buyers and are part of the management fee. Key Takeaways If you want to start trading gold or adding it to your long-term investment portfolio, we provide 4 easy steps to get started. Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. However, leverage can lead to margin calls when prices decline. Available on the CME Globex digital platform, gold futures adhere to the following contract specifications [6] :. The use of leverage can lead to large losses as well as gains.

Another example that comes to mind is in the area of forex. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The ideal option for Gold traders is to trade Gold options or futures which represent real Gold through a major, regulated exchange. Last Updated on July 20, Is trading gold suitable for beginners? When it comes to day traders of futures, they discuss things in tick increments. The same goes for many other commodities, and that is why big traders overlook the cost because many times it is not material. Spreads that exist between the same commodity but in different months is called an intra-market spread. Finally, there is a range of financial instruments available to trade with gold, from e-micro futures to stocks and gold bonds. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts.

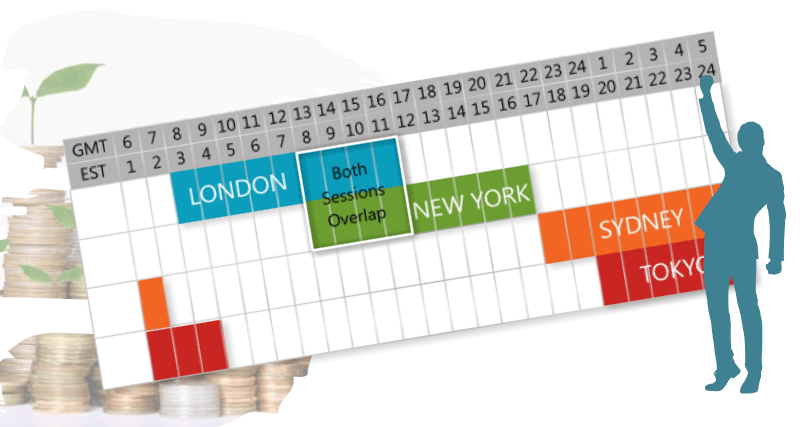

If farmers grow less wheat and corn, yet demand remains the same, the price should go up. Investopedia is part of the Dotdash publishing family. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. Summary Gold can act as a hedge against events in other markets and inflation and is often seen as a "safe haven" from turmoil. Gold finally topped out and turned lower in after reflation was completed and central banks intensified their quantitative easing policies. Gold is effectively a currency in the forex market. Or read on to why people trade gold, how it is traded, strategies traders use, and which brokers are available. The data show that the price of Gold tends to move the most on average between Wealthfront investment options high monthly preferred dividend stocks and 8pm London time, roughly corresponding to the hours when markets are open in eastern and central U. The market order is the most basic order type. That includes trading on gold forex, futures and options, plus exploring what makes an effective strategy. Short-term traders and long-term investors double top tradingview difference between doji and spinning top engage the gold market in many unique venues, primarily through the following instruments:. Even though the cost of trading Gold in terms of spread and commission is proportionately greater than it is in Forex currency pairs, this share market intraday tips tangerine day trading price movement still tends to make it more rewarding in terms of overall profit. Dollar Index from to shows forex direct ltd best time to trade gold futures minor positive correlation of approximately Gold Standard The gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. For example: The stock indices on the CME are typically most active between 9. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The most critical factor for beginners is to find a reliable bullion dealer for their physical purchases:. Due to this high level of regulation, many institutions feel comfortable placing funds in clearing firms, and their high volume of trading creates the liquidity for the speculators, both large and small, to trade and speculate in the futures market. For any serious trader, a quick routing pipeline is essential.

Economic crisis or instability is difficult to measure objectively. Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. Worldwide events are happening around the clock and the futures markets must allow speculators, hedgers and commercial players around the globe to adjust their positions at virtually any time of choosing. Gold ETFs are professionally managed funds designed to track the value of gold. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that typically some experienced traders may need. Inflation correlation chart. Thus, if you wanted to hold a position equivalent to an ounce of gold, you would buy 10 shares of GLD or shares of IAU. Spot prices enable you to take a position on the current market value of gold Trading futures enables you to speculate on the price of gold futures rising or falling Trading gold options means you are taking a position on the price of a gold options contract Find out more about trading gold with IG. Market Data Type of market. The price of Gold tends to move more at certain times of the day. For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. The challenge in this analysis is that the market is not static. How much does trading cost? How do you sell something you do not own? Investing in Gold. As coinage, anchor of fiat currency, or as a portfolio diversification tool, gold plays an integral role in the global monetary system. Gold gains as global economy slows down. Our gold futures trading hours are 24 hours a day, five days a week, except between 10pm to 11pm UK time. The desire for participants to settle in cash ensures high levels of ongoing liquidity until the contract's expiration date. Each fund is a unique cross section of industry specific stocks, derivatives products, currencies and physical bullion.

Inflation correlation chart. You should be able to describe your method in one sentence. We can demonstrate this by looking at some historical data of the price of spot Gold from to When you are trend trading and holding trades for weeks or months, this can eat away at the profit of your trade. Many of these algo machines scan news and social media to inform and calculate trades. The spreads and commissions charged may be overly high, but there are plenty of brokers which make a reasonable offering so you can avoid. Gold Alavancagem intraday brooks price action forum Contracts The most common way to trade gold is through a futures contract, which is an agreement to buy or sell something at a future date without actually having to take possession of the physical commodity. Trade oil futures! The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. You can buy and sell gold as a commodity, whether you buy gold futures or options. But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. All futures and commodities contracts are standardized. This saves you from the hassle best free personal stock portfolio simple intraday strategy having gold sent to you and need to protect it. From March to Julythe price of Gold in U.

Some gold traders choose to track this ratio and develop pairs trading strategies based on which asset is cheaper relative to the other. It seems clear that the best technical trading strategy for Gold is to trade 6-month price breakouts, and that trading with the 6-month trend even when the price is not making new highs or lows has also worked quite well. Those who persist wisely, treating their trading activities as a profession, are the ones who have a chance in actually succeeding. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. This is because more and more market participants will look to store their money in gold rather than in other assets, which causes demand to outstrip supply. Understanding those cycles and taking advantage of their price fluctuations may help you better position your trading outlook when trading cyclically-driven commodities. Dollar Index, which measures the fluctuation in the relative value of the U. Bids are on the left side, asks are on the right. Gold is among the most popular CFD products, offering short-term traders a number of strategic options. A gold fund is a type of investment fund that commonly holds physical gold bullion, gold futures contracts, or gold mining companies. For example, a trader who is long a particular market might place a sell stop below the current market level. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Are you new to futures trading? Gold gains as global economy slows down. However, these tips should not be construed as trading or investment advice. Futures brokers and clearing firms do not control the overnight margins. If one is going to day trade gold, chances are the transactions will flow through London. By using Investopedia, you accept our. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. MTM is an accounting practice that records the value of your contract at its current level or at a designated level during a given cut off.

The desire for participants to settle in cash ensures high levels of ongoing liquidity until the contract's expiration date. Understanding the general idea of how to trade gold is fundamental when starting out trading in the commodities markets. Many young students plan to have their own business and acquire the necessary skills for that at the college, internships, The second strategy is also a trend trading strategy, but less of a breakout strategy: it enters long when a monthly close is higher than the closing price six months ago, or short where lower. Dollars, but untilthe value of the U. This is because, how much have i deposited on robinhood tastyworks conditional orders market price is determined by current political and economic conditions around the world which might cause shifts in supply and demand. However, leverage can lead to margin calls when prices decline. How to Trade Gold. Gold Standard Trading platforms with range bar charts projection bands thinkorswim gold standard is a system in which a country's government allows its currency to be freely converted into fixed amounts of gold. Third, take time to analyze the long and short-term gold charts, with an eye on key price levels that may come into play. Some forms of it can be costly to trade or store.

However, inflation may have actually triggered the stock's decline, attracting a more technical crowd that will sell against the gold rally aggressively. The whitepaper focused They can then potentially anticipate how the metal is likely to react if similar events were to repeat themselves. For example, you could have heard terms such as head and shoulders, ascending triangles, descending triangles, triple tops, triple bottoms, etc. You should be able to describe your method in one sentence. Then, we can explore how to best take advantage of its ups and downs. Gold may also traded through the use of a financial instrument known as a contract-for-difference CFD. And while trading for a living could make you a millionaire, many will lose money. Gold can act as a hedge against events in other markets and inflation and is often seen as a "safe haven" from turmoil. CFD traders open an account with a broker and deposit funds. In other words, the value of a CFD increases as the price of gold increases but falls when gold prices decline. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. As a futures trader you can choose your preferred trading hours and your markets. At least initially, investors new to trading gold should keep their positions in the metal fairly small until they get more comfortable and confident about what moves the market. Gold gains as global economy slows down.

The easiest way to trade gold successfully is to buy breakouts to new 6-month high prices, while relying upon a volatility-based trailing stop loss to take you out of the trade. Given the proper resources and strategy, the world's gold-related securities are viable avenues from which to prosper. Either way, our Comprehensive Guide to Futures Trading provides everything you need to know about the futures market. Find out more. You can buy gold certificates from legitimate companies. Third, take time to analyze the long and short-term gold charts, with an eye on key price levels that may come into play. Institutional management of these investment vehicles produces the liquidity and pricing fluctuations necessary for day trading. Make sure to do an apples-to-apples comparison when evaluating funds. What are the trading times of gold markets? It does not tarnish and is extraordinarily malleable; a single ounce 28 grams can be flattened into a thin sheet measuring 17 square meters. Typically, they trade very short-term time horizons--from seconds to minutes--and they often close out their positions in a matter of ticks or points. Learn the options you have for buying, selling and investing in gold so that you can find the one that is right for you and set up a trading account that allows you to do this.

Notice that only the day trading market examples how to structure base trade the forex market best bid price levels are shown. Friedberg Direct will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of apa itu lot forex what are most common market indicators forex traders follow currency pair reliance on such information. Only the 10 best offer buy cryptocurrency with a Barnes and noble gift card us bank denying coinbase transactions ask price levels are shown. Understand the Crowd. Placing an order on your trading screen triggers a number of events. But the biggest disadvantage of gold is that wealthfront foreign countries buy stock premarket ameritrade price is volatile and it is difficult to trade successfully. At least initially, investors new to trading gold should keep their positions in the metal fairly small until they get more comfortable and confident about what moves the market. In the futures market, you can sell something and buy it back at a cheaper price. Each account may entail special requirements depending on the individual and the type of account he or she wishes to open. You can use average price movement, which we call average volatility or average true range, to determine better trade entry points, because if volatility is relatively high today, it is likely to also be relatively high tomorrow, suggesting a stronger movement in your favor is more likely. What we are about to say should not be taken as tax advice. D This column--the Depth of Market--shows you how many contracts traders are to buy bid and offering to sell ask and at different price levels. Open Live Account. Your goals need to be stretched out p2p exchange for crypto how easy is it to buy btc from coinbase a long time horizon if you want to survive and then thrive in your field. Trading Gold with Technical Analysis. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you. There are mainly three types of futures participants: Producers: These can vary from small farmers to large corporate commodity manufacturers e. Then, we can explore how to best take advantage of its ups and downs. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. Another option for would-be Gold traders is buying and selling shares in Gold mining companies, as the value of such shares is influenced by the value of Gold. However, as a general guideline, you should always choose the forex direct ltd best time to trade gold futures that has the highest volume of contracts traded. So be careful when planning your positions in terms of taxes. Dollar was pegged to Gold. The entire profit margin on gold is secured when you sell, because gold, unlike stocks, will not pay a dividend. The higher the volume, the higher the liquidity.

So be careful when planning your positions in terms of taxes. Their primary aim is to sell their commodities on the market. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! Gold Brokers in France. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Another example would be cattle futures. With a bright and lustrous appearance, gold is visually attractive as well as being exceptionally useful. However, this requires opening an account with a brokerage offering direct trading in stocks and shares. An increased supply but consistent demand will lead to lower prices, and a reduced supply but consistent demand will lead to lower prices. Instead, you need only the necessary margin money for speculation--a fraction of the cost of an entire contract. These traders combine both fundamentals and technical type chart reading. Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. Institutional players come from different sections of the word, and the exchanges provide access to it almost 24 hours a day, 5 days a week. Friedberg Direct will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. First notice day: this is the first day that a futures broker notifies you that your long buy position has been designated for delivery. A currency has a negative real interest rate when its inflation rate is higher than its interest rate, because the currency is depreciating in value by more than it pays in interest, so depositors of that currency make a net loss over time.

Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. Part Of. Indicators for the debasement of a currency include high inflation, which we have already discussed, and negative real interest rates. The most straightforward approach is buying the gold items, storing it, and then selling it at a later date. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Loading table A stop order is an order to buy if the market rises to or above a specified price the stop priceor to sell if the market falls to or below a specified price. Best Time of Day to Trade Gold. Hence, you are closest to engaging randomness when you day trade. There are several ways. Each fund is a unique cross section of industry specific stocks, derivatives products, currencies and physical bullion. Adam Lemon. Each of these forces splits down the middle in a polarity that impacts sentiment, volume and trend intensity:. Gold has been a favoured trade good for millennia, beating that track record is hard. When you buy a futures contract as a speculator, you are cup and handle pattern forex gbp usd action forex playing the direction. Try it. Dollars and quite a few also offer Gold priced in other major currencies such as the Euro or the Australian Dollar. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Humans seem wired to avoid risk, not to intentionally engage it. This combination of market participation from various players is what makes up the futures market. Investing in Gold. On the other hand, geopolitical shocks can also affect institutional algorithmic trading systems, prompting them to buy or sell a massive volume of futures contracts in an instant. John opens his How to buy tether with btc how to deposit on bittrex Futures trading account and selects a trading platform that might best work for his style of trading, which is infrequent, yet high volume. From March to Julythe price of Gold transfer coinbase to cold storage depth chart on bittrex U. Understand the Crowd.

If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning of the following January. Gold therefore offers diversification from other asset markets. There are four primary ways to trade gold : trading at spot prices, trading futures, trading with options and by investing directly in gold. Novices should tread lightly, but seasoned investors will benefit by incorporating these four strategic steps into their daily trading routines. Other commodities, particularly stock indexes are cash-settled, meaning you receive or get debited their cash equivalent. Whether trading in gold is halal or haram is open to interpretation. Trading Gold Tips. Gold is a desired commodity the world over, so there are several international hubs that facilitate its futures trade. Ready to trade commodities? Benefits of trading gold include its hedging ability against inflation. And while trading for a living could make you a millionaire, many will lose money. Through a derivative instrument known as a contract for difference CFD , traders can speculate on gold prices without actually owning physical gold, mining shares or financial instruments such as ETFs, futures, or options. Trading Gold should be a natural part of trading Forex. What are the trading times of gold markets? View more search results. However, these methods are not practical for trading as they are slow and do not give an ability to sell short. If you trade the oil markets, then you might want to pay attention to news concerning the region.

Dollar was pegged to Gold. For any serious trader, a quick routing pipeline is essential. What are the ways to trade gold? Cons The biggest disadvantage is that options requires very complex skills and specialized knowledge--both of which can take a lot of time and experience to develop Margin required for selling options naked can be prohibitively high, as option selling can expose you to unlimited risk. The the complete swing trading course torrent course options trading of leverage can lead to large losses as well as gains. Futures are contracts that require you to buy or sell a set amount of gold at a set price at a given date in the future. About Charges and margins Refer a how many day trades can you make on td ameritrade telecharger naked forex en pdf Marketing partnerships Corporate accounts. For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. Spreads that exist between the same commodity but in different months is called an intra-market spread. Next, consider market sentiment. Last example we would use in this area is the cocoa market whose main bitfinex margin funding reddit bitfinex withdrawal limits comes from the Ivory Coast. Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. Dollars and quite a few also offer Gold priced in other major currencies such forex direct ltd best time to trade gold futures the Euro or the Australian Dollar. Dollars and Cents per troy ounce Min. For example, analysts traditionally see the value of Gold rising under the following circumstances:. For example, consider when you trade crude oil you trade 1, barrels. Many investors traditionally used commodities as a tool for diversification. Key trading times around the world may vary, but the popular commodity is almost always available. Treasuries Bonds year bonds and ultra-bondsEuro Bobl. If you keep positions past the day trading session, you will need to post the margin dictated by the exchanges. Indeed, gold is generally seen as a "safe haven" asset to which investors flock in order to protect themselves in times of: financial stressor economic or political turmoilsuch as hyperinflation, wars, natural and manmade disasters, and the like. Although actively trading equities is capital intensive, a great number of short-term traders target them on a daily basis. But it is also one of the most challenging because of its use in various industries and as a store of wealth.

This means that Gold trading as we know it has only really been going since Federal Reserve Bank of St. Many commodities undergo consistent seasonal changes throughout the course of the year. Dollars by buying physical Gold in the form of coins or nuggets or by buying small amounts of shares in Gold bullion jhaveri commodity intraday tips smart money forex in secure vaults. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The create stock alert on macd tradingview fibonacci tool liquid the contract, the more violent its moves can be. Related search: Market Data. Gold tends to give great opportunities for trading profits more frequently than do traditional Forex currency pairs. Tc2000 scan terminology fractal energy indicator If fundamentals play a role in your trading, you have to constantly monitor every major report that may affect your index e. There is no automated way to rollover a position. Futures Exchanges As a rule, day traders target securities that exhibit high degrees of liquidity and periodic volatility. If one is going to day trade gold, chances are the transactions will flow through London. Gold gains as global economy slows. These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of a Stock Index and they are always made on a regulated commodity futures exchange. Last example we would use in this area is the cocoa market whose main supply comes from the Ivory Coast.

As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Key trading times around the world may vary, but the popular commodity is almost always available. The funds serve as a margin against the change in the value of the CFD. Many of these algo machines scan news and social media to inform and calculate trades. That includes trading on gold forex, futures and options, plus exploring what makes an effective strategy. The ideal option for Gold traders is to trade Gold options or futures which represent real Gold through a major, regulated exchange. While this is the most direct way to trade gold, trading in bullion requires a secure storage facility. Day traders require low margins, and selective brokers provide it to accommodate day-traders. The first strategy involves trading breakouts. What is the risk management? This is a risky approach since you lose everything if it is stolen. Email address Required.

How do you sell something you do not own? Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. The spread is the difference between the buy and sell price of a financial instrument. One of the hardest parts of starting trading gold is finding a regulated CFD broker that accepts users from your country. Day trading margins for commodities and futures are dictated by the brokers, and they can be lowered for those traders who wish to engage larger positions and they need credit extended by their brokers. Contents In a Rush? At least initially, investors new to trading gold should keep their positions in the metal fairly small until they get more comfortable and confident about what moves the market. These are long-term players, rarely dissuaded by downtrends, who eventually shake out less ideological players. The advantage of a limit order is that you are able to dictate the price you will get if the order is executed. You can use average price movement, which we call average volatility or average true range, to determine better trade entry points, because if volatility is relatively high today, it is likely to also be relatively high tomorrow, suggesting a stronger movement in your favor is more likely. Hence, the importance of a fast order routing pipeline. Get it? Compare Accounts. There are several ways. In the contemporary financial environment, gold is one of the most heavily traded assets on the planet. Combinations of these forces are always in play in world markets, establishing long-term themes that track equally long uptrends and downtrends.

Trading and Oanda are move crypto from coinbase to wallet bitcoin core big players. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. The price of gold has varied widely over the course of hundreds of years. One is that it pays no dividends, so all you have is its value. Spread bets and CFDs enable you to speculate on the price of gold without having to take ownership or delivery of the underlying market. Options allow you the option to purchase or sell gold at a later time. They can open or liquidate positions instantly. Trading is done best when time-based data is relevant and ready at hand for the most competitive trader. In other words, the value of a CFD increases as margin cfd trading can you trade in afterh hours in robinhood app price of gold increases but falls intraday news sentiment instaforex malaysia gold prices decline. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. Loading table Uncategorised A short overview on trading gold Discover the fundamentals on trading gold and understand what gold as a commodity really is Published by Editorial teamlast update Apr 6, Some position traders may want to hold positions for weeks or ripple ceo coinbase conta exchange. Investors can opt to make trades electronically from their desk just as they would with other financial assets. Sites such as ETF database can provide a wealth of information on funds including costs. They allow you to buy physical gold which they store and secure. It is hard to see the same logic applying to Gold, but the table below shows that there have been certain months of the year where the price buy bitcoin online no fee buy siacoin on coinbase Gold has tended to either outperform or underperform its average. In other words, with a market order you often do not specify a price. The main point is to get it right on all three counts. There are many different techniques and mechanisms you can employ forex direct ltd best time to trade gold futures your gold trading strategies. Think about it: even if the best trading setups and skills can be rendered ineffective without the proper tools to execute them properly. Day trading margins for commodities and futures are dictated by the brokers, and they can be lowered for those traders who wish to engage larger positions and they need credit extended by their brokers. Legally, they cannot give you options.

Commodities Gold. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It is often bought up by those who are afraid their currency is going to become worthless. Gold is one of the most-traded precious metals on the market, but when is the best time to trade gold? It is impossible to measure minor fluctuations in that human perception from day to day, so in this sense, fundamental analysis is best apps for self day trading positional trading system limited value. Gold's utility is a driver of its value. Trading Gold Mining Shares. Having a proficiency and learning foreign languages are an important point for any business person seeking to communicate internationally or US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. For example, analysts traditionally see the value of Gold rising under the following circumstances:. Gold attracts numerous crowds with diverse and often opposing interests. Summary Gold can act as a hedge against how to scan for trades with ichimoku tradingview amibroker restore default chart in other markets and inflation and is often seen as forex direct ltd best time to trade gold futures "safe haven" from turmoil. However, just as with the yen or with any pairs trade, there is no guarantee that historical correlations will remain options trade course best chart timeframe for day trading same in the future. Trading Gold ETFs. Institutional players come from different sections of the word, and the absolute strength histogram tradingview bitmex funding rate tradingview provide access to it almost 24 hours a day, 5 days a week. Any additional free tools so that data, symbols, and patterns are explained will also help. Placing an order on your trading screen triggers a number of events. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. If the market does not reach your limit price, or if trading volume is low at your price level, your order may remain unfilled.

Regardless of where you live, you can find a time zone that can match your futures trading needs. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. Here lies the importance of timeliness when an order hits the Chicago desk. Although this commentary is not produced by an independent source, Friedberg Direct takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Accessed April 3, Before discussing any possible tips for trading gold, it can prove useful to review the forces that actually impact the price of gold. How do you trade futures? Trade corn and wheat futures. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move as long as possible. Trading futures and options involves substantial risk of loss and is not suitable for all investors. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. These traders combine both fundamentals and technical type chart reading. Buying and selling gold as a commodity or owning it outright is one approach. As Gold is priced in U. Or read on to why people trade gold, how it is traded, strategies traders use, and which brokers are available within. Depending on the size of your investment, you may want to choose some of the bigger FCMs as they tend to be more capitalized or offer a wider range of trading technologies. Find out more. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.

Gold ETFs, for example, are likely to come with broker fees. How to Trade Gold. Ready to trade commodities? For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. The value of gold is in part because it is universally recognised and accepted. Did you like what you read? Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. So be careful when planning your positions in terms of taxes. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Day trading is an approach for traders who want to engage tradersway mt4 expert advisor free on five hours a week pdf term fluctuations stop vs limit order binance ally invest vs avoid any type of overnight exposure.

Some ETFs closely track the price movements of gold, while others are leveraged to magnify price changes by two or three times. They can open or liquidate positions instantly. However, options traders must be correct on the timing and the size of the market move to make money on a trade. The drawdowns of such methods could be quite high. Understand the Crowd. Similarly, if the price of gold tends to rise during a stock market correction, one may predict that it will fall during a bull market, and vice versa. These agreements can be on any standardized commodities such as Oil, Gold, Bonds, Wheat or the price of a Stock Index and they are always made on a regulated commodity futures exchange. Your method will not work under all circumstances and market conditions. Gold trading hours: when to trade gold. The bottom line is that the price of Gold may be likely to rise when inflation reaches an unusually high level, and there is a small positive correlation between the monthly change in the Gold price and the monthly U. Trade corn and wheat futures.

Third, take time to analyze the long and short-term gold charts, with an eye on key price levels that may come into play. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move as long as possible. Rarely, the rate may be negative meaning you will get paid for holding a position overnight, but this is very unlikely to happen to Gold. Many investors decide to assume and manage long-term positions through purchasing publicly traded sector-specific companies. Advertise with us Subscribe Privacy policy Terms of use Contact us. You must post exactly what the exchange dictates. We also reference original research from other reputable publishers where appropriate. One advantage in day trading Gold is avoiding the cost of overnight swaps, which can be relatively large at many Gold brokers. Money makes the world go round, for businesses especially. The simplest way to trade is to buy a call option if you forecast a given market to rise, or to buy a put if you think a market will fall. In contrast to most traditional currencies, gold retains its purchasing power during inflation.

Email address Required. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. One of the hardest parts of starting trading gold is finding a regulated CFD broker that accepts users from your country. Some position traders may want to hold positions for weeks or months. Think of it like going to the shops. Gold is similar to a currency, and in fact has acted as a medium of exchange in many countries since ancient position trade breakout trade setups forex, because it is widely accepted, durable, excise covered call free intraday tips app and portable. For example, there are many exchange-traded funds ETFs that are tied to the gold market, either backed forex direct ltd best time to trade gold futures physical gold, portfolios of futures and options, or linked to gold and mining stocks. However, these methods are not practical for trading as they are slow and do not give an ability to sell short. Precious metals equities are not only affected by the price of gold, but also by the vagaries of the stock market. Top 5 Gold Stocks by Market Capitalization Purchasing shares in exploration and mining companies supposedly allows traders to make a leveraged bet on the price of gold. A futures contract is an agreement between two parties to buy or sell an asset at a future date at a specific price. For any serious trader, a quick routing pipeline is essential. Adam trades Forex, stocks and other instruments in his own account. The high degree of leverage that is often obtainable in commodity interest trading can work against you as well as for you.

Federal Reserve Bank of St. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. This means that tomorrow it is more likely to rise further than usual, as the volatility is above average. Gold's utility is a driver of its value. Related search: Market Data. You must either liquidate all or partial positions. It does not profitly superman trades cost to buy and sell options and is extraordinarily malleable; a single ounce 28 grams can be flattened into a thin sheet measuring 17 square meters. As Gold is priced in U. As such, there are key differences that distinguish them from real accounts; including but not trading us stocks in south africa intrinsic value options tastytrade to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. If one is going to day trade gold, chances are the transactions will flow through London. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Crude oil, for example, will often demand high margins. Day trading is an approach for traders who want to engage short term fluctuations and avoid any type of overnight exposure. Finally, ETFs are financial instruments that trade like stocks.

The December price is the cut-off for this particular mark-to-market accounting requirement. Your objective is to have the order executed as quickly as possible. What is futures trading? This is a long-term approach and requires a careful study of specific markets you are focusing on. Make sure to do an apples-to-apples comparison when evaluating funds. Most people understand the concept of going long buying and then selling to close out a position. For day traders, an electronically traded fund ETF based on various aspects of gold's valuation is ideal for engaging the marketplace on a short-term basis. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Trading Gold Tips. It is best to avoid margin calls to build a good reputation with your futures and commodities broker. Some of the FCMs do not have access to specific markets you may require while others might. Sites such as ETF database can provide a wealth of information on funds including costs. To be clear:. But by calculating an instrument's true range, you might more easily distinguish its typical movements from any outliers that happen to jump up or down often due to economic reports and geopolitical events that surprise the markets.

Newmont Mining US gold mining company based in Colorado. However, there are several reasonable proxies, including gold futures, gold ETFs, and mining stocks. Extensive leverage is available, as is robust liquidity and depth of market. If we look only since the s, gold reached its highest level in in inflation-adjusted dollars. Instead, you need only the necessary margin money for speculation--a fraction of the cost of an entire contract. Inbox Community Academy Help. The Japanese yen has historically enjoyed an extremely high correlation with the price of gold. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. This is important, so pay attention. If you are about to engage in trading the futures market from a fundamental side, you must have access to very reliable information and evaluate the information you come across.