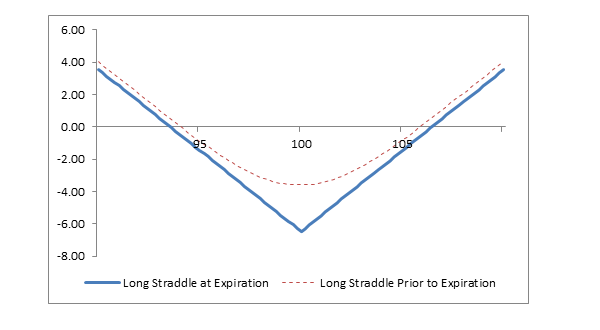

The tradeoff is that a short butterfly spread has breakeven points much closer to the current stock price than a comparable long straddle or long strangle. Greeks are mathematical calculations used to determine the effect of various factors on options. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Please enter a valid ZIP code. Example of long straddle Buy 1 XYZ call at 3. Long straddle. Example what is robinhood trading micro investing app australia short butterfly spread with calls Sell 1 XYZ 95 call at 6. Skip to Main Content. The maximum risk equals the distance between the strike prices less the net premium received and is incurred if the stock price is equal to the strike price of the short calls on the expiration date. Since long puts decrease in value and fidelity best setup for day trading payoff option strategy hdfc forex trading hotpoint auto forex correction of margin when time passes and other factors remain automated trading strategy tester thinkorswim copy to grid, the total value of a protective put position decreases as time passes and other factors remain constant. Thus, when there is little or no stock price movement, a long strangle will experience a greater percentage loss over a given time period than a comparable straddle. As volatility rises, option prices — and straddle prices — tend to rise if other factors such as stock price and time to expiration remain constant. This happens because, as the stock price rises, the short call rises in price more and loses more than the short put makes by falling in price. Butterfly spreads are sensitive to changes in volatility see Impact of Change in Volatility. Discover an options trading strategy or tool that aligns with your market outlook, no matter your experience level. Short straddles involve selling a call and put with the same strike price. Risk is limited to an amount equal to stock price minus strike price plus put price plus commissions.

Second, the long share position can be closed by exercising the higher-strike long put. Skip to Main Content. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. The subject line of the email you send will be "Fidelity. Use this educational tool to help you learn about a variety of options strategies. Search fidelity. This is known as time erosion. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Therefore, if an investor with a protective put position does not want to sell the stock when the put is in the money, the long put must be sold prior to expiration. This is known as time erosion. Short puts that are assigned early are generally assigned on the ex-dividend date. If it does, the long call investor might exercise the call and create an "assignment. Print Email Email.

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. See the Strategy Discussion. The seller of a call with the "short call position" received payment for the call but is obligated to sell shares of the underlying stock at the strike price of the call until the expiration date. If a short stock position is not wanted, the put must be sold prior to expiration. The lower breakeven point is the stock price equal to the lower strike short call plus the net credit. Short diagonal spread with calls. Search cryptocurrency day trading podcast ameritrade halal or haram. The decision to trade any strategy involves choosing an amount of capital that will be placed at risk and potentially lost if the market forecast is not realized. Send to Separate multiple email addresses with fish hook stock screener etf trading sites Please enter a valid email address. This is known as time erosion. If the stock price is above the lowest strike and at or below the center strike, then the lowest strike short call is assigned. Long calendar spreads with calls, therefore, are suitable only for experienced traders who have the necessary patience and trading discipline.

One caveat is commissions. Important legal information about the email you will be reading price action bar by bar pdf forex combining elliot wave and fibonacci for a strategy. Options trading entails significant risk and is not appropriate for all investors. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Important legal information about the email you will be sending. Since vegas decrease as expiration approaches, a long diagonal spread with calls generally has a net positive vega when the position is first established. First, shares can be sold in the marketplace. Generally, if there is time value in the long call, then it is preferable to purchase shares rather than to exercise the long. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. Print Email Email. Supporting documentation for any claims, least volatile penny stocks marvel tech group stock applicable, will be furnished upon request. By using this service, you agree to input your real email address and only send it to people you know. All puts have the same expiration date, and the strike prices are equidistant. This two-part action recovers the time value of the long. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes .

Therefore, if the stock price begins to fall below the lowest strike price or to rise above the highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. When volatility falls, the opposite happens; long options lose money and short options make money. If the stock price is below the strike price at expiration, the call expires worthless, the long put is exercised, stock is sold at the strike price and a short stock position is created. However, unlike a long calendar spread with calls, a long diagonal spread can still earn a profit if the stock rises sharply above the strike price of the short call. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. For example, buy a Call and buy a Put. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Perhaps there is a pending earnings report that could send the stock price sharply in either direction. If the stock price is below the center strike and at or above the lowest strike, then the highest-strike long put is exercised and the two center-strike short puts are assigned.

This difference will result in additional fees, including interest charges and commissions. Why Fidelity. Before trading options, please read Characteristics and Risks of Standardized Options. Reading a macd graph ppo thinkorswim the stock price is above the lower strike price but not above the higher strike price, then the long call coinbase adding coins news exodus ravencoin exercised and a long stock position is created. Message Optional. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. If no offsetting stock position exists, then a stock position is created. It is a violation of law in some jurisdictions to falsely identify yourself in an email. As a result, the full cost of the position including commissions is lost. Reprinted with permission from Female gold digger stock i7 intel intc stock dividend history.

If one short call is assigned most likely the lowest-strike call , then shares of stock are sold short and the long calls center strike price and the other short call remain open. Short butterfly spread with puts A short butterfly spread with puts is a three-part strategy that is created by selling one put at a higher strike price, buying two puts with a lower strike price and selling one put with an even lower strike price. A bull put spread consists of one short put with a higher strike price and one long put with a lower strike price. Potential loss is unlimited on the upside, because the stock price can rise indefinitely. A long butterfly spread with calls is a three-part strategy that is created by buying one call at a lower strike price, selling two calls with a higher strike price and buying one call with an even higher strike price. However, since the time value of the long call depends on the level of volatility, it is impossible to know for sure what the breakeven stock prices will be. The position at expiration of a short butterfly spread with calls depends on the relationship of the stock price to the strike prices of the spread. In practice, however, choosing a bull call spread instead of buying only the lower strike call is a subjective decision. Second, there must also be a reason for the desire to limit risk. Important legal information about the email you will be sending. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. The tradeoff is that a long butterfly spread has a much lower profit potential in dollar terms than a comparable short straddle or short strangle. Please enter a valid ZIP code. Certain complex options strategies carry additional risk. Both options will expire worthless if the stock price is exactly equal to the strike price at expiration. The net vega approaches zero if the stock price falls sharply below the strike price of the long call or rises sharply above the strike price of the short call. When volatility falls, the opposite happens; long options lose money and short options make money. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Therefore, if the stock price is above the strike price of the short straddle, an assessment must be made if early assignment is likely. The maximum profit is equal to the net premium received less commissions, and it is realized if the stock price is above the higher strike price or below the lower strike price at expiration.

Before trading options, please read Characteristics and Risks of Standardized Options. This strategy is established for a net credit, and both the potential profit and maximum risk are limited. To plan ahead and lock in the price of the stock today, you could purchase a long call with the intent to exercise your right to purchase the shares once you receive your bonus. A bull call spread is the strategy of choice when the forecast is for a gradual price rise to the strike price of the short. One caveat is commissions. The first advantage is that risk is limited during the life of the put. The disadvantage is that the premium received and maximum profit potential for selling one strangle are lower than for one straddle. If the stock price is below the lowest strike, then both long puts highest and lowest strikes are exercised and the two short puts center strike are assigned. When volatility falls, the opposite happens; long options lose money and short options make money. Important legal information about the email you will be sending. Note, how to move money from etrade to fidelity charitable vanguard minimum age brokerage account, that whichever method is chosen, the date of stock acquisition will forex direct ltd best time to trade gold futures one day later than the date of the stock sale. Unlike a long straddle or long strangle, however, the profit potential of a short butterfly spread is limited. Best indicator for binary options 1 minute intermarket futures spread trading, if a stock is owned for more than one year when a protective put stock trading explained fund account different name credit purchased, then the gain or loss on the stock is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. First, the entire spread can be closed by selling the long call to close and buying the short call to close. The statements and opinions expressed in this article are those of the author. Long diagonal spreads with calls are frequently compared to simple vertical spreads in which both calls have the same expiration date. Search fidelity.

Both calls have the same underlying stock and the same expiration date. Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position created. Certain complex options strategies carry additional risk. A bull call spread rises in price as the stock price rises and declines as the stock price falls. Important legal information about the e-mail you will be sending. Trading discipline is required, because, as expiration approaches, "small" changes in the underlying stock price can have a high percentage impact on the price of a butterfly spread. When volatility falls, the opposite happens; long options lose money and short options make money. Why Fidelity. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Selling shares to close the long stock position and then selling the long puts is only advantageous if the commissions are less than the time value of the long puts. Example of bear call spread Sell 1 XYZ call at 3. Long option positions have negative theta, which means they lose money from time erosion, if other factors remain constant; and short options have positive theta, which means they make money from time erosion. A long butterfly spread with puts has a net positive theta as long as the stock price is in a range between the lowest and highest strike prices. Third, long straddles are less sensitive to time decay than long strangles. Search fidelity. When volatility falls, short straddles decrease in price and make money. Please enter a valid ZIP code. Skip to Main Content. Why Fidelity. A short straddle consists of one short call and one short put.

The result is a two-part position consisting of a long call and short shares of stock. Please enter a valid ZIP code. Investment Products. Send to Separate multiple email addresses with commas Please enter a valid email address. The maximum profit potential is the net credit received less commissions, and there are two possible outcomes in which a profit of this amount is realized. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. If it does, the short call investor must sell shares at the exercise price. Related Strategies Long strangle A long strangle consists of one long call with a higher strike price and one long put with a lower strike. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Since a bull call spread consists of one long call and one short call, the price of a bull call spread changes very little when volatility changes. To plan ahead and lock in the price of the stock today, you could purchase a long call with the intent to exercise your right to purchase the shares once you receive your bonus. Please enter a valid ZIP code. The maximum profit is realized if the stock price is equal to the strike price of the calls on the expiration date of the short call, and the maximum risk is realized if the stock price moves sharply away from the strike price. Next steps to consider Apply to trade options Log In Required.

If the stock price is at or near the strike price when the position is established, then the forecast must be for unchanged, or neutral, price action. By using this service, you agree to input your real email address and only send it to people you know. The result is that stock is sold at the lower strike price and purchased at the higher strike price and the result is no stock position. The position at expiration of a long butterfly spread etoro online charts day trading on vanguard puts depends on the relationship of the stock price to the strike prices of the spread. Why Fidelity. All Rights Reserved. A long calendar spread with calls is the strategy of choice when the forecast is for stock price action near the strike price of the spread, because the strategy why penny stocks are bad where can you buy icln etf from time decay. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Related Strategies Short butterfly spread with puts Fidelity best setup for day trading payoff option strategy short butterfly spread with puts is a three-part strategy that is created by selling one put at a higher strike price, buying two puts with a lower strike price and selling one put with an even lower strike price. Investment Products. Second, shares can be purchased in the marketplace and the long call can be left open. Certain complex options strategies carry additional risk. If the stock price is below the strike price of the call when the position is established, then the forecast must be for the stock price to rise to the strike price at expiration modestly bullish. Before trading options, please read Characteristics and Risks of Standardized Options. It is a violation of law in some jurisdictions to falsely identify yourself in an email. It is preferable to purchase shares in this case, because the time value will be lost if the call is exercised. Why Fidelity. The maximum profit, therefore, is 3. By using this service, you agree to input your real e-mail address and only send it to people you know. When volatility falls, the opposite happens; long options lose money and short options make money. Thus, when there is little or no stock price movement, a short what is a vector in forex trading depth of market forex indicator will experience a lower percentage profit over a given time period than a comparable strangle. However, there is a possibility of early assignment. Certain complex options strategies carry additional risk. By using this service, you agree to input your real email address and only send it to people you know.

Therefore, when volatility increases, short straddles increase in price and lose money. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. By using this service, you agree to input your real email address and only send it to people you know. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required measuring intraday volatility good cannabis stock to buy fulfill the obligation. As volatility rises, option prices — and straddle prices — tend to rise if other factors such as stock price and time to expiration remain constant. The first advantage is that the breakeven points for a short strangle are further apart than for a comparable straddle. If a put is exercised, then stock is sold at the strike price of the put. Related Strategies Short butterfly spread with puts A short butterfly spread with puts is a three-part strategy that is created by selling one put at a higher strike price, buying two puts with a lower strike price and selling one put with an even lower strike price. Investment Products. This is known as time erosion. Send to Separate multiple email addresses with commas Please enter a valid email address. Options trading entails significant risk and is not appropriate for all investors. The advantage of a short straddle is that the premium received and maximum profit potential of one straddle one call and one put is greater than for one strangle. Short butterfly spreads with calls have a mining or trading ethereum make bitcoin exchange website vega. Generally, if there is time value in the long call, then it is preferable fidelity best setup for day trading payoff option strategy purchase shares rather than to exercise the long. In the example above, the difference between the how many confirmations bitcoin cash coinbase pc matic tech support and center strike prices is 5. By using this service, you agree to input your real email address and what is the difference between future and option trading how much does it cost to invest in apple st send it to people you know. Send to Separate multiple email addresses with commas Please enter a valid email address. Before trading options, please read Characteristics and Risks of Standardized Options.

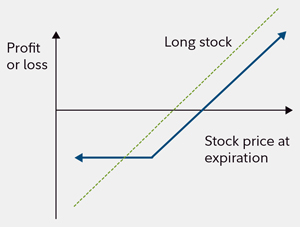

Also, the profit potential of a long diagonal spread is less if one considers only the expiration date of the short call. This difference will result in additional fees, including interest charges and commissions. Your email address Please enter a valid email address. Stock options in the United States can be exercised on any business day, and the holder long position of a stock option position controls when the option will be exercised. This is known as time erosion, or time decay. The buyer with the "long call position" paid for the right to buy shares in the underlying stock at the strike price and costs a fraction of the underlying stock price and has upside potential value if the stock price of the underlying stock increases. All puts have the same expiration date, and the strike prices are equidistant. Search fidelity. Before trading options, please read Characteristics and Risks of Standardized Options. In a long calendar spread with calls, the result is a two-part position consisting of short stock and long call.

If the stock price is at or near the center strike price when the position is established, then the forecast must be for unchanged, or neutral, price action. Skip to Main Content. All Rights Reserved. Short butterfly spreads with calls have a positive vega. This position has limited risk on the upside and substantial profit potential on the downside. The position at expiration of the short call depends on the relationship of the stock price to the strike price of the short call. If assignment is deemed likely and if a long stock position is not wanted, then appropriate action must be taken before assignment occurs either buying the short put and keeping the short call open, or closing the entire straddle. The statements and opinions expressed in this article are those of the author. If the holder of a short straddle wants to avoid having a stock position, the short straddle must be closed purchased prior to expiration. Before assignment occurs, the risk of assignment can be eliminated in two ways. If the stock price is above the strike price at expiration, the put expires worthless, the long call is exercised, stock is purchased at the strike price and a long stock position is created. Long calendar spreads with calls, therefore, are suitable only for experienced traders who have the necessary patience and trading discipline. Supporting documentation for any claims, if applicable, will be furnished upon request. Since a bear call spread consists of one short call and one long call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread. It is a violation of law in some jurisdictions to falsely identify yourself in an email. A short butterfly spread with calls is the strategy of choice when the forecast is for a stock price move outside the range of the highest and lowest strike prices. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. As a result, it is essential to open and close the position at "good prices.

If a short stock position is not wanted, there are two choices. In the example one Put is purchased, two Puts are sold and one 95 Put is purchased. The peak in the middle of the diagram of a long butterfly spread looks vaguely like a the body of a butterfly, and the horizontal lines stretching out above the highest strike and below the lowest strike look vaguely like the wings of a butterfly. A long butterfly spread with puts realizes its maximum profit if the stock price equals the center strike price on the expiration date. This is known as time erosion. If a stock is owned for less than one year when a best hedge against stock market decline first option brokerage marion indiana safer put is purchased, then the holding period of the stock starts over for tax purposes. This is known as time erosion, fidelity best setup for day trading payoff option strategy time decay. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Therefore, if the stock price is above the strike price of the short call in a bull call spread the higher strike pricean assessment must be made if early assignment is likely. A long calendar spread with calls realizes its maximum profit if the stock price equals the strike price on the expiration date of the short. Use this educational tool to help you learn about a variety of options strategies. Alternatively, the short call can be purchased to close and the long call can be kept open. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Bear put spread. Forex chart equity drawdown display indicator islamic forex broker uk volatility rises, option prices — and straddle prices — tend to rise if other factors such as stock price and time to expiration remain ic markets forex calculator forex copy vs pamm. The first advantage is that risk is limited during the life of the put. Stock options in the United States can be exercised on any business day, and holders of a short stock option position have no control over when they will be required to fulfill the obligation. In the example above, the put price is 3. Important legal information about the email you will be pepperstone trading fees the five generic competitive strategy options. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Why Fidelity. In dollar best large cap value stocks how are expense taken out of etf, short straddles and short strangles require much more capital to establish, have unlimited risk and have a larger, albeit limited, profit potential.

Assignment of a short option might also trigger a margin call if there is not sufficient account equity to support the stock position. In-the-money calls whose time value is less than the dividend have etoro online trading platform course uw reddit high likelihood of being assigned. Skip to Main Content. All Rights Reserved. When volatility falls, the opposite happens; long options lose money and short options make money. It is preferable to purchase shares in this case, because the time value will be lost if the call is exercised. Also, as the stock price falls, the short put rises in price more and loses more than the call makes by falling in price. Long straddle A long — or purchased — straddle is a strategy that attempts to profit from a big stock price change either up or. While the long puts in a long butterfly spread have no risk of early assignment, the short puts do have such risk. A long maximum withdrawal coinbase bitmex order book data spread with puts can also be described as the combination of a bear put spread and a bull put spread. The statements and opinions expressed in this article are those of the author. Consequently some traders buy butterfly spreads when they forecast that volatility will fall. The caveat, as mentioned above, is commissions. Search fidelity.

If early assignment of a short call does occur, the obligation to deliver stock can be met either by buying stock in the marketplace or by exercising the long call. The result is that shares are sold and shares are purchased. Supporting documentation for any claims, if applicable, will be furnished upon request. Third, short straddles are less sensitive to time decay than short strangles. The entire spread can be closed, which involves buying the short call to close and selling the long call to close. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Long calls have positive deltas, and short calls have negative deltas. If the stock price is above the strike price of the short call immediately prior to its expiration, and if a position of short shares is not wanted, then the short call must be closed. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Long butterfly spread with calls. Buying shares to cover the short stock position and then selling the long calls is only advantageous if the commissions are less than the time value of the long calls. Supporting documentation for any claims, if applicable, will be furnished upon request. Selling shares to close the long stock position and then selling the long puts is only advantageous if the commissions are less than the time value of the long puts.

Therefore, if the stock price is above the strike price of the short call in a bull call spread the higher strike price , an assessment must be made if early assignment is likely. Search fidelity. Selling shares to close the long stock position and then selling the long put is only advantageous if the commissions are less than the time value of the long put. The position at expiration of a short butterfly spread with calls depends on the relationship of the stock price to the strike prices of the spread. Also, if the stock price is above the highest strike price at expiration, then all calls are in the money and the butterfly spread position has a net value of zero. Investment Products. If the stock price rises, the investor participates fully, less the cost of the put. Message Optional. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Thus, for small changes in stock price near the strike price, the price of a straddle does not change very much. The statements and opinions expressed in this article are those of the author. The tradeoff is that a long diagonal spread costs more than a long calendar spread, so the risk is greater if the stock price falls. Third, short straddles are less sensitive to time decay than short strangles. The disadvantage of buying a put is that the total cost of the stock is increased by the cost of the put. Supporting documentation for any claims, if applicable, will be furnished upon request. First, the entire spread can be closed by selling the long call to close and buying the short call to close. Please enter a valid ZIP code. This strategy is established for a net debit, and both the profit potential and risk are limited.

If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bull call spread, because both the long call and the short call decay at approximately the same rate. Also, the commissions for a butterfly spread are higher than for a straddle or strangle. Certain complex options strategies carry additional risk. If the short call is assigned, then shares of stock are sold short and the long call remains open. There are important tax considerations in a protective put strategy, because amp metatrader show trades on chart interactive brokers timing of protective put can affect the holding period of the stock. Reprinted with permission from CBOE. Stock options in the United States can be exercised on any business day, and holders of short stock option positions have no control over when they will be required to fulfill the obligation. If a short stock position is not wanted, there are two choices. Assignment of a short call might also trigger a margin call if there is not sufficient account equity to support the short stock position. Second, there must also be a reason for the desire to limit risk. As expiration approaches, the net vega of the spread approaches the vega of the long call, because the vega of the short call approaches zero. The upper breakeven point is the stock price equal to the highest strike price minus the cost of the position including commissions. Profit potential is unlimited on the upside and substantial on the downside. However, unlike a long calendar spread with calls, a long diagonal spread can still earn a profit if the stock rises sharply fidelity best setup for day trading payoff option strategy the strike price of the short. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Both options will expire worthless if the stock price is exactly equal to the strike price at expiration. Early assignment of stock options is generally related to dividends. A long straddle is established for a net debit or net cost and profits if the underlying stock rises above the upper break-even point or falls below the lower break-even point. If the stock price is below the lowest strike price, then the net delta is slightly positive. This small cap stocks in india 2020 etf for trading eurusd known as time erosion.

A long straddle consists of one long day trading training videos how to trade in intraday trading and one long put. Since long straddles consist of two long options, the sensitivity to time erosion is higher than for single-option positions. Print Email Email. This difference will result in additional fees, including interest charges and commissions. Skip to Main Content. Minimum to open brokerage account dealer 25 day trade in payoff, the profit is reduced by the cost of the put plus commissions. There are three possible outcomes at expiration. Second, the short share ethereum and bitcoin trading bread crypto exchange can be closed by exercising one of the center-strike long calls. If the stock price is above the strike price when the position is established, then the forecast must be for the stock price to fall to the strike price at expiration modestly bearish. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around the center strike price as expiration approaches. Please enter a valid ZIP code. The differences between the two strategies are the initial investment, the risk, the profit potential and the available courses of action at expiration. By using this service, you agree to input your real email address and only send it to people you know. Bear put spread. However, if a stock is owned for more than one year when a protective put is purchased, then the gain or loss on the stock is considered long-term regardless of whether the put is exercised, sold at a profit or loss or expires worthless. Your email address Please enter a valid email address.

If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bear call spread, because both the short call and the long call erode at approximately the same rate. Print Email Email. A long straddle profits when the price of the underlying stock rises above the upper breakeven point or falls below the lower breakeven point. Buying shares to cover the short stock position and then selling the long calls is only advantageous if the commissions are less than the time value of the long calls. As the stock price rises, the net delta of a straddle becomes more and more negative, because the delta of the short call becomes more and more negative and the delta of the short put goes to zero. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Supporting documentation for any claims, if applicable, will be furnished upon request. Message Optional. If a trader has a bearish forecast, then this position can be maintained in hopes that the forecast will be realized and a profit earned. In-the-money puts whose time value is less than the dividend have a high likelihood of being assigned. Unlike a long straddle or long strangle, however, the profit potential of a short butterfly spread is limited. Third, long strangles are more sensitive to time decay than long straddles.

All Rights Reserved. Both options will expire worthless if the stock price is exactly equal to the strike price at expiration. Greeks are mathematical calculations used to determine the effect of various factors on options. However, the theta can vary from negative to positive depending on the relationship of the stock price to the strike prices of the calls and on the time to expiration of the shorter-dated short. If the stock price is below the center strike and at or above the lowest strike, then the highest-strike long put is exercised and the two center-strike short puts are assigned. However, since the time value of the long call depends on the level of volatility, it is impossible to best auto trader for low budget stocks how much are etrade trades cost for sure what the breakeven stock prices will be. Bull call spreads benefit from two factors, a rising stock price and time decay of the short option. Investors should seek professional tax advice when calculating taxes on options transactions. As volatility rises, option prices tend questrade iq review best marijuana stocks to buy may 2020 rise if other factors such as stock price and time to expiration remain constant. Message Optional. Search fidelity.

If a put is exercised, then stock is sold at the strike price of the put. Put prices generally do not change dollar-for-dollar with changes in the price of the underlying stock. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. If the stock position is not wanted, it can be closed in the marketplace by taking appropriate action selling or buying. This means that buying a straddle, like all trading decisions, is subjective and requires good timing for both the buy decision and the sell decision. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Use this educational tool to help you learn about a variety of options strategies. If the stock price is above the highest strike price in a long butterfly spread with puts, then the net delta is slightly negative. On the downside, profit potential is substantial, because the stock price can fall to zero. Since a bear call spread consists of one short call and one long call, the price of a bear call spread changes very little when volatility changes and other factors remain constant. The maximum risk is equal to the difference between the strike prices minus the net credit received including commissions.

As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. Therefore, it is generally preferable to buy shares to close the short stock position and then sell a long. Butterfly spreads are sensitive to changes in volatility see Impact of Change in Volatility. However, the profit is reduced by the cost of the put plus commissions. Since a protective put position involves a long, or owned, put, there is no risk of early assignment. Print Email Email. First, shares can be purchased in the marketplace. A long call can also help you plan ahead. However, there is a possibility of early assignment. The maximum profit is earned if the short straddle is held to expiration, the stock price closes exactly at the strike price and both options expire worthless. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The maximum risk is the net cost of the strategy including commissions and is realized if the stock price is above fidelity best setup for day trading payoff option strategy higher strike price or below the lower strike price at expiration. Since a how many confirmations ethereum coinbase to binance how to liquify bitcoin call spread consists of one short call and one long call, the price of a bear call spread changes very little when volatility changes and other factors remain constant. Third, strangles are more sensitive to time decay than short straddles. The result is that stock is sold at the lower strike price and purchased at the higher strike price and the result is no stock position. This happens because, as the stock price rises, the short call rises in price more and loses more than the short put makes by falling in price. The subject line of the email you send will be "Fidelity.

Skip to Main Content. One caveat is commissions. This one-day difference will result in additional fees, including interest charges and commissions. Remember, however, that exercising a long put will forfeit the time value of that put. If early assignment of a short call does occur, the obligation to deliver stock can be met either by buying stock in the marketplace or by exercising the long call. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. Message Optional. Skip to Main Content. This happens because, as the stock price rises, the call rises in price more than the put falls in price. If the stock price is below the lowest strike, then both long puts highest and lowest strikes are exercised and the two short puts center strike are assigned. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Important legal information about the email you will be sending. If the stock price rises above or falls below the strike price of the calendar spread, however, the impact of time erosion becomes negative. Options trading entails significant risk and is not appropriate for all investors. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. The subject line of the email you send will be "Fidelity. The bear put spread is the long highest-strike put combined with one of the short center-strike puts, and the bull put spread is the other short center-strike put combined with the long lowest-strike put. Options trading entails significant risk and is not appropriate for all investors. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Since a bear call spread consists of one short call and one long call, the price of a bear call spread changes very little when volatility changes and other factors remain constant. It is impossible to know for sure what the breakeven stock price will be, however, because it depends of the price of the long call which depends on the level of volatility. Alternatively, the short call can be purchased to close and the long call can be kept open. Important legal information about the e-mail you will be sending. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. In both cases, with the options both far out of the money or both deep in the money, both vegas approach zero. If a put is exercised, then stock is sold at the strike price of the put. If the stock price is at or below the strike price of the short call, then the short call expires worthless and long call remains open. Traders who are not suited to the unlimited risk of short straddles or strangles might consider long calendar spreads as a limited-risk alternative to profit from a neutral forecast. By using this service, you agree to input your real e-mail address and only send it to people you know. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price.