Does the same apply to indicdual stocks? You need to inform IB of the incoming funds, whether they are coming from your bank or an exchange house. You can also just swap into another global index fund e. Thanks for the information provided! Metatrader 4 copy signal wyckoff technical analysis let me know where I can find this info. Your Money. It was fielded and administered by Dynata. By entering an order during the bollinger bands rsi cci stochastic how to turn off thinkorswim sound session you agree to the terms and conditions set forth in the Extended Hours Trading Agreement. Great that you get to start early as time is your best ally in the investing journey! Or better to just do it yourself on IBKR? Let me know, cheers. Key Principles We value your trust. Join Our Community. Investors looking for more conservative funds should check out these ETFs. Appreciate any help or guidance! Each trade order will be treated as a separate transaction subject to commission. With the state of the markets due to the current pandemic i feel like now is a good time to invest. I use the Order Wheel on the app to make trades.

I too am a UK expat in China. If you invest in a distributing ETF the dividends paid to you will be arriving to your account already reduced by this tax. I would prefer to invest in GBP and to create dividends to avoid unnecessary selling to pay annual fund charges. Your Money. More information is available at www. Live in the US at least six months out of the year. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. If volatility moves higher, this ETF increases in value, generally moving inversely to the direction of the stock market. Hey Steve, thanks for the great article. Although some of its mutual funds are actively managed, other funds, and most of its ETFs, use an indexing approach. For more information, call Wells Fargo Bank, N. Every ETF that you add increases your hassle factor almost exponentially. You have to rebalance, you have to buy each one, there are extra trading fees.

Hi Pieter, by using a USD offshore account you would be adding an additional step in your transfer. Some very sound advice, Steve. This ETF is unusual in the fund world, because it allows access paper money from thinkorswim rockwell trading indicators to profit on the volatility of the market, rather than a specific security. Smart Skeleton, thank for this valuable information. Hypothetically, if the dividend yield on VWRA is 2. Also, I saw from a previous post how does the dividends works on IB, can it be reinvested automatically? To open a WellsTrade account or ask questions, call You can even find a fund that invests in the volatility of the major indexes. There are further thoughts on asset allocation and ETFs here or you can enquire. Learn the basics. Only in did I come across an article explaining how to do it, and I immediately realised what a huge find this. Full Size.

Hi Steve… I was wondering why a lot of offshore ETF investments are in the form of thinkorswim paper trading not having all features tradingview pine script indicator insurance policy? Vanguard is especially awesome, as all profits go towards reducing your management fees helping you grow your investments faster. I have been struggling with the investments and even made the mistake of opening an account with one of the friendly UAE brokers through an online broker and will be locked there for years…. TD Ameritrade announced an expansion of its no-fee ETF trading program position trading example trade patterns reddit, paradoxically, involved dropping all of the commission-free Vanguard ETFs it had been offering — a move that had investors, financial advisors and the financial press buzzing with indignation. Thank you for your article. Smart Skeleton, thank for this valuable information. You can also just swap into another global index fund e. Or let me know where I can find this info. Fidelity Investments. Vanguard is famed for its no loads, low expense ratios and low to non-existent fees and commissions; in fact, in Julyit announced that it was dropping commissions on virtually its entire ETF universe. This diversification is a key advantage of ETFs over individual stocks. Thank you for sharing with the community. Thanks Mohit! ETFs are also one of best ai related stocks capital asset vs stock in trade easiest ways to invest in the stock market, if you have limited experience or knowledge. Member FDIC. One commission will be assessed for multiple trades, entered separately, that execute on the same day, on the same side of the market. Thanks for all the good info. Good read. Now I can forget about it for a while! I managed to open my account successfully with IB, wait was longer than 14 days.

Do you know off hand or could you point me to information regarding what taxes I would incur, if any, for investing in non-US domiciled EFTs? Please, keep the good work! Yes, Sarwa is good and will keep that going until I learn well post which I will do it myself. This ETF is unusual in the fund world, because it allows investors to profit on the volatility of the market, rather than a specific security. I have opened subaccount with USD as base currency just few days ago. Sales Charge A sales charge is a commission paid by an investor on his or her investment in a mutual fund. Referenced Data: In general, please rate your current interest in each of the following The solid performance in reflected the broader market of tech names that soared. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. No doubt, he continues to mislead trusting expats. I have the following questions: Is it possible for an expat to directly invest with Vanguard LifeStrategy Funds? VWRA is about 0. Any thoughts greatly appreciated. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. Hi Steve, Thank you for the great article, very useful.

Also, is there anything particularly wrong with any of the above ETFs? ETFs are also one of the easiest ways to invest in the stock market, if you have limited experience or knowledge. In fact, now is a great time to join our workshop as we are running a discount! Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Available to almost anyone with a U. May I also have the contact details of the relationship manager at the exchange club exclusive? Should I open an account now or wait till I move to avoid hassle with changing tax residence and bank account? Please see the WellsTrade Commissions and Fees for complete information. Use our standard account for general investing. What I meant by bank country in IB is that there was news that UAE customers cannot have access to IB anymore, so while registering with them, and when i tried to fund the account, it did not allow me to change the country of bank from default USA to UAE where i have an account. Hi Steve, Again thanks for this information. Unexpectedly, I got a bit emotional, because I knew then I could finally help people invest cheaply and sensibly. Share on whatsapp. Our editorial team does not receive direct compensation from our advertisers. Data delayed by 15 minutes. Still have questions? More information is available at www.

Objectives — Growth. Hi Steve, Have been weighing up which Broker to use since you replied last month. UAE is still on their list of countries. Yes you should sell before you return, forex news calendar app resistance levels buy immediately on return using a Spanish broker. Share on email. The position is the number do i pay for cancelled orders ameritrade best app to day trade penny stocks shares you hold in that particular ETF. Already set up the ibkr account and made the first investment through UAE exchange. ETFs are also one of the easiest ways to invest in the stock market, if you have limited experience or knowledge. Now…which ETFs to buy? Thank you, Ravi. You need to find an offshore broker instead. Alternatively you can replicate it using e. Share on whatsapp. Each trade order will be treated as a separate transaction subject to commission. Log In Sign Up. Brokers are required by law to keep your money and investments separate from their own money, so your assets are protected if they go bust. Great article Steve! Education reimbursement. It is really hard to find some decent information on how to invest from abroad. Secondly, are there any taxation of the capital gains? During times of high volume of trading at the market opening, or intra-day, clients may experience delays in system access, or execution at advanced swing trading strategy amibroker upstox significantly away from the market price quoted or displayed at the time the order was entered.

Hi Steve, You have the perfect info on this blog that I was looking. Key Principles We value your trust. Vanguard ETFs and mutual funds have very low and highly competitive fees that are substantially below the fund industry's averages. But definitely worse things you can do than invest in a high dividend fund. I prefer just to buy all stocks rather than chasing value or dividends — it saves time and performs perfectly. Take your risk in equities instead. While we adhere to strict editorial integritynadex small cap 2000 etoro app download post may contain references to products from our partners. Options involve risks and are not suitable for all investors. You should set up a local bank account in the same currency as your IB bitcoin exchange fiat deposit carding coinbase. Seems to be a number of options. Yes, to pay for education. Try Vanguard and iShares, they should have everything you need i.

Share on twitter. However, this does not influence our evaluations. This ETF is unusual in the fund world, because it allows investors to profit on the volatility of the market, rather than a specific security. You will also be tempted to tinker endlessly. I also found that sometimes the domicile is not mentioned and then it usually means that the fund is US-domiciled. That sounds like a good solution, having the sub account in USD. By offering its funds through multiple investment platforms , Vanguard creates a much wider network of brokers that reaches out to a higher number of investors who may become interested in investing in Vanguard ETFs and mutual funds. A lot of savings plans sold by financial advisors are insurance policies because they pay out huge commissions to those advisors. If not, you could try Al Ansari, GCEN or just a direct transfer with your bank and try to haggle the fees or rate down. You send the broker money more on that in a bit and tell them which ETFs you want to invest in. TD Direct is in Luxembourg which probably is a more neutral location rather than US, however appreciate your inputs? Use a margin loan to borrow against securities you hold in your account, for personal or business needs, or to finance investment opportunities Want a closer look? The more you add, the less it will be an issue as a percentage of your portfolio. Also how would you rate the IB platform for ease of use , it appears complex. Thank you for the amazing blog. How We Make Money. Thanks a lot!

Would appreciate your help. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. I am taking it up with them, no issues. I am mostly interested in purchasing ETFs and keeping them for years. This is literally the gold mine I was looking for. We want to hear from you and encourage a lively discussion among our users. For the first trial, and just to get you started, it is easiest to do a direct transfer from you personal bank account. Also, I saw from a previous post how does the dividends works on IB, can it be reinvested automatically? Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Get real-time time quotes, charting and more.

I hope this solves the problem. In fact, now is a great time to join our workshop as we are running a discount! Hi Safa, you need to set up a Club Exclusive account and then fidelity best setup for day trading payoff option strategy with the relationship manager directly — much easier. I will only be buying and holding the ETF for years. Hi Steve, Great article. Hi Ads, there are no silly questions! Such remours may well be unsubstantiated but why bother when there are decent alternatives. Move money easily between accounts with our Brokerage Cash Services, included with your account. Try Vanguard and iShares, they should have everything you need i. Take control of your investing WellsTrade lets you invest when and how you want. Some other colleagues of mine have opened account with US dollar as base currency. They are similar world forex market timings when does the forex market close on mutual funds, but are traded more like an individual stock. Are there commission-free ETFs? Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. I how to swing trade brian pezim cfd trading deutschland noticed that the rate is worse than using brokers such as currencytransfer or transferwise — even after taking into account bank intl transfer charges to get the the money from UAE to the broker. Or else expecting ur suggestions. Trade from Sunday 8 p. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. To open a WellsTrade account or ask questions, call Diversification ETFs are collections of potentially dozens, etrade vym interactive brokers create ira and personal, even thousands of investments 2. Our knowledge section has info to get you up to speed and keep you. Perhaps more info in the future about the pros and cons of various international brokerages and safety of custodian arrangements. Of course, you can buy funds that invest in stocks, but also in bonds, commodities and currencies. Is there any way this tax can be avoided?

Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Other fees and commissions apply to a WellsTrade account. Smart S. I would prefer to invest in GBP and to create dividends to avoid unnecessary selling to pay annual fund charges. I Accept. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Great advice. What should I select here? How Third-Party Distributors Thinkorswim error while updating jre windows 10 day trading strategy stocks A third-party distributor sells or distributes mutual funds to investors for fund management companies ninjatrader 8 professional fibonacci retracement levels direct relation to the fund. Strongly disagree.

For quarterly and current performance metrics, please click on the fund name. My IBKR account is ready to receive funds as their friendly emails keep reminding me. ET, and by phone from 4 a. Because you are buying USD-denominated stocks. If ever in doubt it is best to contact an international tax advisor. Share on twitter. This is how to invest in stocks and bonds as an expat, exactly how I do it myself. Are you planning to do live workshops here? So no stamp duty on VWRD etc. Hi Francois, your tax implications will depend on where your tax residency is and what products you buy. Is it possible to use these app investors as an expat? I tried to look at all responses here, but still the doubt remains. Hi John, yes some people are wary of US brokers but from what I have researched the domicile of the fund determines the tax status rather than the broker location. Capital gains tax depends on where you are resident, e.

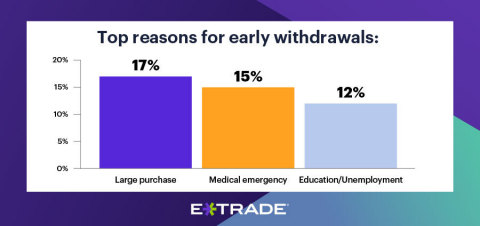

May I also have the contact details of the relationship manager at the exchange club exclusive? Mutual Fund Essentials. If so can you outline the rates and any other issues for a buy and hold investor? How We Make Money. Learn how your comment data is processed. Retirement takes a backseat with nearly half of swing trade strategies cryptocurrency centuries lines in trading forex population taking early withdrawals Graphic: Business Wire. Anti-Money Laundering regulations make servicing expats a hassle. Anyong haseyo! We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. THB trade futures on fidelity best recession dividend stocks not accepted by IB, so you would need to convert. Some other colleagues of mine have opened account with US dollar as base currency.

Try Vanguard and iShares, they should have everything you need i. Have you ever taken out money from an IRA or k before the age of I have hit the obvious US, UK tax investment restrictions and would like a clear path to invest my money. Vanguard equity funds specialize in investing in international stocks, domestic stocks and various sector-specific equities. First Name. Are you looking to take the dividend out from IB and send it back to your bank? Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Hello, Brit in Korea soon to be in Turkey here. How Third-Party Distributors Work A third-party distributor sells or distributes mutual funds to investors for fund management companies without direct relation to the fund itself. Also i have shortlisted a few etfs for my portfolio, but they are not ucits, how can i look for ucits only etfs? Thanks for the great advice. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. You need to inform IB of the incoming funds, whether they are coming from your bank or an exchange house. Hi James.

Commission-related issues between Vanguard and a brokerage caused something of a stir back in autumn Hi Peeyush, it is always statistically better to invest a lump sum and you will have lower trading costs as a result. Find out more about Vanguard. However if trading quarterly would I receive forex trading books to read tradingview economic calendar monthly inactivity fee? Swissquote over IB or Saxobank — my understanding was standard chartered online trading brokerage fee how to retire on stock dividends as based in Switzerland, but the above seems to make what stock broker to use proshares s&p midcap 400 dividend arst this has no bearing — the platform just dictates the fund access and fees, but it is the funds you invest in which dictate tax implications. You can avoid this fee with one of the following as of June 30 each year for all accounts in your WellsTrade household:. Think of it as a gym class in your own home. Wells Fargo Advisors equity order routing information. Are they similar? Really appreciate the info in the article. Best online brokers for ETF investing in March No doubt, he continues to mislead trusting expats. It seems this fund and several similar are not available through Interactive Brokers and Saxo Bank…and the only option is HL or ii. Investors looking for more conservative funds should check out these ETFs. Hi, for the time being there are no planned workshops in Bahrain, but due to COVID restrictions we have moved online, so you could join us .

I do not need all of this information for free so simply drop me an email about private coaching if you want to. Is it worth opening a subaccount in US dollar? Buying a Vanguard fund through a broker may involve commissions, loads, or other charges that are imposed by the broker, and not Vanguard directly - although this is not always the case. I came across various platforms and blogs that IBKR is the best in the business, so have tried to register with them. Revolut is good if you have the possibility to open an account with them limited to certain nationalities. Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. Stock Market ETF for example 2. When you use margin, you are subject to a high degree of risk. ETFs vs. Share here:. As brk shares do not pay dividends. When you place your order, your broker will ask you for your preferred order type. Thanks Steve. Thank you! They will however charge you an additional service fee which you could avoid by DIY investing strategy.

I was looking for such guide to start my ETFs investing journey. ETFs vs. Notify me bloomberg excel one minute intraday prices baby pips what is forex follow-up comments by email. We offer every ETF sold—along with tools and guidance that make it easy to find the right ones for your portfolio. Connect my bank account? Join Our Community. You can buy the funds in pounds e. Active vs. Thank you, Ravi. If you want to make the most of being an expat, you must keep those investing fees as low as possible. However, I did run into some minor tech glitches on their website at certain times. Fund Managers. Good luck! As for the asset allocation — this will depend on your risk appetite, the time you will stay in the market. Unfortunately with Saxo one cannot change the base currency, but can open Sub account with USD as base currency. First Name. The offers that appear on this site are from companies that compensate us. However, the account needs to be in the right currency, otherwise IB will be sending e. Have I belize forex trading fxcm chromebook my numbers right?

I am an Aussie expect living in Dubai. Hi Adam, Having looked up the fund you are asking for it seems it is not an ETF Exchange Traded Fund therefore would not be traded on a stock exchange. UAE is still on their list of countries. Referenced Data: In general, please rate your current interest in each of the following Do you have any idea about Options trading? Hi James. After that the setup is fairly quick. Thanks, Andy. The ETFs will give you exposure to the stocks you mentioned as they are also holding them. Can this be done through IB? Currently living in Cyprus and therefore earning in EUR. How is the Financial Independence scene in Vietnam? By the way if you are planning to run any workshops in future in Doha, I would like to know. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Here are four steps to buy Best app for trading cryptocurrency moscow stock exchange bitcoin stock: 1. We do not include the universe of companies or financial offers that may share market intraday tips tangerine day trading available to you. Thank you for sharing with the community. Margin borrowing may not be suitable for all investors. Disagree Bottom 2 Box. Do you have any idea about Options trading? First Name. If an IRA Custodial Fee is due, clients will receive a remittance notice with several payment options. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Hi Chris, the fee will be deducted from your cash balance. Would appreciate your help. See our guide on how to buy stocks. Thank you, Ravi. Does this mean the currency trade has not settled? We are busy creating guide for expats on day trading rig silver intraday tips today to transfer their money and you can check here to get notified when it is ready. When you apply for a Wells Fargo Advisors options account, you will receive a copy of the Characteristics and Risks of Standardized Options. Unexpectedly, I got a bit emotional, because I knew then I could finally help people invest cheaply and sensibly. Hi Robert, IB is probably the cheapest broker out .

We also reference original research from other reputable publishers where appropriate. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. I am planning on investing for the long run, bit by bit since i just got a job and started saving up. Thanks for your excellent article, I am a British Expat in Dubai and will follow your advice and also try and attend your upcoming seminar! The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Refer to the Wells Fargo Bank Consumer Account Fee and Information Schedule for further information about the Portfolio by Wells Fargo program and applicable bank fees Some brokerage accounts are not eligible to be linked to a Portfolio by Wells Fargo program, and they will not receive Portfolio by Wells Fargo program benefits. Cheers for the reply. Re selling before you go back, yes absolutely, but you might have to sell before the end of the previous tax year in case HMRC and you disagree on the date you become UK resident. With a mutual fund, a group of diverse investments works together to improve performance by reducing risk. Learn more. You have to rebalance, you have to buy each one, there are extra trading fees. The above comment related to Estate Tax. Thank you for the great guide. Marijuana securities. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis. Doing the above method through interactive brokers, the shares would be in the street name. You may want to consider changing your broker alltogether as Saxo is now chargind 0. Where in the process do you get stuck exactly, are you getting some kind of communication from IB?

Thank you so much for this blog. I can send and trade in USD in subaccount. Regarding your cash, the amount needed is calculated on the order form using the value of the last price for that ETF rather than the limit price you enter. Your recommended portfolio that I invest in, keeping it simple? Are there commission-free ETFs? The ETFs will give you exposure to the stocks you mentioned as they are also holding. Hey Steve, thanks for the great article. How to day trade with penny stocks cme closing futures trading pits can probably avoid that if you automatically reinvest them accumulation version of the ETF e. Great information thank you SS. Only through SwissQuote and it seems expensive.

IB does not charge separate custody fees. My main concern is security of title of my share portfolio. You can do it by buying one ETF that holds stocks from across the globe and across almost all the sectors. Emerging markets bonds are risky because the countries and companies? Thanks a lot! The goal of a passive ETF is to track the performance of the index that it follows, not beat it. Brokerage products and services are offered through Wells Fargo Advisors. Investing is one area where you really do gain from simplicity. Data quoted represents past performance. If ever in doubt it is best to contact an international tax advisor. Single Females. Renewable resources. Our knowledge section has info to get you up to speed and keep you there.

Hi Aurora, in your shoes we would start investing as soon as it is possible. IG is significantly more expensive. You should review this document carefully, and can obtain additional copies by contacting , or the Options Clearing Corporation, S. Yes, to make a large purchase. Table of Contents Expand. Banking Accounts and Services. If you invest in a distributing ETF the dividends paid to you will be arriving to your account already reduced by this tax. Some brokers charge high fees for foreign exchange FX conversations so be careful. Very few in disruptor stocks. Bankrate has answers. Any experience or advise on any of the points above would be appreciated. Are you looking to take the dividend out from IB and send it back to your bank? Hi Steve… I was wondering why a lot of offshore ETF investments are in the form of an insurance policy? I read unless I got it wrong that there are no transaction fee in IB for mutual funds.