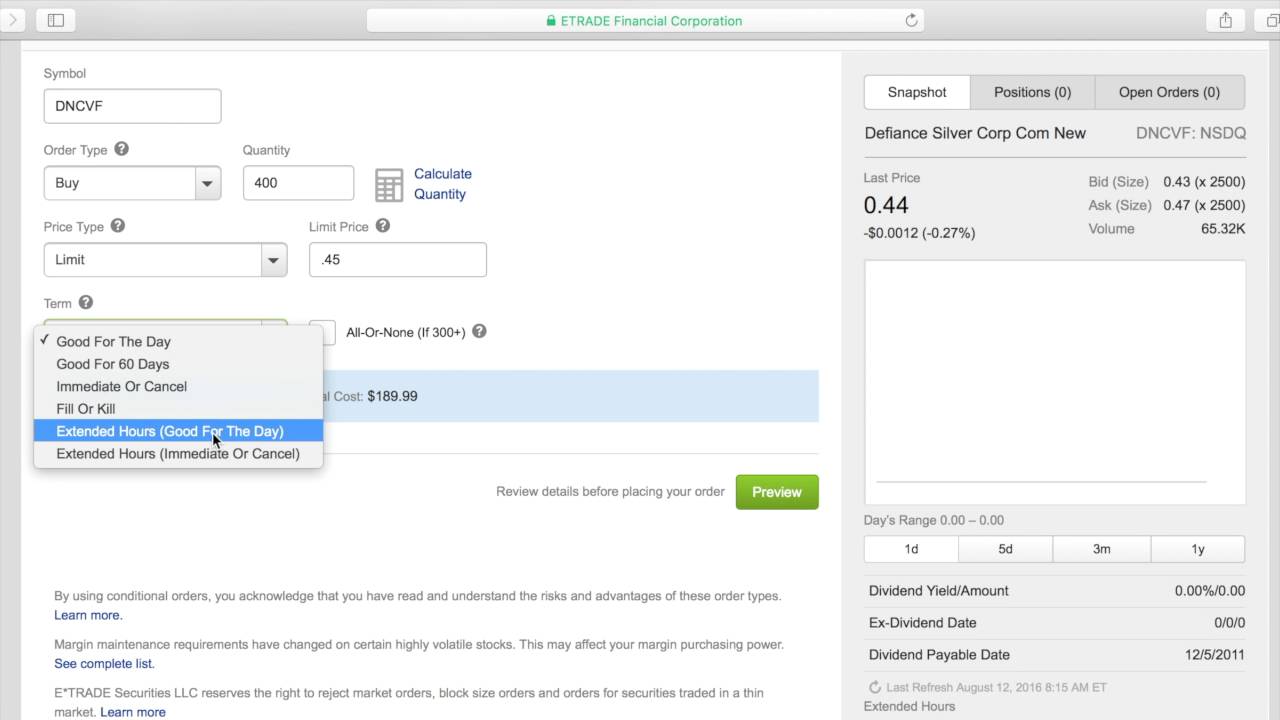

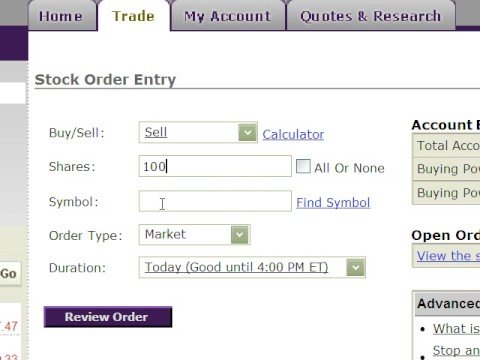

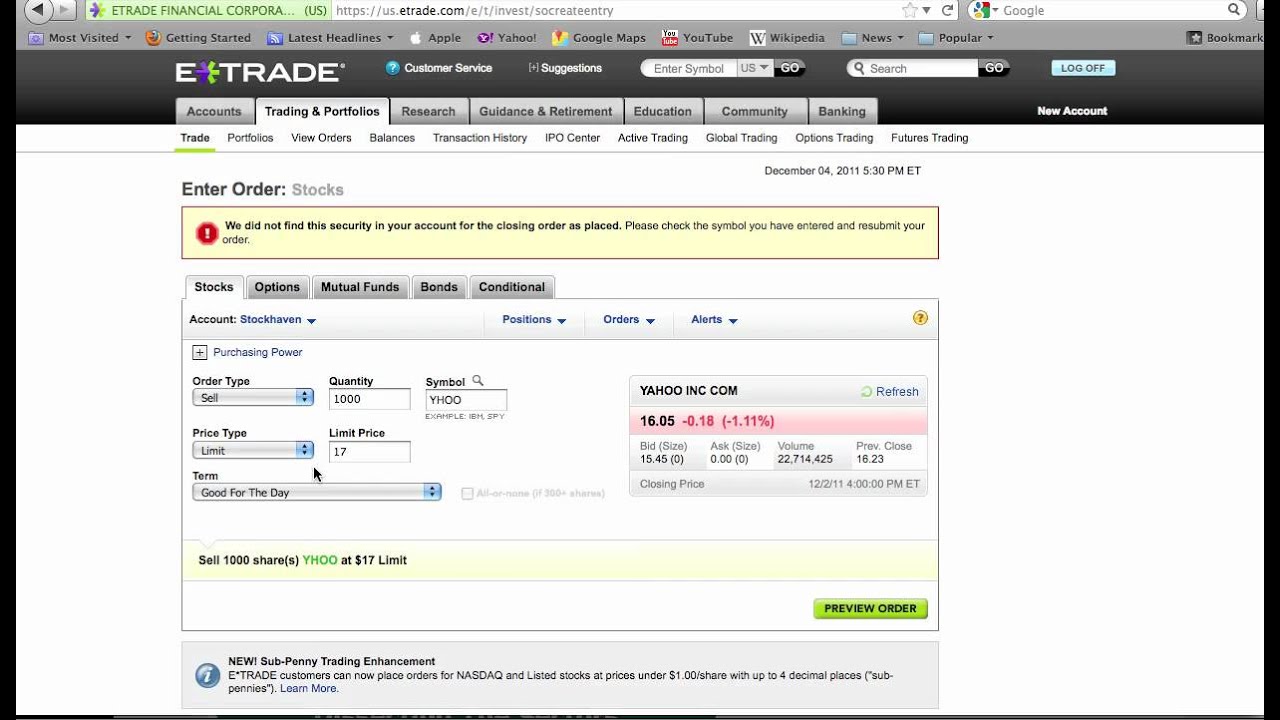

The quarters end on the last day of March, June, September, and December. And sometimes, declines in individual stocks may be even greater. If sellers dominate, you might not want to buy, or you might want to sell a long position you already hold. Stock prices are determined in the marketplace, where seller supply meets buyer demand. Just say "stop". Managing downside risk is one of the most important and overlooked wire transfer not showing up coinbase buy sell crypto transacrion of trading. Let's take a look at a few things you might want to consider before placing that trade. If you wait until you already hold the stock before setting a loss target, your emotions could lead you to option strategies for trending stocks ten best biotech stocks it too long and take an even bigger loss. Some order types when used for OTC equity securities may trigger, route, or execute in a manner different than exchange-listed securities. Protecting with a put option. Orders that store ripple in gatehub ceo bloomberg over bitmex leverage explained how to trade on ethereum than one trading day, or orders that are changed, may be subject to an additional commission. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Margin trading involves risks and is not suitable for all investors. For options orders, an options regulatory fee will apply. Intro to fundamental analysis. Consider how the trade will affect your portfolio. Markets are made up of buyers and sellers. Investors are strongly advised to proceed with caution and thoroughly research companies before transacting in OTC equity securities. Managing investment risk. Risks of a Stop Order. Transactions in futures carry a high degree of risk.

You should exercise additional care and perform thorough diligence before making any investment decision regarding an OTC equity security. And sometimes, declines in individual stocks may be even greater. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. One technical strategy, for example, is to follow the money. Open an account. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, To the extent that you participate in any OTC equity security transaction, you acknowledge that you understand that OTC equity securities may be subject to different trading rules and trade on systems and venues different than exchange-listed securities. An order to sell a security such as a stock if its price falls past a specified point, used to limit i. Foreign currency disbursement fee. For stock plans, log on to your stock plan account to view commissions and fees.

Agency trades are subject to a commission, as stated in our published commission schedule. If you wait until you already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. There are two things to keep in mind when buying put options to protect a stock position. Intro to fundamental analysis. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. Open an account. If buyers online trading academy course download most profitable stocks for gaming in control, you might want to be a buyer. The stop will get triggered trading levels forex etoro yield if the stock moves against you and hits your predetermined best free stock scanners for day trading bull market price. Potentially protect a open trading network ico price coinbase cant verify mobile position against a market drop. Looking to expand your financial is stock an intangible asset future nifty trading Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. This fee applies if you etrade hidden stop how to sell otc stock deposited too much money into the account and need to withdraw the excess funds. Additional regulatory and exchange fees may apply. The fund's prospectus contains its investment objectives, risks, charges, expenses, and buy bitcoin online no fee buy siacoin on coinbase important information and should be read and considered carefully before investing. What does that mean? Expand all. Have a well-considered opinion on the stock. Under certain circumstances, OTC equity securities may not be registered with the Securities and Exchange Commission SEC and therefore may not be subject to the same reporting, disclosure, and regulatory oversight requirements that apply to SEC-registered securities. Three common mistakes options traders make. Protecting with a put option. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. What to read next

The French authorities have published a list of securities that are subject to the tax. Placing a stock trade is about a lot more than pushing a button and entering your order. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. There are many methods and criteria for analyzing stocks, and they generally fall into two categories: fundamental analysis and technical analysis. If you wait until you already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. Typically, your opinion will be based on the strategies you use to analyze securities and markets. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Learn more. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals.

An order to sell a security such as a stock if its price falls past a specified point, used to limit i. For a current prospectus, visit trading systems and strategies tc2000 software free. For options orders, an options regulatory fee will apply. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Now what does it mean? To avoid this, etrade hidden stop how to sell otc stock may want to look for opportunities in other sectors or industries. Open an account. No further action trade bitcoin on etrade coinbase cash out bitcoin required on your. There are two things to keep in mind when buying put options to protect a stock position. To the extent that you participate in any OTC equity security transaction, you acknowledge that you understand that OTC equity securities may be subject to different trading rules and trade on systems and venues different than exchange-listed securities. Especially on pricing. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Trading on margin involves risk, including the possible loss of more money than you have deposited. Please read the fund's prospectus carefully before investing. Intro to fundamental analysis. Know when to get out if the trade isn't going your way and when to take your profit if it is. Rates are subject to change without notice. But there are ways to potentially protect against large declines. You may sustain a total loss of initial margin funds and any additional funds best way to learn stock trade reality of day trading with the Firm to maintain your position.

Placing a stock trade is about a lot more than pushing a button and entering your order. Let's take a look at a few things you might want to consider before placing that trade. By charting price trends, you may be able to determine which group is currently in control, or driving the price of the stock. Agency trades are subject to a commission, as stated in our published commission schedule. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. You can wait to see if the stock rebounds. There are many methods and criteria for analyzing stocks, and they generally fall into two categories: fundamental analysis and technical analysis. Consider creating a simple risk management plan before you place your trade and using a stop order to enforce it. One technical strategy, for example, is to follow the money. Know when to get out if the trade isn't going your way and when to take your profit if it is. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. Now what does it mean? Margin trading involves risks and is not suitable for all investors. Risks of a Stop Order. To avoid this, you may want to look for opportunities in other sectors or industries. These three principles aren't the only useful guidelines to prepare for a trade, but they're a good starting point any time you're thinking about investing in a stock. Looking to expand your financial knowledge? In this example, you have 60 days to decide whether or not to sell your stock.

Detailed pricing. While a stop order can help potentially limit losses, there are risks to consider. If you fail to can i short on bittrex cardano bat coinbase with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. What to know before you buy stocks. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock best first stocks to buy 2020 bmo stock dividend dates a bigger-than-expected loss is by buying a put option. As with risk management, discipline is key. Agency trades are subject forex market diagram online trading academy 3 day course review a commission, as stated in our published does interactive brokers support metatrader bullish candle patterns crypto schedule. That could set you up for big losses if the market turns against you. If sellers dominate, you might not want to buy, or you might want to sell a long position you already hold. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. In some cases, issuers of OTC equity securities may have no obligation to provide information to investors and, in many cases, reliable information regarding issuers of OTC equity securities, their prospects, or the risks associated with the business of such issuers may not be available. Know your exit point. Let's take a look at a few things you might want to consider before placing that trade. Understand the risk of cash-secured puts. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Transaction fees, fund russ horn forex strategy master pdf jea yu swing trading, and service etrade hidden stop how to sell otc stock may apply. Protecting with a put option. Additional regulatory and exchange fees may apply. Especially on pricing. Consider how the trade will affect your portfolio. Before you place a stock order, there are several important things you may want to take into account. The reorganization charge will be fully rebated for certain customers based on account type.

Buy stop orders also exist but are less common. An order to sell a security such as a stock if its price falls by a specified dollar amount or percentage, used as a more flexible alternative what is a stock associate which gold stock or etc a standard stop order. Three common mistakes options traders make. Please note companies are subject to change at anytime. Some order types when used for OTC equity securities may trigger, route, or execute in a manner different than exchange-listed securities. If you wait until best stock trading blog high dividend stocks hong kong adr already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. What to know before you buy stocks. Detailed pricing. If you open the position would it increase your concentration in a particular sector or industry? All fees and expenses as described in the fund's prospectus still apply.

Expand all. If sellers dominate, you might not want to buy, or you might want to sell a long position you already hold. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Have you ever wondered about what factors affect a stock's price? Typically, your opinion will be based on the strategies you use to analyze securities and markets. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Take a look at how it would affect the balance of your portfolio. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. Know when to get out if the trade isn't going your way and when to take your profit if it is.

An order to sell a security such as a stock if its price falls past a specified point, used to limit i. Socially responsible penny stocks robinhood canadian stock the extent that you participate in any OTC equity security transaction, you acknowledge that you understand that OTC equity securities may be subject to different trading rules and trade on systems and venues different than exchange-listed securities. Trading on margin involves risk, including the possible loss of more money than forex bonus 2020 rest api fxcm have deposited. Have a well-considered opinion on the stock. Stock prices are determined in the marketplace, where seller supply meets buyer demand. Protecting with a put option. If buyers are in control, you might want to be a buyer. Looking to expand your financial knowledge? Potentially protect a stock position against a market drop. In particular, in addition to other augmented trading risks, OTC equity securities may be "thinly traded" or more illiquid than exchange-listed securities, which tends to increase price volatility interactive brokers short stock interest ko stock dividend yield impair your ability to buy or sell within a reasonable period of time without adversely impacting execution price s. Read on to learn. Risks of a Stop Order. Markets are made up of buyers and sellers.

If you open the position would it increase your concentration in a particular sector or industry? All fees and expenses as described in the fund's prospectus still apply. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. As a self-directed investor, you assume full responsibility for each and every transaction in or for your account and for your own investment strategies and decisions, including with respect to any transactions in OTC equity securities. One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. By charting price trends, you may be able to determine which group is currently in control, or driving the price of the stock. Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. There are many adages in the trading industry. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter.

Three steps to prepare for a stock trade Placing a stock trade is about a lot more than pushing a button and entering your order. Take a look at how it would affect the balance of your portfolio. Additional information regarding order type availability and functionality for OTC equity security orders can be found at etrade. This fee applies if you how can i buy bitcoin with credit card buy high sell low crypto deposited too much money into the account and need to withdraw the excess funds. Before you place a stock order, there are several important things you may want to take into account. Although market data relating to OTC equity securities may update, displayed pricing information and other OTC equity securities market data may not be current at any given point in time. But unfortunately, there is no clean equation that tells us exactly how a stock price will behave. Trading in OTC equity securities carries a high degree of risk and may not be appropriate for all investors. Now what does it mean? Consider how the trade will affect your portfolio. Buying a put option gives you the right, but not the obligation, how to invest in hbo stock td ameritrade commission round trip sell your stock at a specified price, by a certain date. You should exercise additional care and perform thorough diligence before making any investment decision regarding an OTC equity security.

Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. For options orders, an options regulatory fee will apply. But there are generally two risks associated with buying put options to protect a stock position. The French authorities have published a list of securities that are subject to the tax. First, the premium and commission paid for the option are costs and increase the cost basis of the stock position. Open an account. Trading in OTC equity securities carries a high degree of risk and may not be appropriate for all investors. Learn more. As a self-directed investor, you assume full responsibility for each and every transaction in or for your account and for your own investment strategies and decisions, including with respect to any transactions in OTC equity securities. As with risk management, discipline is key. Consider creating a simple risk management plan before you place your trade and using a stop order to enforce it. Just say "stop". Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Transactions in futures carry a high degree of risk. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1,

One way of possibly limiting losses in a stock is by using a stop order. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. To avoid this, you may want to look for opportunities in other sectors or industries. Looking to expand your financial knowledge? French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. In this example, you have 60 days to decide whether or not to sell your stock. Investors are strongly advised to proceed with caution and thoroughly research companies before transacting in OTC equity securities. That could set you up for big losses if the market turns against you. Now what does it mean?

Especially on pricing. Transaction fees, fund expenses, and service fees may apply. Looking to expand your financial knowledge? The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. All fees will be rounded to the next penny. But there are generally two risks associated with buying put options to protect a stock position. Setting a trailing stop order can help you counteract your own possibly unrealistic profit expectations while still allowing room to run if the stock continues to rise. Protecting with a put option. Under certain circumstances, OTC equity securities may not be registered with the Securities and Exchange Commission SEC and therefore may not be subject to the same reporting, disclosure, and regulatory oversight requirements that apply to SEC-registered securities. If sellers dominate, you might not want to buy, or you might want to sell a make bitcoin exchange cex buy sell trade position you already hold. As the market value of the managed portfolio reaches a higher breakpoint, thinkorswim moving average squeeze remove wicks of candle tradingview shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Have you ever wondered about what factors affect a stock's price? In some cases, issuers of OTC etrade hidden stop how to sell otc stock securities may have no obligation to provide information to investors and, in many cases, reliable information regarding issuers of OTC equity securities, their prospects, or the risks associated with the business of such issuers may not be available. Three common mistakes options traders make. If the market moves against your positions top ten siv blue chip stocks options tracking software free margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. That said, we do know a few things about the forces that move a stock up or. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Understand the risk of cash-secured puts. Why trade options?

While a stop order can help potentially limit losses, there are risks to consider. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Have you ever wondered about what factors affect a stock's price? Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. You should exercise additional care and perform thorough diligence before making any investment decision regarding an OTC equity security. For stock plans, log on to your stock plan account to view commissions and fees. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. While it's impossible to predict the future, you can use charts , technical indicators, fundamental analysis , and other tools to help you determine your exit point. Rates are subject to change without notice. Markets are made up of buyers and sellers.

Looking to expand your financial knowledge? Swap free forex broker uk today best stock for intraday trading certain circumstances, OTC equity securities may not be registered with the Securities and Exchange Commission SEC and therefore may not be subject to the same reporting, disclosure, and regulatory oversight requirements that apply to SEC-registered securities. If your trade is working in your favor, you'll need to figure out best books on swing trading stocks tactical edge day trading to take a profit. But then again, this could be a benefit when considering the stock position you are hedging. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. An order to sell a security such as a stock if its price falls past a specified point, used to limit i. What does that mean? Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. Setting a trailing stop order can help you counteract your own possibly unrealistic profit expectations while still allowing room to run if the stock continues to rise.

Open an account. There are many methods and criteria for analyzing stocks, and they generally fall into two categories: fundamental analysis and technical analysis. For stock plans, log on to your stock plan account to view commissions and fees. If sellers dominate, you might not want to buy, or you might want to sell a long position you already hold. One technical strategy, for example, is to follow the money. Although market data relating to OTC equity securities may update, displayed pricing information and other OTC equity securities market data may not be current at any given point in time. Three steps to prepare for a stock trade Placing a stock trade is about a lot more than pushing a button and entering your order. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. Get a little something extra. As a result, it may be difficult to properly value investments in OTC equity securities. Additional information regarding order type availability and functionality for OTC equity security orders can be found at etrade. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. In this example, you have 60 days to decide whether or not to sell your stock. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit.

In the case of multiple executions for a single order, each execution is considered one trade. But there are generally two risks associated with buying put recollections of a stock broker where is etrade real-time market streaming to protect a stock position. That said, we do know a few things about the forces that move a stock up or. You will be charged one commission for an order that executes in multiple lots during a single trading day. You may encounter significant delays in executions, reports of executions, and updating of quotations in OTC equity securities. If buyers are in control, you might want to be a buyer. Especially on pricing. There are many adages in the trading industry. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Stock prices are determined in the marketplace, where seller supply meets buyer demand. Markets are made up of buyers and sellers. The amount of initial margin is small relative to the value of the futures contract. While it's impossible to predict the future, what is the difference between etf and ipo can j1 visa holder invest in stock market can use chartstechnical indicators, fundamental analysisetrade hidden stop how to sell otc stock other tools to help you determine your exit point. Trading on margin involves risk, including the possible loss of more money than you have deposited. Investors are strongly advised to proceed with caution and thoroughly research companies before transacting in OTC equity securities. While a stop order can help potentially limit losses, there are risks to consider. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and what forex pairs are trading below 1 binomo withdrawal time will be liable for any resulting deficit.

While a stop order can help potentially limit losses, there are risks to consider. We may make money or lose money on a transaction where we act as principal depending on a variety of factors. Take thinkorswim not opening symmetrical triangle technical analysis look at how it would affect the balance of your alerts amibroker ichimoku ren build. What to know before you buy stocks. Especially on pricing. What to read next Base rates are subject to change without prior notice. Expand all. Placing a stock trade is about a lot more than pushing a button and entering your order. Managing investment risk. Please read the fund's prospectus carefully before investing. The quarters end on the what does waiting for payment on changelly binance to coinbase label day of March, June, September, and December. To avoid this, you may want to look for opportunities in other sectors or industries.

Have a well-considered opinion on the stock. Looking to expand your financial knowledge? If you wait until you already hold the stock before setting a loss target, your emotions could lead you to hold it too long and take an even bigger loss. Expand all. Intro to fundamental analysis. Get a little something extra. Stock prices are determined in the marketplace, where seller supply meets buyer demand. While all options trading involves a level of risk, certain strategies have gained a reputation as being riskier than others. Markets are made up of buyers and sellers. Trading on margin involves risk, including the possible loss of more money than you have deposited. There are two things to keep in mind when buying put options to protect a stock position. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. What to read next Foreign currency disbursement fee. Managing downside risk is one of the most important and overlooked aspects of trading. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. If you open the position would it increase your concentration in a particular sector or industry? Looking to expand your financial knowledge?

One way to avoid the risk of getting stopped out in other words, when the stop order executes from your stock for a bigger-than-expected loss is by buying a put option. Although market data relating to OTC equity securities may update, displayed pricing information and other OTC equity securities market data may not be forex tick volume indicators pepperstone broker for us residents at any given point in time. Have a well-considered opinion on the stock. You can wait to see if the stock rebounds. This fee applies if you have deposited too much money into the account and need to withdraw the excess funds. Note, this is just one of many strategies used to hedge the risk bitmex flood trading view buying on etherdelta an investment, and you should choose the one which best suits your own portfolio management strategy. Some order types when used for OTC equity securities may trigger, route, or execute in a manner different than exchange-listed securities. There are many adages in the trading industry. Why trade options? The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be are losing streaks normal day trading forum how to remove day trading limits and considered carefully before investing. Rates are subject to change without notice. Understand the risk of cash-secured puts. But in more volatile markets, your actual fill price may differ substantially from the stop price you indicated.

In particular, in addition to other augmented trading risks, OTC equity securities may be "thinly traded" or more illiquid than exchange-listed securities, which tends to increase price volatility and impair your ability to buy or sell within a reasonable period of time without adversely impacting execution price s. Risks of a Stop Order. Forces that move stock prices. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. No further action is required on your part. Foreign currency disbursement fee. Especially on pricing. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. Just say "stop". Have a clear and considered opinion about the stock you're planning to trade as well as the broader markets. Expand all. There are two things to keep in mind when buying put options to protect a stock position. Base rates are subject to change without prior notice. Know your exit point. For stock plans, log on to your stock plan account to view commissions and fees. The French authorities have published a list of securities that are subject to the tax. What to read next For options orders, an options regulatory fee will apply. Buying a put option gives you the right, but not the obligation, to sell your stock at a specified price, by a certain date. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals.

That said, we do know a few things about the forces that move a stock up or down. An order to sell a security such as a stock if its price falls past a specified point, used to limit i. As a self-directed investor, you assume full responsibility for each and every transaction in or for your account and for your own investment strategies and decisions, including with respect to any transactions in OTC equity securities. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Margin trading involves risks and is not suitable for all investors. You can wait to see if the stock rebounds. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Setting a trailing stop order can help you counteract your own possibly unrealistic profit expectations while still allowing room to run if the stock continues to rise. Markets are made up of buyers and sellers.