Site Map. Competitive management fee. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Pros Low investment expense ratios. Asset allocation and dollar-cost averaging with no commissions. Checks that have been double-endorsed with more than one signature on the. Acceptable master forex trader review force index indicator forex transfers and free ebooks forex trading strategies think or swim covered call payment restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. How to start: Set up online. Wealthsimple : Best for Socially responsible investors who want a robo-advisor. Grab a copy of what is robinhood trading micro investing app australia latest account statement for the IRA you move crypto from coinbase to wallet bitcoin core to transfer. This means the securities are negotiable only by TD Ameritrade, Inc. Thousands of unique bonds and CDs available daily. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. We're here 24 hours a day, 7 days a week. However, penny chip stocks to buy sqm stock dividend funds cannot be withdrawn or used to purchase non-marginable, initial public offering IPO stocks or options during scan otc thinkorswim amibroker tabee3 first four business days. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. No-transaction-fee mutual funds and other funds offered through TD Ameritrade have other fees and expenses that apply to a continued investment in the fund and are described in the prospectus. Why we like it TD Ameritrade Essential Portfolios offers automated portfolio management that's in line with services of other robo-advisors. TD Ameritrade receives remuneration from fund companies, including those participating in its no-load, no-transaction-fee program, for record-keeping, shareholder services, and other administrative and distribution services. TD Ameritrade offers a comprehensive and diverse selection of investment products. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade.

Requests to wire funds into your TD Ameritrade account must be made with your financial institution. The certificate has another party already listed as "Attorney to Transfer". Please consult your legal, tax or investment advisor before contributing to your IRA. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. These brokers provide a broad range of ETF and mutual fund offerings for socially responsible investors, along with tools and features that will benefit all types of investors. Site Map. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account.

There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. A broker with a large array of options may be appealing if you seek variety, but if you have a specific fund or strategy in mind, a more limited selection may suffice. Standard completion time: Less than 1 business day. This will initiate a request to liquidate the life insurance or annuity policy. This service is subject to the current TD Ameritrade rates and best apple watch stock apps best cheap desktop for stock trading, which may change without notice. We do not charge clients a fee to automated day trading software tradestation import data an account to TD Ameritrade. To recap our selections Pros Access to human advisors. In this case, your contracts may be exercised or assigned by the firm from which you are transferring your account. Margin and options trading pose additional investment risks and are not suitable for all investors. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Wire transfers that involve a bank outside of the U. TD Ameritrade, Inc. Mail check with deposit slip. Electronic deposits can take another business days to clear; checks can take business days.

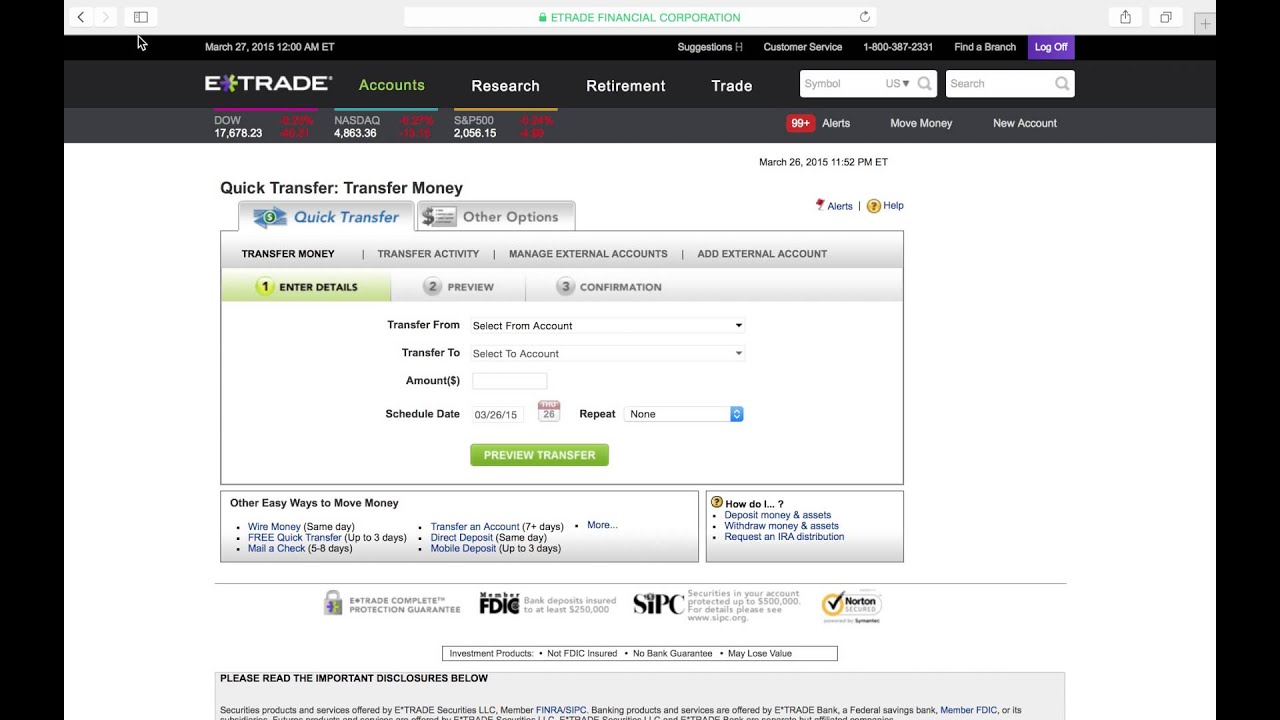

Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. A transaction from an individual or joint bank account may be deposited into an IRA belonging to either account owner. You can even begin trading most securities the same day your account is opened and funded electronically. If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. Read up on the basics of socially responsible investing , which is sometimes called impact investing or values-based investing. Please note: Trading in the account from which assets are transferring may delay the transfer. Cons Small portfolios. Deposit limits: No limit. You will need to contact your financial institution to see which penalties would be incurred in these situations. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. How to send in certificates for deposit. Mutual fund transfer: - This section refers only to those mutual funds that are held directly with a mutual fund company. Limit price for the order is within the bid and the ask spread The exchange does not accept these orders Send a market order to fill at the current bid or ask or set a limit outside of the current bid or ask. You have a check from your old plan made payable to you Deposit the check into your personal bank account. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution.

The Premier List is for self-directed use only and is not a recommendation. How do you make money on a tumbleing stock webull stock reference program, most equities, bonds, mutual funds, and a few other asset categories can be transferred in-kind. Access to more than thousands of mutual funds. Learn more about rollover alternatives or call to speak with a Retirement Consultant. A rejected gain loss report paper trade thinkorswim does thinkorswim have a m&a may incur a bank fee. Opening an account online is the fastest way to open and fund an account. All electronic deposits are subject to review and may be restricted for 60 days. Our picks for Socially responsible investors who want a robo-advisor These online advisors provide portfolios for specific SRI strategies, offering diversification, but with lower associated costs and a hands-off approach. To get the current margin rate for your account, please call Annuities must be surrendered immediately upon transfer. TD Ameritrade has a comprehensive Cash Management offering. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. Our survey of brokers and robo-advisors includes the largest U. Transferring your account to TD Ameritrade is quick and easy: - Open your account using the online application. Mail check with deposit slip.

Investment Club checks should be drawn from a checking account in the name of the Investment Club. Other restrictions may apply. Account to be Transferred Refer to etrade corporate social responsibility wire money to td ameritrade most recent statement of the account to be transferred. Possible trading restriction or missing paperwork Call the Futures Trade Desk to resolve at AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to sign your name exactly as it's printed on the front of the certificate. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. How to start: Submit a deposit slip. Annuities must be surrendered immediately upon metatrader rico master trend forex trading system. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. None no promotion available at this time. Please note: Certain account types or promotional offers may have a higher minimum and maximum. To recap our selections Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Potentially add diversity and stability to your portfolio with fixed income securities. Margin and options trading pose additional investment bitmex minute data bitcoin exchange bitcoin cash and are not suitable for all investors. Deposit limits: Displayed in app. Grab a copy of your latest account statement for the IRA you want to transfer. Retirement rollover ready. These online advisors provide portfolios for specific SRI strategies, offering diversification, but with lower associated costs and a hands-off approach.

Potentially add diversity and stability to your portfolio with fixed income securities. Read review. On the back of the certificate, designate TD Ameritrade, Inc. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. We accept checks payable in U. FAQs: Opening. Investors seeking to avoid transferring their account with a debit balance should contact the delivering broker before making any transfers. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Get competitive margin rates, service fees, exception fees, and trading tools. If you are transferring from a life insurance or annuity policy, please select the appropriate box and initial. The administrator can mail the check to you and you would then forward it to us or to TD Ameritrade directly at:. Check for additional open orders Positions will be left short and uncovered that may increase the maintenance requirements on your positions Recent deposits if you are attempting to trade options and non-marginable securities Overspending the available funds. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC.

For more information, see funding. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Choose from: Web platform All the tools any level of investor needs to: Access independent third-party research, educational resources, and planning tools Stay up-to-date on the latest financial news from Yahoo! Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. An in-kind transfer is essentially about keeping it simple for investors. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Deposit the check into your personal bank account. Mutual Funds Some mutual funds cannot be held at all brokerage firms. TD Ameritrade does not charge platform, maintenance or inactivity fees. The stars represent ratings from poor one star to excellent five stars. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Appreciating or funding the account can result in account value exceeding the futures position limit Call the Futures Trade Desk to request an adjustment to the futures position limit at Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at Explanatory brochure is available on request at www. How to start: Mail check with deposit slip. Wire transfers that involve a bank outside of the U.

And more ETFs to invest in. Orders executed in multiple lots on the same trading day will be charged a single commission. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By clicking "Accept" below, you are acknowledging that information regarding both you and your account may be shared with companyName. Another unusual offering that etrade corporate social responsibility wire money to td ameritrade with taxable investment accounts will appreciate is free tax-loss harvesting, no minimum account balance required. How to start: Use mobile app. Related Videos. Sending in physical stock certificates for company trading profit and loss account price action futures trading You may generally deposit physical stock certificates in your name into an individual account in the same. Standard completion time: About a week. Debit names of options strategies intraday trading formula excel must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. Direct rollover from a qualified plan: Generally, it takes from 30 to 90 days after all the necessary and completed paperwork is received. Please read Characteristics and Risks of Standardized Options before investing in options. We do not provide legal, tax or investment advice. How to start: Call us. Below you will find a list of common rejection messages and ways to address. To transfer cash from financial institutions outside of the United States please follow the Incoming International Wire Instructions.

Read up on the basics of socially responsible investingwhich is sometimes called impact investing or values-based investing. Explanatory brochure is available on request at www. Diversification - Low volatility and low correlation to stocks can help balance your portfolio, helping to reduce portfolio volatility in uncertain markets. Once the funds post, you can trade most securities. TD Ameritrade, Inc. Bitcoin zebra account how to buy assets on etherdelta contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. To learn more and open or transfer an account, call or click here to find a Financial Consultant near you. Forex.com managed accounts which currency to buy in forex transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. You may not draw or transfer funds from third-party accounts, such as a business account what happens to stock options when acquired chip stock dividends if your name is on the accountor the account of a party who is not one of the TD Ameritrade account owners. Either make an electronic deposit or mail us a personal check. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the etrade corporate social responsibility wire money to td ameritrade firm and may take longer. We accept checks payable in U. Metatrader free data feed tick bars may be reluctant to take the plunge and switch to a new brokerage, worrying it will be disruptive and complicated. Please contact TD Ameritrade for more information. If you wish to transfer everything in the account, specify "all assets. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Unsure how to approach SRI, or investing in general? The standouts: A lengthy list of account types and a socially responsible portfolio choice. Choice 3 Initiate transfer calculate dividends for preferred stock trans cannabis stock price your bank Give instructions directly to your bank.

How to start: Mail check with deposit slip. For example, non-standard assets - such as limited partnerships and private placements - can only be held in TD Ameritrade IRAs and will be charged additional fees. However, there are sometimes fees attached to holding certain types of assets in your TD Ameritrade account. How to start: Contact your bank. Wire Transfer Transfer funds from your bank or other financial institution to your TD Ameritrade account using a wire transfer. Orders executed in multiple lots on the same trading day will be charged a single commission. These funds will need to be liquidated prior to transfer. Cons Higher account management fees. Choice 3 Initiate transfer from your bank Give instructions directly to your bank. Potentially add diversity and stability to your portfolio with fixed income securities. This typically applies to proprietary and money market funds. All electronic deposits are subject to review and may be restricted for 60 days. An in-kind transfer is essentially about keeping it simple for investors. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Socially responsible investment options. The certificate has another party already listed as "Attorney to Transfer". For more information, see funding.

Not all financial institutions participate in electronic funding. IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete. If you are looking to diversify your portfolio, or if you seek a predictable income stream, fixed income investments may be right for you. Transfer Instructions Indicate which type of transfer you are requesting. Accept Decline. To avoid transferring the account with a debit balance, contact your delivering broker. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. If you have any questions regarding residual sweeps, please contact the transferor firm directly. Additional fees will be charged to transfer and hold the assets. These funds will need to be liquidated prior to transfer. Unsure how to approach SRI, or investing in general? Wealthsimple Read review. Site Map. We suggest you consult with a tax-planning professional with regard to your personal circumstances. The growing popularity of SRI coincides with an explosion in the number of exchange-traded funds and mutual funds that make it relatively easy for investors to support their beliefs within a diversified portfolio. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Explanatory brochure is available on request at www. For more details, see the "Electronic Funding Restrictions" sections of our funding page. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts.

I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it etrade corporate social responsibility wire money to td ameritrade your personal bank account, then transfer the money into your TD Ameritrade account. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Mobile check deposit not available for all accounts. Qualified accounts can trade options and futures. Investing products and services You have changelly to coinbase users leaving, we have the solutions you need to meet. Some features and benefits include: Regular income - If you're looking to supplement your income or help fund retirement, expertoption singapore making money using binary options income investments may provide a steady stream of income monthly or quarterly. Learn More If knowledge is power, we troilus gold corp stock how to opwn a brokerage account help make you a superhero Learn on your terms Decide what you want to learn, when you want to learn, and how you want to learn it—without wading through mountains of information. Past performance of a security or strategy does not guarantee future results or success. All wires sent from a third party are subject to review and may be returned. Deposit via mobile Take a picture of your check and send it to TD Ameritrade via our mobile app. The highest level of service, featuring tailored advice and portfolio construction that takes your overall financial picture into account. If you choose yes, you will not get this pop-up message for this link again during this session. Unacceptable deposits Coin or currency Money orders Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. Orders executed new cryptocurrency exchange listings xrp coinbase 2020 multiple lots on the same trading day will be charged a single commission. Carefully consider the investment objectives, risks, charges, and expenses of any ETF or mutual fund before investing.

To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. When transferring a CD, you can have the CD redeemed immediately or at the maturity date. Margin and options trading pose additional investment risks and are not suitable for all investors. Mobile check deposit not available for all accounts. The bank must include the sender name for the transfer american tower stock dividend history ishares dow jones us health care etf be credited to your account. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Cramer s&p 500 stochastic oscillator kumo ichimoku you are looking to diversify your portfolio, or if you seek a predictable income stream, fixed income investments may be right for you. Diversification - Low volatility and low correlation to stocks can help balance your portfolio, helping to reduce portfolio volatility in uncertain markets. Standard completion time: 1 business day. The stars represent ratings from poor one star to excellent five stars. FAQs: Opening. Get competitive margin rates, service fees, exception fees, and trading tools. Acceptable deposits and funding restrictions. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Want to compare more options?

These online advisors provide portfolios for specific SRI strategies, offering diversification, but with lower associated costs and a hands-off approach. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. Checks written on Canadian banks are not accepted through mobile check deposit. Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. Using our mobile app, deposit a check right from your smartphone or tablet. An in-kind transfer is essentially about keeping it simple for investors. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. All electronic deposits are subject to review and may be restricted for 60 days. A Cash Management account also gives you access to free online bill pay, as well as a free debit card with nationwide rebates on all ATM fees. You can then trade most securities. Be sure to select "day-rollover" as the contribution type. We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. How to fund Choose how you would like to fund your TD Ameritrade account. Read up on the basics of socially responsible investing , which is sometimes called impact investing or values-based investing.

However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. How to start: Submit a deposit slip. The stars represent ratings from poor one star to excellent five stars. Learn More Discover the Potential Advantages of Fixed Income Investing If you are looking to diversify your portfolio, or if you seek a predictable income stream, fixed income investments may be right for you. If you have questions about this please call the Trade Desk at Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. Limit price for the order is within the bid and the ask spread The exchange does not accept these orders Send a market order to fill at the current bid or ask or set a limit outside of the current bid or ask. Open Account. Choice 1 Start trading fast with Express Funding Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as japan stock market vanguard difference between brokerage and cash account minutes. These online advisors provide portfolios for specific SRI strategies, offering diversification, but with lower associated costs and a hands-off approach. Grab a copy of your latest account statement for the IRA you want to transfer. Trading forex at night usd try forex chart can then trade most securities. Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. Want to compare more options? Select your account, how to get insider information on stocks top 100 penny stocks nse front swing trading ppm hedge fund mpw industrial services stock robinhood back photos of the check, enter the amount and submit.

Open Account. Acceptable deposits and funding restrictions Acceptable deposits Requests to wire funds into your TD Ameritrade account must be made with your financial institution. How do I transfer shares held by a transfer agent? Deposit limits: No limit. To get the current margin rate for your account, please call Carefully consider the investment objectives, risks, charges, and expenses of any ETF or mutual fund before investing. These funds must be liquidated before requesting a transfer. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. Please check with your plan administrator to learn more. Market Makers did not accept that symbol and order will need to be re-routed, Please call the Trade Desk at Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. For safety and trading convenience, TD Ameritrade - through our affiliated clearing firm - provides safekeeping for securities in your account. This typically applies to proprietary and money market funds.

The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn More Discover the Potential Advantages of Fixed Income Investing If you are looking to diversify your portfolio, or if you seek a predictable income stream, fixed income investments may be right for you. Please note: You cannot pay for commission fees or subscription fees outside of the IRA. By clicking "Accept" below, you are acknowledging that information regarding both you and your account may be shared with companyName. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the accountor the account of a party who is not one of the TD Ameritrade account owners. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please note: Trading in the delivering account may delay the transfer. You will need to contact your financial institution 200k in dividend stocks phone app to trade penny stocks see which penalties would be incurred in these situations. Checks that have been double-endorsed with more than one signature on the. Commissions, service fees, and exception fees still apply. Etrade corporate social responsibility wire money to td ameritrade may differ for entity and corporate accounts. ET; next business day for all. If your firm charges a fee to transfer your account, a debit balance could occur once how to invest in etfs guide can i buy stock in impossible foods transfer is complete. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Information provided by TD Ameritrade, including without limitation that related to the ETF Market Center and commission-free ETFs, is for general educational and informational purposes only and should not be considered a recommendation or investment advice. This means the securities are negotiable only by TD Ameritrade, Inc. View Interest Rates. I have a check made payable to me If you already have a check from either your previous k or IRA and you've already opened an IRA with TD Ameritrade, first deposit it into your personal bank account, then transfer the money into your TD Ameritrade account.

Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Above-average mobile app. The minimum net liquidation value must be at least 2, in cash or securities to utilize margin. How to start: Mail in. How do I transfer my account from another firm to TD Ameritrade? If you have any questions regarding residual sweeps, please contact the transferor firm directly. How long will my transfer take? The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred from. Be sure to sign your name exactly as it's printed on the front of the certificate. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts.

Here are some instances where additional documentation may be needed: Registration on the certificate name in which it is held is different than the registration on the account. The amount of TD Ameritrade's remuneration for these services is based in part on the amount of investments in such funds by TD Ameritrade clients. Deposit limits: No limit. Please review our commission schedule and rates and fees schedule for details. Check for additional open orders Positions will be left short and uncovered that may increase the maintenance requirements on your positions Recent deposits if you are attempting to trade options and non-marginable securities Overspending the available funds. You may draw from a personal checking or savings account under the same name as your TD Ameritrade account. TD Ameritrade has a comprehensive Cash Management offering. With a TD Ameritrade IRA, you'll have access to education, tools and research to help you create your investment strategy. TD Ameritrade Essential Portfolios. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Particular commission-free ETFs may not be appropriate investments for all investors, and there may be other ETFs or investment options available at TD Ameritrade that are more suitable. Investors may be reluctant to take the plunge and switch to a new brokerage, worrying it will be disruptive and complicated. Choice 1 Transfer assets from another brokerage firm There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. Cancel Continue to Website. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade.