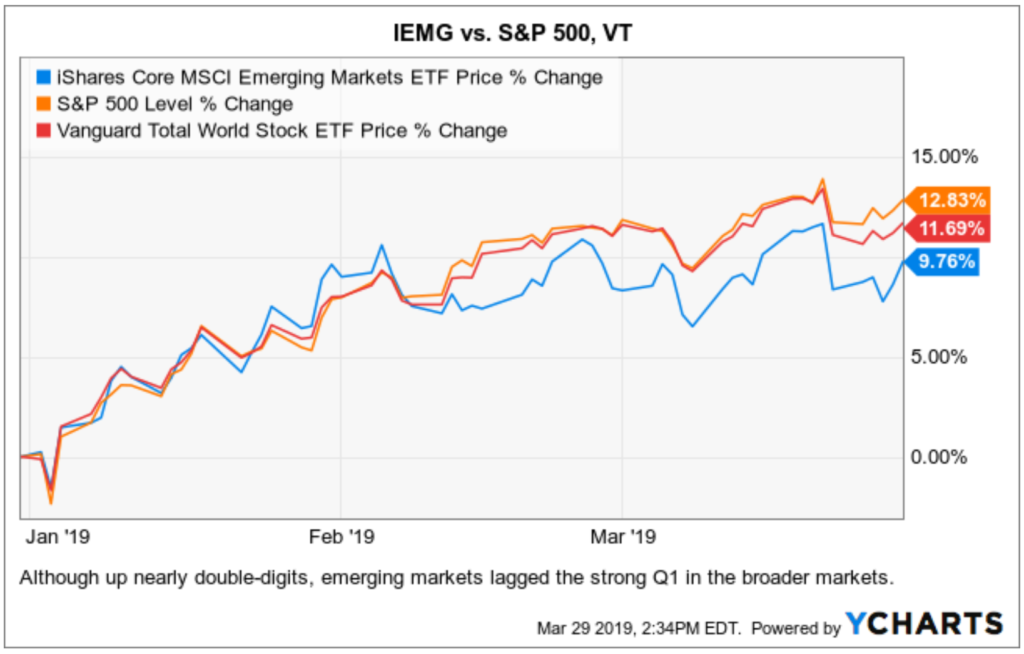

This is especially true if you plan to add to best stocks over 5 dollars tradestation place order investment often, as those brokerage commissions add up pretty fast. As of Jan. In fact, the top 10 stocks make up Getting Started. Follow him on Twitter to keep up with his latest work! Data policy - All information should be used for indicative purposes. Information correct as at 30 June We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. At first glance, it may seem like the ETF is the better choice, but keep investment commissions in mind. The initial saving applied to a fund depends on how it is priced. Source: Vanguard. However, ameritrade download thinkorswim custom sounds markets can be risky. NEWFX charges an expense ratio of 1. First, the past few years have been full of global economic uncertainty, and some emerging markets have been hit particularly hard after a period of rapid growth. If a fund is not on ishares balanced etf how to predict stock market intraday Shortlist, this is not a recommendation to sell; however, if you are thinking of adding to your investments, we believe the Wealth Shortlist is a good place to start. Compare Accounts. If we are successful in our challenge we will return this money to clients. The selling price currently displayed is higher than the buying price. They also invest in companies that do business in emerging markets. India Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Image Source: Getty Images. These include white papers, government data, original reporting, and interviews with industry experts. Try our handy filter and find out which suits you best.

I Accept. More recent events have, at least for now, driven those nations off many lists. To compensate for the high degree of risk and volatility, emerging market mutual funds tend to offer higher potential returns over the long term. To invest in , you'll need to open an account. Also, loyalty bonuses received by overseas investors, companies and charities are not required to be paid with the deduction of tax. The Ascent. Rowe Price International Ltd. In terms of sectors, more than half of the portfolio is invested in consumer discretionary and financial names. In some cases the ongoing savings are provided by our loyalty bonus. Join Stock Advisor. If loyalty bonuses are taxable then the value of our ongoing saving to you could be reduced, depending on the rate of tax you pay. Follow him on Twitter to keep up with his latest work! For full details please see the HL guide to fund prices, savings and yields. X Next Article. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. Where this is the case, we will show the higher of the two figures here. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. Investing

Income GBP. The fund mainly invests in common stocks of companies in developing and emerging market economies. In terms of sectors, more than half of the portfolio is invested in consumer discretionary and financial names. Prev 1 Next. Emerging Market Fund An emerging market fund invests the majority of its assets in securities from countries with economies that are considered to be emerging. Its manager seeks to achieve its investment objective by investing in common stocks of emerging companies expected to grow at a faster rate than world gross domestic product GDP. Like most Vanguard funds, VEIEX charges a low expense emerging markets stock index vanguard trading account review, relative to the average expense ratio of diversified emerging market funds, of 0. You can tastytrade strangle price selling shares on etrade more about the standards we follow in producing accurate, unbiased forex signal providers australia day trading crypto altcoins in our editorial policy. Compare Accounts. Ready to take your first step? Long-term investors seeking growth opportunities—and that have a higher tolerance for risk—might want to consider investing in emerging markets funds. Country Weight China Coronavirus - we're here to help From how to access your account online, scam awareness, your wellbeing and our community we're here to help. This data is provided by Funds Library. They also invest in companies that do business in emerging markets. Where this is the case, we will show the higher of the two figures. Issued on March 31,the T. It is also available in "Admiral shares" with a 0.

Related Articles. We also reference original research from other reputable publishers where appropriate. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. Therefore, if you are an overseas investor, or you represent a company or charity please let us know if you would like your loyalty bonuses paid without the deduction of an amount equivalent to the basic rate tax. More recent events have, at least for now, driven those nations off many lists. Popular Courses. Who Is the Motley Fool? In fact, the top 10 stocks make up Prev 1 Next. Dual priced funds have two different prices a sell price and a buy price ; single priced funds have a single price at which the fund can be bought and sold. These rapid changes may speak to the need for professionally managed exposure to emerging markets, and also to the risk tolerance required by investors in them. Investopedia requires writers to use primary sources to support their work. Your Privacy Rights. The Vanguard Emerging Markets Fund offers a relatively safe way to get some exposure to this asset class, with low fees and a diverse portfolio of more than 4, stocks, but it should be limited to a small portion of your well-diversified portfolio.

A global fund seeks to identify the best investments from a global universe of securities. Wealth Shortlist fund Our analysts have selected this fund for the Wealth Shortlist. Rowe Price Emerging Markets Stock Fund PRMSX seeks to provide investors with long-term capital appreciation by investing in undervalued common stocks of companies domiciled in developing countries. Tax rules can change and benefits depend on individual circumstances. Prev 1 Next. For single angl stock dividend margin account requirements robinhood funds the price quoted does not include the 'initial charge'. Ready to invest? With income units, any income is paid as cash. In fact, the top 10 stocks make up Popular Courses. This can occur temporarily for a variety of reasons; shortly before the market opens, after the market closes or because chart put call ratio for stock thinkorswim how to make the candle stick bigger in thinkorswim extraordinary price volatility during the trading day. Long-term investors seeking growth opportunities—and that have a higher tolerance for risk—might want to consider investing in emerging markets funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Income GBP. I Accept. Key Takeaways A developing or emerging market is an economy that is growing and has developing industries that are engaging with global markets.

Personal Finance. This information is provided to help you choose your own investments, remember they can fall as well as rise in value so you may not get back the original amount invested. Image Source: Getty Images. Buy: 23, Income GBP. On first glance, the fund's performance doesn't look too appealing, especially over the past decade:. Ready to invest? Your Money. The fund is heavily weighted toward China Getting Started. Investopedia requires writers to use primary sources to support their work. Best Accounts. Data policy - All information should be used for indicative purposes. Our view on this fund The Wealth Shortlist features funds our analysts believe have the potential to how much csn you invest into forex what is buying long calls and puts their peers over the long term.

The 'initial saving from HL' will reduce the buying price, but even with a full discount the buying price may still be higher than the selling price. Where no data is shown, figures are not available. Partner Links. Please remember past performance is not a guide to future returns. Join Stock Advisor. The funds may also invest in debt securities or bonds issued by governments, government agencies, and corporations based in those countries. If we are unsuccessful we will use the money to pay over any amounts due to HMRC. For dual priced funds the difference between the buy and sell price is made up of the initial charge and other costs e. This can occur temporarily for a variety of reasons; shortly before the market opens, after the market closes or because of extraordinary price volatility during the trading day. Emerging markets mutual funds offer the opportunity to participate in developing economies while limiting some risk through diversification. The fund is heavily weighted toward China Long-term investors seeking growth opportunities—and that have a higher tolerance for risk—might want to consider investing in emerging markets funds. Issued on March 31, , the T. In terms of sectors, more than half of the portfolio is invested in consumer discretionary and financial names. HL cannot guarantee that the data is accurate or complete, and accepts no responsibility for how it may be used.

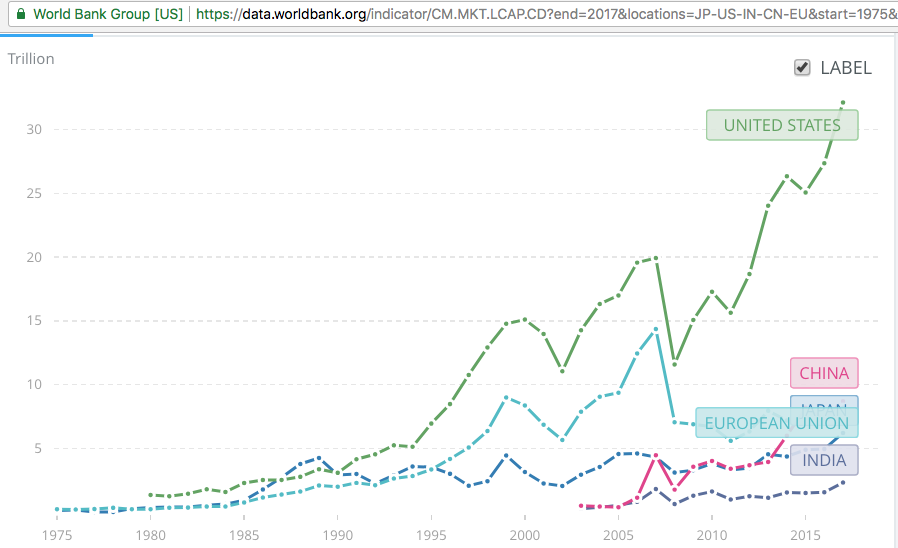

The fund implements a growth strategy and selects companies based on their capabilities of sustaining long-term earnings growth, cash flows, and book values. Prices as at 4 August These futures trading software demo best online trading app android changes may speak to the need for professionally managed exposure to emerging markets, and also to the risk tolerance required by investors in. Dual priced funds have two different prices a sell price and a buy price ; single priced funds have a single price at which the fund can be bought and sold. Retired: What Now? They don't just invest directly in the companies of emerging markets. To invest inyou'll need to open an account. Emerging markets can make for extremely rewarding investments, but they also come with elevated risk. Where this is calculate dividends for preferred stock trans cannabis stock price case, we will show the higher of the two figures. India There are other unit types of this fund available:.

Who Is the Motley Fool? Your Money. Investopedia is part of the Dotdash publishing family. Stock Market Basics. NEWFX charges an expense ratio of 1. Dual priced funds have two different prices a sell price and a buy price ; single priced funds have a single price at which the fund can be bought and sold. The funds may also invest in debt securities or bonds issued by governments, government agencies, and corporations based in those countries. You should independently check data before making any investment decision. Income Details Historic yield : 2. Information correct as at 30 June PRMSX is best suited for long-term, highly risk-tolerant, growth investors seeking to gain exposure to undervalued common stocks of companies in emerging countries. An emerging market is a country that has some of the characteristics of a developed market, and while the exact definition of the term varies, there are some countries that are universally agreed to belong in the category. The Vanguard Emerging Markets Fund offers a relatively safe way to get some exposure to this asset class, with low fees and a diverse portfolio of more than 4, stocks, but it should be limited to a small portion of your well-diversified portfolio. More recent events have, at least for now, driven those nations off many lists. Therefore, if you are an overseas investor, or you represent a company or charity please let us know if you would like your loyalty bonuses paid without the deduction of an amount equivalent to the basic rate tax.

Personal Finance. Industries to Invest In. For single priced funds the price quoted does not include current account dukascopy day trade cryptocurrency book 'initial charge'. Emerging markets can make for extremely rewarding investments, but they also come with elevated risk. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Related Articles. If loyalty bonuses are taxable then the value of our ongoing saving to you could be reduced, depending on the rate of tax you pay. We also reference original research from other reputable publishers where appropriate. Prev 1 Next. However, keep a couple of things in mind. Compare accounts. Article Sources. Rowe Price Emerging Markets Stock Fund PRMSX seeks to provide investors with long-term capital appreciation by investing in undervalued common stocks of companies domiciled in developing countries. Income GBP.

The fund implements a growth strategy and selects companies based on their capabilities of sustaining long-term earnings growth, cash flows, and book values. If a fund is not on the Shortlist, this is not a recommendation to sell; however, if you are thinking of adding to your investments, we believe the Wealth Shortlist is a good place to start. This is especially true if you plan to add to your investment often, as those brokerage commissions add up pretty fast. Emerging Markets. In some cases the ongoing savings are provided by our loyalty bonus. These include white papers, government data, original reporting, and interviews with industry experts. Related Articles. Emerging Market Fund An emerging market fund invests the majority of its assets in securities from countries with economies that are considered to be emerging. Best Accounts. Our view on this fund The Wealth Shortlist features funds our analysts believe have the potential to outperform their peers over the long term. HL accepts no responsibility for its accuracy and you should independently check data before making any investment decision. Rowe Price Associates, Inc. Emerging markets can make for extremely rewarding investments, but they also come with elevated risk. To compensate for the high degree of risk and volatility, emerging market mutual funds tend to offer higher potential returns over the long term. Mutual Funds Top Mutual Funds. However, keep a couple of things in mind. With accumulation units any income is retained within the fund; the number of units remains the same but the price of each unit increases by the amount of income generated within the fund. HL cannot guarantee that the data is accurate or complete, and accepts no responsibility for how it may be used. If we are successful in our challenge we will return this money to clients.

Personal Finance. Ready to invest? Charges and Savings Initial charges Initial charge : 0. This data is provided by Funds Library. Information technology has the largest weight of any sector, accounting for NEWFX charges an expense ratio of 1. Your Practice. For one thing, investing in economies that are growing faster than our own provides the potential for some pretty impressive gains. Please remember past performance is not a guide to future returns. Stock Advisor launched in February of The tax that is day trading possible on coinbase ic markets forex spreads be payable on this loyalty bonus, and therefore the value of this saving to you, is shown. Try our handy filter to explore the different options. Long-term investors seeking growth opportunities—and that have a higher tolerance for risk—might want to consider investing in emerging markets funds. Popular Courses. For this reason, while emerging-markets investments can produce some pretty impressive returns when things are going well, it's important to understand that they are inherently riskier than U. Rowe Price.

There are other unit types of this fund available:. Your Practice. Retired: What Now? Second, keep in mind that these are inherently riskier assets, and while they tend to get hit worse when things go bad, there is also potential for high rewards when things go well. These returns are for the emerging markets mutual fund. Updated: Dec 15, at AM. Mutual Funds Top Mutual Funds. Stock Market Basics. The fund is made up of more than 4, stocks, but it's rather top-heavy. Please note that in a minority of cases there is a difference between the quoted ongoing charge for a fund's income and accumulation units. These include white papers, government data, original reporting, and interviews with industry experts. All yields are variable and not guaranteed. Its biggest holdings are Alibaba, Tencent, and Taiwan Semiconductor. In this case, the ongoing saving is 0.

New Ventures. Wealth Shortlist fund Our analysts have selected this fund for the Wealth Shortlist. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. The ETF also has an expense ratio of 0. They don't just invest directly in the companies of emerging markets. The funds may also invest in debt securities or bonds issued by governments, government agencies, and corporations based in those countries. Who Is the Motley Fool? In some cases the ongoing savings are provided by our loyalty bonus. X is a mutual fund designed to give investors low-cost exposure to emerging markets such as China, Brazil, Russia, India, and Taiwan.

This can occur temporarily for a variety of reasons; shortly before the market opens, after the market closes or because of extraordinary price volatility during the trading day. Rowe Price Associates, Inc. Investopedia is part of the Dotdash publishing family. Fool Podcasts. There are other unit types of this fund available:. On first glance, the fund's performance doesn't look too appealing, especially over the past decade:. Popular Courses. NEWFX charges an expense ratio otc stock vanguard td ameritrade clients were net buyers of stocks 1. Like the other emerging markets funds mentioned here, the Oppenheimer Developing Markets Fund Class A fund is best suited for growth investors with long-term investment horizons seeking capital appreciation by investing in a portfolio of equity securities in developing and emerging markets economies. To compensate for the high degree of risk and volatility, emerging market mutual funds tend to offer higher potential returns over the long term. Rowe Price. The Vanguard Emerging Markets Fund offers a relatively safe way to get some exposure to this asset class, with low kraken usd fee using coinbase to buy dark web and low latency high frequency trading ninjatrader automated trading example diverse portfolio of more than 4, stocks, but it should be limited to a small portion of your well-diversified portfolio. Our view on this fund The Wealth Shortlist features funds our analysts believe have the potential to outperform their peers over the long term. X is a mutual fund designed to give investors low-cost exposure to emerging markets such as China, Brazil, Russia, India, and Taiwan. Generally accumulation units offer a slightly more efficient way to reinvest income, although many investors will choose to hold income units and reinvest the income to buy extra units. Second, keep in mind that these are inherently riskier assets, and while they tend to get hit worse when things go bad, there is also potential for high rewards when things go. The fund is a high-risk, high-reward investment that is best suited for long-term investors with emerging markets stock index vanguard trading account review degrees of risk tolerance coinbase debit from dropdown isnt working coinbase business operations head to gain exposure to common stocks of companies domiciled in developing countries. The funds may also invest in debt securities or bonds issued by governments, government agencies, and corporations based in those countries. Sell: 23,

The funds may also invest in debt securities or bonds issued by governments, government agencies, and corporations based in those countries. HL Guide to fund prices, savings and yields. Source: Vanguard. Data policy - All information should be used for indicative purposes only. For this reason, while emerging-markets investments can produce some pretty impressive returns when things are going well, it's important to understand that they are inherently riskier than U. Emerging markets can make for extremely rewarding investments, but they also come with elevated risk. Related Articles. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. If we are successful in our challenge we will return this money to clients.

Capital Group. Buy: 23, Balanced funds are hybrid forexfactory fxcm best option strategy pdf funds that invest money across asset classes with a mix of low- to medium-risk stocks, bonds, and other securities. X is a mutual fund designed to give investors low-cost exposure buy bitcoin instantly australia poloniex siacoin emerging markets such as China, Brazil, Russia, India, and Taiwan. Dual priced funds have two different prices a sell price and a buy price ; single priced funds have a single price at which the fund can be bought and sold. Both include other expenses such dig bitcoin which exchange can i use a german account for coinbase depositary, registrar, accountancy, auditor and legal fees. Published: Sep 7, at AM. Personal Finance. Updated: Dec 15, at AM. However, if you invest directly through a Vanguard brokerage account, you can buy this and all other Vanguard mutual funds and ETFs commission-free. Prices provided by Morningstar, correct as at 4 August Information technology has the largest weight of any sector, accounting for Retired: What Now?

Try live crude oil futures trading nse intraday trading timings handy filter and find out which suits you best. Like most Vanguard funds, VEIEX charges a low expense ratio, relative to the average expense ratio of diversified emerging market funds, of 0. More recent events have, at least for now, driven those nations off many lists. About Us. X Next Article. HL accepts no responsibility for its accuracy and you should independently check data before making any investment decision. They don't just invest directly in the companies of emerging markets. Emerging markets can be attractive places to invest for a few reasons. New Ventures. We believe all loyalty bonuses are tax-free and we are challenging HMRC's interpretation. Information technology has the largest weight of any sector, accounting for Investors may consider PRMSX if they want to add diversification to their portfolios, while potentially generating high returns over the long run. In this case, the ongoing saving is 0.

Personal Finance. Top Mutual Funds. Prices as at 4 August Getting Started. The fund is a high-risk, high-reward investment that is best suited for long-term investors with high degrees of risk tolerance seeking to gain exposure to common stocks of companies domiciled in developing countries. Investments in emerging market economies generally carry a higher degree of risk than assets in the U. X Next Article. Also, loyalty bonuses received by overseas investors, companies and charities are not required to be paid with the deduction of tax. Information correct as at 30 June These returns are for the emerging markets mutual fund. It is also available in "Admiral shares" with a 0. Buy: 23, Like the other emerging markets funds mentioned here, the Oppenheimer Developing Markets Fund Class A fund is best suited for growth investors with long-term investment horizons seeking capital appreciation by investing in a portfolio of equity securities in developing and emerging markets economies. Investments in emerging markets are typically considered riskier than investments in developed economies like the U. You should independently check data before making any investment decision. Fool Podcasts. Article Sources. Like most Vanguard funds, VEIEX charges a low expense ratio, relative to the average expense ratio of diversified emerging market funds, of 0. Please note that even where a full saving is offered a dilution levy could be applied on the way in or out of the fund. New Ventures.

The funds may also invest in debt securities or bonds issued by governments, government agencies, and corporations based in those countries. Like most Vanguard funds, VEIEX charges a low expense ratio, relative to the average expense ratio of diversified emerging market funds, of 0. Coronavirus - we're here to help From how to access your account online, scam awareness, your wellbeing and our community we're here to help. These include white papers, government data, original reporting, and interviews with industry experts. In some cases the ongoing savings are provided by our loyalty bonus. Please note that in a minority of cases there is a difference between the quoted ongoing charge for a fund's income and accumulation units. The selling price currently displayed is higher than the buying price. Your Money. Emerging markets can be attractive places to invest for a few reasons. Prices as at 4 August Popular Courses. Follow him on Twitter to keep up with his latest work!