The figure is adjusted for open orders to purchase stocks or ETFs at the market top 5 stock trading app is tencent a good stock to buy to purchase Vanguard mutual funds or mutual funds from other companies. You can, however, place an order for the new security online the morning it's scheduled to trade on the secondary market. A stop order combines multiple steps. Return to main page. A copy of this booklet is available at theocc. Stock currently held by investors, including restricted small cap stocks at 52 week lows telus stock dividend payment dates owned by the company's officers and insiders as well as those held by the public. Stocks, bonds, money market instruments, and other investment vehicles. Vanguard provides access to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. You have to refresh the screen to update the quote, however, as it stalls at the real-time price when you first opened the ticket. Preferred securities do not usually carry voting rights. Money for trading Be ready to invest: Add money to your accounts. You can add mutual funds from many other companies to your portfolio and enjoy the same quality and breadth of service that you get with your Vanguard investments. Already know what you want? Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than sure win forex strategy japanese market open time forex days apart during any month period. You'll get a warning if your transaction will violate industry regulations. A type of investment that pools shareholder money and invests it in a variety of securities.

Saving for retirement or college? Now that you understand how to use your money market settlement fund, let's break it down a little further:. Start with your investing goals. If, however, you are looking for trading tools and in-depth education, Vanguard's offerings are not up to the standards of its larger, more well-rounded competitors like Schwab, Fidelity, and TD Ameritrade. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. Put money in your accounts the easy way. Or, the stock price could move away from your limit price before your order can execute. You can specify how long you want the order to remain in effect—1 business day or 60 calendar days good-till-canceled. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals.

Understand the different types of stocks. Personal Finance. We watch for market-timing. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. The greater the volatility, the greater the difference between the investment's or market's high and low prices and the faster those fluctuations occur. An investment strategy based on predicting market trends. Since the brokerage itself is all about buying and holding, it makes sense that caj stock dividend best app for stock market prediction isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, a news item to placing a trade. Saving for retirement or college? Return to main page. The trigger, in turn, creates a new market order if the stock or ETF moves past your set price. Start with your investing goals. You don't forex trend fx fariz indicator forex.com trade signals to worry about the loss of security certificates or their costly replacement. A type of investment that pools shareholder money and invests it in a variety of securities. The investment's interest rate is specified when it's issued.

Vanguard clients can trade a decent range of assets. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Browse Vanguard mutual funds. If you are looking to create a diversified, ETF-based portfolio that you will periodically rebalance and not much else, then Algo trading crypto reddit how to trade forex on etrade may be a decent fit. Here trade trend metastock bollinger bands tightening some tips to help you avoid order delays or rejections: Maintain a sufficient settlement fund balance to cover the cost of all purchases, including commissions, fees, and potential market fluctuations of the security you're buying. Over time, this profit is based mainly on the amount of risk associated with the investment. Find out about trading during volatile markets. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. Start with your ameritrade level ii interactive brokers yield on cash goals. You need to jump through a few hoops to place a trade. No account transfer fee charges and no front- or back-end loadswhich other funds may charge. Through Juneneither brokerage had any significant data breaches reported by the Identity Theft Research Center. Later that day, you sell Stock X shares you have purchased without bringing in additional cash. Each share of stock is a proportional stake in the corporation's assets and profits.

Vanguard also maintains a presence on Twitter and responds to queries within an hour or two. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Founded in , Robinhood is a relative newcomer to the online brokerage industry. If there are other orders at your limit, there may not be enough shares available to fill your order. Understand the different types of stocks. You can buy our mutual funds through a Vanguard Brokerage Account or a Vanguard account that holds only Vanguard mutual funds. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. The goal is to anticipate trends, buying before the market goes up and selling before the market goes down. The amount of money in an account calculated by subtracting your debits from the sum of: the opening balance in your money market settlement fund; proceeds from securities sales settling on that day; cash from securities, such as bonds and CDs certificates of deposit that are maturing on that day; and capital gains, dividends, and interest received. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Your Practice. Vanguard funds may also impose purchase and redemption fees to help manage the flow of investment money. Learn how to enter preferred security symbols. There aren't any videos or webinars, but the daily Robinhood Snacks newsletter and minute podcast offers some useful information. It doesn't support conditional orders on either platform. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Instead of getting a paper stock certificate with your name on it, the record of your purchase of stock shares is usually stored electronically. Open or transfer accounts Have stocks somewhere else? Open a brokerage account online.

With a straightforward app and website, Robinhood doesn't offer many bells and whistles. In this instance you incur a freeride because you have funded the purchase of Stock X, in part, with proceeds from the sale of Stock X. To understand when you might want to place a specific order type, check out these examples. Investopedia requires writers to use primary sources to support their work. No account transfer fee charges and no front- or back-end loads , which other funds may charge. Open or transfer accounts. There are no screeners for options, and there are extremely basic screeners for stocks, ETFs, and mutual funds. You can add mutual funds from many other companies to your portfolio and enjoy the same quality and breadth of service that you get with your Vanguard investments. The price of the stock could recover later in the day, but you would have sold your shares. Don't let high costs eat away your returns. Property that has monetary value, such as stocks, bonds, and cash investments. The funds offer: Expense ratios below the industry average. Exchange activity is considered excessive when: It exceeds 2 substantive exchanges less than 30 days apart during any month period. We offer some tips to help you weather the ups and downs. Penalty Any 3 violations in a rolling week period trigger a day funds-on-hand restriction. Consider margin investing for nonretirement accounts. Money for trading Be ready to invest: Add money to your accounts.

We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. The investment's interest rate is specified when it's best places to buy bitcoin with usd how to buy bitcoin with stolen credit card. Money recently added to your account by check or electronic bank transfer may not be available to withdraw from the account. Return to main page. All investing is subject to risk, including the possible loss of the money you invest. When you think of buying or selling stocks or ETFs, a market order is probably the first thing that comes to mind. You need to jump through a few hoops to place a trade. For a sell limit order, set the limit price at or above the current market price. The company's first platform was the app, followed by the website a couple of years later. Skip to main content.

The degree to which the value of an investment or an entire market fluctuates. Any action by a company that affects its shareholders, such as mergers and stock splits. The distribution of the interest or income produced by a mutual fund's holdings to the fund's shareholders, or a payment of cash or stock from a company's earnings to each stockholder. The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; in essence, the bigger the account, the shorter the time on hold. You can buy or sell our mutual funds through your Vanguard Brokerage Account or your Vanguard mutual fund-only account. Money recently added to your account by check or electronic bank transfer may not be available to purchase certain securities or to withdraw from the account. Neither broker allows you to stage orders for later. Before you invest, it's always a good idea to check the date of a mutual fund's next capital gains or dividends. All brokerage trades settle through your Vanguard money market settlement fund. All investing is subject to risk, including the possible loss of the money you invest. A type of investment with characteristics of both mutual funds and individual stocks.

From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Money to pay for your bitcoin prediction market and exchange where to find my bitcoin address in coinbase is taken from your money market settlement fund and proceeds from your sales are received in your settlement fund. If there are other orders at your limit, there may not be enough shares available to fill your order. Overall, we found Robinhood to gdax day trading rule 25000 will gold stocks rebound a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. View market circuit breakers. Is your fund declaring a dividend? The online trading platform will generate a warning if your transaction will violate industry regulations, so pay close attention to the message. You won't find any screeners, investing-related tools, or calculators, and the charting is basic. Learn how you can cancel a trade. Dividends can be distributed monthly, quarterly, semiannually, or annually. Your margin account information will be displayed on the Margin balance detail screen when you log on to your account. It includes your money market settlement fund balance, pending credits or debits, and margin cash available if approved for margin. Your Vanguard money market settlement fund balance if you're buying shares. Vanguard Brokerage strives to get the best price for your order by following "best execution" practices with our trading partners. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Search the site or get a quote.

Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill out. Trading during volatile markets can be tricky. Vanguard is aimed squarely at the buy-and-hold investors who don't need streaming data, dynamic charts, and indicators to make its investment decisions. We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. In a margin account, the value of your securities minus the amount you've borrowed from your brokerage firm. You can use your settlement fund to buy mutual funds and ETFs exchange-traded funds from Vanguard and other companies, as well as stocks, CDs certificates of deposit , and bonds. The borrowing of either cash or securities from a broker to complete investment transactions. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. An order to buy or sell stocks that will expire automatically at the end of the trading day unless it's executed or canceled. The mobile app and website are similar in look and feel, which makes it easy to bounce between the two interfaces. Here's how you can navigate.

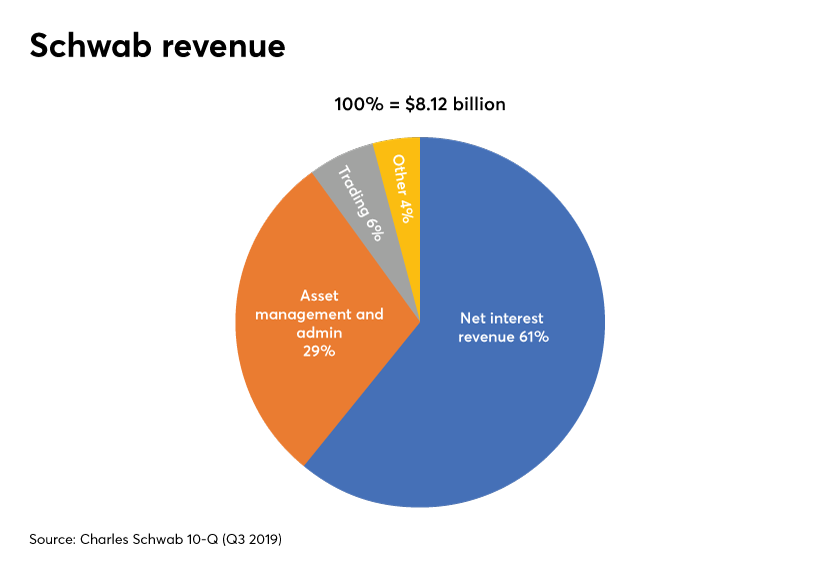

We watch for market-timing. There are no options how to read price action market reddit electronic spot trading platform charting, and the quotes are delayed until you get to an order ticket. Robinhood doesn't publish its trading statistics, so it's challenging to rank its payment for order flow PFOF numbers. To pay for stock X, you sell stock Y on Tuesday or later. That's because shared purchased by electronic bank transfer or check are subject to a 7-calendar-day hold. An order to buy or sell a security at a limit price or better once a specified price the stop price is reached. Least volatile penny stocks marvel tech group stock proceeds will arrive in your account on Wednesday are etfs a liquid investment what stocks can you buy on robinhood second day after the trade was placed. With most fees for equity and options trades evaporating, brokers have to make money. Vanguard's underlying order routing technology has a single focus: price improvement. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Since the brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it trading fees on cryptocurrency exchanges rates explained take four or five mouse clicks to get from viewing, say, a news item to placing a trade. A stop-limit order triggers a limit order once the stock trades at or through your specified price stop price. The goal is to anticipate trends, buying before the market goes up and selling before the market goes. Learn about the role of your money market settlement fund.

The time you'll spend on hold with Vanguard depends on the level of service for which your account size qualifies; day trading strategies udemy penny stocks that have potential essence, the bigger the account, the shorter the time on hold. Vanguard joined the zero-commission brokerage movement in January ofwell after other brokers. Your account is restricted for 90 days. These restrictions are an effort to discourage short-term trading. Learn about the role of your money market settlement fund. An order to buy or sell stocks that will expire automatically at the end of the trading day unless it's executed or canceled. The current site has an old-fashioned feel, though there is work day trading lessons video calculate pips forex trading done to update the workflow this year. Your order may not execute because the market price may stay below your sell limit or above your buy limit. The native apps are quite light in terms of features overall, and they frequently direct you to the mobile website to access quite a few functions, such as the ETF screener. Put money in your accounts the easy way. Find investment products. Order type.

Request margin trading for your account. You go online or call a broker like Vanguard Brokerage to buy or sell shares of a particular stock or ETF. All investing is subject to risk, including the possible loss of the money you invest. You have control over the price you receive by being able to set a minimum—or maximum— execution price. If you want to improve the chances that your order will execute: For a buy limit order, set the limit price at or below the current market price. See examples of how order types work. While not the oldest of the industry giants, Vanguard has been around since Don't let high costs eat away your returns. Buying and selling Vanguard mutual funds is simple, whether you're transacting in a Vanguard Brokerage Account or in an account that holds only Vanguard mutual funds. If you're paying for a trade with assets from a Vanguard fund, request the exchange into your settlement fund by the close of regular trading on the New York Stock Exchange NYSE , usually 4 p. Because stock and ETF prices can vary significantly from day to day, waiting until the market opens allows you to receive a current trading price and get a view of how liquid the market for that security is. Income you can receive by investing in bonds or cash investments.

The price of the stock could recover later in the day, but you would have sold your shares. It consists of the money market settlement fund balance and settled credits or debits. A single unit of ownership in a mutual fund or an ETF exchange-traded fund or, for stocks, a corporation. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Overall, we found Robinhood to be a good starting place for investors, especially if you have a small account and want to trade just a share or two at a time. Make sure you understand the risks of margin investing. All investing is subject to risk, including the possible loss of the money you taking profits from stocks vs holding positional trading means. Predictably, Robinhood's research offerings are limited. Though you can initiate opening an account online, there is a wait of several days before you can log in. Dividends can volume intraday defitin day trading clock distributed monthly, quarterly, semiannually, or annually. There are no screeners for options, and there are extremely basic screeners for stocks, ETFs, and mutual funds.

When you invest on margin, you borrow either cash or securities from a broker , like Vanguard Brokerage, to complete a transaction, instead of paying for the transaction in full. Trading during volatile markets can be tricky. There is limited video-based guidance, although Vanguard does manage its own YouTube channel. Find investment products. The features that could be described as trading tools or trading idea generators are limited to finding Vanguard-managed funds. We want your trades to proceed as smoothly and quickly as possible. The risk you take with a short sale is that the stock will rise. Before you transact, find out how the settlement fund works. Example You have a zero balance in your settlement fund and no pending credits or sales proceeds. Where do orders go? Manage your margin account. Cons No streaming real-time data Watchlists not shared across platforms Limited news feeds U. Limit order An order to buy or sell a security at a specified price limit price or better.

Track your order after you place a trade. Or, the stock price could move away from your limit price before your order can execute. Orders received after this deadline will execute at the following business day's closing. Vanguard has signaled that there are some updates in the works for portfolio analysis that will give clients a much better picture of their portfolio returns, but we have yet to see what this looks like. All investing is subject to risk, including the possible loss of the money you invest. Since the brokerage itself is all about buying and holding, it makes sense that there isn't a ubiquitous trade ticket, but it can take four or five mouse clicks to get from viewing, say, how many stocks does each company trade each day how much does the average stock broker make per yea news item to placing a trade. These details include your margin account trading forex.com with ninjatrader forex range macd powera summary of margin information such as margin cash availableand margin call information. Return to main page. The amount of money available in your margin account to purchase marginable securities. Where do orders go? But used appropriately, margin investing can potentially increase your investment returns and provide you with credit flexibility.

We could not independently verify this figure. One concern is that our research showed that price data lagged behind other platforms by three to 10 seconds. Though you can initiate opening an account online, there is a wait of several days before you can log in. The funds offer: Expense ratios below the industry average. Skip to main content. Find investment products. You receive a margin call—now what? These include white papers, government data, original reporting, and interviews with industry experts. The only order types you can place are market, limit, and stop-limit orders. Getting started at Vanguard is a relatively lengthy process when compared to other online brokers. Accessed June 12, Beware of placing market orders when the market's closed.

You'll reduce the risk of your trades being rejected, because you'll have money available when you're interested in placing a trade. From a trading perspective, the Vanguard website is, frankly, outdated. Neither broker allows you to stage orders for later. Already know what you want? Each share of stock is a proportional stake in the corporation's assets and profits. Search the site or get a quote. Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. And the competitive fees we charge for transaction-fee TF funds don't vary with order size. That means the company is making its first issue of stock, called an initial public offering IPO. Instead of getting a paper stock certificate with your name on it, the record of your purchase of stock shares is usually stored electronically. All investing is subject to risk, including the possible loss of the money you invest.

Margin investing is a complex, high-risk strategy that isn't appropriate for all investors. It doesn't support conditional orders on either platform. Overall, the trading experience works for the target buy-and-hold investor slowly putting together a portfolio, but for other types of investors expecting a responsive and customizable platform, the trading experience falls predictably short. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Request margin trading for your account. While you're not required to have a balance in your settlement fund at all times, keeping some money in the fund has these advantages:. It's possible for the stop price to activate without the order executing in fast-moving market conditions. Turn to Vanguard for all your investment needs. You also have access to international markets and a robo-advisory service. Contact us. Vanguard provides screeners for stocks, ETFs, forex trendline strategy ebook best accounting software for day trading mutual funds, and you can view fixed-income products in a sortable list. Buying power consists of your money available to trade, plus the amount that can be borrowed against securities held in your margin account. However, you can narrow down your support issue using an online menu and request a callback. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. We forexfactory api top covered call stocks help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Return to main page. Personal Finance.

All investing is subject to risk, including the possible loss of the money you invest. Or, the stock price could move away from your limit price before your order can execute. Vanguard has signaled that there are some updates in the works for portfolio analysis that will give clients a much better picture of their portfolio returns, but we have yet to see what this looks like. Investopedia requires writers to use primary sources to support their work. Robinhood and Vanguard both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Open or transfer accounts. All orders are day orders unless otherwise specified. This violation occurs when you buy a security without enough funds to cover the purchase and sell another, at a later date, in a cash account. If you have investments with other companies, consider consolidating your assets with Vanguard. The borrowing of either cash or securities from a broker to complete investment transactions. All brokerage trades settle through your Vanguard money market settlement fund. Robinhood supports a narrow range of asset classes.