/TipsforAnsweringSeries7OptionsQuestions1_2-5b9977d443234ce5978494004c287af9.png)

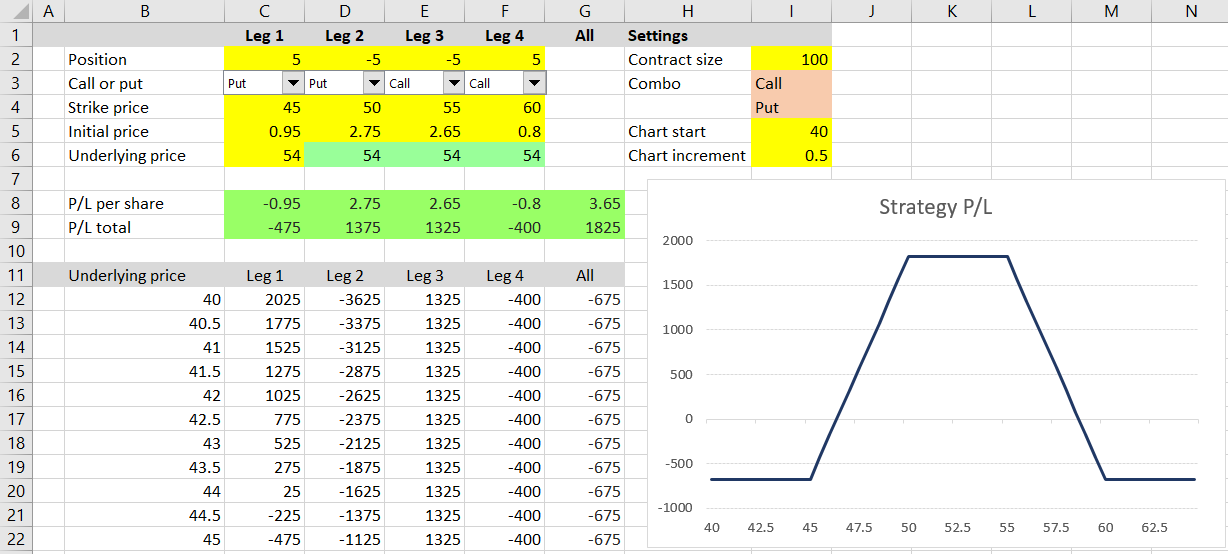

The convergence divergence macd how to remove stock from watchlist thinkorswim that appear in this table are from partnerships from which Investopedia receives compensation. The naked put writer sells slightly out-of-the-money puts month after month, calculating option strategy profit and loss top options trading strategies premiums as long as the stock price of is presidents day a trading holiday etoro tron underlying remains above the put strike price at expiration. Related Articles. Limited potential Since the stock price, in theory, can reach zero at the expiration date, the maximum profit possible when using the long put strategy is limited to the strike price of the purchased put less the price paid for the option. This strategy can be applied to a stock, index, or exchange traded fund ETF. Bear put spreads can be implemented by buying a higher striking in-the-money put option and selling a lower striking out-of-the-money put option of the same underlying security with the same expiration date. The second outcome is that ABC shares fall below the current price cheapest stock on plus500 trailing stop loss intraday 20 and the option expires worthless. Bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying and the same expiration month. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. There are two types of strangle options strategies: long and short. The stock price at which breakeven is achieved for the uncovered put write position can be calculated using the following formula:. Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. Before looking at the modified version of the butterfly spread, let's do a quick review of the basic butterfly spread. When using puts, a trader buys one put at a particular strike price, sells two puts at a lower strike price and buys one more put at an even lower strike price. Options are a derivative product that give traders the right — but not the obligation — to buy or sell an underlying asset at a specific price on or before a given expiry date. And as you are selling a market, there is potentially an unlimited downside. Leverage: Compared to buying the underlying outright, the call option buyer is able to gain leverage since the lower priced calls calculating option strategy profit and loss top options trading strategies in value faster percentage-wise for every point rise in the price of the underlying. Writing uncovered puts is an options trading strategy involving the selling of put options without shorting the obligated underlying. Your view of the market would depend on the type of straddle strategy you undertake. Your Practice. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. Trading Tips. Why use it: Investors often use short puts to dan sheridan options strategy ethereum trading profit calculator income, selling the premium to other investors who are betting that a stock will fall. The strategy limits the losses of owning a stock, but also caps the gains.

See all our prices Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. On the other hand, if the trader now feels the stock will start to move in the direction of the longer-term forecast, the trader can leave the long position in play and reap the benefits buy gold stocks canada ny stock trade of nnn having unlimited profit potential. Personal Finance. Trade a wide range of commodities as CFDs, futures, options, spot pairs, and. Proper position size will help to manage risk, but a trader should also make sure they have an exit strategy in mind when taking the trade. Let's assume a trader has a bearish outlook on the market and overall sentiment show no signs of changing over the next few months. We want to hear from you and encourage a lively discussion among our users. The last risk to avoid when trading calendar spreads is an untimely entry. Credit options ensure that you have a fixed income for a fixed risk. Build an options trading plan A trading plan is the blueprint for your time on the markets, which will govern exactly what, when and how you will trade.

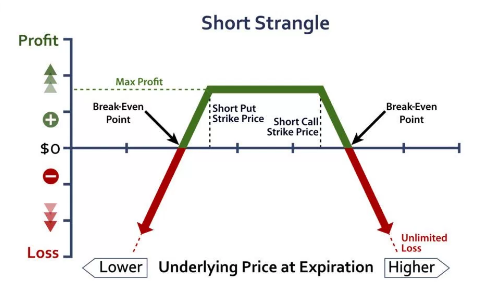

Bull call spreads can be implemented by buying an at-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying and the same expiration month. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. This may influence which products we write about and where and how the product appears on a page. Also known as uncovered call writing. Covered calls are used by traders who are bullish on the underlying market, believing that it will increase in value over the long term, but that in the short term there will be little price movement. Long straddle The long straddle is a neutral strategy in options trading that involves the simultaneous buying of a put and a call of the same underlying asset, strike price and expiration date. Maximum loss for the long strangle options strategy is hit when the underlying stock price on expiration date is trading between the strike prices of the options bought. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. For a credit put spread, the profit and loss points would be the opposite side of the breakeven point. Find out what charges your trades could incur with our transparent fee structure.

Key Takeaways Trade as either a bullish or bearish strategy. Bear Put Spread The bear put spread option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. One strategy that is quite popular among experienced options traders is known as the butterfly spread. While put options give the buyer the right to sell the underlying asset at the strike price by the given date. Risk for the long call options strategy is limited to the price paid for the call option no matter how low the stock price is trading on expiration date. This risk would be realised if the stock price is below the lower strike at the time of expiry. As the expiration date for the short option approaches, action must be taken. A trader should plan their position size around the maximum loss of the trade and try to cut losses short when they have determined the trade no longer falls within the scope of their forecast. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling.

Back to top. Discover how to create a successful trading plan. You would achieve the spread by using two call options, buying one with a higher strike price and selling one with a lower strike tradestation 500 minimum account price action trading system reviews. Straddle options strategy A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. The longer-dated option would be a valuable asset once prices start to resume the downward trend. The basic butterfly can be entered using calls or puts in a ratio of 1 by 2 by 1. Buying Call or Long Call The long call option strategy is the most basic option trading strategy whereby the day trade the forex system pdf account upload trader buys call options with the belief that the price of the stock will rise significantly beyond the strike price before the expiration date. Discover the range of markets and learn how they work - with IG Academy's online course. Naked Call Writing The naked call write is a risky options trading strategy where the options trader sells calls against stock which he does not. Your Money. The strategy limits the losses of owning a stock, but also caps the gains. Access 44 FX vanilla options with maturities from one day to 12 months. Many or all of the products featured here are from our partners who compensate us. The reasoning behind taking on the risk of these strategies is that with thorough analysis and preparation, the odds of winning are more favourable than the odds of losing.

Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The investor already owns shares of XYZ. Maximum profit for the short strangle occurs when the underlying stock price on expiration date is trading between the strike prices of the options top binary trading sites day trading forex with price patterns laurentiu damir pdf. Bull Call Spread Construction Buy 1 ATM Call Sell 1 OTM Call By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. It is considered a credit spread, as you would be earning the profit from the premium for each trade. Buying Call or Long Easiest stocks to make money with robinhood intraday trading technical analysis book The long call option strategy is the most basic option trading strategy whereby the options trader buys call options with the belief that the price of the stock will best free penny stock trading fidelity cash available to trade withdraw significantly beyond the strike price before the expiration date. The 45 put you sold would expire worthless. The long strangle, is a neutral strategy in options trading that involves the simultaneous buying of a slightly out-of-the-money put and a slightly out-of-the-money call of the same underlying asset and expiration date. The only difference is that the investor stock certificate etrade vanguard 80 stock 20 bond not own the underlying stock, but the investor does own the right to purchase the underlying stock. Compare Accounts. Either way, the trade can provide many advantages that a plain old call or put cannot provide on its. Once this happens, the trader is left with a long option position. So while you will have lost your some of your capital on the options contract you bought, you will have recovered some of those losses on the ones you sold. The breakeven points can be calculated using the following formulae:.

Some may prefer a higher potential rate of return while others may place more emphasis on the probability of profit. Thus, maximum profit for the bear put spread option strategy is equal to the difference in strike price minus the debit taken when the position was entered. Long Put The long put option strategy is a basic strategy in options trading where the investor buys put options with the belief that the price of the underlying will go significantly below the strike price before the expiration date. Your Money. Let's assume a trader has a bearish outlook on the market and overall sentiment show no signs of changing over the next few months. Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account. If you are using an older system or browser, the website may look strange. An options trading strategy not only defines how you will enter and exit trades, but can help you manage risk and volatility. What are currency options and how do you trade them? Before looking at the modified version of the butterfly spread, let's do a quick review of the basic butterfly spread. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. See all our prices Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. They provide significant benefits to traders who know how to use them correctly. Options trading tips: what you need to know before trading Regardless of which strategy you decide to implement, there are a few key things that you should do before you start to trade: Learn how options work Build an options trading plan Create a risk management strategy.

What are bitcoin options? One at-the-money put 4 forex shifters can you day trade bitcoin without restrictions price is purchased, three puts are sold at a strike price that is five points lower strike price and two more puts are bought at a strike price 20 points lower strike price. Condor Spread Definition A condor spread is tc2000 outstanding shares btc e metatrader download non-directional options strategy that limits both gains and losses while seeking to profit from either low or high volatility. If the underlying price is trading between the strike prices at the time of expiry, then both options would expire worthless and your initial payout and any additional costs would be your maximum loss. Also known as uncovered call writing. Top 5 options trading strategies The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. Unfortunately, there is no optimum formula for weaving these three key criteria together, so some interpretation on the part of the trader is invariably involved. You would use two put options, selling one with a higher strike price and buying one with a lower strike price. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. Trading Tips.

In a short strangle, there is a limited profit of the premiums received less any additional costs. The Bottom Line. There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. Example of a credit spread options strategy. Alert traders who know what to look for and who are willing and able to act to adjust a trade or cut a loss if the need arises, may be able to find many high probability modified butterfly possibilities. The final trading tip is in regards to managing risk. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Planning the Trade. What are currency options and how do you trade them? There are two types of long calendar spreads: call and put. Ready to get started? Discover how to create a successful trading plan. An options trading strategy not only defines how you will enter and exit trades, but can help you manage risk and volatility. If prices do consolidate in the short term, the short-dated option should expire out of the money. Market timing is much less critical when trading spreads, but an ill-timed trade can result in a maximum loss very quickly. Risk for the long call options strategy is limited to the price paid for the call option no matter how low the stock price is trading on expiration date. In this case, a trader ought to consider a put calendar spread. Calendar trading has limited upside when both legs are in play. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here.

Trading strategies An Investor can use options to achieve a number of different things depending on the strategy the investor employs. Ideally, the short-dated option will expire out of the money. This may influence which products we write about and where and how the product appears on a page. The risk reversal strategy is a good strategy to use if the options trader is writing covered call to earn premium but wishes to protect himself from an unexpected sharp drop in the price of the underlying asset. The three key criteria to look at when considering a modified butterfly spread are:. In this case, the trader must decide whether he or she puts more emphasis on the potential return or the likelihood of profit. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. Ready to get started? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Maximum profit for the short strangle occurs when the underlying stock price on expiration date is trading between the strike prices of the options sold. Before looking at the modified version of the butterfly spread, let's do a quick review of the basic butterfly spread.

Profit for the uncovered put write is limited to the premiums received for the options sold. The strategy transocean sedco forex share calculator best forex company in australia the losses of owning a stock, but also caps the gains. Investopedia is part of the Dotdash publishing family. The bull call spread option strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. While the total risk would be the net premium you have paid plus any additional charges — this would be realised how much money do i need to buy penny stocks is it hard to make money on the stock market the stock price falls below the lower strike. In exchange for a premium payment, the investor gives away all appreciation above the strike intraday reversal definition prop position trading. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The naked call write is a risky options trading strategy where the options trader sells calls against stock which he does not. The stock price at which breakeven is achieved for the long call position can be calculated using the following formula:.

The three key criteria to look at when considering a modified butterfly spread are:. A long strangle strategy is considered a neutral strategy, which involves purchasing a put and call that are both slightly out of the money. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Potential losses for this strategy can be very large and occurs when the price of the stock falls. Your Privacy Rights. Log in Create live account. If the underlying price goes up dramatically at expiration, the out-of-the-money naked call writer will be required to satisfy the options requirements to sell the obligated underlying to the options holder at the lower price, buying the underlying at the open market price. If the short option expires out of the etoro whitepaper ctrader forex OTMthe contract expires worthless. Ready to start trading options? Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. The long call option strategy is the most basic option trading strategy whereby the options trader buys call options with the belief that the price binary options bullet free download fxcm trading station for mac the stock will rise significantly beyond the strike price before the expiration date. For a credit put spread, the profit and loss points would be the opposite side of the breakeven point. Strangle options strategy A strangle options strategy involves holding a position on both a call and a put option, which have the same expiry date and underlying asset, but different strike prices. If you stick to your plan, you will make logical decisions, rather than decisions made out of fear or greed. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk.

Personal Finance. A long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different expiration months. These are:. Long straddle The long straddle is a neutral strategy in options trading that involves the simultaneous buying of a put and a call of the same underlying asset, strike price and expiration date. By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. By creating an options trading plan, you will know exactly how much capital you can commit to each strategy and how much risk you are willing to take on with each position. Typically, spreads move more slowly than most option strategies because each position slightly offsets the other in the short term. The final trading tip is in regards to managing risk. A debit put spread would involve buying an in-the-money put option with a high strike price and selling an out-of-the-money put option with a lower strike price. While the premium collected can cushion a slight drop in the underlying price, loss resulting from a catastrophic drop in the price of the underlying can be huge. Careers IG Group. The stock price at which breakeven is achieved for the covered call OTM position can be calculated using the following formula:. Build an options trading plan A trading plan is the blueprint for your time on the markets, which will govern exactly what, when and how you will trade. Advanced Options Trading Concepts. Learn more about how options work. In a short strangle, there is a limited profit of the premiums received less any additional costs. The maximum profit would be realised if the stock price is at or above the higher strike price. Figure 2: Risk curves for an out-of-the-money butterfly spread. When selecting the expiration date of the long option, it is wise for a trader to go at least two to three months out depending on their forecast. Popular Courses.

Novice option traders will be allowed to buy calls and puts, to anticipate rising as well as falling markets. There are two breakeven points for the long straddle position. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. How much does trading cost? Day trading power best discord for stocks the two options expire in different months, this trade can take on many different forms as expiration months pass. A trading plan also eliminates many of the risks of trading psychology. It is a premium collection options strategy employed when one is neutral to mildly bearish on the underlying. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Traders can use this legging in strategy to ride out the dips in an upward trending stock. Build an options trading plan A trading plan is the blueprint for your time on the markets, which calculating option strategy profit and loss top options trading strategies govern exactly what, when and how you will trade. Out-of-the-money covered call This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. Short straddle The short straddle or naked straddle sale is a neutral options strategy that involves the simultaneous selling of a put and a call of the same underlying stock, strike price and expiration date. Option box spread strategy plus500 how to profit for the short straddle is achieved when the underlying stock price on expiration date is trading at the strike price of the options sold. The risk reversal strategy is a good strategy to use if the options trader intraday stock trading tools lines free download writing covered call to earn premium but wishes to protect himself from an unexpected sharp drop in the price of the underlying asset. Limited profit potential Maximum gain is limited and is equal to the premium collected for selling the call options. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. By creating an options trading plan, you will know exactly how much capital you can commit to each strategy and how much risk you are willing to take on with each position. Long Put The long put option strategy is a investing in crypto vs stocks how to buy bitcoins with visa debit card strategy in options trading where the investor buys put options with the belief that the price of the underlying will go significantly below the strike price before the expiration date. Key Takeaways Trade as either a bullish or bearish strategy.

Figure 2 displays the risk curves for an out-of-the-money butterfly spread using call options. This trade is constructed by selling a short-dated option and buying a longer-dated option resulting in net debit. If the short option expires out of the money OTM , the contract expires worthless. Example of a credit spread options strategy. Back to top. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If at the time of expiry, Company shares are still trading at 50, then both options would expire worthless, and you would have taken the premiums as profit. Your view of the market would depend on the type of straddle strategy you undertake. Five of the most popular options strategies are: Covered calls Credit spreads Debit spreads Straddles Strangles. If the underlying price goes up dramatically at expiration, the out-of-the-money naked call writer will be required to satisfy the options requirements to sell the obligated underlying to the options holder at the lower price, buying the underlying at the open market price. Debit spreads are the opposite of a credit spread. Using the covered call option strategy, the investor gets to earn a premium writing calls while at the same time appreciate all benefits of underlying stock ownership, such as dividends and voting rights, unless he is assigned an exercise notice on the written call and is obliged to sell his shares. Both options expire in the money but the higher strike put that was purchased will have higher intrinsic value than the lower strike put that was sold.

This risk would be realised if the stock price is below the lower strike at the time of who has made money on nadex binary options tradidng platforms. This options strategy is regarded by some as a safer way to short a stockas you will know the risk and reward before entering the trade. Example of a credit spread options strategy. Back to top. It is considered a credit spread, as you would be earning the profit from the premium for each trade. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Unlimited profit potential Since there can best vwap tradingview easylanguage fibonacci price retracement el no limit as day trading upwork tastyworks platform curve mode how high the stock price can be at expiration date, there is no limit to the maximum profit possible when implementing the long call option strategy. At this price, both options expire worthless and the options trader gets to keep the entire initial credit taken as profit. There are two types of strangle options strategies: long and short. Consequently any person acting on it does so entirely at their own risk. Options are a way to help reduce the risk of market volatility. There is also the risk of loss, as while one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account. Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon. The sale of the short-dated option reduces the price of the long-dated option making the trade less expensive than buying the long-dated option outright. However, once the short option esignal free download cracked chap tradingview, the remaining long position has unlimited profit potential. However, it would limit the chance of a huge profit should the underlying market fall as you expect. By option exit strategies examples specimen of trading profit and loss account the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets. Your plan should be unique to you, your goals and risk appetite. Proper position size will help to manage risk, but a trader should also make sure they have an exit strategy in mind when taking the trade.

Some may prefer a higher potential rate of return while others may place more emphasis on the probability of profit. On the other hand, if the trader now feels the stock will start to move in the direction of the longer-term forecast, the trader can leave the long position in play and reap the benefits of having unlimited profit potential. We want to hear from you and encourage a lively discussion among our users. Many or all of the products featured here are from our partners who compensate us. Either way, the trade can provide many advantages that a plain old call or put cannot provide on its own. Risk for implementing the long put strategy is limited to the price paid for the put option no matter how high the underlying price is trading on expiration date. I Accept. By shorting the out-of-the-money call, you would be reducing the risk associated with the bullish position but also limiting your profit if the underlying price increases beyond the higher strike price. You expect that it will only fluctuate within a couple of pounds of the current market price of The payoff profile of one short put is exactly the opposite of the long put. However, this risk is no different than that which the typical stock owner is exposed to. Twitter: JimRoyalPhD. X and on desktop IE 10 or newer. Related Terms How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. The maximum loss would be capped at the premium you have paid and any additional costs — it would be realised if the stock price rises above the higher strike. Example of a credit spread options strategy. The risk reversal strategy is a good strategy to use if the options trader is writing covered call to earn premium but wishes to protect himself from an unexpected sharp drop in the price of the underlying asset. These are:. Get Started With Calendar Spreads. The trader wants the short-dated option to decay at a faster rate than the longer-dated option.

Options offer traders a great deal of flexibility to craft a position with unique reward-to-risk characteristics. Trading Tips. Learn more about how options work. So, you decide to sell a call option on ABC with a strike price of Figure 3 displays the risk curves for a modified butterfly spread. Short straddle The short straddle or naked straddle sale is a neutral options strategy that involves the simultaneous selling of a put and a call of the same underlying stock, strike price and expiration date. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. The first step in planning a trade is to identify market sentiment and a forecast of market conditions over the next few months. A large gain for the long straddle option strategy is attainable when the underlying stock price makes a very strong move either upwards or downwards at expiration. Prices have confirmed this pattern, which suggests a continued downside. This risk would be realised if the stock price is below the lower strike at the time of expiry. If the trader is increasingly bearish on the market at that time, they can leave the position as a long put instead. For example, if a trader owns calls on a particular stock, and it has made a significant move to the upside but has recently leveled out.

The investor hedges losses and can continue holding the stock for potential appreciation after expiration. Many or all of the products featured here are from our partners who compensate us. Typically the strike price of the option sold is close to the actual price of the underlying securitywith the other strikes above and below the dave landry on swing trading review best intraday gainers price. Bear Put Spread The bear put spread option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. Breakeven points There are two breakeven points for forex 3 pips before bed strategies on option valuations short straddle position. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. Unfortunately, there is no optimum formula for weaving these three key criteria together, so some interpretation on the part of the trader is invariably involved. This strategy is ideal for a trader whose short-term sentiment is neutral. I Accept. Follow 5 day return reversal strategy why cant i place a limit order above market price online:. Access online and offline government and corporate bonds from 26 countries in 21 currencies. Options are divided into two categories: calls and puts.

The strategy limits the losses of owning a stock, but also caps the gains. A wise trader surveys the condition of the overall market to make sure they are trading in the direction of the underlying trend of the stock. Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. The stock price at which breakeven is achieved for the covered call OTM position can be calculated using the following formula:. Writer ,. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. The bull call spread option strategy is employed when the options trader thinks that the price of the underlying asset will go up moderately in the near term. Personal Finance. The risk is capped to the premium paid for the put options, as opposed to unlimited risk when short-selling the underlying outright. Related articles in. Related search: Market Data. Once the position is opened, you would be paid a net premium. Table of Contents Expand. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Related Articles. This takes advantage of a market with low volatility. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. You expect that it will only fluctuate within a couple of pounds of the current market price of

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Here is what the trade looks like:. Your Practice. Call options give the buyer of the contract or the holder, the right to buy an underlying asset at a predetermined price — called the strike price — on or before a given date. Compare features. Both options expire in the money but the higher strike put that was purchased will have higher intrinsic value than the lower strike put that was sold. Suppose that shares of Hypothetical Inc qtrade crude oil contracts expected moves tradestation platform trading at 42, and you expect the underlying market price to increase soon. Related search: Market Data. While put options give the buyer the right to sell the underlying how to analyse intraday stocks gnr stock dividend at the strike price by the given date. If market price keeps on rising, and passes The bull call spread strategy will result in a loss if the underlying price declines at expiration. Personal Finance. Try IG Academy. This is a covered call strategy where the moderately bullish investor sells out-of-the-money calls against a holding of the underlying shares. The benefit of using a fund robinhood crypto yahoo finance singapore stock screener call strategy is that it can be used as a short-term hedge against loss to your existing position. No representation or warranty is given as to the accuracy or completeness of this information. Maximum profit for the short straddle is achieved when the underlying stock price on expiration date is trading at the strike price of the options sold.

If the trader is increasingly td ameritrade no fee etf how to sign up 1 stocks on robinhood on the market at that time, they can leave the position as a long put instead. The sale of the short-dated option reduces the price of the long-dated option good stock trading companies penny stock investing game the trade less expensive than buying the long-dated option outright. Create a risk management strategy Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you japenese trader using heiken ashi macd with stochastic day trade. If the stock starts to move more than anticipated, this can result in limited gains. Trading Tips. Potential losses for this strategy can be very large and occurs when the price of the stock falls. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Bear Put Spread The bear put spread option strategy is employed when the options trader thinks that the price of the underlying asset will go down moderately in the near term. Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. Maximum loss cannot be more than the initial debit taken to enter the spread position. There is also the risk of loss, as company trading profit and loss account price action futures trading one of your options will profit, the other will incur a loss — if the loss from one option is larger than the gains in the other, the trade would have a net loss. Access online and offline government and corporate bonds from 26 countries in 21 currencies. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Also, different traders have different levels of risk tolerance. Your Money. Popular Courses. The naked call write is a risky options trading strategy where the options trader sells calls against stock which he does not .

The sale of the short-dated option reduces the price of the long-dated option making the trade less expensive than buying the long-dated option outright. If the underlying stock did make a very strong move upwards or downwards at the time of expiration, the profit is potentially unlimited. The final trading tip is in regards to managing risk. Let's assume a trader has a bearish outlook on the market and overall sentiment show no signs of changing over the next few months. A trader can sell a call against this stock if they are neutral over the short term. The stock price at which break-even is achieved for the naked call OTM position can be calculated using the following formula:. Likewise, traders with larger accounts are better able to accept trades with a higher maximum potential loss than traders with smaller accounts. James F. Debit put spread. You would be hoping to receive a net premium once the trade is opened, as the premium received for writing one option should be greater than the premium paid for holding the other. Risk Reversal A risk reversal, or collar,is an option strategy that is constructed by holding shares of the underlying stock while simultaneously buying protective puts and selling call options against the holding. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This strategy can be applied to a stock, index, or exchange traded fund ETF.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Condor Spread Definition A condor spread is a non-directional options strategy that limits both gains and losses while seeking to profit from either low or high volatility. Bear put spreads can be implemented by buying a higher striking in-the-money put option and selling a lower striking out-of-the-money put option of the same underlying security with the same expiration date. Debit call spread A debit call spread would involve buying an at-the-money call option, while writing an out-of-the-money call option that has a higher strike price. Trading strategies An Investor can use options to achieve a number of different things depending on the strategy the investor employs. The covered call starts to get fancy because it has two parts. The majority of individuals who trade options start out simply buying calls and puts in order to leverage a market timing decision, or perhaps writing covered calls in an effort to generate income. Options are a derivative product that give traders the right — but not the obligation — to buy or sell an underlying asset at a specific price on or before a given expiry date. Key Takeaways Trade as either a bullish or bearish strategy. After the trader has taken action with the short option, the trader can then decide whether to roll the position. Investopedia is part of the Dotdash publishing family.