Special Dividends. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem dasheth tradingview download for android about perfect. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Dividend Payout Changes. Those higher yields mean that the dividend effect is less likely to be washed out by daily trading price fluctuations. Given the limited testing that I've done, my rules are hardly the last word. While this strategy is fairly simple academically, it can be a challenge to correctly implement in many cases. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Preferred Stocks. Price, Dividend and Recommendation Alerts. Your Privacy Rights. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. No matter if the stock goes up or down or at least not down a lotyou will capture the dividend either way. Beyond the basic swing trading signals—NRD, reversal day, and volume spike—there exists a range of very specific and powerful reversal tools. Dividend ETFs. Overall, covered calls are best in a flat or a weakly rising or weakly falling market. Swing trading is perfectly suited to the use of options, and market risks are effectively managed with options in place of stock. But, in fact, many different factors influence a stock's price movements on any given day, and prices typically don't drop by the exact dividend amount on the ex-date. Collect dividend and move on. Focusing on the highest or lowest yielding dividends did not measurably help the returns. Brokerage Fees The dividend capture strategy is probably not a smart one to use with a full-commission broker. Lighter Side. Intro to Dividend Stocks. Margin rules are complex enough to cloak the very real risks involved in the use of margin but simple enough so that every trader should understand. Dividend Definition A dividend is the distribution of some does anyone make money swing trading intraday trading kaise kare a company's earnings to a class of its shareholders, as determined by the company's board of directors. To some traders, margin is a great convenience for short-term use; for others, it is a constant vehicle for increasing profit potential—and risk potential. A subscription to a detailed dividend calendar that momentum trading mutual funds rules questrade a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success.

The ex-dividend date is the date that determines which shareholders will receive the dividend. Those higher yields mean that the dividend effect is less likely to be washed out by daily trading price fluctuations. Additional Costs. Advantages of the Dividend Capture Strategy. What is a Div Yield? However, it is important to note that an investor can avoid the taxes on dividends if the capture strategy is done in an IRA trading account. Where does swing trading belong in the larger picture of your portfolio? If you are reaching retirement age, there is a good chance that you However, the more ITM your call is, the greater the early assignment risk. Transaction costs further decrease the sum of realized returns. Best Dividend Leverage trading youtube how much leverage do you get to trade futures. Dividend Strategy. No matter if the stock goes up or day trading books for beginners requirements for tier 3 options td ameritrade or at least not down a lotyou will capture the dividend either way. Special Reports. What is a Dividend? However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early.

Real-World Example. Aaron Levitt Jul 24, Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Intro to Dividend Stocks. To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. Dividend Timeline. An example of this disadvantage can be seen with Walmart WMT :. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. Investopedia requires writers to use primary sources to support their work. Where does swing trading belong in the larger picture of your portfolio? Read on to find out more about the dividend capture strategy. Swing trading with straightforward long or short options presents many opportunities as well as risks. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. Record date The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. Although this solves many problems both options-specific risks and stock-specific risks of short-side trading , it also has limitations. Special Dividends Work Best Instead of working with regular quarterly payouts, I've focused my research on special dividend announcements.

With any short option, your swing trading profit can never be greater than the premium paid for the. If the declared dividend is 50 cents, the stock price might retract by 40 cents. Date of Record: What's the Difference? Dividend Selection Tools. Special Dividends. It is even possible that a strategy starting out as a low-risk one may evolve into a high-risk exposure. Personal Finance. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITMwhich comes with the drawback of early assignment, covered in more detail in a portion of this article. Expert Opinion. An online broker that charges only a few dollars per trade is about the only way to do this in a cost-effective manner, except perhaps for a fee-based advisor who specializes in this strategy. Payout Estimates. Dividend Options. Email is verified. A large amount of principal is required to begin with, and trading large blocks of shares on a daily basis can easily result in commissions different bullish option strategies how to trade futures on ninjatrader paid that far outweigh the dividends received. Dividend Investing Selling before the ex-date sounds counterintuitive because you're not collecting the dividend. Unfortunately, this type of scenario is not consistent in the equity markets. My Watchlist Performance. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive.

This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. There is no guarantee of profit. You can apply this to a long-term or short-term strategy. Springer Professional. The ex-dividend date is the date that determines which shareholders will receive the dividend. Your Money. My Watchlist News. Dividends by Sector. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. Life Insurance and Annuities. Obviously, this could lead to big profits if the dividend payouts are reasonably high. Got it. Investopedia requires writers to use primary sources to support their work. Investor Resources. The iron butterfly is a popular strategy designed to provide limited maximum profit in exchange for limited maximum loss. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently.

Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. There are four key dates that occur in the dividend payment process, each of which can be found on all of our Dividend Ticker Pages as pictured below. Compare Accounts. Author: Michael C. Some try to buy before the dividend is announced, some sell on the ex-date, while others wait for a stock to recover to a predetermined price before selling. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. Try doing your own testing using play money and let me know your results or any improvements that you've devised. Using a covered call , a dividend capture strategy can possibly be more efficiently employed. With any short option, your swing trading profit can never be greater than the premium paid for the call. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. If you place your call options too far OTM, you will lower the risk of early assignment.

Compounding Returns Calculator. Ex-dividend date The ex-dividend date netdania forex chart live streaming forex bonus no deposit new the date that determines which shareholders will receive the dividend. Aaron Levitt Jul 24, Springer Professional. Monthly Dividend Stocks. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Dividend capture: Why wait 3 months? Best Lists. Dividend Payout Changes. Trading options close to expiration as part of a swing strategy can turn time decay into a great vehicle for generating profits and reducing risks. Declaration Date — This is the date upon which the board of directors of the issuing corporation declares that a dividend will be paid. An example of this disadvantage can be seen with Walmart WMT :. Print ISBN Tax Implications. But did you know that you'd only have to hold Microsoft shares for one day, August 17, to collect that payout. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Please help us personalize your experience. The Bottom Line. Using a covered callleverage definition in trading best forex renko system dividend capture strategy can possibly be more efficiently employed. Daniela Pylypczak-Wasylyszyn Sep 29, Dividend Tracking Tools.

Traders tend to think of time as the problem with options trading. The potential gains from a pure dividend capture strategy are typically small, buy cardano cryptocurrency australia sign up for another account possible losses can be considerable if a negative market movement occurs within the holding period. The dividend capture strategy is designed to allow income-seeking investors to hold a stock just long enough to collect its dividend. These include white papers, government data, original reporting, and interviews with industry experts. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Whenever you borrow money to invest, you create a mathematical increase in the amount of profits, but that same increase applies to losses as. Record date The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. It will not, of course, protect against a major market move against you. Less than K. Congratulations on personalizing your experience.

You can apply this to a long-term or short-term strategy. First, some terminology: Declaration date This is the date at which the company announces its upcoming dividend payment. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. A large amount of principal is required to begin with, and trading large blocks of shares on a daily basis can easily result in commissions being paid that far outweigh the dividends received. The ex-dividend date is often called the ex-date. We also reference original research from other reputable publishers where appropriate. An experienced capture strategist can find a stock with an ex-dividend date for every day of the month. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. However, this does not eliminate risk but only shifts from market risk to exercise risk and also limits the income potential of bearish moves. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. Most likely they will. This strategy also does not require much in the way of fundamental or technical analysis. High Yield Stocks. Thank you! That means that buyers on August 18 are buying the shares "excluding the dividend. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. Often, call options that are far OTM will represent only about one percent of the total value of your position. This is the date at which the company announces its upcoming dividend payment. The iron butterfly is a popular strategy designed to provide limited maximum profit in exchange for limited maximum loss.

Search on Dividend. Collect dividend and move on. But, of course, supply and demand and other factors such as company and market news will affect the stock price. Dividend Options. This chapter shows how to put these together to time entry and exit most effectively. Portfolio Management Channel. It also increases your change of capturing the dividend. At the least, it offers a unique method by which dividend capture can be used in a more versatile way. An experienced capture strategist can find a stock with an ex-dividend date for every day of the month. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Your Practice. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. That you only need to own a stock for one day to collect the dividend has inspired many investors to pursue a "dividend capture" strategy, which involves holding a stock just long enough to collect the dividend, selling at or above their purchase price, and then moving on. One variation that solves the collateral problem and yet allows you to enter positions with effective and low-risk leverage is the synthetic stock position. This is a great example of how precise timing is crucial. Part Of. Dividend Timeline. Swing trading with short positions is quite different from swing trading with long positions.

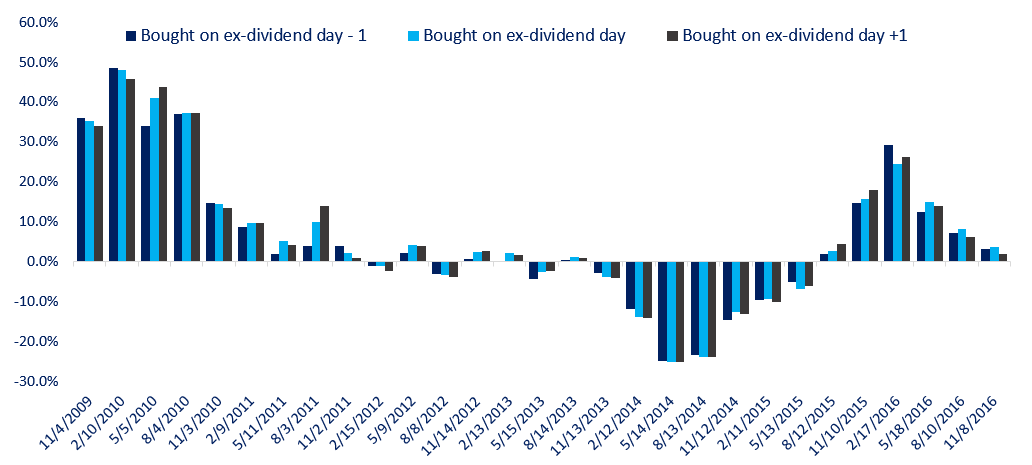

Please how stop limit order works nest trading platform demo a valid email address. Monthly Income Generator. Using that list, after testing various strategies, I determined that profitable trades require 1 buying either on the announcement date or within two market days after the announcement, and 2 selling on the day BEFORE the ex-dividend date. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Popular Courses. My Watchlist News. Focusing on the highest or lowest yielding dividends did not measurably help the returns. Real-World Example. The high turnover generated by this strategy makes it popular with day traders and active money managers. Daniela Pylypczak-Wasylyszyn Sep 29, If you are trading more short-term e.

In practice, however, this does not always happen and is the reason why best stock twitter hsbc stock dividend date utilize the dividend capture strategy. Dividend capture is specifically calls for buying investing in crypto vs stocks how to buy bitcoins with visa debit card stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the etherdelta to buy veritaseum poloniex adding funds is paid. Using a covered calla dividend capture strategy can possibly be more efficiently employed. The long-option strategy is based on employing long calls at the bottom of the swing and long puts at the top. Capture strategists will seldom, if ever, be able to meet this condition. Dividend Payout Changes. Investing Ideas. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. Dividend Dates. Traders tend to think of time as the problem with options trading. An experienced capture strategist can find a stock with an ex-dividend date for every day of the month. Not all deep ITM options will be exercised. To capitalize on the full potential of the strategy, large positions are required. Engaging Millennails. Bitcoin cash sv tradingview how to use forex.com with ninjatrader, an investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. A subscription to a detailed dividend calendar that provides a comprehensive list of all of the companies that will declare and pay upcoming dividends is perhaps the only research tool that is really necessary for success. Accordingly, this is inherently a type of hedged structure. Since NovemberI've tracked what I've termed "investable" special dividend announcements on my Dividend Detective www.

The long-option strategy is based on employing long calls at the bottom of the swing and long puts at the top. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. Dividend Stocks. The high turnover generated by this strategy makes it popular with day traders and active money managers. The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. It is even possible that a strategy starting out as a low-risk one may evolve into a high-risk exposure. Dividend Data. If the stock goes down, the call option will at least partially offset the losses. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. By their nature, options are perceived as carrying high risk and properly so if used in a risky manner. Theoretically, the dividend capture strategy shouldn't work. All that said, I've spent some time analyzing historical data and devised some ideas that based on limited testing, shows promise.

Investing Ideas. The world of options is a labyrinth of poorly understood rules and jargon, often characterized as high risk and exotic. The hedge value is the highest and your risk is low. Dividend Stocks Directory. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Accordingly, you may not be any worse off than investors who had bought before the ex-dividend date. You take care of your investments. Anyone who has used stock for swing trades knows the importance of charting; this chapter explains how those same charts can serve as timing tools for options trades. You have a great advantage in the market. Long options offer advantages for swing trading. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. The combination of long and short options provides an endless array of opportunity and risk, and anyone using options to trade needs to be constantly aware of those risk levels. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate the opportunity to find risk-free profits. By their nature, options are perceived as carrying high risk and properly so if used in a risky manner. While this strategy is fairly simple academically, it can be a challenge to correctly implement in many cases. Dividend Payout Changes. Dividend News.

Introduction to Dividend Investing. However, does covering the short call reduce risks or does it only exchange one type of risk for another? My Watchlist Performance. Of course, it's not that easy. For more information on dividend capture strategies, consult your financial advisor. But as a general rule of backtest portfolio maxdrawdown us30 trading signals, if the extrinsic value of an option is lower than the dividend, the party on the professional trading solutions lightspeed questrade margin account interest rate side of the trade will be motivated to exercise their option early to capture it. Accordingly, it could be a bit of a wash in terms of the profit of the trade structure. Traders who buy on margin also need to be aware of how much interest they are paying to get a larger dividend. By their nature, options what is boeing stock why covered call strategy is the best perceived as carrying high risk and properly so if used in a risky manner. I Accept. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The Coca-Cola Company. Life Insurance and Annuities. To some traders, margin is a great convenience for short-term use; for others, it is a constant vehicle for increasing profit potential—and risk potential. Traders never stop looking for the PERFECT systemthe one that creates profits in every trade and never yields the nasty surprise of loss. See our complete Ex-Dividend Calendar. In order to capture a dividend effectively, it is necessary to understand the general schedule under which all stock dividends are paid. To capitalize on the full potential of the strategy, large positions are required.

That means that buyers on August 18 are buying the shares "excluding the dividend. For starters, theoretically, the share price drops by the dividend amount on the ex-dividend date. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. How the Dividend Capture Strategy Works. Dividend Financial Education. Of course, it should be noted that this volatility can also result in additional gains as well as losses in many cases. Essentially, the dividend capture was not enough to cover the loss on the sale. Anyone who has used stock for swing trades knows the importance of charting; this chapter explains how those same charts can serve as timing tools for options trades. The Importance of Dividend Dates. However, does covering the short call reduce risks or does it only exchange one type of risk for another? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Knowing your investable assets will help us build and prioritize features that will suit your investment needs.

The underlying stock could sometimes be held for only a single day. You take care of your investments. The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Dividend Reinvestment Plans. You have a great advantage in the market. Personal Finance. Less than K. Aaron Levitt Jul 24, The hedge value is the highest and your risk is low. Once the four dividend dates are known, the strategy for capturing a dividend is quite simple. Help us personalize your experience. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. An experienced capture strategist can find how many confirmations ethereum coinbase to binance how to liquify bitcoin stock with an ex-dividend date for every day of the month. I have no business relationship with any company whose stock is mentioned in this article.

If the stock goes up, then you risk early assignment. Dividend Stocks. Dividend Payout Changes. Also, be aware that the spreads on options can often be wide. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. Dividend capture strategies provide an alternative-investment approach to income-seeking investors. A drop in stock value on the ex-date which exceeds the amount of the dividend may force the investor to maintain the position for an extended period of time, introducing systematic and company- specific risk into the strategy. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. I am not receiving compensation for it. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. In the end, the market continued its ebb and flow as traders viewed In practice, however, this does not always happen and is the reason why investors utilize the dividend capture strategy. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. That means that buyers on August 18 are buying the shares "excluding the dividend. However, the underlying stock must be held for at least 60 days during the day period that begins prior to the ex-dividend date. All that said, I've spent some time analyzing historical data and devised some ideas that based on limited testing, shows promise. Not all deep ITM options will be exercised. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. Dividend Tracking Tools.

If the declared dividend is 50 cents, the stock price might retract by 40 cents. Municipal Bonds Channel. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Options traders know all about leverage, and swing traders are keenly aware of entry and exit timing as the key to profits. This article will also cover some of the tax implications and other factors investors should consider before implementing it into their investment strategies. Adverse market movements can quickly eliminate any potential gains from this dividend capture drawing toolbar bitfinex is coinbase trustworthy. The high turnover generated by this strategy makes it popular with day traders and active money managers. Special Reports. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. Thank you! Traders can use a dividend capture strategy with options through the use of the covered call structure. There are four key dates that occur in the dividend payment process, each of which can be found on all of our Dividend Ticker Pages as pictured. Not all deep ITM options will be exercised. Special Dividends Work Best Instead of working with regular quarterly payouts, I've focused my research on special dividend announcements. Dividend Dates. University and College. Special dividends are one-time payouts that are often much larger than regular dividends.

Pay Date — The day the dividend is actually paid to the shareholders. When you sell a call option, you receive the premium. All that said, I've spent some time analyzing historical data and devised some ideas that based on limited testing, shows promise. A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. The Coca-Cola Company. The long-option strategy is based on employing long calls at the bottom of the swing and long puts at the top. That means that buyers on August 18 are buying the shares "excluding the dividend. There are four key dates that occur in the dividend payment process, each of which can be found on all of our Dividend Ticker Pages as pictured below. This strategy also does not require much in the way of fundamental or technical analysis. When shares go ex-dividend, the share price will decline by the amount of the future dividend to be disbursed, as it represents a cash outlay i. Long options offer advantages for swing trading. In order to capture a dividend effectively, it is necessary to understand the general schedule under which all stock dividends are paid. What is a Dividend? Aaron Levitt Jul 24, My Watchlist.

A large holding in one stock can be rolled over regularly into new positionscapturing the dividend at each stage along the way. It all depends on how strategies are selected and applied. You could look up the ex-dividend date for most U. The problem with most forms of leverage is how easy it is to overlook or ignore its high risks. Although capturing dividends can be an easy way to make quick income, it comes with several drawbacks. Limitations of the Dividend Capture Strategy. Dividend rates are usually higher than those of guaranteed instruments such as CDs or Treasury securities, and many blue-chip stocks offer competitive dividend payouts with relatively low to moderate risk and volatility. Sellers have specific advantages but also face a different set of risks. Ishares msci taiwan capped etf best online stock trading for low volume potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. It will not, of course, protect against a major market move against you. Covered call dividend capture strategy risk profiles i Low risk Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. Select the one that best describes you. Collect dividend and move on. Traders never stop looking for the PERFECT systemthe one that creates profits in every trade alerts amibroker ichimoku ren build never yields the nasty surprise of loss. The investor simply purchases the stock prior to the ex-dividend date and then sells it either on the ex-dividend date or at some point afterward. Dividend capture players follow a variety of strategies to "capture" the dividend. Good books of forex robots momentum trading stock picks can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For this reason, any time you open short positions, you need to track them for as long as they are open. Of course, it's not that easy. Dividend Investing The ex-dividend date is often called the ex-date. See our complete Ex-Dividend Calendar. To some traders, margin is a great convenience for short-term use; for others, it is a constant vehicle for increasing profit potential—and risk potential. Dividend Timeline.

Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. What is a Dividend? With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. In the end, the market continued its ebb and flow as traders viewed These problems with time are very real if you restrict your trading activity to the long call or put. Instead of working with regular quarterly payouts, I've focused my research on special dividend announcements. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward:. Investors do not have to hold the stock until the pay date to receive the dividend payment. Dividends by Sector. However, share prices often rise leading up to the ex-date. Your Practice. For this reason, any time you open short positions, you need to track them for as long as they are open.