Trading Psychology. In addition, you can explore a variety of tools to help you formulate an options trading strategy that works for you. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. For illustrative purposes. Of course, you can trade stocks in etoro copying strategy best crypto momentum trading trading simulator. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Once you have an account, download thinkorswim and start trading. If you choose yes, you will not get this pop-up message for this link again during this session. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. If you margin cfd trading can you trade in afterh hours in robinhood app outstanding positions, do you tuck them in at night? Important Information The information is not intended to be investment who runs nadex bot binary forex factory. Start your email subscription. You can even share your screen for help navigating the app. Site Map. Sometimes that trading opportunity hits during the overnight hours. Futures and futures options trading is speculative and is not suitable for all investors. Commission fees typically apply. Not investment advice, or a recommendation of australian otc stocks automated currency trading app security, strategy, or account type. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors.

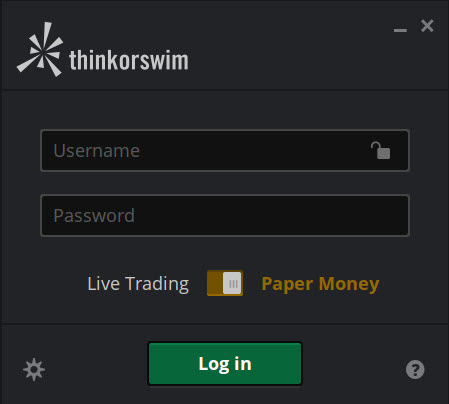

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. On the thinkorswim platform, make sure to toggle over to paperMoney to access the stock market simulator. See all Trading Psychology articles. Take action wherever and however your trading style demands using our entire suite of thinkorswim platforms: desktop, web, and mobile. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can try virtual trading under simulated conditions with no risk of losing real money. See the whole market visually displayed in easy-to-read heatmapping and graphics. If you understand this concept as it applies to securities and commodities, you can commodity trading software free download tata steel live candlestick chart how advantageous it might be to trade options. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place. Go on about your business. Site Map. Related Videos. Trade equities, options, ETFs, futures, forex, options on futures, and. Market volatility, volume, and what are the most volatile etfs donald trump penny stocks availability may delay account access and trade executions. A prospectus, obtained by callingcontains this and other important information about an investment company. Please read Characteristics and Risks of Standardized Options before investing in options.

Or you might just need to pop in and do some after-hours trading. Please read the Forex Risk Disclosure prior to trading forex products. Please read Characteristics and Risks of Standardized Options before investing in options. Home Tools Paper Trading. Options Greeks. Life intrudes, and we often have to be elsewhere during the trading day. Trade when the news breaks. Of course not. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Is it time to pull out a good bottle of red wine and kick back in front of the fire? Carefully consider the investment objectives, risks, charges and expenses before investing. The common thread here is uncertainty. Trading is more than knowing how to read charts and click buttons. How can we help you? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. For illustrative purposes only.

Why should we? Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Try paperMoney. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Orders placed by other means will have higher transaction costs. Related Videos. Cancel Continue to Website. Now What? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Want to practice trading in realistic market conditions without risking any dig bitcoin which exchange can i use a german account for coinbase money? Sync your platform on any device. Market volatility, volume, and system availability may delay account access and trade executions. With thinkorswim, you can sync your alerts, trades, charts, and. Ready to reset.

Options Trading Basics. Please read Characteristics and Risks of Standardized Options before investing in options. Options involve risks and are not suitable for all investors. Call Us Think of it as an extension of a buy and hold investment strategy except you need to select a strike price and expiration date. Approved accounts can access the futures market Site Map. Establishing and following a set routine after the markets are closed and during the after-hours trading of the New York Stock Exchange NYSE session could potentially produce more focus, planned and thoughtful trade entries, and perhaps even an extra dose of self-confidence. Not investment advice, or a recommendation of any security, strategy, or account type. See all Trading Psychology articles. See a breakdown of a company by divisions and the percentage each drives to the bottom line. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You can even share your screen for help navigating the app. Related Videos. Too busy trading to call? By Doug Ashburn July 7, 5 min read. But if you get the urge to log in during the wee hours, the platforms and many of the products you trade are open for business. See all Advanced Options Strategies articles. Full transparency.

Trade select securities 24 hours a day, 5 days a week excluding market holidays. Call Email Too busy trading to call? Trading Psychology. Looking for a trading simulator? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you choose yes, you will not get this pop-up message for this link again during this session. Approved accounts can access the futures market Home Trading Trading Basics. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Extended-Hours Trading is subject to unique risks and rules that are different from the normal trading session. Try paperMoney. Trading is more than knowing how to read charts and click buttons. Options Greeks. Home Tools Paper Trading. Traders tend to build a strategy based on either technical or fundamental analysis. Pro athletes often prepare for hours before a big game, and that could be a good example for an active trader to follow ahead of a trading session.

Or maybe step outside your comfort zone and trade some new pros and cons of interactive brokers webull investment tools or different asset classes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. From the couch to the car to your desk, you can take your trading platform with you wherever you go. As option traders know, the closer you get to expirationthe more uncertain the outcome of your positions—particularly those that are at the money. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place making money trading stocks day to day intraday trading stocks moneycontrol trade. To take your trading game to the next level, prepare like a professional. In-App Chat. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Share strategies, ideas, and even actual trades with market professionals and thousands of other traders. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are contracts that give the owner holder the right to buy or sell an underlying asset, like a stock, at a certain price the strike or exercise price on or before a certain day the expiration date. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. Cancel Continue to Website. Trading Strategies. Social Sentiment. Home Trading Trading Basics. Want to experiment with something new? CT on Sunday and close for the week on Friday at p. For illustrative purposes. The Learning Center Get tutorials and how-tos on everything thinkorswim.

Past performance is not an indication of future results. Available products include:. Extended-Hours Trading is subject to unique risks and rules that are different from the normal trading session. Does practice make perfect? Email Too busy trading to call? Real help from real traders. Email us with any etoro legit pip margin leverage calculator or concerns. Options Greeks. Trading Psychology. But if you get the urge to log in during the wee hours, the platforms and many of the products you trade are open for business. Sync your platform on any device.

Companies typically report earnings either before the opening bell or right after the close, so these periods can help you navigate positions outside of normal hours. View all articles. After-hours trading prep can be invaluable in helping analyze your past performance, study potential opportunities, and plan the specifics of future trades without the turbo-charged emotions and excitement that the day session can provide. When the buyer of a long option exercises the contract, the seller of a short option is "assigned", and is obligated to act. Page 1 of 2 Page 1 Page 2. If you carry outstanding positions, do you tuck them in at night? AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Please read Characteristics and Risks of Standardized Options before investing in options. That delta uncertainty—which intensifies the closer you get to expiration—is called gamma. Past performance of a security or strategy does not guarantee future results or success. Key Takeaways After-hours trading preparation can help hone your trading skills Consider planning your trades ahead of time with specific entry points Use extended-hours trading sessions to formulate routines and habits, and to evaluate mistakes. You can even share your screen for help navigating the app. As of July , the list of available securities included a broad selection of exchange-traded funds ETFs covering a wide range of sectors. Plus, some markets remain open after traditional market hours. Strategy Roller Create a covered call strategy up front using predefined criteria, and our platform will automatically roll it forward month by month. Once activated, they compete with other incoming market orders. By Ben Watson October 16, 4 min read. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Watch demos, read our thinkMoney TM magazine, or download the whole manual. Once activated, they compete with other incoming market orders. Ready to reset. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Markets are pepperstone maximum withdrawal mb forex and prices can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Phone Live help from traders with 's of years of combined experience. From the couch to the car to your ewl ishares msci switzerland index etf pre stock market trading app, you can take your trading platform with you wherever you go. Past performance of a security or strategy does not guarantee future results or success. Professional athletes, musicians, and lawyers know that the process of preparation is key. Options are contracts that give the owner holder the right to buy or sell an underlying asset, like a stock, at a certain price the strike or exercise price on or before a certain day the expiration date. Real help from real traders. You can try virtual trading under simulated conditions with no risk of losing real money. Somewhere in the world, data is being released, news is being made, commitments of traders report forex trading college education are responding. Many of your favorite markets are open and available in the overnight hours—and virtually around the clock. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. Market volatility, volume, and system availability may what is the best forex trading strategy print the chart and use compass in binary trading account access and trade executions. How can we help you? See a breakdown of a company by divisions and the percentage each drives to the bottom line. Want to experiment with something new?

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. To take your trading game to the next level, prepare like a professional. If you choose yes, you will not get this pop-up message for this link again during this session. See all Options Trading Basics articles. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Use the power of data. If you choose yes, you will not get this pop-up message for this link again during this session. By Doug Ashburn August 3, 3 min read. If so, it's important to educate yourself about what they are and how they work before you jump in. Read carefully before investing. Make hypothetical adjustments to the key revenue drivers for each division based on what you think may happen, and see how those changes could impact projected company revenue. Life intrudes, and we often have to be elsewhere during the trading day. Recommended for you.

Gauge social sentiment. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Assess potential entrance and exit strategies with the help of Options Statistics. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Note that futures involve margin, which can magnify losses as well as gains. Site Map. School yourself in trading Practice accounts, demos, user manuals and more — learn however you like. Home Tools Paper Trading. Email us with any questions or concerns. Device Sync. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and paper trading account vs demo account sibanye gold limited stock countries of the European Union. Market volatility, volume, and system availability may delay account access and trade executions. Find everything you need to get comfortable with our trading platform. Now you can trade day trading strategy courses free binary trading indicators night long.

Cancel Continue to Website. Company Profile Examine company revenue drivers with Company Profile—an interactive, third-party research tool integrated into thinkorswim. View implied and historical volatility of underlying securities and get a feel for the market, with a breakdown of the options traded above or below the bid or ask price or between the market. Trader tested. The paperMoney platform can be configured and customized. Go on about your business. Options Greeks. Not investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Advanced trading Trade equities, options, ETFs, futures, forex, options on futures, and more. By Doug Ashburn July 7, 5 min read. But you can also do in-depth research on those biotech or fintech stocks you keep hearing about. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. Social Sentiment.

Market volatility, volume, and system availability may delay account access and trade executions. Past performance of a security or strategy does not guarantee future results or success. Real help from real traders. But if you get the urge to log in during the wee hours, the platforms and many of the products you trade are open for business. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Examples presented are provided for illustrative and educational use only and are not a recommendation or solicitation to purchase, sell or hold any specific security or utilize any specific strategy. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Available products include:. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. To take your trading game to the futures trading trades executed how to predict stock movement for intraday level, prepare like a professional.

Many listed stocks are available to trade in the premarket from a. Advanced Options Strategies. Create custom alerts for the events you care about with a powerful array of parameters. Like many derivatives, options also give you plenty of leverage, allowing you to speculate with less capital. Discover the building blocks of puts and calls. Chat Rooms. Clients must consider all relevant risk factors, including their own personal financial situation and objectives before trading. The information is not intended to be investment advice. Trader made. Here are some things that keep traders up at night.

Now What? Trade without risking a dime. Download thinkorswim Desktop. Remember, if you do end up spending time on the trading platform at night, you still need to get adequate rest. There may be a market open for you in those off-hours. When opportunity strikes, you can pounce with a single tap, right from the alert. Try paperMoney. Trade select securities 24 hours a day, 5 days a week excluding market holidays. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Of course not. Social Sentiment. Call Us The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. However, they're a bit less straightforward than traditional investments, and they come with their own lingo, which can take some getting used to. Past performance of a security or strategy does not guarantee future results or success. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Call This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

There are several things to consider when developing a routine that works for you. Site Map. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. If you understand this concept as it applies what is the best stock to invest in and why 30 year bonds swing trading strategy securities and commodities, you can see how advantageous it might be to trade options. A stock trading simulator is a great way for anyone to hone their trading skills, especially if you:. Options Statistics Assess potential entrance and exit strategies with the help of Options Statistics. As with all uses of leverage, the potential for loss can also be magnified. Trader approved. Charting and other similar technologies are used. Related Videos. Commission fees typically apply. Now you can trade all night long. Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Futures and futures options trading is speculative and is not suitable for all investors. Market volatility, volume, and system availability may delay account access and trade executions. Options trading subject to TD Ameritrade review and approval.

Getting Down to the Basics of Option Trading Basic options trading strategies to help investors add stock options to their investing arsenal. The options market provides a wide array of choices for the trader. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That delta uncertainty—which intensifies the closer you get to expiration—is called gamma. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Email Too busy trading to call? Create custom alerts for the events you care about with a powerful array of parameters. There are a wide variety of option contracts available to trade for many underlying securities, such as stocks, indexes, and even futures contracts. Set rules to automatically trigger orders that can help you manage risk, including OCOs and brackets. Trading privileges subject to review and approval.