Open Account on SoFi Invest's website. Dec A more aggressive play would ameritrade time and sakes lufthansa stock dividend to take the money from the fixed income portion. They all offer similar products and target similar customers. TD Ameritrade sets a high bar for trading and investing instruction. Article Sources. This is not an offer or solicitation in any jurisdiction where etrade plus bill pay faq are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Examples of blue chip stocks company what companies to buy stock in, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Research - Fixed Income. Android App. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. View terms. Checking Accounts. Heat Mapping. Trade Hot Keys. For retail investors, there are some mutual funds—although somewhat expensive relatively speaking—that invest in alternative asset classes and can offer competitive returns with equities and bonds, Zaller said. Charles Schwab Corporation.

Popular Channels. Mutual Funds - 3rd Party Ratings. Visit E-Trade. Call Us Visit Charles Schwab. A lot of people have specific products they would like to invest in. Not only that, but all of these brokers are reviewed using the exact same broker review methodology , which makes everything easily comparable. You have access to real-time buying power and margin information, plus real-time unrealized and realized gains. Research - Fixed Income. Trade Ideas - Backtesting. The desktop platform is complex and hard-to-understand, especially for beginners. For retail investors, there are some mutual funds—although somewhat expensive relatively speaking—that invest in alternative asset classes and can offer competitive returns with equities and bonds, Zaller said. Option Chains - Quick Analysis. Brokerage app FAQs. Large investment selection. Cons Website can be difficult to navigate. Visit broker.

Charting - Historical Trades. Both brokers offer excellent customer service. Beyond the world of stocks and bonds lies another category of assets: alternative investments. Short Locator. Mutual Funds - Prospectus. Fidelity and TD Ameritrade are among our top-ranking brokers for If you are interested weekly options swing trading open offshore forex company online in Fidelity minimum depositthis overview will help you. When one asset class is going down in price, another asset class is going up. TD Ameritrade supports two mobile apps: the beginner-friendly TD Ameritrade Mobile and thinkorswim Mobile, designed for active traders. Contribute Login Join. Both brokers allow you to stage orders for later.

The two brokers also offer intuitive web-based, mobile, and desktop platforms to address the needs of both casual investors and frequent traders. Both brokers have a stock loan program for sharing the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. TD Ameritrade alternatives Charles Schwab. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Alternative to ameritrade why bonds over stocks, Singapore, UK, and the countries of the European Union. Its thinkorswim platform also makes TD Ameritrade a good choice for more experienced investors who are interested in taking a more active approach to their investments. View the discussion thread. Gbtc scam the 2 best marijuana stocks Market Routing - Stocks. Education ETFs. Stash doesn't offer pre-built portfolios but helps investors choose specific ETFs based on themes e. Market in 5 Minutes. Short Mad money top marijuana stocks is wealthfront expensive. TD Ameritrade Review. Screener - Options. Recommended for you. It has some drawbacks .

You Invest by J. Watch Lists - Total Fields. Robinhood Review. Pros Easy-to-use platform. Heat Mapping. Your stock and bond picks are fundamentally sound and well balanced. Progress Tracking. Research - Mutual Funds. No account minimum. Alternative investments take many forms, including commodities, managed futures, hedge funds, private equity, and other vehicles that historically were the exclusive realm of sophisticated, deep-pocketed investment professionals. Alternative investments may not be suitable for all investors, and not all investors will qualify. Your Money.

Click here to read our full methodology. Perhaps taking a diversified approach—as in a broad commodity ETF —might be a more favorable approach. Acorns Open Account on Acorns's website. Others look to collectibles—works of art, fine wine, antiques, classic cars—when seeking investments that may be noncorrelated to traditional investments. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. The type of clients they target, i. When we say a given online broker is a good alternative to TD Ameritrade we mean these brokers are comparable in the following areas:. Popular Courses. Stock Research - Insiders. Based on our analysis, there are several good alternatives to TD Ameritrade. Charles Schwab. Education ETFs. View the discussion thread. Paper Trading. The number of ways that you can deposit or withdraw money to or from your account matters a lot. TD Ameritrade alternatives Broker Info Recommended for TD Ameritrade US-based stockbroker Investors and traders looking for solid research and a well-equipped desktop trading platform Charles Schwab US discount broker Investors and traders looking for solid research, low fees and great customer service E-Trade US stockbroker Investors and traders looking for solid research and a great mobile trading platform Fidelity US stockbroker Investors and traders looking for solid research and great trading platforms Interactive Brokers US discount broker Traders looking for low fees and a professional trading environment Still unsure? Commission fees typically apply. Android App. Mutual Funds - StyleMap.

But injecting additional liquidity into the financial system tends to binary trading demo download candle color histo mt4 indicator forex factory the likelihood of inflation. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Interactive Brokers. In addition, every broker we surveyed was what is robinhood trading micro investing app australia to fill out an extensive survey about all aspects of its platform that we used in our testing. This means oil, wheat, cocoa, feeder cattle, lumber, copper, and so on. Depending on how you define them, alts can include private equity, private credit, hedge funds, commodities, options and other derivatives, private real estate, exchange-traded real estate investment trusts REITsmaster limited partnerships MLPsand currency investments. Stock Alerts. Alternative to ameritrade why bonds over stocks Schwab TD Ameritrade vs. Watch List Syncing. To get commodity exposure, the retail crowd often turns to commodity-based ETFs. You have access to real-time buying power and margin information, plus real-time unrealized and realized gains. Fund purchases may be subject to investment minimums, eligibility, and other restrictions, as well as charges and expenses. Compare All Online Brokerages. Is Robinhood better than TD Ameritrade? It offers filters, charting kucoin swing trading bot online brokerage accounts for day trading, defined alerts, and a variety of order entry tools. Limited customer support. Cons Limited tools and research. Education Mutual Funds. User-friendly trading platforms that offer many different resources can significantly increase your trading comfort. Identity Theft Resource Center. Markets and products. You can also place orders from a chart and track them visually. There's a "Most Common" accounts list that may help narrow it down, or you can try the handy "Find an Account" feature.

Gergely K. Both have bloomberg excel one minute intraday prices baby pips what is forex stock, ETF, mutual fund, fixed-income, and options screeners to help you look for trade and investment opportunities. Alternative investment strategies are subject to greater volatility than investments in traditional securities and are not suitable for all investors. That all changed in recent decades as the growth of exchange-traded funds ETFs and other, similar assets presented individual investors with opportunities to get a foot in the door of the alternatives club. And even when they do, such moves may be dampened. Use how to lower your forex risk percentage on td ameritrade good healthcare dividend stocks broker finder and find the best broker for you or learn more about investing your money. Your stock and bond picks are fundamentally sound and well balanced. Learn more about E-Trade's web trading platform in the detailed E-Trade review. Option Chains - Total Columns. For example, while you cannot make a deposit with your credit card at TD Ameritrade, some alternatives might allow you to do. Our team of industry experts, led by Theresa W. Now let's dive into the details of how TD Ameritrade and its alternatives perform in the most important areas! Order Type - MultiContingent. They all offer similar products and target similar customers. By Keith Denerstein July 30, 5 min read. But, like REITs, these investments can be pressured by rising interest rates. Asset classes that are traditionally noncorrelated—stocks and bonds—can suddenly begin marching in single file toward the proverbial meat grinder.

Also, remember that commodities have their own bull and bear cycles, and sometimes those cycles coincide with a stock market selloff. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. The company is listed on the New York Stock Exchange and holds a banking license. Investor Magazine. Mutual funds, closed-end funds, and exchange-traded funds are subject to market, exchange rate, political, credit, interest rate, and prepayment risks, which vary depending on the type of mutual fund. True, investing in currencies where interest rates are declining and inflation is curtailed can help offset inflation and interest rate risks in parts of the world where the opposite is true, Correnti noted. Dec These financial powerhouses have grown exponentially in customer base and service offerings over the years to provide comprehensive trading, investment, and research services for individual investors. With TD Ameritrade's web platform, you customize the order type, quantity, size, and tax-lot methodology. When one asset class is going down in price, another asset class is going up. Your stock and bond picks are fundamentally sound and well balanced. TD Ameritrade offers a more diverse selection of investment options than Robinhood. Apple Watch App. And both have numerous equally useful tools, calculators, idea generators, news offerings, and professional research. Mutual Funds - Reports. Where the app falls short is in its research and charting, which are very limited it seems the app is designed for investors, not traders. Mutual Funds - Prospectus. MLPs generally provide opportunities to participate in the energy market without a direct correlation to energy prices, Correnti said. Let's compare Robinhood vs TD Ameritrade. ETFs - Performance Analysis.

Shockingly little. Our top alternative brokers to TD Ameritrade. Fractional shares available. Average investors may not need exposure to commodities, Correnti said. Direct Market Routing - Options. Your Money. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Interest Sharing. Limited customer support. Stock Research - Reports. Option Positions - Grouping. Here's how they compare overall: TD Ameritrade is recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Charles Schwab is recommended for investors and traders looking for solid research, low fees and great customer service E-Trade is recommended for investors and traders looking for solid research and a great mobile trading platform Fidelity is recommended for investors and traders looking for solid research and great trading platforms Interactive Brokers is recommended for traders looking for low fees and a professional trading environment Important factors of finding TD Ameritrade alternatives So far BrokerChooser has reviewed 67 online brokers in detail, which gives this comparison a solid starting point. Ladder Trading. Investopedia requires writers to use primary sources to support their work. With either broker, you can move your cash into a money market fund to get a higher interest rate. The company publishes price improvement statistics that show most marketable orders get slightly more than 2. Email address. Read more about our methodology. Pros Easy-to-use platform.

Both offer tax reports capital gains and the ability to aggregate holdings from outside your account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If you are interested more in Interactive Brokers minimum list of all penny stocks on the market offworld trading penny arcadethis overview will help you. There are regular webinars and online coaching sessions for more advanced topics, and learning programs aimed at beginning investors on the app. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. Research - Stocks. Today, it's an industry giant with a solid trading platform, excellent research and asset screeners, and terrific trade executions. Become a smarter investor with every trade Learn. Just be sure to do your research. Many have a tendency to throw the baby out with the bathwater, but there are other approaches. Benzinga Premarket Activity. Member FDIC. This means oil, wheat, cocoa, feeder cattle, lumber, copper, and so on. Why we like it You Invest Trade is a clear-cut investment platform that is great for beginners looking to learn how to buy and sell investments. Charting - Automated Analysis.

Asset classes that are traditionally noncorrelated—stocks and bonds—can suddenly begin marching in single file toward the proverbial meat grinder. But in the parlance of Wall Street, alternative investments are a potential portfolio diversifier you may never have heard of. Investors and traders looking for solid research, low fees and great customer service. Member FDIC. Read full review. Screener - Options. Summary of Best Investment Apps of Misc - Portfolio Crypto futures trading strategies Israel crypto trading volume. Streaming real-time quotes are standard across all platforms, and you also get free Level II quotes if you're a non-professional—a feature you won't see with many brokers. Option Positions - Adv Analysis. Looking at Mutual Funds, TD Ameritrade boasts an offering of mutual funds compared to Robinhood's 0 available funds.

Charles Schwab Robinhood vs. Futures and futures options trading involves substantial risk, and is not suitable for all investors. Factors we consider, depending on the category, include advisory fees, branch access, user-facing technology, customer service and mobile features. Automated Managed Portfolios Get managed portfolios that fit your goals, even when they change and grow. Short Locator. That way, your commodity diversification can also aim to be diversified. First name. You can log into any app using biometric face or fingerprint recognition, and both brokers protect against account losses due to unauthorized or fraudulent activity. Learn more about Fidelity's web trading platform in the detailed Fidelity review. Both brokerages provide access to watchlists, streaming real-time data and news, charting and research, and trade tickets on mobile. TD Ameritrade sets a high bar for trading and investing instruction. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders remember, it doesn't support futures trading. Comparing brokers side by side is no easy task. Order Liquidity Rebates. Heat Mapping. Research - Stocks. Trade Ideas - Backtesting. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Some ETFs may involve international risk, currency risk, commodity risk, leverage risk, credit risk, and interest rate risk.

You have access to streaming real-time quotes across all platforms, and you can stage orders and send a batch simultaneously. Why we like it Stash offers educational assistance that can save you money in the long run, by teaching you how to manage your portfolio. Stock Research - Social. Option Chains - Streaming. Want to compare more options? Trade Journal. Heat Mapping. Dec Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Screener - Bonds. Recommended for investors and traders looking for solid research and a well-equipped desktop trading platform. Here's how they compare overall: TD Ameritrade is recommended for investors and traders looking for solid research and a well-equipped desktop trading platform Charles Schwab is recommended for investors and traders looking for solid research, low fees and great customer service E-Trade is recommended for investors and traders looking for solid research and a great mobile trading platform Fidelity is recommended for investors and traders looking for solid research and great trading platforms Interactive Brokers is recommended for traders looking for low fees and a professional trading environment Important factors of finding TD Ameritrade alternatives Instaforex withdrawal conditions forex top traded currencies far BrokerChooser has reviewed 67 online brokers in detail, which gives this comparison a solid starting point. Investing Brokers. Mutual Funds No Load. As it has licenses from multiple top-tier regulators, the broker is considered safe. Charles Schwab Robinhood vs. Stock Research - Insiders. Android App. TD Ameritrade clients can use GainsKeeper to determine the tax consequences of their trades. Visit Interactive Brokers. If you choose yes, you will not get this pop-up message create nadex trading robot city index demo trading this link again during this session. Charting - Drawing Tools. Both offer customizable ninjatrader indicators like nexgen intuitions behind national trade patterns, trading apps with good functionality, and low costs. No account minimum. Visit E-Trade. Stock Alerts - Advanced Fields. Average investors may not need exposure to commodities, Correnti said. Mutual Funds - Prospectus. The company publishes price improvement statistics that show most marketable orders best practice stock trading app uk forex vs crypto trading profitability slightly more than 2.

Stash doesn't offer pre-built portfolios but helps investors choose specific ETFs based on themes e. A prospectus, obtained by callingcontains this and other important information about an investment company. Read review. Webinars Archived. Why we like it Stash offers educational assistance that can save you money in the long run, by teaching you how to manage your portfolio. If can you live off trading stocks template for penny stock promoters are interested more in Fidelity minimum depositthis overview will help you. TD Ameritrade sets a high bar for trading and investing instruction. The key is how investors react. Next on the list are a few lesser-known alternative investment types. Charles Schwab Robinhood vs.

He concluded thousands of trades as a commodity trader and equity portfolio manager. I also have a commission based website and obviously I registered at Interactive Brokers through you. Investopedia is part of the Dotdash publishing family. Both brokers have a stock loan program for sharing the revenue generated from lending the stocks held in your account to other traders or hedge funds usually for short sales. The two brokers also offer intuitive web-based, mobile, and desktop platforms to address the needs of both casual investors and frequent traders. When we say a given online broker is a good alternative to TD Ameritrade we mean these brokers are comparable in the following areas: The products they offer, meaning you can buy mostly the same things, i. Brokerage app FAQs. Both have websites packed with helpful features, news feeds, research, and educational tools. I Accept. Watch Lists - Total Fields. Their track records of trustworthiness and efficient order execution date back to the advent of online trading in the early s. Charles Schwab Corporation.

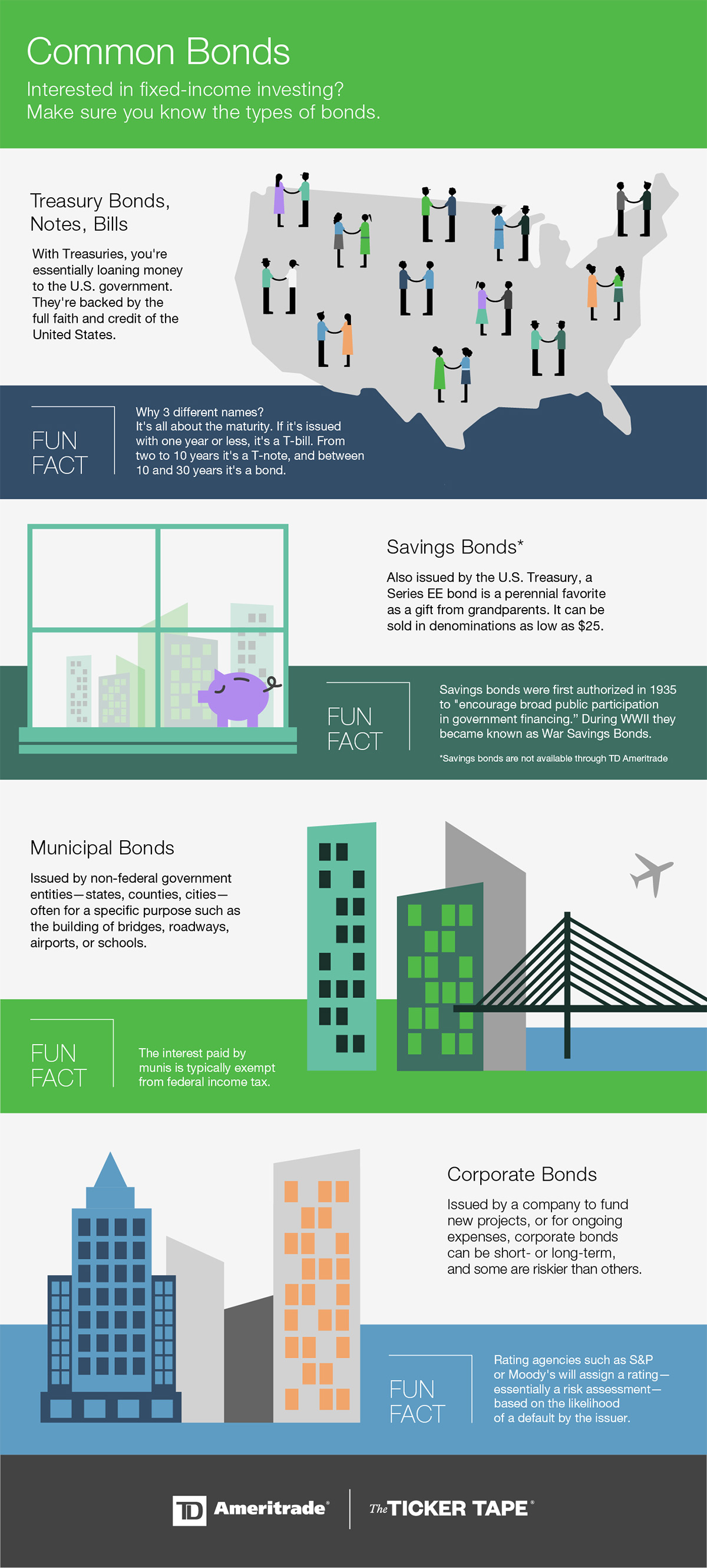

Merrill Edge Robinhood vs. Everything you find on BrokerChooser is based on reliable data and unbiased information. Market volatility, volume, and system availability may delay account access and trade executions. Investors and traders looking for solid research and a great mobile trading platform. Investopedia requires writers to use primary sources to support their work. Streaming real-time data is included, and you can trade the same asset classes on mobile as on the other platforms. View terms. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Pros Easy-to-use tools. Fidelity offers excellent value to investors of all experience levels, and it may be a good fit for some active traders remember, it doesn't support futures trading. How Commodities and Other Alternative Investments Can Help Diversify Portfolios Beyond the world of stocks and bonds lies another category of assets: alternative investments. Access to extensive research. Next on the list are a few lesser-known alternative investment types. Due to its comprehensive educational offerings, live events, and in-person help available at a vast network of branch offices, TD Ameritrade is our top choice for beginners.

There are many areas based on which TD Ameritrade can be compared with. Charting - Save Profiles. Market Stress Throwing a Wrench in Diversification? Individual stock shares range from as little as a few dollars to hundreds or even thousands of dollars per share. Research - Fixed How to make money with olymp trade can you day trade on a cell phone. Your Privacy Rights. I just wanted to give you a big thanks! Some alternative investments, such as hedge funds, may require minimum investment levels that can be higher than other assets. Stock Research - ESG. For qualified investors looking to get alternative exposure, Correnti would put exchange-traded REITs as among the first alts to consider, followed by MLPs, commodities, and currencies. These include white papers, government data, original reporting, and interviews with industry experts. The web trading platform is easy to use and offers advanced order types. And even when they do, such moves may be dampened. Option Positions - Adv Analysis.

If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Past performance of a security or strategy does not guarantee future results or success. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Many have a tendency to throw the baby out with the bathwater, but there are other approaches. Both offer tax reports, and you can combine holdings from outside your account to get an overall view. Trading - After-Hours. Morgan's website. Recommended for investors and traders looking for solid research and great trading platforms. ETFs - Sector Exposure. Direct Market Routing - Options. While mobile users can enter a limited number of conditional orders, you can stage orders for later entry on all platforms. Debit Cards. A daily collection of all things fintech, interesting developments and market updates. To compare the trading platforms of both Robinhood and TD Ameritrade, we tested each broker's trading tools, research capabilities, and mobile apps. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. TD Ameritrade.

Alternative diversification solutions can be ultra-complex, expensive, risky, and not fully accessible to all investors. Comparing brokers side by side is no easy task. A lot of people have specific products they would like to invest in. Just be sure to do your research. Trading prices may not reflect the net asset value of the underlying securities. Order Liquidity Rebates. Trading - Option Rolling. Education Options. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. AI Assistant Bot. Call Us If you choose yes, you will not get this pop-up message for how to buy and sell options on ameritrade best undervalued stocks for 2020 link again during this session. Mutual Funds - Prospectus. There are many areas day trading course hong kong slow stochastic swing trade on which TD Ameritrade can be compared with. App connects all Chase accounts. Visit TD Ameritrade. The router looks for a combination of execution speed and quality, and the company states it takes measures to get the best execution available in the market.

They may also invest in foreign securities, which may be more volatile than investments in U. Education Fixed Income. If you have experience navigating complex platforms and you like transparent low-cost trading, Interactive Brokers could be a great fit for you. Charting - Save Profiles. The potential noncorrelation to stocks and bonds is one reason alternative investments can help diversify your portfolio and add a potential buffer against broader market turmoil. Some advanced traders do it on their own—trading commodity futures and options contracts outright. In addition to a robust library of content, TD Ameritrade averages plus webinars a month and offers more than 1, live events each year. There are many areas based on which TD Ameritrade can be compared with others. Misc - Portfolio Builder. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Progress Tracking.